Professional Documents

Culture Documents

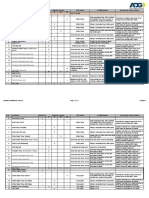

Wave 1

Uploaded by

JerryJoshuaDiazOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wave 1

Uploaded by

JerryJoshuaDiazCopyright:

Available Formats

The biggest challenge in making a decentralized organization function effectively is:

earning maximum profits through fair practices.

minimizing losses.

taking advantage of the specialized knowledge and skills of highly talented

managers.

obtaining goal congruence among division managers.

developing an adequate budgetary control system.

What practice is present when divisional managers throughout an organization work together

in an effort to achieve the organization's goals?

Participatory management.

Goal attainment.

Goal congruenc

Centralization of objectives.

Negotiation by subordinates.

Consider the following statements about goal congruence:

I. Goal congruence is obtained when managers of subunits throughout an

organization strive to achieve the goals set by top management.

II. Managers are often more concerned about the performance of their own

subunits rather than the performance of the entire organization.

III. Achieving goal congruence in most organizations is relatively straightforward

and easy to accomplish.

Which of the above statements is (are) true?

I only.

II only.

I and II.

II and III.

I, II, and III.

Which of the following performance measures is (are) used to evaluate the financial success

or failure of investment centers?

Residual incom

Return on investment.

Number of suppliers.

Economic value adde

All of the above measures are used except Number of Suppliers

ROI is most appropriately used to evaluate the performance of:

cost center managers.

revenue center managers.

profit center managers.

investment center managers.

both profit center managers and investment center managers.

Which of the following is not considered in the calculation of divisional ROI?

Divisional incom

Earnings velocity.

Capital turnover.

Sales margin.

Sales revenu

Which of the following is the correct mathematical expression for return on investment?

Sales margin ÷ capital turnover.

Sales margin + capital turnover.

Sales margin - capital turnover.

Sales margin x capital turnover.

Capital turnover ÷ sales margin.

The ROI calculation will indicate:

the percentage of each sales dollar that is invested in assets.

the sales dollars generated from each dollar of incom

how effectively a company used its invested capital.

the invested capital generated from each dollar of incom

the overall quality of a company's earnings.

A company's sales margin:

must, by definition, be greater than the firm's net sales.

has basically the same meaning as the term "contribution margin."

is computed by dividing sales revenue into incom

is computed by dividing income into sales revenu

shows the sales dollars generated from each dollar of incom

Which of the following is the correct mathematical expression to derive a company's capital

turnover?

Sales revenue ÷ invested capital.

Contribution margin ÷ invested capital.

Income ÷ invested capital.

Invested capital ÷ sales revenue

Invested capital ÷ income

Capital turnover shows:

the amount of income generated by each dollar of capital investment.

the number of sales dollars generated by each dollar of capital investment.

the amount of contribution margin generated by each dollar of capital investment.

the amount of capital investment generated by each sales dollar.

the amount of capital investment generated by each dollar of incom

A division's return on investment may be improved by increasing:

cost of goods sold and expenses.

sales margin and cost of capital.

sales revenue and cost of capital.

capital turnover or sales margin.

capital turnover or cost of capital.

All of the following actions will increase ROI except:

an increase in sales revenues.

a decrease in operating expenses.

a decrease in a company's invested capital.

a decrease in the number of units sol

an improvement in manufacturing efficiency.

Which of the following is used in the calculation of both return on investment and residual

income?

Total stockholders' equity.

Retained earnings.

Invested capital.

Total liabilities.

The cost of capital.

Consider the following statements about residual income:

I. Residual income incorporates a firm's cost of acquiring investment capital.

II. Residual income is a percentage measure, not a dollar measur

III. If used correctly, residual income may result in division managers making

decisions that are in their own best interest and not in the best interest of the

entire firm.

Which of the above statements is (are) true?

I only.

II only.

I and II.

II and III.

I and III.

The basic idea behind residual income is to have a division maximize its:

earnings per shar

income in excess of a corporate imputed interest charg

cost of capital.

cash flows.

invested capital.

