Professional Documents

Culture Documents

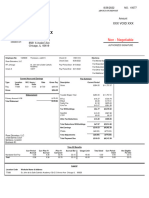

Holmesdale Closed Accounts Investment Rate Sheet

Uploaded by

Mario LanzaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Holmesdale Closed Accounts Investment Rate Sheet

Uploaded by

Mario LanzaCopyright:

Available Formats

Holmesdale Closed

Variable Accounts

Easy Access Accounts

23 April 2020

Easy Access Accounts

Product description Balances of Gross pa/AER Variable

Easy Access £10+ 0.05%

Home Saver £10+ 1.60%

£25,000+ 0.15%

Easy Access (Retention) (formerly Holmesdale 60/Special Shares

£10,000+ 0.05%

& Holmesdale 90/Benefit Shares)

£10+ 0.05%

Branch Saver £10+ 0.10%

Charities Easy Access £75,000+ 0.60%

Holmesdale Business Saver £10+ 0.05%

Maturity Easy Access (HBS) £1+ 0.15%

Charities Easy Access Share £1+ 0.35%

Holmesdale Business Saver £10+ 0.05%

Regular Saver Accounts

Product description Balances of Gross pa/AER Variable

Regular Savings Issue 1 £10+ 0.20%

Notice Accounts

Product description Balances of Gross pa/AER Variable

£100,000+ 0.55%

Save 35 (35 days’ notice) £50,000+ 0.45%

£10,000+ 0.30%

£100,000+ 0.75%

Save 60 (60 days’ notice) £50,000+ 0.65%

£1+ 0.50%

Holmesdale 30 (30 days’ notice) (formerly Monthly Income £40,000+ 0.35%

Shares) £10,000+ 0.05%

£40,000+ 0.35%

Charities Notice (60 days’ notice) £500+ 0.05%

£40,000+ 0.10%

Charities Notice Share £500+ 0.05%

£100,000+ 0.20%

Holmesdale Business 60 (60 days’ notice) (10653) £75,000+ 0.10%

£500+ 0.05%

£100,000+ 0.45%

£75,000+ 0.35%

Holmesdale Business 60 (60 days’ notice) (10069)

£40,000+ 0.15%

£500+ 0.05%

£40,000+ 0.10%

Holmesdale Business 90 share (90 days’ notice) (10654) £500+ 0.05%

£40,000+ 0.35%

Holmesdale Business 90 (90 days’ notice) (10073) £25,000+ 0.10%

£10,000+ 0.05%

23.09.2019 Ref: 314998 Page 1 of 2

Children’s Accounts

Product description Balances of Tax-free pa/AER Variable

Junior ISA £10+ 1.85%

Product description Balances of Gross pa/AER Variable

Young Saver £10+ 1.85%

Cash ISAs

Product description Balances of Tax-free pa/AER Variable

£12,000+ 0.55%

Cash ISA 90 Issue 1 £8,000+ 0.45%

£500+ 0.20%

£15,000+ 0.45%

Cash ISA 90 Issue 2 £8,000+ 0.35%

£500+ 0.10%

£3,000+ 0.70%

Cash ISA (HBS) £500+ 0.10%

£1+ 0.10%

Maturity Cash ISA £1+ 0.45%

For more information, speak to one of our consultants today.

AER stands for Annual Equivalent Rate and shows what the interest rate would be if interest was paid and added each year. All ISA and Child Trust Fund interest

is paid tax-free, which means it’s exempt from income tax. We pay all non-ISA savings interest gross, which means no tax is deducted. It’s your responsibility to

pay any tax due, based on your individual circumstances. Tax rules may change in future.

Call in Talk to us today Visit

branch 0345 850 1722 skipton.co.uk

Skipton Building Society is a member of the Building Societies Association. Authorised by the Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority, under registration number 153706, for accepting deposits, advising on and arranging mortgages and

providing Restricted financial advice. Principal Office, The Bailey, Skipton, North Yorkshire BD23 1DN.

___________________________________________________________________________________________________________________________________

23.09.2019 Ref: 314998 Page 2 of 2

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- April Fools IRS Audit Letter.Document3 pagesApril Fools IRS Audit Letter.moo the cowNo ratings yet

- Short Quiz 3 Set A With AnswerDocument3 pagesShort Quiz 3 Set A With AnswerJean Pierre Isip100% (1)

- US Tax TermsDocument5 pagesUS Tax TermsSatya SripathiNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document29 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Cir vs. FilinvestDocument3 pagesCir vs. FilinvestLeica Jayme50% (2)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- Carnevale Et Al. 2016Document7 pagesCarnevale Et Al. 2016Mario LanzaNo ratings yet

- Final Version of The BME HNA Updated Document 12 March 189460Document294 pagesFinal Version of The BME HNA Updated Document 12 March 189460Mario LanzaNo ratings yet

