Professional Documents

Culture Documents

Amundi Fund Solutions - Buy and Watch High Income Bond

Uploaded by

Radu CiurariuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amundi Fund Solutions - Buy and Watch High Income Bond

Uploaded by

Radu CiurariuCopyright:

Available Formats

AMUNDI FUNDS ABSOLUTE RETURN MULTI-STRATEGY - A EUR

FACTSHEET

31/01/2021

ABSOLUTE PERFORMANCE ■

Investment Objective

Seeks to achieve a positive return in all types of market conditions over the recommended holding period.

The Sub-Fund invests, directly or indirectly, in a broad range of securities from around the world, including emerging markets. These investments may include government and corporate

bonds of any maturity, equities, convertible bonds and money market securities. The Sub-Fund may also seek exposure to commodities, real estate, and currencies. The Sub-Fund may

invest up to 50% of its assets in equities and up to 25% in convertible bonds (including up to 10% in contingent convertible bonds). The Sub-Fund's investments will mainly be denominated

in euro, other European currencies, U.S. dollar or Japanese yen.

The Sub-Fund makes extensive use of derivatives to reduce various risks, for efficient portfolio management and as a way to gain exposure (long or short) to various assets, markets or other

investment opportunities (including derivatives which focus on credit, equities, interest rates, foreign exchange, volatility and inflation). The Sub-Fund may use derivatives to gain exposure to

loans up to a maximum of 20% of its assets.

Benchmark : The Sub-Fund is actively managed. The Sub-Fund may use a benchmark a posteriori as an indicator for assessing the Sub-Fund's performance and, as regards the

performance fee benchmark used by relevant share classes, for calculating the performance fees. There are no constraints relative to any such Benchmark restraining portfolio construction.

Management Process : The investment manager first constructs a macro strategy portfolio to provide a return not correlated to any market, and then overlays this with an investment

strategy to generate excess return.

Meet the Team

Davide Cataldo Francesco Dall’Angelo

Head of Absolute Return Multi Multi-Strategy Portfolio Manager

Strategy

Risk & Reward Profile (SRRI)

Additional Risks

Important risks materially relevant to the Sub-Fund which are not adequately captured by

the indicator:

Lower risk, potentially lower rewards Credit risk: represents the risks associated with an issuer’s sudden downgrading of its

signature’s quality or its default.

Higher risk, potentially higher rewards Liquidity risk: in case of low trading volume on financial markets, any buy or sell trade on

these markets may lead to important market variations/fluctuations that may impact your

The SRRI represents the risk and return profile as presented in the Key Investor portfolio valuation.

Information Document (KIID). The lowest category does not imply that there is no risk. Counterparty risk: represents the risk of default of a market participant to fulfil its

The SRRI is not guaranteed and may change over time contractual obligations vis-à-vis your portfolio.

The risk level of this Sub-Fund reflects the maximum projected volatility of the portfolio. Operational risk: this is the risk of default or error within the different service providers

involved in managing and valuing your portfolio.

Emerging Markets risk : Some of the countries invested in may carry higher political, legal,

economic and liquidity risks than investments in more developed countries.

The use of complex products such as financial derivative instruments might increase market

movements in your portfolio.

The occurrence of any of these risks may have an impact on the net asset value of your

portfolio.

Key Information (source : Amundi) Information

Net Asset Value (NAV) : 64.51 ( EUR ) Fund structure : UCITS

NAV and AUM as of : 29/01/2021 Sub-fund launch date : 07/06/2019

ISIN code : LU1882439323 Share-class inception date : 07/06/2019

Assets Under Management (AUM) : 1,617.56 ( million EUR ) Eligibility : Securities account, life insurance

Sub-fund reference currency : EUR French tax wrapper : Eligible Planilion

Share-class reference currency : EUR Type of shares : Accumulation

Benchmark : None Minimum first subscription / subsequent :

Comparative benchmark : 100.0% DEUTSCHE BANK EONIA TOTAL RETURN 1 thousandth(s) of (a) share(s) / 1 thousandth(s) of (a) share(s)

Entry charge (maximum) : 4.50%

Ongoing charges : 1.45% ( realized 31/12/2020 )

Exit charge (maximum) : 0.00%

Minimum recommended investment period : 4 years

Performance fees : Yes

■ www.amundi.com

For "retail" investors information

AMUNDI FUNDS ABSOLUTE RETURN MULTI-STRATEGY - A EUR

FACTSHEET

31/01/2021

ABSOLUTE PERFORMANCE ■

Returns

Performance evolution (rebased to 100) from 29/01/2016 to 29/01/2021* Risk analysis (rolling)

115 1 year 3 years 5 years

Portfolio volatility 7.84% 4.94% 4.19%

110 Volatility is a statistical indicator that measures an asset’s

variations around its average value. For example, market

variations of +/- 1.5% per day correspond to a volatility of

105 25% per year.

