Professional Documents

Culture Documents

Construction Contracts

Uploaded by

Ms. A0 ratings0% found this document useful (0 votes)

10 views3 pagesAccounting for cosntruction

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting for cosntruction

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesConstruction Contracts

Uploaded by

Ms. AAccounting for cosntruction

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

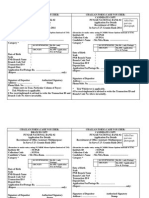

CONSTRUCTION CONTRACTS that is distinct or series of

distinct goods/services that are

Revenue recognition principle (PFRS 15) substantially the same and have

1. Identify the contract with customer. the same pattern of transfer.

The contract is with a customer and the o Can be both explicit and implicit

collectability of consideration is A promised good or service is distinct if:

probable. a. The customer can benefit from the

Contract- agreement between two or good or service either on its own or

more parties creating enforceable rights together with other resources that

and obligations are readily available to the

Attributes: (ALL must be met) customer. A customer can benefit

a. Parties have approved the contract from a good or service if the good

and are committed to perform or service could be used,

b. Each party’s rights to consumed, sold for amount that is

goods/services can be identified. greater than scrap value or

c. The payment terms for otherwise held in a way that

goods/services can be identified. generate economic benefit.

d. The contract has commercial b. The promise to transfer the good or

substance. service is separately identifiable

e. It is probable that an entity will from other promises in the

collect the consideration. contract.

Any consideration received is If no transfer to customer = no PO

recognized as liability and recognized as Separately identifiable:

revenue only when EITHER has o If good or service is not an input

occurred: to a combined output specified

o The entity has no remaining by the customer

obligation to transfer goods or o If it does not significantly

services to the customer and modify another good or service

all, or substantially all, of the promised in the contract

consideration has been o If it is not highly interrelated

received and is non-refundable. with other goods or services

o The contract has been promised in the contract.

terminated and the A promised good or service that is not

consideration received is non- distinct is combined with other goods

refundable. or services until a bundle of goods or

2. Identify the performance obligations in services that is distinct is identified.

the contract. 3. Determine the transaction price.

Each promise to deliver a distinct good Transaction price

or service in the contract is treated as a o The amount that the entity

separate performance obligation. expects to be entitled to in

Performance obligations- exchange for satisfying a

o Promise in a contract with a performance obligation

customer to transfer the excluding the amounts

customer either good/service

collected on behalf of third For a performance obligation satisfied

parties. over time, revenue is recognized as the

o The contract price and any entity progresses towards the complete

subsequent variations in the satisfaction of the performance

contract price to the extent obligation.

that it is probable that they will For a performance obligation satisfied

result in revenue and they are at a point in time, revenue is recognized

capable of being measured when the entity completely satisfies the

reliably. performance obligation.

How to determine the transaction Revenue is measured at the amount of

price? transaction price allocated to the

o Variable Consideration performance obligation satisfied.

o Constraining estimates in Performance obligation is satisfied

variable consideration when a promised good or service is

o Existence of significant transferred to customer.

financing component Contract Costs

o Noncash consideration- at FV a. Costs to obtain a contract

o Consideration payable to o Sales commission, legal fees,

customer bonuses to employees

4. Allocate the transaction price to the o CAPITALIZE + AMORTIZE

performance obligations. b. Costs to fulfill a contract

The transaction price is allocated to the If not within IAS 2/IAS 16/IAS 38:

performance obligations based on the CAPITALIZE if:

relative stand-alone prices of the o Costs relate directly to contract

distinct goods or services. o Costs generate/enhance

To allocate the transaction price to each resources used in satisfying

performance obligation in an amount performance obligation in the

that depicts the amount of future

consideration for transferring promised o Costs are expected to be

goods/services. recovered

How to allocate transaction price?

Based on relative stand-alone selling

prices except for: allocating discounts Construction Contract

and allocating consideration with Contracts for the rendering of services

variable amounts that are directly related to the

Stand-alone selling price construction of asset

o The price at which the entity would Contracts for the destruction or

sell promised good/service restoration of assets, and the

separately to the customer. restoration of the environment

o 1. Take observable prices. following the demolition of assets.

2. If observable selling prices not Generally long-term

available = make estimates

5. Recognize revenue when a

performance obligation is satisfied. Combination of contracts

Each contract is accounted for Output methods

separately. Input methods

If same time with the same customer: o Recognize revenue on the basis

combined and accounted for as single of efforts or inputs expended

contract if: relative to the total expected

o The contracts are negotiated as inputs needed to fully satisfy a

a package with a single performance obligation.

commercial objective. o Cost incurred, resources

o The amount of consideration to consumed, labor hours

be paid in one contract expended, machine hours used,

depends on the price or time elapsed

performance of the other

contract Cost-to-cost method

Most common application of the input

methods

Over Time (if one of the ff is met) Estimation of stage of completion by

The customer simultaneously receives reference to the proportion that

and consumes the benefits provided by contract costs incurred for work

the entity’s performance as the entity performed to date bear to the

performs. estimated total contract costs.

The entity’s performance creates or

enhances an asset that the customer

controls as the asset is created or

enhanced.

The entity’s performance does not

create an asset with an alternative use

to the entity and the entity has an

enforceable right to payment for

performance completed to date.

Transaction Price

Fixed price contract

o The contractor agrees to a fixed

contract price or a fixed rate

per unit of output, which in

some cases is subject to cost

escalation clauses

Cost plus contract

o The contractor is reimbursed

for allowable or defined costs,

plus a fee.

