Professional Documents

Culture Documents

2 Introduction To Accounting Sample Exercises

Uploaded by

Xia AlliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Introduction To Accounting Sample Exercises

Uploaded by

Xia AlliaCopyright:

Available Formats

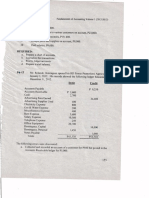

ACFAR 1130 – FINANCIAL ACCOUNTING AND REPORTING

LEARNING SESSIONS 2 – INTRODUCTION TO ACCOUNTING

Sample Exercises

Cheating is not an act of courage. It is an act of ignorance.

Good luck and God bless!

For Test I and Test II, consider the following information:

BYAKUYA FINANCIAL SERVICES

Chart of Accounts

ASSETS INCOME

110 – Cash on Hand 410 – Service Revenue

120 – Accounts Receivable 420 – Gain on Sale of Service Vehicle

130 – Office Supplies

140 – Prepaid Advertising EXPENSES

150 – Service Vehicle 510 – Salaries Expense

160 – Land 520 – Utilities Expense

170 – Building 530 – Gas and Oil Expense

540 – Insurance Expense

LIABILITIES 550 – Repairs and Maintenance Expense

210 – Accounts Payable 560 – Interest Expense

220 – Notes Payable 570 – Loss on Sale of Service Vehicle

EQUITY

310 – Byakuya, Capital

315 – Byakuya, Drawings

January 2020 Transactions

DATE ACCOUNTABLE EVENTS

Invested P500,000 cash, land worth P1,000,000 and an old building worth P500,000

1/1

to the business

1/3 Paid for insurance worth P15,000 and repaired the old building for P35,000

Purchased office supplies amounting to P12,500, paying P7,500 down payment and

1/5

the balance is due 15 days later

Bought an old service vehicle worth P300,000, issuing a promissory note worth

1/5

P250,000 and paying the rest with cash

1/9 Rendered services amounting to P450,000 on account to Rukia

1/10 Paid for an advertising contract worth P50,000 and salaries worth P42,500

1/12 Sold the old service vehicle for P250,000

1/15 Paid for the outstanding balance for the office supplies

1/19 Collected half of the amount due from Rukia

Paid for salaries worth P42,500 and received a bill for gas and oil expense worth

1/20

P25,000

1/21 Bought a new service vehicle worth P327,500

1/25 Rendered services worth P150,000 to Ichigo

1/28 Received a bill for light and water worth P45,000

1/29 Withdrew P250,000 from the business

ACFAR 1130 – FINANCIAL ACCOUNTING AND REPORTING

Learning Sessions 2 – Sample Exercises

Prepared by Rikk Nicholson M. Nalzaro, CPA, CTT, MRITax

1/30 Paid for the 10% fixed monthly interest on the note issued for the old service vehicle

1/31 Sold the new service vehicle for P375,000

1/31 Permanently withdrew P150,000 from the business

TEST I – ANALYSIS OF TRANSACTIONS | Analyze the following transactions and determine the

net effect of such transaction to the assets (A), liabilities (L), equity (C), income (I), and expense (E)

accounts. Write a plus sign ( + ) for increase, minus sign ( – ) for decrease, or a number sign ( # )

for no effect. An example has been given below. No erasures, superimpositions, and other forms of

alterations.

