Professional Documents

Culture Documents

Roles and Responsibilities: The Financing Team in An Initial Municipal Bond Offering

Uploaded by

Antonio J FernósOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Roles and Responsibilities: The Financing Team in An Initial Municipal Bond Offering

Uploaded by

Antonio J FernósCopyright:

Available Formats

Roles and Responsibilities:

The Financing Team in an Initial

Municipal Bond Offering

A key part of issuing new debt is to assemble a team that works for the state or

local government. Generally, the bond offering process is a coordinated effort

among various professionals to finance a state or local government’s capital

projects. A municipal government can benefit from an understanding of the roles

and responsibilities of its deal team.

Once a state or local government decides to finance a A competitive bid is a transaction in which potential

capital project by issuing bonds, it would hire a financing underwriters submit proposals for the purchase of a

team to finalize the financing plan, develop offering new issue of municipal securities and the securities are

documents, prepare for any rating agency and investor awarded to the underwriter or underwriting syndicate

presentations, market the bond offering to investors, price presenting the best bid according to stipulated criteria set

the bonds and close the transaction. forth in the notice of sale. The underwriting of securities

in this manner may also be referred to as a “public sale”

The roles and responsibilities of an issuer’s team may vary or “competitive sale.” The professionals that may be

depending upon the bond offering method of sale — involved in competitive transactions include underwriters,

competitive bid, negotiated or private placement. municipal advisors, underwriter’s counsel, bond counsel,

feasibility consultants, credit enhancers, auditors, rating

In a negotiated sale, an initial bond offering by an issuer

agencies and trustees. View a chart of the professionals

is directly sold to an underwriter or underwriting syndicate

involved in a competitive transaction.

selected by the issuer.1 In addition to the underwriter or

underwriting syndicate, the professionals involved in a The following provides general descriptions of the role,

negotiated municipal bond financing transaction may activities and responsibilities of members of a bond

include municipal advisors, underwriter’s counsel, bond financing team in an initial bond offering. Other activities

counsel, feasibility consultants, credit enhancers, selling conducted by these professionals will depend on the

group members, auditors, rating agencies, trustees, particular type of transaction, the presence of additional

disclosure counsel and other counsel. View a chart of the financing team members and any restricted role they

professionals involved in a negotiated transaction. perform as the issuer may determine.

Among the primary points of negotiation for an issuer are

the interest rate, call features and purchase price of the The State or Local Government

issue, as well as covenants or other key terms of the bond

• defines the financing requirements

documents viewed as important in marketing the new

issue. • determines the method of sale

• sets and implements debt management policies and

procedures of the municipality

• determines available resources for payment of principal

and interest of new debt issue

• selects and manages the financing team

1

Private placements also are sold by negotiation and involve the sale • prepares offering documents in consultation with the

by a placement agent directly to institutional or private investors rather

than through an offering to the general investing public. Investors

financing team

purchasing privately placed securities often must meet certain standards

of sophistication and also are often required to agree to restrictions as to

resale, sometimes required to provide a private placement letter to that

effect. continued on next page

www.msrb.org | emma.msrb.org

© Municipal Securities Rulemaking Board 2012.1.0

• works with the senior manager to determine how orders Municipal Advisor

are filled or allotted2 to investors from the bond pricing • acts in a fiduciary capacity for the state or local

order period government

• determines participation3 of the senior manager’s and • develops requests for proposals and qualifications

syndicate members’ liability in a negotiated bond for underwriters, bond or disclosure counsel, credit

issuance enhancement facilities, investment products

• determines the compensation of financing team • assists in developing the plan of finance and related

• negotiates with the underwriter the final purchase price transaction timetable

of the bonds • identifies and analyzes financing solutions and

• executes the bond purchase agreement4 with the senior alternatives for funding capital improvement plan

manager • advises on the method of sale, taking into account

• adopts bond resolution and/or executes any trust market conditions and near-term activity in the

indenture, loan agreement or other bond financing municipal market

documents • assists in preparation of any rating agency strategies

• pays principal and interest on the bonds as they and presentations

become due • coordinates internal/external accountants, feasibility

• complies with tax and other covenants included in the consultants and escrow agents

bond financing documents • assists with the selection of underwriters, underwriter

• submits continuing disclosures to the MSRB’s Electronic compensation issues, syndicate structure and bond

Municipal Market Access (EMMA) system under the allocations

issuer’s continuing disclosure agreement • assists with negotiated sales, including advice regarding

retail order periods and institutional marketing, analysis

2

Allotments are the number of bonds which are actually sold by an of comparable bonds and secondary market data

underwriter to an investor.

