Professional Documents

Culture Documents

Audit Materiality: Session 10

Uploaded by

Abdullah EjazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Materiality: Session 10

Uploaded by

Abdullah EjazCopyright:

Available Formats

Session 10

Audit Materiality

FOCUS

This session covers the following content from the ACCA Study Guide.

B. Planning and Risk Assessment

3. Assessing audit risks

c) Define and explain the concepts of materiality and performance

materiality.

d) Explain and calculate materiality levels from financial information.

Session 10 Guidance

Revise the IFRS definition of materiality and learn the term "performance materiality" (s.1.1).

Understand the concept of materiality in relation to the types of error, their cumulative effect and

different levels (s.1.2–s.1.4).

Understand the considerations which affect the assessment of materiality, paying particular attention

to quantitative (s.2.2) and qualitative (s.2.3) aspects.

(continued on next page)

F8 Audit and Assurance Becker Professional Education | ACCA Study System

Ali Niaz - ali.niaz777@gmail.com

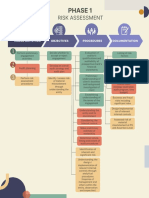

VISUAL OVERVIEW

Objective: To describe the concept of materiality and its relationship with audit risk

and planning.

MATERIALITY

• Concept

• Basic Principles

• Levels of Materiality

• Performance Materiality

• Qualitative Materiality

• Impact

CONSIDERATIONS

• Professional Judgement

• Amount

• Nature

AUDIT PROCEDURES

• Planning

• Effect on Audit Work

• Relationship With Risk

• Changing Materiality

• Documentation

Session 10 Guidance

Understand how materiality affects audit planning (s.3.1) and audit work (s.3.2). Attempt

Examples 1 and 2.

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-1

Ali Niaz - ali.niaz777@gmail.com

Session 10 • Audit Materiality F8 Audit and Assurance (INT)

1 Materiality

1.1 Concept

Materiality (from IASB and IFRS)—information is material if its

omission or misstatement could influence the economic decisions of

users taken on the basis of the financial statements. ... Materiality

depends on the size of the item or error judged in the particular

circumstances of its omission or misstatement. It provides a

threshold or cut-off point rather than being a primary qualitative

characteristic which information must have if it is to be useful.

Performance materiality (from ISA 320)—the amounts set by

the auditor at less than materiality for the financial statements as a

whole to reduce to an appropriately low level the probability that the

aggregate of uncorrected and undetected misstatements exceeds

materiality for the financial statements as a whole.

■ The objective of the auditor is to apply the concept of materiality

appropriately in planning and performing the audit.

■ Materiality is an expression of the relative significance or

importance of a particular matter in the context of the financial

statements as a whole.

● "The objective of an audit is to enable the auditor to express

an opinion whether the financial statements are prepared, in

all material respects, in accordance with an applicable financial

reporting framework." (Session 1)

● "The objective of the auditor is to identify and assess the risks

of material misstatement, whether due to fraud or error, at

the financial statement level and assertion levels, through

understanding the entity and its environment, including the

entity's internal control, thereby providing a basis for designing

and implementing responses to the assessed risks of material

misstatements." (Session 8)

1.2 Basic Principles

The auditor must use his professional judgement to determine

exactly what is, and what is not, material based on:

his understanding of the entity and its environment;

its financial results (transactions and balances) and

*Qualitative

disclosures; and

misstatements include

the requirements of the users of the financial statements. failure to disclose

A rigid materiality model would not be practical because of information as required

the many differences between entities and the users of their by laws, regulations

financial statements. or GAAP (e.g. IFRS

disclosures—but

Materiality may be quantitative (based on values) or remember that IFRSs

qualitative (based on the nature of the matter).* apply only to material

items).

10-2 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

F8 Audit and Assurance (INT) Session 10 • Audit Materiality

Although an individual amount or procedure may not be

material, consideration must be given to the cumulative

impact, for example:

An error in a procedure may not be material, but repeating

(e.g. each month) would indicate a potential material

misstatement.

Individual immaterial pricing errors in raw materials may

result in a cumulative total that will be material especially

when extrapolated through work-in-progress and finished

goods.

Failure to apply an accounting policy (e.g. depreciation

of buildings) may not be material to profit and loss in

any one year, but cumulatively it may become so (e.g. in

accumulated depreciation on the statement of financial

position).

