Professional Documents

Culture Documents

6 Isaguirre V de Lara

6 Isaguirre V de Lara

Uploaded by

Ella CardenasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 Isaguirre V de Lara

6 Isaguirre V de Lara

Uploaded by

Ella CardenasCopyright:

Available Formats

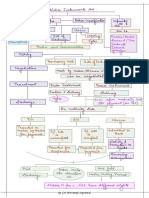

6. CORNELIO M. ISAGUIRRE V.

FELICITAS DE LARA

G.R. No. 138053

May 31, 2000

FACTS

Alejandro de Lara was the original applicant-claimant for a Miscellaneous Sales

Application over a parcel of land with an area of 2,324 square meters. Upon death, he

was succeeded by his wife (respondent) as claimant. By a decision rendered by the

Secretary of Agriculture and Natural Resources, the lot was reduced to 1,000 square

meters. On this lot stands a two-story residential-commercial apartment named to

respondent’s sons.

Respondent obtained several loans from Philippine National Bank. She then

executed a Deed of Sale and Special Cession of Rights and Interests on a 250 square

meter portion of the lot, together with the two-story commercial and residential

structure for a sum of P5,000 in favor of petitioner.

Petitioner then filed a sales application over the subject property based on the

deed of sale and acquired an OCT in his name. Meanwhile, sales application by

respondent for the entire 1000 meter was granted an OCT in the name of the

respondent.

Petitioner then filed an action for quieting of title and damages. The trial court

ruled in favor of petitioner. The Court of Appeals reversed the decision, holding that

the transaction entered into by the parties was an equitable mortgage, not a sale,

thereby declaring petitioner’s title null and void.

ISSUE

Whether or not the mortgagee in an equitable mortgage has the right to retain

possession of the property pending actual payment to him of the amount of

indebtedness by the mortgagor.

HELD

No. A mortgage is a contract entered into in order to secure the fulfillment of a

principal obligation. It is constituted by recording the document in which it appears

with the proper Registry of Property, although, even if it is not recorded, the mortgage

is nevertheless binding between the parties. Thus, the only right granted by law in favor

of the mortgagee is to demand the execution and the recording of the document in

which the mortgage is formalized.

As a general rule, the mortgagor retains possession of the mortgaged property

since a mortgage is merely a lien and title to the property does not pass to the

mortgagee. However, even though a mortgagee does not have possession of the

property, there is no impairment of his security since the mortgage directly and

immediately subjects the property upon which it is imposed, whoever the possessor

may be, to the fulfillment of the obligation for whose security it was constituted. If the

debtor is unable to pay his debt, the mortgage creditor may institute an action to

foreclose the mortgage, whether judicially or extrajudicially, whereby the mortgaged

property will then be sold at a public auction and the proceeds therefrom given to the

creditor to the extent necessary to discharge the mortgage loan. Apparently, petitioner’s

contention that "[t]o require [him] to deliver possession of the Property to respondent

prior to the full payment of the latter’s mortgage loan would be equivalent to the

cancellation of the mortgage" is without basis. Regardless of its possessor, the

mortgaged property may still be sold, with the prescribed formalities, in the event of

the debtor’s default in the payment of his loan obligation.

You might also like

- HI-LON Manufacturing Inc Vs Commission On AuditDocument4 pagesHI-LON Manufacturing Inc Vs Commission On AuditPaola Escobar100% (2)

- Possession DigestsDocument22 pagesPossession DigestsKayeCie RLNo ratings yet

- Case Digest - Department of Education v. Mariano TuliaoDocument2 pagesCase Digest - Department of Education v. Mariano TuliaoXantine Kristel MoralesNo ratings yet

- Essential Requisites of Contracts QuizDocument5 pagesEssential Requisites of Contracts QuizStephanie MendozaNo ratings yet

- Conflict of Laws in MarriageDocument41 pagesConflict of Laws in Marriagesaif aliNo ratings yet

- Department of Education, Culture and Sports (Now Department of Education) Et. Al. v. Heirs of Regino Banguilan Et. Al.Document3 pagesDepartment of Education, Culture and Sports (Now Department of Education) Et. Al. v. Heirs of Regino Banguilan Et. Al.Anna Dizon100% (2)

- Facts:: Javier v. Lumontad, G.R. No. 203760, December 3, 2014Document3 pagesFacts:: Javier v. Lumontad, G.R. No. 203760, December 3, 2014linlin_170% (1)