Fund Statistics

100

Portfolio

95 Modified Duration 7.47

Number of Lines 1576

Modified duration (in points) estimates a bond portfolio’s

90

percentage price change for 1% change in yield

/16

/16

/17

/17

/18

/18

/19

/19

/20

/20

/21

01

07

01

07

01

07

01

07

01

07

01

Portfolio (109.47) Comparative Index (98.08)

Main Lines in Portfolio

Cumulative Returns *

Portfolio *

YTD 1 month 3 months 1 year 3 years 5 years Since AMUNDI PHYSICAL GOLD ETC (AMSTERDAM) 3.46%

Since 31/12/2020 31/12/2020 30/10/2020 31/01/2020 31/01/2018 29/01/2016 12/12/2008 DBRI IE 0.1% 4/23 2.04%

Portfolio 0.36% 0.36% 4.96% 5.34% 3.12% 9.47% 34.17% LYXOR TH-REUTERS CORE COMMO(ITA) 1.99%

Comparative Index -0.04% -0.04% -0.12% -0.47% -1.23% -1.92% 0.53% BTPS 0.95% 03/37 1.97%

BTPS 2.8% 03/67 1.80%

Comparative Spread 0.40% 0.40% 5.08% 5.81% 4.35% 11.39% 33.64%

NZGB 3% 04/29 0429 1.14%

CANADA I 4.25% 12/21 1.03%

Calendar year performance *

JGBI 0.1% 3/27 0.98%

2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 ISHARES S&P GL CLEAN ENERGY 0.95%

CANADA 2.25% 03/24 0.94%

Portfolio 5.12% 3.08% -3.67% 1.47% 1.81% 2.12% 3.84% 3.12% 5.11% -6.02%

* The main lines in portfolio are presented except money

Comparative Index -0.47% -0.40% -0.37% -0.36% -0.32% -0.11% 0.10% 0.09% 0.24% 0.88%

market

Comparative Spread 5.59% 3.48% -3.30% 1.82% 2.13% 2.23% 3.74% 3.03% 4.87% -6.90%

* Source : Amundi. The above results pertain to full 12-month period per calendar year. All performances are

calculated net income reinvested and net of all charges taken by the Sub-Fund and expressed with the round-off

superior. Past performance is not a reliable indicator of future performance. The value of investments may vary

upwards or downwards according to market conditions.

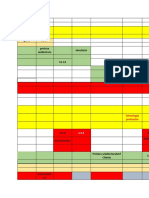

Portfolio Breakdown

Asset Allocation Currency

100 %

Fixed Income 149.66 % 78.33 %

75 %

Equity 12.99 % 50 %

25 %

Cash&FX 10.20 %

4.94 % 4.42 % 4.42 % 4.39 % 2.14 % 1.94 %

1.31 % 1.29 %

0%

-3.18 %

Others 8.51 %

-25 %

s

ng

bi

ah

so

s

ro

er

an

on

on

Ye

in

Pe

pi

rli

Commodities 7.47 %

th

Eu

nm

Fr

Kr

Kr

se

Ru

O

St

an

s

sh

ne

Re

is

an

ia

ic

d

ni

Sw

pa

eg

un

ex

re

si

Da

Ja

ne

w

ho

Po

M

or

do

ffs

0% 25 % 50 % 75 % 100 % 125 % 150 % 175 %

N

In

O

Fund % Fund %

Amundi Asset Management, SAS (French : Société par Actions Simplifiée)

with a capital of 1 086 262 605 €

AMF approved Portfolio Management Company- GP number 04000036

Corporate address: 90, Boulevard Pasteur - 75015 Paris- France 437 574 452 RCS Paris

AMUNDI FUNDS ABSOLUTE RETURN MULTI-STRATEGY - A EUR

FACTSHEET

31/01/2021

ABSOLUTE PERFORMANCE ■

* Expected income target in 2019 for this Sub-Fund, gross of fees. Income can be exceeded or undershot and should not be construed as an assurance or guarantee. The term Distribution

refers to the income paid in any particular year. Treatment for tax purposes may vary depending on the jurisdiction. Please consult your tax adviser in order to understand any applicable tax

consequences.