• assists with competitive bond sales, including

3

Participation is the portion of a new municipal bond issue, expressed preparation of notice of sale and preliminary official

as a percentage of the number of bonds, for which the senior manager

and syndicate members have a legal liability, regardless of whether or

statement, bid verification, true interest cost (TIC)

not they sell that many bonds. There are two major types of syndication calculations and reconciliations/verifications of bidding

agreements: platform calculations, preparation of notice of sale,

Undivided or Eastern Account — A method for determining liability obtaining CUSIP numbers

stated in the agreement among underwriters in which each member of

the underwriting syndicate is liable for any unsold portion of the issue

• prepares preliminary cash flows/preliminary refunding

according to each member’s percentage participation in the syndicate. analysis

Syndicates most frequently are structured as undivided accounts.

• analyzes whether to use SLGS,5 open markets and/or

Divided or Western Account — A method for determining liability agency securities for purposes of investment of bond

stated in the agreement among underwriters in which each member

of an underwriting syndicate is liable only for the amount of its

proceeds

participation in the issue, and not for any unsold portion of the

participation amounts allocated to the other underwriters.

4

Bond purchase agreement is the contract between an underwriter and 5

SLGS are U.S. Treasury securities issued under its State and Local

issuer setting forth final terms, prices, and any other relevant conditions Government Series program for purposes of complying with arbitrage

upon which underwriter purchases a new municipal bond issue. rules under the federal tax code.

continued on next page

www.msrb.org | emma.msrb.org

© Municipal Securities Rulemaking Board 2012.1.0

• manages the escrow bids or reviewing SLGS –– solicits price views from syndicate members, which

applications for structuring advance refunding escrow provides preliminary pricing indications among

• assists in procuring printers, verification agents, etc. underwriters and customers about the offering range

of a new issue

• verifies cash flow calculations –– prepares distribution analysis

• plans and coordinates bond closings –– works with the state or local government to determine

• prepares any required post-sale reports of bond sales how orders are filled from the bond pricing order

period

• evaluates market conditions and pricing performance of

–– executes the bond purchase agreement with the

senior manager and co-managers’ distribution of bonds

municipal government on behalf of the syndicate

Bond Counsel • submits bid in a competitive sale following evaluation of

pricing of comparable issues, discussions with potential

• drafts bond resolution, indenture, loan agreement and/ investors, accessing supply of bonds in the market or

or other bond financing documents bonds scheduled to come to market, weighing possible

• reviews applicable law to confirm the issuer’s authority competition from other firms

to issue the bonds and its conformity with other legal

requirements Underwriting Syndicate

• affirms issuer’s authorization of the bond offering (also known as Co-Manager(s))

• discloses and examines litigation that may jeopardize • has an “arm’s-length” relationship with the state or local

the validity of the bond issue government

• interprets arbitrage regulations and tax law • under the direction of the senior manager, purchases

an initial bond issue from state or local government and

• attests to the validity and enforceability of the bonds offers it for resale to investors

• provides guidance in structuring issues related to tax • provides sufficient capital to purchase an issue

law

• shares the risks of underwriting the issue with the senior

• confirms tax-exempt status manager

• drafts tax certificate • distributes the bonds to investors

Underwriter (also known as Senior Manager, Lead Underwriter’s Counsel

Manager or Bookrunner)

• drafts bond purchase agreement, blue sky

• has an “arm’s-length” relationship with the municipal memorandum6 and agreement among underwriters7

government

• advises underwriters regarding their legal positions with

• provides proceeds at closing and obtains funds from respect to the issue

investors

• advises underwriters on state and federal securities laws

• manages the affairs of any underwriting syndicate

formed in connection with a new issue • assists underwriters in undertaking due diligence

review and provides legal opinion that, based on such

• in a negotiated offering: review, official statement does not contain misleading

–– works with state or local government and municipal information or omit materials information

advisor to design the plan of finance

–– develops the bond structure

–– assists in determining timing to sell bonds based on

market conditions

–– assists in the development of the bond documents

continued on next page

–– assists in preparing any rating agency strategy and

presentation

–– “runs numbers” providing quantitative analysis of 6

Blue sky memorandum specifies the way a specific issue will be treated

financing structure under state securities laws, usually including all 50 states, Puerto Rico,

–– manages the pricing process Guam and the District of Columbia, as well as the steps that must be

undertaken to qualify the issue for sale in those jurisdictions.