1.3 Levels of Materiality*

Materiality level for the financial statements as a whole

*Materiality at the

financial statement

level must be set, as

must performance

Particular classes of materiality.

transactions, account Determining

materiality for

balances or disclosures,

particular transactions,

if considered appropriate

balances and

disclosures is a

matter of professional

judgement, not a

matter of routine.

Performance

Performance materiality Performance materiality for

materiality will usually

for above, if any assessing risks and planning

be less than other

further audit procedures materiality levels.

■ Having determined a materiality level based on the financial

statements as a whole, the auditor must consider if there are any

particular classes of transactions, balances and disclosures for

which misstatements less than the overall materiality level could

reasonably be expected to influence the economic decisions

of users.

Examples include:

● The effect of laws or regulations (e.g. remuneration, related party

transactions, fraud).

● Key disclosures relating to the industry (e.g. research and

development in a pharmaceutical company).

● Events that would cause particular focus on a specific aspect of a

company's activities (e.g. acquisitions and disposals).

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-3

Ali Niaz - ali.niaz777@gmail.com

Session 10 • Audit Materiality F8 Audit and Assurance (INT)

1.4 Performance Materiality

Planning the audit to consider only individually material

misstatements overlooks the cumulative impact of aggregated

undetected immaterial misstatements exceeding the overall

financial statement materiality level.

The determination of performance materiality is not a simple

mechanical calculation, but draws on:*

the nature of the entity;

the auditor's past experience (e.g. numerous immaterial

*Basically, the

errors found during the course of audit testing);

performance

the use of professional judgement; and materiality level is the

the expectation of misstatements in the current period. materiality that is used

In addition, when considering the aggregate of immaterial when performing audit

tests (e.g. receivables

misstatements found during the audit process (but not

confirmation, purchase

adjusted as immaterial), consideration should be given to

transaction testing,

the performance materiality to ensure that the aggregate of inspection of non-

each class of transaction, balance or disclosure unadjusted current assets).

misstatements is not material.

It may be the overall

financial statement

1.5 Qualitative Materiality materiality, the

Materiality can be measured both quantitatively and individual materiality

qualitatively. The difficulty of determining qualitative for specific classes of

transactions, balances

materiality benchmarks cannot be overlooked.

and disclosures that

Benchmarks include, for example, disclosure requirements are key to the users,

detailed by IFRS and listing disclosure rules. These may be or a separate lower

subdivided into objective disclosures (those that can be easily level calculated to

determined and verified (e.g. disclosures concerning changes take into account

in accounting policies or through prior year errors) and the possibility of

subjective disclosures (risk narrative disclosures (IAS 1) and undetected material

segmental narrative disclosures—see Illustration 2). misstatements.

To judge whether or not disclosures concerning subjective

(and estimated) matters are materially misstated, the auditor

needs a thorough understanding of the entity's business and

sound professional judgement (mixed with a large dose of

professional scepticism).* *Discussing such

disclosure matters with

1.6 Impact those charged with

governance (e.g. the

Materiality will impact when: audit committee) is

planning an audit (through its relationship with audit risk); essential.

determining audit procedures (their nature, timing and

extent);

carrying out the audit (identified errors may affect

materiality levels);

evaluating errors identified during the audit process; and

evaluating misstatements in the financial statements.

10-4 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

F8 Audit and Assurance (INT) Session 10 • Audit Materiality

2 Considerations

2.1 Professional Judgement

Understanding the entity and its environment establishes

a framework within which the auditor is able to apply

professional judgement to determine what is material in the

context of the entity, its environment and control procedures.

Professional judgement is also used to determine the classes

of transactions, balances and disclosures that are material.

What is a material class of transaction (or balance) for one

entity may be immaterial for another (e.g. rental income may

not be material to revenue in a retail company but would be

material to a property management company).

Understanding what is, and is not, material enables the auditor

to consider the nature, timing and extent of audit procedures to

apply (e.g. sampling, substantive analytical procedures,

stratification) and what to apply them to, to reduce audit risk

to an acceptably low level.

2.2 Amount (Quantitative Materiality)

In designing the audit plan, the auditor initially sets an

appropriate materiality level so as to detect quantitatively

material misstatements at the financial statement level.

Through understanding the economic decisions of users, lower

materiality levels may also be set based on the classes of

transactions, account balances or disclosures that such users

would consider to be material.

Financial Statement Level Assertion Level

Look at the item in relation to financial Comparing an item to a category as

statements as a whole. For example, a whole (e.g. an inventory error of

compare to: $50,000 compared to total inventory

• revenue; value of $650,000).

• profit before taxation;

• total assets; May be established as a set figure or as

• capital and reserves. a percentage of a total.

