Professional Documents

Culture Documents

Voluntary Registration

Uploaded by

Mikias DegwaleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Voluntary Registration

Uploaded by

Mikias DegwaleCopyright:

Available Formats

Registration

16. Obligatory Registration

1) A person who carries on taxable activity and is notregistered is required to file an application

for VAT registration with the Authority if -

(a) at the end of any period of 12 calendar months the person made, during that period, taxable

transactions the total value of which exceeded 500,000 Birr; or

(b) at the beginning of any period of 12 calendar months there are reasonable grounds to expect

that the total value of taxable transactions to be made by the person during that period will

exceed 500,000 Birr.

2) The Minister of Finance and Economic Development may by directive increase or decrease

the threshold provided for under Sub-Article 1.

3) A person required to. Register shall file an application for registration no later than the last

day of the month after the end of the period in Sub-Article (I) (a), or the last day of the month of

the period in Sub-Article (1) (b).

4) Subject to Sub-Article (5), a registered person who conducts taxable activity in a branch or

division shall be registered only in the name of the registered person.

5) Notwithstanding Sub-Article (4), the Authority may, upon application in writing by a

registered person operating in corporate fonn, authorize the registered pers<;>nto register one or

more of its branches or divisions as separate registered persons where the Authority is satisfied

that the branch or

division maintains an independent accounting system and can be separately idefitified by the

nature of its activities or location.

6) . The registration of a branch or division' under Sub Article (5) is subject to such conditions

and

restrictions as the Minister of Revenue may deem

fit.

7) In determining whether a person has an obligation to register under Sub-Article (1):

(a) the authority may aggregate the value of taxable transactions made by one person with the

value of taxable transitions made by the other person where both persons are related persons; and

(b) the value of the person's taxable transactions is determined under Article 12.

17. Voluntary Registration

A person who carried on taxable activity and is not required to be registered for VAT, may

voluntarily apply to the Authority for such registration, if he regularly is supplying or rendering

at least 75% of his goods and services to registered persons.

18. Registration procedure

I) A person applying to register for VAT is required to do so in such a f.rm as is established by

the implementation directives issued by the Minister of Revenue.

2) Subject to Sub-Article (8), when a person carrying out taxable transactions files an application

to be registered for VAT, the Authority is required to register the person in the VAT register, and

to issue a certificate of registration( n mentioned in Sub-Article 3 below within 30 days lIf the

registration.

3) The Authority shall issue a VAT registration certificate containing such details as:

(a) the full name and other relevant details of the registered person;

(b) the date of issuance of the certificate;

(c) the date from which the registration takes effect;and

(d) the registered person's taxpayer identification number.

. 4) Registration takes place on one of the following dates, depending on which date comes first:

(a) in case of obligatory registration, on the first day of the accounting period following the

month in which the obligation to apply for registration arose;

(b) in the case of voluntary registration, on the first day of the accounting penGd following the

month in which the person applied for registration.

(c) on the date selected by the registered person on his application for registration.

5) The Authority is required to establish and maintain a VAT register containing details of all

persons registered for VAT.

6) If a person is required to register for VAT and has not applied to be registered, the Authority

may register the person on its own initiative and send to the registered person the certificate as

mentioned in Sub-Article (2) of this Article.

7) A person registered for VAT is required to use his taxpayer identification number on all VAT

invoices, and on all tax returns and official communications with the Authority.

8) When a person applied for voluntary registration under Article 17. the Authority can deny the

application for registration if :

(a) the person has no fixed place of abode or business; or

(b) the Authority has reasonable grounds to believe that the person will not keep proper records

or will not submit regular and reliable tax returns, as required under this Proclamation.

Penalties

The following penalties are imposed for violations of this Proclamation:

a) Where any person engages in taxable transactions without VAT registration where VAT registration is

required - 100 percent of the amount of tax payable for the' entire period of operation without VAT

registration;

(b) Where any person issued incolTect tax invoice resulting in a decrease in the amount of tax or increase

in aClTeditor in the event of the event of the failure to issue a tax invoice - 100 percent of the amount of

tax for the invoice or on the transaction;

(c) Where a person who is not registered for VAT issues a tax invoce - a penalty of 100 percent of the tax

which is indicated in the tax invoice and is due for transfer to the budget but has oat been trans. felTed;

and

(d) Where a person fails to maintain records required under Article 37- 2,000 BilT for each month 01

portion thereof that the failure continues.

46. Penalties for Late Filing

1) Execpt as otherwise provided in this Proclamation, a person who fails to file a timely return is liable

for apenalty equal to 5 percent of the amount of tax underpayment for each month (or portion thereot)

during which the failure continues, up to 25 percent of such amount.

