Professional Documents

Culture Documents

Afar

Afar

Uploaded by

Mika0 ratings0% found this document useful (0 votes)

158 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

158 views16 pagesAfar

Afar

Uploaded by

MikaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

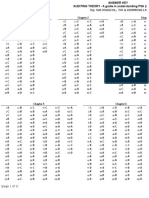

¢ ) ReSA /

i ‘The Review Schoo! of Accountancy

‘BTel. No. 735-9807 & 734-3989

Advanced Financial Accounting & Reporting 09 April 2017 (Sunday)

Final Pre-Board Examination 3:00 P.M. — 6:00 P.M.

MULTIPLE CHOICE

ENSERUCTIONS: Select the correct answer for each of the following ,

questions. Mark only one answer for each item by shading the box

corresponding to the letter of your choice on the sheet provided.

+ _STRICTLY NO ERASURES ARE ALLOWED. Use pencil no. 2 only.

1. Certain balance sheet accounts of a foreign subsidiary of Rose Company have

v been stated in Phi as

5 Stated

[Eievent Rates | aiatorical Rates

ceivable ® 220, 000

Accounts receivabte, 110,000

[Brepaid insurance 55,000

Goodwill a @5, 000

£470.00

i. The ubsidiary’s : - Tocal currency unit. what

amount should Rose's balance sheet jnclude ‘for the preceding itens?

a. P430,000—b. 435,000 @) P4490, 000 d. 450,000

II. ‘The subsidiary’s functional currency is peso. What total ancunt Rose's

“palance sheet include for the preceding ites?

Gi pt30,000°b. P495,000 . P440,009 4. P450,000

Roi-e; m-a Gc r-ar tle

so tes gary D. None of the above

i B partnership begins its first year with the following capital balances: , > &

9 Bee tee Peon eee ee

Baxter, capital 80, 000 = :

Cartwright,’ capital 100/000 es 8 arse Mbp

&

The articles of partnership stipulate that profits and losses be assigned in.

the following manner

* Each partner is allocated interest equal to,10 percent of the beginning

Capital balance. e

Baxter is allocated compensation of 220,000 per year.

Any remaining profits and losses are allocated on a 3:3:4 basis,

respectively.

«Bach partner is allowed te withdaw up to PS,000 cash per year.

Assuming that the net income is 36,000 and that each partner withdraws the

maximum amount allowed, what iz the balance in Cartwright’s capital account

at the end of that year?

A. Fi0s,e00 €. 2106, 900

B. P106,200 p. R107, 490

3. Which choice correctly describes the following statements?

Statement I:If an entity cannot distinguish the research phase from the

development phase, it should treat an expenditure on a project

as if it were inctrred in the research phase only and recognize

an expense accordingly. ~

Statement 11:1f it is difficult to distinguish between a change in

accounting estimate and 2 change in accounting policy, then the

change is treated a5 a change in estimate and must be accounted

for currently and prospectiveiy. ¥

Statement III:in rere circumstances, when a retirement benefit plan has

attributes of both defined benefit plan and defined

contribution plan, the plan ts deemed as a defined contribution

plan. ~

a. Only statement I is false

b. Only statement Ir is true

c./ Only statement IIT is true

d. only statement III is false

ff The following are information regarding partnership business:

I. A partnership has the following capital balances:

Allen, capital 60,000

he

Y

ReSA: The Review School of Accountancy Page 2 of 14

J FPA O06 b

II. Rt year-end, the Cieco part

Mteairta .

Burns, capital 30,000

Costelio, capitol 50,000

Profits and 10 faze split as fo’ en (203), Burns (30%), ‘and

Costello (504). Costeilo wants to leave the partnership and is. paid

100,000. from the business based on provisions in the articles ‘of

partnership. If the partuersh:} uses the bonus method, what is the balance

of Burns's capital account after ello withdraws?

P27, 000 233, 000 d. 36,000

ronip has the following capital balances:

£130,000: 3

Montana,

Rice, 120,000. =

Craig, capital €0,000 ”

Taylor, capital 70,0007 % <5

Profits and losses are split ona 3:3:2:2 basis, respectively. Craig

decides to. leave the partnersiip and is paid P90,000 fron the business

Baced cn ubesurigienl Cecteestae: upeeement 1k crergeedvid wether is, tc

be applied, what is the balance of Montana’s capital~account after Craig

withdrams? com :

a. P133,000 b.-P237, 500 P140,.605 P1245, 000

tsb ua

None of the shove

Ib-e

5. The following are infornaticn regarding a partnershie undergoing liquidation:

z

qT.

7. Whi

A local partrership is liquidating and is currently reporting the

following capital balances

Angela, capital (592 share of

Ali profits ard issses) P 19,000

Woodrow, capital (201) 12,000

Cassidy, capital (20!) (12,000)

Cassidy has indicated thac 2 forthcoming contribution will cover the

712,000 deficit. flowever, the two remaining partners have asked to

receive the P25,900 in cash that is presently available. How much of this

money should each of the partners be given?

a. Angela, P13,000; Woodzer, 212,009

b Angela, P11,400: Woodrow, P12,500

Woodrou, 13,000

75007 Weodrox, 12,500

A partnership has the fclloving balance sheet just before the final,

Liguidation is to beg

Cash #26,000 Liabilisies P 50,009

Taventory 31,900 capital (403) 18,000

Other. assets €2,000 _ ®aymond, capital (30%) 25,000

Darby, capital (30%) 26,000

Total : total, PiL9, 000

Liquidation expenses are estimated to be P12,000. ‘The other assets are

sold fer P40,000. What distribution can be made to the partners?

a. Pr0- to Art, ®1,500 ymoad, 12,500 to Darby.

(Pi 22,293 te act, P1399 to Raymond, 24 ve Darby.

%, P-0- to Art, PL,200 te Raymond, P2,800 to Darby.

Gd. P600 to Art, P1,200 to Raymond, £2,200 to Derby

eb -b G. I> bs tra

Mone of the above

following steps in the accounting cycle?

