Professional Documents

Culture Documents

Module 1 AUDIT PLANNING

Uploaded by

Lady BirdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 1 AUDIT PLANNING

Uploaded by

Lady BirdCopyright:

Available Formats

ACCTG 3220: AUDITING IN CIS ENVIRONMENT

AUDIT PLANNING (Lecture #1) To obtain understanding of entity’s

Importance of Audit Planning measurement of performance

“Plans are worthless but planning is everything.” –

Sources of Information

Dwight D. Eisenhower

Review of prior year’s working papers

Even if the auditor or auditing team has already

reviewed the same firm or client with the same Tour of the client’s facilities

internal controls for the current year, it is critical Reading relevant books, periodicals, and

to interview as many workers as possible to other publications

avoid assessment failure. Audit planning should Discussion with people within and outside the

be continuous and cumulative. entity

An engagement that is effectively planned could Reading corporate documents (e.g. minutes

eliminate over-or-under-testing, lead to more of meeting) and financial reports

relevant documentation, and help reduce the Uses of Information Obtained

likelihood of audit failure or a potential Assessing risks and identifying potential

professional liability claim, saving time in the problems

long run. Planning and performing the audit effectively

Understanding the Client and efficiently

PSA 315 Evaluating audit evidence as well as the

Requires the auditor to obtain sufficient reasonableness of client’s representations

understanding of the entity and its environment and estimates

including its internal control Providing better service to the client – focus

Such understanding involves obtaining on adding value to the client not just to

knowledge about the entity’s comply or finish the audit

o Industry, regulatory, and other external

factors, including financial reporting Additional Consideration on New Engagements

framework; - Full PFRS PFRS for SMEs etc A firs-time audit engagement requires more

o Nature of the entity, including its selection work than a repeat engagement. This is

and application of accounting policies; - mngt because there are additional audit

decides the accounting policy; accounting procedures that need to be performed in

standards connection with the opening balances. –

o Objectives and strategies and the related review prior year documentation of papers, fs

business risks that may result in a material etc.

misstatement of the financial statements; - PSA 510 requires the auditor to sufficient

during interview with managers and appropriate audit evidence that:

employees; management letter points The opening balances do not contain

Such understanding involves obtaining misstatements that materially affect the

knowledge about the entity’s current year’s financial statements;

o Measurement and review of the entity’s The prior period’s closing balances have

performance; and been correctly brought forward to the

o Internal Control current period or, when appropriate, have

Importance of Understanding the Client been restated; and

To identify and understand the events, Accounting policies are appropriate and have

transactions and practices that may have a been consistently applied

significant effect on the financial statements

To evaluate the reasonableness of the client’s Understanding the Internal Control

estimates To obtain sufficient understanding of the

To understand entity’s objectives and entity’s internal control systems

strategies, and the related business risks

ACCTG 3220: AUDITING IN CIS ENVIRONMENT

To anticipate the type of potential PSAs do not provide specific guidelines as to

misstatements that can occur in the financial how the allocation should be done. This process

statements is highly subjective and requires the exercise of

great deal of professional judgment.

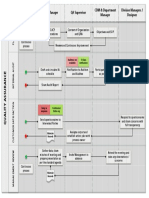

Developing an Overall Audit Strategy

How much evidence to accumulate? Performance of Audit Procedures (substantive

What are the procedures to be performed testing)…

When should the procedures be performed?

Step 3: Compare the aggregate amount of

Materiality uncorrected misstatements with the overall

Information is material if its omission or materiality (Completion Phase)

misstatement could influence economic decision

of users taken on the basis of the financial Performance Materiality

statements. It is the reduced level of materiality that auditors

In audit, materiality may be viewed as: use to both at the fs and account balance level

o The largest amount of misstatement that the When auditing financial statements, it is

auditor could tolerate in the financial common for auditors to exercise prudence by

statements; or setting materiality at an amount lower than the

o The smallest aggregate amount that could overall materiality

misstate any one of the financial statements The extent of the audit procedures is increased

Materiality is a matter of professional judgment thereby reducing the risk that the amount of

and necessarily involves quantitative factors uncorrected and undetected misstatements will