No. TRANSACTION A L C I E

Invested P500,000 cash, land worth

Ex. P1,000,000 and an old building worth + # + # #

P500,000 to the business

Paid for insurance worth P15,000 and repaired

1

the old building for P35,000

Purchased office supplies amounting to

2 P12,500, paying P7,500 down payment and

the balance is due 15 days later

Bought an old service vehicle worth P300,000,

3 issuing a promissory note worth P250,000 and

paying the rest with cash

Rendered services amounting to P450,000 on

4

account to Yoruichi

Paid for an advertising contract worth P50,000

5

and salaries worth P42,500

6 Sold the old service vehicle for P250,000

Paid for the outstanding balance for the office

7

supplies

8 Collected half of the amount due from Yoruichi

Paid for salaries worth P42,500 and received a

9

bill for gas and oil expense worth P25,000

10 Bought a new service vehicle worth P327,500

Rendered services worth P150,000 to

11

Unohana

Received a bill for light and water worth

12

P45,000

13 Withdrew P250,000 from the business

Paid for the 10% fixed monthly interest on the

14

note issued for the old service vehicle

15 Sold the new service vehicle for P375,000

Permanently withdrew P150,000 from the

16

business

TEST II – CREATION OF ACCOUNTING REPORT | Create a financial transaction worksheet that

presents the net effects of the accountable events to specific account titles used by the business

above. Make sure to present the account titles under the element of financial statement they belong

to and make sure that all account titles are in their normal balances.

ACFAR 1130 – FINANCIAL ACCOUNTING AND REPORTING

Learning Sessions 2 – Sample Exercises

Prepared by Rikk Nicholson M. Nalzaro, CPA, CTT, MRITax

TEST III – CALCULATION | Calculate the total net effect of the accountable transactions above to

the following items:

1. Cash on Hand 11. Insurance Expense

2. Accounts Receivable 12. Repairs and Maintenance Expense

3. Office Supplies 13. Interest Expense

4. Prepaid Advertising 14. Loss on Sale of Service Vehicle

5. Service Vehicle 15. Byakuya, Drawings

6. Land 16. Accounts Payable

7. Building 17. Notes Payable

8. Salaries Expense 18. Byakuya, Capital

9. Utilities Expense 19. Service Revenue

10. Gas and Oil Expense 20. Gain on Sale of Service Vehicle

END OF THE SAMPLE EXERCISES

The fruit of hard labor is sweeter than the fruit of luck.

ACFAR 1130 – FINANCIAL ACCOUNTING AND REPORTING

Learning Sessions 2 – Sample Exercises

Prepared by Rikk Nicholson M. Nalzaro, CPA, CTT, MRITax

You might also like

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Fundamentals of Accountancy, Business and Management 1Document19 pagesFundamentals of Accountancy, Business and Management 1Shiellai Mae Polintang0% (1)

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagNo ratings yet

- Fabm1 Module 7Document26 pagesFabm1 Module 7Randy Magbudhi100% (10)

- 6 ProblemsDocument6 pages6 ProblemsAzelAnnAlibinNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document25 pagesFundamentals of Accountancy, Business and Management 1Worship Songs / Choreo / LyricsNo ratings yet

- Compilation Notes On Journal Ledger and Trial Balance - Part 2Document8 pagesCompilation Notes On Journal Ledger and Trial Balance - Part 2Andra FleurNo ratings yet

- Complete Accounting Cycle Service EntityDocument2 pagesComplete Accounting Cycle Service EntityChristine PalaganasNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- 24-Month Note Due To BDODocument3 pages24-Month Note Due To BDOEliza CruzNo ratings yet

- Soal Penyesuaian PT TrunojoyoDocument10 pagesSoal Penyesuaian PT TrunojoyoAsa fadhilahNo ratings yet

- Adjusting Entries Lecture/ Exercises: II. Adjusting Entries. The Following Account Balances ofDocument2 pagesAdjusting Entries Lecture/ Exercises: II. Adjusting Entries. The Following Account Balances ofWilson MirandaNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- 1st Practice Set On Fabm2 1Document6 pages1st Practice Set On Fabm2 1Kezie GirayNo ratings yet

- 17 Lecture 1 Bookkeeping and AccountingDocument11 pages17 Lecture 1 Bookkeeping and AccountingCrisceldette ApostolNo ratings yet

- Father Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsDocument2 pagesFather Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsErika BucaoNo ratings yet

- Business Transactions of A Service BusinessDocument17 pagesBusiness Transactions of A Service Businessmarissa casareno almuete50% (2)

- Problems in AccountingDocument4 pagesProblems in AccountingRaul Soriano CabantingNo ratings yet

