Professional Documents

Culture Documents

Nama: Cellila Aditama NIM: 2301875931

Uploaded by

Kezia N. ApriliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nama: Cellila Aditama NIM: 2301875931

Uploaded by

Kezia N. ApriliaCopyright:

Available Formats

Nama: Cellila Aditama

NIM: 2301875931

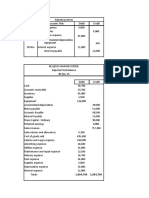

P 10 -1A a) Transaction Journal

Tgl

5-Jan Cash € 22,470

Sales € 21,000

Sales tax payable € 1,470

12-Jan unearned service revenue € 10,000

service revenue € 10,000

14-Jan sales tax payable € 5,800

cash € 5,800

20-Jan account receivable € 38,948

sales € 36,400

sales tax payable € 2,548

21-Jan cash € 14,000

notes payable € 14,000

25-Jan cash € 12,947

sales € 12,100

sales tax payable € 847

b) adjusting journal entries

Tgl

31-Jan Interest expense € 23.33

interest payable € 23.33

c) current liabilities account

Notes payable € 14,000

accounts payable € 52,000

unearned service revenue € 3,000

sales tax payable € 4,865

interest payable € 23

total current liabilities € 73,888

P10 - 2A tgl

2-Jan Purchases € 30,000

accounts payable € 30,000

1-Feb account payable € 30,000

notes payable € 30,000

31-Mar interest expense € 300

interest payable € 300

1-Apr notes payable € 30,000

interest payable € 300

cash € 30,300

1-Jul equipment € 48,000

cash € 8,000

notes payable € 40,000

30-Sep interest expense € 700

interest payable € 700

1-Oct notes payable € 40,000

interest payable € 700

cash € 40,700

1-Dec cash € 15,000

notes payable € 15,000

31-Dec interest expense € 75

interest payable € 75

b) T-accounts

notes payable

1-Apr € 30,000 € 30,000 1-Feb

1-Oct € 40,000 € 40,000 1-Jul

€ 15,000 1-Dec

€ 15,000

interest payable

1-Apr € 300 € 300 31-Mar

1-Oct € 700 € 700 30-Sep

€ 75 31-Dec

€ 75

interest expense

31-Mar € 300

30-Sep € 700

31-Dec € 75

€ 1,075

c) Current liabilities

notes payable € 15,000

interest payable € 75

d) total interest expense is € 1,075

P10 - 3A a) journal entry

1-May cash € 600,000

bonds payable € 600,000

b)

31-Dec bonds interest expense € 36,000

bond interest payable € 36,000

c) non current liabilities

bonds payable € 600,000

current liabilities

bond interest payable € 36,000

d) bond interest payable € 36,000

bond interest expense € 14,000

cash € 50,000

e) bond interest expense € 36,000

cash € 36,000

f) bond payable € 600,000

loss on bond redemtion € 12,000

cash € 612,000

P10 - 4A a) journal entry

1-Jan cash € 5,880,000

discount on bonds payable € 120,000

bonds payable € 6,000,000

b) non current liabilities

bonds payable € 5,888,000

current liabilities

bonds interest payable € 39,253

c)

1-Jan bonds payable € 6,000,000

loss on bond redemtion € 224,000

cash € 6,120,000

€ 104,000

carrying value of bonds at 1-Jan-2019 € 5,896,000

market value of bonds at 1-Jan-2019 € 6,120,000

€ 224,000

You might also like

- Jimenez Enterprises journal entries and financial statementsDocument9 pagesJimenez Enterprises journal entries and financial statementshelmyNo ratings yet

- E7 11Document2 pagesE7 11-kuro Yuki-No ratings yet

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaNo ratings yet

- Bank Reconciliation and Adjusting Entries for Aglife GeneticsDocument9 pagesBank Reconciliation and Adjusting Entries for Aglife GeneticsDetha Prasetio KumaraNo ratings yet

