Professional Documents

Culture Documents

Multiple Choice Questions on Cost Accounting Concepts

Uploaded by

AiraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multiple Choice Questions on Cost Accounting Concepts

Uploaded by

AiraCopyright:

Available Formats

1

CHAPTER 6

Multiple Choice Questions – Theoretical

Theoretical

1. a 6. b 11. c 16. a

2. d 7. a 12. b 17. b

3. a 8. a 13. d

4. a 9. c 14. b

5. a 10. d 15. C

Multiple Choice Questions – Computational

Computational

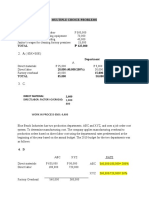

1. (a)

P800,000 / 10,000 units = P80 per unit.

2. (a)

P800,000 / P400,000 = 200% of material cost

3. (a)

P800,000 / P600,000 = 133% of direct labor cost

cost.

4. (a)

P800,000 / 25,000* = P32 per direct labor hour.

hour.

* P600,000 / P24 = 25,000 estimated direct labor hour.’

5. (a)

P800,000 / 3.333*

3.333* = P2.40 per machine hour

20 minutes / 60 minutes = 1/3 machine hour per unit

1/3 hour

hour per

per unit x 10,000 units = 3.333 estimated machine hours.

6. (a)

P800,000 / 12,500 units* = P64 overhead per unit.

*10,000 units / 80s% = 12,500 units.

7. (a)

P800,000 / P500,000* = 160% of material cost.

* P40 x 12,500 units

2

8. (a)

P800,000 / (1/3 hour x 12,500 units) = P92 per machine hour.

9. (a)

Estimated overhead / Estimated units of production = Overhead per unit.

2009: P180,000 / P15 = 12,000 estimated units of production .

2010: P198,000 / P18 = 11,000 estimated units of production

10. (b)

Applied factory overhead (10,000 units x P15) P150,000

Actual factory overhead ( P50,000 + P95,000) 145,000

Overapplied overhead P 5,000

11. (b)

Actual factory overhead (P55,000 = P150,000) P205,000

Applied factory overhead (11,000 units x P18) 198,000

Underapplied overhead P 7,000

12. (a)

Actual output 4,100 units

Overhead rate:

Fixed overhead rate: P1,440 / (48,000 / 12) = P0.36

Variable overhead rate 2.10 P2.46

Applied manufacturing overhead P10,086

13. (a)

Applied manufacturing overhead P10,086

Actual manufacturing overhead 9,000

Overapplied manufacturing overhead P 1,086

14. (c)

Actual production 2,700 hours

Overhead rate:

Fixed overhead rate: (P16,920/12) ÷ (36,000/12) P0.47

Variable overhead rate 2.10 2.57

Applied manufacturing overhead P6,939

15. (c)

Actual manufacturing overhead P7,800

Applied manufacturing overhead 6,939

Underapplied manufacturing overhead P 861

3

16. (a)

Actual manufacturing overhead P1,618,340

Applied manufacturing overhead (248,300 DLH x 6.45*) 1,601,535

Underapplied overhead P 16,805

*P1,677,000 / 260,000 DLH = P6.45 per DLH

17. (b)

Budgeted fixed overhead P 585,000

Applied fixed overhead (248,300 DLH x 2.25*) 558,675

Volume variance (U) P 26,325

*P585,000 / 260,000 DLH = P2.25 per DLH

18. (c)

Budgeted overhead”

Fixed overhead P 585,000

Variable overhead (248,300 x P4.20*) 1,042,860 P1,627,860

Actual manufacturing overhead 1,618,340

Spending variance (F) P 9,520

19. (a)

Volume variance (U) P 26,325

Spending variance (F) 9,520

Net overhead variance (U) P 16,805

20 (d)

Actual overhead:

Fixed P348,000

Variable 637,880 P985,880

Applied overhead 995,880

Overapplied overhead P 10,000

21. (b)

Budgeted fixed overhead P348,000

Applied fixed overhead (115,800 x P2.90*) 335,820

Volume variance (U) P 12,180

* P348,000 / 120,000 DLH = P2.90 per DLH

22. (b)

Budgeted overhead:

Fixed overhead P348,000

Variable (115,800 x P5.70*) 660,060 P1,008,060

Actual overhead 985,880

Spending variance (F) P 22,180

P684,000 / 120,000 DLH = P5.70 per DLH

4

23. (b)