(amount of item in relation to the financial exceed the overall materiality

statements) and qualitative factors (the nature 1M – overall materiality

of misstatement) 65% - percentage of performance materiality

1M * 65% = 650,000 – performance materiality

Using Materiality in an Audit The determination of performance materiality

Step 1: Determine the Overall Materiality – involves the exercise of professional judgment

Financial Statement Level (Planning Phase)

The auditor should determine the amount of Bases that can be used to determine the

misstatement that could be material to the materiality level

financial statements taken as a whole. Annualized financial statements

The auditor should consider materiality in Prior year financial statements; or

terms of the smallest aggregate level of Budgeted financial statements of the current

misstatement that could distort any one of year

the fs.

Statement of Financial position: 500k Audit Risk

Statement of Financial performance: 300k – When designing substantive tests, the auditor

overall materiality level should consider 3 main issues

300k < 500k 1. What level of assurance does the auditor wish to

A common method of estimating the overall attain that the financial statements do not

materiality at the financial statement level is contain material misstatements? As this level of

to multiply a financial statement base (total assurance increases, the scope of the auditor’s

assets, sales, net income etc.) by a certain substantive test also increases (Audit Risk)

percentage. 2. How susceptible is the account to material

Step 2: Determine the Tolerable Misstatement misstatement? As the susceptibility of the

– Account Balance Level (Planning Phase) account to material misstatement increases, the

This is done by allocating the overall materiality scope of the auditor’s substantive tests also

to the financial statement account balances. increases (Inherent Risk); and

ACCTG 3220: AUDITING IN CIS ENVIRONMENT

3. How effective is the client’s internal control in If the entity’s internal control is effective, then

preventing or detecting misstatements? As the the risk that the control will fail to detect or

effectiveness of the client’s internal control prevent material misstatement (control risk)

increases, the scope of the auditor’s decreases.

substantive test decreases. (Control Risk)

Detection Risk

The risk that an auditor may not detect a

Audit Risk Model

material misstatement that exists in an assertion

Audit Risk = Inherent Risk * Control Risk *

The more effective substantive test are, the

Detection Risk

lower misstatement the exists in assertion

Detection Risk – uncontrollable; depends on the

substantive testing used as strategy to decrease Using the Audit Risk Model

this risk 1. Set the acceptable level of Audit Risk (Audit

Planning)

Audit Risk 2. Assess the level of Inherent Risk (Audit Planning)

Refers to the risk that the auditor might be 3. Assess the level of Control Risk (Consideration of

given an appropriate audit opinion on the Internal Control)

financial statements 4. Determine acceptable level of Detection Risk

Audit Risk is the complement of audit assurance (Performing Substantive Tests)

If Audit Risk = 5%

Then, Audit Assurance = 95% - confidence level Acceptable Level of Detection Risk = Acceptable

High confidence lever, low detection risk, Level of Audit Risk

broader substantive testing Inherent Risk * Control Risk

Inherent Risk

From this equation, we can conclude that for

The susceptibility of an account balance or class

a given level of Audit Risk, there is an inverse

of transactions to a material misstatement

relationship between the Acceptable level of

assuming that there were no internal controls.

Detection Risk and the Assessed level of

PSA 315 requires the auditor to assess inherent

Inherent and Control Risk

risk at the financial statement and account

balance or transaction.

Designing Substantive Tests

Factors that may influence the auditor’s Designing substantive tests depends on the

assessment of the risk of misstatement at the acceptable level of detection risk; a after

financial statement level include: consideration to the assessment of inherent

The management integrity and control risks

Management characteristics As the acceptable level of detection risk

Operating characteristics decreases, the assurance provided by

Industry characteristics substantive tests increases.

Factors affecting inherent risk at the account

balance level may include the ff:

Susceptibility of the account to theft

Complexity of calculations related to account

The complexity underlying transactions and

other events

The degree of judgment involved in determining

account balances

Control Risk

Control risk is directly related to the condition of

the entity’s internal control system.