Legal information

Issued by Amundi Asset Management SAS. AMUNDI FUNDS (the “Fund”) is a Luxembourg registered umbrella fund organised under the laws of the Grand Duchy of Luxembourg and is

regulated by the Commission de Surveillance du Secteur Financiaer (“CSSF”), number of registration B68.806.

This material is for information purposes only, is not a recommendation, financial analysis or advice, and does not constitute a solicitation, invitation or offer to purchase or sell the Fund in any

jurisdiction where such offer, solicitation or invitation would be unlawful.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or

possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Fund). The Fund have not been registered in the United States under the

Investment Company Act of 1940 and units of the Funds are not registered in the United States under the Securities Act of 1933. Accordingly, this material is for distribution or to be used

solely in jurisdictions where it is permitted and to persons who may receive it without breaching applicable legal or regulatory requirements, or that would require the registration of Amundi or

its affiliates in these countries.

Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment in the Fund may go up or down

and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the

investment and its suitability. It is the responsibility of investors to read the legal documents in force in particular the current prospectus of the Fund. Subscriptions in the Fund will only be

accepted on the basis of their latest prospectus and/or, as applicable, the Key Investor Information Document (“KIID”) available in local language in EU countries of registration.

The information in this document is as at the date shown at the top of the document, except where otherwise stated.

© 2021 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; (3) are not

warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this Information.

Austria: The prospectus of the Fund, along with the Key Investor Information Document (as applicable) available in German, the current annual and semi-annual report, can be obtained, free

of charge, at Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.at.

Bulgaria: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.bg

Belgium: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.be

Czech Republic:The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.cz

Cyprus: The prospectus of the Fund, along with the Key Investor Information Document (where applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.com.cy

Denmark: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.dk

Finland: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at Amundi

Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.fi

France: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at Amundi

Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.fr or, for Luxembourg funds, at www.amundi.lu or at the centralising correspondence for Amundi Funds and

Amundi Index Solutions: CACEIS Bank, Luxembourg branch, 5 allée Scheffer, 2520 Luxembourg, Grand Duchy of Luxembourg / or for First Eagle Amundi: Société Générale Bank & Trust, 11

avenue Emile Reuter, L-2420 Luxembourg, Grand Duchy of Luxembourg.

Germany: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.lu and at www.amundi.de

Greece: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at Amundi

Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.gr

Hong Kong: The prospectus of the Fund, along with the Key Facts Statement, the current annual and semi-annual report, can be obtained, free of charge, at Amundi Hong Kong Limited, 9th

Floor One Pacific Place, 88 Queensway, Hong Kong or at www.amundi.com.hk

Hungary: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.hu

Ireland: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at Amundi

Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.ie

Italy: The prospectus of the Fund, along with the Key Investor Information Document, the current annual and semi-annual report, can be obtained, free of charge, at Amundi Luxembourg

S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.lu and at www.amundi.it

Japan: The prospectus of the Fund, along with the Fact Statement, the current annual and semi-annual report can be obtained, free of charge, from the approved distributors of the funds or,

together with and all applicable regulatory information, at www.amundi.co.jp

Liechtenstein: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.lu

Luxembourg: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.lu

Amundi Asset Management, SAS (French : Société par Actions Simplifiée)

with a capital of 1 086 262 605 €

AMF approved Portfolio Management Company- GP number 04000036

Corporate address: 90, Boulevard Pasteur - 75015 Paris- France 437 574 452 RCS Paris

AMUNDI FUNDS ABSOLUTE RETURN MULTI-STRATEGY - A EUR

FACTSHEET

31/01/2021

ABSOLUTE PERFORMANCE ■

Legal information

Macau: The prospectus of the Fund, along with the Key Facts Statement, the current annual and semi-annual report, can be obtained, free of charge, at Amundi Hong Kong Limited, 9th Floor

