Professional Documents

Culture Documents

Age Net Debit Balance Percentage To Be Applied After Correction Have Been Made

Uploaded by

Mark Michael LegaspiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Age Net Debit Balance Percentage To Be Applied After Correction Have Been Made

Uploaded by

Mark Michael LegaspiCopyright:

Available Formats

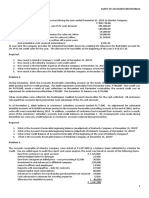

In connection with your examination of the statements of Ringo Inc.

for the year ended December 31, 2018, you were able

to obtain certain information during your audit of the accounts receivable and related accounts.

The December 31, 2018 balance in the Accounts Receivable control accounts is P837,900.

An aging schedule of the accounts receivable as of December 31, 2018 is presented below:

Age Net debit Percentage to be applied after correction have

balance been made

60 days and under P387,800 1%

61 to 90 days 307,100 2%

91 to 120 days 89,800 5%

Over 120 days 53,200 Definitely uncollectible, P9,000, the remainder is

estimated to be 25% uncollectible.

P837,900

The Allowance for Doubtful Accounts schedule I presented below:

Debit Credit Balance

January 1, 2018 P19,700

November 30, 2018 P6,100 13,600

December 31, 2018 (837,900x5%) 41,895 P55,495

Entries made to Doubtful Accounts Expense account were:

o A debit on December 31 for the amount of the credit to the Allowance for Doubtful Accounts.

o A credit for P6,100 on November 30, 2018, and a debit to Allowance Doubtful Accounts because of a

bankruptcy. The related sales took place on October 1, 2018.

There is a credit balance in one account receivable (61 to 90 days) of P11,000; it represents an advance on a

sales contract.

Required: Determine the following as of and for the year ended December 31, 2018:

a. Accounts receivable

b. Allowance for doubtful accounts

c. Doubtful accounts expense

Bahrain bank granted a loan to a borrower in the amount of P10,000,000 on January 1, 2017. The interest rate on the

loan is 10% payable annually starting December 31, 2017. The loan matures in 5 years on December 31, 2021. Bahrain

Bank incurs P130,900 of direct loan origination cost and P50,000 of indirect loan origination cost. In addition, Bahrain

bank charges the borrower a 5-point nonrefundable loan origination fee.

The borrower paid the interest due on December 31, 2017. However, during 2018 the borrower began to experience

financial difficulties, requiring the bank to reassess the collectability of the loan. As of December 31, 2018, the bank

expects that only P8,000,000 of the principal will be recovered. The P8,000,000 principal amount is expected to be

collected in 2 equal installments on December 31, 2020 and December 31, 2022. The prevailing interest rates for similar

type of note as of December 31, 2017 and 2018 are 155 and 16% respectively.

Required: Determine the following:

a. Interest income to be recognized in 2017

b. Carrying amount of the loan as of December 31, 2017

c. Loan impairment loss to be recognized in 2018.

You might also like

- Accounts ReceivableDocument2 pagesAccounts ReceivableArcillas Jess NiñoNo ratings yet

- Quiz AP Receivables 2ndsetDocument7 pagesQuiz AP Receivables 2ndsetMaritessNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- Problem 1,2,4 and 6Document4 pagesProblem 1,2,4 and 6Wendelyn JimenezNo ratings yet

- Quiz # 11 Bank Reconciliation, Proof of Cash & AR - FinalDocument2 pagesQuiz # 11 Bank Reconciliation, Proof of Cash & AR - FinalDarren Jacob EspinaNo ratings yet

- Drilll 7 ReceivablesDocument4 pagesDrilll 7 ReceivablesEDELYN PoblacionNo ratings yet

- Receivable - Q2Document3 pagesReceivable - Q2Dymphna Ann CalumpianoNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- Receivables - Quiz No. 3Document2 pagesReceivables - Quiz No. 3Anie MartinezNo ratings yet