Volume variance (U) P12,180

Spending variance (F) 22,180

Total variance (F) P10,000

24. (b)

Sales P790,670

Cost of goods sold:

Finished goods, July 1, 2009 P 33,500

Cost of goods manufactured 450,700

Total available 484,200

Finished goods, June 30, 2010 83,000

Cost of goods sold 401,200

Underapplied overhead 4,200 397,000

Gross profit 393,670

Operating expenses 157,500

Net income (loss) P236,170

25. (b)

Fixed factory overhead:

Heat and light P 54,900

Depreciation 793,000

Taxes and insurance 300,500

Total P1,148,400

Variable factory overhead:

Indirect labor P 240,000

Employee benefits 90,000

Supplies 60,000

Power 48,000

Total P 438,000

Fixed overhead rate (P1,148,400 / 220,000 DLH) P 5.22 per DLH

Variable overhead rate (P438,000 / 60,000 DLH) 7.30 per DLH

Total factory overhead rate per DLH P 12.52

Actual DLH, 2011 220,000

Estimated total factory overhead for next year (2011) P2,754,400

26. (c)

Fixed overhead rate (P1,200,000 / 240,000 machine hrs.) P 5

Variable overhead rate (P2,400,000 / 240,000 machine hrs.) 10

Predetermined overhead rate P15

27. (b) 21,000 machine hours x P15

28. (b)

Applied variable overhead (21,000 x P10) P210,000

Actual variable overhead 214,000

Underapplied variable manufacturing overhead P 4,000

5

29. (c)

Actual variable overhead P214,000

Budgeted variable overhead (21,000 hrs. x P10) 210,000

Variable spending variance (U) P 4,000

30. (c)

Budgeted fixed overhead P100,000

Applied fixed overhead (21,000 hrs. x P5) 105,000

Volume variance (F) P 5,000

6

PROBLEMS

Problem 6-1

(1) Work in process 22,040,000

Applied factory overhead 22,040,000

To record applied factory overhead

(P22,800,000 / 1,200,000 mixers) x 1,160,000

Factory overhead control 22,384,000

Various credits 22,384,000

To record actual factory overhead incurred.

(2) Actual factory overhead P22,384,000

Applied factory overhead 22,040,000

Underapplied factory overhead P 344,000

Problem 6-2

1. Work in process inventory 400

Finished goods inventory 2,533

Cost of goods sold 5,067

Underapplied overhead 8,000

To allocate underapplied overhed to inventories

and cost of goods sold computed as follows:

Work in process (P12,000 / P240,000) x P8,000 = P 400

Finished goods (P76,000 / P240,000) x P8,000 = 2,533

Cost of goods sold (P152,000 / P240,000) x P8,000 = 5,067

2. Overapplied overhead 8,000

Work in process inventory 400

Finished goods inventory 2,533

Cost of goods sold 5,067

To close overapplied overhead to inventories

and cost of goods sold.

3. Cost of goods sold 10,000

Underapplied overhead 10,000

To close underapplied overhead to cost of goods sold.

4. Work in process inventory 400

Finished goods inventory 3,200

Cost of goods sold 6,400

Underapplied overhead 10,000

To close underapplied overhead to inventories

and cost of goods sold, computed as follows:

Work in process (P4,000 / P100,000) x P10,000 = P 400

Finished goods (P32,000 / P100,000) x P10,000 = 3,200

Cost of goods sold (P64,000 / P100,000) x P10,000 = 6,400

7

Problem 6-3

(a) Work in process 630,000

Materials (18,000 x P15) 270,000

Factory payroll (18,000 x P17) 306,000

Applied factory overhead (18,000 x P3*) 54,000

To record materials, labor and overhead charged

Production. Factory overhead control may also

be credited instead of Applied factory overhead.

* (P22,000 + P16,000 + P7,000 + P5,000 + P10,000) / 20,000 = P3

Factory overhead control 56,500

Various credits 56,500

To record actual factory overhead incurred.

Applied factory overhead 54,000

Underapplied overhead 2,500

Factory overhead control 56,500

To record underapplied overhead.

Alternative entry if applied factory overhead is not used.

