Professional Documents

Culture Documents

Tugas Personal Ke-3 Minggu 08 / Session 09: ISYE9001 - Engineering Optimization

Tugas Personal Ke-3 Minggu 08 / Session 09: ISYE9001 - Engineering Optimization

Uploaded by

dian wahyuningtyasCopyright:

Available Formats

You might also like

- Fundamental Analysis of Public Sector Banks in India (SBI)Document81 pagesFundamental Analysis of Public Sector Banks in India (SBI)Meraj Ansari60% (5)

- Letter of Appointment Letter For ManagerDocument3 pagesLetter of Appointment Letter For Managerzaw75% (4)

- TP3-W8-S9-R0 (Dhadung P)Document2 pagesTP3-W8-S9-R0 (Dhadung P)Dhadung PrihanantoNo ratings yet

- Decision TreeDocument4 pagesDecision Treeyudhistira iptNo ratings yet

- Decision Analysis:: Choice of The Best AlternativeDocument46 pagesDecision Analysis:: Choice of The Best AlternativeAyda KhadivaNo ratings yet

- ModellingDocument2 pagesModellingnguyenlanquynh985No ratings yet

- Gofer BrokeDocument11 pagesGofer BrokeARUN VIJAYNo ratings yet

- GoferbrokeDocument11 pagesGoferbrokeARUN VIJAYNo ratings yet

- LP Exercise - Alpujarra - Kelompok 4Document6 pagesLP Exercise - Alpujarra - Kelompok 4Gema Fajri AzmiNo ratings yet

- Week 3 - TreePlanDocument4 pagesWeek 3 - TreePlanVieri SuhermanNo ratings yet

- Journal Transactions: Dwyer Delivery ServiceDocument10 pagesJournal Transactions: Dwyer Delivery ServiceClara Saty M LambaNo ratings yet

- 12 Rules For Life An Antidote To ChaosDocument21 pages12 Rules For Life An Antidote To Chaosbastian_wolf0% (1)

- Crude ConductivityDocument15 pagesCrude ConductivityJayaprakash RattiNo ratings yet

- Special Exam Manac 3 Module 1 2023 MemoDocument9 pagesSpecial Exam Manac 3 Module 1 2023 MemoLuciaNo ratings yet

- Material SORDocument2 pagesMaterial SORKrishna RaiNo ratings yet

- PPE Tuto 7Document3 pagesPPE Tuto 7LAVINNYA NAIR A P PARBAKARANNo ratings yet

- State of Nature Alternatives 1 2 3Document10 pagesState of Nature Alternatives 1 2 3Michael Allen RodrigoNo ratings yet

- Alvina Risk Simulation ClassDocument16 pagesAlvina Risk Simulation Classtaneer.gameNo ratings yet

- Success 0.45 Potential Profit $ 500: Which Generator To FundDocument5 pagesSuccess 0.45 Potential Profit $ 500: Which Generator To FundAyda KhadivaNo ratings yet

- AL-IBRAHIM PALACE BOQ - FinalDocument75 pagesAL-IBRAHIM PALACE BOQ - FinalChristopher NiadasNo ratings yet

- Break-Even Analysis - Revision.: A Technique To Help Answer Some Key QuestionsDocument18 pagesBreak-Even Analysis - Revision.: A Technique To Help Answer Some Key QuestionsUncle MattNo ratings yet

- 04 - EngineDocument14 pages04 - Enginephdum23No ratings yet

- X Y Objective 12 4 20 Constraint 1 2 4 20 Constraint 2 5 2 10 X y Solution 0 5Document26 pagesX Y Objective 12 4 20 Constraint 1 2 4 20 Constraint 2 5 2 10 X y Solution 0 5Mavie MolinoNo ratings yet

- McDonalds Farm Part IDocument17 pagesMcDonalds Farm Part IPaul LeeNo ratings yet