- 13 - PEOPLE. v. PLETCHADocument2 pages13 - PEOPLE. v. PLETCHAmark anthony mansuetoNo ratings yet

- Yap vs. TanadaDocument1 pageYap vs. TanadaJulie AnnNo ratings yet

- Law of AgencyDocument15 pagesLaw of AgencyEfua Addison100% (2)

- Isaguirre v. de Lara, G.R. No. 138053, May 31, 2000Document1 pageIsaguirre v. de Lara, G.R. No. 138053, May 31, 2000Al Jay Mejos100% (1)

- Bustos v. Court of Appeals, G.R. No. 120784-85, January 24, 2001Document1 pageBustos v. Court of Appeals, G.R. No. 120784-85, January 24, 2001mark anthony mansueto100% (1)

- Case DigestDocument6 pagesCase DigestFlorencio Saministrado Jr.No ratings yet

- 5 Rodil Enterprises, Inc. vs. CADocument2 pages5 Rodil Enterprises, Inc. vs. CAVox Populi100% (2)

- Garcia v. CA G.R. No. 133140Document1 pageGarcia v. CA G.R. No. 133140Neslie MarieNo ratings yet

- 1.del Banco Vs IAC - DigestDocument2 pages1.del Banco Vs IAC - DigestDianne Esidera Rosales100% (1)

- Caro vs. CaDocument3 pagesCaro vs. CaDonvidachiye Liwag CenaNo ratings yet

- Edwin Case v. Heirs of TuasonDocument1 pageEdwin Case v. Heirs of TuasonCourtney Tirol100% (2)

- Case Digest Sulo Sa Nayon Vs Nayong PilipinoDocument2 pagesCase Digest Sulo Sa Nayon Vs Nayong PilipinoDivina Gracia Hinlo100% (1)

- Robles v. CADocument2 pagesRobles v. CAPolo MartinezNo ratings yet

- Isaguirre vs. de LaraDocument1 pageIsaguirre vs. de LaraArvy AgustinNo ratings yet

- Andres Vs Sta Lucia SaireeDocument2 pagesAndres Vs Sta Lucia Saireecute_treeena5326No ratings yet

- Rodil VS CaDocument1 pageRodil VS CaKling KingNo ratings yet

- Property Cases DigestDocument3 pagesProperty Cases DigestWilton Norman Jvmantoc100% (1)

- Robles V CADocument2 pagesRobles V CARomNo ratings yet

- BACHRACH MOTOR CO Vs TALISAY-SILAY MILLINGDocument2 pagesBACHRACH MOTOR CO Vs TALISAY-SILAY MILLINGDara CompuestoNo ratings yet

- Heirs of DuranoDocument2 pagesHeirs of DuranoJan Jason Guerrero LumanagNo ratings yet

- 100 Land Bank of The Philippines Vs Perez, G.R. No. 166884, June 13, 2012Document1 page100 Land Bank of The Philippines Vs Perez, G.R. No. 166884, June 13, 2012Alan GultiaNo ratings yet

- Catedrilla v. LauronDocument2 pagesCatedrilla v. LauronChristian Roque100% (1)

- Case Digest Ignacio Vs HilarioDocument1 pageCase Digest Ignacio Vs HilarioDivina Gracia Hinlo100% (1)

- Diamond Farms Inc Vs Diamond Farm WorkersDocument2 pagesDiamond Farms Inc Vs Diamond Farm WorkersdarylNo ratings yet

- Tomas Claudio vs. CADocument1 pageTomas Claudio vs. CAmaryNo ratings yet

- Bradford United Church of Christ Vs AndoDocument1 pageBradford United Church of Christ Vs AndoErrol DobreaNo ratings yet

- Pacific Farms Inc Vs Esguerra 30 Scra 684Document13 pagesPacific Farms Inc Vs Esguerra 30 Scra 684Che Poblete Cardenas100% (2)

- Javier V Veridiano GR No L-48050Document1 pageJavier V Veridiano GR No L-48050mark anthony mansuetoNo ratings yet

- Pilar v. DumadagDocument2 pagesPilar v. DumadagKalvin ChesterNo ratings yet

- Property Digest Pool: Case Title: Augusto V. Dy G.R. No: Topic: Date: Tickler: Doctrine/s: Facts Case TypeDocument3 pagesProperty Digest Pool: Case Title: Augusto V. Dy G.R. No: Topic: Date: Tickler: Doctrine/s: Facts Case Typegem baeNo ratings yet