Underapplied overhead 2,500

Factory overhead control 2,500

(b) Cost of goods sold 2,500

Underapplied overhead 2,500

To close underapplied overhead to cost of goods

sold.

Problem 6-4

1. Actual overhead (P283,400 + P647,426.67) P930,826.67

Applied overhead (168,630 hrs. x P5.49) 925,778.70

Underapplied overhead P 5,047.97

2. Volume variance:

Fixed overhead applied (168,630 x P1.65*) P278,239.50

Fixed overhead budgeted 272,250.00

Volume variance (F) P 5,989.50

*P272,250 / 165,000 = P1.65

Spending vari ance:

Actual overhead per year P930,826.67

Budgeted overhead:

Fixed P272,250.00

Variable (168,630 x 3.84*) 647,539.20 919,789.20

Spending variance (U) P 11,037.47

*P633,600 / 165,000 = P3.84

Total variance (U) P 5,047.97

8

Problem 6-5

Elena Machinery Corporation

Income Statement

Year Ended December 31, 2010

Sales P960,500

Sales returns and allowances 43,700

Net Sales 916,800

Cost of goods sold:

Finished goods inventory, 1/1 P98,700

Cost goods manufactured 641,100

Total available 739,800

Finished goods inventory, 12/31 94,500

Cost of goods sold 645,300

Add overapplied overhead 3,500 648,800

Gross profit 268,000

Operating expenses:

Selling expense P 65,400

Administrative expenses 82,500 147,900

Net income before income tax 120,100

Provision for income tax 36,030

Net income after income tax P 84,070

Problem 6-6

1. Fixed manufacturing overhead P 7,500

Variable manufacturing overhead [(P60,000/12) x P7.50] 37,500

Budgeted manufacturing overhead for the month P 45,000

2. Fixed overhead rate (P7,500 / 5,000 units/mo.) P 1.50

Variable overhead rate 7.50

Total overhead rate P 9.00

Actual output 4,800

Applied manufacturing overhead P 43,200

3. Actual manufacturing overhead P 46,500

Budgeted factory overhead 45,000

Controllable overhead variance (U) P 1,500

Applied manufacturing overhead P 43,200

Budgeted manufacturing overhead 45,000

Volume variance ((U) P 1,800

4. Controllable overhead variance (U) P 1,500

Volume variance (U) 1,800

Net overhead variance (U) P 3,300

Or:

Actual overhead incurred P 46,500

Applied overhead 43,200

Underapplied overhead P 3,300

9

Problem 6-7

1. Fixed overhead P 16,920

Variable overhead (36,000 DLH x P6.30) 226,800

Budgeted manufacturing overhead P243,720

2. Fixed overhead rate (P16,920 / 36,000 hrs.) P 0.47

Variable overhead rate 6.30

Total overhead rate P 6.77

Actual DLH 2,700

Applied manufacturing overhead P 18,279

3. Actual manufacturing overhead P 23,877

Budgeted manufacturing overhead:

Fixed overhead (P16,920 / 12) P 1,410

Variable (2,700 DLH x P6.30) 17,010 18,420

Controllable variance (U) P 5,457

Fixed overhead applied (2,700 DLH x .47) P 1,269

Fixed overhead budgeted (16,920 / 12) 1,410

Volume variance (U) P 141

4 Controllable variance (U) P 5,457

Volume variance (U) 141

Net variance (U) P 5,598

Or:

Actual overhead P 23,877

Applied overhead 18,279

Underapplied overhead P 5,598

Problem 6-8

1. Fixed overhead rate (P900,000 / 150,000 machine hours ) P 6.00

Variable overhead rate (P450,000 / 150,000 machine hours) 3.00

Total manufacturing overhead rate P 9.00

2. Actual manufacturing overhead P1,305,000

Applied manufacturing overhead (140,000 hrs. x P9.00) 1,260,000

Underapplied overhead P 45,000

3. Actual manufacturing overhead P1,305,000

Budgeted manufacturing overhead (based on actual hrs.)

