Professional Documents

Culture Documents

BIR VAT Ruling No. 007-99

Uploaded by

Adrian CabanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR VAT Ruling No. 007-99

Uploaded by

Adrian CabanaCopyright:

Available Formats

January 19, 1999

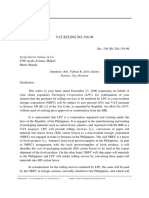

VAT RULING NO. 007-99

Sec. 105-000-00-007-99

Tricom Dynamics, Inc.

Ground Floor Metro House

354 Sen. Gil Puyat Avenue

Makati City

Attention: Mr. Antonio S. Manalang, Jr.

Credit & Collection Supervisor

Subject: Forum Exploration, Inc. (FORUM)

Gentlemen :

Referring to your letter of 26 November 1998, please be informed that as per

VAT Ruling No. 516-88 dated November 16, 1988, subcontactors engaged in petroleum

operations in the Philippines are exempt from all taxes (including value-added tax)

pursuant to the provisions of Presidential Decree No. 1354 and Fiscal Incentives

Review Board (FIRB) Resolution No. 19-87. However, the aforesaid VAT ruling means

that the aforesaid subcontractors are exempted from taxes to which they shall

otherwise be liable to. LLpr

VAT is a direct tax on the seller of goods, property or services while an indirect

tax on the part of the buyer. Section 105 of the National Internal Revenue Code, as

amended by R.A. No. 7716, and as re-numbered by R.A. No. 8424 provides:

"The value-added tax is an indirect tax and the amount of tax may be shifted or

passed on to the buyer, transferee or lessee of the goods, properties or services. . .

."

Thus, the aforesaid VAT ruling on the tax exemption of subcontactors engaged in

petroleum operations in the Philippines may only apply to taxes on their sale of goods,

property or services. However, it does not include the value-added taxes due from and

which are indirectly passed on by their VAT-registered suppliers of goods, properties or

services.

In connection with the contention that FORUM is also exempt from documentary

stamp taxes under the aforesaid law and FIRB Resolution, Section 173 of the Tax Code

of 1997 provides, in part: "Provided, That whenever one party to the taxable document

enjoys exemption from the tax herein imposed, the other party who is not exempt shall

be the one directly liable for the tax." Thus, even granting that FORUM is exempt from

documentary stamp tax, the tax on any taxable document in which FORUM is a party

shall nevertheless be paid by the other party, unless such other party is also exempt

from documentary stamp tax pursuant to the provision of any existing law. cdasia

This ruling is being issued on the basis of the foregoing facts as represented.

However, if upon investigation it will be disclosed that the facts are different, then this

ruling shall be considered null and void.

CD Technologies Asia, Inc. 2018 cdasiaonline.com

Very truly yours,

Commissioner of Internal Revenue

By:

(SGD.) SIXTO S. ESQUIVIAS IV

Deputy Commissioner

Legal & Enforcement Group

CD Technologies Asia, Inc. 2018 cdasiaonline.com

You might also like

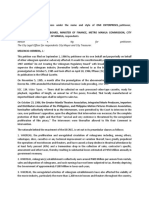

- BIR Ruling ECCP 068-08Document4 pagesBIR Ruling ECCP 068-08Kendra Miranda LorinNo ratings yet

- 1999 ITAD RulingsDocument97 pages1999 ITAD RulingsJerwin DaveNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- VAT Digests and NotesDocument20 pagesVAT Digests and NotesJoseph FullNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvoDocument3 pages2012 ITAD - BIR - Ruling - No. - 310 1220190228 5466 1jldnvonathalie velasquezNo ratings yet

- BIR Ruling DA-229-06 (PAGCOR) PDFDocument4 pagesBIR Ruling DA-229-06 (PAGCOR) PDFJonNo ratings yet

- Association of Customs Brokers v. Municipal Board, G.R. No. L-4376, May 22, 1953 FactsDocument24 pagesAssociation of Customs Brokers v. Municipal Board, G.R. No. L-4376, May 22, 1953 FactsFaith TangoNo ratings yet

- Itad Bir Ruling No. 065-05Document4 pagesItad Bir Ruling No. 065-05msdivergentNo ratings yet

- PLDT vs. City of Bacolod, G.R. No. 149179, July 15, 2005Document11 pagesPLDT vs. City of Bacolod, G.R. No. 149179, July 15, 2005Vox PopuliNo ratings yet

- 8 CIR v. American ExpressDocument21 pages8 CIR v. American ExpressHannah MedNo ratings yet

- Bir Ruling 418-03 PDFDocument2 pagesBir Ruling 418-03 PDFSor Elle100% (1)