Methods of measuring progress

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- 5-Government AccountingDocument3 pages5-Government AccountingMs. ANo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 6-Budget ProcessDocument4 pages6-Budget ProcessMs. ANo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 6-Responsibility Acctg and Transfer PricingDocument5 pages6-Responsibility Acctg and Transfer PricingMs. ANo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 5-Deductions From Gross IncomeDocument7 pages5-Deductions From Gross IncomeMs. ANo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Fe As I B ExplanationDocument1 pageFe As I B ExplanationMs. ANo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Department of Backward Classes WelfareDocument1 pageDepartment of Backward Classes WelfareMahesh KoujalagiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Corporate Budget Circular No 23Document7 pagesCorporate Budget Circular No 23Tesa GDNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Multi Choice Questions On Income Approach K. C. Jhavar, Btech, Mba, Mval (Re) Retd. Asst. Gen. Manager, Erst S. B. Indore Govt. Regd. ValuerDocument8 pagesMulti Choice Questions On Income Approach K. C. Jhavar, Btech, Mba, Mval (Re) Retd. Asst. Gen. Manager, Erst S. B. Indore Govt. Regd. ValuerAnirban DeyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument6 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETMarco Regunayan100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Discurso Del Ex Presidente Bill Clinton en Su Intervención Ante La Convención Demócrata de Denver Del Día 27 de Agosto de 2008 (En Inglés)Document4 pagesDiscurso Del Ex Presidente Bill Clinton en Su Intervención Ante La Convención Demócrata de Denver Del Día 27 de Agosto de 2008 (En Inglés)Anonymous m2Ae7c4y9No ratings yet

- Full Download Engineering Economy 15th Edition Sullivan Solutions ManualDocument35 pagesFull Download Engineering Economy 15th Edition Sullivan Solutions Manualaminamuckenfuss804uk100% (29)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Loren Legarda: Philippine Name Middle Name Family NameDocument11 pagesLoren Legarda: Philippine Name Middle Name Family NameDarren CariñoNo ratings yet

- Green Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDocument27 pagesGreen Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDickNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- 8th Grade Unit 1 Friendship Rules Vocabulary Worksheet Verbs and Phrases KelimeDocument2 pages8th Grade Unit 1 Friendship Rules Vocabulary Worksheet Verbs and Phrases Kelimepepa1poNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 43 - People V Lol-Lo and SarawDocument2 pages43 - People V Lol-Lo and Sarawnikol crisangNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Lecture 07 Poverty and DemocaryDocument13 pagesLecture 07 Poverty and DemocaryNirob Rahman AzadNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Adelaida B. Aquino vs. Sss & Us Naval Commissary StoreDocument1 pageAdelaida B. Aquino vs. Sss & Us Naval Commissary StoreJug HeadNo ratings yet

- Atp Full Texts Cases (Partnership)Document114 pagesAtp Full Texts Cases (Partnership)Anonymous r1cRm7FNo ratings yet

- I-04 Cooperation AgreementDocument9 pagesI-04 Cooperation AgreementGeorgio RomaniNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Condition of Transgender in IndiaDocument9 pagesCondition of Transgender in IndiaAnupam Kumar YadavNo ratings yet

- Asian Terminals v. Daehan Fire and Marine Insurance Co.Document12 pagesAsian Terminals v. Daehan Fire and Marine Insurance Co.Miguel ManzanoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mobil Engineering Procurement Construction Offshore Installation 20190606 PDFDocument2 pagesMobil Engineering Procurement Construction Offshore Installation 20190606 PDFWale OyeludeNo ratings yet

- Thorne - Business and Society 4eDocument7 pagesThorne - Business and Society 4e星拉斐No ratings yet

- Firm Foundation He Wont Songselect Chart in GDocument2 pagesFirm Foundation He Wont Songselect Chart in GMemeNo ratings yet

- Railway Applications - Communication, Signalling and Processing Systems - Safety Related Electronic Systems For SignallingDocument17 pagesRailway Applications - Communication, Signalling and Processing Systems - Safety Related Electronic Systems For Signallingsayed100% (2)

- PNB Bank Challan Form Sarva UP Gramin Bank Officer Office Asst PostsDocument2 pagesPNB Bank Challan Form Sarva UP Gramin Bank Officer Office Asst PostsGaurav JaiswalNo ratings yet

- Partnership Dissolution AgreementDocument5 pagesPartnership Dissolution AgreementKielRinonNo ratings yet

- Lectures On Admin I 032796 MBPDocument230 pagesLectures On Admin I 032796 MBPSimz SaimaNo ratings yet

- TDS Australia Senatel PowersplitDocument4 pagesTDS Australia Senatel PowersplitFlávia GomesNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Kenyan Constitution KiswahiliDocument4 pagesKenyan Constitution Kiswahilimotego 1No ratings yet

- Let's Check Activity 1: Practice Set 7 Mathematics in Our WorldDocument6 pagesLet's Check Activity 1: Practice Set 7 Mathematics in Our WorldMarybelle Torres VotacionNo ratings yet

- Yap Weng WahDocument32 pagesYap Weng WahKamaruzzaman NordinNo ratings yet

- LC'S Copy: Parish Renewal Experience (Prex) Seminar GuidelinesDocument8 pagesLC'S Copy: Parish Renewal Experience (Prex) Seminar GuidelinesLheiDanielMariellMonteroNo ratings yet

- Article 12 and 3 Republic of The Philippines by Shirley FarrioDocument8 pagesArticle 12 and 3 Republic of The Philippines by Shirley FarrioRonalyn BarrogoNo ratings yet

- Ultimate FeatsDocument258 pagesUltimate Featscloudsteps100% (11)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)