Professional Documents

Culture Documents

6-Budget Process

Uploaded by

Ms. A0 ratings0% found this document useful (0 votes)

54 views4 pagesBudget

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBudget

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

54 views4 pages6-Budget Process

Uploaded by

Ms. ABudget

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

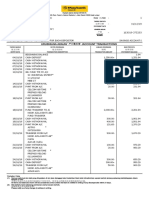

Budget Process o Budgeting several parties

participate in the budget

The National Budget preparation starting from

The Philippine Constitution and other lowest to the highest levels of

laws require government funds to be the government

utilized in accordance with a national o Opposite is the “top-down”

budget that is duly approved by In 2011, The Philippine Government

legislation attempted to start a new tradition by

It is the government’s estimate of the shifting from the old “incremental”

sources and uses of government funds system of budgeting to the “zero-based

within a fiscal year budgeting” approach

Forms the basis for expenditures and is

the government’s key instrument for Incremental Zero-based

promoting its socio-economic Budgeting budgeting

objectives The current year’s The current year’s

The formulation and utilization of the budget is formulated budget is formulated

national budget are summarized in the based on the without regard to the

budget cycle. previous year’s previous year’s

budget. The budget

The Budget Cycle proposed programs

and expenditures in

Budget Preparation

the previous year are

1. Budget Call

approved in the

2. Budget Hearing current year

3. Presentation to the Office of the Uses “roll-over” Uses a “back-to-zero”

President approach or “clean slate”

Budget Legislation approach

4. House Deliberations Prone to abuse Promotes efficient

5. Senate Deliberations and effective

6. Bicameral Deliberations utilization of funds

7. President’s Enactment

Budget Execution Budget Preparation

8. Release Guidelines and BEDs Budget Call

9. Allotment o DBM issues budget call to all

10. Incurrence of Obligations government agencies

11. Disbursement Authority o Contains the next fiscal year’s

Budget Accountability targets, the agency’s budget

12. Budget Accountability Reports ceiling and other guidelines in

13. Performance Reviews the completion and submission

14. Audit of agency budget proposals

o Balanced Budget

Budget Preparation Estimated revenues

Uses a “bottom-up” approach exceed estimated

Bottom-up expenditures

o Annual Budget

o Special Budget of the country’s fiscal

Provide for items not policy and budget

covered or not included priorities

in the general National Expenditure

appropriations act Program (NEP):

o Line item Budget contains the details of

Focuses on specific all the government

expenditures entities’ proposed

o Performance Budget expenditures in the

Plan of activities to be coming year

undertaken Budget of Expenditures

Main focus is on the and Sources of

work to be done or Financing (BESF):

services to be rendered Other documents

o Obligations Budget o President’s Budget

Focuses on Intended to assist the

expenditures incurred Congress in their review

in the current year and deliberation of the

which are to be paid proposed national

either in the same year budget

or in the following year o The President shall submit the

Budget Hearing proposed budget to the

o Conducted after the agencies Congress within 30 days from

submit their budget proposals the opening of every regular

o DBM deliberates on budget session

proposals, makes

recommendations, and Budget Legislation

consolidates the deliberated House Deliberations

proposals into the National o Prepares the General

Expenditure Program (NEP) and Appropriations Bill

Budget of Expenditures and Senate Deliberations

Sources of Financing (BESF) o Conduct its own deliberations

Presentation to the Office of the on the GAB

President Bicameral Deliberations

o After the President approves o Formed to harmonize any

the proposed budget, the DBM conflicts between the

finalizes the budget documents Representatives and Senate

to be submitted to the versions of GAB

Congress. President’s Enactment

o President’s Budget contains the o General Appropriations Act

following: (GAA)

President’s Budget o When the proposed budget is

Message: contains the not enacted before the fiscal

President’s explanation

year starts, the last year’s GAA o To be used directly by agencies

is automatically reenacted concerned for their operation

or specific purposes

The Approved Budget Revolving Funds

Expenditure authority derived from o Receipts derived from business-

appropriation laws, government type activities

ordinances, and other decisions related o Shall be self-liquidating

to the anticipated revenue or receipts Trust Receipts

for the budgetary period

Appropriation Budget Execution

o Authorization made by a Phase where government funds are

legislative body to allocate spent

funds for purposes specified by Release guidelines and BEDs

the legislative or similar o DBM issues guidelines on the

authority release and utilization of funds

o Major recipients of budget:

Appropriations National Government

No law shall be passed authorizing any Agencies (NGAs)

transfers of appropriations Local Government Units

New General Appropriations (LGUs)

o Annual authorizations for GOCCs

incurring obligations during a o Budget Execution Documents

specified budget year, as listed (BEDs)

in GAA Physical and financial

Continuing Appropriations plan

o Support obligations for a Monthly cash program

specific purpose Estimate of monthly

Supplemental Appropriations income

o Additional appropriations List of obligations that

authorized by law to augment are not yet due and

the original appropriations demandable

Automatic Appropriations Allotment

o Authorizations programmed o Obligational authority

annually or for some other o Authorization issued by DBM to

period prescribed by law which government agencies to incur

do not require periodic action obligations for specified amounts

by Congress contained in a legislative

Unprogrammed Funds appropriation in the form of budget

o Standby appropriations release documents

authorized by Congress in the o Illegal for government entity to

annual GAA incur obligations without having

Retained Income/Funds first received the “Allotment”

o Allotment Release Program (ARP)

Set the limit for allotment make disbursements out of

releases during the government funds

upcoming year o Notice of Transfer of Allocation

Control device to ensure Issued by an agency’s

that releases conform to Central Office

the national budget o Non-cash Availment Authority

o Cash Release Program (CRP) Issued by DBM to agencies

Set the disbursement limits to cover the liquidation of

o Obligations: act of a duly authorized their actual obligations

official which binds the government incurred against available

to the immediate or eventual allotments for availment of

payment of a sum of money proceeds from loans through

Disbursement Authority supplier’s

o DMB issues disbursement authority credit/constructive cash

to the government agencies o Cash Disbursement Ceiling

o Point where government agencies Issued by DBM to agencies

obtain access to the government with foreign operations

funds GAME

o Disbursement are most commonly Appropriation Authorization by

made through checks that are legislative body to

chargeable against the account of allocate funds for

the Treasurer of the Philippines. specified purposes

Checks issued under this scheme Allotment Authorization to

are called “Modified Disbursement agencies to incur

obligations

System (MDS) Checks”

Obligation Amount contracted

Documents used in releasing

by an authorized

disbursement authority to government

officer for which the

agencies: government is held

o Notice of Cash Allocation (NCA) liable

Issued by the DBM to Disbursement Actual amount paid

central, regional and out of the budgeted

provincial offices and amount

operating units to cover

their cash requirements Budget Accountability

Specifies the maximum Performance reviews

amount of cash that can be o DBM and COA perform periodic

withdrawn from reviews of the agencies’

government servicing bank performance and budget

in a certain period accountability and report to the

Based on the agency’s President

submitted Monthly Cash Audit

Program o COA audits the agencies

Form of authorization to

government agency to

You might also like

- Government Accounting Manual For National Government Agencies Volume IDocument27 pagesGovernment Accounting Manual For National Government Agencies Volume IKath Hidalgo100% (1)

- 2 - Secrecy of Bank DepositsDocument14 pages2 - Secrecy of Bank Depositsrandyblanza2014No ratings yet

- Government Accounting FundamentalsDocument8 pagesGovernment Accounting FundamentalsElai TrinidadNo ratings yet

- Government Accounting System Ref 2Document15 pagesGovernment Accounting System Ref 2Romeo AnacanNo ratings yet

- Reviewer-Government Accounting-Chap2Document2 pagesReviewer-Government Accounting-Chap2Nicale Jeen100% (1)

- Oil & Gas Business PlanDocument29 pagesOil & Gas Business PlanKhalil Ibrahim Ahmed100% (2)

- T08 - Government Accounting PDFDocument9 pagesT08 - Government Accounting PDFAken Lieram Ats AnaNo ratings yet

- Start-Ups and Early Stage Companies: A Valuation InsightDocument11 pagesStart-Ups and Early Stage Companies: A Valuation InsightViktorNo ratings yet

- Chapter 03 The Government Accounting ProcessDocument20 pagesChapter 03 The Government Accounting ProcessRygiem Dela CruzNo ratings yet

- Revenue and Other Receipts - ScriptDocument30 pagesRevenue and Other Receipts - ScriptChristine Leal-Estender100% (2)