- Oblicon LawDocument5 pagesOblicon LawJulie Neay AfableNo ratings yet

- Quiz - ReceivablesDocument2 pagesQuiz - ReceivablesAna Mae HernandezNo ratings yet

- Intermacc Receivables Postlec WaDocument3 pagesIntermacc Receivables Postlec WaClarice Awa-aoNo ratings yet

- Drill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormDocument3 pagesDrill 1 (15 Marks) : General Direction: Place On A Separate Sheet of Paper and Show Supporting Solutions in Good FormKaye GonxalesNo ratings yet

- Unit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - T21920 (Final)Document7 pagesUnit 3. Audit of Receivables, Related Revenues and Credit Losses - Handout - T21920 (Final)Alyna JNo ratings yet

- Auditing Revenue CycleDocument3 pagesAuditing Revenue CycleJhunNo ratings yet

- 2.1 Assignment - Audit of Sales and ReceivablesDocument4 pages2.1 Assignment - Audit of Sales and ReceivablesORIEL RICKY IGNACIO GALLARDONo ratings yet

- 1Document8 pages1Cindy CrausNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- Practice SetDocument4 pagesPractice SetXena Natividad100% (1)

- Aud Rev - Accounts ReceivableDocument4 pagesAud Rev - Accounts ReceivablexjammerNo ratings yet

- Case 1: Audit of Accounts Receivable and Related AccountsDocument6 pagesCase 1: Audit of Accounts Receivable and Related Accountskat kaleNo ratings yet

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocument9 pagesApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNo ratings yet

- Day 1A - Receivables - AM SeatworkDocument7 pagesDay 1A - Receivables - AM SeatworkdgdeguzmanNo ratings yet

- Audit Quiz 2Document4 pagesAudit Quiz 2Amir LM67% (3)

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- Prac 1 Tua LiabilitiesDocument7 pagesPrac 1 Tua LiabilitiesKrisan Rivera0% (1)

- Auditing ProblemsDocument26 pagesAuditing ProblemsKingChryshAnneNo ratings yet

- Intermediate Accounting - ReceivablesDocument3 pagesIntermediate Accounting - ReceivablesDos Buenos100% (1)

- Template - Assignment - Audit of ReceivablesDocument6 pagesTemplate - Assignment - Audit of ReceivablesEdemson NavalesNo ratings yet

- QuizletDocument4 pagesQuizletKizzea Bianca GadotNo ratings yet

- HE Ntegrated Eview: Far Eastern Uni Ersity - ManilaDocument11 pagesHE Ntegrated Eview: Far Eastern Uni Ersity - ManilaChanelNo ratings yet

- Audit of Accounting ReceivablesDocument9 pagesAudit of Accounting ReceivablesHelix HederaNo ratings yet

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- HW On ReceivablesDocument4 pagesHW On ReceivablesJazehl Joy ValdezNo ratings yet

- PDF ReceivablesDocument6 pagesPDF ReceivablesJanine SarzaNo ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Intacc ReceivablesDocument9 pagesIntacc Receivablesaugustokita5No ratings yet

- Receivables Problem 1: Account Is One To Six Months ClassificationDocument4 pagesReceivables Problem 1: Account Is One To Six Months ClassificationMary Grace NaragNo ratings yet

- Acc ActivityDocument6 pagesAcc ActivityJoyce Eguia100% (1)

- 10.21.2017 Audit of ReceivablesDocument10 pages10.21.2017 Audit of ReceivablesPatOcampoNo ratings yet

- Required Ending Allowance For Doubtful AccountsDocument4 pagesRequired Ending Allowance For Doubtful AccountsAngelica SamonteNo ratings yet

- ACCTG102 - PrelimSW4 Accounts Receivable Part 1 Answer KeyDocument2 pagesACCTG102 - PrelimSW4 Accounts Receivable Part 1 Answer KeyJessica Albaracin100% (1)