You might also like

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Audit Planning and Materiality in CIS EnvironmentsDocument4 pagesAudit Planning and Materiality in CIS EnvironmentsLady BirdNo ratings yet

- Audit PlanningDocument29 pagesAudit PlanningReshyl HicaleNo ratings yet

- Audit Planning: Auditor's Main ObjectiveDocument7 pagesAudit Planning: Auditor's Main Objectivemarie aniceteNo ratings yet

- Auditing Full Version Sir Jaypee Tinipid Version1Document17 pagesAuditing Full Version Sir Jaypee Tinipid Version1Lovely Rose ArpiaNo ratings yet

- Audit PlanningDocument12 pagesAudit PlanningDeryl GalveNo ratings yet

- Chapter 5 - AUDIT PLANNINGDocument8 pagesChapter 5 - AUDIT PLANNINGAljean Castro DuranNo ratings yet

- Definition and Objective of AuditDocument7 pagesDefinition and Objective of AuditZednem JhenggNo ratings yet

- Chapter 3: Process of Assurance: Planning The AssignmentDocument12 pagesChapter 3: Process of Assurance: Planning The AssignmentShahid MahmudNo ratings yet

- Major 2: Auditing & Assurance Principles: Concept & Application 1Document17 pagesMajor 2: Auditing & Assurance Principles: Concept & Application 1Ma. Katrina BusaNo ratings yet

- Audit PlanningDocument16 pagesAudit PlanningNyaba NaimNo ratings yet

- Audit 1report On Audit Planning of Beximco Pharmaceuticals Ltd.Document29 pagesAudit 1report On Audit Planning of Beximco Pharmaceuticals Ltd.nidal_adnanNo ratings yet

- Audit Planning ProcessDocument7 pagesAudit Planning ProcessJun Guerzon PaneloNo ratings yet

- Module 6: Audit PlanningDocument15 pagesModule 6: Audit PlanningMAG MAGNo ratings yet

- CHAPTER5 AudTheoDocument18 pagesCHAPTER5 AudTheoadarose romaresNo ratings yet

- 5 Audit PlanningDocument31 pages5 Audit PlanningEliza BethNo ratings yet

- Audit Planning Chapter 5Document6 pagesAudit Planning Chapter 5威陈No ratings yet

- Planning The Audit and Development of Audit StrategyDocument38 pagesPlanning The Audit and Development of Audit StrategyReyna Mae ZamoraNo ratings yet

- Planning the Audit WorkDocument2 pagesPlanning the Audit WorkShahid MahmudNo ratings yet

- Function of Audit PlannningDocument4 pagesFunction of Audit PlannningGelly Dominique GuijoNo ratings yet

- Audit & Assurance Individual Assignment: A Report by by Mr. G.L.S Anuradha Sab/Bsc/2020A/We-044Document9 pagesAudit & Assurance Individual Assignment: A Report by by Mr. G.L.S Anuradha Sab/Bsc/2020A/We-044Shehan AnuradaNo ratings yet

- Chapter 5 Audit Planing and Risk Assessment-1Document17 pagesChapter 5 Audit Planing and Risk Assessment-1HamzajuttNo ratings yet

- CHAPTER5Document8 pagesCHAPTER5Anjelika ViescaNo ratings yet

- PSA 520, Analytical Procedures: PSA 320 Revised and Redrafted Materiality in Planning and Performing An Audit, andDocument22 pagesPSA 520, Analytical Procedures: PSA 320 Revised and Redrafted Materiality in Planning and Performing An Audit, andGarcia Alizsandra L.No ratings yet

- Effective Audit PlanningDocument18 pagesEffective Audit PlanningonyrulanamNo ratings yet

- AudTheo Compilation Chap9 14Document130 pagesAudTheo Compilation Chap9 14Chris tine Mae MendozaNo ratings yet

- CH 9 Assessing The Risk of Material MisstatementDocument7 pagesCH 9 Assessing The Risk of Material MisstatementNada An-NaurahNo ratings yet

- Chapter 7 - Audit EvidenceDocument11 pagesChapter 7 - Audit EvidenceUSMAN SARWARNo ratings yet

- Unit 5 Materiality Audit Strategy and PlanDocument24 pagesUnit 5 Materiality Audit Strategy and PlanVincent LyNo ratings yet

- Reviewer Sa AuditDocument6 pagesReviewer Sa Auditprincess manlangitNo ratings yet