- Accounting For Budgetary AccountsDocument11 pagesAccounting For Budgetary AccountsjenieNo ratings yet

- Government Accounting ManualDocument9 pagesGovernment Accounting ManualGabriel PonceNo ratings yet

- 2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPODocument6 pages2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPOVernn100% (1)

- Understanding the UACS Code StructureDocument5 pagesUnderstanding the UACS Code StructureJamila Zarsuelo100% (1)

- Government AccountingDocument131 pagesGovernment AccountingAngelo Andro SuanNo ratings yet

- Life Cycle of a Trade in 40 CharactersDocument98 pagesLife Cycle of a Trade in 40 Characterspatcamp@blueyonder.co.uk100% (1)

- Accounting for Government, Not-for-Profits and Specialized IndustriesDocument58 pagesAccounting for Government, Not-for-Profits and Specialized IndustriesSandra DoriaNo ratings yet

- Accounting For Government Organizations Mock CEDocument15 pagesAccounting For Government Organizations Mock CEDena Heart OrenioNo ratings yet

- 07 Valuing Early-Stage BusinessesDocument8 pages07 Valuing Early-Stage Businessesmaghanna88No ratings yet

- Chapter 5 Accounting For Disbursements and Related TransactionsDocument2 pagesChapter 5 Accounting For Disbursements and Related TransactionsJaps100% (1)

- Govt. Acctg. CHP 9Document11 pagesGovt. Acctg. CHP 9Shane KimNo ratings yet

- Ac 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesDocument53 pagesAc 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesHarley Gumapon100% (1)

- Special Economic ZoneDocument19 pagesSpecial Economic Zonekim cheNo ratings yet

- Accounting For Government and Not-For-Profit Organizations: ACCO 30033Document13 pagesAccounting For Government and Not-For-Profit Organizations: ACCO 30033Angelito Mamersonal100% (1)

- CMPC 311 PRELIM QUIZ 2Document9 pagesCMPC 311 PRELIM QUIZ 2Sevastian jedd EdicNo ratings yet

- Module 2Document4 pagesModule 2quennie vilchezNo ratings yet

- Government Accounting ReportDocument48 pagesGovernment Accounting ReportReina Regina S. CamusNo ratings yet

- Features of the Government Accounting ManualDocument30 pagesFeatures of the Government Accounting ManualMay Joy ManagdagNo ratings yet

- Government Accounting Punzalan Solman Chap 2Document6 pagesGovernment Accounting Punzalan Solman Chap 2Alarich Catayoc100% (1)

- Government Accounting SyllabusDocument12 pagesGovernment Accounting SyllabusJean Diane JoveloNo ratings yet

- Government Accounting & Non-Profit Organizations PPEDocument38 pagesGovernment Accounting & Non-Profit Organizations PPENoeline ParafinaNo ratings yet

- Feu Notes 231Document7 pagesFeu Notes 231Naiv Yer NagaliNo ratings yet

- Government Accounting PDFDocument33 pagesGovernment Accounting PDFKenneth RobledoNo ratings yet

- Government Accounting Manual outlines policies and proceduresDocument3 pagesGovernment Accounting Manual outlines policies and proceduresMariaCarlaMañagoNo ratings yet

- Module 1 - Introduction To Government AccountingDocument11 pagesModule 1 - Introduction To Government AccountingRiviera MehsNo ratings yet

- NOTESDocument2 pagesNOTESJñelle Faith Herrera SaludaresNo ratings yet

- Gross Profit Analysis ExplainedDocument4 pagesGross Profit Analysis ExplainedLady Lhyn LalunioNo ratings yet

- Public Fiscal Administration Budgeting ProcessDocument14 pagesPublic Fiscal Administration Budgeting ProcessKarenina Victoria100% (1)

- Overview Obnbn PPSASDocument44 pagesOverview Obnbn PPSASJenofDulwn0% (1)

- Comparative Study of Home Loan and Personal Loan of Icici Bank With Sbi & Other BanksDocument136 pagesComparative Study of Home Loan and Personal Loan of Icici Bank With Sbi & Other Banksrahulsogani12350% (2)

- Example 2 St. Paul Hospital: Net Revenues 4,620,000Document1 pageExample 2 St. Paul Hospital: Net Revenues 4,620,000Von Andrei MedinaNo ratings yet

