Professional Documents

Culture Documents

Check Account Summary

Uploaded by

Юлия ПOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Check Account Summary

Uploaded by

Юлия ПCopyright:

Available Formats

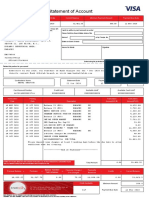

Date 3/29/19 Page 1

Account number 0000000009124845

Roating number 082900432

DAVID E HINTON

POD

NCA

55 N ARBOR TRL

PARK FORES IL 60466

CHECKING ACCOUNTS

Money Market Savings Number of Enclosures 1

Account Number 0000000009124845 Statement Dates 3/09/20 thru4/28/20

Previous Balance 5,161.11 Days in the statement period 31

Deposits/Credits Average Ledger 6,451.43

Service Charge Average Collected 6,451.43

Interest Paid Current Balance 4,259.12 Interest Earned 25.03

Annual Percentage Yield Earned 0.15%

2020 Interest Paid 82.30

Deposits and Additions

Date Description Amount

3/09 Deposit 100.00

3/31 Interest Deposit 1.07

4/22 Funds ROBINHOOD David Hinton 0.27

4/22 Funds ROBINHOOD David Hinton 0.19

4/28 Funds ROBINHOOD 1000.00

4/28 Funds ROBINHOOD 0.46

* Denotes skip in sequential check numbers

Daily Balance Information

Date Balance Date Balance Date Balance

3/01 5,161.11 3/01 5,161.11 5/04 4,259.12

Thank you for banking with Simmons Bank.

************************** END OF STATEMENT ****************************

ADDRESS OR NAME CHANGES – You are responsible for notifying us of any change in your address or your name. Unless we agree otherwise, change of

address or name must be made in writing by at least one of the account holders. Informing us of your address or name change on a check reorder form is not

sufficient. We will attempt to communicate with you only by use of the most recent address you have provided to us. If we receive returned mail, we may

impose a service fee.

IF YOUR ADDRESS IS INCORRECT, MARK THROUGH THE ADDRESS PLEASE CHANGE MY ADDRESS TO:

SHOWN ON THE FRONT OF THIS STATEMENT. COMPLETE THE FORM

STREET

AT THE RIGHT, DETACH AND MAIL TO P. O. BOX 7009, PINE BLUFF, AR

71603-7009.

CITY STATE ZIP CODE

EFFECTIVE DATE SIGNATURE

PLEASE CHANGE MY ADDRESS

TYPE OF ATM / DEBIT

ON FOLLOWING ACCOUNTS. CHECKING SAVINGS LOAN CD OTHER

ACCOUNT CARD

ACCOUNT

List all accounts you want changed.

NUMBER

We will change only the accounts you

indicate since some customers prefer ACCOUNT

to maintain separate account NUMBER

addresses.

PLEASE EXAMINE YOUR STATEMENT PROMPTLY AND NOTIFY US OF ANY ERRORS

RECONCILEMENT INFORMATION

These 6 Fast, Easy Steps Will

(1) Balance now shown in your checking........................................ $_____________

Reconcile The Balance Shown On

(2) Add interest shown on the statement ......................................... $_____________

This Statement With The Balance

(3) Subtract bank charges included in this statement. (be sure Shown In Your Checkbook

to enter any Bank charges and unrecorded checks in your

checkbook)................................................................................ $_____________

NEW BALANCE SHOWN

IN YOUR CHECKBOOK.................... $_____________

(4) Last balance shown on this statement......................................... $_____________

(5) Add total of those deposits which have been made

and shown in your checkbook, but not yet shown

on this statement........................................................................ $_____________

SUB-TOTALS $_____________

(6) List outstanding checks below (checks which are shown

in your checkbook, but not yet paid by the bank.)

CHECK AMOUNT CHECK AMOUNT

NUMBER NUMBER

If they are not the same, recheck your

figures. If still not the same, please

call Customer Service.