- Chapter 1 - Accounting Equation - CorporationDocument37 pagesChapter 1 - Accounting Equation - CorporationadriamNo ratings yet

- E5-19 Journal EntriesDocument15 pagesE5-19 Journal EntriesDzaky FarhansyahNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- Practice Chap 5Document17 pagesPractice Chap 5HIRA KHAN L1S15MBAM0023No ratings yet

- Customer Day Browser Time (Min) Pages Viewed Amount Spent ($)Document32 pagesCustomer Day Browser Time (Min) Pages Viewed Amount Spent ($)Jimbo ManalastasNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- Neraca LajurDocument10 pagesNeraca LajurFeny MariaNo ratings yet

- 645873Document3 pages645873mohitgaba19No ratings yet

- Kieso Chapter 10Document6 pagesKieso Chapter 10Dian Permata SariNo ratings yet

- Trial Balance Adjustments Account Titles DR KR DR KR: Firdaus Company Worksheet For The Ended Period August 31, 2016Document8 pagesTrial Balance Adjustments Account Titles DR KR DR KR: Firdaus Company Worksheet For The Ended Period August 31, 2016Marsa ArrahmanNo ratings yet

- Bank Reconciliation for Shou Florists at December 31, 2020Document9 pagesBank Reconciliation for Shou Florists at December 31, 2020Aditya DzikirNo ratings yet

- Soal 1: 1. Computed Equivalent Unit For Production CostDocument10 pagesSoal 1: 1. Computed Equivalent Unit For Production CostRaihan Rohadatul 'AisyNo ratings yet

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- IFRS vs GAAP differences and financial accounting conceptsDocument4 pagesIFRS vs GAAP differences and financial accounting conceptsRahmat AlamsyahNo ratings yet

- Tugas MK Dasar Akuntansi Pertemuan Ke-15Document2 pagesTugas MK Dasar Akuntansi Pertemuan Ke-15Mochamad Ardan FauziNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Cash Flow Statement for Lopez IncDocument4 pagesCash Flow Statement for Lopez IncAura Anggun Permatasari auraanggun.2021No ratings yet

- No. Tipe Akun Kode Perkiraan NamaDocument6 pagesNo. Tipe Akun Kode Perkiraan Namapkm.sdjNo ratings yet

- PT. Bintang Makmur invoice for Anugerah, Toko BukuDocument3 pagesPT. Bintang Makmur invoice for Anugerah, Toko Bukubahrumjaji100% (1)

- Adjusting and Closing Entries for Bellemy Fashion CenterDocument3 pagesAdjusting and Closing Entries for Bellemy Fashion CenterNam Nguyen100% (1)

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYADocument3 pagesPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziNo ratings yet

- Chapter 15 JawabanDocument24 pagesChapter 15 JawabanDamelinaNo ratings yet

- Tugas 4 AKM - Kelompok 5 - 142200278Document13 pagesTugas 4 AKM - Kelompok 5 - 142200278muhammad alfariziNo ratings yet

- End. 12,133 End. 6,950 End. 612Document3 pagesEnd. 12,133 End. 6,950 End. 612Nam NguyenNo ratings yet

- Adjusting Allowance for Doubtful AccountsDocument2 pagesAdjusting Allowance for Doubtful AccountsWisanggeni RatuNo ratings yet

- B. Sheet PRB 1Document5 pagesB. Sheet PRB 1Tahsinul Haque TasifNo ratings yet

- Worksheet Akuntansi DahliaDocument4 pagesWorksheet Akuntansi DahliaDahliaNo ratings yet

- Ch8 AR Test 9902Document7 pagesCh8 AR Test 9902ايهاب غزالةNo ratings yet

- Condensed Income Statement, Periodic Inventory MethodDocument2 pagesCondensed Income Statement, Periodic Inventory MethodAsma HatamNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- Unit 7Document12 pagesUnit 7ALEXANDRA VACANo ratings yet

