Professional Documents

Culture Documents

Projected Sales (All On Account) For The Following Three Months Are

Uploaded by

Dada ManatadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Projected Sales (All On Account) For The Following Three Months Are

Uploaded by

Dada ManatadCopyright:

Available Formats

SAMPLE PROBLEM

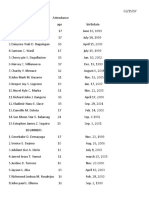

The July 31, 2010, balance sheet for World Windows Inc. includes the following information:

Cash P40, 000 debit

Accounts Receivable P270, 000 debit

Merchandise Inventory A 8750 debit

Merchandise Inventory B 7200 debit

The firm’s management has designated P35, 000 as the firm’s monthly minimum cash balance. Because a piece of

equipment was sold at the end of July, the beginning cash balance was greater than the minimum desired amount.

Other information about World Windows is as follows:

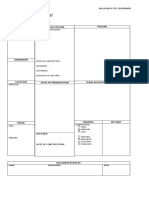

Projected sales (all on account) for the following three months are:

Inventory selling price August September October

A P250 1,OOO units 800 units 1100 units

B P480 500 units 700 units 1300 units

• Cost of Goods Sold (CGS) for A and B approximates 70 and 60 percent, respectively, of sales revenues.

• Management wants to end each month with units costing the equivalent of 5 percent of the following month’s sales

in units. Unit costs are assumed to be stable.

• The collection pattern for accounts receivable is 55 percent in the month of sale,

44 percent in the month following the sale, and 1 percent uncollectible.

• All accounts payable for inventory are paid in the month of purchase.

• Other monthly expenses are P28, 000, which includes P6, 000 of depreciation but does not include uncollectible

accounts expense.

• Investments of excess cash are made in P5, 000 increments.

REQUIRED:

A. Prepare a sales budget for August, September, and October.

B. Prepare a purchase budget for August and September.

C. Prepare the cash budget for August including the effect of financing (borrowing or investing).

You might also like

- Cost Accounting ReportDocument9 pagesCost Accounting ReportDada ManatadNo ratings yet

- Cost Chapter 6 PDFDocument1 pageCost Chapter 6 PDFDada ManatadNo ratings yet

- Disaster Risk Reduction Reflection #2Document1 pageDisaster Risk Reduction Reflection #2Dada ManatadNo ratings yet

- Disaster Risk Reduction ReflectionDocument1 pageDisaster Risk Reduction ReflectionDada ManatadNo ratings yet

- Cost Chapter 7 PDFDocument1 pageCost Chapter 7 PDFDada ManatadNo ratings yet

- Cost Chapter 6Document1 pageCost Chapter 6Dada ManatadNo ratings yet

- Reporting StsDocument2 pagesReporting StsDada ManatadNo ratings yet

- Bukidnon Provincial Medical Center ProgramDocument2 pagesBukidnon Provincial Medical Center ProgramDada ManatadNo ratings yet

- Business Proposal LetterDocument2 pagesBusiness Proposal LetterDada ManatadNo ratings yet

- 02Document1 page02Dada ManatadNo ratings yet

- The Effects of Television Violence On Children: Samson C. Wasil G-12 Peter DruckerDocument1 pageThe Effects of Television Violence On Children: Samson C. Wasil G-12 Peter DruckerDada ManatadNo ratings yet

- StaffingDocument1 pageStaffingDada ManatadNo ratings yet

- Built Heritage: Picture Name Special FeatureDocument4 pagesBuilt Heritage: Picture Name Special FeatureDada ManatadNo ratings yet

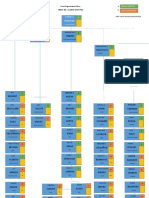

- Actual Organizational ChartDocument4 pagesActual Organizational ChartDada ManatadNo ratings yet

- 02Document1 page02Dada ManatadNo ratings yet

- Validate CustomerDocument1 pageValidate CustomerDada ManatadNo ratings yet

- APDUHAN2Document2 pagesAPDUHAN2Dada ManatadNo ratings yet

- 02Document1 page02Dada ManatadNo ratings yet

- Carbon MonoxideDocument4 pagesCarbon MonoxideDada ManatadNo ratings yet

- 02Document1 page02Dada ManatadNo ratings yet

- APDUHAN2Document2 pagesAPDUHAN2Dada ManatadNo ratings yet

- Actual Organizational ChartDocument4 pagesActual Organizational ChartDada ManatadNo ratings yet

- 02Document1 page02Dada ManatadNo ratings yet

- Recovering After A StrokeDocument17 pagesRecovering After A StrokeTiffany MatthewsNo ratings yet

- Drug Indication Adverse Effect Nursing Responsibil Ities Antidepressa NTDocument7 pagesDrug Indication Adverse Effect Nursing Responsibil Ities Antidepressa NTDada ManatadNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)