Professional Documents

Culture Documents

Workshop: Finding Objects, Then Classes, Then Model Problem

Uploaded by

Bryan CastroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workshop: Finding Objects, Then Classes, Then Model Problem

Uploaded by

Bryan CastroCopyright:

Available Formats

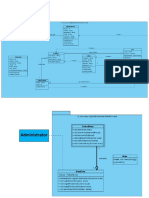

Workshop: Finding Objects, then classes, then

model

Problem

We need a system that compares analysts from records of the

analyst’s own stock buy/sell transactions, so we can recommend

investors to invest with the best analyst.

To understand what the program needs to do, it is first

necessary to understand a little bit about the stocks, buy and

sell transactions, and their records. We’ll keep things simple,

though, and only deal with basic stock purchases and sales.

Overview

In the domain of financial investment, individual investors may

base buy/sell decisions on the opinions of investment analysts,

who spend considerable time studying the fundamentals and

potential of selected companies. When an investor relies on an

analyst’s recommendations to any degree, then that investor

typically wants know something about the analyst’s track record.

Background

Think of a share of stock as a piece of a company, albeit

typically a very small piece. The value of a share is loosely

related to the value of the company divide by the number of

outstanding shares (i.e., total shares owned by shareholders.)

For example, if a company was worth $10M and there was a total

of 1M shares owned by shareholders, then each share would be

worth $10.

In a stock market, all companies and their stock are identified

by symbols, which are short character strings. For example,

Amazon’s symbol is AMZN, Apple’s is AAPL, and Microsoft’s is

MSFT.

An investor will buy some number of shares at a specific

purchase price and pay a small fee to a broker to complete that

transaction. Then, at late time, the investor will sell all or

some of those shares at a sales price and pay another small fee

to a broker. Obviously, if an investor sells at a price higher

than the purchase price (adjusting for the fees), the investor

will make money. For example, if an investor buy 10 shares of

AMZN at $800/share for a $10 fee, then sell those 10 shares at

$850/share for $10 fee, that investor will make a profit of $480

(850*10 – 10 – 800*10 – 10).

For taxes purpose and asset management, investors correlate the

sale of a block of stocks to specific purchases. For example,

consider an investor who buy 100 shares of ABC at $10/share and

a little while later another 100 shares at $11/share. Then,

image that the investor sell 125 shares. In making that sale,

the investor will say how many of the 125 shares come from the

first block of shares purchase and how many come from the second

block, because it will impact how many profit the investor

makes.

An investor does not actually make or loss money until shares

are sold. Shares that an investor is holding onto only represent

potential profits or losses. So, to rank an analyst perform, we

need to know about completed purchase/sales cycles. Therefore, a

history will contain records with following data:

Stock symbol A short string that identifies the company

Quantity (Q) A integer that represent the number of shares

purchase and sold Purchase Date/time (PT) A number that

represents time of purchase in minutes since Jan 1, 2016

Purchase Price (PP) An integer represents the purchase price in

cents. For example, 1234 would be a purchase price of $12.34.

Purchase Trans. Fee (PF) An integer represents the purchase

transaction fee in cents. Sale Date/time (ST) A number that

represents time of purchase in minutes since Jan 1, 2016 Sale

Price (SP) An integer represents the purchase price in cents.

For example, 1234 would be a purchase price of $12.34. Sale

Trans. Fee (SF) An integer represents the purchase transaction

fee in cents. Q, PT, PP, PF, ST, SP, SF

See Table 1 for an example of a small history for an investor

who purchased and sold stock for four companies: Amazon (AMZN),

Apple (AAPL), Microsoft (MSFT), and Google (GOOGL).

The amount of money invested (INV) in a purchase/sale is the

cost of the shared adjust plus both the purchase fee and the

sales fees INV = Q*PP + PF + SF

So, the profit/loss (PL) for each purchase/sale can be computed

as PL = Q*SP – INV

Table 2 shows INV and PL for each of the row, identified by the

symbol and ST, of Table 1.