Consider in relation to the elements of The error of $50,000 may be considered

the financial statements (e.g. a different material to inventory, but may not be

materiality level for the statement of material to the statement of financial

comprehensive income and the statement position, if inventory as a whole is not

of financial position). a material item.

As a "yardstick", materiality must be relevant to the user

rather than the preparer of financial statements and should

take into account critical points. For example:

profit loss (may be material to employees);

net current assets net current liabilities

(may be material to investors).

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-5

Ali Niaz - ali.niaz777@gmail.com

Session 10 • Audit Materiality F8 Audit and Assurance (INT)

The auditor must also take into account that some balances

are capable of "precise determination" and dictated by law

and regulations, while others are not and are determined by

opinion and judgement rather than fact.

Precise Determination Use of Opinion/Judgement

For example, directors' emoluments and For example, bad debt allowance, contingent

share capital. liabilities and asset useful lives.

Any error (however small) may be The depreciation charge based on five years

considered material and adjusted, may be material to profit and loss, but if

especially as the precise amount is based on six years it may not be: five or six

required to be disclosed by law. years is a matter of opinion and judgement.

Both could be equally acceptable.

Some reasonable degree of latitude is

acceptable.

2.3 Nature (Qualitative Materiality)

The nature of a misstatement (i.e. qualitative factors) must

be considered when determining whether the misstatement is

material.

Mistatements are more likely to be considered material

when they:

Affect trends in profitability or mask a change in trend, or

change a loss into profit (or vice versa);

Affect compliance with loan covenants, contracts or

regulatory provisions;

Increase management compensation or indicate a pattern of

management bias;

Involve fraud;

Affect significant financial statement elements.

Some transactions are material by nature, such as directors

transactions.

*The increased complexity of disclosure requirements (e.g. under

IFRS) and recent developments in corporate governance have

resulted in increased difficulty for auditors in determining whether

a particular disclosure is materially misstated (e.g. where directors

have to give a business review including risks). A significant element

of this would be determined by the directors' interpretation of past

and future events and risks, making the disclosure subjective (and

thus making it more difficult to determine materiality).

10-6 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

F8 Audit and Assurance (INT) Session 10 • Audit Materiality

3 Audit Procedures

3.1 Planning

■ In planning the audit, the auditor makes judgements about the

size of misstatements that will be considered material. These

judgements provide a basis for:

● determining the nature, timing and extent of risk assessment

procedures;

● identifying and assessing the risks of material misstatement; and

● determining the nature, timing and extent of further audit

procedures.

Determining materiality involves the exercise of professional

judgement. A percentage is often applied to a chosen

benchmark as a starting point in determining materiality for

the financial statements as a whole.

Factors that may affect the identification of an appropriate

benchmark include the following:*

the elements of the financial statements (e.g. revenue,

expenses, assets, liabilities);

elements that are of particular importance to users (e.g. for *Professional

judgement will also be

the purpose of evaluating financial performance, users may

applied in determining

tend to focus on profit, revenue or net assets);

a percentage or range

the nature of the entity, where the entity is in its life cycle, to be applied to a

and the industry and economic environment in which the chosen benchmark.

entity operates;

the entity's ownership structure and the way it is financed

(for example, if an entity is financed solely by debt rather

than equity, users may put more emphasis on assets, and

claims on them, than on the entity's earnings); and

the relative volatility of the benchmark.

Past practice has, over time, established general percentage

guidelines for the calculation of an initial materiality level at

the planning stage. For example:*

5–10% net profit before taxation

1–2% net assets *Note that the ISA

½–1% total assets does not specify any

½–1 % revenue particular guidelines or

values. To do so would

In this approach, profit, net assets, total assets and revenue quickly mean that

are considered the prime quantitative elements in the financial professional judgement

statements. The auditor then uses professional judgement to would not be used.

determine:

which element is the prime driver for materiality, or, more

usually, which combination; and

where, within the range, to set materiality.

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-7

Ali Niaz - ali.niaz777@gmail.com

Session 10 • Audit Materiality F8 Audit and Assurance (INT)

Illustration 1 Benchmark

High-turnover, low-margin operations would probably use revenue as

the benchmark as this would be the key to their success.

Industrial entities would typically use assets and revenue as

benchmarks, with profits as an indicator within the range suggested

by assets and revenue.

Entities that are asset-based (e.g. in property management and

development) would use assets as the benchmark.