- Mikita Cookies Jurnal PostingDocument132 pagesMikita Cookies Jurnal PostingGabriela Siagian100% (1)

- CH 13Document80 pagesCH 13ddNo ratings yet

- Soal Asistensi AK1 Pertemuan 7Document3 pagesSoal Asistensi AK1 Pertemuan 7Afrizal WildanNo ratings yet

- Book Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanDocument2 pagesBook Ak Bi P-11 Contoh Soal Joint Cost Physical Method + JawabanRynaldo xf100% (1)

- Format PROPOSAL P2MW 2022Document4 pagesFormat PROPOSAL P2MW 2022Jems OtnielNo ratings yet

- Lisa's Accounting ExercisesDocument5 pagesLisa's Accounting ExercisesLisa HaryatiNo ratings yet

- Soal UTS GANJIL 2018-2019 B'Rita FathiahDocument5 pagesSoal UTS GANJIL 2018-2019 B'Rita FathiahDaeng Buana SaputraNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- AnswerDocument2 pagesAnswertouya hibikiNo ratings yet

- Akuntansi P1 - 2A Esti FatmawatiDocument4 pagesAkuntansi P1 - 2A Esti FatmawatiEsti FatmawatiNo ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Le Nguyen Thu UyenNo ratings yet

- Akuntansi DagangDocument13 pagesAkuntansi DagangAsmarani SiregarNo ratings yet

- 1 637304139596797833 Stockholders Equity Section AccountingDocument7 pages1 637304139596797833 Stockholders Equity Section AccountingShandaNo ratings yet

- Cost Analysis of EventsDocument3 pagesCost Analysis of EventsTiffany Shane GantuangcoNo ratings yet

- CADocument30 pagesCAZulfa Aulia Nurul PutriNo ratings yet

- Exercise 1: Nama: Irfan Sebastian NPM: C00200027Document4 pagesExercise 1: Nama: Irfan Sebastian NPM: C00200027Emmanuella GrachiaNo ratings yet

- Bab 2 Cost Concept and The Cost Accounting Information SystemDocument5 pagesBab 2 Cost Concept and The Cost Accounting Information SystemFransiskusSinagaNo ratings yet

- Chapter 6Document13 pagesChapter 6Saharin Islam ShakibNo ratings yet

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceDocument5 pagesA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaNo ratings yet

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- Case 1 (Accounting Equation)Document7 pagesCase 1 (Accounting Equation)friti anifaNo ratings yet

- Latihan AKM 1 TM 4Document5 pagesLatihan AKM 1 TM 4chyntia susantoNo ratings yet

- Latihan AKM 1 CH 08Document5 pagesLatihan AKM 1 CH 08chyntia susantoNo ratings yet

- Chapter 11 and 12Document6 pagesChapter 11 and 12TyaInvincibleNo ratings yet

- Introduction to Computer-Aided Audit Tools and Techniques (CAATTDocument34 pagesIntroduction to Computer-Aided Audit Tools and Techniques (CAATTKezia N. ApriliaNo ratings yet

- Homework Assignment DoneDocument6 pagesHomework Assignment DoneKezia N. ApriliaNo ratings yet

- Determinants of Firms Value Evidence From FinanciDocument10 pagesDeterminants of Firms Value Evidence From Financijoni hajriNo ratings yet

- Chapter 11 and 12Document6 pagesChapter 11 and 12TyaInvincibleNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Job 14 Okt - Akmen Process CostDocument2 pagesJob 14 Okt - Akmen Process CostKezia N. ApriliaNo ratings yet

- Job 14 Okt - Akmen Process CostDocument2 pagesJob 14 Okt - Akmen Process CostKezia N. ApriliaNo ratings yet

