Professional Documents

Culture Documents

Government Accounting Fundamentals

Uploaded by

Elai TrinidadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Accounting Fundamentals

Uploaded by

Elai TrinidadCopyright:

Available Formats

Chapter 1: GOVERNMENT ACCOUNTING ▪ audit and settlement of the accounts of all persons respecting funds

or property received or held by them in an accountable capacity,

Fundamental principles of any government agencies’ financial ▪ examination, audit, and settlement of all debts and claims of any

transactions and operations. sort due from or owing to the Government or any of its subdivisions,

1. No money shall be paid out of any public treasury of depository agencies and instrumentalities.

except in pursuance of an appropriation law or other specific

statutory authority. COA’s jurisdiction extends to:

2. Government funds or property shall be spent or used solely for ▪ all government-owned or controlled corporations, including their

public purposes. subsidiaries, and other self-governing boards, commissions, or

3. Trust funds shall be available and may be spent only for the specific agencies of the Government,

purpose for which the trust was created or the funds received. ▪ non-governmental entities subsidized by the government

4. Fiscal responsibility shall, to the greatest extent, be shared by all ▪ those funded by donations through the

those exercising authority over the financial affairs, transactions, government

and operations of the government agency. ▪ those required to pay levies or government

5. Disbursements or disposition of government funds or property shall share

invariably bear the approval of the proper officials. ▪ those for which the government has put up a

6. Claims against government funds shall be supported with complete counterpart fund or those partly funded by

documentation. the government.

7. All laws and regulations applicable to financial transactions shall be

faithfully adhered to. Commission on Audit Mandates

8. Generally accepted principles and practices of accounting as well 1. To determine whether or not the fiscal responsibility that rests

as of sound management and fiscal administration shall be directly with the head of the government agency has been properly

observed, provided that they do not contravene existing laws and and effectively discharged;

regulations. 2. To develop and implement a comprehensive audit program that

shall encompass an examination of financial transactions,

GOVERNMENT ACCOUNTING accounts, and reports, including evaluation of compliance with

Encompasses the processes of analyzing, recording, classifying, summarizing applicable laws and regulations;

and communicating all transactions involving the receipt and disposition of 3. To institute control measures through the promulgation of rules and

government funds and property, and interpreting the results thereof. regulations governing the receipts, disbursements, and uses of

(PD 1445, Sec. 109) funds and property, consistent with the total economic development

effort of the government;

Objectives of government accounting. 4. To promulgate auditing and accounting rules and regulations so as

▪ produce information concerning past operations and present to facilitate the keeping, and enhance the information value, of the

conditions; accounts of the government;

▪ provide a basis for guidance for future operations; 5. To adopt measures calculated to hasten the full professionalization

▪ provide for control of the acts of public bodies and officers in the of its services;

receipt, disposition and utilization of funds and property; and 6. To institute measures designed to preserve and ensure the

▪ report on the financial position and the results of operations of independence of its representatives; and

government agencies for the information of all persons concerned. 7. To endeavor to bring its operations closer to the people by the

(PD 1445, Sec. 110) delegation of authority through decentralization, consistent with the

provisions of the new Constitution and the laws.

Accounting Responsibility

The Constitution of the Philippines mandates the keeping of the general Department of Budget and Management

accounts of the government, promulgation of accounting rules, and the The DBM shall assist the President in the:

submission of reports covering the financial condition and operation of the 1. preparation of a national resources and expenditures budget,

government. 2. preparation, execution and control of the National Budget,

The government agencies charged with accounting responsibility are: 3. preparation and maintenance of accounting systems essential to

▪ Commission on Audit the budgetary process,

▪ Department of Budget and Management 4. achievement of more economy and efficiency in the management

▪ Bureau of Treasury of government operations,

▪ Government Agencies discharging the functions of government to 5. administration of compensation and position classification systems,

enable it to attain it commitments to the Filipino people. 6. assessment of organizational effectiveness and review

7. evaluation of legislative proposals having budgetary or

Commission on Audit organizational implications.

The authority and powers of the Commission shall extend to and comprehend

all matters relating to: Mandates of DBM

▪ auditing procedures, ▪ The Department shall be responsible for the formulation and

▪ systems and controls, implementation of the National Budget with the goal of attaining our

▪ keeping of the general accounts of the Government, national socio-economic plans and objectives.

▪ preservation of vouchers pertaining thereto for a period of ten ▪ The Department shall be responsible for the efficient and sound

years, utilization of government funds and revenues to effectively achieve

▪ examination and inspection of the books, records, and papers our country's development objectives.

relating to those accounts; (EO 292, Title XVII)

Bureau of Treasury 3. Budget basis for presentation of budget information in the financial

Plays the pivotal role in the cash operations, collections, remittances and statement in accordance with PPSAS 24.

disbursements in the government. ▪ Requires comparison of budget amounts and actual amounts arising from

execution of the budget to be included in the financial statements.

Mandates of Bureau of Treasury

▪ Requires disclosure of an explanation of the reasons for material differences

▪ Assist in the formulation of policies on borrowing, investment and

between budget and actual amounts.

capital market development;

▪ Formulate adequate operations guidelines for fiscal and financial 4. Revised Chart of accounts prescribed by commission on audit

policies; ▪ Uniform accounts to be used in the government accounting and

▪ Assist in the preparation by government agencies concerned of an budget systems to facilitate the preparation of harmonized financial

annual program for revenue and expenditure targets, borrowing and budget accountability reports.

levels and cash balances of National Government; 5. Double entry bookkeeping

▪ Maintain books of accounts of the cash transactions; ▪ Two accounting entries (debit, credit) are required to record each

▪ Manage the cash resources, collect taxes made by the National accounting transactions.

Government (NG) and guarantee forward cover fees due NG,

control and service its public debt, both foreign or domestic; 6. Financial statements based on accounting and budgetary records.

▪ Issue, service, redeems government securities for the account of Provide information:

the National Government as may be authorized by the President ▪ useful in decision making

pursuant to law; ▪ about the sources, allocation, and uses of financial resources

▪ Administer the Securities Stabilization Fund by purchase and sale ▪ about how the entity financed its activities and met its cash

in the open market of government bills and bonds to increase the requirement

liquidity and stabilize the value of said securities in order to promote ▪ useful in evaluating the entity’s ability to finance its activities and

private investment in government securities; meet its liabilities and commitments

▪ Act as principal custodian of financial assets of the National ▪ about the financial condition of the entity and changes in it

Government, its agencies and instrumentalities; ▪ useful in entity’s performance in terms of service costs, efficiency

▪ Bond all accountable public officials and employees pursuant to the and accomplishments

provisions of the Public Bonding Law and issue appropriate ▪ whether resources were obtained and use in accordance with

guidelines therefore; legally adopted budget

Perform such other related functions as may be assigned to it by ▪ whether resources were obtained and used in accordance with

legal and contractual requirements, including financial limits

National Government Agencies established by appropriate legislative authorities.