1-866 246 2400 Toll Free

TOTAL $_____________

SUBTRACT THIS TOTAL

OF OUTSTANDING $_____________

CHECKS FROM SUB-TOTAL ABOVE $_____________

ELECTRONIC TRANSFER ERROR RESOLUTION NOTICE (CONSUMER ACCOUNTS ONLY)

In case of Errors or Questions about your Electronic Transfer, call us at 1-866-246-2400 or write to us at P. O. Box 7009. Pine Bluff, AR 71611-7009, as soon as you can, if you think

your statement or receipt is wrong, or if you need more information about a transfer listed on a statement or a receipt. We must hear from you no later than 60 days after we sent the

FIRST statement on which the problem or error appeared .

(1) Tell us your name and account number (if any).

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

We will investigate your complaint and will correct any error promptly. If we take more than 10 business days to do this, we will credit your account for the amount you think is in error, so

that you will have use of the money during the time it takes us to complete our investigation.

You might also like

- Summary of Account Activity Payment InformationDocument4 pagesSummary of Account Activity Payment InformationAnonymous 7DmNfQeSQNo ratings yet

- Explanation of Amount Due: Account Summary Past Payments BreakdownDocument3 pagesExplanation of Amount Due: Account Summary Past Payments BreakdownTribe Of JudahNo ratings yet

- Estmt - 2016 08 31 PDFDocument4 pagesEstmt - 2016 08 31 PDFAnonymous dVQ61xYNo ratings yet

- Statement Dec 2011Document2 pagesStatement Dec 2011Iris KhanashatNo ratings yet

- 000 Citibank Client Services 000 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 000 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AKeiver jimenezNo ratings yet

- Peach State Federal Credit Union StatementsDocument6 pagesPeach State Federal Credit Union StatementsPeter MichaelsonNo ratings yet

- Ally-Bank-Statement - Helen ZhaoDocument4 pagesAlly-Bank-Statement - Helen ZhaoJonathan Seagull Livingston100% (1)

- Your Statement PDFDocument6 pagesYour Statement PDFpattiNo ratings yet

- Bank StatementDocument4 pagesBank StatementKristin BrooksNo ratings yet

- TD Simple Checking: Account SummaryDocument2 pagesTD Simple Checking: Account SummaryMD MasumNo ratings yet

- Unknown PDFDocument2 pagesUnknown PDFMadalina MadaNo ratings yet

- Statement Summary: Statement Period Account NumberDocument5 pagesStatement Summary: Statement Period Account NumberSharon JonesNo ratings yet

- This Study Resource Was: Fifth Third Business PlusDocument2 pagesThis Study Resource Was: Fifth Third Business PlusPatsy HilllNo ratings yet

- Quick Bill Summary: Change To Your ServiceDocument1 pageQuick Bill Summary: Change To Your ServiceЮлия П50% (6)

- Statement PDFDocument8 pagesStatement PDFklymsolutions100% (4)

- Feb 29 2020Document2 pagesFeb 29 2020Юлия П50% (2)

- Feb 29 2020Document2 pagesFeb 29 2020Юлия П50% (2)

- Feb 29 2020Document2 pagesFeb 29 2020Юлия П50% (2)

- Feb 29 2020Document2 pagesFeb 29 2020Юлия П50% (2)

- Chase Bank Statement BankStatements - Net SepDocument4 pagesChase Bank Statement BankStatements - Net SepJoe SFNo ratings yet

- Equity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Document5 pagesEquity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Test000001No ratings yet

- Vault GuideDocument414 pagesVault Guidethum_liangNo ratings yet

- Estmt - 2022 12 31Document4 pagesEstmt - 2022 12 31anastasiya DubininaNo ratings yet

- January 31, 2021Document1 pageJanuary 31, 2021Юлия ПNo ratings yet

- For Clients Usinga TDD/TTY Device, Please Call 1-800-539-8396Document1 pageFor Clients Usinga TDD/TTY Device, Please Call 1-800-539-8396James JenkinsNo ratings yet