- Understanding the Audit ProcessDocument5 pagesUnderstanding the Audit ProcessJoyce Ann CortezNo ratings yet

- CHAPTER 5 - AudTheoDocument4 pagesCHAPTER 5 - AudTheoVicente, Liza Mae C.No ratings yet

- Module 1 PPT Audit Process PDFDocument27 pagesModule 1 PPT Audit Process PDFJasmine LimNo ratings yet

- Assurance Principles Quiz and Audit Planning DiscussionDocument17 pagesAssurance Principles Quiz and Audit Planning Discussionagent2100No ratings yet

- Audit PlanningDocument5 pagesAudit PlanningDeopito BarrettNo ratings yet

- This Study Resource Was: (Select All That Apply.)Document6 pagesThis Study Resource Was: (Select All That Apply.)Jeap JeavNo ratings yet

- Interactive Training On Overall Audit Process and DocumentationDocument19 pagesInteractive Training On Overall Audit Process and DocumentationAmenu AdagneNo ratings yet

- Reviewer AuditDocument9 pagesReviewer AuditElisha BascoNo ratings yet

- Accounting 1Document44 pagesAccounting 1Kristan John ZernaNo ratings yet

- Audit Materiality and RiskDocument5 pagesAudit Materiality and RiskDenny June CraususNo ratings yet

- Audit One, CH 3 - 2022 Version-Student Copy - Revised PDFDocument19 pagesAudit One, CH 3 - 2022 Version-Student Copy - Revised PDFUtban AshabNo ratings yet

- DGs BriefDocument13 pagesDGs BriefAmir UsmanNo ratings yet

- ACCA Paper F 8 AUDIT AND ASSURANCE SERVICES (INTERNATIONAL STREAM) Lecture 3 Audit Planning and Risk AssessmentDocument20 pagesACCA Paper F 8 AUDIT AND ASSURANCE SERVICES (INTERNATIONAL STREAM) Lecture 3 Audit Planning and Risk AssessmentFahmi AbdullaNo ratings yet

- M6 - Audit Planning, Supervision, and MonitoringDocument8 pagesM6 - Audit Planning, Supervision, and MonitoringAlain CopperNo ratings yet

- Assessing and Responding To Risks in A Financial Statement Audi Part IIDocument10 pagesAssessing and Responding To Risks in A Financial Statement Audi Part IIGerman Chavez100% (1)

- Chapter-6: in An Effective Manner. Planning Consists of A Number of Elements. However, They Could Be Summarized AsDocument10 pagesChapter-6: in An Effective Manner. Planning Consists of A Number of Elements. However, They Could Be Summarized AsNasir RifatNo ratings yet

- Chapter 3 General Types of Audit - PPT 123915218Document32 pagesChapter 3 General Types of Audit - PPT 123915218Clar Aaron Bautista100% (2)

- Auditing Book EditedDocument72 pagesAuditing Book EditedJE SingianNo ratings yet

- Week 1 and 2 QuestionsDocument3 pagesWeek 1 and 2 QuestionsANGELI GRACE GALVANNo ratings yet

- Chapter Three Basic Concepts of Audit PlanningDocument20 pagesChapter Three Basic Concepts of Audit PlanningNigussie BerhanuNo ratings yet

- At IntroDocument13 pagesAt IntrocmpaguntalanNo ratings yet

- Tax 2 and Ism ProjetDocument22 pagesTax 2 and Ism ProjetAngelica CastilloNo ratings yet

- Data Analytics: The Key To Risk-Based AuditingDocument11 pagesData Analytics: The Key To Risk-Based AuditingRafik BelkahlaNo ratings yet

- Santos, Paulo Emmanuel S. - 3a7 - Acc5111 DB 1Document4 pagesSantos, Paulo Emmanuel S. - 3a7 - Acc5111 DB 1The Brain Dump PHNo ratings yet

- Audit PlanningDocument21 pagesAudit Planningablay logeneNo ratings yet

- Audit PlanningDocument4 pagesAudit PlanningLoo Bee YeokNo ratings yet

- Lesson 2 - Audit PlanningDocument24 pagesLesson 2 - Audit PlanningrylNo ratings yet