Fixed overhead P900,000

Variable (140,000 hrs. x P3) 420,000 1,320,000

Controllable variance (F) P 15,000

4. Applied fixed overhead (140,000 hrs. x P6) P 840,000

Budgeted fixed overhead 900,000

Volume variance (U) P 60,000

10

Problem 6-9

1, Fixed overhead rate (P42,000 / 60,000 DLH) P 0.70

Variable overhead rate (P168,000 / 60,000 DLH) 2.80

Total overhead rate P 3.50

2. Actual direct labor hours 62,400

Overhead rate X P3.50

Applied overhead P218,400

3. Actual manufacturing overhead P213,100

Applied manufacturing overhead 218,400

Overapplied overhead (F) P 5,300

4. Fixed overhead volume variance:

Applied fixed overhead (62,400 x .70) P 43,680

Budgeted fixed overhead 42,000

Volume variance (F) P 1,680

Spending variance:

Actual overhead P213,100

Budgeted overhead based on Std. hours:

Fixed overhead P 42,000

Variable (62,400 x P2.80) 174,720 216,720

Controllable variance (F) P 3,620

Problem 6-10

a. Actual manufacturing overhead P 60,000

Budgeted manufacturing overhead 64,000

Controllable variance (F) P 4,000

Applied manufacturing overhead P 58,000

Budgeted manufacturing overhead 64,000

Volume variance (U) P 6,000

b. Applied manufacturing overhead P 30,000

Volume variance (F) 14,000

Budgeted manufacturing overhead 16,000

Controllable variance (F) 2,000

Actual manufacturing overhead P 18,000

c. Actual manufacturing overhead P 48,000

Controllable variance (U) 12,000

Budgeted manufacturing overhead 36,000

Applied manufacturing overhead 48,000

Volume variance (F) P 12,000

11

d. Budgeted manufacturing overhead P 36,000

Controllable variance (F) 2,000

Actual manufacturing overhead P 34,000

Budgeted manufacturing overhead P 36,000

Volume variance (F) 4,000

Applied manufacturing overhead P 40,000

e. Actual manufacturing overhead P 36,000

Controllable variance (F) 6,000

Budgeted manufacturing overhead 42,000

Applied manufacturing overhead 40,000

Volume variance P 2,000

f. Actual manufacturing overhead P 54,000

Controllable variance (U) 12,000

Budgeted manufacturing overhead 42,000

Volume variance (U) 4,000

Applied manufacturing overhead P 38,000

g. Actual manufacturing overhead P 32,000

Controllable variance -0-

Budgeted manufacturing overhead 32,000

Applied manufacturing overhead 32,000

Volume variance P -0-

Problem 6-11

1. Work in process, Oct. 1 P109,000

Current cost:

Direct materials 90,000

Direct labor (P204,000 x 7/17) 84,000

Applied overhead (7,000 P9) 63,000

Total cost of Job 20 P346,000

2. 4,000 DLH x P9 = P 36,000

3. 17,000 total direct labor hours x P9 = P153,000

4. Supplies P 4,000

Indirect labor 30,000

Supervisory salaries 83,000

Building occupancy costs 7,000

Factory equipment costs 12,000

Other factory costs 10,000

Total actual manufacturing overhead P150,000

5. Close to cost of goods sold account.

6, No. The amount should be apportioned to the Work in Process Inventory

account, Finished Goods Inventory account and Cost of Goods Sold.

12

Problem 6-12

1. Indirect materials and supplies P 30,000

Indirect labor 106,000

Employee benefits 46,000

Depreciation 24,000

Supervision 40,000

Total actual manufacturing overhead P246,000

2. P140,000 actual direct labor cost x 160% = P224,000

3. Actual manufacturing overhead P246,000

Applied manufacturing overhead 224,000

Underapplied overhead P 22,000

Problem 6-13

1. Work in Process Finished Goods

Direct materials P 18,000 P 20,000

Direct labor 36,000 40,000

Applied overhead:

WIP (4,000 hours x P7.20) 28,800

FG (10,000 hours x P7.20) 72,000

Total inventory cost P 82,800 P132,000

2. Supervision P 37,000

Indirect labor 58,100

Utilities 45,600

Depreciation – factory building 15,000

Property tax 8,000

Freight-in 13,000

Depreciation – factory equipment 15,000

Insurance 6,000

Repairs and maintenance 16,500

Miscellaneous 19,800

Total actual manufacturing overhead P234,000

3. Actual manufacturing overhead P234,000

Budgeted manufacturing overhead (P141,750 + P85,050) 226,800

Controllable variance (U) P 7,200

Budgeted manufacturing overhead P226,800

Applied manufacturing overhead 230,400

Volume variance (F) P 3,600

Net overhead variance (U) P 3,600

13

Problem 6-13 (continued)

