Professional Documents

Culture Documents

01 ELMS Activity 2

Uploaded by

Gonzaga Fam0 ratings0% found this document useful (0 votes)

22 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pages01 ELMS Activity 2

Uploaded by

Gonzaga FamCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

BM2002

NAME: DATE: SCORE:

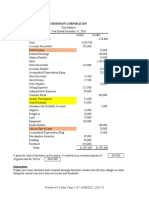

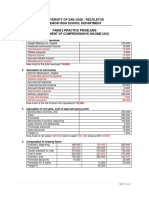

PC Incorporated

PC Company is engaged in small export business. The company maintains limited records. Most of the company’s

transactions are summarized in a cash journal; non-cash transactions are recorded by making memorandum entries. The

following are extracted from the company’s records:

Accounts receivable 370,000 increase

Notes receivable 200,000 decrease

Accounts payable 150,000 decrease

Notes payable – trade 200,000 increase

Notes payable bank 300,000 increase

Sales returns (P50,000 was refunded) 80,000

Sales discounts 20,000

Purchase returns (P30,000 was refunded) 80,000

Purchase discounts 35,000

Accounts written-off 60,000

Recovery of accounts written off 18,000

Cash sales 300,000

Cash purchases 250,000

Cash received from account customers 1,500,000

Cash payment to trade creditors 1,200,000

Required:

Compute for the balances of these accounts on December 31, 2X20 (2 items x 10 points).

Total gross sales P2,062,000

Total gross purchases P1,185,000

Accounts receivable P370,000

Collection of Accounts receivable 1,500,000

Sales return (80,000-50,000) 30,000

Sales discounts 20,000

Accounts written-off 60,000

Recovery of accounts written off (18,000) 42,000

Total P1,962,000

Less: Note payable-trade 200,000

Sales on account 1,762,000

Cash sales 300,000

Total Gross Sales P2,062,000

Accounts receivable P150,000

Payments of notes payable 1,200,000

Purchase return (80,00030,000) 50,000

Purchase discount 35,000

Total P1,435,000

Less Notes payable trade 200,000

Notes payable bank 300,000 (500,000)

Cash purchase 250,000

Total Gross Purchase P1,185,000

Rubric for grading:

PERFORMANCE INDICATORS POINTS

Correct accounts and amounts used 6

Computed final amounts are correct/balanced 4

TOTAL 10

01 eLMS Activity 2 *Property of STI

Page 1 of 1

You might also like

- Total Gross Sales Total Gross PurchasesDocument2 pagesTotal Gross Sales Total Gross PurchasesMaui0% (1)

- 01 Elms Activity 2 Ia3Document1 page01 Elms Activity 2 Ia3Jen DeloyNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- DELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSDocument2 pagesDELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSLoren's Acads AccountNo ratings yet

- Thompson Corporation: InstructionsDocument7 pagesThompson Corporation: InstructionsrahmawNo ratings yet

- 01 Quiz On Topic 02 With Answer KeyDocument7 pages01 Quiz On Topic 02 With Answer KeyNye NyeNo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDocument17 pagesA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONo ratings yet

- Bayer Lamp CompanyDocument5 pagesBayer Lamp CompanyTrisha Mae CorpuzNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- Credo CompanyDocument2 pagesCredo CompanyYan TagleNo ratings yet

- CH 3 In-Class Exercises SOLUTIONS CorrectedDocument2 pagesCH 3 In-Class Exercises SOLUTIONS CorrectedAbdullah alhamaadNo ratings yet

- Activity Review StatementDocument5 pagesActivity Review Statementangel ciiiNo ratings yet

- Ratios QDocument1 pageRatios Qkashif.ali60001No ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Pa12 Trần Khánh Vy Hw Ch5Document5 pagesPa12 Trần Khánh Vy Hw Ch5Vy Tran KhanhNo ratings yet

- 01 ELMS Activity 3Document2 pages01 ELMS Activity 3Gonzaga FamNo ratings yet

- Accounting Chap 5Document6 pagesAccounting Chap 5Nguyễn Ngọc MaiNo ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Assignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMDocument5 pagesAssignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMMarinella LosaNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Document8 pages2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemENIDNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- Ia Assignment 2Document2 pagesIa Assignment 2Shekinah SesbrenoNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- Mock Test PreparationDocument6 pagesMock Test PreparationHà Quảng TâyNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Comprehensive IncomeDocument2 pagesComprehensive IncomeLeomar CabandayNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesDocument10 pagesFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousNo ratings yet

- For Lecturers - Interpretation of FS - Ratio Analysis - Example, Exercises, SolutionsDocument13 pagesFor Lecturers - Interpretation of FS - Ratio Analysis - Example, Exercises, SolutionsdimniousNo ratings yet

- PA10 Nguyen Ngoc Thanh Nhi HW CH5Document4 pagesPA10 Nguyen Ngoc Thanh Nhi HW CH5Minh Anh NguyễnNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesRusselle Therese DaitolNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Seatwork Ratio AnalysisDocument2 pagesSeatwork Ratio AnalysisMARIBEL SANTOSNo ratings yet