- Madeline Tan-Yap Vs Hannibal Patrick (2019)Document1 pageMadeline Tan-Yap Vs Hannibal Patrick (2019)Shimi Fortuna100% (1)

- HI-Lon vs. Coa DigestDocument6 pagesHI-Lon vs. Coa DigestAllanjoe TorculasNo ratings yet

- Choco Vs Santamaria 21 Phil 132Document2 pagesChoco Vs Santamaria 21 Phil 132Charles Gerard B. BeluanNo ratings yet

- 14 Bank of Commerce V San PabloDocument2 pages14 Bank of Commerce V San PabloAleezah Gertrude RaymundoNo ratings yet

- Alcantara V. Reta, 372 Scra 364 - Personal Easement: FactsDocument5 pagesAlcantara V. Reta, 372 Scra 364 - Personal Easement: FactsCj BautistaNo ratings yet

- CASE DIGEST Ignao Vs IacDocument1 pageCASE DIGEST Ignao Vs IacErica Dela CruzNo ratings yet

- PROPERTY - Abejaron v. NabasaDocument2 pagesPROPERTY - Abejaron v. NabasaDianne Bernadeth Cos-agon100% (1)

- Case Digest Manotok Realty Inc Vs TecsonDocument2 pagesCase Digest Manotok Realty Inc Vs Tecsonkikhay11No ratings yet

- 20 First Mega Holdings Corp. v. Guiguinto Water District, G.R. No. 208383 June 8, 2016Document2 pages20 First Mega Holdings Corp. v. Guiguinto Water District, G.R. No. 208383 June 8, 2016mark anthony mansuetoNo ratings yet

- CARBONILLA Vs ABIERADocument2 pagesCARBONILLA Vs ABIERAmark anthony mansuetoNo ratings yet

- 1 - Case Digest German Management & Services Inc V CADocument3 pages1 - Case Digest German Management & Services Inc V CAdeuce scri100% (2)

- Garcia v. Court of AppealsDocument2 pagesGarcia v. Court of Appealslinlin_17No ratings yet

- Civ Rev Digest Republic v. SantosDocument2 pagesCiv Rev Digest Republic v. SantosCharmila SiplonNo ratings yet

- 15 Dominador Apique v. Fahnestich, G.R. No. 205705, August 5, 2015Document1 page15 Dominador Apique v. Fahnestich, G.R. No. 205705, August 5, 2015mark anthony mansuetoNo ratings yet

- Case Title Cureg vs. Intermediate Appellate Court G.R. No. Date: FactsDocument2 pagesCase Title Cureg vs. Intermediate Appellate Court G.R. No. Date: FactsVox PopuliNo ratings yet

- GR No. 152423 (2010) - Sps Esmaquel V CopradaDocument2 pagesGR No. 152423 (2010) - Sps Esmaquel V CopradaNikki Estores GonzalesNo ratings yet

- Augusto vs. DyDocument1 pageAugusto vs. DyMicha RodriguezNo ratings yet

- CASE DIGEST Filipinas Colleges Inc Vs TimbangDocument2 pagesCASE DIGEST Filipinas Colleges Inc Vs TimbangErica Dela Cruz50% (2)

- Green Acres Holdings, Inc. v. Cabral PDFDocument3 pagesGreen Acres Holdings, Inc. v. Cabral PDFJaime Añonuevo Jr.100% (1)

- Pardell v. Bartolome 23 Phil. 450Document2 pagesPardell v. Bartolome 23 Phil. 450Tryzz dela MercedNo ratings yet

- Bogacki v. InsertDocument2 pagesBogacki v. InsertPepper PottsNo ratings yet

- Tsai Vs Court of Appeals DigestDocument2 pagesTsai Vs Court of Appeals Digestgnrslash01No ratings yet

- German Management and Services Inc. vs. CADocument2 pagesGerman Management and Services Inc. vs. CAyannie isananNo ratings yet

- Isaguirre vs. de LaraDocument3 pagesIsaguirre vs. de LaraRAINBOW AVALANCHENo ratings yet

- 15 Isaguirre V de LaraDocument2 pages15 Isaguirre V de LaraFloyd MagoNo ratings yet

- CASE DIGEST Isaguirre Vs de LaraDocument2 pagesCASE DIGEST Isaguirre Vs de LaraErica Dela CruzNo ratings yet