One Pacific Place, 88 Queensway, Hong Kong or at www.amundi.com.hk

Netherlands: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.nl

Norway: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.no

Portugal: Any investment in the Fund or their respective sub-funds must be made through an authorised distributor registered with the Portuguese Securities Market Commission (Comissão

de Mercado de Valores Mobiliários or CMVM). The latest copy of the prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-

annual report, can be obtained, free of charge, at Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.pt

Romania: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.ro

Singapore: The prospectus of the Fund, along with the Product Highlight Sheet, the current annual and semi-annual report, can be obtained, free of charge, at Amundi Luxembourg S.A., 5

Allée Scheffer, L-2520 Luxembourg or at www.amundi.com.sg

Slovakia: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.sk

Slovenia: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.si

South Korea: The prospectus of the Fund, along with the Key Facts Statement, the current annual and semi-annual report, can be obtained, free of charge, at Amundi Hong Kong Limited,

9th Floor One Pacific Place, 88 Queensway, Hong Kong or at www.amundi.com.hk

Spain: Any investment in the Funds or their respective sub-funds must be made through a registered Spanish distributor. Amundi Iberia SGIIC SAU is the main distributor for the Funds in

Spain, registered with number 31 in the CNMV’s SGIIC registry, with address at P° de la Castellana 1, Madrid 28046. A list of all Spanish distributors may be obtained from the CNMV at

www.cnmv.es. The latest copy of the prospectus of the Fund, the Key Investor Information Document (as applicable) available in Spanish and the other legal documentation can be obtained,

free of charge, at the registered office of the management company or at www.amundi.es

Sweden: The prospectus of the Fund, along with the Key Investor Information Document (as applicable), the current annual and semi-annual report, can be obtained, free of charge, at

Amundi Luxembourg S.A., 5 Allée Scheffer, L-2520 Luxembourg or at www.amundi.se

Switzerland: The Representative and Paying Agent for Funds registered for public offer in Switzerland are, in respect of Amundi Funds and First Eagle Amundi: Representative - CACEIS

(Switzerland) SA and Paying Agent - CACEIS Bank, Nyon Branch both at 35 Route de Signy, Case postale 2259, CH-1260 Nyon; KBI Institutional Fund ICAV: Representative – ACOLIN Fund

Services AG, Affolternstrasse 56, CH-8050 Zurich and Paying Agent – NPB Neue Privat Bank AG, Limmatquai 1, CH-8001 Zurich. Free copies of the prospectus, key investor information

documents (as applicable), annual and semi-annual reports, management regulations and other information are available at the representative’s address shown above.

Taiwan: The Chinese translation of the prospectus of the Fund, along with the Investor Brochure and the current annual and semi-annual report, can be obtained, free of charge, at

www.amundi.com.tw

United Kingdom: The AMUNDI FUNDS ABSOLUTE RETURN MULTI-STRATEGY (the “Sub-Fund”) is a sub-fund of the Fund and has been recognised for public marketing in the United

Kingdom by the Financial Conduct Authority (the “FCA”). A distributor or platform may obtain the latest Fund prospectus, the KIID (as applicable), the articles of incorporation as well as the

annual and semi-annual reports free of charge from the facilities agent (Amundi (UK) Limited, 41 Lothbury, London EC2R 7HF, United Kingdom) and at www.amundi.lu. The latest available

prospectus, including the Sub-Fund’s risk factors, as well as the KIID, as applicable, should be consulted before considering any investment in the Fund. Amundi (UK) Limited is authorised

and regulated by the FCA under number 114503. This may be checked at https://register.fca.org.uk/ and details about the extent of regulation by the FCA are available on request. Amundi

(UK) Limited does not have the permissions to sell to retail investors. Any retail investor shall invest through a duly appointed distributor or platform and obtain the above-detailed Fund and

Sub-Fund information from such distributor or platform. UK investors will not have any protection under the UK Financial Services Compensation Scheme. There will be no right to cancel an

agreement to purchase Fund units under section 15 of the FCA’s Conduct of Business Sourcebook.

In Chile and Peru, this document is approved for use by Administradora de Fondos de Pensiones/Pension Fund Administrators and other institutional investors.

