Professional Documents

Culture Documents

1stPB Afar10.17

1stPB Afar10.17

Uploaded by

MikaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1stPB Afar10.17

1stPB Afar10.17

Uploaded by

MikaCopyright:

Available Formats

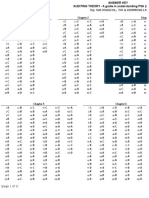

. a Slane sietxomaton Fr Greenbelt Corporation ot nus 1, 2012, 16 summarized as follows: a - ps Sir fa ee + Pires "3008 Shon pea, rio par" 8 Se 680,000 ” P 680,000 et ts Gre i Habilites are fality valued except for plant Fens tat 28 wadervalved by 50,000. On January 2, 2017, Sesomstone Conary esues res. of its P10_par roca nares 6 al Of Greenbelt's net assets and Greenbelt IS Market quotations forthe two stocks on this date are: eM ss) “ae! a aR peri oPBTO7 ‘ne oi Ain se ering sera \elowstone ordinary shares Groonbelt ordinary shares Valens fe Yelowstone pave the following out-of packet cats in connestion Finders fee 10,000 Costs of regietering and issuing stock "5,000 {legal and aceoumtng fees éo00 27, Aasuming Yellowstone 1 Non-SME, calculate Yellowstone's coat of acguiring Greeabelt Corporation ‘576,000 ©. P581,000 565,000 «4. P60,000 28, Resuming Yellowstone © an SME, tne amount of goemil stun in ts December 51, 2017 balance sect = a. 130,000 151,000 135,000 4.P117,000 29, According to the instalment method of accounting, grees profit on an installenent sal s recognized in income on the date cf sale ‘On the date the final collection is received Tn proportion tothe cash eallection ‘After cash calecons eatal Lo the cost oF sales have ben receives 30. Under the costrecovery method, no revenue ss recognied unt Collections are equal to the amount ef cost of goads Sala CCollechons ae less than the cest of goods soho. “The eeling prices collected All of the above apis 98 Fam omninnioa? ova Frail ecurg 48 Rape as angkrap Enteronses is in bankruptcy and is in the process of question. The trstee has converted a eon-cash gene et 20,000 cas and has prepared the foowiNy lt of api ee ears Fe Troaev foto oe eso bution 450% Marana yee secured by pope tet was sag $4202 pty = ie payable to bank, scum althe acounte zo, anp ‘egceivabie of which 15,000 were cllected and 5,000 were writen off Prepaid revenue (P500 from each of 2 customers that 1,000 ordered products that were never delivered) Property taxes payable) 2.000 231. How much wil the hank be paid forte note payable? 0 a Pit000 ‘© 716,000, b. P12,000 6. P18,000 32. How much isthe dficieney to creditors? 713,000, €.P16,000 & P12,000, 4. P18,000 33-How much willbe the total payment to unsecured. eeferea- A seston a. P11,000 «.P16,000 © 12,000, 4. 18,000 1 *# Franchise fees are property recognized as revenue when received in cash, Ben conan sgreement has ben in & Merihe andi nines hes begun opcoeans are the hs substantially performed its service 35-Continuing franchise tees shouldbe recorded. by the 2. as revenue when earned end recsvabe from the Cin accordance with the accounting procedures speafed in the franchise agreement 4. as revenue only after the balacice of he ial franchise fee has been cllectes. ‘on May 4, 2017, For Easter Company consigned 80 freezes, {oxting, P5000 each, to Marta Central Enerproes. The cost of Shipping the freezers amounted to P8,¢00 and was paid by Far Enstern Campary. On Decarnber 20, 2017, a pon was recenes from the consignee indeoting thet 23 freezers had bsen sold fot 7.500 eben. Remtange was mode ty the consgnee for the fmmount doe after deducting a commusion of Ge, advertising of 20,000, an vatal installation costs of P3,200 onthe raczers sa 536. Ins inventory valve of the ute Desai In the hands of Ne consignee 3 835,550