All instrumentalities of the National Government, including the Congress, the

Judiciary, the Constitutional bodies, state Universities and colleges and self- 7. Fund cluster accounting

contained institutions and hospitals are required by law to have accounting Fund cluster – an accounting entity for recording expenditures and revenues

units/divisions/departments, which are to be the same level with other associated with specific activity for which accounting records are maintained

units/division/departments and under the supervision of the Head of the and periodic financial reports are prepared.

Agency. Detailed financial statements and trial balances consolidated by the fund

cluster as follows:

Accounting personnel shall: ▪ Regular Agency Fund

1. Maintain and keep current the accounts of the agency. ▪ Foreign Assisted Projects Fund

2. Provide advice on the financial condition and status of the ▪ Special Account- Locally Funded/Domestic Grants Fund

appropriations and allotments of the agency as its Head may ▪ Special Account- Foreign Assisted/Domestic Grants Fund

require. ▪ Internally Generated Funds

3. Develop and conduct procedures designed to meet the needs of ▪ Business Related Funds

management. ▪ Trust Receipt/Inter-agency Transferred Funds (IAFT)

They shall perform the aforesaid duties in accordance with existing laws, rules,

regulations, procedures and comply with the reporting requirements of COA, Responsibility Accounting

DOF and DBM. Failure to comply is sufficient ground for dismissal from the ▪ System that relates the financial results to a responsibility center,

government service. (Insert Registries) which provides access to cost and revenue information under the

supervision of a manager having direct responsibility for it

Basic accounting and budget reporting principles performance.

Government entities are required to recognized and present its financial ▪ System that measures the plans (by budget) and actions (by actual

transactions and operations in conformity with the following: results) of each responsibility.

1. Generally accepted government accounting principles in accordance Responsibility center

with PPSAS and pertinent rules and regulations. Part, segment, unit or function of government agency a government agency,

headed by a manager, who is accountable for a specified set of activities.

• The use of Philippine Public Sector Accounting Standard (PPSAS) Responsibility accounting aims to:

effective January 1, 2014 is in accordance with COA Resolution ▪ Ensures that all costs and revenues are properly charged/credit to

No. 2014-0030. the correct responsibility so that the deviations from the budget can

• PPSAS was based on International Public Sector Accounting be readily attributed to managers accountable therefor,

Standards. ▪ Provide a basis for making decisions for future operations,

▪ Facilitate review activities, monitoring the performance of each

2. Accrual basis of accounting in accordance with PPSAS responsibility center and evaluation of the effectiveness of agency’s

▪ Transactions and other events are recognized when they occur, operation.

and not when cash or its equivalent is received or paid.

CHAPTER 2: UNIFIED ACCOUNT CODE STRUCTURE (UACS) • Automatic Appropriations- are authorizations made annually or for

The Unified Account Code Structure (UACS) some other period prescribed by law, by virtue of standing legislation,

- is a government-wide harmonized budgetary, treasury and accounting which do not require periodic action by the Congress. These are

code classification framework jointly developed by the Department of automatically and annually included in the National Expenditure Program

Budget and Management (DBM), the Commission on Audit (COA), the of the National Government.

Department of Finance (DOF) and the Bureau of the Treasury (BTr) to Examples:

facilitate reporting of all financial transactions of agencies including 1. Retirement and Life Insurance Premiums

revenue reporting. 2. Pension under R.A. No. 2087, as amended by P.D. No. 1625

and R.A. No. 5059

- its key purpose is to enable the timely and accurate reporting of actual 3. Domestic Grant Proceeds

revenue collections and expenditures against budgeted programmed 4. Customs duties and taxes, including tax expenditures

revenues and expenditures. • Unprogrammed Funds- are standby appropriations for priority

programs or projects of the government. The utilization of

KEY ELEMENTS OF UACS Unprogrammed Funds may be approved if any of the following conditions

• Funding Source (8-digit) are met:

• Organization (12-digit) • Revenue collections for the year exceed targets

• Location (9-digit) • New revenues not included in the original revenue targets are

• MFO/PAP (15-digit) successfully generated, or

• Object (10-digit • Foreign loan proceeds are generated for newly approved

projects covered by perfected loan agreements.

• Retained Income/Funds- are collections that are authorized by law to

be used directly by agencies for their operation or specific purposes.

These include but are not limited to receipts from:

• State Universities and Colleges (SUCS) - tuition and

matriculation fees and other internally generated receipts

• Department of Health (DOH) - hospital income.

• Revolving Funds- are receipts derived from business-type activities of

departments/agencies as authorized by law, and which are deposited in

an authorized government depository bank. These funds shall be self-

01-1-03-251 liquidating. All obligations and expenditures incurred because of these

business-type activities shall be charged against the Revolving Fund.

• General Funds- are funds available for any purpose that Congress may

choose to apply, and is composed of all receipts or revenues that do not • Trust Receipts- are receipts that are officially in the possession of

otherwise accrue to other funds. government agencies or a public officer as trustee, agent, or

administrator, or which have been received for the fulfillment of a

• Off-Budgetary Funds - refer to receipts for expenditure items that are particular obligation.

not part of the National Expenditure Program, and which are authorized These receipts may be classified as:

for depositing in government financial institutions. These are categorized • Inter-Agency Transferred Funds (IATF), which are receipts or

into: fund transfers from any government-agency or Government

• Retained Income/Receipts, and Owned and/or Controlled Corporations (GOCC) to another

• Revolving Funds agency, and which are deposited in the National Treasury to

• Custodial Funds- refer to receipts or cash received by any government facilitate project implementation;

agency—whether from a private source or another government • Receipts deposited with the National Treasury other than IATF,

agency—to fulfill a specific purpose. Custodial receipts include receipts which are receipts from other sources—including private persons

collected as an agent for another entity. or foreign institutions—which are deposited with the National

• New General Appropriations- are annual authorizations for incurring Treasury, pursuant to E.O. No. 338, for the fulfillment of some

obligations during a specified budget year, as listed in the General obligations; and,

Appropriations Act (GAA). The GAA is the legislative authorization that • Receipts deposited with Authorized Government Depository Bank

identifies new appropriations for the implementation of programs, (AGDB), which are receipts from other sources that should be

projects and activities of all departments, bureaus and offices of deposited in the AGDB for the fulfillment of some obligations.

government for a given year.