You might also like

- (I) Introduction To Investment CentreDocument28 pages(I) Introduction To Investment CentreBook wormNo ratings yet

- SSF From LinnyDocument80 pagesSSF From Linnymanojpatel51No ratings yet

- Control: The Management Control EnvironmentDocument49 pagesControl: The Management Control EnvironmentvinnaNo ratings yet

- Topic:: Introduction To Financial ManagementDocument44 pagesTopic:: Introduction To Financial Managementnavid abedinNo ratings yet

- Chapter III Lecture NoteDocument22 pagesChapter III Lecture NoteKalkidan NigussieNo ratings yet

- 404A - Hilton Irm Chapter 13Document14 pages404A - Hilton Irm Chapter 13Chloe Quirona PoliciosNo ratings yet

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument3 pagesSegmented Reporting, Investment Center Evaluation, and Transfer Pricingeskelapamudah enakNo ratings yet

- Module VII Profit Mgmt.Document15 pagesModule VII Profit Mgmt.Apoorv BNo ratings yet

- ACCT 102 Chapter 22 Handout DecentralizationDocument3 pagesACCT 102 Chapter 22 Handout DecentralizationxxxcxxxNo ratings yet

- Summary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSDocument9 pagesSummary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSliaNo ratings yet

- Return On Investment & It's Maximization: - Submitted To Prof. GannachariDocument4 pagesReturn On Investment & It's Maximization: - Submitted To Prof. Gannacharihardikdave6No ratings yet

- Segmented Reporting Investment Center Evaluation and Transfer PricingDocument42 pagesSegmented Reporting Investment Center Evaluation and Transfer PricingAyu Dian SetyaniNo ratings yet

- Textual Learning Material - Module 5Document62 pagesTextual Learning Material - Module 5Jerry JohnNo ratings yet

- Financial Management (8513) Assignment No.1: Name Faisal JavedDocument18 pagesFinancial Management (8513) Assignment No.1: Name Faisal JavedFj's MotivationNo ratings yet

- Chapter 7 Decentralization and Transfer PricingDocument34 pagesChapter 7 Decentralization and Transfer Pricingtamirat tadeseNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisFrank Agbeko TorhoNo ratings yet

- Pemran QuizDocument14 pagesPemran QuizGegante Shayne SarahNo ratings yet

- Responsibility AccountingDocument20 pagesResponsibility AccountingaddityarajNo ratings yet

- Corporate Financial Management IntroDocument17 pagesCorporate Financial Management IntroADEYANJU AKEEMNo ratings yet

- What Is ROICDocument4 pagesWhat Is ROICionut_onisiiNo ratings yet

- Chapter 13-Inv Center TranspferpricingDocument41 pagesChapter 13-Inv Center TranspferpricingKaren hapukNo ratings yet

- Gross MarginDocument13 pagesGross MarginIshita Ghosh100% (1)

- AccountingDocument8 pagesAccountingHimanshu Upadhyay AIOA, NoidaNo ratings yet

- Profitability: 1-Profit Margin On Revenues 2 - Return On InvestmentDocument10 pagesProfitability: 1-Profit Margin On Revenues 2 - Return On InvestmentAhmed TaherNo ratings yet

- Performance Evaluation ROI-RI-EVADocument42 pagesPerformance Evaluation ROI-RI-EVAraghavendra_20835414No ratings yet

- Introduction FinanceDocument19 pagesIntroduction FinanceolmezestNo ratings yet

- Financial Ratio Analysis-IIDocument12 pagesFinancial Ratio Analysis-IISivaraj MbaNo ratings yet

- EV The Price of A BusinessDocument11 pagesEV The Price of A BusinesspatrickNo ratings yet

- MAS 2 Responsibility Accounting Part 1Document4 pagesMAS 2 Responsibility Accounting Part 1Jon garciaNo ratings yet

- 1081 A1 Profits CA 02 FA Combined With NAVDocument38 pages1081 A1 Profits CA 02 FA Combined With NAVLyfe SpanNo ratings yet

- Mowen/Hansen/Heitger Learning Objectives: Cornerstones of Managerial Accounting, 3 EditionDocument3 pagesMowen/Hansen/Heitger Learning Objectives: Cornerstones of Managerial Accounting, 3 EditionAgustinus Dwichandra12No ratings yet

- Business FormulaeDocument16 pagesBusiness Formulae12345JONESNo ratings yet

- Profit Margin PDFDocument2 pagesProfit Margin PDFbungaNo ratings yet

- Investment Center and Transfer PricingDocument10 pagesInvestment Center and Transfer Pricingrakib_0011No ratings yet

- Financial ManagementDocument26 pagesFinancial ManagementbassramiNo ratings yet

- List of Ratio Analysis Formulas and ExplanationsDocument18 pagesList of Ratio Analysis Formulas and ExplanationsCharish Jane Antonio CarreonNo ratings yet

- Responsibility Accounting LNDocument7 pagesResponsibility Accounting LNzein lopezNo ratings yet

- G10 Q1 LAS5 W5 For-LectureDocument19 pagesG10 Q1 LAS5 W5 For-Lecturekaorinim28No ratings yet