- Accounting and Budgeting Policies for Local Government UnitsDocument34 pagesAccounting and Budgeting Policies for Local Government UnitsRachel Sanculi LustinaNo ratings yet

- Liabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive ObligationDocument40 pagesLiabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive Obligationmaria isabellaNo ratings yet

- Chapter 3 - The Govt Acctg ProcessDocument11 pagesChapter 3 - The Govt Acctg Processjerome orillosaNo ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- The Government Accounting ProcessDocument4 pagesThe Government Accounting ProcessWawex DavisNo ratings yet

- INCOME STATEMENT (CTT Exam)Document1 pageINCOME STATEMENT (CTT Exam)Mharck AtienzaNo ratings yet

- Government Budgeting Experience in The PhilDocument9 pagesGovernment Budgeting Experience in The PhilPOC MMPA17No ratings yet

- Accounting For Budgetary AccountsDocument7 pagesAccounting For Budgetary AccountsSharn Linzi Buan MontañoNo ratings yet

- Coa C2015-003Document10 pagesCoa C2015-003JOHAYNIENo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- 015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Document3 pages015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Zatsumono YamamotoNo ratings yet

- 001 Government AccountingDocument75 pages001 Government AccountingMark Brian Parantar100% (1)

- Taxation Review: General Principles and Key ConceptsDocument175 pagesTaxation Review: General Principles and Key Conceptssha marananNo ratings yet

- CFAS Graded Recitation CompleteDocument14 pagesCFAS Graded Recitation CompleteJONATHAN LANCE JOBLENo ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- Financial Management Part 2: Analyzing ReportsDocument36 pagesFinancial Management Part 2: Analyzing ReportsJudy Anne RamirezNo ratings yet

- Ra 9298Document9 pagesRa 9298JessicaGonzalesNo ratings yet

- VHWODocument6 pagesVHWOJodie Sagdullas100% (1)

- Philippine Budget Cycle ProcessDocument12 pagesPhilippine Budget Cycle ProcessMark DaryllNo ratings yet

- Intermediate Accounting 3 - Statement of Financial PositionDocument6 pagesIntermediate Accounting 3 - Statement of Financial PositionLuisitoNo ratings yet

- Chapter 2: Accounting Concepts and Principles (FAR By: Millan)Document7 pagesChapter 2: Accounting Concepts and Principles (FAR By: Millan)Ella MontefalcoNo ratings yet

- CFAS INTRo1Document14 pagesCFAS INTRo1Hannah Pamela LegaspiNo ratings yet

- Ast TX 1001 Capital Assets (Batch 22)Document3 pagesAst TX 1001 Capital Assets (Batch 22)CeciliaNo ratings yet

- Budget ProcessDocument7 pagesBudget Processmaefgr1012No ratings yet

- The Budget ProcessDocument16 pagesThe Budget ProcessAldrin John TungolNo ratings yet

- The Budget Process: (The Philippine Public Transparency Reporting Project, January 11, 2011)Document8 pagesThe Budget Process: (The Philippine Public Transparency Reporting Project, January 11, 2011)rochNo ratings yet

- 10 Process CostingDocument1 page10 Process CostingMs. ANo ratings yet

- 7-Govt Accounting ProcessDocument1 page7-Govt Accounting ProcessMs. ANo ratings yet

- 5-Government AccountingDocument3 pages5-Government AccountingMs. ANo ratings yet

- 9 Cost AccumulationDocument1 page9 Cost AccumulationMs. ANo ratings yet

- 10 Process CostingDocument1 page10 Process CostingMs. ANo ratings yet

- ReferencesDocument1 pageReferencesMs. ANo ratings yet

- 5-Deductions From Gross IncomeDocument7 pages5-Deductions From Gross IncomeMs. ANo ratings yet

- 9 Capital BudgetingDocument1 page9 Capital BudgetingMs. ANo ratings yet

- 4-Gross IncomeDocument2 pages4-Gross IncomeMs. ANo ratings yet

- FlowofreportDocument2 pagesFlowofreportMs. ANo ratings yet

- Responsibility Accounting and Transfer Pricing ExplainedDocument5 pagesResponsibility Accounting and Transfer Pricing ExplainedMs. ANo ratings yet