Example 1 Planning Materiality

Turnover $5,000,000

Total assets $6,250,000

Profit before tax $417,000

Required:

(a) Commenting on the suitability of setting a materiality level for

planning purposes at:

(i) $20,000

(ii) $40,000

(iii) $100,000

(b) Justify a materiality level which you consider to be more suitable

(if any).

Solution

(a) Suitability of levels

(i) $20,000

(ii) $40,000

(iii) $100,000.

(b) Recommendation

10-8 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

F8 Audit and Assurance (INT) Session 10 • Audit Materiality

3.2 Effect on Audit Work

All matters that are identified as being material must be

subject to detailed audit work (e.g. tested in detail). The

auditor must then use his judgement in dealing with the

remaining items (e.g. sampling or analytical procedures).

Illustration 2 Materiality Level

Having set a materiality level for the financial statements as a

whole, the auditor may (through judgement and expectations from

past experience of there being various errors in the transactions

and balances) set separate performance materiality levels for

transactions, assets and liabilities (e.g. 50%, 75% and 50%) of the

financial statement materiality level when considering substantive

testing.

Thus all balances greater than the performance materiality level will

be tested with the remaining items in the sample being selected

using, for example, random selection.

If sample sizes are calculated using a materiality level, the

performance materiality level would be used.

Example 2 Trade Receivables

Trade receivables total approximately $210,000, made up as follows:

Value Range Number of Total

$000 Balances $000

10-15 2 22.3

5-10 6 41.5

1-5 40 87.0

0-1 89 59.6

137 210.4

Prepayments amount to $16,450.

No material misstatements were found in the previous year's audit.

Required:

Suggest how a financial statement materiality level of $25,000 may affect audit

procedures on trade receivables and prepayments.

Solution

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-9

Ali Niaz - ali.niaz777@gmail.com

Session 10 • Audit Materiality F8 Audit and Assurance (INT)

3.3 Relationship With Audit Risk

The relationship between materiality and the level of audit

risk is described as inverse: as the materiality level decreases,

audit risk increases (and vice versa).

The auditor compensates for this increase in audit risk by

either:

reducing control risk (if possible) and carrying out extended

or additional tests of the effectiveness of controls; or

reducing detection risk by modifying the nature, timing and

extent of planned substantive procedures (i.e. increasing

the level of audit work).

Illustration 3 Materiality Level

and Audit Risk

If, for a given population, the materiality level is lowered, more items

will be greater than the materiality level.

In this case, more items can be considered as potential material

errors, which, if left untested, increases audit risk.

So, by testing all items greater than performance materiality (in this

example there will be more of them, hence more work) the level of

audit risk can be reduced back to an acceptable level.

3.4 Changing Materiality as

the Audit Progresses

Setting the materiality level for the financial statements at

the planning stage of the audit only takes into account the

understanding, transactions, balances and disclosures known

at that stage. As the audit progresses, information obtained

and evidence gathered, if known at the planning stage, may

have resulted in a different determination of materiality (and

audit approach).

As material matters are determined, the auditor must consider

their effect on the performance materiality (quantitative

factors) and the nature, timing and extent of further audit

procedures (quantitative and qualitative factors).

Illustration 4 Changing Materiality

Level

During the course of an audit, material overstatements in the

quantity and valuation of inventory are noted. On reworking the

original financial statement materiality calculations, the materiality

level has decreased.

Audit risk will increase and further testing may need to be carried out

(e.g. larger sample sizes or additional items now greater than the

materiality level will need to be tested).

The auditor will need to use professional judgement to determine if

a higher level of testing is required on other balances and the effect

this will have on performance materiality.

10-10 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

F8 Audit and Assurance (INT) Session 10 • Audit Materiality

3.5 Documentation

As discussed in Session 6, the auditor must document all

matters to support the audit opinion, especially those involving

the use of professional judgement.

Example 3 Documentation

List the key matters that should be documented in relation to materiality.

Solution

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-11

Ali Niaz - ali.niaz777@gmail.com

Summary

Materiality is the expression of the relative significance or importance of a particular matter

in relation to the financial statements as a whole.

Materiality may be set for particular transactions, balances and disclosures for which

misstatements less than the overall materiality level may influence the decisions of users.

The auditor also sets performance materiality (at less than materiality for the financial

statements as whole) to use in performing audit tests.

Factors which affect the assessment of materiality include the economic decisions of users,

professional judgement, quantitative amounts and qualitative aspects.

Overall materiality is a matter of professional judgement based initially on a percentage

applied to a chosen benchmark.

All material matters must be subject to substantive audit procedures.