–– executes pre-sale marketing 7

Agreement among underwriters is a contract among syndicate group

members setting forth their rights, duties and underwriter’s commitments

to each other with respect to a new issue of securities.

www.msrb.org | emma.msrb.org

© Municipal Securities Rulemaking Board 2012.1.0

Rating Agencies Selling Group Members

• assess the credit quality of the bonds • assist in the distribution of a new issue of municipal

• assigns rating to the bond issue securities

• updates ratings periodically while debt is outstanding • acquire new issue securities from the underwriting

syndicate but do not participate in residual syndicate

profits nor share any liability for unsold bonds

Trustee (also known as Paying Agent, or Registrar)

• acts in a fiduciary role for the benefit of bondholders in Verification Agent

enforcing the terms of the trust indenture

• verifies cash flow sufficiency to the call date of the

• transmits principal and interest payments from an issuer escrow securities to pay principal and interest on

of municipal securities to the bondholders refunded bonds

• holds and invests moneys held in a construction fund,

reserve fund or other funds that serve as security for Escrow Agent

payment of debt service on the bonds

• serves as custodian of funds and holds securities to pay

• maintains records on behalf of the issuer that identify debt service on refunded bonds

the registered owners of the bonds and related matters

• represents the interests of bondholders in the event of a Printer

default • prints, or creates the electronic version of, the

preliminary and final official statements for distribution

Depending upon the type of transaction, other deal

to the marketplace

participants may be retained as required including:

Auditor

Other Counsel

• compiles and examines the municipal government’s

Other counsel in the bond issuance process may include financial statements upon which the auditor has

disclosure counsel, special tax counsel, bank counsel, expressed or disclaimed an opinion

and borrower’s counsel. Such special counsel may be

• reports, audits or investigates a municipal government’s

necessary for specific issues that are more complex

financial position and results of operations for a set

or have particular characteristics calling for such

period of time

participation.

Generally, the audit includes: (a) a statement of the

Feasibility Consultant scope of the audit; (b) explanatory comments concerning

exceptions from generally accepted accounting principles

• writes the feasibility report prepared for revenue bond and auditing standards; (c) expression or disclaimer

sales (such as in airport and water and sewer revenue of opinions; (d) explanatory comments concerning

bond offerings) and included in the official statements. verification procedures; (e) financial statements and

schedules; and (f) statistical tables, supplementary

The report may evaluate the economic viability, the

comments and recommendations.

adequacy of revenues generated by a capital project or

program to repay debt. The report generally describes

historic and projected demand for the services, economic

trends, user base, user fees and rates that generate

revenues pledged to cover debt service.

Credit Enhancers

• supports an issuer’s credit in exchange for a fee or a

premium, in the form of enhancement such as bond

insurance or a letter of credit

www.msrb.org | emma.msrb.org

© Municipal Securities Rulemaking Board 2012.1.0

You might also like

- finmar strat 1.2Document3 pagesfinmar strat 1.2Monica ErojoNo ratings yet

- Group6-Role of Fin AdvisorsDocument19 pagesGroup6-Role of Fin AdvisorsABHYUDAYA BHARADWAJ MBA W 2021-24No ratings yet

- A Best Practice Oversight Approach For Securities Lending PDFDocument5 pagesA Best Practice Oversight Approach For Securities Lending PDFFierDaus MfmmNo ratings yet

- Unit 10 PDFDocument32 pagesUnit 10 PDFBanshul vyasNo ratings yet

- 2022 PFRM Ipmx SyndicationDocument30 pages2022 PFRM Ipmx SyndicationRAHUL DASNo ratings yet

- Unit 1 So FarDocument4 pagesUnit 1 So FarmanishaNo ratings yet

- SecuritizationDocument46 pagesSecuritizationHitesh MoreNo ratings yet

- 8.managing Risk - Off The Balance Sheet With Loan Sales and SecuritizationDocument38 pages8.managing Risk - Off The Balance Sheet With Loan Sales and SecuritizationChristine Joy AguilaNo ratings yet