Analyst Comparison

To compare analysts, we give each analyst “play” money (called

the seed amount) and let them make whatever purchases and sales

they desire, using simulated transaction. We record the

purchase-sales for each investor in a separate purchase-sale

histories file. Each investor starts off with same seed money,

but they can start and end their simulation at different times.

The number of days between the start and end of an analyst’s

simulation is called the Simulation Days (D).

One measure of overall investor performance is total of all PL’s

computed for each purchasesale in that investor’s history. We’ll

call this Total Profit-Loss (TPL). Another measure of overall

investor performance is TPL divided by the D. We’ll call this

Profit/Loss per Day (PLPD).

Another measure is an investor’s performance for an individual

stock. This is the sum of PL for that stock, divided by the

total days invested in that stock. See Table 3 for an example.

You might also like

- PEZA CITIZENS CHARTER (Rev 10, 31 Mar 2023, 1st Edition) - Compressed PDFDocument458 pagesPEZA CITIZENS CHARTER (Rev 10, 31 Mar 2023, 1st Edition) - Compressed PDFPatrickNo ratings yet

- How to Read Options ChainDocument13 pagesHow to Read Options Chainscriberone50% (8)

- Mergers and Acquisitions - A Beginner's GuideDocument8 pagesMergers and Acquisitions - A Beginner's GuideFforward1605No ratings yet

- Insiders Guide To The Best Techniques and StrategiesDocument12 pagesInsiders Guide To The Best Techniques and Strategiesabishakekoul50% (2)

- Stock Market Practical Knowledge-The Art of InvestmentDocument26 pagesStock Market Practical Knowledge-The Art of InvestmentNitinJaiswal100% (2)

- PDF Question BankDocument453 pagesPDF Question BankSyamil Sanusi100% (1)

- Stock Trading Made Simple: How to Trade on the Stock Market: The Beginner's GuideFrom EverandStock Trading Made Simple: How to Trade on the Stock Market: The Beginner's GuideNo ratings yet

- Audit Data MapDocument553 pagesAudit Data MapDarma Bonar TampubolonNo ratings yet

- Investment BankingDocument11 pagesInvestment BankingAmit Katkar0% (1)

- T Eco H P II: HE Istogram ARTDocument8 pagesT Eco H P II: HE Istogram ARTPorfirio MorilloNo ratings yet

- Relative or Comparable ValuationDocument21 pagesRelative or Comparable ValuationYash SankrityayanNo ratings yet

- Adam Khoo Investment Summary PDFDocument16 pagesAdam Khoo Investment Summary PDFclone909100% (1)

- BFS L0 QuesDocument360 pagesBFS L0 QuesShubhamKaseraNo ratings yet

- 1.financial Performance of A Co-Operative BankDocument2 pages1.financial Performance of A Co-Operative BankN.MUTHUKUMARAN71% (7)

- Vol-2-Forex Trading GuideDocument25 pagesVol-2-Forex Trading GuidePankaj SharmaNo ratings yet

- The PalmDocument45 pagesThe PalmDarren_1986No ratings yet

- A Project On Camparative Study Between Private Sector and Public Sector BanksDocument75 pagesA Project On Camparative Study Between Private Sector and Public Sector Banksthaheerhauf1234No ratings yet

- Director Commercial Real Estate in Columbus OH Resume Richard WolneyDocument2 pagesDirector Commercial Real Estate in Columbus OH Resume Richard WolneyRichardWolneyNo ratings yet

- Thomas J. Sargent, Jouko Vilmunen Macroeconomics at The Service of Public PolicyDocument240 pagesThomas J. Sargent, Jouko Vilmunen Macroeconomics at The Service of Public PolicyHamad KalafNo ratings yet

- Assignment 1stDocument3 pagesAssignment 1stAmmar ButtNo ratings yet

- Economic Stock MarketDocument6 pagesEconomic Stock Marketapi-288821901No ratings yet