- Answer Keys - Excercise QuestionsDocument4 pagesAnswer Keys - Excercise QuestionsHan ZhongNo ratings yet

- Nmr-601 Rev 03 PZV Po 1345 Binzagr Mrp-061 - Copy 22Document1 pageNmr-601 Rev 03 PZV Po 1345 Binzagr Mrp-061 - Copy 22Hajarath AliNo ratings yet

- PR Minggu IniDocument17 pagesPR Minggu IniGloriaDorothyNo ratings yet

- MGMT 298D-2 1.a) Nash Equilibrai Are at Oasis Oasia, and Brews BrewsDocument2 pagesMGMT 298D-2 1.a) Nash Equilibrai Are at Oasis Oasia, and Brews BrewsLiz ParkerNo ratings yet

- W3. Bayes Rule and Decision Tree PDFDocument25 pagesW3. Bayes Rule and Decision Tree PDFHENRIKUS HARRY UTOMONo ratings yet

- Error Lesson WorkingsDocument4 pagesError Lesson WorkingsKiri chrisNo ratings yet

- 2023 EMAC2624 Test 2 MemoDocument3 pages2023 EMAC2624 Test 2 Memoasandantlumayo77No ratings yet

- PG 20 044Document15 pagesPG 20 044Sakshi BakliwalNo ratings yet

- Canotech FormDocument1 pageCanotech Formasfandkamal12345No ratings yet

- Chettinad Cement Factory DetailsDocument49 pagesChettinad Cement Factory DetailsRavi RajaNo ratings yet

- Inventory-Raw Present Totals Date Season Category Bricks Tile (S) Tile (PL) Tile (FR) Gutka MiscDocument17 pagesInventory-Raw Present Totals Date Season Category Bricks Tile (S) Tile (PL) Tile (FR) Gutka MiscAnees GillaniNo ratings yet

- This Budget Is Interactive: INPUT DATA: Your Values in The Unprotected or Highlighted CellsDocument15 pagesThis Budget Is Interactive: INPUT DATA: Your Values in The Unprotected or Highlighted CellsGeros dienosNo ratings yet

- Daily Look Ahead Inspection Log 11-12-22Document1 pageDaily Look Ahead Inspection Log 11-12-22wg NADZNo ratings yet

- ITP - Tyre ShopDocument4 pagesITP - Tyre ShopismailsaziliNo ratings yet

- Ipsas 17 ExampleDocument4 pagesIpsas 17 Examplesenbetotilahun8No ratings yet

- Preliminary ComputationsDocument3 pagesPreliminary ComputationsFarrell DmNo ratings yet

- Financial Statement Analysis Current RatioDocument8 pagesFinancial Statement Analysis Current RatioAdrian MontemayorNo ratings yet

- Session 7A-Salt Harbor Faculty DebriefDocument20 pagesSession 7A-Salt Harbor Faculty Debriefim masterNo ratings yet

- Production System Overview-Ø Ø Ø Ø Ø Ø Ø Ù 2023Document44 pagesProduction System Overview-Ø Ø Ø Ø Ø Ø Ø Ù 2023اسامه محمد نبيلNo ratings yet

- 11 Solutions PDFDocument9 pages11 Solutions PDFKenneth KibataNo ratings yet

- Floor PlanDocument1 pageFloor PlanViktoria YumangNo ratings yet

- CH23-Managment Control System Transfer PricingDocument7 pagesCH23-Managment Control System Transfer PricingamitNo ratings yet

- Heat Balance (Cooler 2)Document4 pagesHeat Balance (Cooler 2)Junaid Mazhar100% (1)

- Assab Steels 705M Machinery Steel: Metal, Ferrous Metal, Alloy SteelDocument2 pagesAssab Steels 705M Machinery Steel: Metal, Ferrous Metal, Alloy SteelMuhammad FikriNo ratings yet

- Session 1 2 Solver Sensitivity AnalysisDocument8 pagesSession 1 2 Solver Sensitivity AnalysisSwadhin SwadeshNo ratings yet