- Pointers in Taxation (Atty. Roberto Lock) PDFDocument97 pagesPointers in Taxation (Atty. Roberto Lock) PDFReinald Kurt VillarazaNo ratings yet

- Landmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosDocument12 pagesLandmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosJudeRamosNo ratings yet

- Case Digest TaxDocument39 pagesCase Digest TaxJesse RazonNo ratings yet

- Diaz V SofDocument5 pagesDiaz V SofLiana AcubaNo ratings yet

- BIR Ruling No. 340-11 - E-BooksDocument5 pagesBIR Ruling No. 340-11 - E-BooksCkey ArNo ratings yet

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- Itad Bir Ruling No. 328-12: September 3, 2012 September 3, 2012Document3 pagesItad Bir Ruling No. 328-12: September 3, 2012 September 3, 2012nathalie velasquezNo ratings yet

- Maceda VS Macaraig, GR No 88291, May 31, 1981Document43 pagesMaceda VS Macaraig, GR No 88291, May 31, 1981KidMonkey2299No ratings yet

- G.R. No. 152609 June 29, 2005 Commissioner of Internal Revenue, Petitioner, American Express International, Inc. (Philippine Branch), RespondentDocument16 pagesG.R. No. 152609 June 29, 2005 Commissioner of Internal Revenue, Petitioner, American Express International, Inc. (Philippine Branch), RespondentSamuel John CahimatNo ratings yet

- Petitioner Respondent Litigation Division (BIR) Avisado Agan Montenegro & AssociatesDocument17 pagesPetitioner Respondent Litigation Division (BIR) Avisado Agan Montenegro & AssociatesRobert Jayson UyNo ratings yet

- Tax CasesDocument8 pagesTax CasesLaUnion ProvincialHeadquarters Bfp RegionOneNo ratings yet

- 112034-2005-Commissioner of Internal Revenue v. Toshiba20180404-1159-12ci6skDocument15 pages112034-2005-Commissioner of Internal Revenue v. Toshiba20180404-1159-12ci6skCamshtNo ratings yet

- CIR v. Commonwealth Management & Services CorporationDocument9 pagesCIR v. Commonwealth Management & Services CorporationHazel SegoviaNo ratings yet

- PLDT Vs BacolodDocument12 pagesPLDT Vs BacolodJenNo ratings yet

- 2000 ITAD RulingsDocument409 pages2000 ITAD RulingsJerwin DaveNo ratings yet

- Notes Taxation UVDocument12 pagesNotes Taxation UVJohn MarstonNo ratings yet

- DST On Policy Holders Registered With PEZADocument5 pagesDST On Policy Holders Registered With PEZACkey ArNo ratings yet

- Taxation Law Philippine Supreme Court DecisionsDocument106 pagesTaxation Law Philippine Supreme Court DecisionsChil BelgiraNo ratings yet

- Petitioner Vs Vs Respondents The Solicitor General Benilda V. Quevedo-Santos and Anita A. Diomalanta-ArcinueDocument7 pagesPetitioner Vs Vs Respondents The Solicitor General Benilda V. Quevedo-Santos and Anita A. Diomalanta-ArcinueKing ForondaNo ratings yet

- BIR Ruling No. 015-12Document5 pagesBIR Ruling No. 015-12nikkaremullaNo ratings yet

- Silkair Singapore V. CirDocument6 pagesSilkair Singapore V. CirConie NovelaNo ratings yet

- ITAD Ruling No. 065-05Document3 pagesITAD Ruling No. 065-05Anezka Danett CortinaNo ratings yet

- BIR Ruling 10-98Document3 pagesBIR Ruling 10-98Russell PageNo ratings yet

- Renato v. Diaz v. Secretary of Finance, GR No. 193007, 2011-07-19Document3 pagesRenato v. Diaz v. Secretary of Finance, GR No. 193007, 2011-07-19Anonymous NiKZKWgKqNo ratings yet

- BIR RULING (DA-203-06) : April 3, 2006Document2 pagesBIR RULING (DA-203-06) : April 3, 2006Richard100% (1)

- G.R. No. 118702 March 16, 1995Document2 pagesG.R. No. 118702 March 16, 1995Angelo FabianNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- Benefits-Protection Theory Lorenzo V Posadas (Tax) : Double TaxationDocument9 pagesBenefits-Protection Theory Lorenzo V Posadas (Tax) : Double Taxationkristel jane caldozaNo ratings yet

- What The Future Holds: PEZA Zero Rated Sales: Under The TRAIN LawDocument2 pagesWhat The Future Holds: PEZA Zero Rated Sales: Under The TRAIN LawkarenongsucoNo ratings yet