=e; M-a

38 the correct otder of

Step 1: Preparation of financial statements

Step 2: Making closing ertries in the general journal

Step 3: Posting Fransaction entries in the general ledger

Step 4: Making reversing entries in the general journal

2,3/4/4

32.2.4 a :

2/4, 3d

BAe

ee eee

ReSA: The Review Schoot of Accountancy Page 3 of 14

sj. Coats are assigned to the taint products by che markee yalMOPReERed,

allocating joint costs fo the by-product, the market vaiue or reversal cost

nethod is used. The tota! manufacturing costs for €Q,00) units were £172,000

during the quarter. Production and cost daua follo —

fep | Vin” zest

onite produced 5.000 4,000 1,000

Sales price per unit P59 P40 PS

Further processing cost rer unit u Bie

Selling ane adninteteative expcuee’eek awe > 46 2

oy Operating progit per uni 7 Ms

1. the. value ot(fes) deducted Fron the joint costs is:

25,000 a

©. P 60,000 7199,.000

Ay cits erin a

B Be None of the avove

9. The following are information regarding parent and subsidiary:

% I. Clark Company had the following” transactions with affiliated parties

during 2003:

Sates + ‘Sales of P60,00U to Dean, with 20,009 gross profit. Dean had P15,900

of this inventory on hand at yedP=@ma. Clark onns a GD interest in

Dean and does now exer® significane snéluence.

+ Purchases of raw zaterials totaling P240,000 from Kent Corporation, a

wholiy-cmned subsidiary. Kent's gross profit on the wale wes P49, 000.

Clark haa 260,000 of this inventory renairing on December “31, 2008.

Before eliminating entries, Clark had consolidated current sssets of

320,008. What amount shold Clark report in its December 31, 2008,

consoladated batance shee* for current assets?

a. 320,009 b. F917, 200 €. 308,000 4. P302, 090

71. Pax company. sunK603) of_sulcospts outstanding capital stock. on May 1,

7 Pag advanced “Sub P7C, 009 in cagk, which wes still outstanding 2c

Decenber 31, 2008-WREE portion.of this advance should be eliminated “in

the preparation ef the Fecenber 31, 2098 consol ideted balance sheet?

ne 0.000. b. p42, 009 Gap O BOO uae 0. Ser eeemneneee

~Tiesea i - a i-d <

ie apq1-4 D. None of the above

10. Which of the following shall be treated ax part of PRE (Property, Plant «

Equipment) according to PAS intangipts assets?

3. Operating eystem

b, Application softwa:

c. Digitally stored database

d. Outsourced online program

11. At the Inception of thd! le

equivalent to 58% of the

contra\

lease as

a, Neither asset nor Liabiis:

bl Asset put not liability

©. Asset and lisbility

d, Expense Fe

For equity-settled snare-based payment transactions, the entity shall measure

the goods or services received and tne corresponding increase in equity:

Stacenent I: Directly at fair value of the goods or service received

Statement IZ: Indirectly, by teference to the fair value of the equity

instruments granted, if the fair value of the goods or services received

cannot be estimated reliably

a. Only statement 1 is true

b. Only statement IT is true

Both statements I an are true 7

G. Neither of the staternts ts true

¢ contract, the lease term iz determined to be

nomic life bf the leased property If the lease

contains a bargain purchase option, the lessee should record the

13: Hartwell Company distribuiss the service ‘department overhead costs to

producing departments and the following information for the month of January

is presented as follous

Maintenance Utilities

Overhead costs incurred P18,700 P9,090

‘Advanced Financial Accounting & Repoiting- Final Pre-Board Examination (BATCH 33) &

nz

behelibe rk waned

ReSAi the Revlon echiolat accents) Page 4 of 14

Services provided to: « ee a

Maintenance «: 9 ae ewe

ent eT :

Utilities department “4 208 - —— aw

Producing department A 303 30%

Producing department B 408 60%

Hartwell Company distribaces service department overhead costs based on the

<€eClprocal metbes, what would be the formula to determine the total |

maintenance costs? :

A. Ws Pig,700 + 109 Ls M= p18, 700 4.300 4.40 4.408

BM =P 9,000 + <200 BM = £27,700 + /40R + 408

14. Which of the following ix

its realization is v.

a. As an asset

be Disclose only

© ks unearned revenue

d. Research and development

proper way to report a contingent

ally certain?

J. Pistahan Corporation (sa manutece

fa single special product knows a3

B With che use of a Job-ordet coon systems

ompany engaged in the production of

“. Production costs are accumulated

jg om 18D

The following information is availanie as of June 1 :

Work-in process. ee : P 10,720

Direct materials inventory... 48,600

In analyzing the job-order cost sheets, the records disclosed that the

compositions of the worf-in-precess inventory on June i, 2012 were as

follows:

Direct materiais used. “PR 4,960

Direct labor (900 hours). re 4,500

Factory overhead applied. pice resi

bio, 720

the following manvfacturing a

Purchased direct materials centing 960,000,

Direct labor worked 9,900 hours at P'S Ber hour ~ J :

Factory overhead of © 2.50 per direct labor nour was applied to production.

commmpnnppnmonepihguandacfaduse 2012, the follovng infersation nas gathered -n. conieg sei. ceome

with the inventories:

Inventory of work-in-precess se? :

Direct matertals used. -P 12,960 LOwo

Dizect labor i, 500 hours 7,500 (sis

Factory overhead applied. .cyeteecrcre+ 31950 310

Paz 4 ne

$1,000 = Na

“Bye m7

visy occurred during the month of June 2008

A. P 142,560 1350

BP 118,380 $00

% ye X,Y, and Z, ‘a partnersh. January 1, had the following

initial investnen

a 2 i : ia --P 200, 00,

¥ x : 150, 000 45¢)

goa EI i 225to0n

The partnership agreement staves that the profits and losses are te be shared

equally by the partners sfcer consideration is mada for the following:

> Salaries allowed to partners: 60,009 for %, P48,000 for Y, and P36,00

for z.

OA cig bactnaa! eagh tal cians raring Poet pein A sideweel @O

addiecene! infocnat son:

= 22 withdrew P7¢,004, fram the partnership on September 30, 2012.