- (G.R. No. 170770, January 09, 2013)Document12 pages(G.R. No. 170770, January 09, 2013)JamieNo ratings yet

- Second Division (G.R. No. 147905, May 28, 2007)Document5 pagesSecond Division (G.R. No. 147905, May 28, 2007)JamieNo ratings yet

- Third Division (G.R. No. 118843, February 06, 1997)Document7 pagesThird Division (G.R. No. 118843, February 06, 1997)JamieNo ratings yet

- Second Division (G.R. No. 168266, March 05, 2010)Document7 pagesSecond Division (G.R. No. 168266, March 05, 2010)JamieNo ratings yet

- Third Division (G.R. No. 215280, September 05, 2018) : Peralta, J.Document13 pagesThird Division (G.R. No. 215280, September 05, 2018) : Peralta, J.JamieNo ratings yet

- Third Division (G.R. No. 200784, August 07, 2013)Document11 pagesThird Division (G.R. No. 200784, August 07, 2013)JamieNo ratings yet

- (G.R. No. 190187, September 28, 2016)Document15 pages(G.R. No. 190187, September 28, 2016)JamieNo ratings yet

- Second Division (G.R. No. 210538, March 07, 2018)Document7 pagesSecond Division (G.R. No. 210538, March 07, 2018)JamieNo ratings yet

- Second Division (G.R. No. 212774, January 23, 2017)Document10 pagesSecond Division (G.R. No. 212774, January 23, 2017)JamieNo ratings yet

- (G.R. Nos. 188642 & 189425, October 17, 2016)Document18 pages(G.R. Nos. 188642 & 189425, October 17, 2016)JamieNo ratings yet

- G.R. No. 157479, November 24, 2010Document12 pagesG.R. No. 157479, November 24, 2010JamieNo ratings yet

- First Division (G.R. No. 188769, August 03, 2016)Document6 pagesFirst Division (G.R. No. 188769, August 03, 2016)JamieNo ratings yet

- G.R. No. 185894, August 30, 2017Document15 pagesG.R. No. 185894, August 30, 2017JamieNo ratings yet

- Second Division (G.R. No. 206038, January 25, 2017) : Mendoza, J.Document12 pagesSecond Division (G.R. No. 206038, January 25, 2017) : Mendoza, J.JamieNo ratings yet

- Second Division (G.R. No. 108905, October 23, 1997)Document8 pagesSecond Division (G.R. No. 108905, October 23, 1997)JamieNo ratings yet

- Second Division (G.R. No. 224099, June 21, 2017) : Mendoza, J.Document11 pagesSecond Division (G.R. No. 224099, June 21, 2017) : Mendoza, J.JamieNo ratings yet

- First Division (G.R. No. 208844, November 10, 2015) : Perlas-Bernabe, J.Document8 pagesFirst Division (G.R. No. 208844, November 10, 2015) : Perlas-Bernabe, J.JamieNo ratings yet

- (G.R. NO. 141994, January 17, 2005)Document12 pages(G.R. NO. 141994, January 17, 2005)JamieNo ratings yet

- First Division (G.R. NO. 153468, August 17, 2006) : Panganiban, Cj.Document8 pagesFirst Division (G.R. NO. 153468, August 17, 2006) : Panganiban, Cj.JamieNo ratings yet

- Second Division (G.R. No. 212038, February 08, 2017) : Peralta, J.Document13 pagesSecond Division (G.R. No. 212038, February 08, 2017) : Peralta, J.JamieNo ratings yet

- (G.R. No. 75885, May 27, 1987)Document27 pages(G.R. No. 75885, May 27, 1987)JamieNo ratings yet

- (G.R. No. 224307, August 06, 2018)Document9 pages(G.R. No. 224307, August 06, 2018)JamieNo ratings yet

- (G.R. No. 221813, July 23, 2018)Document22 pages(G.R. No. 221813, July 23, 2018)JamieNo ratings yet

- First Division (G.R. No. 225022, February 05, 2018) : Tijam, J.Document10 pagesFirst Division (G.R. No. 225022, February 05, 2018) : Tijam, J.JamieNo ratings yet

- Third Division (G.R. No. 184332, February 17, 2016)Document8 pagesThird Division (G.R. No. 184332, February 17, 2016)JamieNo ratings yet