- Lecture 4 - Syndicated - LoansDocument12 pagesLecture 4 - Syndicated - LoansYvonneNo ratings yet

- Steps To Issuing A Municipal Bond An Interactive Module: December 2013Document53 pagesSteps To Issuing A Municipal Bond An Interactive Module: December 2013Nikhil BhatiaNo ratings yet

- Merger and Acquisition ProcessDocument4 pagesMerger and Acquisition Processmy youtube advisorNo ratings yet

- Unit 11 Corporate Advisory Services: ObjectivesDocument14 pagesUnit 11 Corporate Advisory Services: ObjectivesamitprgmrNo ratings yet

- Corporate Financial ServicesDocument21 pagesCorporate Financial ServicesANSHA JASMIN S NNo ratings yet

- 2014 US Loan PrimerDocument27 pages2014 US Loan Primerxen101No ratings yet

- Securitisation of Debt AssetsDocument24 pagesSecuritisation of Debt AssetsANITTA M. AntonyNo ratings yet

- Lecture 4 - Syndicated LoansDocument13 pagesLecture 4 - Syndicated LoansEmmanuel MwapeNo ratings yet

- Chapter 5Document24 pagesChapter 5PaiNo ratings yet

- A Syndicated Loan Primer PDFDocument27 pagesA Syndicated Loan Primer PDFmilinddhandeNo ratings yet

- Who Is A Merchant Banker?: Arrangements Regarding Selling, Buying or Subscribing To Securities As ManagerDocument19 pagesWho Is A Merchant Banker?: Arrangements Regarding Selling, Buying or Subscribing To Securities As ManagerUday TambeNo ratings yet

- How To Obtain Surety Bonds PDFDocument16 pagesHow To Obtain Surety Bonds PDFMikeDouglas100% (2)

- The IB Business of Debt - Fixed IncomeDocument36 pagesThe IB Business of Debt - Fixed IncomeNgọc Phan Thị BíchNo ratings yet

- Corporate BondsDocument4 pagesCorporate BondsWaseem ManshaNo ratings yet

- Lending Tutorial Martin Corrall and Matthew KetleyDocument47 pagesLending Tutorial Martin Corrall and Matthew KetleygholiNo ratings yet

- Rem 7Document148 pagesRem 7Kevin JugaoNo ratings yet

- Securities lending guide for trusteesDocument8 pagesSecurities lending guide for trusteesAnand BiradarNo ratings yet

- Module - 5Document63 pagesModule - 5Debojyoti Dey SarkarNo ratings yet

- CEM - Development Finance Project Funding - Mac2021 - Lecture 6Document29 pagesCEM - Development Finance Project Funding - Mac2021 - Lecture 6Tham CherryNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- Securitization 130715232722 Phpapp01Document70 pagesSecuritization 130715232722 Phpapp01MRS.NAMRATA KISHNANI BSSSNo ratings yet

- Chapter Two: Non - Current LiabilitiesDocument10 pagesChapter Two: Non - Current LiabilitiesJuan KermaNo ratings yet

- Private Money Brokering Demystified: A Step-by-Step Guide for the Novice Real Estate InvestorFrom EverandPrivate Money Brokering Demystified: A Step-by-Step Guide for the Novice Real Estate InvestorNo ratings yet

- C1 Module 3Document6 pagesC1 Module 3AbhishekNo ratings yet

- Capital MarketDocument2 pagesCapital MarkettymphNo ratings yet

- Housing Bond Basics: A Developer's PerspectiveDocument37 pagesHousing Bond Basics: A Developer's PerspectiveSrikanth VukkaNo ratings yet

- Chapter 14 Study GuideDocument7 pagesChapter 14 Study GuideStephanie RobinsonNo ratings yet

- Financial Instruments: Lesson 1.4Document66 pagesFinancial Instruments: Lesson 1.4Friendlyn AzulNo ratings yet

- European LL GlossaryDocument6 pagesEuropean LL GlossarybharathaNo ratings yet

- AlmiraDocument4 pagesAlmiraAlmira GregorioNo ratings yet

- Chapter 10-11-1Document18 pagesChapter 10-11-1fouad.mlwbdNo ratings yet

- Loan Syndication For Domestic Borrowings in Merchant BankingDocument24 pagesLoan Syndication For Domestic Borrowings in Merchant BankingKinjal ShahNo ratings yet