, P230,510 4, 312,080 pewaes Frans hesoitng os Ree * ove act Pci eg +39, Under PAS 11 ~ Construction Contracts, the Primary issue in ae sccounting for construction contracts 's S04 wees the percentage cmaletion metho in accounting fr 7 the allocation of contract revenue to the account Se WS sous in which construction work's performed: ALFTne amount of construction cost recopnze for Project Lat b. the alocation of contract costs to the accounting periods ee tn which construction work ls performed, 2,500,000 P4550,000 the determination of percentage of completion, . P4525,000 4. 4,505/00 Sond 6 asa ots ot negpeeeeealls tem eas 40, SHOC Construction Company has a project that extends over year-end balance sheet is rs Bsmt rs an cacion freon ss 2. P546,875 456,675 Eira. Each project has 0 contract that species a price and >. 7568875 4. P68 785 the nghts and cbigations ofall parties. Both the contractor find the customer are expected to fulfil their contractual 4, me amount of ventory reported forthe projects nthe yea Sbigatons on each prosect, Reliable estimates can be made end balance sheet is Gf tne extent of progress and costs to complete each projec. 9. P875,000 «860,000 ‘The method that SMDC must use to account for construction 1 b. P 15,000 4. PO Ie eee oer inca 14a. The amount of current labity reported for the projects the , morcentage- of completion method yearend balance sheets © Completed -contract method 2. 875.000, = 15,000 &. Cost recovery method D. PO 6. P 860,000 584 Construction Company began operations in 2017, 45. The net profit or loss reported by PSBA In tS Income Construction actvty for the fst year is shawn below: Al ST cero at mi rr cnr on ay mare reel eee 2017 expected tobe completed 2018. Fala ee cat moet ON dual tocompet™ 46, Which following should be recognized each period scones mnanagee rSuanind rasoe aod 7225000 tnder the cosErecowery method? 2 “Siroono “2200/00 "200.000 "1,260,000 9[040,000 ~ a. Coste 3 Sironooo Samaceo s3si25 | 3/900.000 , 8. Revenue {ze0000 piivonncen pi0,435,125 p9.so0.000 P1650 Bath costs and revenue &. Neither cost nor reverse as aah FaR pe PTO es a eeEEEEEE—EeEEe soarea France Accitig we Rar at 47. Which statement is e t ig-incgrect when the outcome of DD constauetion contract Cannotbe estimated rab Revenue shall be recognized only tothe extent of con 2sts incurred that ts probeble il be recaverstig No Contract costs shall be recognized a: an espence in 5 Period in which they are incurred. 2 ve ‘An expected loss on the construction contract shall be recognized as an expense immediately Contract revenue and contract costs shall be recounized by reference to the stage of competion of the contract jctivity on belance sheet date, 48.4 Company uses the percentage of completion method to A Secunt for four-year contrucion canoe. "Wm tthe following would be used ia the calculation of the income Progress bilings Collection on progress biings a ‘No. No ». No Yes < Yes No fi Yes ves inte Corperatior, a smatkmedum enterprise, (SME), sued {o0,000 shares of 20 par common stk of lack Emerpen w Smear cancummated on August 1, 2037. Whte Corporation aa eee setng at P20 per shore at the date ot senition un epost costs of the busmess combraven fotos pave Fates Recaro se Raping a 49, The acquisition cost ofthe combination to White Company | ‘a. P3,108,000 . P3,050,000, . P3,080,000 4. 3,000,000 50, In accounting for sales on consignment, sales revenue and the relates cost of goods sol should be recoonzed by the ‘2. Consignor when the goods are shipped tothe consignee. B. Consignee when the goods are shipped tothe third party ©. Consignor when notation fs received that the consgnce has 20d the goods, 4. Consignee when cash is received from the customer | St. Southgate Co. paid the in-transit insurance gremium for consignment goods shipped to Hendon Co,, the consignee. In ‘deition, Southgate advanced part of the commssions that ‘wll be due when Hendon sels the goods. Shoula Southgate Include the In-transit insurance premium and the aevanced ‘omissions in inventory eosts? so nsurange seamium Advanced commissions 6. No Ne e ves No 4 No Yes 52. Which of following statement is(are) rue regarding sales p iaeneyand at LA branch is not 2 self-contained business but rather acts 50,00 4 bran con conta ee odor) roveeo n, 2s Sgeey isa soecntained buses which {egal ee (eeu) 22,000 Incepenerty bat main the Bours of company Prog ct of tex cetcates 5,000 eae SEC registration costs and fees 12. a. Toniy © Land Total 97,000 b. Monly & Netther I nor ra ann Fiera? von Francis Accra ra epcing sera SURGOS and CASINO sre partcipants in a Jen venture forthe burcas ra Bding an also supine ors SOR ee ining bid ree of EaBE.090 naps sal by Bute nd CASING, constcing thar investments Be Yok sone They agreed that each records No. purthoses” sales sd cxpeees im te wn books ond share’ afe ond ost ely Bet seven (7) months the ot venture was teminsted andthe following data relate te the joint venture. a BURGOS CASINO Joint venture account 155,000 Ce 175,000 cr. Expenses paid trom IV cash 7,500” 35,000 (Cost of auto parts taken 5500 48,000 53. How much isthe Jom venture sales? a. 752,500 . P776,000 b. 330,000, 3. 