• Specific Budgets of National Government Agencies- refers to the

• Continuing Appropriations- are authorizations to support obligations budgets appropriated for a specific department or agency of the

for a specified purpose or project, even when these obligations are National Government.

incurred beyond the budget year. Because MOOE and CO • GoP Counterpart Funds and Loans/Grants from Development

appropriations in the GAA are valid for two years, unobligated and Partners or the Multilateral/Bilateral Assistance- fund category code

unreleased appropriations for these budget items are valid until the end for counterpart funds, loan proceeds and grant proceeds.

of their second year and are classified as Continuing Appropriations.

The authorization code—which precedes the fund category code—will

• Supplemental Appropriations- are additional appropriations vary depending on whether funds were loans or grants, as well as if they

enacted by Congress to augment original appropriations that have were unprogrammed or included in the regular budget. Appropriated loan

proven insufficient for their intended purpose because of economic, proceeds will use authorization code 01, grant proceeds will use

political or social conditions. Supplemental Appropriations must also be authorization code 04 and unprogrammed loan proceeds will use

supported by a certification of availability of funds by the BTr. authorization code 05.

• Allocation to Local Government Units (ALGU)- refers to the share of • City - a political corporate unit of government which consists of a more

Local Government Units (LGUs) from the revenue collections of the urbanized and developed group of barangays. It serves primarily as

National Government. The total ALGU is based on a sharing scheme a general-purpose government for the coordination and delivery of basic,

computed for each LGU, as provided for under the Local Government regular and direct services and effective governance of the inhabitants

Code and other special laws. within its territorial jurisdiction.

• Municipality - a political corporate unit of government which consists of

• Budgetary Support to Government Corporations (BSGC)- refers to

a group of barangays. It serves primarily as a general-purpose

either subsidies for operations or projects, equity contributions, and net

government for the coordination and delivery of basic, regular and direct

lending and/or advances to Government-Owned or Controlled

services and effective governance of the inhabitants within its territorial

Corporations (GOCC) for loan repayments.

jurisdiction.

• Financial Assistance to Metropolitan Manila Development • Municipality Code. This is a two-digit code that generally used to

Authority-refers to national government subsidy in the form of regular identify the municipalities, cities or municipal districts in a particular

appropriations as provided in the GAA which shall only be used to province, and is dependent upon the Province Code to fully

augment any deficiency in the consolidated funds of the MMDA to cover establish the identity of municipality.

valid and authorized expenditures. It ranges from 01 to 99.

• A Special Account in the General Fund (SAGF)- is a fund where • Barangay - the basic political unit of government. It serves as the primary

proceeds from specific revenue measures and grants earmarked by law planning and implementing unit of government policies, plans, programs,

for priority projects are recorded. These sources are automatically projects and activities in the community, and also as a forum where the

appropriated. collective views of its constituents may be expressed, crystallized and

• Special Purpose Funds (SPF)- are lump-sum funds included in the considered, and where disputes may be amicably settled.

GAA which are not within the approved appropriations of • Barangay Code. This is a three-digit code which generally defines

Departments/Agencies/Lower Level Operating Units, and which are the relative alphabetical sequence of the barangays within the

available for allocation to any Department/Agency/Lower Level municipality. The code ranges from 001 to 999.

Operating Unit or Local Government Unit for a specific purpose, as may Barangay Code 010 means it is the 10th barangay in alphabetical

be duly approved in accordance with special provisions on the use of sequence within that municipality. The Barangay Code is

these funds. dependent upon the Municipality Identifier to fully

establish the identity of a given barangay

Department Agency Operating Unit Lowel Level

Class Operating Unit Sector or Program MFO or Activity Activity

00 000 00 00000 Horizontal / Project Project Level 1 Level 2

Organization Outcomes Category

• Department – the primary subdivision of the Executive Branch 00000 0 00 00 00000

responsible for the overall management of a sector or a permanent Major or Final Output (MFO) / Program, Activity & Project (PAP)

national concern with nationwide or international impact1. A department • Sector/Horizontal Outcomes- are specific programs implemented with

is headed by a Secretary or an official with an equivalent position level. the aim of achieving common policy objectives among government

• Agency – refers to any of the various units of the government, including agencies.

an office, instrumentality or Government-Owned and/or Controlled • Major Final Output- defined as a good or service that a department or

Corporation (GOCC)2 that may not approximate the size of a agency is mandated to deliver to external clients through the

Department, but which nevertheless performs tasks that are equally implementation of programs, activities and projects.

important and whose area of concern is nationwide in scope (e.g., Other • Program- is an integrated group of activities that contributes to an

Executive Offices [OEOs]). agency or department’s continuing objective. Examples include General

• Operating Units – organizational entities charged with carrying out Administration and Support, Support to Operations,

specific substantive functions or with directly implementing and Operations.

programs/projects of a department or agency, such as line bureaus • Activity- is defined as a work process that contributes to the fulfillment

and field units. of a program or project. Each activity shall be attributed to only one MFO.

Region Province City / Municipality Barangay Activities are to be assigned to General Administration and Support, or

00 000 Support to Operations if they benefit internal clients. On the other hand,

00 00 an activity that benefits external clients shall be attributed to an MFO.

Location • Projects- are special department/agency undertakings carried out within

• Region - a sub-national administrative unit composed of several a definite timeframe, and which are designed to produce a pre-

provinces having more or less homogenous characteristics, such as determined measure of goods or services (MFOs). A project is

ethnic origin of inhabitants, dialect spoken, agricultural produce, etc. considered an investment toward expanding the capacity of a

• Region Code. This is a two-digit code that identifies a specific department/agency to deliver MFOs.

region. It ranges from 01 to 99. Salaries and Wages – Regular 50101010 00

• Province - a political corporate unit of government which consists of a Basic Salary – Civilian 50101010 01

cluster of municipalities, or municipalities and component cities. A Revised Chart of Sub-Object

province serves as a dynamic mechanism for developmental processes Accounts 00

and effective governance of local government units within its territorial 00000000

jurisdiction. Object

• Province Code. This is a two-digit code that identifies the province. Particulars UACS

It ranges from 01 to 99, generally defining the relative alphabetic Assets 1

sequence of all provinces in the country, except those created after Liabilities 2

1977, which were added to the list following the updating Equity 3

procedures. Income 4

Expenses 5

CHAPTER 4: ACCOUNTING FOR BUDGETARY ACCOUNTS The Budget Cycle

The Philippine Government Accounting System

• Budgetary Accounts System

• Receipt/Income and Deposit System

• Disbursement System

• Financial Reporting System

Accounting for Budgetary Accounts

- Article VI of the 1987 Constitution Section 29 (1).