- 3 CorporationsDocument2 pages3 CorporationsMs. ANo ratings yet

- Construction ContractsDocument3 pagesConstruction ContractsMs. ANo ratings yet

- 9 Capital BudgetingDocument1 page9 Capital BudgetingMs. ANo ratings yet

- Absorption and VariableDocument1 pageAbsorption and VariableMs. ANo ratings yet

- Application LetterDocument1 pageApplication LetterMs. ANo ratings yet

- MC ProjectDocument2 pagesMC ProjectMs. ANo ratings yet

- PartnershipDocument1 pagePartnershipMs. ANo ratings yet

- Application LetterDocument1 pageApplication LetterMs. ANo ratings yet

- Fe As I B ExplanationDocument1 pageFe As I B ExplanationMs. ANo ratings yet

- That Helps To Evaluate Which Vendors More Closely Match Your List of PrioritiesDocument3 pagesThat Helps To Evaluate Which Vendors More Closely Match Your List of PrioritiesMs. ANo ratings yet

- HSBC Immigration - Brochure For Global Use PDFDocument4 pagesHSBC Immigration - Brochure For Global Use PDFBubblyDeliciousNo ratings yet

- Black BookDocument41 pagesBlack BookMoazza QureshiNo ratings yet

- TS Grewal Solutions for Class 12 Accountancy Chapter 7 - Calculating Goodwill and Partner's Gains/SacrificesDocument34 pagesTS Grewal Solutions for Class 12 Accountancy Chapter 7 - Calculating Goodwill and Partner's Gains/SacrificesblessycaNo ratings yet

- Finance Chapter 18Document35 pagesFinance Chapter 18courtdubs100% (1)

- 102A - Principles of AccountingDocument38 pages102A - Principles of AccountingMuhammad Arslan Usman0% (1)

- 4 - 1-A Macro Risk-Based Approach - J-TeiletcheDocument19 pages4 - 1-A Macro Risk-Based Approach - J-TeiletcheLoulou DePanamNo ratings yet

- 163019-375293 20191231 PDFDocument6 pages163019-375293 20191231 PDFAmran KeloNo ratings yet

- EMBA Applied Value Investing (Ajdler) SP2016Document3 pagesEMBA Applied Value Investing (Ajdler) SP2016darwin12No ratings yet

- Nedai, Abbas (562-388-900) and Hosseini Ssayadnavard, MaryamDocument122 pagesNedai, Abbas (562-388-900) and Hosseini Ssayadnavard, Maryamirajiraj77No ratings yet

- Islamic Finance and BankingDocument10 pagesIslamic Finance and BankingMaruf AhmedNo ratings yet

- Functions of Central Bank PDFDocument27 pagesFunctions of Central Bank PDFPuja BhardwajNo ratings yet

- Igcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossDocument205 pagesIgcse Accounting Cash Book & Petty Cash Book: Prepared by D. El-HossThiri Myit Mo 9DNo ratings yet

- Turning Point Brands: Release Date: 10 July 2019Document24 pagesTurning Point Brands: Release Date: 10 July 2019Anonymous 2nAj0N9MxqNo ratings yet

- Real Estate Finance Presentation PDFDocument10 pagesReal Estate Finance Presentation PDFEsther LeeNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnAman AnandNo ratings yet

- Banking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduDocument27 pagesBanking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduilusonaNo ratings yet

- Bill Gates Profile and Milestone AchievementsDocument72 pagesBill Gates Profile and Milestone AchievementsvaibhavNo ratings yet

- Ali Cloud Investment ProfileDocument23 pagesAli Cloud Investment ProfileFarhan SheikhNo ratings yet

- Homework on Share-Based PaymentsDocument4 pagesHomework on Share-Based PaymentsCharles TuazonNo ratings yet

- Role of Sebi - As A Regulatory AuthorityDocument4 pagesRole of Sebi - As A Regulatory Authoritysneha sumanNo ratings yet

- Managing Business Finances: Section 17.1Document18 pagesManaging Business Finances: Section 17.1Thiên TíuNo ratings yet

- Module 11-Inventory Cost FlowDocument8 pagesModule 11-Inventory Cost FlowCreative BeautyNo ratings yet

- Bank Regulations and SupervisionDocument6 pagesBank Regulations and SupervisionYashna BeeharryNo ratings yet