- 5i Enas Spoydaios AnthrwposDocument5 pages5i Enas Spoydaios AnthrwposMario LanzaNo ratings yet

- Tourism-Related Planning in CreteDocument28 pagesTourism-Related Planning in CreteMario LanzaNo ratings yet

- Waxman CeramicsDocument13 pagesWaxman CeramicsMario LanzaNo ratings yet

- The Crete Declaration On Oral Cancer Prevention 2005 - A Commitment To ActionDocument1 pageThe Crete Declaration On Oral Cancer Prevention 2005 - A Commitment To ActionMario LanzaNo ratings yet

- Weld-Crete® Concrete Bonding AgentDocument3 pagesWeld-Crete® Concrete Bonding AgentMario LanzaNo ratings yet

- New Data On Elephas Chaniensis (Vamos Cave, Chania, Crete)Document4 pagesNew Data On Elephas Chaniensis (Vamos Cave, Chania, Crete)Mario LanzaNo ratings yet

- ΔΕΔΔΗΕ ΑνακοίνωσηDocument1 pageΔΕΔΔΗΕ ΑνακοίνωσηMario LanzaNo ratings yet

- Dittany of Crete Herb - OreganoDocument2 pagesDittany of Crete Herb - OreganoMario LanzaNo ratings yet

- 8th Congress of The Balkan Geophysical. Society (BGS) - 2015Document44 pages8th Congress of The Balkan Geophysical. Society (BGS) - 2015Mario LanzaNo ratings yet

- Mini Map of They City of Chania in Crete.Document2 pagesMini Map of They City of Chania in Crete.Mario LanzaNo ratings yet

- Highlights of CreteDocument1 pageHighlights of CreteMario LanzaNo ratings yet

- Chania MapDocument1 pageChania MapMario LanzaNo ratings yet

- Sunville Tourist Destinations in Greece 2013Document15 pagesSunville Tourist Destinations in Greece 2013Mario LanzaNo ratings yet

- Chania Property Market Outlook 2019 - ARENCORESDocument14 pagesChania Property Market Outlook 2019 - ARENCORESMario LanzaNo ratings yet

- The Effects of Exercise Standards On The Quality of Life To People With Chronic DiseaseDocument18 pagesThe Effects of Exercise Standards On The Quality of Life To People With Chronic DiseaseMario LanzaNo ratings yet

- Chania PDFDocument2 pagesChania PDFMario LanzaNo ratings yet

- City Guide For ChaniaDocument2 pagesCity Guide For ChaniaMario LanzaNo ratings yet

- p15 PDFDocument69 pagesp15 PDFDaniel LevineNo ratings yet

- Circular 23 2017Document2 pagesCircular 23 2017Singh SranNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Part 2 Competency Exam - WORKSHEETDocument4 pagesPart 2 Competency Exam - WORKSHEETCondoriano BatumbakalNo ratings yet

- Payslip ReportDocument1 pagePayslip Reporteki permanaNo ratings yet

- NikhilDocument4 pagesNikhilAditya JoshiNo ratings yet

- The Mobile Masses Store: Biweekly Payroll ReportDocument2 pagesThe Mobile Masses Store: Biweekly Payroll Reportemilyrc14No ratings yet

- Axis Bank LTD Payslip For The Month of May - 2021Document2 pagesAxis Bank LTD Payslip For The Month of May - 2021Suman DasNo ratings yet

- State Tax FormDocument2 pagesState Tax FormSaintjinx21No ratings yet

- Canada - Prepare Tax ReportDocument11 pagesCanada - Prepare Tax ReportMukesh SharmaNo ratings yet

- New ContractDocument5 pagesNew ContractJohn Roman Cerrera ToledanaNo ratings yet

- SK-PST FormDocument1 pageSK-PST FormOsama JavaidNo ratings yet

- Taxation Question BankDocument3 pagesTaxation Question BankRishikesh BhujbalNo ratings yet

- Flipkart Labels 31 Aug 2023-11-33Document26 pagesFlipkart Labels 31 Aug 2023-11-33Rohan ChawlaNo ratings yet

- Transport BillDocument4 pagesTransport Billprashil parmarNo ratings yet

- Invoice 8217843351654654517Document2 pagesInvoice 8217843351654654517Abhigyan DihingiaNo ratings yet

- Payroll Fundamentals Practice TestDocument10 pagesPayroll Fundamentals Practice Testmohitkashap869No ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Tax and Taxation PDFDocument2 pagesTax and Taxation PDFwinky colinaNo ratings yet

- Assignment III-LGS311-12th-DECDocument2 pagesAssignment III-LGS311-12th-DECMohammad Iqbal SekandariNo ratings yet

- Rates of Income TaxDocument9 pagesRates of Income TaxAiza KhanNo ratings yet

- Signed By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Document8 pagesSigned By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Aviral SankhyadharNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet