Professional Documents

Culture Documents

Ratios Q

Uploaded by

kashif.ali60001Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios Q

Uploaded by

kashif.ali60001Copyright:

Available Formats

Part 9 ● An introduction to financial analysis

➔ 39.10 You are to study the following financial statements for two businesses that operate in the same

industry and then answer the questions which follow.

Financial Statements

Business J Business K

£ £ £ £

Income Statements

Sales 472,000 695,000

Less Cost of goods sold

Opening inventory 51,000 62,000

Add Purchases 264,000 401,000

Less Closing inventory ,000) 251,000) 0,000) 413,000)

Gross profit 221,000 282,000

Less Depreciation 12,000 16,000

Wages, salaries and commission 135,000 151,000

Other expenses 36,000 183,000) 47,000 214,000)

Net profit 8,000 8,000

Balance Sheets

Non-current assets

Equipment at cost 120,000 160,000

Less Accumulated depreciation 0,000) 70,000 0,000) 130,000

Current assets

Inventory 64,000 50,000

Trade receivables 68,000 123,000

Bank 15,000 147,000 5,000 178,000

Total assets 217,000 308,000

Current liabilities

Trade payables ,000) ,000)

Net assets 151,000 209,000

Financed by:

Capitals

Balance at start of year 148,000 221,000

Add Net profit 38,000 68,000

Less Drawings ,000) 80,000)

Total capital 151,000 209,000

Required:

a) Calculate the following ratios for each business:

i) gross profit as percentage of sales;

ii) net profit as percentage of sales;

iii) expenses as percentage of sales;

iv) inventory turnover;

v rate of return of net profit on capital employed use the average of the capital account for

this purpose);

vi) current ratio;

vii) acid test ratio;

viii) trade receivable days;

ix) trade payable days.

b omment on the ratios you have calculated in a) and suggest some possible reasons for the differ-

ences and similarities between the businesses indicated by your figures.

678

M39 Frank Wood's Business Accounti 65435.indd 678 31/03/2021 07:41

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesDocument10 pagesFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousNo ratings yet

- Case Study 1Document2 pagesCase Study 1ruruNo ratings yet

- For Lecturers - Interpretation of FS - Ratio Analysis - Example, Exercises, SolutionsDocument13 pagesFor Lecturers - Interpretation of FS - Ratio Analysis - Example, Exercises, SolutionsdimniousNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Cash Flow Statement for 2017 ProjectDocument2 pagesCash Flow Statement for 2017 ProjectShakil ShekhNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Zach Industries Financial Ratio AnalysisDocument2 pagesZach Industries Financial Ratio AnalysisCarla RománNo ratings yet

- Ratio Analysis (Divya Jadi Booti)Document85 pagesRatio Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- ABC Company financial statementsDocument3 pagesABC Company financial statementsADRIANO, Glecy C.75% (8)

- AsdfaDocument2 pagesAsdfaKevin T. OnaroNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMelanie SamsonaNo ratings yet

- Financial Ratios and Analysis of XYZ CompanyDocument4 pagesFinancial Ratios and Analysis of XYZ CompanyMa Theresa MaguadNo ratings yet

- Additional Cash Flow Problems QuestionsDocument3 pagesAdditional Cash Flow Problems QuestionsChelle HullezaNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- ADVANCED ACCOUNTING 2CDocument5 pagesADVANCED ACCOUNTING 2CHarusiNo ratings yet

- Excess Cash or Need To Borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800Document3 pagesExcess Cash or Need To Borrow 111,300 297,600 (155,100) (22,800) 118,500 187,800Marjon0% (1)

- Accountancy Auditing 2018Document7 pagesAccountancy Auditing 2018Abdul basitNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- TutoriaL 05-Financial Ratios PDFDocument6 pagesTutoriaL 05-Financial Ratios PDFKhiren MenonNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Poa T - 13Document3 pagesPoa T - 13SHEVENA A/P VIJIANNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- Overall TemplateDocument5 pagesOverall TemplateUsman GhaniNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Accountancy-I Subjective PDFDocument4 pagesAccountancy-I Subjective PDFM Umar MughalNo ratings yet

- Accountancy and Auditing-2018Document6 pagesAccountancy and Auditing-2018Aisar Ud DinNo ratings yet