- Requirements in Fundamentals of AccountingDocument7 pagesRequirements in Fundamentals of AccountingMoises Macaranas JrNo ratings yet

- Practice Set 2Document4 pagesPractice Set 2Mylene CandidoNo ratings yet

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalNo ratings yet

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- Mba Zc415 Ec-2r Second Sem 2016-2017Document3 pagesMba Zc415 Ec-2r Second Sem 2016-2017ritesh_aladdinNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Lesson 1 Week 1 FABM 2Document14 pagesLesson 1 Week 1 FABM 2Mikel Nelson AmpoNo ratings yet

- Actrev 3 - Adfina 1 - 2016NDocument4 pagesActrev 3 - Adfina 1 - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- Fundamentals AnswerDocument12 pagesFundamentals AnswerRienalyn Dumlao Duldulao-DaligconNo ratings yet

- FAR 1 - Journal EntriesDocument3 pagesFAR 1 - Journal EntriesAnime LoverNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- ABM - 111 - Final ExaminationDocument2 pagesABM - 111 - Final ExaminationTimothy JamesNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Question April-2010Document51 pagesQuestion April-2010zia4000100% (1)

- Addl Correction of TB Errors - 20200921 - 0002Document3 pagesAddl Correction of TB Errors - 20200921 - 0002Dalemma FranciscoNo ratings yet

- Lesson 1.2Document3 pagesLesson 1.2crisjay ramosNo ratings yet

- Jenjen 2Document11 pagesJenjen 2Kim FloresNo ratings yet

- AFB Lecture 3Document11 pagesAFB Lecture 3Ana-Maria GhNo ratings yet

- SCC 4000 Assessment 1 - 2021 Information 1LMDocument5 pagesSCC 4000 Assessment 1 - 2021 Information 1LMOdzulaho DemanaNo ratings yet

- Fabm2 Learning-Activity-1Document7 pagesFabm2 Learning-Activity-1Cha Eun WooNo ratings yet

- PT Sinar MotorDocument67 pagesPT Sinar MotorHesti RisqyasariNo ratings yet

- Group - C: DA 4104 - Computer Based AccountingDocument10 pagesGroup - C: DA 4104 - Computer Based AccountinghemacrcNo ratings yet

- Quizbowl With Answer KeyDocument3 pagesQuizbowl With Answer Keyaccounting probNo ratings yet

- Acct 1 and 2 ProblemsDocument3 pagesAcct 1 and 2 ProblemsRenz AlconeraNo ratings yet

- MODULE 3 Step 1Document7 pagesMODULE 3 Step 1yugyeom rojasNo ratings yet

- Chapter 2 Abm 3Document9 pagesChapter 2 Abm 3Joan Mae Angot - Villegas50% (2)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- 1-13 Chapters Questions PDFDocument14 pages1-13 Chapters Questions PDFPonkoj Sarker TutulNo ratings yet

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- Problems On Income StatementDocument3 pagesProblems On Income Statementcnagadeepa100% (1)

- The Feature of P &L AccountDocument14 pagesThe Feature of P &L Accountchand1234567893No ratings yet

- 15-Mca-Or-Accounting and Financial ManagementDocument4 pages15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTANo ratings yet

- CCP102Document13 pagesCCP102api-3849444No ratings yet

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Learning Module In: Grade 11Document12 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Lesson 6 Corporate LiquidationDocument11 pagesLesson 6 Corporate Liquidationheyhey100% (2)

- Pechtree Exercise 2023Document3 pagesPechtree Exercise 2023tesfalidetdawitNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- BIO 101 Module 7Document4 pagesBIO 101 Module 7Xia AlliaNo ratings yet

- BIO 101-Image-8Document7 pagesBIO 101-Image-8Xia AlliaNo ratings yet

- BIO 101 Progress Report 2Document5 pagesBIO 101 Progress Report 2Xia AlliaNo ratings yet

- BIO 101 Progress Report 3Document4 pagesBIO 101 Progress Report 3Xia AlliaNo ratings yet