- FAR620 - Jun2023 - S - DR SHUKRIAH SAADDocument9 pagesFAR620 - Jun2023 - S - DR SHUKRIAH SAADNora ArifahsyaNo ratings yet

- Beechcraft Debonair C33 (BE33) : Weight and Balance WorksheetDocument5 pagesBeechcraft Debonair C33 (BE33) : Weight and Balance WorksheetGary RayNo ratings yet

- DecisionAnalysis DRSZDocument99 pagesDecisionAnalysis DRSZmuhdanialNo ratings yet

- Case Study Solution 20% - ImpairmentDocument4 pagesCase Study Solution 20% - ImpairmentSeiniNo ratings yet

- Module A: Discussion QuestionsDocument10 pagesModule A: Discussion Questionskaranjangid17No ratings yet

- Process Sol For StudentsDocument9 pagesProcess Sol For Studentsfernandesjervis8No ratings yet

- CVP AnalysisDocument3 pagesCVP Analysisilyasabdullah984No ratings yet

- Econ 100.1 Practice Problems AnswersDocument3 pagesEcon 100.1 Practice Problems AnswersPamela May NavarreteNo ratings yet

- CF Before Tax 0 1000 1040 1081 1122Document3 pagesCF Before Tax 0 1000 1040 1081 1122Navhin MichealNo ratings yet

- Garcia Luis Unit9Document4 pagesGarcia Luis Unit9Esteban SevillaNo ratings yet

- DSSAB Levy HikeDocument2 pagesDSSAB Levy HikepegspirateNo ratings yet

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Document6 pagesCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Budget Planner PDFDocument1 pageBudget Planner PDFAden BanksNo ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- Satyam Scam: Will PWC Be Punished For Lapses? - Timesofindia-EconomictimesDocument2 pagesSatyam Scam: Will PWC Be Punished For Lapses? - Timesofindia-EconomictimesJagruti NiravNo ratings yet

- Diego V FernandoDocument2 pagesDiego V FernandoIra AgtingNo ratings yet

- Fac4863 103-2021, UnisaDocument135 pagesFac4863 103-2021, UnisasamNo ratings yet

- 94209674Document10 pages94209674Anjo VasquezNo ratings yet

- CGTMSE FAQsDocument19 pagesCGTMSE FAQsVarun DeshpandeNo ratings yet

- The Trial Balance of Steve Mentz Cpa Is Dated March PDFDocument1 pageThe Trial Balance of Steve Mentz Cpa Is Dated March PDFAhsan KhanNo ratings yet

- Chapter-2 Review of LiteratureDocument5 pagesChapter-2 Review of LiteratureRajesh BathulaNo ratings yet

- Faqs Home Loan Plus June 2015 Over 1Document2 pagesFaqs Home Loan Plus June 2015 Over 1Naga RajNo ratings yet

- Palantir Tech Inc - Research ReportDocument1 pagePalantir Tech Inc - Research Reportapi-5547624790% (1)

- Documents To Prepare For An Inspection of DOLEDocument2 pagesDocuments To Prepare For An Inspection of DOLEGilbert A MercadoNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormSourabh ShrivastavaNo ratings yet

- Account Statement: Folio Number: 1017949588Document2 pagesAccount Statement: Folio Number: 1017949588Z Limtsukiu Khiungrü YimchungerNo ratings yet

- LOA Renewal and ExtensionDocument31 pagesLOA Renewal and ExtensionsrinivasNo ratings yet

- Narrative Report GovernmentAccountingDocument2 pagesNarrative Report GovernmentAccountingNiña Blanca LagonNo ratings yet

- Corporate Valuation - 2-V-2 - Module - 2 and 3Document11 pagesCorporate Valuation - 2-V-2 - Module - 2 and 3Ravichandran RamadassNo ratings yet

- A Comparative Study of ELSSDocument4 pagesA Comparative Study of ELSSSilparajaNo ratings yet