There is an "inverse" relationship between audit risk and materiality. The amount which is

considered to be material must be decreased as the risk of misstatement increases.

Session 10 Quiz

Estimated time: 10 minutes

1. Define materiality. (1)

2. Explain the concept of performance materiality. (1.4)

3. Explain the difference between quantitative and qualitative materiality. (2)

10-12 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

Session 10

EXAMPLE SOLUTIONS

Solution 1—Planning Materiality

(a) Suitability of Levels

(i) $20,000: This is likely too low as it falls below the lower limits for

turnover, total assets and profit before tax.

(ii) $40,000: This is more suitable in that it is within the percentage

ranges for turnover and profit before tax. However, it may still

be regarded as too low in relation to the statement of financial

position.

(iii) $100,000: Although suitable for the audit of the statement of

financial position, this is likely to be considered too high for

classes of transactions. Material errors in the statement of

comprehensive income may therefore not be detected by audit

procedures.

(b) Recommendation

This is clearly a matter of judgement; however, as profit before tax is a

function of the make-up of balances and transactions (and at this stage

in the audit only draft), it is more likely that preliminary materiality will

be determined in relation to turnover and/or total assets. As there is

no overlap of these ranges, no one range will satisfy both. Therefore,

an amount could be set to satisfy just one judged on the needs of

users. (For example, if users are more interested in revenues than

assets/liabilities, $50,000 may be appropriate.) Alternatively, an

amount could be set between ranges as a compromise: say, $60,000.

Working

% $000

Turnover ½–1 25–50

Total assets 1–2 62.5–125

Profit before tax 5–10 20.8–41.7

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-13

Ali Niaz - ali.niaz777@gmail.com

Solution 2—Trade Receivables

Trade Receivables

Although there is no one trade account receivable balance greater

than $25,000, the eight largest balances total $63,800 and have

the greatest potential for containing cumulative material error (of

overstatement). These individual balances are likely to be tested

in detail (see Session 24) to take into account the concept of

performance materiality.

The average balance in the range $1,000–$5,000 is $2,100 and the

average balance less than $1,000 is $670. If the profile of these

balances is similar to the previous year's audit, analytical procedures

may be used (see Session 16).

Prepayments

If $16,450 is in line with the prior period, it is unlikely to be

materiality incorrectly stated and audit tests may be limited to an

analytical comparison with the prior year.

Solution 3—Documentation

In relation to materiality, the auditor will be expected to document:

● The materiality level for the financial statements as a whole and

the underlying factors considered in its determination.

● Any materiality levels, if applicable, for particular classes of

transactions, balances and disclosures that are key for the users of

the financial statements (with underlying factors).

● Performance materiality with underlying factors.

● Any revision of any materiality level and the reasons why each

revision was necessary.

● Reasons for any adjustments made that relate to material

misstatements.

● All unadjusted errors and the aggregate of such errors for each

class of transaction, balance and disclosure, with reasons why

each error (and aggregate total) is not considered to be material.

10-14 © 2014 DeVry/Becker Educational Development Corp. All rights reserved.

Ali Niaz - ali.niaz777@gmail.com

NOTES

© 2014 DeVry/Becker Educational Development Corp. All rights reserved. 10-15

Ali Niaz - ali.niaz777@gmail.com

You might also like

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Planning Kaplan Chapter 6: Acca Paper F8 Int Audit and AssuranceDocument38 pagesPlanning Kaplan Chapter 6: Acca Paper F8 Int Audit and Assurancehaddad2020No ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- At.3207-Considering Materiality and Audit RiskDocument5 pagesAt.3207-Considering Materiality and Audit RiskDenny June CraususNo ratings yet

- Information Systems Auditing: The IS Audit Reporting ProcessFrom EverandInformation Systems Auditing: The IS Audit Reporting ProcessRating: 4.5 out of 5 stars4.5/5 (3)

- Updated Slides Introducing The Conceptual FrameworkDocument24 pagesUpdated Slides Introducing The Conceptual FrameworkHunal Kumar MautadinNo ratings yet

- F8-17 Accounting EstimatesDocument10 pagesF8-17 Accounting EstimatesReever RiverNo ratings yet

- Lecture 21 - Standards On Auditing (SA 320 and 402) PDFDocument6 pagesLecture 21 - Standards On Auditing (SA 320 and 402) PDFAruna RajappaNo ratings yet

- AT.109 - Materiality and RisksDocument7 pagesAT.109 - Materiality and Risksandrew dacullaNo ratings yet