9730,000, 4 In the tina settemans, how much wil Burgos receive? Ca» 378,750 371,250 B p30e,250 4. 176.750 Drops Company started operations on Jenuary 1, 2016, ‘Seliph Rome apnhances on the installment basis Fo 2016 and 2017, the flloming information are avetable 2016 2017 Installment cates 1,200,000 1,500,000 Coat of instalment sales Collections of 20165 sales Collections of 2017 esies "720,000 1/050,000 830,000 “ss0,000 909,000 On January 6, 2017, an installment sale account balance of 2016 was defauted and the merenancise, with current value of P15,000 ‘Was repossessed. The account balance defaulted wes 224,000. posse Fen econ a Repreg 55. The balance of the nreallzed gross prof thd oF 2017 was 2, p218,400 F450,000 i. P275,000 16. 9228,000 (on April 1, 2037 DOD, EEE, FFF, and GGG became joint operators of a joint arrangement. They’ contributed_equal amounts and Src to are etal conte ve te rete evo te “incertaking. The contributions were alin cash ex Saulpment wth a far valve of PT80,000 snd carrying cost Gs sesounting records af P164,000. The equipment Nad an ‘Scemmated remaining life of Years atthe date was contributed. Se. At what amount will DDD and GGG shew this equipment at 8s individual balance sheet at Apri 1, 2017, respectively? 2) 45,000 and 38,250 ¢. 9 34,450 and P32,600 bh. P3e,250 and P41,000 d.PaS,000.and 43,000, 57. At what amount wil EE and GEE show this EaGMER atts individual Dalace sheet at December 31, fh p30.250 and 734,850. 936,000 ane 24450 1. P34,450 and 936,000 6. 36,000 and 734,850, 58. For external reporting, the ual financial statements of the home office andthe branch ae combined 2 by using complex consadation procedures 8: by recountang the home ofe's own assets, tables _ Meome and expenses lus share ie th, Bands a ce ee ee ate itar cent worms of ssc, fabIRS, pre oe Bd hac at 4. by dng en tn repo aE accent ae sera HHH and IIL are venturers in a joint arrangement sharing contro! ‘and profits equally. They contributed P625,000 each to establish Joint Venture 33) early in 2017. The Joint Venture paid cash dividends of 45,000 apd reported 9 net income. of 180,000 uring the year. ‘On the other hand, HHH paidscash dividends of 22,500 and Feported a net income of £90,000 during the year. Its'Retaines Earnings at the beginning of We’ year 's 125,000, '59. At what amounts will HHH report in ts December 31, 2017 balance sheet the IN7EEEREnt in Joint Venture and Retained Earnings accounts, respectively? 629,500 and P25i,000 < P692,500 and P282,500 'b. P625,900 and #250,109 3. 9552,900 ana P201,500 ‘The BREEDER ENTERPRISES in Bulacan has 2 branch In Bacolod ity. The brench gets its merchariese fromm the HOME OFFICE a7 from a LOCAL VENDOR. The folowing are some of the relevant decount balances in their individual records at December 31 2017. HOME OFFICE BRANCH OFFICE Inventory, January 1 P 18,000 28,800 Merchandise shiomerts 144,000, 168,000 1) Purchases 540,000 180,000 Deferred Prost 39,600 - Sales 720,000 432,000 Operating expenses 374,000 66,000 “The encing inventory of the BACOLOD CITY BRANCH is P43,200, Gf which 9,600 1s from local purchases. The ending inventory of the HOME OFFICE is P90,009, The branch is biled at 25% above ost by the HOME OFFICE 160. The HOME OFFICE net income from its own operations is a. 222,000 bP 62,880 . B 32,400 9. 277,500 FAR Opt 1017 pavance Prdi cairn on Reparng ser 61. The net income reported by the BRANCH OFFICE is 2, 62,880 cP 32,400. b. P44.400 1. P 277,500 662. The combined net Income reported by the HOME OFFICE for 2013 15 a. 7254/40 b, P340,380 $43,900 @.P 284,880, Dolce Co. which began operations on January 1, 2016, appropnately uses the installment method of accounting fo record Feverues. The following information is avaliable for the years fended December 31, 2016 and 2017: 206 Gory) 4s Sole ost of ste 7ooa00 P1200) Gros ott walzed onsale ode oe EP ssoo00 908. four © stew ery roe rth percentages son om 3: wnat amount of statment accounts recat should Doce reece Gocember 31,2007 Blanca sheet Oe ent crue BRL ». P1.300,000 EPL TBO yi _gcvT (on December 31, 2016, Greyhound Bread Co. authorized Bakes, Tre to operne as a franctisce for an intial franchise fee of 150,000, OF this amount, 760,000 pon ira {he agreement and the belonc, represented by 2 “i thee annual payments of P30 000 each bepinning Decemte 3 Bory. The’ prevent value on December 38, 2016, of the tree annal penta aporooately counted i 7720009 the agreement, tre nonrefundable dows payment represents {Gir messure of the services alteady performed by Greyhound me = ae rece $I} eaoe Finca Accouig st Repering SETA however, substantial future services are required of Greyhound, CCollectibility of the note is reasonably certain, 464 In Greyhound’s December 31, 2016 balance sheet, unearned D franchise fees trom Baker's franchise should 2. 