Professional Documents

Culture Documents

Case: The Big Three Roar Back Class: FY MBA Section I Team No: 7 Members

Case: The Big Three Roar Back Class: FY MBA Section I Team No: 7 Members

Uploaded by

Perpetual LearnersOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case: The Big Three Roar Back Class: FY MBA Section I Team No: 7 Members

Case: The Big Three Roar Back Class: FY MBA Section I Team No: 7 Members

Uploaded by

Perpetual LearnersCopyright:

Available Formats

Case: The Big Three Roar Back

Class: FY MBA Section I

Team No: 7

Members:

Pulkit Agrawal I007

Sameer Dhuri I017

Jivesh Kaul I027

Adwait Nadkarni I037

Punit Sethia I046

Siddharth Srivastava I056

Context/Background:

The city of Detroit had seen a stable economic growth due to its booming automobile sector.

The “Big 3” – Ford Motor Company (Ford), General Motors (GM) and Chrysler of the US

automobile industry had presence in Detroit, each offering steady flow of economic and health

benefits to its working population. The industry however saw a decline in the period of 1970

due to the rising oil prices and foreign competition leading to loss of market share of Big 3.

However, 3 years starting from 2008 the Big 3 saw a turnaround reestablishing themselves as

major players in the market.

The challenge for the firms to stay competitive is to obtain competent workforce as the city

had seen a loss of population following the decline in 1970s. The case analysis the studies the

actions that led to the turnaround of the Big 3 and provides suggestion for future growth in the

light of transformation of US Automobile industry.

Problems and Key Issues in the Case:

1. High dependency of the sector on international oil prices

2. Fuel efficient and cheaper alternatives provided by foreign players

3. High wage and health benefits costs compared to the competitors

4. Inability of established players to adjust to the change in Industry (Automaker’s Hubris)

5. Management problems in terms of poor cost control and relationship between labor and

management.

6. Loss of reputation among consumers and inability of the management to counter it

7. Lack of innovation in products of domestic players

Frameworks/Theories used for Analysis:

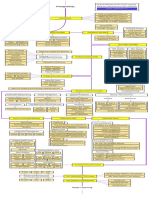

US Automobile Industry - Porters Five Forces:

1. Threat of New Entrants: (High)

- Entry of cheap and high quality exports were one of the prime reason for losses

faced by automobile sector.

2. Bargaining Power of Suppliers: (Moderate)

- The supplier of the parts are closely tied with the Automakers and hence the

collapse of the key players would result into their significant loss. This limits their

bargaining power.

- The workers are the most affected by the loss of the industry due to their dependence

on the sector as it was the primary employer in Detroit. Further they also form one

of the major cost component of the industry. However, presence of unions (United

Auto Workers) helps them exercise a moderate power on industry.

- Competitive strength of the industry players depend on the competency of the

available workforce.

3. Threat of Substitutes: (Moderate)

- Availability of cheap and fuel efficient vehicles from Japanese companies like

Toyota.

4. Bargaining power of consumers: (Moderate)

- Buyers bargaining power is restricted due to high switching cost

- Companies have power to differentiate their products by R&D further restricting

buyers influence

- Buyers however has large options to choose from which include trusted domestic

brands as well as cheap and efficient foreign brands

5. Rivalry among competitors: (Moderate)

- High level competition between domestic and foreign players, as foreign players

have lower cost and better technology while domestic players have more

aspirational value.

- High exit barriers, slow market growth and comparable size of the players (Exhibit

1) increases the competition

- Dependence of supply chain infrastructure on the collective health of the industry

limits competition as the failure of one firm could prove fatal for the suppliers.

US Automobile Industry – Trajectories of Industry Change:

1. Industries core activity includes production and selling of 4-wheeler automobiles and

truck-based vehicles, like pickup trucks, sports utilities and minivans. As per the case,

the industry is facing a threat of obsolescence of 4-wheeler vehicles from more fuel-

efficient models of foreign players. Truck based category however is protected due to

exemption of fuel-economy regulations.

2. Industry core assets includes its brand value, technology and competent workforce. The

foreign players provide better technology products leading to threat of obsolescence of

this asset for the domestic players. As per Exhibit 2 in period from 2000-2009, the

population of Detroit has reduced and many of the competent workforce has migrated

leading to shortage of competent workforce

As the US Automobile industry is facing threat on both its core activities and assets, it can be

stated that it is in state of Radical Change

Analysis of issues identified:

1. High dependency of the sector on international oil prices: The oil prices is dependent

on International factors and the domestic players have no control over them. Further

they exhibit equal impact on the players.