- Share the remaining partnership profat was P5,000 for each partner.

bey oa

nership net profit at December 32, 2012 before salaries, interests

partners’ sare on the renainder@s>: ip ad

‘ROPE Ts wo Li

Be 207, 750, B

17. What item appears first on Use statement of cash flows prepared using the

direct. method? ee

da Nee Ancome

&

«Advanced Financial Accounting & Reporting= Finai Pre-Board Examination (BATCH 33) &

cv

~ ReSA: The Review Schoo! of Accountancy Page 5 of 14

b. Depreciation

¢. Retained earnings

d. Cash receipts from customers

December 31, 2010 and 201

Follor

20:

P400, 000 | F500, 000

240,000K 350, 000 [wb

instalinen: sales ey

e ee

Additional information:

On Yanuary 5, 2012, an installment sales on 2010 was defaulted and th:

Merchandise with an appraiscc value cf P5,000 was repossessed. Related

installment receivable balance on January 5, 2012 was P8, 000.

The balance of the beferred Gross Profit control’ing account at December 31,

ne eee

76,000 G. #460, 090

B. P130,000 D. Pi90,000 >

¥9. Which of the following is ret listed under the “faithful representation”

characteristic of financial information based on the Conceptual Framework of

Financial Reporting? .

a. Prudence ~

b. Neutrality

©. Completeness

d. Freedom from error

20. Determine the true statement regarding IFRS when referred collectively.

a. The term “1AS" generaily covers “IFRS”

b. The term “IERS" generally cevers “1

c. The term YIAS" generally covers: “TERIC”

d. The term “EFRIC” generally covers “IFRS”

21. Dividends in the form of none:

asp Fairevalue of the assets

assets are measured at

tributed ‘

b.” Carrying amount of the aasets distributed

&- Either the carrying ancunt or fair value of the assets distributed

d. “Neither the carrying amount uor fair value of the assets distributed

22. The investor's interest income for @ pericd would be lowest if the bonds is

purchased at

a. In between interest payment dates

b. At the face value of the bonds

€. “A discount,

d. A premium

23, Other than financial liabilities measured at fair value through profit or

joss, how are financial liabilities stesequen

a. Fair value if acceptable co “he entity

“b. “Amortized east using the effective interest rate method.

e, Bmortized cost using the stated interes: rate of the debt.

d. The amount of undiscounted cash that would be required to settle the

obligation at the end of the reporting period.

measured undes DFRS?

Lucille Inc. manufactures a product that gives rise to a by-product called

iduen ine Seal cares wand ee ees Ce es

of aac each unit, iucilie accounts for “ghon" sales first by deducting

ee ee et ie re ee ae

Sona oe ee oe.

ELE ret lg gages acon cr am Gate ere

BABE i Nera ere is eof Gear le akan A ae

a0, O00 uspAceIVENe Saupstrel tag tere Set = dear ce eres (2d en

“product sales and costs.

000 units of

If Lucille changes its mechod of accounting for Rohon sales by showing the

et amount as "other Income,” the’ gtfect on the gross margin would be:

: be. 000 on

eo

A. PO

FR P2000 Pe,09

Advanced Financial Accounting & Reporting Final Pre-Board Examination (BATCH 33)

Kanlaon Corporation started opecaticne on January 7, 2010 selling home

appliances and furniture sets both for cash and on instalinent basis. Data on

the installment sales operaticns ot the company gathered far the years ending

150,000 b 30, gonad =

ye aw Hee

76

ReSA: The Review School of Accountancy Page 6 of 14

25. A lumber company produces two-by fuse and fomeiy-esghts as joint products

and saws as a by-oroat The packaged sawdus} can be sold for per

pound. Packaging costs tor che sawdust are Pet pound and sales

commissions axe @) of sales price. The by-product net revenue serves to

Xeduce joint proc&ssing costs for joint products. Joint products are assigned

jeint cests based.on board fewt. Data follows:

U Joint processing costs . ee P -50,0004207

Two-by-fours produced roard feet)... é 200, 000

Foar-by-eights produced ipcard feet)... . ‘ 199,000 *

Sawdust produced (pounds). , 6 +1 + 1s se 1, 000%2.9 215 HA = 209

What is the G5pt assigned

fours? 0 2m: 2x Get

A. P32, 000

BS. P32,133 De P33, 333

26. The following information summarizes the standard cest for producing one

metal. tennis racket. frame. In addizion, the variances for one month*

production are given. Assume tnat ali inventery accounts have zero balances

at the beginning of the mnths

Standard Cost Standard Monthly

Ber Unit ___ Costs

Materials ¥ 4.00 F_§, 400

: Direct labor 2 hrs 5.26 26,920

Factory overhead

yy Variable 1.99 3,780

Fixed 5100 10, 500

Variances:

Mate 1.75 unfavorable

0.00 unfavorable

labor tate, “DG unfavorable

Labor efficiency, P2,080.00 unfavorable

What were the actual direct laber hours worked during the month?

A. 5,000 4,000

4,800 2,400

27. Using the same informecicn in' Nc. 26, what were the actual quantities of

uy materials used during tle month?

Son 2n5by 2. aeen

2, 100 d. 1,97:

Items 28 and 29 are based ou the following information:

Presented belox ia the unadjusted trial balance of Sterling Products

Corporation.

ie Desenber 31, 2010

[Gash

Inventory, 12/

‘Other assets

Recounts payable #50, 000

Daeeatisee gcoee 10,000

inigatived grees peorit 36000

Unrealized yross peotit == "99. 600

capital stock si 600, 000

[Retained earnings

‘in_on Fepossession

| Qpexating expenses

Total

Shicbsoraas

3 sz.000 | —Fsaa, oo

Coat of goods sold had been uniform over the years at 60% of sales.