132,000 . P-90,000 b. 100,000 4. P 72,000 INSOLBENT, INC. has had severe financial considering’ the possibility of liquidation. Al distressed company has the following asset realizable value) and abilities: Assats (pledged against debts of P70,000) Assets (pledged against debts of P130,000) Other assets = abilities with priority Unsecured creditors ‘65. In the event of liquidation at this poiat, ‘estimated amount recaverable by partialy-s a. 130,000 =P 74,090 b. P 50,000 6. P200,000 In 2046 SMDC Builders, Inc. had a successful ta contract to a factory building for P7BM. be reported as difficulties and is t this time, the 's (stated at net 116,000 '50,000 80,000 42,000 200,0007¢7 how much is the secured creditors? Wd on a fixed price 'SMDC uses. the percentage of completion method and the following data are ‘obtained on the project: 2016 2017 Percentage of completion as at 2 December 31 smated total cost at 0% 60% ‘completion ae at December 31 58,500,000 72,000,000 Profit recognized to date at December 34 3,900,000 3,600,000 Billings to date at December 31 38,000,000 39,000,000 evan Feancil Accoxeting wd Reporting ee 166, The entry to record the actual cost incurred in 2047 includes a debit to ‘2. Construction in Progress, P31,500,000 'b. Construction Cost, P31,500,000 © Construction In Progress, 43,200,000 4d. Construction Cost, P43,200,000 ‘A heavy power generator was sold to Victor Percy for ®96,000 ‘which included 2 40% markup on selling price. Alan made & down payment of 20% and paid four of the 16 equal installments for the balance and defaulted on further payments. ‘The power ‘generator was repossessed at which time the fair value was ‘determined to be P40,800,, ‘67. How much is the gaia or loss on repessession for income statement purposes? ‘a. P6,240 loss ‘c. P16,800 gain b. Po 6. P 6,240 gain ‘The following were taken from the statement of affairs of Distressed Company. Assets pledged with full ‘creditors. —_P 71,000 ‘Assets pledged with partially secured 12,500 creditors Free assets 14,000 Preferred creditors 3,000 Fully secured creditors — 9,000 Partially secured creditors 20,000 Unsecured creditors without priority 18,0004 9: (68. The estimated deficiency to unsecured creditors is a. P 5,000 c. P15,500 b. P12,500 . 14,500 wo ft Nag aaa a areata vance Final Aout an Ror a Uiysses Inc. and Grant Inc. agreed to enter into @ combinat Which meets all the qualifications of purchase. Their condensed balance sheets before the combination follows: Unsses aes 6,675,000 2,615,006 Cabs 2/500,000 “168/000 Captal stock (parf100) 500,000 1,250,000 Adena pot canta 373.000 "375/000 Retained Earnings 1,300,000. 3,025/000 Ulysses shall be the surviving entity and in exchange for the net {assets of Grant which had a fair market value of P2,933,000 Ulysses shall issue 7,500 shares of its common stocks, The total valve of the issued shares equals the total value of the acquired ht assets. 16 What willbe the capital stock (CS), adeitional paid-in capital {AIC} and retained earrings (RE) of Ulysses after the A, combination? 6S: P3,250,000 APIC; P2,558,000 RE: P1,200,000 ‘CS: P3,250,000 APIC: P1,250,000 RE: P2;225,000 CS: 1,500,000 APIC: P "125,000. RE: P1,025,000 CS: P3,750,000 APIC: P 750,000 RE: 2,225,000 SME RRE tssued 120,000 shares of its P25 par ordinary shares for all the net assets of CCC Company on July 1, 2016. RAR'S ‘ordinary shores were selling at P30 per share at the acquisition date, in addition » cash payment of 200,000 was made plus a” feed deterred cash payment of P990,000 payable on July ty 2017, The market rate of interest atthe time (5 10% RR also agreed to pay additional cash consideration of P250,000 \n the event RRR'S net income fails below the current level wiAhin the next 2 years. RRA's financial officers were 99% sure tHE Current levet of income wil at least be sustained during te prescribed period. ee te: era vance Franca Aecouring and Reporting “The following out-of-pocket costs were paid in cash by Baas Legal and accounting fees paid ta advisers 8,000 Broker's fees 4.000 Indirect acquisition costs 3.000 Costs to issue and register the shares, 10,400 Total °25,400 70. Determine the. cost of the investment for SME RRR Da 4,702,500 4,174,500 b. p4,347;500, 4. P§,714,500 end of examination « ‘Prease submit your answer sheet ‘Keep the questionnaire, Thank you {for taking the PRTC Open Pre-Board Examinations! © aaa sera