- F8-30 The Auditor's Report On Financial StatementsDocument18 pagesF8-30 The Auditor's Report On Financial StatementsReever RiverNo ratings yet

- AT - Materiality and RisksDocument7 pagesAT - Materiality and RisksRey Joyce AbuelNo ratings yet

- Pre0131 Midterm Reviewer - Pdf-MaterialityDocument2 pagesPre0131 Midterm Reviewer - Pdf-MaterialityEliny CruzNo ratings yet

- Resumen Capitulo 2Document4 pagesResumen Capitulo 2Lucho EnriqueNo ratings yet

- Nature of AccountingDocument39 pagesNature of AccountinghotpokerchipsNo ratings yet

- Conceptual Frame Work-CAP IIDocument9 pagesConceptual Frame Work-CAP IIbinuNo ratings yet

- Cfas Chapter 2Document55 pagesCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- Materiality, Misstatements and Reporting Part I: ISA Implementation Support ModuleDocument14 pagesMateriality, Misstatements and Reporting Part I: ISA Implementation Support ModulelloydNo ratings yet

- Going Concern: Session 31Document14 pagesGoing Concern: Session 31Abdullah EjazNo ratings yet

- Cost Accounting (Chapter 1-3)Document5 pagesCost Accounting (Chapter 1-3)eunice0% (1)

- Accounting 1Document146 pagesAccounting 1Touhidul IslamNo ratings yet

- Audit Planning: Auditor's Main ObjectiveDocument7 pagesAudit Planning: Auditor's Main Objectivemarie aniceteNo ratings yet

- Planning The Audit and Development of Audit StrategyDocument38 pagesPlanning The Audit and Development of Audit StrategyReyna Mae ZamoraNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument57 pagesInvesting and Financing Decisions and The Balance Sheetd-fbuser-57033070No ratings yet

- IAASB ISA 315 Revised 2019Document16 pagesIAASB ISA 315 Revised 2019Bianca Marie PedrozoNo ratings yet

- Phase I-Risk Assessment Planning The AudDocument21 pagesPhase I-Risk Assessment Planning The AudGelyn CruzNo ratings yet

- Rapid Review Kieso v1Document12 pagesRapid Review Kieso v1mehmood981460No ratings yet

- Acctg 14 - Midterm Lesson Part3Document21 pagesAcctg 14 - Midterm Lesson Part3NANNo ratings yet

- Chapter 3: Sampling & Materiality: SA 320 - Materiality in Planning & Performing An AuditDocument14 pagesChapter 3: Sampling & Materiality: SA 320 - Materiality in Planning & Performing An AuditlohitacademyNo ratings yet

- Kieso, Weygandt, WarfieldDocument56 pagesKieso, Weygandt, WarfieldShevina Maghari shsnohsNo ratings yet

- Status and Purpose of The Framework, Objective and Qualitative CharacteristicsDocument35 pagesStatus and Purpose of The Framework, Objective and Qualitative CharacteristicsCharmaine Mari OlmosNo ratings yet

- Framework For Accounting & ReportingDocument32 pagesFramework For Accounting & ReportingJason InufiNo ratings yet

- Aa CH10Document26 pagesAa CH10Thuỳ DươngNo ratings yet

- LS 2.90 - PSA 320 Materiality in The Planning and Performing An AuditDocument6 pagesLS 2.90 - PSA 320 Materiality in The Planning and Performing An AuditSkye Lee100% (1)

- Audit and Assurance PrincipleDocument2 pagesAudit and Assurance PrincipleIsabell CastroNo ratings yet

- GROUP 8 - Risk AssessmentDocument1 pageGROUP 8 - Risk AssessmentRhad Lester C. MaestradoNo ratings yet

- Module 1 AUDIT PLANNINGDocument3 pagesModule 1 AUDIT PLANNINGLady BirdNo ratings yet

- "Plans Are Worthless But Planning Is Everything." - Dwight D. EisenhowerDocument4 pages"Plans Are Worthless But Planning Is Everything." - Dwight D. EisenhowerLady BirdNo ratings yet

- The Concept MaterialityDocument27 pagesThe Concept MaterialityemeraldNo ratings yet

- Topic 2 - Conceptual FrameworkDocument36 pagesTopic 2 - Conceptual FrameworkA2T5 Haziqah HousnaNo ratings yet

- 2 Financial Reporting Theory UpdatedDocument52 pages2 Financial Reporting Theory UpdatedSiham OsmanNo ratings yet