- Manila Gas Co. vs. CIRDocument3 pagesManila Gas Co. vs. CIRPrince CayabyabNo ratings yet

- VAT Ruling No. 16-09Document4 pagesVAT Ruling No. 16-09Rieland CuevasNo ratings yet

- TAXATION1 1st Batch CasesDocument7 pagesTAXATION1 1st Batch CasesKobe BullmastiffNo ratings yet

- VatDocument4 pagesVatColeenNo ratings yet

- 1 CIR vs. CADocument11 pages1 CIR vs. CAAnonymous 8liWSgmINo ratings yet

- BIR Ruling No. 750-18Document4 pagesBIR Ruling No. 750-18SGNo ratings yet

- By: Bryan Joseph L. Mallillin: G.R. No. 179800, February 4, 2010Document3 pagesBy: Bryan Joseph L. Mallillin: G.R. No. 179800, February 4, 2010Marivic SorianoNo ratings yet

- SalesDocument40 pagesSalesElle MichNo ratings yet

- G.R. No. 150154Document19 pagesG.R. No. 150154Henson MontalvoNo ratings yet

- 2006 ITAD Rulings - Delegated AuthorityDocument537 pages2006 ITAD Rulings - Delegated AuthorityJerwin DaveNo ratings yet

- Taxation Q&ADocument18 pagesTaxation Q&AZsazsaNo ratings yet

- Commissioner of Internal Revenue vs. Court of AppealsDocument7 pagesCommissioner of Internal Revenue vs. Court of Appealsvince005No ratings yet

- Villanueva V City of IloiloDocument48 pagesVillanueva V City of Iloiloamun dinNo ratings yet

- Creba V RomuloDocument18 pagesCreba V RomuloJuhainah TanogNo ratings yet

- How The New Tax Law Impacts CryptocurrenciesDocument2 pagesHow The New Tax Law Impacts CryptocurrenciesSosrukoNo ratings yet

- Nelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerDocument11 pagesNelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerdingNo ratings yet

- Value Added TaxDocument20 pagesValue Added TaxJerlene Sydney Centeno100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Joint Testimonial of Good Moral CharacterDocument1 pageJoint Testimonial of Good Moral CharacterDennisOlayresNocomoraNo ratings yet

- Commercial Law Reivew 10202021Document1 pageCommercial Law Reivew 10202021Adrian CabanaNo ratings yet

- Civil Law Review 3132021Document7 pagesCivil Law Review 3132021Adrian CabanaNo ratings yet

- Resignation LetterDocument1 pageResignation LetterAdrian CabanaNo ratings yet

- Commercial Law Review 1032021Document5 pagesCommercial Law Review 1032021Adrian CabanaNo ratings yet

- Civil Law Review 2272021Document4 pagesCivil Law Review 2272021Adrian CabanaNo ratings yet

- Civil Law Review 372021Document2 pagesCivil Law Review 372021Adrian CabanaNo ratings yet

- Civil Law Review 04242021Document4 pagesCivil Law Review 04242021Adrian CabanaNo ratings yet

- Civil Law Review 05012021Document14 pagesCivil Law Review 05012021Adrian CabanaNo ratings yet

- Civil Law Review 11212021Document1 pageCivil Law Review 11212021Adrian CabanaNo ratings yet

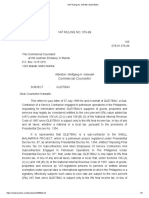

- BIR VAT Ruling No. 005-92Document2 pagesBIR VAT Ruling No. 005-92Adrian CabanaNo ratings yet

- BIR VAT Ruling No. 076-99Document3 pagesBIR VAT Ruling No. 076-99Adrian CabanaNo ratings yet

- MONTELIBANO ET AL Vs - BACOLOD-MURCIA MILLING CO., INC.Document2 pagesMONTELIBANO ET AL Vs - BACOLOD-MURCIA MILLING CO., INC.Ian CabanaNo ratings yet

- Ra 7160 IrrDocument263 pagesRa 7160 IrrAlvaro Garingo100% (21)

- Manila Law College: Course Outline in Corporation Law Atty. Manuel T. Gatcho 2 Sem School Year 2020-2021Document14 pagesManila Law College: Course Outline in Corporation Law Atty. Manuel T. Gatcho 2 Sem School Year 2020-2021Adrian CabanaNo ratings yet

- Revised Terms and ConditionsDocument11 pagesRevised Terms and ConditionsAdrian CabanaNo ratings yet

- Special Power of AttyDocument2 pagesSpecial Power of AttyAdrian CabanaNo ratings yet

