Professional Documents

Culture Documents

Accounting For Private Not-For-Profit Organizations: Acc316/413 2 Sem SY 2020-2021

Accounting For Private Not-For-Profit Organizations: Acc316/413 2 Sem SY 2020-2021

Uploaded by

Ma Teresa B. CerezoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Private Not-For-Profit Organizations: Acc316/413 2 Sem SY 2020-2021

Accounting For Private Not-For-Profit Organizations: Acc316/413 2 Sem SY 2020-2021

Uploaded by

Ma Teresa B. CerezoCopyright:

Available Formats

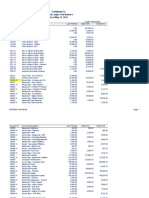

Acc316/413

2nd sem SY 2020-2021

UNIVERSITY OF LUZON

COLLEGE OF ACCOUNTANCY

ACCOUNTING FOR PRIVATE NOT-FOR-PROFIT ORGANIZATIONS

The following information was taken from the accounts and records of the Samaritan Foundation, a

private no-for-profit organization. The balances are as of December 31, 2020, unless otherwise noted:

Unrestricted support – contribution P5,000,000

Unrestricted support – membership dues 600,000

Unrestricted revenues – investment income 96,000

Temporarily restricted gain on sale of investments 9,000

Expenses – research 3,200,000

Expenses – fund raising 700,000

Expenses – management and general 300,000

Temporarily restricted support – contributions 600,000

Temporarily restricted revenues – investment income 50,000

Permanently restricted support – contributions 60,000

Unrestricted net assets, January 1, 2020 500,000

Temporarily restricted net assets, January 1, 2020 6,000,000

Permanently restricted net assets, January 1, 2020 50,000

The unrestricted support from contributions was all received in cash during the year. The expenses

included P1,300,000 payable from donor-restricted net assets.

Required: Statement of Activities for 2020 (columnar format in MS excel)

You might also like

- AFAR8722 - Nonprofit Organizations PDFDocument2 pagesAFAR8722 - Nonprofit Organizations PDFSid Tuazon100% (1)

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixieNo ratings yet

- Lesson 6 - Cash Flows PDFDocument40 pagesLesson 6 - Cash Flows PDFChy B80% (5)

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Statement of Cash FlowDocument24 pagesStatement of Cash FlowUgly Duckling0% (1)

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Statement of Financial PositionDocument3 pagesStatement of Financial Positionlyka0% (1)

- FundamentalsofABM2 Q1 M5Revised.-1Document12 pagesFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Unit 1 - 4-AK2Document8 pagesUnit 1 - 4-AK2ayeshaNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Cash Flow Statement (CFS)Document8 pagesCash Flow Statement (CFS)KhayNo ratings yet

- Senior High School Department: LessonDocument10 pagesSenior High School Department: LessonJane Decenine CativoNo ratings yet

- Final Individual Assignment - 4 Nov 2022Document6 pagesFinal Individual Assignment - 4 Nov 2022Vernice CuffyNo ratings yet

- Topic 2 - Af09101 - Financial StatementsDocument42 pagesTopic 2 - Af09101 - Financial Statementsarusha afroNo ratings yet

- CH 16 Practice SolutionsDocument9 pagesCH 16 Practice SolutionsaaaNo ratings yet

- CH 2 - Investasi SahamDocument42 pagesCH 2 - Investasi SahamJulia Pratiwi ParhusipNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- FAR Final Preboards (May 2023)Document19 pagesFAR Final Preboards (May 2023)John DoeNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Gov AcctngDocument15 pagesGov AcctngAtiene VillanuevaNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- 4 Template PPT4Document11 pages4 Template PPT4ダイ アンNo ratings yet

- Skills MARCH... JULY 2020 #IfrsiseasyDocument138 pagesSkills MARCH... JULY 2020 #IfrsiseasyEniola OlakunleNo ratings yet

- Accounting 2Document3 pagesAccounting 2cherryannNo ratings yet

- Pathfinder May 2018 ProfessionalDocument162 pagesPathfinder May 2018 ProfessionalJason Baba KwagheNo ratings yet

