Professional Documents

Culture Documents

Stability Through Exponential Growth : Price Increases Price Decrease

Uploaded by

Optimuz OptimuzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stability Through Exponential Growth : Price Increases Price Decrease

Uploaded by

Optimuz OptimuzCopyright:

Available Formats

Volatility - digital assets are highly volatile and as such finding a stable Rooted in Legacy Systems - many assets

Rooted in Legacy Systems - many assets in this class are pegged only

currency as a trading pair and store of value remains out of reach. to the U.S. dollar or other legacy systems which are constraining and

According to surveys by Bloomberg and Forbes, the main barrier for unsuitable on a macro and long term time horizon.

adoption is related to volatility associated risk.

Apollo (AOX) is not pegged solely to legacy assets (like USD), but not

M I

Seigniorage odel ssues - Seniorage is a system that utilizes two

constrained by 100% collateralization (like Maker DAO), or being solely Lack of Composability - some of the innovations in this space can not tokens to create a stable currency. Current models have not achieved a

subjective by being 100% synthetic (like Ampleforth). Apollo melds fit in every system and require codebase adjustments to function. truly stable peg as the token meant to be stable is also meant to

multiple models together to create the ideal mix of a synthetic base, provide incentive.

collateralization, decentralization, and robust ecosystem. Our model

takes the best of multiple leading digital assets and creates an 7,500%

ETH-BTC 3 M AT M I mp l i e d Vol S p rea d

optimized new ecosystem that integrates: Bitcoin bubble bursts

Bitcoin peak 2017

600%

Dotcom bubble bursts

X

Nasdaq Composite 1999

STABILITY THROUGH E PONENTIAL GROWTH Permanently Locked Liquidity: creating a price floor and collateralized

value

Apollo is a rebasing seigniorage share model capturing the value of a Elastic Supply Seigniorage Governance Token (AOZ): allowing for

world wealth index from a basket of stable assets (natural resources, aligned incentives within the ecosystem and a decentralized universal 3 m o n th imp l i e d s p rea d Min : -2.4, M a x : 33%, A vg : 12%, Last: 29%

multiple countries’ GDP, multiple currencies), creating a future proof digital asset

and innovative unit of account for the digital asset revolution. Price increases Price decrease

Standard Stable ERC 20 Currency Token (AOY): This token can instantly

be used in any ecosystem and stays pegged to $1.00 USD and eventually

will also include tokens pegged to CNY and EUR.

Value Based on a Dynamic Weighted Basket of Assets: The AOX token BUY sell

aims to track a diverse and responsive basket of assets from natural BUY sell BUY sell

resources to GDP.

BUY sell

1 2

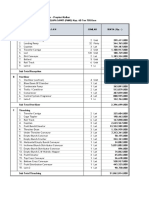

AOX is pegged to a weighted basket of 21 global assets normalized to $1.00 (ratio 1:1.06 adjusted yearly). Users buy AOX and if the time-weighted The token supply is 1,800,000 with 900,000 AOX and 900,000 AOZ. Of these total tokens, 1,188,000 are sold in a 1:1 AOX:AOZ ratio prior to launch. The

average price (TWAP) is greater than the peg price (PEG) then positive rebases are incentivized. Users create all of our rebases, this makes our token fit sale includes partners who buy at $0.85/token capped at 85,000 USDT per person (25% unlocked at launch, and 75% unlocked at 3 months). Private

into any DeFi ecosystem. Rebases occur in epochs where each epoch is 30 minutes with 25 AOX as incentive. To be eligible, users can lock their AOX into sales at $0.90/token capped at $22,500 USDT per person (100% unlocked at launch). Public sales at $1.00/token capped at 25,000 USDT per person

our DAO permanently. The rewards for locked AOX are as follows:

unlocked at launch (100% unlocked at launch). The initial circulation market cap is estimated to be $814,500 with $720,000 locked into liquidity.

$AOY

Stable

If TWAP>PEG and coupons>redemption then mint:

(TWAP-PEG)/(PEG) OR 3% (whichever is lower)

The quest for the perfect digital unit of account is massive, it is essential for

5% Team Development people to store their wealth and use as trading pairs. Many stablecoins that are

If TWAP>PEG and coupons=redemption then mint:

dapp pegged to the U.S. dollar have recently faced added regulation and scrutiny. A

(TWAP-PEG)/(PEG) OR 6% (whichever is lower)

20% Initial Liquidity few of the digital assets that we are seeking to disrupt include:

If TWAP>PEG then ELIGIBLE burn:

(PEG-TWAP)/(PEG) OR 2% (whichever is lower) 5% Incentives/Rewards Tether: Market Cap $20.92 Billion (third largest digital asset)

ETH USDC: $1.15 Billion

Liquidity providers can lock for 24 epochs which allows for 12

hour cycles for active LP users. The 2% eligible burn function LP1 LP2

2% Audit/recurrent checks Dai: $1.16 Billion

Binance USD: $895 Million

as above is provided to users during negative rebases allowing

for the burning of AOX for future gains with coupons. Coupons

$AOZ

2% Advisors Maker: $562 Million

AMPL: $214 Million

do NOT expire but are redemable but decay at 1% EVERY epoch. $AOX Empty Set Dollar: $195 Million

Growth Shares

66% Token Sale Reserve Rights: $175 Million

The rewards themselves are distributed between the DAO lock (55%), liquidity providers at 20% and the AOZ governance token at 20%. AOZ will

become more relevant as our project expands with additional tokens (AOY, CNY peg, EUR peg, etc.) each with unique functions that hedge volatility. A

final 5% of the rewards are sent to our dApp locked AOY-ETH pool.