In Mexico, this document is approved for use with institutional investors. It may not be distributed to third parties or to the public.

US and US-Offshore (permitted jurisdictions): Amundi Pioneer Distributor, Inc., 60 State Street, Boston, MA 02109 (“APD”) a U.S.-registered broker-dealer, provides marketing services in

connection with the distribution of products managed by Amundi Asset Management or its affiliates. APD markets these products to financial intermediaries, both within and outside of the

U.S. (in jurisdictions where permitted to do so), who in turn offer such products for sale to persons who are not United States persons. APD engages with financial intermediaries only and

does not engage in retail business. Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate advisers before making any investment or financial

decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi Pioneer does not provide

investment advice or investment recommendations.

Please check the prospectus for Unit / Share classes suitable for Professional or Retail Clients.

Amundi Asset Management, SAS (French : Société par Actions Simplifiée)

with a capital of 1 086 262 605 €

AMF approved Portfolio Management Company- GP number 04000036

Corporate address: 90, Boulevard Pasteur - 75015 Paris- France 437 574 452 RCS Paris

You might also like

- Monthly Factsheet Lu1883841022 Eng Rou Retail AmundiDocument5 pagesMonthly Factsheet Lu1883841022 Eng Rou Retail Amundiiulian_macoveiciucNo ratings yet

- Monthly Factsheet Lu0557858130 Eng Rou Retail AmundiDocument5 pagesMonthly Factsheet Lu0557858130 Eng Rou Retail Amundiiulian_macoveiciucNo ratings yet

- Monthly Factsheet Lu1883318740 Eng Rou Retail AmundiDocument5 pagesMonthly Factsheet Lu1883318740 Eng Rou Retail Amundiiulian_macoveiciucNo ratings yet

- Monthly Factsheet Lu1883872332 Eng Rou Retail AmundiDocument5 pagesMonthly Factsheet Lu1883872332 Eng Rou Retail Amundiiulian_macoveiciucNo ratings yet

- Amundi Funds Pioneer Flexible Opportunities - I Usd A Sub-Fund of The Sicav Amundi FundsDocument2 pagesAmundi Funds Pioneer Flexible Opportunities - I Usd A Sub-Fund of The Sicav Amundi FundsFlamain HugoNo ratings yet

- 2023 - 01 - 04 3 PDFDocument3 pages2023 - 01 - 04 3 PDFjessica callesNo ratings yet

- Lyxor MSCI South Africa UCITS ETF - Acc (The "Fund") : Objectives and Investment PolicyDocument2 pagesLyxor MSCI South Africa UCITS ETF - Acc (The "Fund") : Objectives and Investment PolicysigurddemizarNo ratings yet

- Kiid Emqq IE00BFYN8Y92 en GBDocument2 pagesKiid Emqq IE00BFYN8Y92 en GBMónica CletoNo ratings yet

- Key Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesDocument2 pagesKey Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesAl BoscoNo ratings yet

- SBI PSU Fund NFO Application FormDocument16 pagesSBI PSU Fund NFO Application Formrkdgr87880No ratings yet

- Key Investor Information: Credit Suisse (Lux) Fixed Maturity Bond Fund 2021 S-IIDocument2 pagesKey Investor Information: Credit Suisse (Lux) Fixed Maturity Bond Fund 2021 S-IIanushreerNo ratings yet

- Kim Sbi Fixed Maturity Plan (FMP) Series 79 (1130 Days)Document64 pagesKim Sbi Fixed Maturity Plan (FMP) Series 79 (1130 Days)nakulmudhikondaNo ratings yet

- Product Highlights Sheets-Dynamic Income FundDocument7 pagesProduct Highlights Sheets-Dynamic Income FundCheeseong LimNo ratings yet

- Bond Credit Opp KiidDocument2 pagesBond Credit Opp KiidMassimiliano RizzoNo ratings yet

- Fsuu - Ebi GBP Cash Margin Fund (Eng)Document2 pagesFsuu - Ebi GBP Cash Margin Fund (Eng)Gangi Reddy UbbaraNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment Policyduc anhNo ratings yet

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025415Document2 pagesKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025415Isabelle ChapuysNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0794389287Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0794389287Isabelle ChapuysNo ratings yet