2. Foreign Competition: Emergence of low-cost fuel efficient alternatives from the foreign

players acted as a trigger for the Industry transformation. This coupled with rise of oil

prices led to the movement of consumer away from the Big 3.

3. Cost Control: Compared to their foreign competitor the domestic players incurred high

cost in terms of healthcare facility and wages that had to be provided to the workers.

For example: GM paid $2235 per vehicle on worker benefits while Toyota spent only

$215.

4. Management Hubris: The management’s faith in their brand value coupled with

complex hierarchy slowed the decision making process in the organization. This led to

lack of innovation in products resulting in to loss of consumer faith.

Conclusion and Recommendations:

1. As per the analysis, Automotive Industry is in the stage of Radical change. The reason

for this is increasing price consciousness of the consumer due to global changes in

supply of oil and increasing competitiveness from foreign market. The nature of Radical

changes allows industries with significant time for adjusting to change if measures are

taken early. In case of US Automotive Industry most players including both domestic

and foreign players have comparable market share as evident from Exhibit 1. Therefore

traditional players will survive as each has equal competitive advantage. Following

measures however, will be suggested to stay competitive:

- Reducing the number of variants and focusing on few cost-effective variants

- Explore possible chances of consolidation among existing players

- Increase plant utilization by redesigning to produce multiple models

- Developing R&D measures to develop more fuel efficient technologies

- Start training centers for reskilling the current population of Detroit

- Cultivating better relations with labor unions

- Make a marketing teams to ensure that consumer opinions are taken in developing

product

2. Benefits of Industry clusters:

Benefits from localization include sharing of sector-specific skilled labour, sharing of

tacit and codified knowledge, intra-industry linkages, and opportunities for efficient

subcontracting. Further, the presence of disproportionately high concentration of firms

within the same industry increases the possibilities for reduction of prices of

intermediate products. These location-based externalities imply that firms are likely to

benefit from locating near large concentration of other firms in their own industry. The

presence of local suppliers can reduce transaction costs and therefore increase

productivity. Increase in efficiency due to clustering can be seen from Exhibit 4

Appendix

Exhibit 1: Company US Market Share 1995-2011 (As % of Total Automotive Market)

Exhibit 2: Total Number of Autoworkers in Michigan (January 2000- January 2010)

Exhibit 3: November 2009 Economic Survey of Detroit Residents

Exhibit 4: Cluster and Efficiency Cycle

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Consumer LawDocument25 pagesConsumer LawSam DhuriNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tesla Coil Instruction DiyDocument7 pagesTesla Coil Instruction Diydmj90464100% (1)

- Steel Deck Institute Diaphragm Design Manual - Third EditionDocument295 pagesSteel Deck Institute Diaphragm Design Manual - Third Editionalexander100% (1)

- Material Engineer ReviewerDocument64 pagesMaterial Engineer ReviewerEulogio JameroNo ratings yet

- Fasten Case AnalysisDocument3 pagesFasten Case AnalysisSam DhuriNo ratings yet

- Food Chain GangDocument115 pagesFood Chain GangJoy FernandezNo ratings yet

- Sub Contracting AgreementDocument4 pagesSub Contracting AgreementJaljala NirmanNo ratings yet

- Are You Fully Charged - Tom RathDocument1 pageAre You Fully Charged - Tom RathHoratiu BahneanNo ratings yet

- Virginia Braun - Victoria Clarke Successful Qualitative Research - A Practical Guide For Beginners SagDocument515 pagesVirginia Braun - Victoria Clarke Successful Qualitative Research - A Practical Guide For Beginners Saggm85% (27)

- ch1 Mitra DSP CDocument65 pagesch1 Mitra DSP CRakibuzzaman TonmoyNo ratings yet

- Google Car Case Analysis ICLADocument5 pagesGoogle Car Case Analysis ICLASam DhuriNo ratings yet

- AC Report PDFDocument20 pagesAC Report PDFSam DhuriNo ratings yet

- Porters 5 Forces: Industry: Automation VehiclesDocument3 pagesPorters 5 Forces: Industry: Automation VehiclesSam DhuriNo ratings yet

- Fasten Case AnalysisDocument7 pagesFasten Case AnalysisSam Dhuri33% (3)

- The Syndication Process: Week 2Document26 pagesThe Syndication Process: Week 2Sam DhuriNo ratings yet

- Project Finance 1 Network of Contracts PDFDocument41 pagesProject Finance 1 Network of Contracts PDFSam DhuriNo ratings yet

- Financial SustainabilityDocument33 pagesFinancial SustainabilitySam DhuriNo ratings yet

- Capital Budgeting For Infra InvestmentDocument41 pagesCapital Budgeting For Infra InvestmentSam DhuriNo ratings yet