- AcctgDocument2 pagesAcctgJona FranciscoNo ratings yet

- 03 Receivables PDFDocument13 pages03 Receivables PDFReyn Saplad PeralesNo ratings yet

- Intermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterDocument3 pagesIntermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterClaire Magbunag AntidoNo ratings yet

- Acctg 100G 08 1Document4 pagesAcctg 100G 08 1lov3m3No ratings yet

- Cordillera Career Development CollegeDocument12 pagesCordillera Career Development CollegeDonalyn BannagaoNo ratings yet

- Receivables DiscussionDocument5 pagesReceivables DiscussionTrazy Jam BagsicNo ratings yet

- Far Eastern University - Manila Institute of Accounts, Business and Finance Nicanor Reyes Sr. ST., Sampaloc, Manila Applied AuditingDocument6 pagesFar Eastern University - Manila Institute of Accounts, Business and Finance Nicanor Reyes Sr. ST., Sampaloc, Manila Applied AuditingKenneth A. S. AlabadoNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- CCE ReceivablesDocument5 pagesCCE ReceivablesJane TuazonNo ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- Practice Problems AR and NotesDocument7 pagesPractice Problems AR and NotesDonna Zandueta-TumalaNo ratings yet

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- FAR HandoutDocument34 pagesFAR HandoutIamchyNo ratings yet

- ReceivablesDocument11 pagesReceivablesmobylay25% (4)

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AP Equity 2Document2 pagesAP Equity 2Mark Michael LegaspiNo ratings yet

- AP Equity 3Document2 pagesAP Equity 3Mark Michael Legaspi100% (1)

- CH0303Document2 pagesCH0303Mark Michael LegaspiNo ratings yet

- AP Equity 5Document3 pagesAP Equity 5Mark Michael LegaspiNo ratings yet

- AP Equity 4Document3 pagesAP Equity 4Mark Michael LegaspiNo ratings yet

- Process Costing 3Document3 pagesProcess Costing 3Mark Michael LegaspiNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- PROBLEM NO. 2 - Current and Noncurrent LiabilitiesDocument3 pagesPROBLEM NO. 2 - Current and Noncurrent LiabilitiesMark Michael LegaspiNo ratings yet

- Process Costing 4Document3 pagesProcess Costing 4Mark Michael LegaspiNo ratings yet

- Process Costing 1Document2 pagesProcess Costing 1Mark Michael LegaspiNo ratings yet

- Process Costing 5Document3 pagesProcess Costing 5Mark Michael LegaspiNo ratings yet

- PROBLEM NO. 21 - Pension: QuestionsDocument2 pagesPROBLEM NO. 21 - Pension: QuestionsMark Michael LegaspiNo ratings yet

- Receivables, While The Related Loan Will Be Reported Under Current LiabilitiesDocument2 pagesReceivables, While The Related Loan Will Be Reported Under Current LiabilitiesMark Michael LegaspiNo ratings yet

- PROBLEM NO. 3 - Various Current LiabilitiesDocument2 pagesPROBLEM NO. 3 - Various Current LiabilitiesMark Michael LegaspiNo ratings yet

- AUDLIAB3Document1 pageAUDLIAB3Mark Michael LegaspiNo ratings yet

- MAS3Document1 pageMAS3Mark Michael LegaspiNo ratings yet

- MAS1Document1 pageMAS1Mark Michael LegaspiNo ratings yet

- Navarro Vs Pineda (G.R. No. L-18456 November 30, 1963)Document3 pagesNavarro Vs Pineda (G.R. No. L-18456 November 30, 1963)Ann ChanNo ratings yet

- G.R. No. 207786 - Tapayan vs. MartinezDocument10 pagesG.R. No. 207786 - Tapayan vs. MartinezMarkNo ratings yet

- APAC Recruiting Deck v.FINALDocument30 pagesAPAC Recruiting Deck v.FINALPari SethNo ratings yet