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CPAR AFAR 2016FirstPBDocument29 pagesCPAR AFAR 2016FirstPBMikaNo ratings yet

- Resa AfarDocument14 pagesResa AfarMika100% (1)

- Resa Afar Final PB 2017 With AnswersDocument26 pagesResa Afar Final PB 2017 With AnswersMikaNo ratings yet

- AfarDocument16 pagesAfarMikaNo ratings yet

- Afar FPB May 2017Document36 pagesAfar FPB May 2017MikaNo ratings yet

- 1CRCA 1stPB AFARDocument24 pages1CRCA 1stPB AFARMikaNo ratings yet

- Crc-Ace Afar Summary Quizzer 2 2016 Inc AnswersDocument10 pagesCrc-Ace Afar Summary Quizzer 2 2016 Inc AnswersMikaNo ratings yet

- Solman Audtheo Salosagcol 2014 PDFDocument4 pagesSolman Audtheo Salosagcol 2014 PDFMikaNo ratings yet

- Cpar Manila Gross Income With AnswersDocument9 pagesCpar Manila Gross Income With AnswersMikaNo ratings yet

- Mas Formulas PDFDocument9 pagesMas Formulas PDFMikaNo ratings yet

- Auditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryDocument33 pagesAuditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryMikaNo ratings yet

- Oblicon Summary PDFDocument21 pagesOblicon Summary PDFMikaNo ratings yet

- GOODLUCK CPA!! - , CPA: Financial Accounting and Reporting " Must Review "Document21 pagesGOODLUCK CPA!! - , CPA: Financial Accounting and Reporting " Must Review "MikaNo ratings yet

- Mas Summary 50 Pages PDFDocument50 pagesMas Summary 50 Pages PDFMikaNo ratings yet

- Cpar Far MCQ PDFDocument36 pagesCpar Far MCQ PDFMikaNo ratings yet

- Cpar Tax Estate, Trust, Fringe, Gross Income PDFDocument15 pagesCpar Tax Estate, Trust, Fringe, Gross Income PDFMikaNo ratings yet

- Baybayin PDFDocument29 pagesBaybayin PDFMikaNo ratings yet