- Inputs Transformation Process Outputs: A Simple Transformation Process Diagram of A Car Repair ShopDocument5 pagesInputs Transformation Process Outputs: A Simple Transformation Process Diagram of A Car Repair ShopKezia N. ApriliaNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Akmen Inventory Costing - 14 OktDocument2 pagesAkmen Inventory Costing - 14 OktKezia N. ApriliaNo ratings yet

- Akmen Inventory Costing - 14 OktDocument2 pagesAkmen Inventory Costing - 14 OktKezia N. ApriliaNo ratings yet

- Meningkatkan Imunitas Saat WabahDocument17 pagesMeningkatkan Imunitas Saat WabahKezia N. ApriliaNo ratings yet

- Intermediate Accounting - 14 NovemberDocument4 pagesIntermediate Accounting - 14 NovemberKezia N. ApriliaNo ratings yet

- Homework #1 Total Produc T Output Total Fixed Cost Total Variabl e Cost Total Cist Total Revenu e LossDocument2 pagesHomework #1 Total Produc T Output Total Fixed Cost Total Variabl e Cost Total Cist Total Revenu e LossKezia N. ApriliaNo ratings yet

- Homework #1 Total Produc T Output Total Fixed Cost Total Variabl e Cost Total Cist Total Revenu e LossDocument2 pagesHomework #1 Total Produc T Output Total Fixed Cost Total Variabl e Cost Total Cist Total Revenu e LossKezia N. ApriliaNo ratings yet

- Intermediate Accounting - 14 NovemberDocument4 pagesIntermediate Accounting - 14 NovemberKezia N. ApriliaNo ratings yet

- Fitur Netflix Berdasarkan Content Based Filtering Dan Collaborative FilteringDocument5 pagesFitur Netflix Berdasarkan Content Based Filtering Dan Collaborative FilteringKezia N. ApriliaNo ratings yet

- Chapter 13 CASH FLOWDocument2 pagesChapter 13 CASH FLOWKezia N. ApriliaNo ratings yet

- TP5 AssignmentDocument4 pagesTP5 AssignmentKiran BennyNo ratings yet

- Things You Must NoticeDocument2 pagesThings You Must NoticeKezia N. ApriliaNo ratings yet

- How the On-Demand Economy Changes Business Models <40Document13 pagesHow the On-Demand Economy Changes Business Models <40Kezia N. ApriliaNo ratings yet

- Accountant's Perception On Fraud Detection in Financial Statement Reporting Using Fraud Triangle AnalysisDocument8 pagesAccountant's Perception On Fraud Detection in Financial Statement Reporting Using Fraud Triangle AnalysisKezia N. ApriliaNo ratings yet

- Introduction To Qualitative ResearchDocument12 pagesIntroduction To Qualitative ResearchKezia N. ApriliaNo ratings yet

- Mobile Gaming Market Disrupts Traditional Games IndustryDocument5 pagesMobile Gaming Market Disrupts Traditional Games IndustryKezia N. ApriliaNo ratings yet

- Mobile Gaming Market Disrupts Traditional Games IndustryDocument5 pagesMobile Gaming Market Disrupts Traditional Games IndustryKezia N. ApriliaNo ratings yet

- Research Methods in Behavioral AccountingDocument44 pagesResearch Methods in Behavioral AccountingKezia N. ApriliaNo ratings yet

- ANALYZE QUALITATIVE DATA CODING STEPSDocument12 pagesANALYZE QUALITATIVE DATA CODING STEPSKezia N. ApriliaNo ratings yet

- Chap 1 - Overview of Malaysian TaxationDocument22 pagesChap 1 - Overview of Malaysian TaxationrajarajeswryNo ratings yet

- Basilan Estates Inc. v. CIR and CTADocument2 pagesBasilan Estates Inc. v. CIR and CTATon Ton CananeaNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFKeran VarmaNo ratings yet

- Financial Statement LiquidationDocument3 pagesFinancial Statement LiquidationaquilaneNo ratings yet