Manuel Company

Statement of Cost of Goods Manufactured and Sold

Month Ended January 31, 2010

Direct materials used:

Materials inventory, Jan. 1 P 42,000

Purchases (P216,000 – P10,100) 205,900

Total available 247,900

Materials inventory, Jan. 31 18,000 P 229,900

Direct labor 512,000

Applied manufacturing overhead 230,400

Manufacturing cost 972,300

Work in process inventory, Jan. 1 65,000

Total cost of goods placed in process 1,037,300

Work in process inventory, Jan. 31 82,800

Cost of goods manufactured 954,500

Finished goods inventory, Jan. 1 36,000

Goods available for sale 990,500

Finished goods inventory, Jan. 31 132,000

Cost of goods sold at normal 858,500

Underapplied overhead 3,600

Cost of goods sold at actual P 862,100

You might also like

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Cost Acctg Chapter-3Document11 pagesCost Acctg Chapter-3Renzo Ramos100% (1)

- MAS Assessment Exam Answer Key SolutionDocument7 pagesMAS Assessment Exam Answer Key SolutionJonalyn JavierNo ratings yet

- Industrial Process Plant Construction Estimating and Man-Hour AnalysisFrom EverandIndustrial Process Plant Construction Estimating and Man-Hour AnalysisRating: 5 out of 5 stars5/5 (1)

- Accounting For Business IncorporationDocument45 pagesAccounting For Business IncorporationAira100% (1)

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Cost Chapter 15Document13 pagesCost Chapter 15Marica Shane100% (3)

- PRTC First Answer Key PDFDocument48 pagesPRTC First Answer Key PDFnanabaNo ratings yet

- Cost Acctg CHAPTER-5 PDFDocument17 pagesCost Acctg CHAPTER-5 PDFRenzo RamosNo ratings yet

- Multiple Choice Questions and Problems on Overhead Costing and Variance AnalysisDocument13 pagesMultiple Choice Questions and Problems on Overhead Costing and Variance AnalysisJuliet Austria Dimalibot67% (3)

- CHAPTER 4-CostDocument15 pagesCHAPTER 4-Costvernie65% (17)

- Practical Guide to Plant Turnaround ManagementDocument11 pagesPractical Guide to Plant Turnaround Managementt_saumitra100% (2)

- Chapter 12Document23 pagesChapter 12Maica GarciaNo ratings yet

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewJ Camille Mangundaya Lacsamana77% (30)

- Financial Markets and Institutions 8th Edition Mishkin Eakins Solutions Manual Instant DownloadDocument6 pagesFinancial Markets and Institutions 8th Edition Mishkin Eakins Solutions Manual Instant DownloadEng Abdikarim WalhadNo ratings yet

- Regional Education Department Brigada Eskwela Implementation PlanDocument1 pageRegional Education Department Brigada Eskwela Implementation PlanLyn RomeroNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Answers To Multiple Choices - TheoreticalDocument29 pagesAnswers To Multiple Choices - TheoreticalMaica GarciaNo ratings yet

- Tax Supplemental Reviewer - October 2019Document46 pagesTax Supplemental Reviewer - October 2019Daniel Anthony CabreraNo ratings yet

- Tax Supplemental Reviewer - October 2019Document46 pagesTax Supplemental Reviewer - October 2019Daniel Anthony CabreraNo ratings yet

- IRCA QMS Internal Auditor Training CourseDocument1 pageIRCA QMS Internal Auditor Training Coursesilswal1988No ratings yet

- Cost Accounting - 2019 Chapter 2 - Costs - Concepts and ClassificationDocument4 pagesCost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification?????No ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsPremium AccountsNo ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDale MartinNo ratings yet

- Afar Final PBDocument6 pagesAfar Final PBFloriza Cuevas RagudoNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument12 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AHardin LavistreNo ratings yet

- CH 6 SolutionsDocument4 pagesCH 6 SolutionsGabriel PanoNo ratings yet

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- Chapter 5 Factory Overhead Accounting ExercisesDocument10 pagesChapter 5 Factory Overhead Accounting ExercisesxicoyiNo ratings yet