- Sample Bank StatementDocument4 pagesSample Bank StatementSinchai Jones100% (1)

- TD Mar 2021Document8 pagesTD Mar 2021James FranklinNo ratings yet

- 000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AMónica M. RodríguezNo ratings yet

- Simply Jordan TD Bank Statement Andrew Oct 2021Document2 pagesSimply Jordan TD Bank Statement Andrew Oct 2021MD MasumNo ratings yet

- Citibank business account statement summaryDocument8 pagesCitibank business account statement summaryKumar100% (1)

- STMT 20210131Document2 pagesSTMT 20210131manonmani somasundaramNo ratings yet

- Statements 6792Document2 pagesStatements 6792muchas guataNo ratings yet

- Statement PDFDocument5 pagesStatement PDFYash EmrithNo ratings yet

- January e StatementDocument3 pagesJanuary e Statement76xzv4kk5vNo ratings yet

- 164152336 Aug 30 2013ыыыыDocument2 pages164152336 Aug 30 2013ыыыыЮлия П0% (1)

- Your Consolidated Statement: Contact UsDocument5 pagesYour Consolidated Statement: Contact UsSAM50% (2)

- Westpac Choice: Stacey Greenwood Reginald 36 Reginald Pde Craigmore Sa 5114Document26 pagesWestpac Choice: Stacey Greenwood Reginald 36 Reginald Pde Craigmore Sa 5114stacyNo ratings yet

- Your September 2021 Memo StatementDocument2 pagesYour September 2021 Memo StatementВалентина Швечикова100% (1)

- BANK Four Star Checking 4446Document1 pageBANK Four Star Checking 4446Юлия ПNo ratings yet

- Westpac Business Account Summary Provides Details on Transactions and BalanceDocument3 pagesWestpac Business Account Summary Provides Details on Transactions and BalanceLaurence SunNo ratings yet

- BankStatement PDFDocument1 pageBankStatement PDFsantiago ospinaNo ratings yet

- Operation Statement 12.07.2022Document1 pageOperation Statement 12.07.2022Юлия ПNo ratings yet

- Sankmobile: Summary of Account BalanceDocument10 pagesSankmobile: Summary of Account BalanceSAMNo ratings yet

- DELTA CCU Business Premier Checking: Account SummyarDocument1 pageDELTA CCU Business Premier Checking: Account SummyarSAMNo ratings yet

- 000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. Afortha loveof100% (1)

- Summary of Accounts: Contacting UsDocument5 pagesSummary of Accounts: Contacting UsJohn0% (1)

- Chase B Statement-MarDocument4 pagesChase B Statement-MarЮлия ПNo ratings yet

- Chase B Statement-MarDocument4 pagesChase B Statement-MarЮлия ПNo ratings yet

- BOA StatementDocument3 pagesBOA Statementstanjh2012No ratings yet

- Avery Houston Patterson 2118 10TH PL'W BIRMINGHAM AL 35204-1309 20107016615Document2 pagesAvery Houston Patterson 2118 10TH PL'W BIRMINGHAM AL 35204-1309 20107016615Tesatee0% (1)

- American ExpressDocument3 pagesAmerican ExpressЮлия ПNo ratings yet

- American ExpressDocument3 pagesAmerican ExpressЮлия ПNo ratings yet

- American ExpressDocument3 pagesAmerican ExpressЮлия ПNo ratings yet

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account SummaryedgarNo ratings yet

- Chase College Checking StatementDocument4 pagesChase College Checking StatementЮлия П100% (1)

- Chase College Checking StatementDocument4 pagesChase College Checking StatementЮлия П100% (1)

- Chase College Checking StatementDocument4 pagesChase College Checking StatementЮлия П100% (1)

- Payoneer Account Statement: Amazon Registered Seller DetailsDocument1 pagePayoneer Account Statement: Amazon Registered Seller DetailsĐào Văn CườngNo ratings yet

- 000 Citibank Client Services 008 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 008 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AqjianNo ratings yet

