Professional Documents

Culture Documents

The Deposit Insurance and Credit Guarantee Corporation

The Deposit Insurance and Credit Guarantee Corporation

Uploaded by

AkshayCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Certificate of AuthenticityDocument3 pagesCertificate of AuthenticitySummerRainNo ratings yet

- Tasks 1 - 3 SBM 2021Document3 pagesTasks 1 - 3 SBM 2021AkshayNo ratings yet

- Draft On Management in Action Project': With Reference ToDocument4 pagesDraft On Management in Action Project': With Reference ToAkshayNo ratings yet

- The Benefits From CSR For A Company and Society: J C R LDocument14 pagesThe Benefits From CSR For A Company and Society: J C R LAkshayNo ratings yet

- Retail and Wholesale IndustriesDocument2 pagesRetail and Wholesale IndustriesAkshayNo ratings yet

- Management in Action On Shree Bhavani GranitesDocument2 pagesManagement in Action On Shree Bhavani GranitesAkshayNo ratings yet

- 10 de Borja vs. Vda. de de BorjaDocument11 pages10 de Borja vs. Vda. de de BorjaSimeon TutaanNo ratings yet

- Valentina S. Clemente GR NO. 175483 October 14, 2015 FactsDocument3 pagesValentina S. Clemente GR NO. 175483 October 14, 2015 FactsWilliam DC RiveraNo ratings yet

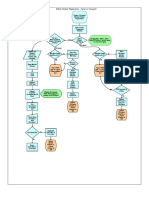

- Mobile Number Reg FlowchartDocument1 pageMobile Number Reg FlowchartKarthikayani PalaniNo ratings yet

- Elc Bistro and Food Inc. Elc Bistro and Food Inc.: Official Receipt Official ReceiptDocument1 pageElc Bistro and Food Inc. Elc Bistro and Food Inc.: Official Receipt Official ReceiptSeyer AprilNo ratings yet

- 20 Very Basic Question Related To Noting and Drafting (For Department of Local Government, Exam)Document2 pages20 Very Basic Question Related To Noting and Drafting (For Department of Local Government, Exam)Chaitanya KumarNo ratings yet

- LAW486 Assessment 1 Group Assignment OctFeb2022Document2 pagesLAW486 Assessment 1 Group Assignment OctFeb2022Aminul HafizNo ratings yet

- Alberta Innovates Work Plan and Budget Workbook - V2 102020Document10 pagesAlberta Innovates Work Plan and Budget Workbook - V2 102020Tayo ShonibareNo ratings yet

- Property - INTERNATIONAL HARDWOOD AND VENEER COMPANY OF THE PHILIPPINES Vs UP, G.R. No. L-52518 August 13, 1991.Document2 pagesProperty - INTERNATIONAL HARDWOOD AND VENEER COMPANY OF THE PHILIPPINES Vs UP, G.R. No. L-52518 August 13, 1991.Lewrej De PerioNo ratings yet

- David M. Gurewitz/State Bar No. 76641 1Document10 pagesDavid M. Gurewitz/State Bar No. 76641 1jmiedeckeNo ratings yet

- LegForms ReportDocument23 pagesLegForms ReportVikki AmorioNo ratings yet

- Walmart - History & Profile: Early Years (1945 - 1969)Document4 pagesWalmart - History & Profile: Early Years (1945 - 1969)vinivasu06No ratings yet

- Scripting Apply The Law of AttractionDocument5 pagesScripting Apply The Law of AttractioncharNo ratings yet

- Seven Principles of The Social Work RelationshipDocument8 pagesSeven Principles of The Social Work RelationshipHay Conserve EcologyNo ratings yet

- SAP SD Transaction Codes ListDocument3 pagesSAP SD Transaction Codes ListsreekanthNo ratings yet

- Friends With Mel Gibson On Jodie Foster PDFDocument2 pagesFriends With Mel Gibson On Jodie Foster PDFTomooTeradaNo ratings yet