- Multiple Choice SolutionsDocument21 pagesMultiple Choice SolutionsrandyNo ratings yet

- Cost Accounting Test Materials & Job Costing SolutionsDocument9 pagesCost Accounting Test Materials & Job Costing Solutionsカイ みゆきNo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- Summary of Answers PPE Part 1 Theory QuestionsDocument2 pagesSummary of Answers PPE Part 1 Theory QuestionsYameteKudasaiNo ratings yet

- PRTC 1stPB - 05.22 Sol FARDocument7 pagesPRTC 1stPB - 05.22 Sol FARCiatto SpotifyNo ratings yet

- Chapters 1 3Document112 pagesChapters 1 3julygg0710No ratings yet

- Problem 11&17Document12 pagesProblem 11&17Kaira GoNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Quiz 3Document3 pagesQuiz 3Aerin AenNo ratings yet

- Management Advisory Services Solution to ProblemDocument13 pagesManagement Advisory Services Solution to ProblemMIKKONo ratings yet

- Answer Key Midterm Exam Cost Acounting With Solutions PART IIDocument7 pagesAnswer Key Midterm Exam Cost Acounting With Solutions PART IINoel Carpio100% (1)

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- SINGH007 Ans Homework Lec 14 To 21Document47 pagesSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiNo ratings yet

- Lecture Note - Overhead Variances 2078-08-19Document6 pagesLecture Note - Overhead Variances 2078-08-19Sarose ThapaNo ratings yet

- Costco1 - Assign 5Document7 pagesCostco1 - Assign 5Deryl GalveNo ratings yet

- Determine factory overhead and variances in JanuaryDocument3 pagesDetermine factory overhead and variances in Januarygazer beamNo ratings yet

- Chapter 6 Computational ProblemsDocument3 pagesChapter 6 Computational ProblemsPamela GalangNo ratings yet

- ABS Problems (1-2)Document3 pagesABS Problems (1-2)dewlate abinaNo ratings yet

- Strategic Cost Management Exercises 12369Document2 pagesStrategic Cost Management Exercises 12369Arlene Diane OrozcoNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionGem Alcos NicdaoNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionLyzaNo ratings yet

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- Efficiency of Investment in a Socialist EconomyFrom EverandEfficiency of Investment in a Socialist EconomyMieczyslaw RakowskiNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Torrent Downloaded FromDocument4 pagesTorrent Downloaded FromJULIUS L. LEVENNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMa Precylla Cerraine FloresNo ratings yet

- Lump Sum LiquidationDocument3 pagesLump Sum LiquidationJose Mariano MelendezNo ratings yet

- Tax Module 10Document27 pagesTax Module 10AiraNo ratings yet

- PUP Junior Philippine Institute of Accountants Special Qualifying Exam ReviewDocument3 pagesPUP Junior Philippine Institute of Accountants Special Qualifying Exam ReviewJose Mariano MelendezNo ratings yet

- Multiple Choice Questions TheoreticalDocument18 pagesMultiple Choice Questions TheoreticalAiraNo ratings yet

- OBLIGATIONS MCQsDocument12 pagesOBLIGATIONS MCQsDenise Abbygale GanzonNo ratings yet

- Special Qualifying Examination Review 2019: Partnership OperationsDocument4 pagesSpecial Qualifying Examination Review 2019: Partnership OperationsJonalyn AnchetaNo ratings yet

- Events After The Reporting PeriodDocument12 pagesEvents After The Reporting PeriodaandmwhimNo ratings yet

- Answering Questions From Employers About Criminal Records or ArrestsDocument5 pagesAnswering Questions From Employers About Criminal Records or ArrestsLegal MomentumNo ratings yet

- Guide On Philippine TaxationDocument15 pagesGuide On Philippine TaxationmyfrankpovNo ratings yet

- Multiple Choice Questions - TheoreticalDocument7 pagesMultiple Choice Questions - TheoreticalAiraNo ratings yet

- IAS33Document26 pagesIAS33Joselyne Estefanía Soledispa MezonesNo ratings yet

- Book Value and Earnings Per ShareDocument40 pagesBook Value and Earnings Per ShareAira100% (1)

- Lump Sum LiquidationDocument3 pagesLump Sum LiquidationJose Mariano MelendezNo ratings yet