- SecuritizationDocument68 pagesSecuritizationPranav ViraNo ratings yet

- Chapter 6 - Debt Securities MarketDocument15 pagesChapter 6 - Debt Securities MarketWill De Ocampo100% (1)

- Major Difference Between Merchant Banking and Investment BankingDocument9 pagesMajor Difference Between Merchant Banking and Investment BankingHoney RoyNo ratings yet

- Introduction To Bond MathDocument43 pagesIntroduction To Bond MathnazNo ratings yet

- Syndicated Loans May Provide Attractive Investment OpportunitiesDocument21 pagesSyndicated Loans May Provide Attractive Investment OpportunitiesMus ChrifiNo ratings yet

- AE-18-Group-04Document14 pagesAE-18-Group-04rayvie.sanchezNo ratings yet

- LN 06 Fixed income notesDocument59 pagesLN 06 Fixed income noteshersanyNo ratings yet

- Mortgage Markets and Derivatives 2Document35 pagesMortgage Markets and Derivatives 2caballerod0343No ratings yet

- Understand Muni Bond Credit RiskDocument4 pagesUnderstand Muni Bond Credit Riskkishore13No ratings yet

- Development of Real Estate Consulting Practice (Mai)Document165 pagesDevelopment of Real Estate Consulting Practice (Mai)rochel95% (20)

- Securitization of DebtDocument52 pagesSecuritization of Debtnjsnghl100% (1)

- Capital Market Services - Issue Management and Processing (Chapter 8)Document24 pagesCapital Market Services - Issue Management and Processing (Chapter 8)SuvajitLaikNo ratings yet

- Securitization of assets: An SEO-optimized titleDocument24 pagesSecuritization of assets: An SEO-optimized titlekhush preet100% (1)

- INTRO TO UNDERWRITING: KEY ROLES & BENEFITSDocument8 pagesINTRO TO UNDERWRITING: KEY ROLES & BENEFITSMonalisa BagdeNo ratings yet

- Debt Securities Market ObjectivesDocument4 pagesDebt Securities Market ObjectivesFaith Barredo InfanteNo ratings yet

- Corporate BankingDocument6 pagesCorporate BankingDeven RanaNo ratings yet

- Fin358 - BondsDocument9 pagesFin358 - Bondsnur amalinaNo ratings yet

- Merchant bankerDocument3 pagesMerchant bankeransh071102No ratings yet

- A Federal Strategic Action Plan On Immigrant & Refugee Integration - April2015 - TheWhiteHouseDocument70 pagesA Federal Strategic Action Plan On Immigrant & Refugee Integration - April2015 - TheWhiteHouseAntonio J FernósNo ratings yet

- Dealing With The Tax Issues: Discount and Premium BondsDocument4 pagesDealing With The Tax Issues: Discount and Premium BondsAntonio J FernósNo ratings yet

- S&P Perspectives On The State of The Municipal Market: Where We Have Been and Where We Are HeadingDocument52 pagesS&P Perspectives On The State of The Municipal Market: Where We Have Been and Where We Are HeadingAntonio J FernósNo ratings yet

- Professionals Involved in A Negotiated Municipal Bond Financing TransactionDocument1 pageProfessionals Involved in A Negotiated Municipal Bond Financing TransactionAntonio J FernósNo ratings yet

- BBrandeis13-22 BrownDocument29 pagesBBrandeis13-22 BrownAntonio J FernósNo ratings yet

- S&P Perspectives On The State of The Municipal Market: Where We Have Been and Where We Are HeadingDocument52 pagesS&P Perspectives On The State of The Municipal Market: Where We Have Been and Where We Are HeadingAntonio J FernósNo ratings yet

- Fama&MacBeth PresentationDocument16 pagesFama&MacBeth PresentationAntonio J FernósNo ratings yet

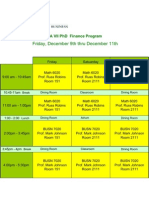

- LA VII PhD Finance Program Schedule Dec 9-11Document1 pageLA VII PhD Finance Program Schedule Dec 9-11Antonio J FernósNo ratings yet