- Five Types of TRADING: StocksDocument5 pagesFive Types of TRADING: StocksManziniLeeNo ratings yet

- FinanceDocument57 pagesFinanceNina HooperNo ratings yet

- 5fabc83fea801b002d0ebda1-1635949302-SIM - ACC 212 - Week 4-5 - ULObDocument18 pages5fabc83fea801b002d0ebda1-1635949302-SIM - ACC 212 - Week 4-5 - ULObAdassah UriNo ratings yet

- Finance HelpDocument15 pagesFinance HelpkaminiNo ratings yet

- What is a stock and how do the stock market and trading workDocument5 pagesWhat is a stock and how do the stock market and trading workdhadweNo ratings yet

- Dekmar Trades CourseDocument15 pagesDekmar Trades CourseKyle MNo ratings yet

- Three Questions Faced by InvestorsDocument12 pagesThree Questions Faced by InvestorsAyesha KarimNo ratings yet

- CAPITAL MARKETS - Basic Concepts: What Are Equity Assets?Document7 pagesCAPITAL MARKETS - Basic Concepts: What Are Equity Assets?coolguy_3122No ratings yet

- Investment AnalysisDocument4 pagesInvestment AnalysisBismarck PartosaNo ratings yet

- Problems and Prospects of Bangladesh Capital Market (SHARE)Document45 pagesProblems and Prospects of Bangladesh Capital Market (SHARE)Ferdous MostofaNo ratings yet

- DefinitionsDocument5 pagesDefinitionsAnkita JoshiNo ratings yet

- Understanding Intrinsic Value - An Introduction To Islamic FinanceDocument7 pagesUnderstanding Intrinsic Value - An Introduction To Islamic FinanceecsudcaNo ratings yet

- Definition of Profitability: Profitability Is The Ability of A Business To Earn A Profit. A Profit Is What IsDocument7 pagesDefinition of Profitability: Profitability Is The Ability of A Business To Earn A Profit. A Profit Is What IsAlexander ShresthaNo ratings yet

- TTM Figures Can Also Be Used To Calculate Financial Ratios. The Price/earnings Ratio Is OftenDocument39 pagesTTM Figures Can Also Be Used To Calculate Financial Ratios. The Price/earnings Ratio Is OftenPANKAJ SHUKLANo ratings yet

- Stock MarketDocument5 pagesStock MarketSagar KansalNo ratings yet

- COTIZACIÓN DE ACCIONES INTERNACIONALESDocument53 pagesCOTIZACIÓN DE ACCIONES INTERNACIONALESCARLOSNo ratings yet

- Stock Market Opens: Bid Price Ask Price Implied VolatilityDocument4 pagesStock Market Opens: Bid Price Ask Price Implied VolatilityUsha KiranNo ratings yet

- What's A Stock/Share?Document8 pagesWhat's A Stock/Share?mailrahulrajNo ratings yet

- Learning About Trading PlatformDocument8 pagesLearning About Trading PlatformGuan ChuangNo ratings yet

- Forex Trading GuideDocument24 pagesForex Trading GuideAkın GündoğduNo ratings yet

- Vol 2 Forex Trading GuideDocument25 pagesVol 2 Forex Trading GuideSMadhusuthanaPerumalNo ratings yet

- Understanding Forex Trading FundamentalsDocument25 pagesUnderstanding Forex Trading FundamentalsSMadhusuthanaPerumalNo ratings yet

- Important Formulas - Stocks and SharesDocument3 pagesImportant Formulas - Stocks and SharespruddviNo ratings yet

- Josh Tan Course-NotesDocument7 pagesJosh Tan Course-NotesTan YongshanNo ratings yet

- Annual Turnover Is A Term Used When Describing The Amount of Securities Removed From ADocument6 pagesAnnual Turnover Is A Term Used When Describing The Amount of Securities Removed From AElitsa DermendzhiyskaNo ratings yet

- Stock Market Terms and Meanings: Equity: - StocksDocument20 pagesStock Market Terms and Meanings: Equity: - StocksMera Birthday 2021No ratings yet

- Analyze Stocks with Market Prospect RatiosDocument4 pagesAnalyze Stocks with Market Prospect RatiosDarlene SarcinoNo ratings yet

- Equity Research ExplainedDocument16 pagesEquity Research ExplainedbhaskkarNo ratings yet

- Vol-2 Forex Trading GuideDocument24 pagesVol-2 Forex Trading Guidesenad1981No ratings yet

- Understanding Options Trading: The Australian SharemarketDocument43 pagesUnderstanding Options Trading: The Australian SharemarketAndrewcaesarNo ratings yet

- Stock Market Abbreviations Quick GuideDocument10 pagesStock Market Abbreviations Quick Guideforstermakhado492No ratings yet

- Investment Analysis and Stock Market OperationsDocument45 pagesInvestment Analysis and Stock Market Operationssurabhi24jain4439100% (1)

- Stock AnalysisDocument13 pagesStock AnalysisRajesh PattanaikNo ratings yet

- Average Cost MethodDocument3 pagesAverage Cost MethodRaja MonemNo ratings yet

- Auction Process Explained: Bid, Ask Spreads and How Supply & Demand Impact Stock PricesDocument32 pagesAuction Process Explained: Bid, Ask Spreads and How Supply & Demand Impact Stock PricesJesse SalinasNo ratings yet

- Suggestion and FormullaDocument35 pagesSuggestion and FormullapandeyshivpatiNo ratings yet

- Shares CourseDocument11 pagesShares Courseengrwaqas_11No ratings yet

- Swap Ratio Determination & Evaluation of Merger ProposalDocument21 pagesSwap Ratio Determination & Evaluation of Merger Proposalpriyasunil2008No ratings yet

- EquityDocument23 pagesEquityMahek GalaNo ratings yet

- Workshop: Basic Understanding of Share Market & Its Future and ScopeDocument23 pagesWorkshop: Basic Understanding of Share Market & Its Future and Scopesarfaraz kNo ratings yet

- Price Equity RatioDocument5 pagesPrice Equity RatioRose Ann De GuzmanNo ratings yet

- AfsDocument6 pagesAfsDewi Leigh Ann MangubatNo ratings yet

- Fundamental Analysis of Stocks Quick GuideDocument13 pagesFundamental Analysis of Stocks Quick GuidejeevandranNo ratings yet

- Technical Analysis Even Pages UneditedDocument88 pagesTechnical Analysis Even Pages UneditedKushal BrNo ratings yet

- Commercial Uses of Functional Programming in Exotic Financial Derivatives TradingDocument20 pagesCommercial Uses of Functional Programming in Exotic Financial Derivatives TradingRanit BanerjeeNo ratings yet

- Stocks and Crypto DefinitionsDocument7 pagesStocks and Crypto DefinitionsAndrei GeorgeNo ratings yet

- Y (1+t 6) Dy+t 2 (Y 4+1) DT 0 - Wolfram - AlphaDocument2 pagesY (1+t 6) Dy+t 2 (Y 4+1) DT 0 - Wolfram - AlphaBryan CastroNo ratings yet

- Stoeckli2020 Article HowAffordancesOfChatbotsCrossTDocument35 pagesStoeckli2020 Article HowAffordancesOfChatbotsCrossTBryan CastroNo ratings yet

- Definition - Billing - System - V1.0Document2 pagesDefinition - Billing - System - V1.0Bryan CastroNo ratings yet

- Stoeckli2020 Article HowAffordancesOfChatbotsCrossTDocument35 pagesStoeckli2020 Article HowAffordancesOfChatbotsCrossTBryan CastroNo ratings yet

- Y (1+t 6) Dy+t 2 (Y 4+1) DT 0 - Wolfram - AlphaDocument2 pagesY (1+t 6) Dy+t 2 (Y 4+1) DT 0 - Wolfram - AlphaBryan CastroNo ratings yet