- (G.R. No. 213088, June 28, 2017)Document11 pages(G.R. No. 213088, June 28, 2017)JamieNo ratings yet

- Atong Paglaum Inc. v. COMELECDocument39 pagesAtong Paglaum Inc. v. COMELECJamieNo ratings yet

- Second Division (G.R. No. 210621, April 04, 2016) : Leonen, J.Document15 pagesSecond Division (G.R. No. 210621, April 04, 2016) : Leonen, J.JamieNo ratings yet

- (G.R. No. 211519, August 14, 2017)Document10 pages(G.R. No. 211519, August 14, 2017)JamieNo ratings yet

- Banat v. ComelecDocument25 pagesBanat v. ComelecJamieNo ratings yet

- CLSP Amendments To Textbook p.57 v2 (With Highlights)Document2 pagesCLSP Amendments To Textbook p.57 v2 (With Highlights)Sim BritneyNo ratings yet

- Partnership ExerciseDocument11 pagesPartnership ExerciseCris Tarrazona Casiple0% (1)

- Latin Maxim Quicquidplantatorsolosolocedit'Document5 pagesLatin Maxim Quicquidplantatorsolosolocedit'Sudarshani SumanasenaNo ratings yet

- de Bautista vs. de GuzmanDocument11 pagesde Bautista vs. de Guzmanrachelle baggaoNo ratings yet

- SPECIAL POWER OF ATTORNEY - ThorDocument2 pagesSPECIAL POWER OF ATTORNEY - ThorJamel AgantalNo ratings yet

- Guidote Vs BorjaDocument6 pagesGuidote Vs Borjayangkee_17No ratings yet

- INDIAN CONTRACT ACT CASE STUDIES FOR CA FOUNDATION UPLOADED ON 7th April 2018 636587145256888474 PDFDocument5 pagesINDIAN CONTRACT ACT CASE STUDIES FOR CA FOUNDATION UPLOADED ON 7th April 2018 636587145256888474 PDFsachin choudhary100% (1)

- Negotiable Instruments Act CHARTSDocument16 pagesNegotiable Instruments Act CHARTSJames power100% (4)

- Finals PropertyDocument10 pagesFinals PropertyMekiNo ratings yet

- Breach of Contract and RemediesDocument6 pagesBreach of Contract and RemediesNavya DantuluriNo ratings yet

- Standard Addendum To ContractDocument3 pagesStandard Addendum To ContractjasonNo ratings yet

- Void Agreements IntroDocument7 pagesVoid Agreements IntroShouldNo ratings yet

- Car Loan Agreement For CompaniesDocument51 pagesCar Loan Agreement For CompaniesMohammad Ali Reza AhmedNo ratings yet

- Termination of ContractDocument2 pagesTermination of ContractkarenepacinaNo ratings yet

- Moa Vas Sole Proprietor 02022023Document7 pagesMoa Vas Sole Proprietor 02022023Bryan BautistaNo ratings yet

- Insurance Law-AssignmentDocument7 pagesInsurance Law-AssignmentDavid FongNo ratings yet

- Summary For Contracts PDFDocument16 pagesSummary For Contracts PDFLeslie An GarciaNo ratings yet

- Rose Frank Co. V Crompton Bros Co..editedDocument5 pagesRose Frank Co. V Crompton Bros Co..editedSarthak ChaudharyNo ratings yet

- Torts I SteinerDocument43 pagesTorts I SteinerJuliana MirkovicNo ratings yet

- SegurosDocument36 pagesSegurosSamira Carazas CalderónNo ratings yet

- History of Companies ActDocument5 pagesHistory of Companies ActAthisaya cgNo ratings yet

- C&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernDocument48 pagesC&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernPalikatowns LLPNo ratings yet

- Malaysian Company LawDocument7 pagesMalaysian Company Lawsyahirah77No ratings yet

- Unit Iii Workmen's Compensation Act, 192Document26 pagesUnit Iii Workmen's Compensation Act, 19221BAM025 RENGARAJANNo ratings yet

- Mariano, Jr. vs. CallejasDocument2 pagesMariano, Jr. vs. CallejasAlphaZuluNo ratings yet

- Case Digest AssignmentDocument5 pagesCase Digest AssignmentRikka ReyesNo ratings yet

- Tenancy Agreement (Industrial) 30.7.2020Document9 pagesTenancy Agreement (Industrial) 30.7.2020Hii Yiik YewNo ratings yet