Sterling Products Corporati:

installment sales, the cozpor

and credits inventory gross p:

adopts perpetital inventory procedures) On

taen stallment accounts receivable

Repossessions of merchan’

customers’ failure to’ pay maturing ins

transactions were sumsarized a5 follows:

ise have been made during 2010 due to some

aliments. Analyses of these

Inventory. Eb iia 74509

‘ Onréalized gross profi, 200%,.iwe we 800

Y Unrealized gross profit, 2908.00 2,400

Installment Accounts Receivable - 2008 2,000

Installment. Accounts Receivable ~ 2009... 6,090

% Gain on repossessien = 2,700

"aevanced Financial Accounting & Reporting Final Pre Board Examination (BATCH 33)

a ReSA: The Review School of Accountancy Page 7 of 14

~ The repossessed merchand:. © unsold at Secember 33, 2010. It was

ascertained that they were booked upon repossession at original costs, A fair

Valuation of these items would be a sale price of ‘the reposseased merchandise

at P10/000 after incurring costs $f reconditioning of 25,000 and cost to

@ispose them in the market at F500:

3 Realized gross profit on 2010 sates wast

A. B44, 0007 ©. ¥iz4,c00

B. P56, 000 . 136,000

29. Gain/loss on repessesaion vas

A. 2200 loss <1 P30? logs

Be 200 gain P300 gain

30, The joint venture accounts in the books of the’ venturers (participants) M,N

and 0, show the balances below, upon rermination of the joint venture and

distribution of the

: SRD ahi

fined ascent of the Seitz veicixe wS1 vamiite papente aa lice {A

© pays P900 to M and P750 to ae

31, For | emall and medium entities, “SIRE may urder certain conditions’ replace

Which two (2) financial etatenents?

yp a. Balance Sheet and Income Statement

bs Balance Sheet and Statement ‘of Comprehensive Income

Gi Income Statement “and Statement of Changes in Equity

d- "Statement of Conprenensive Trcome and S$eatement cf Changes in Equity —

Dh The Moor te Beccese actouht ok, Ge Malinch Coepony hich vess ¢ Joo otaee

cost system feliows:

ors 00a: es

April 1 balance 5,000 | Finished goods Pi25,450 4s {a0 me

Direct materials 50/960 | aera

Direct labor 40,000 | ae

Overhead appied 30,000 ta} m0)

Meresed ss apgisg so geome UWS: 4 pledeccimined rate. based on dsrect

He ethers cote wien edo ee ne oe Lng

456, which has been charged with dizect laor ecst of £3,000 and Sob me

which has been charged with applied overhead of E,dig™ To Bn

The cost of direct mteriala charged to Job Nos. 456 and 769 amounted to:

2. Pa, 200 con ey F130

789

B. P4,500 Pa, 700 age

33, The Natural ‘Company acquired €o%)or The Loco. Company for a consideration

b transferred of millien. The considerstion’ was estimated to include a

control prenitm 6f P24 million. ioco’s net assets were P85 million at the

acquisition date. Ake the toliowing statements true or false, according te

PERS} Business combinations?

@) Goedwill should’ be menoured at P32\ million if the nen-contrel!:

interest is measured at ite share of facal's net assers

(2) Goodwill “shoeld be yeaspred at P3¢\ million. if the

interest is meas fair value. 7

cement (2) Statement (1) Stavement (2)

Faise es True False 80

tre De true True A mes}

Company acuuired st in tho ian Compan) tor Fi420, ovob

fair vaine of durtifiable asgeta and liabilittes Was} )

Moon acguiced 0 (650 snares tm The Gagan) Company” for to00, oak”

fair value of ‘emet's identifidbie’ assets and liabilities ‘was ass

Moon measures non controlling interests at the relevant share of MIs

the Identifiable net assets a: tne acquisition date. Neither swan nor Hones \reyye

had any centangent isabiit the acquisition date and the above fair

values were the sane an the g amounts in their. financial statements

hon-controlling

Advanced Financial Accounting & Reporting Final Pre-Board Examination (BATCH 33) &

ReSA: The Review School of Accountancy Page 8 of 14

Annual Smpairment reviews have not restlted in any impaizment losses being

recognized

Under PFRS 3 Business combinations, what figures in respect of goodwill and

ef gains on bargain purchases should be included in Mcon's consolidated

statement of ‘financial position?

A. Goodwijl; P580,009; Gains on rhe bargain purchases: P116,000<

B. Goodwill: Nil Or zero; Gains on the bargain purchases: P116,000

+ Goodwill: Nil or zero Gaing on the burgain purchases: Nil or zero

D. Goodwitl: P580,900; Gains on ‘the bargain purchases: Nil or zero

Reihsenk Gants aaa pam ta Tntenig Cae” sont ean

2,000 shail be paid to partners A & cy

respectively. Ria

eae

Assuming a net income of Pad,G00 for the year, the total profit sflare of

partner C was: G:\0L(44o0-6) es iene:

he P 7,800 = aR- wT of vi, 400 Zee »

B. P1E, 800 = c. 219,800 s i

OS @ 6 Rou 8 oF

Ttems 36 and 37 are based on the following information:

The income statement submitted by the Pampanga Branch te the Home Office for

the month of December, 20iU is shown below. After effecting the necessary

adjustments the true net incone of the Branch was ascertained to be PJS6.000.

Sales oe P 600,000

Cost of sales:

Enventory, DOCEMbEZ Leewnes wn P 80,009

Shipments from Home Of 6168 cm. 350,000

Boe al Purchase emma

Total available for salen.

won £460,000

Inventory, December 21. 109,000° "360,000

GLOSS MALGLD soonmmnrns vine tte 240,000

ie a operating’

Net income

The, branch inventories were:

20,

12/01/2010 12/31/2019

Merchandise from home office. 70,900 P 84,000

Local purchase since ie 16,009 26,000

Total .. es £80,000 “ p109, 060 .

The billing price based on cost imposed by che home office to the branch,

1403 ce. 408

2008 D., 298

37. The balance of allowance for evervalvation of branch December 21, 2008 after

8 adjustment.

A. P10,000 P16, 000

B. P24, 000 * ‘B. Wone of the above

The parthers of the Mit Party

ip stare

ed liguidating their business on.

uly 1, 2019, at which time the parcners were sharing profits and losses 40%

,

to M and 608 to N. The bala: sheet of the partnership appeared as follows:

ei Labitietes ¢ |

U Beaten) |

tank a, $00" Haugounes Pavesi » 32,400

Receivable £91,000

Inventery 1400 25, 600

Equipment P65,200 P33, 200

Accumulated 200 33, 000

Depreciation _ 34,400 14,090

Total 2105, F105, 005

During the month of July, the paxtuers collected Gap of the receivables with

no loss. ‘The partners also seid daring Phe month the entize. inventory on

tt they realized « tocal of £32,190.