- 01-15-2016 PDFDocument6 pages01-15-2016 PDFAnonymous CuFbT1NswYNo ratings yet

- Synovus Statement JulDocument2 pagesSynovus Statement JulВалентина Швечикова100% (1)

- List PDFDocument4 pagesList PDFMartita LuevanoNo ratings yet

- 000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AS RNo ratings yet

- Lyndsie Barnes BankDocument4 pagesLyndsie Barnes BankJaram JohnsonNo ratings yet

- Manage your credit card statementDocument1 pageManage your credit card statementAbdul AleemNo ratings yet

- NationwideDocument1 pageNationwideЮлия ПNo ratings yet

- View Statement ImageDocument3 pagesView Statement ImageJackson340No ratings yet

- Your Military - Land Adv Safebalance Banking: Account SummaryDocument4 pagesYour Military - Land Adv Safebalance Banking: Account SummaryDairin DuarteNo ratings yet

- Bank Statement 4Document4 pagesBank Statement 4Alfred CardonaNo ratings yet

- Justin Hermanson: 231 Valley Farms Street Santa Monica, CA 90403Document2 pagesJustin Hermanson: 231 Valley Farms Street Santa Monica, CA 90403Gary Joel Galva BlancoNo ratings yet

- LCD79741Document3 pagesLCD79741donglaiduyNo ratings yet

- Bank Statement March - 2019Document13 pagesBank Statement March - 2019Rowella De MesaNo ratings yet

- ss4 PDFDocument4 pagesss4 PDFЮлия ПNo ratings yet

- DICTIOFORMULA Audit of CashDocument13 pagesDICTIOFORMULA Audit of CashEza Joy ClaveriasNo ratings yet

- Cebos Noa078237 PDFDocument1 pageCebos Noa078237 PDFGV ArredamentiNo ratings yet

- Nick Atkins 1Document1 pageNick Atkins 1Юлия ПNo ratings yet

- Bill 05122022Document2 pagesBill 05122022Юлия ПNo ratings yet

- KB Energy, LLCDocument1 pageKB Energy, LLCЮлия ПNo ratings yet

- Avalanche Bank Statement 26.02.2021Document2 pagesAvalanche Bank Statement 26.02.2021HerbertNo ratings yet

- Trader TemplateDocument4 pagesTrader TemplateAndre ParnellNo ratings yet

- Police Circular On Sexual Offences Mumbai Aug 30 2013Document4 pagesPolice Circular On Sexual Offences Mumbai Aug 30 2013Kimberly WrightNo ratings yet

- 651015812554 bill 0512202п2Document2 pages651015812554 bill 0512202п2Юлия ПNo ratings yet

- Control in Logistics Purpose IntegrationDocument23 pagesControl in Logistics Purpose IntegrationRohit shahiNo ratings yet

- Pay Advice CIP2231022548Document1 pagePay Advice CIP2231022548Юлия ПNo ratings yet

- Andrew Mono LLC Andrew Feller 8995 W Inca CT BOISE ID 83709: Account Summary VIP Interest Checking 070159215240784Document3 pagesAndrew Mono LLC Andrew Feller 8995 W Inca CT BOISE ID 83709: Account Summary VIP Interest Checking 070159215240784Юлия ПNo ratings yet

- Factura ENEL NR 22MI17068251 10 11 2022gDocument1 pageFactura ENEL NR 22MI17068251 10 11 2022gЮлия ПNo ratings yet

- (GEO) Telmico (Electricity)Document1 page(GEO) Telmico (Electricity)Юлия ПNo ratings yet

- Manage your everyday account onlineDocument6 pagesManage your everyday account onlineGhassan Mousa50% (2)

- Attachment 1SADocument10 pagesAttachment 1SA76xzv4kk5vNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- 2022-11-30 Statement - USB Nkul Betis 2591-2Document4 pages2022-11-30 Statement - USB Nkul Betis 2591-276xzv4kk5vNo ratings yet