- “No money shall be paid out of the Treasury except in pursuance of

an appropriation by law.”

THE NATIONAL BUDGET 1. BUDGET PREPARATION

- plan for financing the government activities for a fiscal year prepared and

1. Determination of the overall economic targets, expenditure levels,

submitted by responsible executive to a representative body whose

revenue projection and the financing plan by the Development

approval and authorization are necessary before the plan can be

Budget Coordinating Committee (DBCC).

executed.

• The DBCC is an inter-agency body composed of the DBM

- definite proposal or estimate or statement of receipts and expenditures

Secretary as Chairman and the Bangko Sentral Governor, the

that may be approved or rejected.

Secretary of the Department of Finance, the Director General of the

- the financial blue print of a country’s development plan.

National Economic and Development Authority and a

representative of the Office of the President as members.

Balanced Budget

2. Issuance by the DBM of the Budget Call which defines the budget

The budget where the proposed expenditures are equal or less than the

framework; sets economic and fiscal targets; prescribe the priority thrusts

estimated revenues.

and budget levels; and spells out the guidelines and procedures,

technical instructions and the timetable for budget preparation;

Performance-Informed Budgeting (PIB)

3. Preparation by various government agencies of their detailed budget

• Budgeting approach that uses performance information to assist in

estimates ranking programs, projects and activities using the capital

deciding where the funds will go.

budgeting approach and submission of the same to DBM;

• Performance information typically includes:

4. Conduct budget hearings were agencies are called to justify their

• The purpose for the funds required.

proposed budgets before DBM technical panels;

• The outputs that would be produced or the services that would be

5. Submission of the proposed expenditure program of

rendered.

department/agencies/special for confirmation by department/agency

• The outcomes that would be achieved by the outputs and services.

heads.

• The cost of the programs and activities proposed to achieve the

6. Presentation of the proposed budget levels of

objectives.

department/agencies/special purpose funds to the DBCC for approval.

• Simplified budgeting approach that focuses more on outputs and

7. Review and approval of the proposed budget by the President and

outcomes and places less emphasis on the inputs.

the Cabinet;

• PIB is an integral process whereby agency performance information and

8. Submission by the President of proposed budget to Congress.

their corresponding indicators under their Organizational Performance

Indicator Framework (OPIF) is presented hand-in-hand with the agency

2. BUDGET LEGISLATION

budget to ensure that the outcomes an agency is committing to deliver

in exchange for its budget are clear to the public and the legislators. 1. The President submits his/her proposed annual budget in the form of

Budget of Expenditure and Sources of Financing (BESF) supported by

Kinds of Budget details of proposed expenditures in the form of a National Expenditure

Program (NEP) and the President's Budget Message which summarizes

the budget policy thrusts and priorities for the year.

2. The proposed budget goes first to the House of Representatives, which

assigns the task of initial budget review to its Appropriation Committee.

3. The Appropriation Committee together with the other House Sub-

Committee conduct hearings on the budgets of departments/agencies

and scrutinize their respective programs/projects. Consequently, the

amended budget proposal is presented to the House body as the

General Appropriations Bill (GAB).

4. While budget hearings are on-going in the House of Representatives, for

expediency, the Senate Finance Committee, through its different

subcommittees also starts to conduct its own review and scrutiny of the

proposed budget and proposes amendments to the House Budget Bill to

the Senate body for approval. The Committee submits its proposed

amendment to the GAB to plenary only after it has been formally

transmitted by the House of the Representatives.

5. To thresh out differences and arrive at a common version of the General

Appropriations Bill, the House and the Senate creates a Bicameral

Conference Committee that finalizes the General Appropriations Bill.

6. The Bicam version is then submitted to both Houses, which will then vote 3. Monitoring and Evaluation- Agencies must set-up and implement

to ratify the final GAB for submission to the President. Once submitted to monitoring and evaluation mechanisms to ascertain the effectiveness of

the President, the GAB is considered enrolled. the programs and projects on which they spend. Agencies must have

7. Budget legislation ends when the President signs the GAA into law. Prior internal control mechanisms to ensure that public funds are spent and

to this, the President may veto or set conditions for implementation accounted for properly.

of certain items in the GAA, which are then specified in the President’s 4. Agencies’ Accountability Reports- Agencies submit Financial

Veto Message. Unlike other legislation, the President may effect a “line Accountability Reports on a monthly or quarterly basis, as required by

item veto” of specific provisions of the GAB. the DBM and the COA. These reports are submitted online through the

If in case Congress fails to pass the GAB on time, the President may re-enact Unified Reporting System.

the previous year’s GAA until such time that the fresh Budget is passed. 5. Performance Review- The DBM reviews the financial and physical

performance of agencies against their targets.

• The General Appropriations Act (GAA) is the legislative authorization 6. In -Year Reports- The DoF and the DBM regularly publish snapshots of

that contains the new appropriations in terms of specific amounts for the government’s fiscal performance, revenue collections, debt, and

salaries, wages and other personnel benefits; maintenance and other expenditures.

operating expenses; and capital outlays authorized to be spent for the 7. DBCC Mid-Year Report- The DBCC publishes a comprehensive report

implementation of various programs/projects and activities of all on macroeconomic developments, the fiscal situation of the national

departments, bureaus and offices of the government for a given year. government, and the performance of key programs and projects. The

3. BUDGET EXECUTION & PREPARATION Mid-Year Report also discusses any adjustments that the DBCC makes

to the government’s economic projections and fiscal targets for the rest

1. Early Procurement Activities - Agencies are required to prepare their of the year

Annual Procurement Plans and other bid documents before the new 8. DBCC Year-End Report- The DBCC publishes another comprehensive

fiscal year starts. Moreover, the government adopted a policy of allowing report covering the full year. Compared to the Mid-Year Report, the Year-

agencies—such as the DPWH and others which implement infrastructure End Report provides more discussions and details about actual revenue

projects—to bid their projects before the GAA is enacted. Early bidding and expenditure outturns against program, and the financial and physical

allows agencies to award their approved projects as soon as the new performance of priority programs.