- CLOSURE ACTIVITIES-Answer Key (Cash and Accrual Basis and Single Entry)Document6 pagesCLOSURE ACTIVITIES-Answer Key (Cash and Accrual Basis and Single Entry)Jamaica DavidNo ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- Wahyudi-Syaputra Homework-10Document5 pagesWahyudi-Syaputra Homework-10Wahyudi SyaputraNo ratings yet

- Ex 2-3 PPT: Prepare The Necessary Journal Entries in Klaus AG's Book From The Above InformationDocument4 pagesEx 2-3 PPT: Prepare The Necessary Journal Entries in Klaus AG's Book From The Above InformationBryan LukeNo ratings yet

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanNo ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- (Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Document2 pages(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Irene ArantxaNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Corporate Reporting 3.1 Icag PDFDocument30 pagesCorporate Reporting 3.1 Icag PDFmohed0% (1)

- Suria BHD Income Statement For The Year Ended (RM'000) SalesDocument3 pagesSuria BHD Income Statement For The Year Ended (RM'000) SalesAzzurin ArissaNo ratings yet

- BSA32 (Team 5) Team Task - University of San Jose RecoletosDocument11 pagesBSA32 (Team 5) Team Task - University of San Jose RecoletosVon Andrei MedinaNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- Intacc Chapter 49-50Document17 pagesIntacc Chapter 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Solution To Problems - Chapter 10Document14 pagesSolution To Problems - Chapter 10GFGSHSNo ratings yet

- Tugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Cuenco, Julie Ann (Bsa 1-1) Activity #7 CfasDocument2 pagesCuenco, Julie Ann (Bsa 1-1) Activity #7 CfasJulie Ann CuencoNo ratings yet

- CHAPTER 17 Investment in AssociatesDocument18 pagesCHAPTER 17 Investment in AssociatesJohn CentinoNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- Seminar 12.2 Outline - Auditing of Group Financial Statements IIDocument6 pagesSeminar 12.2 Outline - Auditing of Group Financial Statements IIJasmine TayNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- Direct LaborDocument8 pagesDirect LaborAreli DuyoNo ratings yet

- Week 06 - 03 - Module 15 - Fund and Other Types of Investment & DerivativesDocument16 pagesWeek 06 - 03 - Module 15 - Fund and Other Types of Investment & Derivatives지마리No ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- The Problems of Hospital AccountingDocument3 pagesThe Problems of Hospital AccountingPoppy VaniaNo ratings yet

- CA23 Financial Reporting and AnalysisDocument6 pagesCA23 Financial Reporting and AnalysisBENSON NGARINo ratings yet

- Village of Parry Print Shop Fund Statement of Cash Flows For The Year Ended April 30, 2017Document1 pageVillage of Parry Print Shop Fund Statement of Cash Flows For The Year Ended April 30, 2017deepakdohare1011No ratings yet

- Chapter18 BuenaventuraDocument6 pagesChapter18 BuenaventuraAnonnNo ratings yet

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsFrom EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachDocument2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Full Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Ma Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 6Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 6Ma Teresa B. CerezoNo ratings yet

- Company Ex - Trial Balance - 2012Document7 pagesCompany Ex - Trial Balance - 2012Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Document4 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 4 & 5Ma Teresa B. CerezoNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Document2 pagesChapter 15 Afar Solman (Dayag 2015ed) - Prob 3 Case 1 & 2Ma Teresa B. CerezoNo ratings yet

- Incremental Analysis QiuzzerDocument4 pagesIncremental Analysis QiuzzerMa Teresa B. CerezoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Document2 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 3 Case 3 & 4Ma Teresa B. CerezoNo ratings yet

- Account ID Account Description: Company ExDocument14 pagesAccount ID Account Description: Company ExMa Teresa B. CerezoNo ratings yet

- Statement of CF Company Ex - 2012Document3 pagesStatement of CF Company Ex - 2012Ma Teresa B. CerezoNo ratings yet