- Class DiagramDocument2 pagesClass DiagramBryan CastroNo ratings yet

- Definition - Billing - System - V1.0Document2 pagesDefinition - Billing - System - V1.0Bryan CastroNo ratings yet

- Problemas Electrostatica PDFDocument2 pagesProblemas Electrostatica PDFBryan CastroNo ratings yet

- Problemas ElectrostaticaDocument2 pagesProblemas ElectrostaticaBryan CastroNo ratings yet

- Arvind Mills AnalysisDocument18 pagesArvind Mills AnalysisAnup AgarwalNo ratings yet

- Profile of DirectorsDocument5 pagesProfile of DirectorsSho NaNo ratings yet

- Problem SetDocument105 pagesProblem SetYodaking Matt100% (1)

- Investment and Security Laws ProjectDocument3 pagesInvestment and Security Laws ProjectUmesh Kumar33% (3)

- Impact of Capital Structure On Firms Financial PerformanceDocument15 pagesImpact of Capital Structure On Firms Financial PerformanceArunallNo ratings yet

- The Truth About MoneyDocument21 pagesThe Truth About MoneyTaha MirNo ratings yet

- Banking DWH Model E-BookDocument37 pagesBanking DWH Model E-BookShekharNo ratings yet

- Cost PracticeDocument4 pagesCost Practicejaswinireddy.potuganumaNo ratings yet

- Explain How Interest Rates Can Affect Supply and DemandDocument2 pagesExplain How Interest Rates Can Affect Supply and Demandhafeez ahmedNo ratings yet

- Government Incentives For EntrepreneurshipDocument3 pagesGovernment Incentives For EntrepreneurshipCato InstituteNo ratings yet

- Submitted From:-Shampa Dhali (06) Priyanka Dhoot (07) Neeraj Gupta (14) Hardik Joshi (18) Jitendra MishraDocument24 pagesSubmitted From:-Shampa Dhali (06) Priyanka Dhoot (07) Neeraj Gupta (14) Hardik Joshi (18) Jitendra MishraShompa Dhali NandiNo ratings yet

- Ch14 Bonds - Intermediate 2Document103 pagesCh14 Bonds - Intermediate 2BLESSEDNo ratings yet

- Accounting for Partnerships: A Comprehensive GuideDocument74 pagesAccounting for Partnerships: A Comprehensive GuideHussen Abdulkadir100% (2)

- Jay Singh Dairy: Project Formulation For Bank LoanDocument6 pagesJay Singh Dairy: Project Formulation For Bank LoanAANAND SHARMANo ratings yet

- 1 MPB-501 - Application For Pension 2 MPC - 60Document10 pages1 MPB-501 - Application For Pension 2 MPC - 60Anitha Mary DambaleNo ratings yet

- NOCIL Investor PresentationDocument28 pagesNOCIL Investor PresentationSaurabh JainNo ratings yet

- IMIS Info Bulletin 2023 - The B-School that thinks aheadDocument16 pagesIMIS Info Bulletin 2023 - The B-School that thinks aheadAl OkNo ratings yet

- Purchaseworkbook PDFDocument56 pagesPurchaseworkbook PDFNikkie WhiteNo ratings yet

- Investing Fundamentals: Stocks, Bonds, Mutual Funds and Home OwnershipDocument72 pagesInvesting Fundamentals: Stocks, Bonds, Mutual Funds and Home OwnershipMadeline PangilinanNo ratings yet

- MIT18 S096F13 Lecnote14Document34 pagesMIT18 S096F13 Lecnote14eni100% (1)

- Day Trader - ScreenplayDocument18 pagesDay Trader - ScreenplayCyprian FrancisNo ratings yet

- Computation of Shankar Sharma V2Document2 pagesComputation of Shankar Sharma V2akhil kwatraNo ratings yet