GAA takes effect. 9. Audit- The COA reviews the accounts of each agency to ascertain if

2. Budget Program- Agencies submit Budget Execution Documents public funds are used properly, according to the law and standards, and

(BEDs) to outline their financial plans and performance targets for the with value-for-money. The COA produces audit reports for each agency;

year. The DBM consolidates these plans into the budget program, which a whole-of-government Annual Financial Report; as well as Special Audit

breaks down the allotment and cash releases for each month of the year. Reports. The DBM uses COA’s Audit Reports in confirming agency

3. Allotment Release- The DBM issues allotments to agencies to authorize performance, determining budgetary levels for agencies, and addressing

the latter to incur obligations. With the GAA-as-Release Document, the issues in fund usage.

enacted Budget itself serves as the allotment release for all budget items

except those contained in a negative list that are issued the Special Budgetary Account System

Allotment Release Orders (SAROs) after agencies comply with the Allotment Release Program (ARP)

documentary requirements. - Shall serve as the ceiling for the aggregate allotment releases during the

4. Obligation - Agencies incur liabilities that the national government will year from all sources.

pay for, as they implement programs, activities, and projects. Agencies - Composed of the following:

incur obligations when they hire new staff or enter into a contract with - Obligations incurred,

suppliers of goods and services that are subject to a transparent and - Obligations authorized as overdraft,

competitive procurement process. - Special Allotment Release Order (SAROs) issued from the

5. Cash Allocation- The DBM issues disbursement authorities, such as beginning of the fiscal year to the effectivity date of the current GAA,

the Notice of Cash Allocation (NCA), to authorize an agency to pay the - Releases from the unprogrammed fund (UF).

obligations it incurs. To ease budget execution, the DBM issues Budgetary Accounts

comprehensive NCAs to cover the cash requirements of agencies for the • Appropriation – an authorization made by law or other legislative

first semester. enactment, directing payment of goods and services out of

6. Disbursement- Monies are paid out from the Treasury to settle government funds under specific purposes.

obligations that government incurred for the delivery of services to • Allotment- An Authorization issued by the DBM to the government

citizens. To ease the payments process, the DBM introduced checkless agencies, which allow them to incur obligations, for specified

and cashless disbursement schemes. amounts, within the legislative appropriation.

• Obligation- a commitment by government agency arising from an

4. BUDGET ACCOUNTABILITY act of duly authorized official which binds the government to the

1. Performance Targets- Budget accountability starts with the setting of immediate or eventual payment of sum of money.

targets that agencies are to be held accountable for. With the Fund Release Documents

Performance-Informed Budget, the GAA now contains the targeted 1. Obligational Authority or Allotment

outcomes, outputs and performance indicators of each agency. These a. General Appropriation Act Release Document (GAARD)- serves as the

targets are also reflected in agencies’ BEDs (see “Budget Program” obligational authority for the comprehensive release of budgetary items

under Budget Execution), which effectively serve as the agencies’ plans appropriated in GAA, categorized as For Comprehensive Release

for the year (FCR).

2. Citizen Engagement- To empower citizens during Budget b. Special Allotment Release Order (SARO)- covers budgetary items under

Accountability, the government ensures transparency-agencies disclose For Later Release (FLR) (negative list) in the entity submitted Budget

their budgets, reports, and other relevant information through the Execution Documents (BEDs), subject to compliance of required

Transparency Seal; and make available data in open format. In addition, documents/clearances. Releases of allotments for Special Purpose

the government also publishes the People’s Budget along with other Funds (SPFs), like Calamity Fund, are also covered by SARO.

technical documents and reports.

c. General Allotment Release Order (GARO)- is a comprehensive authority BED No. 4: Annual Procurement Plan for Common-Use Supplies and

issued to all national government agencies, in general, to incur Equipment

obligations not exceeding an authorized amount during a specified • Shall reflect the monthly quantity and cash requirements by items

period for the purpose indicated therein. It covers automatically categorized:

appropriated expenditures common to most, if not all, agencies without • Available at Procurement Service Stores

need of special clearance or approval from competent authority, i.e. • Other items not available at Procurement Service but regularly

Retirement and Life Insurance Premium. purchased from other sources.

• Submitted through e-mail to DBM-PS and Philippine Government

2. Disbursement Authority

Electronic Procurement System (PhilGEPS).

a. Notice of Cash Allocation (NCA) – authority issued by the DBM to central,

regional and provincial offices and operating units to cover the cash

2. Budget and Financial Accountability Reports (BFARs)

requirements of the agencies;

• Use to monitor and/or evaluate agency performance versus plans

b. Non-Cash Availment Authority (NCAA) – authority issued by the DBM to

and target which shall serve as a basis for sound policy decisions.

agencies to cover the liquidation of their actual obligations incurred

against available allotments for availment of proceeds from loans/grants BAR No. 1: Quarterly Report of Operation (QRPO)

through supplier’s credit/constructive cash; • Reflects the department’s/ agency’s actual physical

c. Cash Disbursement Ceiling (CDC) – authority issued by DBM to the accomplishments as of given quarter in terms of performance

Department of Foreign Affairs (DFA) and Department of Labor and measures indicated in BED No. 2 (Physical Plan.)

Employment (DOLE) to utilize their income collected/retained by their • Submitted to DBM and COA within 30 days after the end of each

Foreign Service Posts (FSPs) to cover their operating requirements, quarter.

but not to exceed the released allotment to the said post; and

d. Notice of Transfer of Allocation – authority issued by the Central Office FAR No. 1: Statement of Appropriations, Allotments, Obligations,

to its regional and operating units to cover the latter’s cash requirements. Disbursements and Balances (SAAODB)

• Shall reflect the authorized appropriations and adjustments, total

Reporting Requirements allotments received including transfers/adjustments, total obligations,

1. Budget Execution Documents (BEDs) total disbursements and balances of unreleased appropriations,

• Reflected the plans, targets and schedules that will guide agencies unobligated allotments, and unpaid obligations of

in the early implementation of priority programs and projects. department/office/agency by fund cluster and by allotment class.

• Must be submitted to the DBM every November 30, before financial • Presented by the following:

year. If there are any adjustments, revision shall be submitted on • Fund Authorization

or before January 7 of the financial year. • Major Final Output

BED No. 1: Financial Plan • Program/Activity/Project

• Includes the comparative obligation level for the budget year (2019) • Major Programs/Project

broken down by quarter, versus current year (2018) actual obligations • Submitted to DBM and COA within 30 days after the end of each quarter.

as of September 30 and the emerging level obligations for the remaining

FAR No.-A: Summary of Appropriations, Allotments, Disbursements and

quarter.

Balances by Object of Expenditures (SAADBOE)

BED No. 2: Physical Plan • Reflect the summary of appropriations, allotments, obligations,

• Consists the performance indicators and targets of department/ agency disbursements and balances detailed by object of expenditures

such as: consistent with RCA.

• For Operations, the performance indicators by MFOs. • Prepared by Fund Cluster

• For Major Programs and Projects committed to the President and • Submitted to COA and DBM within 30 days after the end of each quarter.

closely monitored by Presidential Staff.