- H One (PVT) LTD 20-21-ExemptDocument164 pagesH One (PVT) LTD 20-21-ExemptShehara GamlathNo ratings yet

- Pob SbaDocument20 pagesPob Sbaromariobartley71% (7)

- Soal PBL AKD 1Document3 pagesSoal PBL AKD 1Dita EnsNo ratings yet

- Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditDocument12 pagesLyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditAmie Jane Miranda0% (1)

- The Asset Transfer AgreementDocument3 pagesThe Asset Transfer AgreementJean Marc LouisNo ratings yet

- Three Models of Financial RegulationDocument16 pagesThree Models of Financial RegulationRamjunum RandhirsinghNo ratings yet

- Bond Valuation: Dr. Salman Masood SheikhDocument19 pagesBond Valuation: Dr. Salman Masood SheikhAwais A.No ratings yet

Tugas Personal Ke-3 Minggu 08 / Session 09: ISYE9001 - Engineering Optimization

Tugas Personal Ke-3 Minggu 08 / Session 09: ISYE9001 - Engineering Optimization

Uploaded by

dian wahyuningtyasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas Personal Ke-3 Minggu 08 / Session 09: ISYE9001 - Engineering Optimization

Tugas Personal Ke-3 Minggu 08 / Session 09: ISYE9001 - Engineering Optimization

Uploaded by

dian wahyuningtyasCopyright:

Available Formats

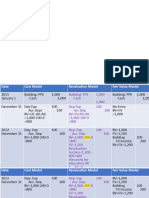

Tugas Personal ke-3

Minggu 08 / Session 09

The PT Geo Teknika (GT) owns a tract of land that may contain oil. A consulting geologist

has reported to management that he believes there is oil with probability of 0.2. Because of

this prospect, another oil company has offered to purchase the land for $120,000. However,

PT GT is considering holding the land in order to drill for oil itself. The cost of drilling is

$150,000. If oil is found, the resulting expected revenue will be $1,050,000, so the

company’s expected profit (after deducting the cost of drilling) will be $900,000. A loss of

$150,000 (the drilling cost) will be incurred if the land is dry (no oil).

Table 1 summarizes these data. Determine the decision of whether to drill or sell based just

on these data.

Table1: Prospective profits for the PT Geo Teknika (GT).

Status of Land Payoff

Alternative Oil Dry

Drill for oil $ 900,000 -$150,000

Sell the land $ 120,000 $ 120,000

Probability of status 0.2 0.8

ISYE9001 - Engineering Optimization

Jawab :

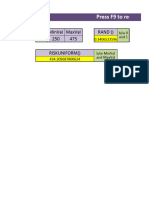

DECISION MAKING WITHOUT EXPERIMENTATION

Status of

Payoff

Land minimum

Alternative Oil Dry

Drill for oil 900 -150 -150

Sell the land 120 120 120 maximin

Probability

0,2 0,80

of status

Status of

Payoff

Land minimum

Alternative Oil Dry

Drill for oil 900 -150 -150

Sell the land 120 120 120 maximum in this column

Prior

0,2 0,80

Probability

maximum

Bayes Decision Rule

E[Payoff (drill)] = 60,00

E[Payoff (sell)] = 120,00

karena pay off drill < pay off sell, maka alternatif action adalah menjual tanah

ISYE9001 - Engineering Optimization

You might also like

- Fundamental Analysis of Public Sector Banks in India (SBI)Document81 pagesFundamental Analysis of Public Sector Banks in India (SBI)Meraj Ansari60% (5)

- Letter of Appointment Letter For ManagerDocument3 pagesLetter of Appointment Letter For Managerzaw75% (4)

- TP3-W8-S9-R0 (Dhadung P)Document2 pagesTP3-W8-S9-R0 (Dhadung P)Dhadung PrihanantoNo ratings yet