2) The penalty under Sub-Article (1) of this Article is limited to 50,000 Birr for the furst month (or

portion thereot) in which no teturn is filed.

3) For purposes of this Article, an underpayment of tax is the difference between the tax required to be

shown on the return and the amount of tax paid by the due date.

4) In any event the penalty may not be less than smallerof the two amounts:

(a) 10,000 BilT;

(b) 100 percent of the amount of tax required to be

shown on the return.

1) If any amount of tax is not paid by the due date, the

person liable is obliged to pay interest on such

amount for,the period from the due date to the date

the tax is paid

2) The interest rate under Sub Article (1) of this Article

is set at 25% (twenty five percent) over and above the

highest commercial lending interest rate that

prevailed during the preceding quarter.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter Two-Foundation of Individual Behavior and Learning in An OrganizationDocument16 pagesChapter Two-Foundation of Individual Behavior and Learning in An OrganizationMikias DegwaleNo ratings yet

- Chapter Three Foundation of Group Behavior: 1.1. Defining and Classifying Team And/or GroupDocument15 pagesChapter Three Foundation of Group Behavior: 1.1. Defining and Classifying Team And/or GroupMikias DegwaleNo ratings yet

- Chapter Three Foundation of Group Behavior: 1.1. Defining and Classifying Team And/or GroupDocument17 pagesChapter Three Foundation of Group Behavior: 1.1. Defining and Classifying Team And/or GroupMikias DegwaleNo ratings yet

- CH 01Document13 pagesCH 01Mikias DegwaleNo ratings yet

- 1.1. What Is Stress?: Chapter Six-Stress ManagementDocument6 pages1.1. What Is Stress?: Chapter Six-Stress ManagementMikias DegwaleNo ratings yet

- Chapter Seven-Organizational Culture and DiversityDocument7 pagesChapter Seven-Organizational Culture and DiversityMikias Degwale100% (1)

- Chapter Two-Foundation of Individual Behavior and Learning in An OrganizationDocument14 pagesChapter Two-Foundation of Individual Behavior and Learning in An OrganizationMikias DegwaleNo ratings yet

- Chapter Three: Dividend Decision/PolicyDocument38 pagesChapter Three: Dividend Decision/PolicyMikias DegwaleNo ratings yet

- Chapter Eight - Power and Politics in An OrganizationDocument4 pagesChapter Eight - Power and Politics in An OrganizationMikias DegwaleNo ratings yet

- Chapter Five Part One: Business ValuationDocument57 pagesChapter Five Part One: Business ValuationMikias Degwale100% (1)

- Chapter Two: Financing Decisions / Capital StructureDocument72 pagesChapter Two: Financing Decisions / Capital StructureMikias DegwaleNo ratings yet

- Chapter Four: Investment/Project Appraisal - Capital BudgetingDocument40 pagesChapter Four: Investment/Project Appraisal - Capital BudgetingMikias DegwaleNo ratings yet

- Registering For VATDocument1 pageRegistering For VATMikias DegwaleNo ratings yet

- Advanced Corporate Finance (ACFN - 551) (Credit Hours: 3) : Departmet of Accounting and FinanceDocument85 pagesAdvanced Corporate Finance (ACFN - 551) (Credit Hours: 3) : Departmet of Accounting and FinanceMikias DegwaleNo ratings yet

- Chapter Four Financial Markets in The Financial SystemDocument66 pagesChapter Four Financial Markets in The Financial SystemMikias DegwaleNo ratings yet

- Chapter Five Regulation of Financial Markets and Institutions and Financial InnovationDocument22 pagesChapter Five Regulation of Financial Markets and Institutions and Financial InnovationMikias DegwaleNo ratings yet

- Financial Institutions and Market: (ACFN, 2 Credit Hour)Document25 pagesFinancial Institutions and Market: (ACFN, 2 Credit Hour)Mikias DegwaleNo ratings yet

- Chapter Six: Risk Management in Financial InstitutionsDocument22 pagesChapter Six: Risk Management in Financial InstitutionsMikias DegwaleNo ratings yet

- Raw Materials InventoryDocument4 pagesRaw Materials InventoryMikias DegwaleNo ratings yet

- Chapter Five: Interest Rate Determination and Bond ValuationDocument38 pagesChapter Five: Interest Rate Determination and Bond ValuationMikias DegwaleNo ratings yet

- Debre Markos Universty College of Post-Graduate Studies Department of Accounting and FinanceDocument14 pagesDebre Markos Universty College of Post-Graduate Studies Department of Accounting and FinanceMikias DegwaleNo ratings yet