- Consolidated Case Digests 49 To 89Document69 pagesConsolidated Case Digests 49 To 89Bert RoseteNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Solutions To Problems: LG 1 BasicDocument13 pagesSolutions To Problems: LG 1 BasicMuwadat Hussain67% (3)

- PNB V CADocument7 pagesPNB V CAAriana Cristelle L. PagdangananNo ratings yet

- West Bengal Land Reforms Act 1955Document77 pagesWest Bengal Land Reforms Act 1955Pakela ThakelaNo ratings yet

- Money - Credit Class 10Document1 pageMoney - Credit Class 10Legendary Pokemon Blaster 2406No ratings yet

- Allied Bank Corporation Vs CADocument3 pagesAllied Bank Corporation Vs CARitzchelle BelenzoNo ratings yet

- Global Capital Partners Fund LLC Has Funded Over $2 Billion in TransactionsDocument4 pagesGlobal Capital Partners Fund LLC Has Funded Over $2 Billion in TransactionsPR.comNo ratings yet

- Five Cs of Credit: CreditworthinessDocument3 pagesFive Cs of Credit: CreditworthinessSakshi Singh YaduvanshiNo ratings yet

- Ffi,:Ilril, T ': Il Fiflb Ilfffi 1.Document30 pagesFfi,:Ilril, T ': Il Fiflb Ilfffi 1.sourav8450% (2)

- Order Information: (Additional Resources)Document5 pagesOrder Information: (Additional Resources)pournima mohiteNo ratings yet

- Bookkeeping NC III Assessment Tool Part 2Document1 pageBookkeeping NC III Assessment Tool Part 2Donalyn BannagaoNo ratings yet

- Pike County Properties Sold ListDocument20 pagesPike County Properties Sold ListSheera LaineNo ratings yet

- Toaz - Info Heirs of Sps Maglasang V Manila Banking Corp PRDocument4 pagesToaz - Info Heirs of Sps Maglasang V Manila Banking Corp PRJimi SolomonNo ratings yet

- General Debt Advice - Sample Letters To CreditorsDocument9 pagesGeneral Debt Advice - Sample Letters To CreditorswtflopNo ratings yet

- Racial Profiling EssaysDocument5 pagesRacial Profiling Essayszobvbccaf100% (2)

- 2021 Altima PaperworkDocument24 pages2021 Altima Paperworkqqvhc2x2prNo ratings yet

- MSMEDocument7 pagesMSMERitika SharmaNo ratings yet

- Credit Transactions (Mutuum)Document38 pagesCredit Transactions (Mutuum)Maestro LazaroNo ratings yet

- Late Payment Removal CreditDocument15 pagesLate Payment Removal CreditKadir Wisdom78% (18)

- E 06 H 1 MortgageDocument6 pagesE 06 H 1 MortgageMintNo ratings yet

- Mercado Vs Allied Banking Corporation, GR No. 171460, July 27, 2007Document18 pagesMercado Vs Allied Banking Corporation, GR No. 171460, July 27, 2007Ej CalaorNo ratings yet

- Practice Quiz 5 Module 3 Financial MarketsDocument5 pagesPractice Quiz 5 Module 3 Financial MarketsMuhire KevineNo ratings yet

- STOP or PRE - Foreclosure of Real Property Affidavit &instructionsDocument2 pagesSTOP or PRE - Foreclosure of Real Property Affidavit &instructionsricetech100% (6)

- Agency Reviewer Doc Jim NotesDocument13 pagesAgency Reviewer Doc Jim NotesNA Nanorac JDNo ratings yet

- Perjanjian Pinjaman Polisi: Policy Loan AgreementDocument2 pagesPerjanjian Pinjaman Polisi: Policy Loan Agreementlimited legacyNo ratings yet

- Mary Poppins ReturnsDocument1 pageMary Poppins Returnsmohind mohandasNo ratings yet