- Decision TreeDocument4 pagesDecision Treeyudhistira iptNo ratings yet

- Decision Analysis:: Choice of The Best AlternativeDocument46 pagesDecision Analysis:: Choice of The Best AlternativeAyda KhadivaNo ratings yet

- ModellingDocument2 pagesModellingnguyenlanquynh985No ratings yet

- Gofer BrokeDocument11 pagesGofer BrokeARUN VIJAYNo ratings yet

- GoferbrokeDocument11 pagesGoferbrokeARUN VIJAYNo ratings yet

- LP Exercise - Alpujarra - Kelompok 4Document6 pagesLP Exercise - Alpujarra - Kelompok 4Gema Fajri AzmiNo ratings yet

- Week 3 - TreePlanDocument4 pagesWeek 3 - TreePlanVieri SuhermanNo ratings yet

- Journal Transactions: Dwyer Delivery ServiceDocument10 pagesJournal Transactions: Dwyer Delivery ServiceClara Saty M LambaNo ratings yet

- 12 Rules For Life An Antidote To ChaosDocument21 pages12 Rules For Life An Antidote To Chaosbastian_wolf0% (1)

- Crude ConductivityDocument15 pagesCrude ConductivityJayaprakash RattiNo ratings yet

- Special Exam Manac 3 Module 1 2023 MemoDocument9 pagesSpecial Exam Manac 3 Module 1 2023 MemoLuciaNo ratings yet

- Material SORDocument2 pagesMaterial SORKrishna RaiNo ratings yet

- PPE Tuto 7Document3 pagesPPE Tuto 7LAVINNYA NAIR A P PARBAKARANNo ratings yet

- State of Nature Alternatives 1 2 3Document10 pagesState of Nature Alternatives 1 2 3Michael Allen RodrigoNo ratings yet

- Alvina Risk Simulation ClassDocument16 pagesAlvina Risk Simulation Classtaneer.gameNo ratings yet

- Success 0.45 Potential Profit $ 500: Which Generator To FundDocument5 pagesSuccess 0.45 Potential Profit $ 500: Which Generator To FundAyda KhadivaNo ratings yet

- AL-IBRAHIM PALACE BOQ - FinalDocument75 pagesAL-IBRAHIM PALACE BOQ - FinalChristopher NiadasNo ratings yet

- Break-Even Analysis - Revision.: A Technique To Help Answer Some Key QuestionsDocument18 pagesBreak-Even Analysis - Revision.: A Technique To Help Answer Some Key QuestionsUncle MattNo ratings yet

- 04 - EngineDocument14 pages04 - Enginephdum23No ratings yet

- X Y Objective 12 4 20 Constraint 1 2 4 20 Constraint 2 5 2 10 X y Solution 0 5Document26 pagesX Y Objective 12 4 20 Constraint 1 2 4 20 Constraint 2 5 2 10 X y Solution 0 5Mavie MolinoNo ratings yet

- McDonalds Farm Part IDocument17 pagesMcDonalds Farm Part IPaul LeeNo ratings yet

- Answer Keys - Excercise QuestionsDocument4 pagesAnswer Keys - Excercise QuestionsHan ZhongNo ratings yet

- Nmr-601 Rev 03 PZV Po 1345 Binzagr Mrp-061 - Copy 22Document1 pageNmr-601 Rev 03 PZV Po 1345 Binzagr Mrp-061 - Copy 22Hajarath AliNo ratings yet

- PR Minggu IniDocument17 pagesPR Minggu IniGloriaDorothyNo ratings yet

- MGMT 298D-2 1.a) Nash Equilibrai Are at Oasis Oasia, and Brews BrewsDocument2 pagesMGMT 298D-2 1.a) Nash Equilibrai Are at Oasis Oasia, and Brews BrewsLiz ParkerNo ratings yet

- W3. Bayes Rule and Decision Tree PDFDocument25 pagesW3. Bayes Rule and Decision Tree PDFHENRIKUS HARRY UTOMONo ratings yet