We have taken the best parts of each of these models and some models not on the list to create the ideal digital currency that is future proof and

innovative. It is a native digital currency, created from the blockchain out, rather than trying to shoehorn legacy systems into the blockchain space.

This proposal allows for multiple viable avenues to utilize the ecosystem. The low epoch time and the increased structure allows for a far faster, Apollo is a self-governing, decentralized, blockchain volatility solution. Apollo is a currency for the future.

3 4

sleeker user experience. **KYC required to be submitted with SAFT agreement as per regulation.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Whitepaper HIZ FinanceDocument14 pagesWhitepaper HIZ FinanceOptimuz OptimuzNo ratings yet

- Certik Final Report For BTCSTDocument15 pagesCertik Final Report For BTCSTOptimuz OptimuzNo ratings yet

- Protocol Whitepaper V1.0: January 2020Document23 pagesProtocol Whitepaper V1.0: January 2020Dung Quoc VanNo ratings yet

- Professional Digital Asset Exchange WhitepaperDocument18 pagesProfessional Digital Asset Exchange WhitepaperOptimuz OptimuzNo ratings yet

- FTT White Paper.92bb0d80Document13 pagesFTT White Paper.92bb0d80Optimuz Optimuz100% (1)

- White Paper Univesal Coin en A4 2020Document25 pagesWhite Paper Univesal Coin en A4 2020Optimuz OptimuzNo ratings yet

- 5ffd84a5a114a038988a412c - Bridge Deck 1.85 Bridge Decentralized InsuranceDocument16 pages5ffd84a5a114a038988a412c - Bridge Deck 1.85 Bridge Decentralized InsuranceOptimuz OptimuzNo ratings yet

- FTT White Paper.92bb0d80Document13 pagesFTT White Paper.92bb0d80Optimuz Optimuz100% (1)

- Finxflo FXF WhitepaperDocument30 pagesFinxflo FXF WhitepaperOptimuz OptimuzNo ratings yet

- VEROX Ed5e22Document25 pagesVEROX Ed5e22Optimuz OptimuzNo ratings yet

- Miny WhitepaperDocument23 pagesMiny WhitepaperOptimuz OptimuzNo ratings yet

- ICON Whitepaper EN 2 PDFDocument38 pagesICON Whitepaper EN 2 PDFOptimuz OptimuzNo ratings yet

- White PaperDocument38 pagesWhite PaperOptimuz OptimuzNo ratings yet

- Litepaper Bonded Sep 29Document13 pagesLitepaper Bonded Sep 29Optimuz OptimuzNo ratings yet

- White Paper Univesal Coin en A4 2020Document25 pagesWhite Paper Univesal Coin en A4 2020Optimuz OptimuzNo ratings yet

- Indodax X Tokenomy Market Survey en PDFDocument26 pagesIndodax X Tokenomy Market Survey en PDFOptimuz OptimuzNo ratings yet

- ICON Whitepaper EN 2 PDFDocument38 pagesICON Whitepaper EN 2 PDFOptimuz OptimuzNo ratings yet

- ICON Whitepaper EN 2 PDFDocument38 pagesICON Whitepaper EN 2 PDFOptimuz OptimuzNo ratings yet

- Contribution Proposal Paper ENDocument12 pagesContribution Proposal Paper ENOptimuz OptimuzNo ratings yet

- Indodax X Tokenomy Market Survey en PDFDocument26 pagesIndodax X Tokenomy Market Survey en PDFOptimuz OptimuzNo ratings yet

- Sugeng Procedure Option 1&2Document2 pagesSugeng Procedure Option 1&2Optimuz OptimuzNo ratings yet

- Centre Whitepaper PDFDocument24 pagesCentre Whitepaper PDFwilliamhancharekNo ratings yet

- ICON Whitepaper EN 2 PDFDocument38 pagesICON Whitepaper EN 2 PDFOptimuz OptimuzNo ratings yet

- Indodax X Tokenomy Market Survey en PDFDocument26 pagesIndodax X Tokenomy Market Survey en PDFOptimuz OptimuzNo ratings yet

- C0a06a5935 014bd8c97dDocument55 pagesC0a06a5935 014bd8c97dOptimuz OptimuzNo ratings yet