- Special Qualifying Examination Review 2019: Partnership OperationsDocument4 pagesSpecial Qualifying Examination Review 2019: Partnership OperationsJonalyn AnchetaNo ratings yet

- Non Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon Current Assets Held For Sale and Discontinued OperationsMehreen KhanNo ratings yet

- Nature of Partnership BusDocument24 pagesNature of Partnership BusRia GayleNo ratings yet

- OBLIGATIONS MCQsDocument12 pagesOBLIGATIONS MCQsDenise Abbygale GanzonNo ratings yet

- PUP Junior Philippine Institute of Accountants Special Qualifying Exam ReviewDocument3 pagesPUP Junior Philippine Institute of Accountants Special Qualifying Exam ReviewJose Mariano MelendezNo ratings yet

- Torrent Downloaded FromDocument4 pagesTorrent Downloaded FromJULIUS L. LEVENNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMa Precylla Cerraine FloresNo ratings yet

- A Study On Capital Structure of Five Selected Companies in Auto-Ancillary IndustryDocument95 pagesA Study On Capital Structure of Five Selected Companies in Auto-Ancillary Industryrahul100% (1)

- System analysis and design process overviewDocument13 pagesSystem analysis and design process overviewCassandra FrancescaNo ratings yet

- df7c557b54 C5dd7df45e PDFDocument248 pagesdf7c557b54 C5dd7df45e PDFNevi Nur RahmadhiniNo ratings yet

- Principles of AccountingDocument183 pagesPrinciples of AccountingJoe UpZone100% (1)

- 1Document26 pages1Nuray Aliyeva50% (2)

- Facilitative LeadershipDocument23 pagesFacilitative LeadershiphasminNo ratings yet

- Shiferaw DibabaDocument90 pagesShiferaw DibabaTaklu Marama M. BaatiiNo ratings yet

- Karim Ibrahim: Legal ConsultantDocument3 pagesKarim Ibrahim: Legal ConsultantKarim Mamdouh fahmyNo ratings yet

- Citymall Promoting Patronage Among Locals PreviewDocument7 pagesCitymall Promoting Patronage Among Locals PreviewSamael LightbringerNo ratings yet

- IGCSE Accounting - Revision NotesDocument42 pagesIGCSE Accounting - Revision Notesfathimath ahmedNo ratings yet

- Bank of Punjab Internship UOGDocument38 pagesBank of Punjab Internship UOGAhsanNo ratings yet

- PDDocument159 pagesPDHina ArifNo ratings yet

- WSO Advice ResumeDocument1 pageWSO Advice Resumenate bilskiNo ratings yet

- Change AgentDocument3 pagesChange AgentAlamin SheikhNo ratings yet

- Choose A Company at Your Locality and Do PresentatDocument3 pagesChoose A Company at Your Locality and Do PresentatPadua CdyNo ratings yet

- HRM 21 Collective BargainingDocument16 pagesHRM 21 Collective BargainingMahima MohanNo ratings yet

- SCM 1Document23 pagesSCM 1Dani Leonidas SNo ratings yet

- Khaled Hosseini: The Kite RunnerDocument44 pagesKhaled Hosseini: The Kite RunnersanjayfrnzNo ratings yet

- Target Dental Patients with SegmentationDocument10 pagesTarget Dental Patients with Segmentationaj4444No ratings yet

- SME 2001 MANAGERIAL ACCOUNTING QUIZDocument7 pagesSME 2001 MANAGERIAL ACCOUNTING QUIZEdward Prima KurniawanNo ratings yet

- Alexandra Inguaggiato: ExperienceDocument7 pagesAlexandra Inguaggiato: ExperienceakashparnamiNo ratings yet

- Group 4-Malicdem, Ronald Abon, Adrian Garong, AizaDocument1 pageGroup 4-Malicdem, Ronald Abon, Adrian Garong, AizaRichard MendozaNo ratings yet

- Company Profile TNSBDocument13 pagesCompany Profile TNSBMoktar BakarNo ratings yet

- TestDocument5 pagesTestashup260% (1)

- Quality & Supplier Management: Mike GilletteDocument14 pagesQuality & Supplier Management: Mike GilletteAiko Mara VillanuevaNo ratings yet

- Salesforce Trailhead AssignmnetDocument5 pagesSalesforce Trailhead AssignmnetSaikiran JadavNo ratings yet