- Error Lesson WorkingsDocument4 pagesError Lesson WorkingsKiri chrisNo ratings yet

- 2023 EMAC2624 Test 2 MemoDocument3 pages2023 EMAC2624 Test 2 Memoasandantlumayo77No ratings yet

- PG 20 044Document15 pagesPG 20 044Sakshi BakliwalNo ratings yet

- Canotech FormDocument1 pageCanotech Formasfandkamal12345No ratings yet

- Chettinad Cement Factory DetailsDocument49 pagesChettinad Cement Factory DetailsRavi RajaNo ratings yet

- Inventory-Raw Present Totals Date Season Category Bricks Tile (S) Tile (PL) Tile (FR) Gutka MiscDocument17 pagesInventory-Raw Present Totals Date Season Category Bricks Tile (S) Tile (PL) Tile (FR) Gutka MiscAnees GillaniNo ratings yet

- This Budget Is Interactive: INPUT DATA: Your Values in The Unprotected or Highlighted CellsDocument15 pagesThis Budget Is Interactive: INPUT DATA: Your Values in The Unprotected or Highlighted CellsGeros dienosNo ratings yet

- Daily Look Ahead Inspection Log 11-12-22Document1 pageDaily Look Ahead Inspection Log 11-12-22wg NADZNo ratings yet

- ITP - Tyre ShopDocument4 pagesITP - Tyre ShopismailsaziliNo ratings yet

- Ipsas 17 ExampleDocument4 pagesIpsas 17 Examplesenbetotilahun8No ratings yet

- Preliminary ComputationsDocument3 pagesPreliminary ComputationsFarrell DmNo ratings yet

- Financial Statement Analysis Current RatioDocument8 pagesFinancial Statement Analysis Current RatioAdrian MontemayorNo ratings yet

- Session 7A-Salt Harbor Faculty DebriefDocument20 pagesSession 7A-Salt Harbor Faculty Debriefim masterNo ratings yet

- Production System Overview-Ø Ø Ø Ø Ø Ø Ø Ù 2023Document44 pagesProduction System Overview-Ø Ø Ø Ø Ø Ø Ø Ù 2023اسامه محمد نبيلNo ratings yet

- 11 Solutions PDFDocument9 pages11 Solutions PDFKenneth KibataNo ratings yet

- Floor PlanDocument1 pageFloor PlanViktoria YumangNo ratings yet

- CH23-Managment Control System Transfer PricingDocument7 pagesCH23-Managment Control System Transfer PricingamitNo ratings yet

- Heat Balance (Cooler 2)Document4 pagesHeat Balance (Cooler 2)Junaid Mazhar100% (1)

- Assab Steels 705M Machinery Steel: Metal, Ferrous Metal, Alloy SteelDocument2 pagesAssab Steels 705M Machinery Steel: Metal, Ferrous Metal, Alloy SteelMuhammad FikriNo ratings yet

- Session 1 2 Solver Sensitivity AnalysisDocument8 pagesSession 1 2 Solver Sensitivity AnalysisSwadhin SwadeshNo ratings yet

- FAR620 - Jun2023 - S - DR SHUKRIAH SAADDocument9 pagesFAR620 - Jun2023 - S - DR SHUKRIAH SAADNora ArifahsyaNo ratings yet

- Beechcraft Debonair C33 (BE33) : Weight and Balance WorksheetDocument5 pagesBeechcraft Debonair C33 (BE33) : Weight and Balance WorksheetGary RayNo ratings yet

- DecisionAnalysis DRSZDocument99 pagesDecisionAnalysis DRSZmuhdanialNo ratings yet

- Case Study Solution 20% - ImpairmentDocument4 pagesCase Study Solution 20% - ImpairmentSeiniNo ratings yet

- Module A: Discussion QuestionsDocument10 pagesModule A: Discussion Questionskaranjangid17No ratings yet