- Bonollo Energia CaseDocument10 pagesBonollo Energia CaseSam DhuriNo ratings yet

- A Journey From Being Stooges To Leaders: 6 Wise Men: The BeginningDocument2 pagesA Journey From Being Stooges To Leaders: 6 Wise Men: The BeginningSam DhuriNo ratings yet

- Compaq - Group 7 AnalysisDocument1 pageCompaq - Group 7 AnalysisSam DhuriNo ratings yet

- Bajaj Atom Pitch NMIMSDocument1 pageBajaj Atom Pitch NMIMSSam DhuriNo ratings yet

- Script-Consumer LawDocument4 pagesScript-Consumer LawSam DhuriNo ratings yet

- Quikr: Unlocking The Value of Used Goods MarketDocument3 pagesQuikr: Unlocking The Value of Used Goods MarketSam DhuriNo ratings yet

- Clean Hands in Dirty Business Case AnalysisDocument4 pagesClean Hands in Dirty Business Case AnalysisSam Dhuri100% (1)

- Circular Economy HUL TechtonicDocument1 pageCircular Economy HUL TechtonicSam DhuriNo ratings yet

- Prodect Commercialisation PlanDocument1 pageProdect Commercialisation PlanSam DhuriNo ratings yet

- Case STPD NiveaDocument6 pagesCase STPD NiveaSam DhuriNo ratings yet

- TAB Report - Group7Document10 pagesTAB Report - Group7Sam DhuriNo ratings yet

- Marketing ManagementDocument7 pagesMarketing ManagementSam DhuriNo ratings yet

- Storage Devices & Media QuizDocument4 pagesStorage Devices & Media QuizRoze Daniella DiazNo ratings yet

- V05N11 Nov1983Document76 pagesV05N11 Nov1983Yami FubukiNo ratings yet

- Prepositional PhrasesDocument13 pagesPrepositional PhrasesBerlianova Cahya CantikaNo ratings yet

- Postgresql DbaDocument1 pagePostgresql DbaWitor SantosNo ratings yet

- Imrad PR2Document5 pagesImrad PR2Jesser BornelNo ratings yet

- Marrow UpdatesDocument9 pagesMarrow UpdatesVirat KohliNo ratings yet

- Technical Data Sheet Gardoclean A 5722Document2 pagesTechnical Data Sheet Gardoclean A 5722Christian del CastilloNo ratings yet

- Tutorial2 ChipScope Part 1Document36 pagesTutorial2 ChipScope Part 1udara11No ratings yet

- Whirlpool WED9400SU0 DryerDocument12 pagesWhirlpool WED9400SU0 DryerJOSE CAMPOSNo ratings yet

- Openswitch Opx Install Guide r221Document10 pagesOpenswitch Opx Install Guide r221Ahmad WahidNo ratings yet

- Bcpo Estimated LitigationPlanforBCPODocument2 pagesBcpo Estimated LitigationPlanforBCPOussrecount2358No ratings yet

- Chorasical Sketch Script StateDocument7 pagesChorasical Sketch Script StateAtikah007100% (1)

- Spec Tween 80 PDFDocument2 pagesSpec Tween 80 PDFtary_nuryanaNo ratings yet

- Unit 5 MensurationDocument5 pagesUnit 5 MensurationAzista PharmaNo ratings yet

- Staff Development UBD Stage 3 Lesson PlanningDocument4 pagesStaff Development UBD Stage 3 Lesson Planningdebra_scott_6No ratings yet

- Avkis: College of Engineering, HassanDocument2 pagesAvkis: College of Engineering, HassankiranNo ratings yet

- Editorial Director: Scientific BoardDocument106 pagesEditorial Director: Scientific BoardTobyNo ratings yet

- Presents: Attacking The Ipv6 Protocol Suite: Van Hauser, THCDocument41 pagesPresents: Attacking The Ipv6 Protocol Suite: Van Hauser, THConeil.paulj7400No ratings yet

- Lecture9A - CpE 690 Introduction To VLSI DesignDocument20 pagesLecture9A - CpE 690 Introduction To VLSI DesignjvandomeNo ratings yet

- Participation in Collegial ActivitiesDocument6 pagesParticipation in Collegial Activitiesapi-453747665No ratings yet

- Physical Science Model Lesson PlanDocument7 pagesPhysical Science Model Lesson Plannineteen oneNo ratings yet

- Specification Picture Standard Configuration:: Quotation Sheet To Drone JT15L-606Document4 pagesSpecification Picture Standard Configuration:: Quotation Sheet To Drone JT15L-606Wan Buanan Wan HussainNo ratings yet