Botan

Bone mart'oe tI ceee SAE cae ou on vuly 34, 20107

A. P25, 600 2329

B. P 5,400 FO

“Advanced Financial Accounting & Reporting- Final Pre-Board Examination (BATCH 33) &

~ ReSA: The Review School of Accountancy Page 9 of 14

Fae Potiemne tate

installment bepiss

ain to. Matiisin c

mpany which sells appliances on an

[ae B00 “2010

F420, 000 | F460, 000

343, coo] 299-000

2010

F 320,000

Rept ring 2010, as foLiow:

repossi

The total’ rea:

2010 sales was:

AL PB 9,360 co. F 46,600

Be P62, 000 + PL67, 960

40. The net gain (Joss; on repossession on defaulted sales of 2009 and 2010 was:

g A. B 500 2: 2 800 A

B. B(800) be PA, 400)

Pasig Garment Company operates = branch in Cabanatuan City. at the end of the

year, the Branch account in the Locks of the hone office at Manila shows a

balance of P150,900. The, following information are ascertained:

1. The hone office has billed the branch the amount of 737,500 for the

merchandise, which was in transit on Decenber 2

A hone office accounts receivable for 210,500 was collected by the branch.

Said collection was nct reported to che home aftice by the branch.

3. Supplies of Pi,500 was returned by the branch to the nome office but the

home office has not yei reflected in its records the receipt of the

supplies.

4. The branch made profit of 010; 100 for the month~of-December-but™the-home!

ffice erroneously recorded it ag £11,190. :

The branch has not. received the cash in the amount, of P25,000 sent by

home office en Yecenbe= #1, This was chargea to General Expense account.

All transactions are presumed +o have been properly recorded.

What is the balance of the

of December 31, before aa)

a. Pl21, 920 1, 420)

B. 2123, 009 Pins,

D a2. wnat, is the adjusted balance of ghe rec

A. P 96,620 AS pir? 26)

B. Pave, 920 + PL79, 320

43. The Carly Company owns 754

v from their separate financial

ive account on the books of the branch as

he following figures are fr

Garly: Trade receivables 21,040,000,

Halley: Trade receivables 221,009, in

ueluding 30,000 due from Hi

uding P40,000 due from Carly.

According to PAS 27 Consvlidated and Separate financial statements, what

figure should appear for trade receivables in Carly's consolidated statement

of financial position?

A. PI, 215,000 G. Fiy285, 090

A» P1,225, 000 Bi, 265, 000

44, the white company acquires an 6) intesest in the Pulley Company when

Pulley's eguley comprised share Sipital of 100,000 and retained eurainay of

7500, 000. Pulley" current. statenent af| financial position shows ehase

capital 9f P100,000, 2 revaluation feserve of €400,000 ‘and retainea earmiogs

ca of Pi490,000.

Under PAS 27 Consolidated and separate financial atatements, what figure in

respect of Pulley's retained earnings should be included in the consolidated

A. P 720,006

B. Pi, 440,000

‘Advanced Financial Accounting & Repos ting- Final Pre-Board Examination (BATCH 33) &

ReSA: The Review School of Accountancy Page 10 of 14

45. The ‘Shipes Company ow

accounting pericd Geni

At the Genie Compeny. On the last day of the

‘te Snipes @non-current asset for @200,0002 ‘he

asset originally. cost P30G,000Sand at the end of the reporting period its

carrying amount in Genie‘ cocks was PI60,000. The group's consolidated

statement of financial position has been drafted without any adjustments in

relation to this ron-current asset.

B Under PAS2? Consolidated and separave financial statements, what adjustments

should be made to che consclidated statement of financial position figures

for non d @axnings?

current assets and x

Non-cvrrent assets Retained wa:

ancrease by P300, 000 tnerease by P195,009

Reduce by P40; 000 Reduce by P26, 000

©. Reduce by P40, 000 Reduce by P40, 000

B. Increase by P200,000 Tnerease by P300, 000

Ye Bonifacie contractors had a snyear

P900,000. The comeany uses the percentage-of-completion method for financial

statement purposes. Incone co be recognized each year is based on the ratio

D af cost incurred to total estimated cost to complete the contract. Data on

this, Gentine eel ieen

contract in 2012. for

Accounts receivable - constzuct:en contract billings 49,000

Construction in progress.

less: Amounts billed......

10% retention. 9,375

Net income recognized in 2012 {before tax}... 18,000

Bonifacio Contractors mainaire a separate bank account for each construction

contract. Sank deposits to this contract amounted to P59, 000.

What was the estimated Ectal-tecons -befere tax bn this contract?

A. 243,000. ©, P135,000

B, 294,000 1 plad, 000A

The Lakers Company owns 75? of

last day of the accou

ne Viking Company. On Decesber 31, 2012, the

Vikings sol@ to Lgkers a noncurrent asset

ja for 200,000. ea crigi®s! code wee 950,000 and on December Ji 2012.

itsearrying amount in Viking's Locke sas Pl6t,000. The group's consolidated

Statement of financial positicn has een drafted without any adjustments in

Felavion ta this ns

“current asset.

Under PAS 27 Consolidated end separate financial statements, what adjustments

should be made to the iigated statement of financial position figures

for retained earnings end non-controlling interest?

ins Pee aide

494 Ye Vizgst Company nos Ge ct the wig company. om Ovcenber 31,2012) ine

Last day of the accounting erica, Virgil sold to Migu a noncurrent asset for

The asset's original cost wasP7,50Q and on December 31, 2012 its

b Sattying amcunt in Virgil's beoks ‘Sar @PEQD) The group's consolidated

Dedvadeues oe einanetar' pastel an eta lbeenl drakrhd ithaue any cetliukendncs' ie

relation to this non-current asset.