- USAA Bank Statement 2 Page 1Document3 pagesUSAA Bank Statement 2 Page 1Adnan HussainNo ratings yet

- 2202 Schedule of Liabilities-508Document1 page2202 Schedule of Liabilities-508Юлия ПNo ratings yet

- Stanley Chinedu Nwafor 1422102310 20210130092323Document1 pageStanley Chinedu Nwafor 1422102310 20210130092323Юлия ПNo ratings yet

- MDI Placement-1Document87 pagesMDI Placement-1Aditya GavadeNo ratings yet

- Basic Accounting1Document7 pagesBasic Accounting1Melvs100% (1)

- Digital Fundraising - Pandemic Situation - SAIDocument17 pagesDigital Fundraising - Pandemic Situation - SAIHelmi SonhajiNo ratings yet

- 15A05502 Computer NetworksDocument1 page15A05502 Computer NetworksJaya SankarNo ratings yet

- Ar 101Document2 pagesAr 101GraceeyNo ratings yet

- USPS Shipping Overseas USPS Shipping Overseas USPS Shipping Overseas USPS Shipping OverseasDocument13 pagesUSPS Shipping Overseas USPS Shipping Overseas USPS Shipping Overseas USPS Shipping OverseasaldilnojinjaloNo ratings yet

- Cyber Park, Sector 39 Unitech Cyber Park, Sector-39 Gurgaon IndiaDocument2 pagesCyber Park, Sector 39 Unitech Cyber Park, Sector-39 Gurgaon IndiaSubhadeep GhoshNo ratings yet

- A Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Document98 pagesA Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Md MubashirNo ratings yet

- Fmi 2Document41 pagesFmi 2Lebbe PuthaNo ratings yet

- TD-W8960N (EU) V8 DatasheetDocument5 pagesTD-W8960N (EU) V8 DatasheetSimon AntonyNo ratings yet

- Hyd To PuneDocument2 pagesHyd To PuneSarathBattaNo ratings yet

- Walmart Case SolutionDocument4 pagesWalmart Case SolutionAnubhav Kumar100% (2)

- FINANCIAL ACCOUNT YEAR 10 2nd Term TERM TESTDocument4 pagesFINANCIAL ACCOUNT YEAR 10 2nd Term TERM TESTJanet HarryNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 12107, 06-Apr-2023, SL, VGLJ - ASHDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 12107, 06-Apr-2023, SL, VGLJ - ASHSachinNo ratings yet

- Import Export Management ReportDocument14 pagesImport Export Management ReportAsfand375yar KhanNo ratings yet

- Assignment On Insurance Policy Method Abd Sinking Fund MethodsDocument2 pagesAssignment On Insurance Policy Method Abd Sinking Fund Methodsgaurav prajapatiNo ratings yet

- Flight Ticket - New Delhi To Guwahati: (Economy)Document2 pagesFlight Ticket - New Delhi To Guwahati: (Economy)Hamom BijayaNo ratings yet

- How To Create VIRAL Talking A.I Generated VideosDocument9 pagesHow To Create VIRAL Talking A.I Generated VideosBrilliance TNo ratings yet

- (M2M), Skynet or Internet of EverythingDocument15 pages(M2M), Skynet or Internet of EverythingAdil AhmedNo ratings yet

- Fund and Non Fund Based BankingDocument17 pagesFund and Non Fund Based BankingPrajakta SamantNo ratings yet

- Curriculum Vitae: Career ObjectiveDocument4 pagesCurriculum Vitae: Career ObjectiveNaveen LagishettyNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument2 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoWilliam AsunNo ratings yet

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- Fazle Omar Hospital-04052023QMSDocument2 pagesFazle Omar Hospital-04052023QMSjunaid ahmadNo ratings yet

- Customer Type Account Manager Order Priority Ship Mode Order TotalDocument44 pagesCustomer Type Account Manager Order Priority Ship Mode Order Totalashwin shresthaNo ratings yet

- Research Paper TopicsDocument9 pagesResearch Paper TopicsAnju VipulNo ratings yet