- Lecture 5-Audit MaterialityDocument3 pagesLecture 5-Audit Materialityakii ramNo ratings yet

- AUD 1.2 Client Acceptance and PlanningDocument10 pagesAUD 1.2 Client Acceptance and PlanningAimee Cute100% (1)

- Strat Long QuizDocument8 pagesStrat Long QuizLady BirdNo ratings yet

- Module 3 Auditing in CIS EnvironmentDocument1 pageModule 3 Auditing in CIS EnvironmentLady BirdNo ratings yet

- AIS Webinar ReflectionDocument3 pagesAIS Webinar ReflectionLady BirdNo ratings yet

- Assign 1 DraftDocument2 pagesAssign 1 DraftLady BirdNo ratings yet

- Lec Questions - Assign #1Document3 pagesLec Questions - Assign #1Lady BirdNo ratings yet

- Auditing in A Computerized Environment QuestionsDocument2 pagesAuditing in A Computerized Environment QuestionsLady BirdNo ratings yet

- An Exploration Into Peoples Perception and IntentDocument36 pagesAn Exploration Into Peoples Perception and IntentLady BirdNo ratings yet

- Investors' Attitude Towards Cryptocurrency Differs by GenderDocument9 pagesInvestors' Attitude Towards Cryptocurrency Differs by GenderLady BirdNo ratings yet

- Mathematics: Cryptocurrencies As A Financial Tool: Acceptance FactorsDocument16 pagesMathematics: Cryptocurrencies As A Financial Tool: Acceptance FactorsLady BirdNo ratings yet

- SponsorsDocument4 pagesSponsorsLady BirdNo ratings yet

- Acceptability of Investing in Cryptocurrencies: ArticleDocument22 pagesAcceptability of Investing in Cryptocurrencies: ArticleLady BirdNo ratings yet

- Self Test Financial MarketsDocument6 pagesSelf Test Financial MarketsLady BirdNo ratings yet

- QUIZ W1 W3 MaterialsDocument11 pagesQUIZ W1 W3 MaterialsLady BirdNo ratings yet

- The Giving Tree PDFDocument32 pagesThe Giving Tree PDFCristan Dave ZablanNo ratings yet

- SSRN Id3501549Document77 pagesSSRN Id3501549Lady BirdNo ratings yet

- SponsorsDocument4 pagesSponsorsLady BirdNo ratings yet

- State The Difference Between Positive and Negative Messages 2. Give The Importance of Transforming Plain Texts Into Non-Verbal MaterialsDocument2 pagesState The Difference Between Positive and Negative Messages 2. Give The Importance of Transforming Plain Texts Into Non-Verbal MaterialsLady BirdNo ratings yet

- Final Exam-MKTG 3208: Multiple Choice QuestionsDocument11 pagesFinal Exam-MKTG 3208: Multiple Choice QuestionsLady BirdNo ratings yet

- SponsorsDocument4 pagesSponsorsLady BirdNo ratings yet

- Muddiest Point Sec GovernanceDocument31 pagesMuddiest Point Sec GovernanceLady BirdNo ratings yet

- Prelims Exam - Part II Instruction: Please Be Concise With Your Answers. Limit Your Answers From 100 To 120Document1 pagePrelims Exam - Part II Instruction: Please Be Concise With Your Answers. Limit Your Answers From 100 To 120Lady BirdNo ratings yet

- Answers To Final ExamsDocument42 pagesAnswers To Final ExamsLady BirdNo ratings yet

- Webinar scriptsDocument2 pagesWebinar scriptsNurul FadilaNo ratings yet

- Rais12 SM CH01Document18 pagesRais12 SM CH01Chris SearchNo ratings yet

- Total 2,773,723 2,926,417Document10 pagesTotal 2,773,723 2,926,417Lady BirdNo ratings yet

- Script NyertDocument3 pagesScript NyertLady BirdNo ratings yet

- Opman ExamDocument5 pagesOpman ExamLady BirdNo ratings yet

- STAT 2100 - Final Term ExamDocument4 pagesSTAT 2100 - Final Term ExamLady BirdNo ratings yet

- Facilities 05 Review 1Document2 pagesFacilities 05 Review 1zelestaireNo ratings yet

