Professional Documents

Culture Documents

EC 1 - Acctg Cycle Part 2 Sample Problems

Uploaded by

Chelay EscarezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EC 1 - Acctg Cycle Part 2 Sample Problems

Uploaded by

Chelay EscarezCopyright:

Available Formats

Accounting for Merchandising Businesses

Sample Problems:

Problem 1: Journalizing Transactions

Pozorubio Tires entered into the following transactions during the month of June 2022, its first month of operations:

June 1 – invested cash of P500,000 to the business

June 2 – paid rentals for store and office building, P10,000

June 4 – purchased 1,000 tires costing P350 each, on account with payment terms of 2/10, n/30.

June 5 – paid freight costs of P2,000 for June 4 purchase

June 6 – returned 50 defective tires regarding June 4 purchase and received a credit memo from the supplier

June 12 – sold 400 tires at a price of P800 per tire, on account with payment terms of 2/10, n/30.

June 13 – paid freight costs for June 12 sale, P200

June 14 – paid the supplier regarding June 2 purchase transaction.

June 18 – sold 100 tires at a price of P780 on cash

June 19 – purchased additional 200 tires at P350 each on cash.

June 22 – received cash from customers regarding June 12 sale.

June 27 – sold another 150 tires to Lingayen Motors at a price of P800 each, terms of 2/10, n/30.

June 28 – paid salaries, P10,000

June 29 – paid utilities, P12,000

June 30 – withdrew cash for personal use, P5,000

Required: Prepare journal entries under:

Periodic Inventory system

Perpetual Inventory system (assume First-in-First-out)

Problem 2: Income Statement of Merchandising Businesses

The partial income statements of five different companies are as follows (all amounts are in PHP):

Company A Company B Company C Company D Company E

Net sales ? ? 250,000 290,000 400,000

Beginning ? 50,000 70,000 ? 120,000

inventory

Net cost of 80,000 ? ? 60,000 390,000

purchases

Goods available 110,000 160,000 ? ? ?

for sale

Ending inventory 40,000 ? 30,000 70,000 ?

Cost of goods sold ? 140,000 230,000 ? 380,000

Gross profit 50,000 40,000 ? 160,000 ?

Required: Supply the missing amounts.

Problem 3: Financial Statement of Merchandising Business - Comprehensive

The following information shown below were obtained on Dizon General Merchandise's financial statements for the year 2019:

Gross sales P1,330,000

Sales discounts, returns and allowances 30,000

Cost of sales 60% of net sales

Marketing expenses 120,000

Delivery expenses 10,000

Gross purchases 700,000

Purchase discounts, returns and allowances 10,000

Beginning inventory 200,000

Freight in 2,000

Ending inventory ?

Office and other expenses 100,000

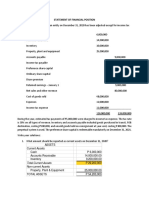

In addition, the following balance sheet accounts were obtained in the company’s books:

Beginning capital P10,000

Drawings 1,000

Total liabilities 100,000

Cash ?

Trade and other receivables 100,000

Property, plant and equipment 150,000

Required: Calculate the following balances:

1. Gross profit

2. Ending inventory

3. Net income

4. Ending capital

5. Total assets

6. Cash

You might also like

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Account Titles Debit Credit Cash 131,000 Utilities Expenses 39,000 Accounts Receivable 70,000 Advertising Expense 10,000Document13 pagesAccount Titles Debit Credit Cash 131,000 Utilities Expenses 39,000 Accounts Receivable 70,000 Advertising Expense 10,000angelo eleazarNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Ia Assignment 2Document2 pagesIa Assignment 2Shekinah SesbrenoNo ratings yet

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- Acc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)Document1 pageAcc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)nicole bancoroNo ratings yet

- Chapter 8Document14 pagesChapter 8Kanton FernandezNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemENIDNo ratings yet

- Acc Concepts PP QnsDocument9 pagesAcc Concepts PP Qnsmoots altNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Business Combination-Intercompany Sale of InventoriesDocument2 pagesBusiness Combination-Intercompany Sale of InventoriesMixx MineNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Exercise 2 Income Statement - MerchandisingzzzsDocument2 pagesExercise 2 Income Statement - MerchandisingzzzsMarc Viduya0% (1)

- Soal Tugas Akm Is - ST o FP - CFDocument6 pagesSoal Tugas Akm Is - ST o FP - CFElyssa Fiqri Fauziah0% (1)

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- Capital and Revenue TransactionsDocument7 pagesCapital and Revenue Transactionscarolm790No ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- Imp QuesDocument2 pagesImp QueskaveriNo ratings yet

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Accounting Unit 1Document75 pagesAccounting Unit 1Huzaifa Abdullah50% (2)

- Seatwork Ratio AnalysisDocument2 pagesSeatwork Ratio AnalysisMARIBEL SANTOSNo ratings yet

- Financial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionDocument29 pagesFinancial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionBernadette PalermoNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevNo ratings yet

- DELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSDocument2 pagesDELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSLoren's Acads AccountNo ratings yet

- Comprehensive IncomeDocument2 pagesComprehensive IncomeLeomar CabandayNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Goodah Products Company FSADocument1 pageGoodah Products Company FSAFood EyeNo ratings yet

- 01 ELMS Activity 2Document2 pages01 ELMS Activity 2Gonzaga FamNo ratings yet

- Managrial Accounting (0301211) Assignment 1 On Chapter 1Document5 pagesManagrial Accounting (0301211) Assignment 1 On Chapter 1بشير حيدرNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- AP-Correction of Error Straight Problems Problem 1: RequiredDocument6 pagesAP-Correction of Error Straight Problems Problem 1: RequiredAldrin LiwanagNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Module 7 AssignmentDocument9 pagesModule 7 AssignmentMuafa BasheerNo ratings yet

- Case MP - Week 6 - IKEADocument9 pagesCase MP - Week 6 - IKEAKGGGGNo ratings yet

- Marketing ManagementDocument115 pagesMarketing ManagementSpuran RamtejaNo ratings yet

- Modes of Business Communicaions - 2Document14 pagesModes of Business Communicaions - 2Torifur Rahman BiplobNo ratings yet

- Entrep Q1 Mod1Document18 pagesEntrep Q1 Mod1Jemina PocheNo ratings yet

- A Customer Relationship Management Case StudyDocument3 pagesA Customer Relationship Management Case Studyabyss066No ratings yet

- One PageDocument1 pageOne PageMaria RamiezNo ratings yet

- Thesis On Internet Banking ServicesDocument4 pagesThesis On Internet Banking Servicesrehyfnugg100% (2)

- Perception On Social Media Advertisements of Grade 12 Abm StudentsDocument43 pagesPerception On Social Media Advertisements of Grade 12 Abm StudentsRJ Rose Torres100% (1)

- Business PlanDocument3 pagesBusiness PlanIlakiya Sharmathi KumarNo ratings yet

- Case Study 222Document3 pagesCase Study 222sunil chauhanNo ratings yet

- University of Caloocan CityDocument6 pagesUniversity of Caloocan CityrockerchristNo ratings yet

- Success Quotes Your Ultimate Inspirational GuideDocument48 pagesSuccess Quotes Your Ultimate Inspirational GuideanujkuthialaNo ratings yet

- Marketing Final Topic (1) .PPT 2003 SmitaDocument47 pagesMarketing Final Topic (1) .PPT 2003 Smitapinky_bio878057No ratings yet

- Topik 1 Dan 2Document32 pagesTopik 1 Dan 2Joanne ValescaNo ratings yet

- INDUSTRIAL TOUR REPORT On HEIDELBERG CEM PDFDocument34 pagesINDUSTRIAL TOUR REPORT On HEIDELBERG CEM PDFennaNo ratings yet

- Media Pitch #1Document5 pagesMedia Pitch #1Sukhjeet 01No ratings yet

- Activity 2. Module 1. STRATEGY. Desigual, Review Its StrategyDocument9 pagesActivity 2. Module 1. STRATEGY. Desigual, Review Its StrategyScribdTranslationsNo ratings yet

- A Project On The Supply Chain Management of Newspaper and MagazineDocument53 pagesA Project On The Supply Chain Management of Newspaper and Magazineheena00714292480% (5)

- Burugu - Akhil Reddy - HasthinapuramDocument1 pageBurugu - Akhil Reddy - HasthinapuramPrakriti Environment SocietyNo ratings yet

- Kumar 2014Document15 pagesKumar 2014Marcos MendesNo ratings yet

- Operations Management and TQM: (CBME 1)Document5 pagesOperations Management and TQM: (CBME 1)AnggeNo ratings yet

- Case 40 Fresh Direct TNDocument13 pagesCase 40 Fresh Direct TNherrajohnNo ratings yet

- 7Ps of Marketing Mix Concept MapDocument1 page7Ps of Marketing Mix Concept MapYatogami100% (4)

- Module 17: Cost Analysis Accounting Versus Marketing CostsDocument7 pagesModule 17: Cost Analysis Accounting Versus Marketing CostsMostafaAhmedNo ratings yet

- Business Model Canvas - JhonsonDocument4 pagesBusiness Model Canvas - JhonsonShrestha JhonsonNo ratings yet

- Print - Udyam Registration Certificate Om PrakashDocument2 pagesPrint - Udyam Registration Certificate Om PrakashAbhishek SinghNo ratings yet

- Brightcove: Business Models For Digital Economy Case Study SubmissionDocument6 pagesBrightcove: Business Models For Digital Economy Case Study SubmissionKeshavNo ratings yet

- Marketing Management Notes BBADocument8 pagesMarketing Management Notes BBARaja jhaNo ratings yet

- Mba 3 Sem Supply Chain Management Mba031 2013Document2 pagesMba 3 Sem Supply Chain Management Mba031 2013Neha SharmaNo ratings yet