- Equity Valuation.Document70 pagesEquity Valuation.prashant1889No ratings yet

- Company Analysis of Bharthi Airtel LTDDocument21 pagesCompany Analysis of Bharthi Airtel LTDP.sai.prathyushaNo ratings yet

- Financial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIDocument3 pagesFinancial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIMeyannaNo ratings yet

- Ratio Analysis (Theory, Numerical With Solution)Document38 pagesRatio Analysis (Theory, Numerical With Solution)SUDIPTA SHIBNo ratings yet

- Chapter 8 - Divisional Perfomance and BudgetingDocument34 pagesChapter 8 - Divisional Perfomance and BudgetingJeremiah NcubeNo ratings yet

- Profitability AnalysisDocument14 pagesProfitability AnalysisJayanta SarkarNo ratings yet

- Meaning of Ratio AnalysisDocument45 pagesMeaning of Ratio AnalysisSunny LalakiaNo ratings yet

- Economic Value Added: The Invisible Hand at Work: By: Michael Durant, CPA, CCEDocument7 pagesEconomic Value Added: The Invisible Hand at Work: By: Michael Durant, CPA, CCEChao ChenNo ratings yet

- Strategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingDocument10 pagesStrategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingAnnamarisse parungaoNo ratings yet

- AE 191 M-TEST 1 With Answer KeyDocument3 pagesAE 191 M-TEST 1 With Answer KeyVenus PalmencoNo ratings yet

- Reinvestment PaperDocument15 pagesReinvestment PapermecontactyelNo ratings yet

- Divisional MeasurementDocument29 pagesDivisional MeasurementNagaraj UpparNo ratings yet

- Balanced Scorecard SCMDocument5 pagesBalanced Scorecard SCMudelkingkongNo ratings yet

- Financial PlanningDocument4 pagesFinancial PlanningMartin MinotNo ratings yet

- SegmentreportingworkshopDocument28 pagesSegmentreportingworkshopAdelyn CasinilloNo ratings yet

- Q1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDocument18 pagesQ1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDhaval LagwankarNo ratings yet

- Shareholders Value CreationDocument58 pagesShareholders Value CreationManeesh SharmaNo ratings yet

- Segment Reporting WorkshopDocument28 pagesSegment Reporting WorkshopasdfghjklNo ratings yet

- Profit and Wealth MaximizationDocument3 pagesProfit and Wealth MaximizationArshad MohammedNo ratings yet

- Run # 2 ForecastDocument19 pagesRun # 2 ForecastJerryJoshuaDiazNo ratings yet

- SFI QuizDocument5 pagesSFI QuizJerryJoshuaDiazNo ratings yet

- Yates Case Study - LT 11Document23 pagesYates Case Study - LT 11JerryJoshuaDiazNo ratings yet

- Yates Financial ModellingDocument18 pagesYates Financial ModellingJerryJoshuaDiazNo ratings yet

- E-Numan Game 12.25 v1Document6 pagesE-Numan Game 12.25 v1JerryJoshuaDiazNo ratings yet

- Din Tai Fung Revenue Scheds & Graph (Annualized 2013)Document4 pagesDin Tai Fung Revenue Scheds & Graph (Annualized 2013)JerryJoshuaDiazNo ratings yet

- Consulting Case - Market SizingDocument127 pagesConsulting Case - Market SizingJerryJoshuaDiaz100% (1)

- Consulting Case: Business TurnaroundDocument72 pagesConsulting Case: Business TurnaroundJerryJoshuaDiazNo ratings yet

- Do It All Solution - Part 1 - Page 1 of 2Document23 pagesDo It All Solution - Part 1 - Page 1 of 2JerryJoshuaDiazNo ratings yet

- Consulting Case: Business TurnaroundDocument72 pagesConsulting Case: Business TurnaroundJerryJoshuaDiazNo ratings yet

- Consulting Case - Merger and AcquisitionDocument115 pagesConsulting Case - Merger and AcquisitionJerryJoshuaDiazNo ratings yet

- Format Pre - LOBDocument21 pagesFormat Pre - LOBJerryJoshuaDiazNo ratings yet

- Consulting Case Operations StrategyDocument185 pagesConsulting Case Operations StrategyJerryJoshuaDiaz100% (2)

- Consulting Case GuesstimateDocument82 pagesConsulting Case GuesstimateJerryJoshuaDiazNo ratings yet

- Consulting Case Pricing and EvaluationDocument112 pagesConsulting Case Pricing and EvaluationJerryJoshuaDiazNo ratings yet

- Red Hen Financial Projectins v2Document13 pagesRed Hen Financial Projectins v2JerryJoshuaDiazNo ratings yet