- Article 19 Civil CodeDocument13 pagesArticle 19 Civil CodeAnonymous oGfAqF1No ratings yet

- Svnas 8e Ism Chapter 10Document53 pagesSvnas 8e Ism Chapter 10젼No ratings yet

- Fidic Forms of Contract & TenderDocument4 pagesFidic Forms of Contract & TenderFaisal GulNo ratings yet

- Saint Louis Univesity V CobarrubiasDocument11 pagesSaint Louis Univesity V CobarrubiasAmylieNo ratings yet

- CFC Constitution 2015Document12 pagesCFC Constitution 2015Elvin AmuguNo ratings yet

- 316689-2020-Bacomo v. Heirs of Mingua Sr.20211022-11-1tm1uh7Document17 pages316689-2020-Bacomo v. Heirs of Mingua Sr.20211022-11-1tm1uh7Kirsty Mae Ilalto-MagnoNo ratings yet

- BF Felisians r4Document5 pagesBF Felisians r4Gab G.100% (1)

- LAW 3100 - Persons & Family Relations - JD 55. G.R. No. 199601 - BDO vs. Gomez - Case DigestDocument8 pagesLAW 3100 - Persons & Family Relations - JD 55. G.R. No. 199601 - BDO vs. Gomez - Case DigestJOHN KENNETH CONTRERASNo ratings yet

- LawDocument3 pagesLawSaidaNo ratings yet

- Full Download Test Bank For Educational Psychology Fifth Canadian Edition Anita e Woolfolk PDF FreeDocument15 pagesFull Download Test Bank For Educational Psychology Fifth Canadian Edition Anita e Woolfolk PDF FreeKristinAlexandercakn100% (10)

- Submissions Taxation AcaitumDocument4 pagesSubmissions Taxation AcaitumALLAN MUKAMANo ratings yet

- Deed of Ownership: Trollskull ManorDocument1 pageDeed of Ownership: Trollskull ManorOsman AydarNo ratings yet

- TA-10069 RFP Section 2 - Definitions (56132-001)Document5 pagesTA-10069 RFP Section 2 - Definitions (56132-001)yasminia sarasfitriNo ratings yet

- Trusteeship in NigeriaDocument14 pagesTrusteeship in NigeriaChristiana FehintolaNo ratings yet

- Topic: An Account of Different Authorities Under Industrial Disputes Act, 1947Document10 pagesTopic: An Account of Different Authorities Under Industrial Disputes Act, 1947mohit nainaniNo ratings yet

- Introduction To Law in Nursing: NMC Standards For Pre-Registration Nursing EducationDocument23 pagesIntroduction To Law in Nursing: NMC Standards For Pre-Registration Nursing EducationAmee PatelNo ratings yet

- SE Penalities - Jan 22, 2020Document12 pagesSE Penalities - Jan 22, 2020G V KrishnakanthNo ratings yet

- Presidential Decree No. 11Document7 pagesPresidential Decree No. 11Enrico ReyesNo ratings yet

- Legal NoticeDocument3 pagesLegal NoticeMOHIT SAMANIANo ratings yet

- MDF Declaration Verification AffidavitDocument3 pagesMDF Declaration Verification AffidavitcarlamachadoclementeNo ratings yet

- Commentary On Contracts in EthiopiaDocument104 pagesCommentary On Contracts in EthiopiaHailegnaw Azene100% (1)

- Assignment On Rights of Indemnity HolderDocument11 pagesAssignment On Rights of Indemnity HolderMukul Pratap SinghNo ratings yet

- Memorandum of Understanding (MOU) - Prima Lab SADocument5 pagesMemorandum of Understanding (MOU) - Prima Lab SAAyesha Akhtar100% (1)

- Guide To Complete Joining FormDocument20 pagesGuide To Complete Joining FormAnto JoisenNo ratings yet

- Topic 3 - The Commencement of LegislationDocument11 pagesTopic 3 - The Commencement of LegislationLightning McKnightNo ratings yet

- WomensTeam SeasonTicket TermsConditions 23241676987354648Document9 pagesWomensTeam SeasonTicket TermsConditions 23241676987354648RatkoMRNo ratings yet

- Crossroads Between IBC and Competition LawDocument4 pagesCrossroads Between IBC and Competition LawAman KumarNo ratings yet

- Bus 323Document10 pagesBus 323KEHINDE BABALOLANo ratings yet

- Frequently Asked Questions - PassportDocument2 pagesFrequently Asked Questions - PassportPuneeth KumarNo ratings yet

- Agency-Ppt - RFBT3Document39 pagesAgency-Ppt - RFBT316 Dela Cerna, RonaldNo ratings yet