- Draft - BS 45002-2 2017Document16 pagesDraft - BS 45002-2 2017Ahmet SenlerNo ratings yet

- Corpo Cases 1Document251 pagesCorpo Cases 1KayeCie RLNo ratings yet

- Vda 6-3Document7 pagesVda 6-3julio_0489No ratings yet

- Internal Audit Procedure - Adopted 13082013Document7 pagesInternal Audit Procedure - Adopted 13082013Sayed Abbas100% (1)

- Connie L Becker & Mark L Defond & James Jiambalvo & K R Subramanyam (1998) PDFDocument25 pagesConnie L Becker & Mark L Defond & James Jiambalvo & K R Subramanyam (1998) PDFTheofanny Juna DastriNo ratings yet

- DDO HandbookDocument314 pagesDDO Handbookmohsinkhatri7464% (11)

- HR Audit Materials 179Document6 pagesHR Audit Materials 179amit3125No ratings yet

- Lecture 2 - Audit Plan PDFDocument24 pagesLecture 2 - Audit Plan PDFMoud KhalfaniNo ratings yet

- Home Energy Audit DiyDocument24 pagesHome Energy Audit DiyStewart7000No ratings yet

- Auditing I Chap 1Document14 pagesAuditing I Chap 1Yitera SisayNo ratings yet

- Food Safety Manager's ResumeDocument5 pagesFood Safety Manager's ResumeMarsit Med AmineNo ratings yet

- Resume - CA Ajoy SharmaDocument2 pagesResume - CA Ajoy SharmaCA Ajoy SharmaNo ratings yet

- Opening Meeting PresentationDocument23 pagesOpening Meeting PresentationThupten Gedun Kelvin OngNo ratings yet

- Financial Accounting Auditing - Paper V PDFDocument335 pagesFinancial Accounting Auditing - Paper V PDFRaju P VishwakarmaNo ratings yet

- Psa Updates: The New Auditing StandardsDocument16 pagesPsa Updates: The New Auditing StandardsMae AstovezaNo ratings yet

- The Relationship Between Accounting Information System AIS and The Company Internal ControlDocument34 pagesThe Relationship Between Accounting Information System AIS and The Company Internal ControlMega Pop LockerNo ratings yet

- Financial Reporting Process and Standard Setting BodiesDocument21 pagesFinancial Reporting Process and Standard Setting BodiesBasanta K SahuNo ratings yet

- What Is Basel IIDocument3 pagesWhat Is Basel IIStinkyLinkyNo ratings yet

- ICOLD Bulletin Dam Safety Management-Draft October 2010Document163 pagesICOLD Bulletin Dam Safety Management-Draft October 2010jnfNo ratings yet

- PEFA Regional Government of SomaliDocument172 pagesPEFA Regional Government of SomaliGirmaye HaileNo ratings yet

- Checklist ISO IEC Guide 65-1996 PDFDocument27 pagesChecklist ISO IEC Guide 65-1996 PDFThuHoangThanhNo ratings yet

- AMFI Final Due Diligence 2021Document11 pagesAMFI Final Due Diligence 2021padmaniaNo ratings yet

- IMS Case PresentationDocument2 pagesIMS Case PresentationLakshyaKumarNo ratings yet

- Medical EquipmentDocument48 pagesMedical EquipmentKhalid Khassawneh100% (2)

- ACE Annual Report 2008-09Document64 pagesACE Annual Report 2008-09susegaadNo ratings yet

- PAPS 1001: Computer Information Systems Environment - Stand-Alone Personal ComputersDocument8 pagesPAPS 1001: Computer Information Systems Environment - Stand-Alone Personal ComputersJomaica AmadorNo ratings yet

- Bs en Iso 41001 2018 CompressDocument56 pagesBs en Iso 41001 2018 Compressadrian ursachiNo ratings yet

- Do The Fraud Triangle Components Motivate Fraud in IndonesiaDocument10 pagesDo The Fraud Triangle Components Motivate Fraud in IndonesiaAgung Giantino ManfaNo ratings yet

- ISO9001 QHSE Policy Procedures AuditDocument1 pageISO9001 QHSE Policy Procedures AuditRuel LacopiaNo ratings yet