- Turbulence Modeling - BetaDocument88 pagesTurbulence Modeling - BetaMayra ZezattiNo ratings yet

- Animal Testing (Black Mamba)Document3 pagesAnimal Testing (Black Mamba)Robespade El PistoleroNo ratings yet

- Leadership and AccountabilityDocument49 pagesLeadership and AccountabilityChineduNo ratings yet

- Atsap Briefing SheetDocument1 pageAtsap Briefing Sheetapi-20616942No ratings yet

- TABLE OF SPECIFICATIONS - Grade-10 (4th Grading)Document4 pagesTABLE OF SPECIFICATIONS - Grade-10 (4th Grading)Aljon Jay Sulit SiadanNo ratings yet

- NCPFORMATstudentcopy 2Document4 pagesNCPFORMATstudentcopy 2Reinhardt MostolesNo ratings yet

- Key Players in The Indian Industry TodayDocument46 pagesKey Players in The Indian Industry TodaydakshjainNo ratings yet

- VNL WP Telecom Rural IndiaDocument13 pagesVNL WP Telecom Rural IndiaMukul AzadNo ratings yet

- 9702 PHYSICS: MARK SCHEME For The May/June 2012 Question Paper For The Guidance of TeachersDocument7 pages9702 PHYSICS: MARK SCHEME For The May/June 2012 Question Paper For The Guidance of TeachersxiaokiaNo ratings yet

- Construction Issue: Qty. (Nos) AI DI AO DO Hvac System I Water Chilling Units 3Document11 pagesConstruction Issue: Qty. (Nos) AI DI AO DO Hvac System I Water Chilling Units 3Al Amin Hossain Srabon100% (1)

- Review Notes FinalDocument12 pagesReview Notes FinalJoseph AbalosNo ratings yet

- Episode 1 FS 2Document9 pagesEpisode 1 FS 2Daniela RiosNo ratings yet

- Walls Sbu of UnileverDocument25 pagesWalls Sbu of Unilevermaham azizNo ratings yet

- CH 11 Admission, Discharge, Transfers & ReferralsDocument14 pagesCH 11 Admission, Discharge, Transfers & ReferralsNilakshi Barik Mandal100% (1)

- Letter MDocument5 pagesLetter Malshamsi studentNo ratings yet

- Code Billing Heads Rate Quantity Amount in RsDocument2 pagesCode Billing Heads Rate Quantity Amount in RsPrasanna Nammalwar85% (27)

- UNIT-5 FullDocument99 pagesUNIT-5 Fullsyedali24779No ratings yet

- About ONGC Global Ranking: HR Vision, Mission & ObjectivesDocument6 pagesAbout ONGC Global Ranking: HR Vision, Mission & ObjectivesShweta AnandNo ratings yet

- Drufelcnc Ddcm6V5 (Ddream) Installation ManualDocument32 pagesDrufelcnc Ddcm6V5 (Ddream) Installation ManualgowataNo ratings yet

- Social Media Strategy TemplateDocument11 pagesSocial Media Strategy TemplateCall Central USA ITNo ratings yet

- Chapter 6 Recursion PDFDocument16 pagesChapter 6 Recursion PDFBangtan gurlNo ratings yet

- Summer Internship Project: Scoping of Institutional Banking in Delhi / NCR"Document31 pagesSummer Internship Project: Scoping of Institutional Banking in Delhi / NCR"Sumit AnandNo ratings yet

- Drug ListDocument104 pagesDrug Listخانه پزشکNo ratings yet

- Installation & Maintenance Instructions: Description / IdentificationDocument6 pagesInstallation & Maintenance Instructions: Description / IdentificationPrimadani KurniawanNo ratings yet

- Articles - English Lesson PlanDocument7 pagesArticles - English Lesson PlanSneha TaliyanNo ratings yet

- Business Model Canvas - Editable TemplateDocument2 pagesBusiness Model Canvas - Editable TemplateVijayNo ratings yet

- Accelerating Matrix Multiplication With Block Sparse Format and NVIDIA Tensor Cores - NVIDIA Technical BlogDocument7 pagesAccelerating Matrix Multiplication With Block Sparse Format and NVIDIA Tensor Cores - NVIDIA Technical BlogShrey AgarwalNo ratings yet

- Worksheet16 Transcription To TranslationDocument3 pagesWorksheet16 Transcription To Translationliterally deadNo ratings yet

- Nonfiction Biography Unit: 3 - 5 GradeDocument54 pagesNonfiction Biography Unit: 3 - 5 GradeSusana MatthewsNo ratings yet

- MARUTI Vision and MissionDocument10 pagesMARUTI Vision and MissionAarif Raheem Rather80% (5)