- BIO 101 Lecture 7Document4 pagesBIO 101 Lecture 7Xia AlliaNo ratings yet

- BIO 101 - Pre - Lab - 4Document4 pagesBIO 101 - Pre - Lab - 4Xia AlliaNo ratings yet

- BIO 101-Notes-1Document3 pagesBIO 101-Notes-1Xia AlliaNo ratings yet

- BIO 101-Demo-9Document3 pagesBIO 101-Demo-9Xia AlliaNo ratings yet

- BIO 101 - Notes - 4Document3 pagesBIO 101 - Notes - 4Xia AlliaNo ratings yet

- BIO 101 Practice Problems 1Document4 pagesBIO 101 Practice Problems 1Xia AlliaNo ratings yet

- BIO 101 Study Guide 4Document5 pagesBIO 101 Study Guide 4Xia AlliaNo ratings yet

- BIO 101 - Pset - 8Document2 pagesBIO 101 - Pset - 8Xia AlliaNo ratings yet

- BIO 101 Lab Report 10Document5 pagesBIO 101 Lab Report 10Xia AlliaNo ratings yet

- BIO 101 Analysis 3Document4 pagesBIO 101 Analysis 3Xia AlliaNo ratings yet

- BIO 101 Worksheet 10Document4 pagesBIO 101 Worksheet 10Xia AlliaNo ratings yet

- BIO 101 - Image - 5Document5 pagesBIO 101 - Image - 5Xia AlliaNo ratings yet

- BIO 101 Slides 5Document4 pagesBIO 101 Slides 5Xia AlliaNo ratings yet

- BIO 101 Infomation 9Document5 pagesBIO 101 Infomation 9Xia AlliaNo ratings yet

- BIO 101-Pset-3Document4 pagesBIO 101-Pset-3Xia AlliaNo ratings yet

- BIO 101 - Image - 9Document4 pagesBIO 101 - Image - 9Xia AlliaNo ratings yet

- BIO 101 Lec Notes 10Document6 pagesBIO 101 Lec Notes 10Xia AlliaNo ratings yet

- BIO 101 Exercise 4Document4 pagesBIO 101 Exercise 4Xia AlliaNo ratings yet

- EDU303 Review 3Document4 pagesEDU303 Review 3Xia AlliaNo ratings yet

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- EDU303 Progress Report 9Document4 pagesEDU303 Progress Report 9Xia AlliaNo ratings yet

- EDU303 Exercise 7Document5 pagesEDU303 Exercise 7Xia AlliaNo ratings yet

- Edu303 Pset 1Document4 pagesEdu303 Pset 1Xia AlliaNo ratings yet

- EDU303 Problem 6Document2 pagesEDU303 Problem 6Xia AlliaNo ratings yet

- EDU303 Essay 10Document6 pagesEDU303 Essay 10Xia AlliaNo ratings yet

- EDU303 Sheet 10Document6 pagesEDU303 Sheet 10Xia AlliaNo ratings yet

- John Kotter On AccelerateDocument4 pagesJohn Kotter On AccelerateDr Thomas GohNo ratings yet

- Dinks (Dual Income No Kids) Preferences and Condominium Choice BehaviorDocument6 pagesDinks (Dual Income No Kids) Preferences and Condominium Choice BehaviorJuan Pablo Patiño EscobarNo ratings yet

- 6 The Sixth Meeting Is Organization Part 2 PDFDocument4 pages6 The Sixth Meeting Is Organization Part 2 PDFRiko AryantoNo ratings yet

- Olansi Catalogue 1Document16 pagesOlansi Catalogue 1Duy NamNo ratings yet

- Akg Exim Limited Akg Exim Limited Akg Exim Limited: Annual Report Annual Report 2019-2020Document80 pagesAkg Exim Limited Akg Exim Limited Akg Exim Limited: Annual Report Annual Report 2019-2020Nihit SandNo ratings yet