- Process Sol For StudentsDocument9 pagesProcess Sol For Studentsfernandesjervis8No ratings yet

- CVP AnalysisDocument3 pagesCVP Analysisilyasabdullah984No ratings yet

- Econ 100.1 Practice Problems AnswersDocument3 pagesEcon 100.1 Practice Problems AnswersPamela May NavarreteNo ratings yet

- CF Before Tax 0 1000 1040 1081 1122Document3 pagesCF Before Tax 0 1000 1040 1081 1122Navhin MichealNo ratings yet

- Garcia Luis Unit9Document4 pagesGarcia Luis Unit9Esteban SevillaNo ratings yet

- DSSAB Levy HikeDocument2 pagesDSSAB Levy HikepegspirateNo ratings yet

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Document6 pagesCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Budget Planner PDFDocument1 pageBudget Planner PDFAden BanksNo ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- Satyam Scam: Will PWC Be Punished For Lapses? - Timesofindia-EconomictimesDocument2 pagesSatyam Scam: Will PWC Be Punished For Lapses? - Timesofindia-EconomictimesJagruti NiravNo ratings yet

- Diego V FernandoDocument2 pagesDiego V FernandoIra AgtingNo ratings yet

- Fac4863 103-2021, UnisaDocument135 pagesFac4863 103-2021, UnisasamNo ratings yet

- 94209674Document10 pages94209674Anjo VasquezNo ratings yet

- CGTMSE FAQsDocument19 pagesCGTMSE FAQsVarun DeshpandeNo ratings yet

- The Trial Balance of Steve Mentz Cpa Is Dated March PDFDocument1 pageThe Trial Balance of Steve Mentz Cpa Is Dated March PDFAhsan KhanNo ratings yet

- Chapter-2 Review of LiteratureDocument5 pagesChapter-2 Review of LiteratureRajesh BathulaNo ratings yet

- Faqs Home Loan Plus June 2015 Over 1Document2 pagesFaqs Home Loan Plus June 2015 Over 1Naga RajNo ratings yet

- Palantir Tech Inc - Research ReportDocument1 pagePalantir Tech Inc - Research Reportapi-5547624790% (1)

- Documents To Prepare For An Inspection of DOLEDocument2 pagesDocuments To Prepare For An Inspection of DOLEGilbert A MercadoNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormSourabh ShrivastavaNo ratings yet

- Account Statement: Folio Number: 1017949588Document2 pagesAccount Statement: Folio Number: 1017949588Z Limtsukiu Khiungrü YimchungerNo ratings yet

- LOA Renewal and ExtensionDocument31 pagesLOA Renewal and ExtensionsrinivasNo ratings yet

- Narrative Report GovernmentAccountingDocument2 pagesNarrative Report GovernmentAccountingNiña Blanca LagonNo ratings yet

- Corporate Valuation - 2-V-2 - Module - 2 and 3Document11 pagesCorporate Valuation - 2-V-2 - Module - 2 and 3Ravichandran RamadassNo ratings yet

- A Comparative Study of ELSSDocument4 pagesA Comparative Study of ELSSSilparajaNo ratings yet

- H One (PVT) LTD 20-21-ExemptDocument164 pagesH One (PVT) LTD 20-21-ExemptShehara GamlathNo ratings yet

- Pob SbaDocument20 pagesPob Sbaromariobartley71% (7)

- Soal PBL AKD 1Document3 pagesSoal PBL AKD 1Dita EnsNo ratings yet

- Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditDocument12 pagesLyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditAmie Jane Miranda0% (1)

- The Asset Transfer AgreementDocument3 pagesThe Asset Transfer AgreementJean Marc LouisNo ratings yet

- Three Models of Financial RegulationDocument16 pagesThree Models of Financial RegulationRamjunum RandhirsinghNo ratings yet

- Bond Valuation: Dr. Salman Masood SheikhDocument19 pagesBond Valuation: Dr. Salman Masood SheikhAwais A.No ratings yet