• For other projects, consider those milestones indicated in FAR No. 1-B: List of Allotments and Sub-Allotments (LASA)

approved project profile. • Reflects the allotments released by DBM and the sub-allotments issued

• Physical Plan must be same with those appearing in the Financial by Central Office/Regional Office, and their corresponding numbers, date

Plan. of issuances, and amounts by allotment class and by Fund Cluster.

• Total allotments per this report should be equal to the total allotments

BED No. 3: Monthly Disbursement Program (MDP)

appearing in the FAR No. 1 (SAAODB)

• Used by the DBM as basis for determining the monthly level of

• Submitted to COA and DBM within 30 days after the end of each quarter.

disbursement authorities to be used by national government agencies.

• Reflects the total cash and non-cash program for the budget year, by FAR No. 2: Statement of Approved Budget, Utilizations, Disbursements

fund category, by allotment class and by type of disbursement authority, and Balances (SABUDB) (for Off-Budget Fund)

such as: • Shall reflect the approved budget, utilizations, disbursements, and

• NCA for cash requirements of the national government. balances of the agency authorized by law to use their income. ( ex. SUC)

• CDC for authorized disbursements charged against income • Submitted to COA and DBM within 30 days after the end of each quarter.

collected and retained by the Foreign Service Post of FDA and

DOLE. FAR No.2-A: Summary of Approved Budget, Utilizations, Disbursements

• NCAA for the cost of goods and services paid directly by lending and Balances by Object of Expenditures (SABUDBOE)

institutions to creditors of the NGAs/GOCCs. (for Off-Budget Fund)

• Tax Remittance Advice (TRA) for the remittance of tax withheld • Reflects the details of the approved budget, utilizations, disbursements

computed and estimated: PS (8%), MOOE and CO (5%). and balances of the agency authorized by law to used their income

• Other tax expenditures such as: Custom Duties and Taxes, BTr presented by object of expenditures consistent with RCA.

Documentary Stamps. • Submitted to COA and DBM within 30 days after the end of each quarter.

FAR No. 3: Aging of Due and Demandable Obligations (ADDO) Agency Performance Review

• Reflect the balances of unpaid obligations as indicated in the • The DBM shall conduct a quarterly evaluation by comparing

Obligation Request and the aging of due and demandable agency plans and targets per BEDs to the actual accomplishments

obligations as of year end. reflected on the BFARs.

• Submitted to COA and DBM on or before the 30th day of the month • This is to ensure that programs and projects reflected in the

following end of the year. financial and physical plan will be accomplished.

FAR No. 4: Month Report of Disbursements (MRD) Sample Illustration

• Reflect the total disbursements made by department, office or Upon approval of the GAA, the DBM released the following to the Department

agency and operating unit by Fund Cluster through disbursement of Health:

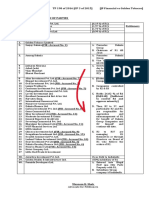

authorities. General Appropriation Allotments NCA

• Track the actual disbursement of the department/agencies against Personnel Services 100,000,000.00 70,000,000.00 63,000,000.00

their Disbursement Program, and the reason for over or under MOOE 500,000,000.00 350,000,000.00 315,000,000.00

spending shall be indicated. Financial Expenses 100,000,000.00 70,000,000.00 63,000,000.00

Capital Outlay 1,000,000,000.00 700,000,000.00 630,000,000.00

• Submitted to DBM and COA on or before the 30th day of the

Total 1,700,000,000.00 1,190,000,000.00 1,071,000,000.00

following month covered by the report.

FAR No. 5: Quarterly Report of Revenue and Other Receipts (QRROR) For the first quarter of the fiscal year, DOH incurred the following

• Reflects the report om actual revenue and other receipts of the obligations/expenses.

agency/operating units for the current year presented by quarter Obligation

and by specific sources consistent with RCA. Personnel Services 15,750,000.00

MOOE 78,750,000.00

• Shall be submitted to COA and DBM within 30 days after the end

Capital Outlay 157,500,000.00

of each quarter.

Total 252,000,000.00

Consolidation of Quarterly Reports

Non-submission of the said reports will result to the automatic

suspension of the salary payments to the concerned Budget

Officer/Chief Accountant or their authorized representatives.

Three consecutive violations during the year without justifiable cause

shall be a ground for administrative disciplinary action, subject to

pertinent civil service rules and regulations.

Validity of Appropriation

• Personnel Service – until the end of the current year.

• MOOE and CO – until the end of the following year.

• Continuing Appropriation of the previous year (MOOE & CO) – until

the end of the current year.

• Supplemental Budget for MOOE and CO appropriation – until the

end of the current year.

• Automatic Appropriations for PS,MOOE and CO – until the end of

the current year.

Tax Remittance Advice (TRA) System

• The NCA released to the government agency is reduced by the

amount of the estimated taxes expected to be remitted by the

agency. (NCA net of TRA)

• PS = 8%

• MOOE & CO = 5%

You might also like

- Government Accounting Manual For National Government AgenciesDocument14 pagesGovernment Accounting Manual For National Government AgenciesKenneth CalzadoNo ratings yet

- Gov Acc 2019 JaaDocument9 pagesGov Acc 2019 JaaGlaiza Lerio100% (1)

- T08 - Government Accounting PDFDocument9 pagesT08 - Government Accounting PDFAken Lieram Ats AnaNo ratings yet

- Acctg 16 - Midterm Exam PDFDocument4 pagesAcctg 16 - Midterm Exam PDFjoan miral0% (1)

- Government AccountingDocument25 pagesGovernment AccountingArdyll N100% (1)

- Co vs. MilitarDocument2 pagesCo vs. MilitarjoyceNo ratings yet

- Government AccountingDocument5 pagesGovernment AccountingPrincessa Lopez Masangkay100% (1)

- Government Accounting 2018 Questions AnswersDocument158 pagesGovernment Accounting 2018 Questions AnswersElea Morata100% (1)

- Role of Financial Markets and InstitutionsDocument23 pagesRole of Financial Markets and InstitutionsIbnuIqbalHasanNo ratings yet

- Government AccountingDocument32 pagesGovernment AccountingLaika Mae D. CariñoNo ratings yet

- Gov AccDocument13 pagesGov AccZarah H. LeongNo ratings yet

- Tax Updates Vs Tax Code OldDocument7 pagesTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- Understanding the UACS Code StructureDocument5 pagesUnderstanding the UACS Code StructureJamila Zarsuelo100% (1)

- Internal Control System of The Philippine GovernmentDocument40 pagesInternal Control System of The Philippine GovernmentFRANZ MARTIN CALLANONo ratings yet

- Government AccountingDocument131 pagesGovernment AccountingAngelo Andro SuanNo ratings yet