Under PAS2? Consolidated atid separate financial statements, what adjustments

should be made to the consclidsted statement of financial position figures

for non-current assets and non-cntroilang interest?

shsatcrart “aunts wee doneaa ling Batevest

pee Re eri asge Te

(B. Reduce by P200 No ¢Ghange

orate pepe Bee aati

Pee re mene

ge On eee al UO eee ee

poo age Mie ueecirie Ge Pee ee Ger nt reign va cok etary

1, 2012 The Muldon Company acquired 100% of Roel and estimated the fair value

of the equipment at P460,000, with » remaining life of 5 years. this fair

value was not incorporated into Poel’s boos and the depreciation expense

continued to be calcwlated by reference to original cost

“Advanced Financial Accounting & Reporting. Final Pre-Baard Examination (BATCH 33)

__ ReSA: The Review School of Accountancy Page 11 of 14

~.* Under PAS 27 Consolidated and separate financial statements, what adjustments

should be made to the depreciation expense for the year and the statement of

financial position cerrying amount in preparing the consolidated financial

statements for the year ended Derenber 21, 20137

spreciation expenge

A. Increase by 8,000

B. Increase by P2,000

C. Decrease by P8,900 Increase

D. Decrease by P8,000 Secrease by :

to be included in the cost of

50. Which of the following is LEAST lixe?;

cinventory> —~ =

a. Freight tn 2

b. cost to store goods

©. Purchase cost of goods

d@ Excise tax on gosds purchased

Items 51 and 52 are based on tha following information:

Apo Supply Company is encayed in merchandising Eoth at Home Office in Makati,

Metro Manila and a branch in Davac. Selested accounts in the trial balances of

the Home Office and the brancn at December 21, 2010 follow:

Deb fone Office Branch

Inventory, January i, 2 ® 23,000 211,550

Davae Branch 58,300

Purchases 190,000 108, 900

Freight-in from tore o: 5,500

Sundry expenses 52,000 28,000

credits

Home office P 53,300

Sales

Sales te Branch

Allowance for

branch inven:

3,000 - 40,000

210,009

1,000

Additional information:

1, Davao branch receives all sta mercheng

Office BiI1s the goods. ak cost. pius(@0) mark-up. At. December 34,2010,

shipment with a billing valde of PB.A0-waa in tranpit to the beanch

Freight on this shipment was F250 which is to be treated aa part of

snventory.

from the home office. The Hone

2. December A 201Dinventerits excluding the shipment in transit , are:

Hone office, at cost. P40, 000 ;

Davao branch, at bilied value :

(excluding freight of P20}. 12, 400-Ra>|0,q—9 © iM, 10

© fl. Net indine of the Hone Office uae:

A, P10,000 "#26, 000

fr 52+ Net income of Davao branch was:

A. B10, 470 ¢. Pi2,470

8. PL1,470 7 D.. P13, 470

Ga A hospital has the following account bslances:

Revenue from newsstand 50,000

Amount charged to patier 800, 000%

Interest income 30,000 yt

Salary expense ~ 1urses 209,000)

Bad debts €, 000%

Undesignated gifts £0,000

Contractual adjustments 140, 000

What is the hospital's

A. P880,000

3B. 800,000 >. #620, 500

54. On| January 1, 2013, two real estate companies (the parties - packet Company

and Sacket Company) set ap a Separate vehicle (iarzisen Company) for the

purpose of acquiring and operating a shopping centre. The contractual

arrangement between the parvies establishes jeint control of the activities

that are conducted in Warrisor Conteny. The main feature of Harrison’a legal

form is that the entity, not ‘the parties, | has rights to the assets, and

obligations for the liabiliri relating. te the arrangement., ‘These

activities include rental of the ze POT ere

Oeteber 1, 2012 st % 160

| becerber iu, nba: 195

2012 average: 22 oss: 1.03

The December 31, 2012 Loans payable ac

investment amounted to

A. P196, 000, 000

BR. P200,000, 000

87.

Kuchen Manufacturing uses backflu

¢ sold 15,809

fhe standacd cost

Direct material

Conversion costs

Total

Assume that the company had ro

took place in August

1. Purchased P320,000 ct direct vateria

2. Incurred P708,000 of conversion cost:

32. Applied P704,000 o£ conversicn cost

4. Finighed 16,000 meters.

5. Sold 18,800 meters for P199 each.

Compute the Finished Scods, eriding ang the amount of C

the adjustment of over-unde:

Finished Goods, erding

applied conv!

ober

Use the following information for questions 5

on January 3,

260,000 cash consideratfon. The reuaining 2

date fair value of £65,000, Cn January 1,

that was undervalued on ite peoks by PL,

unt balance obt:

ory

PPu6, 009, 000

219,000, 000

sting to account

P20

aa

a

or August 2,

ae

meter it makes. During August 201i, the firm produced 16,000 meters of which

for each meter is

ined to hedge the net

an electronic

The following event

te Raw and In Process Inventory.

ersion cost:

A to 59:

J3 acquired 80 percert cf the outstanding voting stock of Sz for

percent

doo.

of SZ had an atquisition-

z possessed equipment

8% aiso had developed several

(S-year life)

© “Advanced Financia! Accounting & Reporting- Final Pre-Board Examination (BATCH 33) &

ReSA: The Review School of Accountancy Page 13 of 14

~ Sceret | farmilae thet’ Ud), assessed eat 50,000: -these= formide althougn nex

fecorded oh S2's financial records, were estimated to have a 20-year future life.

As of December 31, £8 appeared as follows:

f id &

Revenues... é (300,000) —_Pr200,000)

Cost of goods soi 140,000 90,0001.

Expenses... 70,000 19,600

Nel income +++...

P4090) P110,000)

Retained earings. 1/1

(300.000) —_P(150000)

Netincome 110,000) (110,000),

Dividends paid... 0. 2

Retained camings. 12/3) rae (440.000) —_P(260,000)

Gosh and receivables. ve vsvesesevesesy 210.000 'P90,000

Inventory... a 150,000 110.000

Investment in iJ... c..- Aa 260,000 o

| Equipment inet) ena 440,000 300,000

etal atteeDenaatcy.. 7 co ees 1,060,000 500,000

tiobities «TTI Pa (420,000) (140,000)

Common stockist! liu aes ee as! (200,000). (100,000)

Relined eamings, 12/31 00.01... {440,000} (260,000),

Total liobiities ena aqui

During the year, JI bought inventory for £60,090 and séld it to sz for P100,000.

$2 had paid for only halt of! this’ purchase) by the and of the yea?. > OF these

goods, 82 still owns60 percent on Deceaber 31.