- The Volcker Rule As Proposed QuestionsDocument51 pagesThe Volcker Rule As Proposed QuestionsAntonio J FernósNo ratings yet

- Valet Parking Locations UAEDocument3 pagesValet Parking Locations UAEvineet sharmaNo ratings yet

- Daily Notes: Wilcon Depot, Inc. (pse:WLCON)Document2 pagesDaily Notes: Wilcon Depot, Inc. (pse:WLCON)Anonymous xcFcOgMiNo ratings yet

- Pakistan Oil and Gas - The Undiscovered Value (Detailed Report)Document79 pagesPakistan Oil and Gas - The Undiscovered Value (Detailed Report)Faiz MehmoodNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument59 pagesChapter 4 - Completing The Accounting CycleTâm Lê Hồ HồngNo ratings yet

- Intermediate Accounting Ch1 Test BankDocument21 pagesIntermediate Accounting Ch1 Test Bankgabrielrrr100% (2)

- FAR - Level 1 TestDocument3 pagesFAR - Level 1 TestRay Joseph LealNo ratings yet

- Hire Purchase PDFDocument12 pagesHire Purchase PDFliamNo ratings yet

- Essay On InflationDocument2 pagesEssay On InflationAlyani Korner100% (5)

- GST Invoice for MuleSoft TrainingDocument6 pagesGST Invoice for MuleSoft TrainingSrinivasa HelavarNo ratings yet

- Rencana Bisnis Art Box Creative and Coworking SpaceDocument2 pagesRencana Bisnis Art Box Creative and Coworking SpacesupadiNo ratings yet

- Brockhaus-Long ApproximationDocument8 pagesBrockhaus-Long Approximationmainak.chatterjee03No ratings yet

- Axis Mutual Fund PDFDocument2 pagesAxis Mutual Fund PDFSunil KoricherlaNo ratings yet

- Financial Ratio Analysis of Ciawi HospitalDocument11 pagesFinancial Ratio Analysis of Ciawi Hospitalkristina dewiNo ratings yet

- Fixed Assets and Intangible AssetsDocument73 pagesFixed Assets and Intangible AssetsLay TekchhayNo ratings yet

- Capital BudgetingDocument52 pagesCapital Budgetingrabitha07541No ratings yet

- Jaiib Questions Accounting & Finance Module D Part 1: Current InvestmentsDocument120 pagesJaiib Questions Accounting & Finance Module D Part 1: Current InvestmentsBiswajit DasNo ratings yet

- Contract of Bailment and PledgeDocument6 pagesContract of Bailment and PledgeAnayta SharmaNo ratings yet

- Slides Show - Importance of InsuranceDocument8 pagesSlides Show - Importance of InsuranceVeron Melvin YusakNo ratings yet

- Corporate Governance in Financing and Banking in BangladeshDocument22 pagesCorporate Governance in Financing and Banking in BangladeshAsrafia Mim 1813026630No ratings yet

- Customer Inquiry ReportDocument4 pagesCustomer Inquiry ReportHartito HargiastoNo ratings yet

- Corporate Governance Oversight: External Mechanisms & Regulatory RolesDocument43 pagesCorporate Governance Oversight: External Mechanisms & Regulatory RolesTawsif HasanNo ratings yet

- Private Retirement Scheme (PRS) - A Guide To Malaysia's Voluntary Private Retirement SchemeDocument4 pagesPrivate Retirement Scheme (PRS) - A Guide To Malaysia's Voluntary Private Retirement Scheme阿咪老师MissAmyNo ratings yet

- Finance and Economics - 22 CasesDocument35 pagesFinance and Economics - 22 CasesSeong-uk KimNo ratings yet

- Finan MGT DoneDocument22 pagesFinan MGT DonesnehitachatterjeeNo ratings yet

- Forex StrategyDocument11 pagesForex StrategyNoman Khan100% (1)

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- Tax Incentives Impact SME PerformanceDocument12 pagesTax Incentives Impact SME PerformanceJoe LagalaNo ratings yet

- Basel IiiDocument32 pagesBasel Iiivenkatesh pkNo ratings yet

- VAT ExemptionDocument3 pagesVAT ExemptionJusefNo ratings yet

- Genmath 1 20Document144 pagesGenmath 1 20Oriel Dave100% (4)