- Brewer Chapter 13Document7 pagesBrewer Chapter 13Atif RehmanNo ratings yet

- Accounting Chap 5Document6 pagesAccounting Chap 5Nguyễn Ngọc MaiNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Advanced Costing and Auditing ProblemsDocument5 pagesAdvanced Costing and Auditing ProblemsOur Beatiful Waziristan OfficialNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Non-Integrated Cost AccountsDocument20 pagesNon-Integrated Cost Accountsriya thakurNo ratings yet

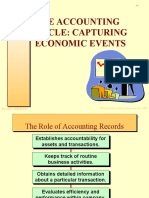

- The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinDocument51 pagesThe Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/Irwinazee inmixNo ratings yet

- Budgeting guide with tips and templatesDocument3 pagesBudgeting guide with tips and templatesMarielle CastañedaNo ratings yet

- Finance Group AssignmentDocument7 pagesFinance Group AssignmentAreej AJNo ratings yet

- Week 1 Weygandt Financ Ch01Document61 pagesWeek 1 Weygandt Financ Ch01Ananda KurniawanNo ratings yet

- PC1 eDocument74 pagesPC1 esuksesNo ratings yet

- Dion Global Solutions LimitedDocument10 pagesDion Global Solutions LimitedArthurNo ratings yet

- Case The Super ProjectDocument6 pagesCase The Super ProjectpaulNo ratings yet

- Marriott financial strategy analysisDocument9 pagesMarriott financial strategy analysisZaim Zain100% (2)

- Finiii MaDocument311 pagesFiniii MamanishaNo ratings yet

- Profit and LossDocument23 pagesProfit and LossANDREA DEINLANo ratings yet

- IND AS 32, 107, 109 (With Questions & Answers)Document69 pagesIND AS 32, 107, 109 (With Questions & Answers)Suraj Dwivedi100% (1)

- Balance Sheet AuditDocument10 pagesBalance Sheet AuditFathiah HamidNo ratings yet

- Managerial Accounting 10th Edition Hilton Solution ManualDocument11 pagesManagerial Accounting 10th Edition Hilton Solution ManualAlfie33% (6)

- ACCOUNTANCY Test 2Document2 pagesACCOUNTANCY Test 2krishnansivanNo ratings yet

- HHDocument6 pagesHHJoyce BusaNo ratings yet

- SAP Shortcut KeyDocument24 pagesSAP Shortcut KeySAURABH SINHANo ratings yet

- MODULE 2 - BUSINESS ACCOUNTING RevisedDocument16 pagesMODULE 2 - BUSINESS ACCOUNTING RevisedArchill YapparconNo ratings yet

- SHAREHOLDERS EQUITY EXPLAINEDDocument45 pagesSHAREHOLDERS EQUITY EXPLAINEDJeong malyow0% (1)

- Ben & Jerry's Takeover AnalysisDocument3 pagesBen & Jerry's Takeover Analysisarie mardiansyahNo ratings yet

- Questions Related To Project Segment ReportDocument14 pagesQuestions Related To Project Segment ReportOm Prakash Sharma100% (1)

- Profit Prior To IncorporationDocument12 pagesProfit Prior To Incorporationhk7012004No ratings yet

- MBA - Full Time (Regular) - Regulation & Syllabus: Bharathiar University: Coimbatore-46Document59 pagesMBA - Full Time (Regular) - Regulation & Syllabus: Bharathiar University: Coimbatore-46RamkumarNo ratings yet

- FI504 Case Study 1 - The Complete Accounting Cycle RevisedDocument16 pagesFI504 Case Study 1 - The Complete Accounting Cycle RevisedBrittini Beyondcompare BridgesNo ratings yet

- Intangible AssetsmarykellyDocument7 pagesIntangible AssetsmarykellyAshura ShaibNo ratings yet

- 61dfcmodule IIDocument14 pages61dfcmodule IIyogesh607No ratings yet

- Conceptual Framework For Financial Reporting Part 1Document32 pagesConceptual Framework For Financial Reporting Part 1cornandpurplecrabNo ratings yet

- Sources of Long Term FinanceDocument308 pagesSources of Long Term FinanceVrinda BansalNo ratings yet

- Mid Test IB1708 SE161403 Nguyễn Trọng BằngDocument14 pagesMid Test IB1708 SE161403 Nguyễn Trọng BằngNguyen Trong Bang (K16HCM)No ratings yet

- Bhavya Creators PVT LTD BalanceSheet 2011Document16 pagesBhavya Creators PVT LTD BalanceSheet 2011ghyNo ratings yet