- ENG 5 Academic Paper: Republic Act No. 10963 Tax Reform For Acceleration and Inclusion (TRAIN) To Sustainable Near-Term GrowthDocument4 pagesENG 5 Academic Paper: Republic Act No. 10963 Tax Reform For Acceleration and Inclusion (TRAIN) To Sustainable Near-Term GrowthRey Joyce AbuelNo ratings yet

- TXN 2301E PC08.CaseDocument6 pagesTXN 2301E PC08.CasejobaratetaNo ratings yet

- FBDC VS CirDocument13 pagesFBDC VS CirRene ValentosNo ratings yet

- Facts:: REYNALDO V. UMALI v. JESUS P. ESTANISLAO, GR No. 104037, 1992-05-29Document2 pagesFacts:: REYNALDO V. UMALI v. JESUS P. ESTANISLAO, GR No. 104037, 1992-05-29ron dominic dagumNo ratings yet

- Session 23-25 Permissible Deduction From Gross Total IncomeDocument14 pagesSession 23-25 Permissible Deduction From Gross Total Incomeomar zohorianNo ratings yet

- Types of Tax CollectionDocument2 pagesTypes of Tax CollectionNahid Hussain AdriNo ratings yet

- HRMS BASIC DETAILS FOR GOVT EMPLOYEE IN BIHARDocument10 pagesHRMS BASIC DETAILS FOR GOVT EMPLOYEE IN BIHARTraining and Placement OfficeNo ratings yet

- Practice Set - Basic AccountingDocument26 pagesPractice Set - Basic AccountingThessaloe B. Fernandez0% (1)

- 6 Royal Shirt V CoDocument1 page6 Royal Shirt V CoErwinRommelC.FuentesNo ratings yet

- Scientific Publishing Services Pay Slip Title GeneratorDocument1 pageScientific Publishing Services Pay Slip Title GeneratorJagan EashwarNo ratings yet

- Financial Accounting Quiz 1-Total Marks 30: ConfidentialDocument2 pagesFinancial Accounting Quiz 1-Total Marks 30: ConfidentialSyed Ali ShanNo ratings yet

- Cost of Living Comparison ChartDocument1 pageCost of Living Comparison ChartEmad AfifyNo ratings yet

- JR business transactions April 2020Document18 pagesJR business transactions April 2020Phoebe Balino100% (2)

- Salary SlipDocument1 pageSalary Slipsaadbshaheen97No ratings yet

- Format PT Galaxy Elektronik 2Document53 pagesFormat PT Galaxy Elektronik 2sabrina damayantiNo ratings yet

- 2 DIGEST Madrigal Vs Rafferty DigestDocument1 page2 DIGEST Madrigal Vs Rafferty DigestLeo FelicildaNo ratings yet

- CH 10 Accruals and PrepaymentsDocument8 pagesCH 10 Accruals and PrepaymentsSumiya YousefNo ratings yet

- Tax Law Project On: Capital Gain and Capital AssetsDocument15 pagesTax Law Project On: Capital Gain and Capital AssetsAazamNo ratings yet

- 2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureDocument1 page2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureAvinash ChavanNo ratings yet

- Building A Network To Share and Discuss: Dialogue On TaxDocument156 pagesBuilding A Network To Share and Discuss: Dialogue On TaxcadrjainNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Income Taxation On Individuals ModuleDocument18 pagesIncome Taxation On Individuals ModuleCza PeñaNo ratings yet

- Acct 261 Final ExamDocument6 pagesAcct 261 Final ExamPrince-SimonJohnMwanzaNo ratings yet

- 2022 Turbo Tax ReturnDocument6 pages2022 Turbo Tax ReturnAbisola Adeyemi75% (4)

- BIR Ruling No. 206-90Document2 pagesBIR Ruling No. 206-90Raiya Angela100% (2)

- One Nation One TaxDocument12 pagesOne Nation One TaxAvijit DindaNo ratings yet