- COA Resolution 2018-07Document2 pagesCOA Resolution 2018-07Gerard DGNo ratings yet

- Accounting for Government, Not-for-Profits and Specialized IndustriesDocument58 pagesAccounting for Government, Not-for-Profits and Specialized IndustriesSandra DoriaNo ratings yet

- Chapter 5 Accounting For Disbursements and Related TransactionsDocument2 pagesChapter 5 Accounting For Disbursements and Related TransactionsJaps100% (1)

- 50 Questions to Ask FranchisorsDocument3 pages50 Questions to Ask FranchisorsRegie Sacil EspiñaNo ratings yet

- Government Accounting ManualDocument62 pagesGovernment Accounting ManualDez Za100% (1)

- Government Auditing1Document77 pagesGovernment Auditing1RyannDeLeonNo ratings yet

- PA 231 Session 10 Government Auditing April 25Document29 pagesPA 231 Session 10 Government Auditing April 25Reina Regina S. CamusNo ratings yet

- CHAPTER 2 - Unified Accounts Code StructureDocument56 pagesCHAPTER 2 - Unified Accounts Code StructureRafael VictoriaNo ratings yet

- Government Accounting Process Books and RegistriesDocument48 pagesGovernment Accounting Process Books and RegistriesJoyce CandelariaNo ratings yet

- Ac 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesDocument53 pagesAc 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesHarley Gumapon100% (1)

- Government AccountingDocument13 pagesGovernment AccountingReniella Villondo100% (1)

- Module 3 Quiz AnswersDocument2 pagesModule 3 Quiz AnswersVon Andrei Medina100% (1)

- AA 4102 1st Hand OutDocument9 pagesAA 4102 1st Hand OutMana XDNo ratings yet

- Accounting For Government and Not-For-Profit Organizations: ACCO 30033Document13 pagesAccounting For Government and Not-For-Profit Organizations: ACCO 30033Angelito Mamersonal100% (1)

- Government Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityDocument36 pagesGovernment Accounting and Budgeting Module at Don Mariano Marcos Memorial State UniversityErika MonisNo ratings yet

- Chapter 1 SolmanDocument14 pagesChapter 1 Solmancalypso greyNo ratings yet

- Features of the Government Accounting ManualDocument30 pagesFeatures of the Government Accounting ManualMay Joy ManagdagNo ratings yet

- Government Procurement ActDocument11 pagesGovernment Procurement ActLeah YangaNo ratings yet

- Government Accounting OverviewDocument18 pagesGovernment Accounting OverviewCherrie Arianne Fhaye Naraja100% (1)

- Taxation Quizzer PDFDocument61 pagesTaxation Quizzer PDFPrince Guese86% (7)

- Government AccountingDocument10 pagesGovernment AccountingRampotz Ü EchizenNo ratings yet

- Government Accounting PDFDocument33 pagesGovernment Accounting PDFKenneth RobledoNo ratings yet

- Rudy Wong Case StudyDocument7 pagesRudy Wong Case StudyUnknwn Nouwn100% (3)

- NOTESDocument2 pagesNOTESJñelle Faith Herrera SaludaresNo ratings yet

- Table Sap b1Document25 pagesTable Sap b1shmilyou100% (2)

- Government AccountingDocument17 pagesGovernment AccountingJaniña Natividad100% (1)

- Warehouse Receipts Law PDFDocument13 pagesWarehouse Receipts Law PDFIrishSantosSiguaNo ratings yet

- Gaming Zone PDFDocument18 pagesGaming Zone PDFMian Adi ChaudhryNo ratings yet

- PLP Government Accounting Final ExamDocument4 pagesPLP Government Accounting Final ExamApril ManjaresNo ratings yet

- Govt Acctg Manual ExplainedDocument3 pagesGovt Acctg Manual ExplainedLabLab Chatto0% (1)

- GovAcc HO No. 2 - The Philippine Budget CycleDocument9 pagesGovAcc HO No. 2 - The Philippine Budget Cyclebobo kaNo ratings yet

- Not-for-Profit Organization Revenue and Asset ClassificationsDocument3 pagesNot-for-Profit Organization Revenue and Asset ClassificationsSid TuazonNo ratings yet

- CHAPTER 5 REVENUEDocument40 pagesCHAPTER 5 REVENUECeline ClaudioNo ratings yet

- National College Mid-Term Exam ReviewDocument7 pagesNational College Mid-Term Exam ReviewkylacerroNo ratings yet

- Quiz Chapter 7Document2 pagesQuiz Chapter 7PauNo ratings yet

- Philippine Government Accounting StandardsDocument9 pagesPhilippine Government Accounting StandardsShien AgucayNo ratings yet

- New Government Accounting System FeaturesDocument4 pagesNew Government Accounting System FeaturesabbiecdefgNo ratings yet

- 6-Budget ProcessDocument4 pages6-Budget ProcessMs. ANo ratings yet

- Accounting and Budgeting Policies for Local Government UnitsDocument34 pagesAccounting and Budgeting Policies for Local Government UnitsRachel Sanculi LustinaNo ratings yet

- Appendix 50 - PCFRec-2Document1 pageAppendix 50 - PCFRec-2Sherelyn MendozaNo ratings yet

- Governmental and Not-For-profit Accounting Solution of c7Document20 pagesGovernmental and Not-For-profit Accounting Solution of c7Cathy Gu75% (4)

- Liabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive ObligationDocument40 pagesLiabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive Obligationmaria isabellaNo ratings yet

- Chapter 3 - The Govt Acctg ProcessDocument11 pagesChapter 3 - The Govt Acctg Processjerome orillosaNo ratings yet

- Accounting For Budgetary AccountsDocument10 pagesAccounting For Budgetary AccountsIsah Ma. Zenaida Felisilda100% (1)

- Long-term Obligations Chapter 8Document21 pagesLong-term Obligations Chapter 8Cathy Gu100% (1)

- Chapter 6-Audit ReportDocument14 pagesChapter 6-Audit ReportDawit WorkuNo ratings yet

- Module 2 Quiz AnswersDocument1 pageModule 2 Quiz AnswersVon Andrei MedinaNo ratings yet

- The Government Accounting ProcessDocument4 pagesThe Government Accounting ProcessWawex DavisNo ratings yet

- AUDITING THEORY MULTIPLE CHOICEDocument11 pagesAUDITING THEORY MULTIPLE CHOICEJenifer GaliciaNo ratings yet

- BudgetingDocument2 pagesBudgetingjhericz100% (2)

- Asfaw, Audit II Chapter 5Document3 pagesAsfaw, Audit II Chapter 5alemayehu100% (1)

- Government Accounting ObjectivesDocument16 pagesGovernment Accounting ObjectivesMarinel FelipeNo ratings yet