- Yanmar 4tna92 98 Repair ManualDocument20 pagesYanmar 4tna92 98 Repair Manualangela100% (58)

- BMT Lending Guidelines and Procedures Nov 2014Document13 pagesBMT Lending Guidelines and Procedures Nov 2014styliiNo ratings yet

- Butterfly Damper InstallationDocument5 pagesButterfly Damper InstallationRepl microsoft, PuneNo ratings yet

- My AnsDocument25 pagesMy AnsNIHARIKA SIROHINo ratings yet

- Huntsville City Council Minutes, May 11Document14 pagesHuntsville City Council Minutes, May 11Kayode CrownNo ratings yet

- IPCR-Lawyer - AS Urbina - July-December 2020Document2 pagesIPCR-Lawyer - AS Urbina - July-December 2020Christian UrbinaNo ratings yet

- Re-KYC NRI FormDocument9 pagesRe-KYC NRI FormPaxton FettelNo ratings yet

- Tagbilaran Integrated Settlers Association (Tisa) vs. Honorable Court of AppealsDocument4 pagesTagbilaran Integrated Settlers Association (Tisa) vs. Honorable Court of AppealsHoven MacasinagNo ratings yet

- NREGA RFP Final CompleteDocument121 pagesNREGA RFP Final CompleteAbhi JitNo ratings yet

- Hurt and Grievous HurtDocument9 pagesHurt and Grievous HurtAshish SinghNo ratings yet

- Arranger AgreementDocument5 pagesArranger AgreementNadym Gulam RasulNo ratings yet

- Notice: Proposed Withdrawal and Opportunity For Public Meeting New MexicoDocument2 pagesNotice: Proposed Withdrawal and Opportunity For Public Meeting New MexicoJustia.comNo ratings yet

- Anti Money: LaunderingDocument49 pagesAnti Money: LaunderingjalzakiNo ratings yet

- ChristianityDocument31 pagesChristianitynnaa.aguilarNo ratings yet

The Deposit Insurance and Credit Guarantee Corporation

The Deposit Insurance and Credit Guarantee Corporation

Uploaded by

AkshayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Deposit Insurance and Credit Guarantee Corporation

The Deposit Insurance and Credit Guarantee Corporation

Uploaded by

AkshayCopyright:

Available Formats

'The Deposit Insurance and Credit Guarantee Corporation

The Deposit Insurance Corporation (DIC) Bill was introduced in the Parliament on August

21, 1961. After it was passed by the Parliament, the Bill got the assent of the President on

December 7, 1961 and the Deposit Insurance Act, 1961 came into force on January 1,

1962. For insuring the bank deposits at the time of Banking crisis or Bankruptcy.

The Government of India, in consultation with the Reserve Bank of India, introduced a Credit

Guarantee Scheme in July 1960. The Reserve Bank of India also promoted a public limited

company on January 14, 1971, named the Credit Guarantee Corporation of India Ltd. (CGCI)

was aimed at encouraging the commercial banks to cater to the credit needs of the hitherto

neglected sectors, particularly the weaker sections of the society engaged in non-industrial

activities, by providing guarantee cover to the loans and advances granted by the credit

institutions to small and needy borrowers covered under the priority sector.

With a view to integrating the functions of deposit insurance and credit guarantee, the above two

organizations (DIC & CGCI) were merged and the present Deposit Insurance and Credit

Guarantee Corporation (DICGC) came into existence on July 15, 1978. Consequently, the title of

Deposit Insurance Act, 1961 was changed to 'The Deposit Insurance and Credit Guarantee

Corporation Act, 1961 '.

The functions of the DICGC are governed by the provisions of 'The Deposit Insurance and

Credit Guarantee Corporation Act, 1961' (DICGC Act)

The authorized capital of the Corporation is 50 crore, which is fully issued and subscribed by

the Reserve Bank of India (RBI). The management of the Corporation vests with its Board of

Directors, of which a Deputy Governor of the RBI is the Chairman. As per the DICGC Act,

the Board shall consist of, besides the Chairman, (nominated by the Central Government in

consultation with the RBI, having special knowledge or practical experience in respect of

accountancy, agriculture and rural economy, banking, co-operation, economics, finance, law

or small scale industry or any other matter which may be considered to be useful to the

Corporation.

The Head Office of the Corporation is at Mumbai. An Executive Director is in overall charge

of its day-to-day operations

Insurance coverage

Initially, under the provisions of Section 16(1) of the DICGC Act, the insurance cover was limited

to 1,500/- only per depositor(s) for deposits held by him (them). However, the Act also empowers

the Corporation to raise this limit with the prior approval of the Central Government. Accordingly,

the insurance limit was enhanced from time to time as follows:

5,000/- with effect from 1st January 1968

10,000/- with effect from 1st April 1970

20,000/- with effect from 1st January 1976

30,000/- with effect from 1st July 1980

1, 00,000/- with effect from 1st May 1993 onwards.

5, 00,000/- with effect from 4th February 2020 onwards.

Types of Deposits Covered

DICGC insures all bank deposits, such as saving, fixed, current, recurring, etc. except the

following types of deposits.

Deposits of foreign Governments;

Deposits of Central/State Governments;

Inter-bank deposits

The premium paid by the insured banks to the Corporation is required to be absorbed by the

banks themselves so that the benefit of deposit insurance protection is made available to the

depositors free of cost. The formula for working out the half-yearly premium is as follows: -

Deposits in rupees rounded to thousands X 0.06 / 100

The deposits should be rounded off to the nearest thousand Rupees

Accounts

The Corporation maintains the following Funds:

Deposit Insurance Fund

Credit Guarantee Fund

General Fund

The first two are funded respectively by the insurance premia and guarantee fees received and

are utilised for settlement of the respective claims.The General Fund is utilised for meeting the

establishment and administrative expenses of the Corporation.

The surplus balances in all the three Funds are invested in Central Government securities which

is the only investment permissible under the Deposit Insurance and Credit Guarantee

Corporation Act, 1961 and the income derived out of such investments is credited to the

respective Funds. Inter-Fund transfer is permissible and if there is a shortfall in one of the Funds,

it is made good by transfer from either of the other two Funds.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Certificate of AuthenticityDocument3 pagesCertificate of AuthenticitySummerRainNo ratings yet

- Tasks 1 - 3 SBM 2021Document3 pagesTasks 1 - 3 SBM 2021AkshayNo ratings yet

- Draft On Management in Action Project': With Reference ToDocument4 pagesDraft On Management in Action Project': With Reference ToAkshayNo ratings yet

- The Benefits From CSR For A Company and Society: J C R LDocument14 pagesThe Benefits From CSR For A Company and Society: J C R LAkshayNo ratings yet

- Retail and Wholesale IndustriesDocument2 pagesRetail and Wholesale IndustriesAkshayNo ratings yet

- Management in Action On Shree Bhavani GranitesDocument2 pagesManagement in Action On Shree Bhavani GranitesAkshayNo ratings yet

- 10 de Borja vs. Vda. de de BorjaDocument11 pages10 de Borja vs. Vda. de de BorjaSimeon TutaanNo ratings yet

- Valentina S. Clemente GR NO. 175483 October 14, 2015 FactsDocument3 pagesValentina S. Clemente GR NO. 175483 October 14, 2015 FactsWilliam DC RiveraNo ratings yet

- Mobile Number Reg FlowchartDocument1 pageMobile Number Reg FlowchartKarthikayani PalaniNo ratings yet

- Elc Bistro and Food Inc. Elc Bistro and Food Inc.: Official Receipt Official ReceiptDocument1 pageElc Bistro and Food Inc. Elc Bistro and Food Inc.: Official Receipt Official ReceiptSeyer AprilNo ratings yet