- Security Analysis: Chapter - 1Document47 pagesSecurity Analysis: Chapter - 1Harsh GuptaNo ratings yet

- Ishares J.P. Morgan $ em Corp Bond Ucits Etf: Objectives and Investment PolicyDocument2 pagesIshares J.P. Morgan $ em Corp Bond Ucits Etf: Objectives and Investment PolicyIulian Claudiu PascalNo ratings yet

- Kim - Sbi Equity Hybrid FundDocument24 pagesKim - Sbi Equity Hybrid FundbbaalluuNo ratings yet

- HDFC Income Fund December 2012Document19 pagesHDFC Income Fund December 2012khadenileshNo ratings yet

- Kiid Ishares Core Msci em Imi Ucits Etf Usd Acc GB Ie00bkm4gz66 enDocument2 pagesKiid Ishares Core Msci em Imi Ucits Etf Usd Acc GB Ie00bkm4gz66 endasadsNo ratings yet

- Fuel Ventures SEIS Fund KIDDocument3 pagesFuel Ventures SEIS Fund KIDctmcmenemyNo ratings yet

- Kiid Ishares Core Global Aggregate Bond Ucits Etf Usd Hedged Acc GB Ie00bz043r46 enDocument2 pagesKiid Ishares Core Global Aggregate Bond Ucits Etf Usd Hedged Acc GB Ie00bz043r46 enAl BoscoNo ratings yet

- IDFC Government Securities Fund: Key Information MemorandumDocument19 pagesIDFC Government Securities Fund: Key Information MemorandumRakesh KumarNo ratings yet

- Definition of 'Dividend Discount Model - DDM'Document2 pagesDefinition of 'Dividend Discount Model - DDM'Siddhesh PatwaNo ratings yet

- T Class Shares in Fundsmith Equity Fund: Key Investor InformationDocument2 pagesT Class Shares in Fundsmith Equity Fund: Key Investor InformationJohn SmithNo ratings yet

- Corporate Finance: Running Head: Corproate Finance 0Document8 pagesCorporate Finance: Running Head: Corproate Finance 0Ravi KumawatNo ratings yet

- Fundsmith Equity Fund I Class KIID (For Institutional Investors)Document2 pagesFundsmith Equity Fund I Class KIID (For Institutional Investors)John SmithNo ratings yet

- Fidelity Funds - Iberia Fund: Key Investor InformationDocument2 pagesFidelity Funds - Iberia Fund: Key Investor InformationMNo ratings yet

- 1up1 - IShares - SandP500Document2 pages1up1 - IShares - SandP500Antonio MaticNo ratings yet

- P-7 PBF PKF Eng - PHSDocument6 pagesP-7 PBF PKF Eng - PHSKhalisNo ratings yet

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Document2 pagesKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Isabelle ChapuysNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment PolicyGeorgio RomaniNo ratings yet

- Kiidoc 2020 02 24 en Lu 2020 02 24 Lu1744468221 YcapfundDocument2 pagesKiidoc 2020 02 24 en Lu 2020 02 24 Lu1744468221 Ycapfundmatthieu massieNo ratings yet

- Professional Factsheet FF - Global Technology Fund Y-ACC-USD 122020Document7 pagesProfessional Factsheet FF - Global Technology Fund Y-ACC-USD 122020Rithi JantararatNo ratings yet

- SBI Fact ShewtDocument28 pagesSBI Fact ShewtRaawakeNo ratings yet

- Key Investor Information: Vanguard FTSE Emerging Markets UCITS ETF (The "Fund")Document2 pagesKey Investor Information: Vanguard FTSE Emerging Markets UCITS ETF (The "Fund")sinwha321No ratings yet

- Kiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enDocument2 pagesKiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enfraknoNo ratings yet

- SSRN Id1669398Document64 pagesSSRN Id1669398Michael EnricoNo ratings yet

- Introduction To Mutual FundDocument13 pagesIntroduction To Mutual FundSujata TiwariNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Isabelle ChapuysNo ratings yet

- Risk and Return1Document45 pagesRisk and Return1Devanshi SinghNo ratings yet

- Kiid Xact Bull 2 (Etf) 0p0000mh7cDocument2 pagesKiid Xact Bull 2 (Etf) 0p0000mh7cAntonio Rodríguez de la TorreNo ratings yet