- Chapter 2: The Conceptual FrameworkDocument36 pagesChapter 2: The Conceptual FrameworkNida Mohammad Khan AchakzaiNo ratings yet

- Chapter 2 Aau Understanding Materiality Context Financial StatementsDocument4 pagesChapter 2 Aau Understanding Materiality Context Financial StatementsDaysonNo ratings yet

- Basel II Capital Accord SlidesDocument25 pagesBasel II Capital Accord SlidesAamir RazaNo ratings yet

- Lu - Valuation Challenges Credit Institutions Investment Firms - 03072015Document17 pagesLu - Valuation Challenges Credit Institutions Investment Firms - 03072015Simon AltkornNo ratings yet

- Lecture 1Document38 pagesLecture 1Preet LohanaNo ratings yet

- Audit of Financial StatementsDocument69 pagesAudit of Financial StatementsFazlihaq DurraniNo ratings yet

- 1 - Overview of AuditingDocument13 pages1 - Overview of AuditingZooeyNo ratings yet

- F2-17 Capital Budgeting and Discounted Cash Flows PDFDocument28 pagesF2-17 Capital Budgeting and Discounted Cash Flows PDFJaved ImranNo ratings yet

- CR November 2020 Mark PlanDocument31 pagesCR November 2020 Mark PlanZaid AhmadNo ratings yet

- Revised CF Webcast Slides April 2018Document16 pagesRevised CF Webcast Slides April 2018drew aranasNo ratings yet

- Summary NotesDocument2 pagesSummary NotesFar100% (1)

- Standards and The Conceptual Framework Underlying Financial AccountingDocument26 pagesStandards and The Conceptual Framework Underlying Financial AccountingLodovicus LasdiNo ratings yet

- Chap 4 - Audit Planning P2Document14 pagesChap 4 - Audit Planning P2hangNo ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- COA R2019-016 AnnexA GuidelinesDocument56 pagesCOA R2019-016 AnnexA Guidelinesbislig water district67% (3)

- Auditing & Assurance MAC005 Trimester 2 2020 ASSIGNMENTDocument8 pagesAuditing & Assurance MAC005 Trimester 2 2020 ASSIGNMENTKarma SherpaNo ratings yet

- Chapter 2 - Framework - Edited Oct 2022Document26 pagesChapter 2 - Framework - Edited Oct 2022Kim AlyaNo ratings yet

- Welcome To Acc721: Framework For Accounting & ReportingDocument30 pagesWelcome To Acc721: Framework For Accounting & ReportingJason InufiNo ratings yet

- Chapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldDocument36 pagesChapter 2: The Conceptual Framework: Fundamentals of Intermediate Accounting Weygandt, Kieso, and WarfieldMohammed Akhtab Ul HudaNo ratings yet

- External Audit: Session 2Document20 pagesExternal Audit: Session 2Abdullah EjazNo ratings yet

- Non-Current Asse TS: Session 22Document14 pagesNon-Current Asse TS: Session 22Abdullah EjazNo ratings yet

- Using The Work of An Expert: Session 18Document12 pagesUsing The Work of An Expert: Session 18Abdullah EjazNo ratings yet

- Tests of Control: Session 12Document40 pagesTests of Control: Session 12Abdullah EjazNo ratings yet

- Internal Audit: Session 32Document26 pagesInternal Audit: Session 32Abdullah EjazNo ratings yet

- Going Concern: Session 31Document14 pagesGoing Concern: Session 31Abdullah EjazNo ratings yet

- Inventory: Session 23Document22 pagesInventory: Session 23Abdullah EjazNo ratings yet

- 5154 Articles (SBR) Examiners Approach v3Document4 pages5154 Articles (SBR) Examiners Approach v3Htoo HtooNo ratings yet

- Day 1 - Capital Gain TaxDocument20 pagesDay 1 - Capital Gain TaxAbdullah EjazNo ratings yet

- ACCA Exam Approach Webinars September 2020Document3 pagesACCA Exam Approach Webinars September 2020Abdullah EjazNo ratings yet

- Questoin 1Document6 pagesQuestoin 1Abdullah EjazNo ratings yet

- Examiner's Report: Strategic Business Reporting (SBR) July 2020Document7 pagesExaminer's Report: Strategic Business Reporting (SBR) July 2020OzzNo ratings yet

- Question - September 2018 BackgroundDocument6 pagesQuestion - September 2018 BackgroundAbdullah EjazNo ratings yet

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- Details of Sample Watches-Converted (Version 1)Document4 pagesDetails of Sample Watches-Converted (Version 1)Abdullah EjazNo ratings yet