- 20 Very Basic Question Related To Noting and Drafting (For Department of Local Government, Exam)Document2 pages20 Very Basic Question Related To Noting and Drafting (For Department of Local Government, Exam)Chaitanya KumarNo ratings yet

- LAW486 Assessment 1 Group Assignment OctFeb2022Document2 pagesLAW486 Assessment 1 Group Assignment OctFeb2022Aminul HafizNo ratings yet

- Alberta Innovates Work Plan and Budget Workbook - V2 102020Document10 pagesAlberta Innovates Work Plan and Budget Workbook - V2 102020Tayo ShonibareNo ratings yet

- Property - INTERNATIONAL HARDWOOD AND VENEER COMPANY OF THE PHILIPPINES Vs UP, G.R. No. L-52518 August 13, 1991.Document2 pagesProperty - INTERNATIONAL HARDWOOD AND VENEER COMPANY OF THE PHILIPPINES Vs UP, G.R. No. L-52518 August 13, 1991.Lewrej De PerioNo ratings yet

- David M. Gurewitz/State Bar No. 76641 1Document10 pagesDavid M. Gurewitz/State Bar No. 76641 1jmiedeckeNo ratings yet

- LegForms ReportDocument23 pagesLegForms ReportVikki AmorioNo ratings yet

- Walmart - History & Profile: Early Years (1945 - 1969)Document4 pagesWalmart - History & Profile: Early Years (1945 - 1969)vinivasu06No ratings yet

- Scripting Apply The Law of AttractionDocument5 pagesScripting Apply The Law of AttractioncharNo ratings yet

- Seven Principles of The Social Work RelationshipDocument8 pagesSeven Principles of The Social Work RelationshipHay Conserve EcologyNo ratings yet

- SAP SD Transaction Codes ListDocument3 pagesSAP SD Transaction Codes ListsreekanthNo ratings yet

- Friends With Mel Gibson On Jodie Foster PDFDocument2 pagesFriends With Mel Gibson On Jodie Foster PDFTomooTeradaNo ratings yet

- Yanmar 4tna92 98 Repair ManualDocument20 pagesYanmar 4tna92 98 Repair Manualangela100% (58)

- BMT Lending Guidelines and Procedures Nov 2014Document13 pagesBMT Lending Guidelines and Procedures Nov 2014styliiNo ratings yet

- Butterfly Damper InstallationDocument5 pagesButterfly Damper InstallationRepl microsoft, PuneNo ratings yet

- My AnsDocument25 pagesMy AnsNIHARIKA SIROHINo ratings yet

- Huntsville City Council Minutes, May 11Document14 pagesHuntsville City Council Minutes, May 11Kayode CrownNo ratings yet

- IPCR-Lawyer - AS Urbina - July-December 2020Document2 pagesIPCR-Lawyer - AS Urbina - July-December 2020Christian UrbinaNo ratings yet

- Re-KYC NRI FormDocument9 pagesRe-KYC NRI FormPaxton FettelNo ratings yet

- Tagbilaran Integrated Settlers Association (Tisa) vs. Honorable Court of AppealsDocument4 pagesTagbilaran Integrated Settlers Association (Tisa) vs. Honorable Court of AppealsHoven MacasinagNo ratings yet

- NREGA RFP Final CompleteDocument121 pagesNREGA RFP Final CompleteAbhi JitNo ratings yet

- Hurt and Grievous HurtDocument9 pagesHurt and Grievous HurtAshish SinghNo ratings yet

- Arranger AgreementDocument5 pagesArranger AgreementNadym Gulam RasulNo ratings yet

- Notice: Proposed Withdrawal and Opportunity For Public Meeting New MexicoDocument2 pagesNotice: Proposed Withdrawal and Opportunity For Public Meeting New MexicoJustia.comNo ratings yet

- Anti Money: LaunderingDocument49 pagesAnti Money: LaunderingjalzakiNo ratings yet

- ChristianityDocument31 pagesChristianitynnaa.aguilarNo ratings yet