- S.C.Pangiran Budi Services S.R.L (Romania) S.C.Pangiran Budi Services S.R.L (Romania) S.C.Pangiran Budi Services S.R.L (Romania)Document10 pagesS.C.Pangiran Budi Services S.R.L (Romania) S.C.Pangiran Budi Services S.R.L (Romania) S.C.Pangiran Budi Services S.R.L (Romania)Optimuz OptimuzNo ratings yet

- 161226070012Document17 pages161226070012Optimuz Optimuz100% (1)

- Whitepaper EnglishDocument7 pagesWhitepaper EnglishOptimuz OptimuzNo ratings yet

- Rab Pks 60 Ton Tbs Per JamDocument5 pagesRab Pks 60 Ton Tbs Per JamOptimuz Optimuz75% (4)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Equity Securities MarketDocument23 pagesEquity Securities MarketILOVE MATURED FANSNo ratings yet

- Peranggaran - Materi 2Document42 pagesPeranggaran - Materi 2citra kurniaNo ratings yet

- Chapter FiveDocument14 pagesChapter Fivemubarek oumerNo ratings yet

- 2007-2013 MERCANTILE Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Document173 pages2007-2013 MERCANTILE Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh97% (103)

- NBFC Group 2 (Sales Incentive Structure)Document9 pagesNBFC Group 2 (Sales Incentive Structure)jay jariwalaNo ratings yet

- Financial Modeling HandbookDocument43 pagesFinancial Modeling HandbookAkshay Chaudhry100% (5)

- Gurukripa’s Guide to Nov 2014 CA Final SFM ExamDocument12 pagesGurukripa’s Guide to Nov 2014 CA Final SFM ExamShashank SharmaNo ratings yet

- Ar 2011Document410 pagesAr 2011Dennis AngNo ratings yet

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiNo ratings yet

- 1 - An Overview of Financial ManagementDocument14 pages1 - An Overview of Financial ManagementFawad Sarwar100% (5)

- Primary Dealer System - A Comparative StudyDocument5 pagesPrimary Dealer System - A Comparative Studyprateek.karaNo ratings yet

- Friendly Aquaponics Financial Proforma For Single 35 X 96 Greenhouse Projections For A SINGLE Species (Lettuce, OR Bok Choi, OR Green Onions Etc)Document3 pagesFriendly Aquaponics Financial Proforma For Single 35 X 96 Greenhouse Projections For A SINGLE Species (Lettuce, OR Bok Choi, OR Green Onions Etc)Juan Carlos FernandezNo ratings yet

- Income Tax: General Principles: Module No. 4Document4 pagesIncome Tax: General Principles: Module No. 4Jay Lord Floresca100% (1)

- Financial Statement Analysis 2Document21 pagesFinancial Statement Analysis 2San Juan EzthieNo ratings yet

- House No. 123-A,, Street No. 12, Lane # 4, Chaklala Scheme 3, Rawalpindi, Cantonement. Adnan AhmedDocument4 pagesHouse No. 123-A,, Street No. 12, Lane # 4, Chaklala Scheme 3, Rawalpindi, Cantonement. Adnan AhmedAdnan AfridiNo ratings yet

- VAT ExemptionDocument3 pagesVAT ExemptionJusefNo ratings yet

- Lesson 3c The Statement of Comprehensive Income - Merchandising BusinessDocument11 pagesLesson 3c The Statement of Comprehensive Income - Merchandising BusinessBenedict CladoNo ratings yet

- Resume - Bharati Desai Senior Accounting PositionsDocument4 pagesResume - Bharati Desai Senior Accounting PositionsJeremy SmithNo ratings yet

- 4BSA2 GROUP2 GroupActivityNo.1Document4 pages4BSA2 GROUP2 GroupActivityNo.1Lizerie Joy Kristine CristobalNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument5 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signaturegaming boyNo ratings yet

- Candlestick Patterns PDF Free Guide DownloadDocument11 pagesCandlestick Patterns PDF Free Guide DownloadGreg Mavhunga88% (8)

- Part 4A. Moving Average Technical Indicator AnalysisDocument42 pagesPart 4A. Moving Average Technical Indicator AnalysisAnDy YiMNo ratings yet

- HH HDocument2 pagesHH HPrashant UpadhyayNo ratings yet

- LomaDocument4 pagesLomaUshaNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosVenz LacreNo ratings yet

- Rencana Bisnis Art Box Creative and Coworking SpaceDocument2 pagesRencana Bisnis Art Box Creative and Coworking SpacesupadiNo ratings yet

- Umali Vs CADocument2 pagesUmali Vs CAMekiNo ratings yet

- Akshat Ratio AnanlysisDocument8 pagesAkshat Ratio AnanlysisAshutosh GuptaNo ratings yet

- Data Analysis of Infosys ShareDocument22 pagesData Analysis of Infosys ShareJoshuaNo ratings yet

- BPI UITF Client Suitability Assessment FormDocument6 pagesBPI UITF Client Suitability Assessment FormNorman PeñaNo ratings yet