- Retriever June 13Document3 pagesRetriever June 13Abdullah EjazNo ratings yet

- Lark Dec 12Document3 pagesLark Dec 12Abdullah EjazNo ratings yet

- Retriever June 13Document3 pagesRetriever June 13Abdullah EjazNo ratings yet

- Quiz 1 - ACGN PrelimsDocument9 pagesQuiz 1 - ACGN Prelimsnatalie clyde matesNo ratings yet

- Some of The Accounting Recits PointersDocument7 pagesSome of The Accounting Recits PointersJoseNo ratings yet

- Ienergizer Limited 31 March 2019 Execution VersionDocument85 pagesIenergizer Limited 31 March 2019 Execution VersionzvetibaNo ratings yet

- Exam Techniques Articles - Part 2 - Risk - Part 3 - Accounting Issues PDFDocument18 pagesExam Techniques Articles - Part 2 - Risk - Part 3 - Accounting Issues PDFLoveluHoqueNo ratings yet

- At-03: Financial Statements Audits - OverviewDocument70 pagesAt-03: Financial Statements Audits - OverviewMae Danica CalunsagNo ratings yet

- Auditing Theory Chapter 9 Summary NotesDocument10 pagesAuditing Theory Chapter 9 Summary NotesJwyneth Royce DenolanNo ratings yet

- Chapter 8 Con .: Audit Planning and Analytical ProceduresDocument15 pagesChapter 8 Con .: Audit Planning and Analytical Proceduresاحمد العربيNo ratings yet

- International Standard On Auditing (UK) 530: Audit SamplingDocument16 pagesInternational Standard On Auditing (UK) 530: Audit SamplingTaehyung KimNo ratings yet

- Chapter 4 Accounting Concepts and PrinciplesDocument14 pagesChapter 4 Accounting Concepts and PrinciplesAngellouiza MatampacNo ratings yet

- Refference Book 2Document77 pagesRefference Book 2ahmed hindiNo ratings yet

- CFASDocument17 pagesCFASKie Magracia BustillosNo ratings yet

- @catatan Audit Siap MidDocument31 pages@catatan Audit Siap MidEarly Saputra100% (1)

- CFASDocument19 pagesCFASKuroko TetsuyaNo ratings yet

- Audit Handbook For MFIDocument96 pagesAudit Handbook For MFIChirag Vasa100% (1)

- Statutory Audit ChecklistDocument7 pagesStatutory Audit ChecklistRanganathan NRGNo ratings yet

- 1) AFC Club Licensing RegulationsDocument68 pages1) AFC Club Licensing RegulationssaidNo ratings yet

- Auditing TheoryDocument13 pagesAuditing TheoryJamaica DavidNo ratings yet

- Chap 006Document28 pagesChap 006Rafael GarciaNo ratings yet

- Salamatu Chapter 1 3Document33 pagesSalamatu Chapter 1 3Ishmael FofanahNo ratings yet

- Account MCQ PDFDocument93 pagesAccount MCQ PDFsunil kalura100% (1)

- At.2506 Determining MaterialityDocument26 pagesAt.2506 Determining Materialityawesome bloggersNo ratings yet

- Week 5 & 6 Risk Assessment and ResponseDocument53 pagesWeek 5 & 6 Risk Assessment and ResponsefauziahezzyNo ratings yet

- Making Materiality Judgment Practice StatementDocument48 pagesMaking Materiality Judgment Practice StatementwellawalalasithNo ratings yet

- Efficiency GuidanceDocument25 pagesEfficiency GuidanceSalauddin Kader ACCANo ratings yet

- Audit Questions 6Document20 pagesAudit Questions 6Humayun KhanNo ratings yet

- Chapter 3 SolutionsDocument15 pagesChapter 3 Solutionsjohn brown100% (1)

- Aud689 Advanced Auditing Exam February 2021 Suggested SolutionsDocument10 pagesAud689 Advanced Auditing Exam February 2021 Suggested SolutionsAKMAL ASYRAF BIN HASHIM (MOH)No ratings yet

- Auditing Theory 3rd Examination (Answer Key)Document13 pagesAuditing Theory 3rd Examination (Answer Key)KathleenNo ratings yet

- Audit Procedure: A Case Study On ACNABIN-Chartered AccountantsDocument18 pagesAudit Procedure: A Case Study On ACNABIN-Chartered AccountantsAdnanNo ratings yet

- Final Exam AADocument29 pagesFinal Exam AAFungai MajuriraNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)