- The Effectof Experiential Marketingand Service Qualityon Customer Loyaltyof Dominos Pizzain Cirebon CityDocument7 pagesThe Effectof Experiential Marketingand Service Qualityon Customer Loyaltyof Dominos Pizzain Cirebon CityĐạt LêNo ratings yet

- 2008 08 TPS 51 Lab Multi LocalDocument4 pages2008 08 TPS 51 Lab Multi LocalMauroNo ratings yet

- Khalil QuestionnaireDocument6 pagesKhalil QuestionnaireAffan KhanNo ratings yet

- AIS AssignmentDocument18 pagesAIS AssignmentImran Azad100% (1)

- Chapter 17 Consolidated Fs Part 1 Afar Part 2Document23 pagesChapter 17 Consolidated Fs Part 1 Afar Part 2Kathrina RoxasNo ratings yet

- TALF Annual Report 2018Document197 pagesTALF Annual Report 2018Doni WarganegaraNo ratings yet

- 09-MalabonCity2018 - Part2-Observations - and - RecommDocument45 pages09-MalabonCity2018 - Part2-Observations - and - RecommJuan Uriel CruzNo ratings yet

- Vita ReporttDocument84 pagesVita ReporttTamanna GoyalNo ratings yet

- FT Partners Report - Buy Now Pay LaterDocument191 pagesFT Partners Report - Buy Now Pay LaterAnand MoroneyNo ratings yet

- Ch. 5 in Class Exercises 1 PDFDocument5 pagesCh. 5 in Class Exercises 1 PDFRasab AhmedNo ratings yet

- ANTHONY PAUWELS, Individually and On Behalf of All Others Similarly Situated, Plaintiff, v. Bit Digital, Inc., Min Hu, and Erke Huang, Defendants. Case NoDocument22 pagesANTHONY PAUWELS, Individually and On Behalf of All Others Similarly Situated, Plaintiff, v. Bit Digital, Inc., Min Hu, and Erke Huang, Defendants. Case NoForkLogNo ratings yet

- Maya 5, JVT BrochureDocument27 pagesMaya 5, JVT BrochureAshiq ApNo ratings yet

- Aqualisa Quartz: Presented By: - Amit Mallick - Shourya Nagaria - Ankit PandeyDocument20 pagesAqualisa Quartz: Presented By: - Amit Mallick - Shourya Nagaria - Ankit Pandeysamiksha bagdi100% (1)

- Role of NCLT - IbcDocument23 pagesRole of NCLT - IbcVicky D67% (3)

- Entry, Capacity, Investment and Oligopolistic Pricing (A J) 1977Document12 pagesEntry, Capacity, Investment and Oligopolistic Pricing (A J) 1977pedronuno20No ratings yet

- BUSM4692 - Literature ReviewDocument4 pagesBUSM4692 - Literature ReviewLinh BuiNo ratings yet

- How Are The 3 Financial Statements LinkedDocument7 pagesHow Are The 3 Financial Statements LinkedMuiz SaddozaiNo ratings yet

- Dokumen PDFDocument21 pagesDokumen PDFMark AlcazarNo ratings yet

- Us Consumer Discretionary Equities PreferenceDocument52 pagesUs Consumer Discretionary Equities PreferenceTung NgoNo ratings yet

- HD RegulationDocument78 pagesHD RegulationzamsiranNo ratings yet

- p5 2012 Jun QDocument12 pagesp5 2012 Jun QIftekhar IfteNo ratings yet

- 1 ch07 Cash - Warren Reeve WajibDocument40 pages1 ch07 Cash - Warren Reeve WajibAdilaNo ratings yet

- Marketing Project Perfume - RemovedDocument33 pagesMarketing Project Perfume - Removedparsaniyamanan100% (1)

- Definition of International TradeDocument7 pagesDefinition of International TradeSinta YuliawatiNo ratings yet

- Harsh Vora - Team 1 - Task 1Document6 pagesHarsh Vora - Team 1 - Task 1Harsh VoraNo ratings yet