- VatDocument3 pagesVatElai TrinidadNo ratings yet

- Ifrs 15Document7 pagesIfrs 15Elai TrinidadNo ratings yet

- Corporate Social ResponsibilityDocument2 pagesCorporate Social ResponsibilityElai TrinidadNo ratings yet

- Final PricesDocument19 pagesFinal PricesElai TrinidadNo ratings yet

- The Competitive Profile MatrixDocument5 pagesThe Competitive Profile MatrixElai TrinidadNo ratings yet

- BPS Reaction PaperDocument2 pagesBPS Reaction PaperElai TrinidadNo ratings yet

- An Overview of Human Behavior in OrganizationDocument1 pageAn Overview of Human Behavior in OrganizationElai TrinidadNo ratings yet

- Local Business Tax LectureDocument3 pagesLocal Business Tax LectureElai TrinidadNo ratings yet

- Mind Body Soul Marvin Cyrille Carl JeremyDocument13 pagesMind Body Soul Marvin Cyrille Carl JeremyElai TrinidadNo ratings yet

- 1 - Silent GenerationDocument12 pages1 - Silent GenerationElai TrinidadNo ratings yet

- Financial interest threatsDocument2 pagesFinancial interest threatsElai TrinidadNo ratings yet

- An Overview of Human Behavior in OrganizationDocument1 pageAn Overview of Human Behavior in OrganizationElai TrinidadNo ratings yet

- Unified Accounts Code StructureDocument23 pagesUnified Accounts Code StructureElai TrinidadNo ratings yet

- The Competitive Profile MatrixDocument5 pagesThe Competitive Profile MatrixElai TrinidadNo ratings yet

- Quicknotes On ValueDocument9 pagesQuicknotes On ValueMarton Emile DesalesNo ratings yet

- The Competitive Profile MatrixDocument5 pagesThe Competitive Profile MatrixElai TrinidadNo ratings yet

- HBO Chapter 3 and 4Document7 pagesHBO Chapter 3 and 4Elai TrinidadNo ratings yet

- 1 - Silent GenerationDocument12 pages1 - Silent GenerationElai TrinidadNo ratings yet

- A Guide To Train Ra10963Document35 pagesA Guide To Train Ra10963Elai TrinidadNo ratings yet

- Michael Porter discusses competitiveness and prosperity in IndiaDocument2 pagesMichael Porter discusses competitiveness and prosperity in IndiaElai TrinidadNo ratings yet

- The Philippine Market Group3Document51 pagesThe Philippine Market Group3Elai TrinidadNo ratings yet

- 1 - Silent GenerationDocument12 pages1 - Silent GenerationElai TrinidadNo ratings yet

- Hbo Chapter 6Document7 pagesHbo Chapter 6Elai TrinidadNo ratings yet

- Financial interest threatsDocument2 pagesFinancial interest threatsElai TrinidadNo ratings yet

- A Guide To TRAIN RA10963 PDFDocument18 pagesA Guide To TRAIN RA10963 PDFJay Ryan Sy Baylon100% (2)

- TAX. M-1401 Estate Tax: Basic TerminologiesDocument33 pagesTAX. M-1401 Estate Tax: Basic TerminologiesJimmyChaoNo ratings yet

- An Overview of Human Behavior in OrganizationDocument1 pageAn Overview of Human Behavior in OrganizationElai TrinidadNo ratings yet

- Linsangan vs. Tolentino: Lawyer Disciplined for Unethical SolicitationDocument2 pagesLinsangan vs. Tolentino: Lawyer Disciplined for Unethical SolicitationKelvin CulajaráNo ratings yet

- 147 3Document1 page147 3Manjeet Kumar0% (1)

- Rifc ProspectusDocument122 pagesRifc ProspectusnrhcrossNo ratings yet

- 0124Document88 pages0124AqilaliraNo ratings yet

- Nyabwanga Et Al 2013Document16 pagesNyabwanga Et Al 2013Robert Nyamao NyabwangaNo ratings yet

- Debt Acknowledgement SummaryDocument6 pagesDebt Acknowledgement SummarySavara MarhabanNo ratings yet

- Tanzania's History, Geography, Wildlife and GovernmentDocument34 pagesTanzania's History, Geography, Wildlife and GovernmentJohnBenardNo ratings yet

- Chapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument13 pagesChapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- General CodeDocument507 pagesGeneral Codeoptimist_24No ratings yet

- NCLT, Ahmedabad TP 198 of 2016 (CP 3 of 2015) (JP Financial Vs Golden Tobacco)Document3 pagesNCLT, Ahmedabad TP 198 of 2016 (CP 3 of 2015) (JP Financial Vs Golden Tobacco)masoom shahNo ratings yet

- DebenturesDocument47 pagesDebentureslalitvet100% (1)

- Valuation of Securities-3Document54 pagesValuation of Securities-3anupan92No ratings yet

- Repayment of Term/Fixed Deposits in BanksDocument2 pagesRepayment of Term/Fixed Deposits in BanksMohammad Sazid AlamNo ratings yet

- Multi Tenant Lease GrossDocument12 pagesMulti Tenant Lease GrossMandy Cooks0% (2)

- Bank Nomination FormDocument7 pagesBank Nomination FormBP SharmaNo ratings yet

- GSAA Home Equity Trust 2005-15, Tranche 2A3 Sold To Govt As Part of Maiden Lane IIDocument79 pagesGSAA Home Equity Trust 2005-15, Tranche 2A3 Sold To Govt As Part of Maiden Lane IITim Bryant100% (1)

- Application Form For Computer AdvanceDocument5 pagesApplication Form For Computer AdvanceSushant SaxenaNo ratings yet

- Beverly City Council Agenda - 4.19.16Document44 pagesBeverly City Council Agenda - 4.19.16Matt St HilaireNo ratings yet

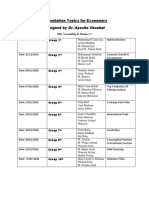

- Economics presentation topics for MSc studentsDocument1 pageEconomics presentation topics for MSc studentsusama ijazNo ratings yet

- Capital Structure (WordDocument32 pagesCapital Structure (Wordrashi00100% (1)

- Oblicon Compiled Cases Full Texts Articles 1164Document65 pagesOblicon Compiled Cases Full Texts Articles 1164Rascille LaranasNo ratings yet

- Financial Markets and Direct FinanceDocument3 pagesFinancial Markets and Direct FinanceLê Hoài PhongNo ratings yet

- The Haryana Apartment Ownership ActDocument34 pagesThe Haryana Apartment Ownership ActNidhi AtreNo ratings yet