58. What is the total of consciidated revenues?

500,009 €. 426,000

P4609, 000 a. asc; 000

59. What is the rotal

Piao, 000

bi P1S2,000

cE goods sold?

30,000

P2132, 000

60. The component of defined benefit cout. include all of the following, EXCRET:

4. Service cos:

b. Net interes:

cc. Remeasurenenta

d. Plan contributions

ol: Barnings "per share aiscio:

+ @ublic entities

Private entities

Entities with complex cacitai vtrveture

Butities that change their capital structure during the reporting

peried i

poe

62. The failure te Yeecrd an

overstatement errors

Net_incox

yense at year-end will resui

On 1/3/x6, Pylux sold equipment costing FLOOD GOD to its 100%-owned subsidiary,

64. What is the amount of the intercompany profit or loss that must be deferred

at 12/31/x6? rere

3 26,000 ay b24,000

b. P14, 000 ©, P20,000

ce. P16,000

What is the amount of the agjusiment 10 Sepreciation Expense in preparing the

consclidaticn worksheet ac 12/,

Poe

P5000

Advanced Financial Accounting & Reporting Final Pre-Board Examination (BATCH 33)

cquized only for ra inaanneiemeas

ReSA: The Review Schooi of Accountancy Page 14 of 14 ;

be 3,060 6

ce. P4,000

Use the following information for questions 66 and 67.

cc corpora bsidiary buys marketable equity se

April 1, 20x4, for 100,000 foreigh curtencies each.

dune 1, 20x4), and they are stali

cost under the lower-of-cost~cr-marke

follow:

urities and inventory o1

it pays for both items on

hand at year- end. Trventory is carried at

rule. Currency exchange rates for 1 peso

66. Assume that the (feresan 2)

currency. Whet balances soes a consol.

December 31,2044?

a. Marketable equity secumiies = ?16,000 and Inventory = P16,

b. Marketable equity securities + 217,000 end Inventory = P17, 000.

o: Marketable equity securities 19,000 and Inventory = P16,000,

a, Marketable equity securities 229,000 and Inventory P19, 000.

the subsidiery’S functional

balance sheet repo:

tas of

peso is the subsidiary's functional currency. what bale

sheet repert as of December 31, 2024?

6,000 and Inventory = P16, 000.

b. Marketable equity securities = F17,009 and Inventory ~ 8L7,000.

Marketable equity securities 19,000 and Inventory = 16,090.

“a. Marketable equity securities 719,900 and Inventory P19, 000

68. The following Iz (Income Taxesi:

Statement I: A deferred vax esset shall be recognized for the carry forward

bf unused tax lorses and unused tex credits to the extent that it is probable

that future taxable profit fe available against which the unused tax

losses and unusea tax creaite can be etilized

Statement II; Current tux liabilities (assets) for the current and prior

periéds shall be measured at the amount expected to be paid (recovered from)

the taxation authorities, usicg the tae cates (and tax laws) that have been

@ or substantively enacted hy the end-cf the reporting period.

Statement III: Deferred tax asects and diubilities SWalT~ be*measured=wtwethosmseme,

tax rates that are expected to apply to the period when the asset is/realized

or the liability is sectied, besea on tax rates (and tax laws) that have been

enacted or substa! enacted bY the end of the reporting period.

a. Only statement T is false

b. Only statemen: Ii is false

Only statement 111 is. fa:

d. None of the statenents 25 tuise

c./ Operating or financing activi’

d. Operating, investing or cing activities

20, Any loss incurred

gasur) shares shall be..chargedato~

a. Share premium fr T igstence, share Drenium fron treasury

hares and then retained earnings.

Loss on sale of treasury shares to be reported as other expense

Retained earnings and then shar? preazam from treasury shares

Sha¥e premium from treasury shares and then retained earnings.

“end of examination ~

The most difficult secret of a ran to keep is the opinion he has of himself.

Nothing great was ever achieved without determination.

Don't be discouraged; everyone who got where he fs, started where he was.

i Impossibilities vanish when ¢ man and his GOD confront a mountain.

z :

Ke

"Advanced Financial Accounting & Reperting- Final Pre-Board Examination (BATCH 33) &)

‘N,_under ras 29, one of tne following is an indicator of hyperinflation,

a, People prefer to keep their wealth in monetary assets:

DB ¥ beople preter to, keep their vesith in selatively stable foreign currency

Interest rates, wages and prices are not linked ta a price iniex

‘The cwndlative infla

508

CDEP TIS 11) flint arcangeaea> that are dist ventieee union’ were ‘jointly

Sontrolled entities’ Under the PAS 21) are accounted Tor under

4 A® Cost method in accordance with ZA5 39

B. Equity method in accordance with Pas 2°

Fair value method in accordasce with PRS §

4. Proportionate consolidation method in accordance with PAS 31

Under PFRS 10, when a parent loses

investment retained in the former subs

@. Carrying anount

b, Fair value, with any gain or 2

Fair value, with any gain or loss recognized in other compechensi

@- Qriginal acquisition cost, adjusted for any dividend received tres "the

subsidiary

dg nat

1 Pe mettnd fe a

sip eal areca eae

ee

D 1: 76 be highly effective, the

‘a, “100k ~ 1508

1008 - 1258

c. 80 - 1098

a. 808 - 1258

OW. onder nae 4, st raters to a pocty that haa a right to receive canpsnssticn under co

cotane

a.