- HDFC MF Monthly Income Plan LTP December 2012Document18 pagesHDFC MF Monthly Income Plan LTP December 2012khadenileshNo ratings yet

- HSBC Portfolios - World Selection 5: Key Investor InformationDocument2 pagesHSBC Portfolios - World Selection 5: Key Investor Informationsinwha321No ratings yet

- Public Healthcare-Global Equity Fund (Phgef) : Responsibility StatementDocument5 pagesPublic Healthcare-Global Equity Fund (Phgef) : Responsibility StatementAzmiManNorNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Isabelle ChapuysNo ratings yet

- Ucits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enDocument2 pagesUcits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enja1220087No ratings yet

- Kiid Isin Lu2225683403 en GBDocument2 pagesKiid Isin Lu2225683403 en GBrt raoNo ratings yet

- L1 R48 HY NotesDocument4 pagesL1 R48 HY Notesayesha ansariNo ratings yet

- MPU 3353 Personal Financial Planning in Malaysia: Investment Basics: Understanding Risk and ReturnDocument33 pagesMPU 3353 Personal Financial Planning in Malaysia: Investment Basics: Understanding Risk and ReturnherueuxNo ratings yet

- Nippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Document29 pagesNippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Saif MansooriNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Isabelle ChapuysNo ratings yet

- HDFC Short Term PlanDocument20 pagesHDFC Short Term PlanAbhishek ChandraNo ratings yet

- Kiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enDocument2 pagesKiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enxacaxaNo ratings yet

- Fundamentals of Multinational Finance Moffett Stonehill 4th Edition Solutions ManualDocument7 pagesFundamentals of Multinational Finance Moffett Stonehill 4th Edition Solutions ManualMikeOsbornenjoi100% (38)

- Key Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")Document2 pagesKey Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")sinwha321No ratings yet

- Cămin E5 2021-2022: Nr. Crt. Nume Student Specializare An Studiu Media Punctaj Medie Bac CaminDocument8 pagesCămin E5 2021-2022: Nr. Crt. Nume Student Specializare An Studiu Media Punctaj Medie Bac CaminRadu CiurariuNo ratings yet

- Prospectus Bond Flexible RON ENDocument31 pagesProspectus Bond Flexible RON ENRadu CiurariuNo ratings yet

- Rezultate FinaleDocument1 pageRezultate FinaleRadu CiurariuNo ratings yet

- Cămin T22 - StudentiDocument2 pagesCămin T22 - StudentiRadu CiurariuNo ratings yet

- Medicină Dentară - NecazațiDocument2 pagesMedicină Dentară - NecazațiRadu CiurariuNo ratings yet

- Cămin 1 Mai B 2021-2022: Nr. Crt. Nume Student Specializare An Studiu Media Punctaj Medie Bac CaminDocument5 pagesCămin 1 Mai B 2021-2022: Nr. Crt. Nume Student Specializare An Studiu Media Punctaj Medie Bac CaminRadu CiurariuNo ratings yet

- RD pdf7-5 Ways To Boost Financial Outlook in 2021Document6 pagesRD pdf7-5 Ways To Boost Financial Outlook in 2021Radu CiurariuNo ratings yet

- Annual Report Lu0557858130 EngDocument842 pagesAnnual Report Lu0557858130 EngRadu CiurariuNo ratings yet

- Amundi FoundsDocument223 pagesAmundi FoundsRadu CiurariuNo ratings yet

- Annual Report Lu0557858130 EngDocument842 pagesAnnual Report Lu0557858130 EngRadu CiurariuNo ratings yet

- 5exemple Studii - DateDocument43 pages5exemple Studii - DateRadu CiurariuNo ratings yet

- Dual Wavelengths One of A KindDocument8 pagesDual Wavelengths One of A KindRadu CiurariuNo ratings yet

- Igiena S2-14 Proteza Unidentara Simulator: Tehnologia ProtezelorDocument2 pagesIgiena S2-14 Proteza Unidentara Simulator: Tehnologia ProtezelorRadu CiurariuNo ratings yet

- HypertensiDocument7 pagesHypertensizazaNo ratings yet

- Acct 284 Clem Exam One - Doc Fall 2004Document3 pagesAcct 284 Clem Exam One - Doc Fall 2004noranycNo ratings yet