- Chapter Three Financial Institutions in The Financial SystemDocument9 pagesChapter Three Financial Institutions in The Financial SystemMikias DegwaleNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- House No.D-9, Block N, North Nazimabad, Karachi Central North Nazimabad Town Imran Bashir CHDocument2 pagesHouse No.D-9, Block N, North Nazimabad, Karachi Central North Nazimabad Town Imran Bashir CHMIRZA AKHTAR ALINo ratings yet

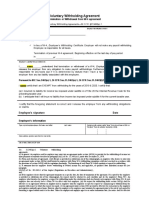

- Voluntary Withholding Agreement: Termination or Withdrawal From W-4 AgreementDocument2 pagesVoluntary Withholding Agreement: Termination or Withdrawal From W-4 Agreementkildea90% (20)

- Withholding Tax On Rental Services: Guide 01Document2 pagesWithholding Tax On Rental Services: Guide 01Abdul NafiNo ratings yet

- Commissioner of Internal Revenue Vs Soriano y CIADocument1 pageCommissioner of Internal Revenue Vs Soriano y CIAAmor5678No ratings yet

- Salary Slip (32119327 April, 2019)Document1 pageSalary Slip (32119327 April, 2019)Hassan RanaNo ratings yet

- IRS Reporting Requirements For Offshore Trusts and Foreign LLCDocument2 pagesIRS Reporting Requirements For Offshore Trusts and Foreign LLCed_nyc100% (1)

- W8-Eci 2021-06-01 Preview DocDocument1 pageW8-Eci 2021-06-01 Preview Docfuture warriorNo ratings yet

- Army Institute of Law, Mohali: Provisions Relating To Rebates Under The Income Tax Act, 1961 A Project Submitted ToDocument7 pagesArmy Institute of Law, Mohali: Provisions Relating To Rebates Under The Income Tax Act, 1961 A Project Submitted ToAyushi JaryalNo ratings yet

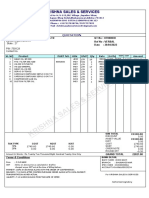

- Sales InvoicesDocument1 pageSales InvoicesMayank ManiNo ratings yet

- As485070 Dec2022 PayslipDocument2 pagesAs485070 Dec2022 PayslipAKM Enterprises Pvt LtdNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Quotation QU100949Document1 pageQuotation QU100949LesegoNo ratings yet

- Salary Details For 06/2020: Earnings Code Description Source AmountDocument1 pageSalary Details For 06/2020: Earnings Code Description Source AmountHomi NathNo ratings yet

- SYLLABUS Tax FOR 2023 BARDocument3 pagesSYLLABUS Tax FOR 2023 BARJournal SP DabawNo ratings yet

- Cir vs. CA and Anscor, G.R. No. 108576, January 20. 1999Document2 pagesCir vs. CA and Anscor, G.R. No. 108576, January 20. 1999Ayra CadigalNo ratings yet

- Uma Salary Slip JulyDocument1 pageUma Salary Slip Julyjyothi sNo ratings yet

- Reinforcement in Business TaxationDocument24 pagesReinforcement in Business TaxationTulungan Para sa Modular at Online Classes0% (1)

- Pay Slip - 604316 - Mar-23Document1 pagePay Slip - 604316 - Mar-23ArchanaNo ratings yet

- State Tax FormDocument2 pagesState Tax FormSaintjinx21No ratings yet

- Aguinaldo Industries V CirDocument1 pageAguinaldo Industries V CirChristine JacintoNo ratings yet

- SAJ-Sales Quotation - 10-Sep-2022Document2 pagesSAJ-Sales Quotation - 10-Sep-2022Michael NjugunaNo ratings yet

- RV ICE S: Krishna Sales & ServicesDocument1 pageRV ICE S: Krishna Sales & ServicesSaikatNo ratings yet

- Instructions For Schedule R (Form 941) : (Rev. June 2021)Document3 pagesInstructions For Schedule R (Form 941) : (Rev. June 2021)Josh JasperNo ratings yet

- Rajasthan - State FormatDocument9 pagesRajasthan - State FormatvjvksNo ratings yet

- Rian Inc Proforma Invoice 2019-2020Document2 pagesRian Inc Proforma Invoice 2019-2020Saurabh GujratiNo ratings yet

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023Pani NiNo ratings yet

- ACT Internet BillDocument3 pagesACT Internet BillPradeep N KNo ratings yet

- GST CouncilDocument2 pagesGST CouncilMilind SwaroopNo ratings yet

- Home TestDocument22 pagesHome TestSelina ChenNo ratings yet