Somme

Tollcyilaer

14 Financial statement of/60t for prolit aryenteation focuses on

a 4. Basic antomatdon forthe. azderisation ae a ohote

b. Seahtaidisation GF tmar soceciseee

cr Miherene,‘ditterences a sot—for-protit organization that impact reporting

preleesticae

one ae ‘

mn Face over three (3) years exceeds or is approaching

ontrol Of a subsidiary, it mist recognize any

diary at

accounting for government transactions means

when received while expenses are recognized when

etual resulte of the hedge must be within a range of

27- The following statements are based on ¥2RS 3 (Business Combinations)

Stacamant 71 ans enzity shall account: for each Bitinesn combimstion by applying the

acquisition merhed. :

A Statement 1-the acquirer shail mesaure the identifiable assets acquired and the

Liabilities assumed ar these acquisition date fair velues

Seatoment TET:For each business conbinstion, the acquirer shall measure any non-

ferorenesaa interest in the acquires either at fair value or at the nom-conteoliing

interest’s proportionate share of the acquites’s ideatifiable net aveeta,

@. All of the statements are tzue

b: Only statement 1 is tras

. Only statement 1 in false

Al Only statement III is false

; A Philippine importer that parchases movchandices from foreign firm's foreign

t EREFent unit (FCO) would be exposed tc @ net exchange gain on the unpaid belavce if

the =

: fo the FCU and the FCU wes the denominated currency

D: 2859 woshened relative ts the SC and the peso was the denominated certoncy

+ Boag Stkanythened relative to the, mo” ad's the 2U nas’ the Geceaiicted

currency

G Beso strengthened relative to ‘the FOU dnd the peso ‘wae’ ‘the denominated

20. Abnormal spoilage ina minafacturing provess should be charyed to

& “Tar Profit or loss

Accumulated profit or loss

Manufacturing overhead applica

Manufacturing overhead sontrol

ta freee eee eet ce ae

C7 Sit Se corres scons ing for ace pana

"

_s: Joint arrangements classified a2 joint ventures are accounted for under PAS 28.

@. Joint arrangements classified as joint operations are accounted for under PAS

20.

22. Gains or losses that arise as a result of translating foreign currency ‘denominated

operations inte the reporting currshiay exe recognized in income:

a. only if they are materiel itexs

Bony when they are settled in c

g- in the reporting period in whica they arise

4. only when the interest in the foreign operation is sold

Se eee ee eesti et ee ieee tae ein

cuortroceion coHttact Will auteed toval GBEbegEE revenue, tho expected Toor should be

apc tpt eraiedl craelh op otha aeeretiog cart tact tency apatcls

By tabopuined 4s" all uasion Stesdlst4l6y Galati] ptatoe’ fo dies paspate! Soets

Seance :

sh Regering Ree ieee Cece eestaiod Be cee nec canars oe

elec ote

Po eter

Go Si ek eet tar eee eters ee eet rete enyl ce veces) cea ciny

considers

‘a. Current cost only

b. Current cost plus cost of ending work in process inventory

Gr Current cost plus cost of soyinsing work in process inventory

@. Current cost less cost of beginning work in process inventory

50. Goodwill should be recorded in the accounting records only when

a. It is internally generated

b. It can be established that a definite benefit or advantage has resulted to a

fixm from some item such as good name, capable. staff, or reputation

ce. It is acquired through the acquisition of another business

4. A fizm reports above normal earnings for tive or more consecutive years

f) (2 FOE which eye of hedge are changes in fair value deferred and anortized as an equity

adjustment?

a. Cash flow heage 7

(i Operating hedge

©. Fair value hedge

4. Notional value hedge

61. which models are allowed to be ured by the private operator for build-operate-

transfer (BOT) schemes under TREC 127

T= Pinancial Asset aodel HI - Intangible Asset model

XIT ~ Property, Plast + Uquipsent: model

a, Tana tr

Wot and rar

Wand 12

4d. f, If and tir

62, If shares are issued as pact

brokerage fees may be i

appropriate accounting treatment =

debit tot

a. Cash

bl Investments

©. Share capital

A Acquisition expenses

the consideretion paid, transactions costs such as

ed. According to PERS 3 ‘Business Combinations the

Such sorts in the records of the acquirer is a

® 68 Under BPRS 10, which {s NOF one of the three (2) elements of control?

a. power over the izveatee _~

b. holding majority voting tights ~~

2 exposure, or rights, to variable returns from involvement with the investee

d. the ability to use poncr over the investee to affect the anount of the

investor’s returns

indicating that en intre group business Sransaction has been realized &

che genezation of profit fzom che transection -

b, the involvement of an externai party in the transaction +

€. the presence of only within the group as parties to the transaction

d. whether or not an operating profit or loss occurred as a result of the

eransaction

one a Se ce

eee cue ae sare re a Pea ea, Seamed” opt series

Hegie pareence,

eee

Sommcien

ci dpe

ERE or es areca

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1stPB Afar10.17Document12 pages1stPB Afar10.17MikaNo ratings yet

- CPAR AFAR 2016FirstPBDocument29 pagesCPAR AFAR 2016FirstPBMikaNo ratings yet

- Afar FPB May 2017Document36 pagesAfar FPB May 2017MikaNo ratings yet

- Resa Afar Final PB 2017 With AnswersDocument26 pagesResa Afar Final PB 2017 With AnswersMikaNo ratings yet

- Resa AfarDocument14 pagesResa AfarMika100% (1)

- Crc-Ace Afar Summary Quizzer 2 2016 Inc AnswersDocument10 pagesCrc-Ace Afar Summary Quizzer 2 2016 Inc AnswersMikaNo ratings yet

- Cpar Manila Gross Income With AnswersDocument9 pagesCpar Manila Gross Income With AnswersMikaNo ratings yet

- 1CRCA 1stPB AFARDocument24 pages1CRCA 1stPB AFARMikaNo ratings yet

- Mas Formulas PDFDocument9 pagesMas Formulas PDFMikaNo ratings yet

- Oblicon Summary PDFDocument21 pagesOblicon Summary PDFMikaNo ratings yet

- GOODLUCK CPA!! - , CPA: Financial Accounting and Reporting " Must Review "Document21 pagesGOODLUCK CPA!! - , CPA: Financial Accounting and Reporting " Must Review "MikaNo ratings yet

- Solman Audtheo Salosagcol 2014 PDFDocument4 pagesSolman Audtheo Salosagcol 2014 PDFMikaNo ratings yet

- Auditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryDocument33 pagesAuditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryMikaNo ratings yet

- Mas Summary 50 Pages PDFDocument50 pagesMas Summary 50 Pages PDFMikaNo ratings yet

- Baybayin PDFDocument29 pagesBaybayin PDFMikaNo ratings yet

- Cpar Far MCQ PDFDocument36 pagesCpar Far MCQ PDFMikaNo ratings yet

- Cpar Tax Estate, Trust, Fringe, Gross Income PDFDocument15 pagesCpar Tax Estate, Trust, Fringe, Gross Income PDFMikaNo ratings yet