- Formula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NDocument5 pagesFormula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NrohansahniNo ratings yet

- 5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467Document152 pages5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467sukriti2812No ratings yet

- Exim BankDocument11 pagesExim Bankkaran MishraNo ratings yet

- Decoding DuPont AnalysisDocument3 pagesDecoding DuPont AnalysisShalu PurswaniNo ratings yet

- How To Identify Winning Mutual Funds (Safal Niveshak)Document20 pagesHow To Identify Winning Mutual Funds (Safal Niveshak)Vishal Safal Niveshak KhandelwalNo ratings yet

- Business Accounts Papers 2003 OnwardsDocument329 pagesBusiness Accounts Papers 2003 OnwardsAbdul WahidNo ratings yet

- Balance Sheet of Idea CellularDocument4 pagesBalance Sheet of Idea CellularJohn NewmanNo ratings yet

- 7110 w14 Ms 21Document11 pages7110 w14 Ms 21Muhammad Umair100% (1)

- Calvares VineyardsDocument16 pagesCalvares Vineyardsigulati23100% (6)

- Argus Coalindo Indonesian Coal Index Report PDFDocument2 pagesArgus Coalindo Indonesian Coal Index Report PDFEko RubiartantoNo ratings yet

- The Erawan Group: Book Now, Good Price GuaranteedDocument10 pagesThe Erawan Group: Book Now, Good Price GuaranteedbodaiNo ratings yet

- Chapter 4 SolutionsDocument80 pagesChapter 4 SolutionssurpluslemonNo ratings yet

- WM Retirment SumsDocument8 pagesWM Retirment SumsTarun SukhijaNo ratings yet

- Nacpil v. IBC (GR 144767) Case DigestDocument2 pagesNacpil v. IBC (GR 144767) Case DigestEricha Joy GonadanNo ratings yet

- EToro Press ReleaseDocument6 pagesEToro Press ReleaseForkLogNo ratings yet

- The Exchange: PlasticsDocument1 pageThe Exchange: PlasticsSamuel FonsecaNo ratings yet

- Total Money Makeover WorkbookDocument36 pagesTotal Money Makeover WorkbookJason Schultz80% (5)

- Smu 4th Sem Finance AssignmentsDocument13 pagesSmu 4th Sem Finance AssignmentsProjectHelpForuNo ratings yet

- Chapter16 PDFDocument29 pagesChapter16 PDFervin sasongkoNo ratings yet

- Capital Gains TaxDocument6 pagesCapital Gains Taxnadj72576No ratings yet

- Company Law 23 NotesDocument15 pagesCompany Law 23 NotesChirag8076No ratings yet

- Dunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Document2 pagesDunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Cath VeluzNo ratings yet

- Tos - Fundamentals of Abm 2 First QuarterDocument2 pagesTos - Fundamentals of Abm 2 First QuarterFrancez Anne Guanzon100% (2)

- 91 SA Institutional Cautious Managed Fund Factsheet enDocument1 page91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNo ratings yet

- Royal Caribbean Cruises Ltd. Shipboard Seniority Retirement Plan Distribution Election FormDocument2 pagesRoyal Caribbean Cruises Ltd. Shipboard Seniority Retirement Plan Distribution Election FormAldrin Moraes100% (5)

- Project Report On "Debentures"Document14 pagesProject Report On "Debentures"Imran Shaikh88% (8)

- Birth Certificate Bond - Applicable UCC CodeDocument6 pagesBirth Certificate Bond - Applicable UCC CodeAllen-nelson of the Boisjoli family100% (3)

- SEBI Registered Investment Adviser Application ProcessDocument14 pagesSEBI Registered Investment Adviser Application ProcesskshitijsaxenaNo ratings yet

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Money Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasFrom EverandMoney Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasRating: 3 out of 5 stars3/5 (1)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Summary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamFrom EverandSummary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamRating: 5 out of 5 stars5/5 (1)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestFrom EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestRating: 5 out of 5 stars5/5 (1)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeFrom EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyFrom EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyRating: 4 out of 5 stars4/5 (4)

- 109 Personal Finance Tips: Things you Should Have Learned in High SchoolFrom Everand109 Personal Finance Tips: Things you Should Have Learned in High SchoolNo ratings yet