- Emanuel Swedenborg Menny Es PokolDocument7 pagesEmanuel Swedenborg Menny Es PokolImre VíghNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (Q4W5-7)Document6 pagesFundamentals of Accountancy, Business and Management 1 (Q4W5-7)tsuki100% (1)

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Assignment - Cash FlowsDocument9 pagesAssignment - Cash FlowsArshad ChaudharyNo ratings yet

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- Quiz 1Document2 pagesQuiz 1Leonie Jhoy Concepcion MillanesNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Untitled Document - EditedDocument3 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument8 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- GBERMICDocument2 pagesGBERMICGonzaga FamNo ratings yet

- Untitled Document - EditedDocument5 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- 01 ELMS Activity 1Document2 pages01 ELMS Activity 1Gonzaga FamNo ratings yet

- Jasper Jones - EditedDocument1 pageJasper Jones - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument5 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument3 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument2 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- 01 ELMS Activity 3Document2 pages01 ELMS Activity 3Gonzaga FamNo ratings yet

- Untitled Document - EditedDocument3 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument1 pageUntitled Document - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument3 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- Untitled Document - EditedDocument2 pagesUntitled Document - EditedGonzaga FamNo ratings yet

- BibliographyDocument14 pagesBibliographyshrikrushna javanjalNo ratings yet

- New Approaches To SME Finance Using Bank Account Information (Big Data)Document19 pagesNew Approaches To SME Finance Using Bank Account Information (Big Data)ADBI EventsNo ratings yet

- Deposit Insurance System in BangladeshDocument2 pagesDeposit Insurance System in BangladeshSohel RanaNo ratings yet

- Isb540 - HiwalahDocument16 pagesIsb540 - HiwalahMahyuddin Khalid100% (1)

- 11 Quiz 1 (Trade)Document2 pages11 Quiz 1 (Trade)Melanie PermijoNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument7 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancelalit JainNo ratings yet

- Unit 29: The Money System: D. Lines of Credit Accessible With Credit CardsDocument7 pagesUnit 29: The Money System: D. Lines of Credit Accessible With Credit CardsMinh Châu Tạ ThịNo ratings yet

- History of CryptocurrencyDocument3 pagesHistory of CryptocurrencyBunda DungaNo ratings yet

- Credit Cases CompilationDocument65 pagesCredit Cases CompilationCyrusNo ratings yet

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDocument2 pagesUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- Practice Quiz 5 Module 3 Financial MarketsDocument5 pagesPractice Quiz 5 Module 3 Financial MarketsMuhire KevineNo ratings yet

- Maputim ProblemDocument2 pagesMaputim ProblemRowel Dela CruzNo ratings yet

- AssignmDocument7 pagesAssignmGeorgeAruNo ratings yet

- Marty SweetenDocument2 pagesMarty SweetenmartysweetenpNo ratings yet

- E StatementDocument6 pagesE Statementfislam1631No ratings yet

- I.K. Gujral Punjab Technical University Jalandhar, KapurthalaDocument3 pagesI.K. Gujral Punjab Technical University Jalandhar, Kapurthalaayush negiNo ratings yet

- Priority Payment: Debit Account and Beneficiary DetailsDocument3 pagesPriority Payment: Debit Account and Beneficiary DetailsShohag RaihanNo ratings yet

- Ifr 11 23 2019 PDFDocument108 pagesIfr 11 23 2019 PDFKaraNo ratings yet

- Disbursement Voucher: Department of Agrarian Reform Iv-ADocument36 pagesDisbursement Voucher: Department of Agrarian Reform Iv-AThea TrinidadNo ratings yet

- Case Study: PaparaDocument6 pagesCase Study: PaparaderyaNo ratings yet

- Indian Financial System Chapter 1Document16 pagesIndian Financial System Chapter 1Rahul GhosaleNo ratings yet

- Bim NotesDocument12 pagesBim NotesBasudev SahooNo ratings yet

- A STUDY ON LOAN MANAGEMENT OF NEPAL BANK LIMITED AND AGRICULTURAL DEVELOPMENT BANK LIMITED1stDocument7 pagesA STUDY ON LOAN MANAGEMENT OF NEPAL BANK LIMITED AND AGRICULTURAL DEVELOPMENT BANK LIMITED1stOmisha KhatiwadaNo ratings yet

- "A Study On Cryptocurrency in India - Boon or Bane": Mr.J.P.Jaideep,, Mr. K.Rao Prashanth JyotyDocument6 pages"A Study On Cryptocurrency in India - Boon or Bane": Mr.J.P.Jaideep,, Mr. K.Rao Prashanth JyotyJagan MbaNo ratings yet

- Assignment 3: Notes ReceivableDocument2 pagesAssignment 3: Notes ReceivableRodlyn LajonNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- Time Value of Money: Abm5 - Business FinanceDocument34 pagesTime Value of Money: Abm5 - Business FinanceBarbie BleuNo ratings yet

- PLDT OctoberDocument6 pagesPLDT OctoberAkosi RizNo ratings yet

- Mathematics of Investments: Simple Interest and Simple DiscountDocument43 pagesMathematics of Investments: Simple Interest and Simple DiscountremelynNo ratings yet

- Important Banking Awareness QuestionsDocument29 pagesImportant Banking Awareness QuestionsSelvi balanNo ratings yet