Professional Documents

Culture Documents

Lecture 5 AMA - Process Costing

Uploaded by

Ngọcc Bảo0 ratings0% found this document useful (0 votes)

9 views19 pagesOriginal Title

Lecture 5 AMA- Process Costing

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views19 pagesLecture 5 AMA - Process Costing

Uploaded by

Ngọcc BảoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

Process Costing

© 2012 Pearson Prentice Hall. All rights reserved.

Job versus Process Costing

Job-Costing Systems Process-Costing

Systems

Distinct, identifiable

units of a product Masses of identical

or service or similar units of a

product or service

Examples:

Custom-made Examples:

machines, Food,

houses chemical processing

design product themself, mass produce, not prodcue

for any order

© 2012 Pearson Prentice Hall. All rights reserved.

Process Costing

Process costing is a system where the unit cost of a

product or service is obtained by assigning total

costs to many identical or similar units.

Each unit receives the same or similar amounts of

direct materials costs, direct labor costs, and

manufacturing overhead.

Unit costs are computed by dividing total costs

incurred by the number of units of output from the

production process. total cost / no. of unit output

© 2012 Pearson Prentice Hall. All rights reserved.

Process-Costing Assumptions

Direct materials are added at the beginning of the

production process, or at the start of work in a

subsequent department down the assembly line.

Conversion costs are added equally along the

production process. when we use, we add.

eg: finish 50% of output -> add 50% conversion cost

© 2012 Pearson Prentice Hall. All rights reserved.

Five-Step Process-Costing Allocation

1. Summarize the flow of physical units of output.

2. Compute output in terms of equivalent units.

sp tương đương

3. Summarize total costs to account for .

4. Compute cost per equivalent unit.

5. Assign total costs to units completed and to units in

ending work-in-process.

Equivalent unit = degree of completion x physical units

eg: 2units of 50% completion

= 2 x 50% = 1 unit

© 2012 Pearson Prentice Hall. All rights reserved.

Equivalent Units

A derived amount of output units that:

1. Takes the quantity of each input in units completed

and in unfinished units of work in process and

2. Converts the quantity of input into the amount of

completed output units that could be produced with

that quantity of input

Are calculated separately for each input (direct

materials and conversion cost)

When calculating equivalent units in step 2, focus

on quantities and disregard dollar amounts until

after the equivalent units are computed

© 2012 Pearson Prentice Hall. All rights reserved.

Steps 1 and 2 Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

General Ledger Cost Flows

Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

Transferred-In Costs

Are costs incurred in previous departments that are

carried forward as the products cost when it moves

to a subsequent process in the production cycle.

Also called previous department costs.

Journal entries are made to mirror the progress in

production from department to department.

Transferred-in costs are treated as if they are a

separate type of direct material added at the

beginning of the process.

eg: sx 1 cái tượng: 3 bước: nặn -> nung -> hthanh

DM $10

DL -> $10 DM

DL Hall. All rights reserved.

OH© 2012 Pearson Prentice

OH

Lecture example

completion

Physical Direct Conversion

Transferred in

units materials costs

$

Work in process, beginning (March 1) 240 $ 33,600

18,000

Degree of completion, BWIP 100% 0% 62.5%

Transferred in during March 400

Completed and transferred out during March 440

Work in process, ending (March 31) 200

Degree of completion, EWIP 100% 0% 80%

Total costs added during March

$ $

Direct material and conversion costs

13,200 48,600

Transferred in (WAC) $ 52,000

Transferred in (FIFO) $ 52,480

© 2012 Pearson Prentice Hall. All rights reserved.

Weighted-Average

Process-Costing Method

Weighted-average costs is the total of all costs in the

work-in-process account divided by the total

equivalent units of work done to date. số sp tới thời điểm này

The beginning balance of the work-in-process account

(work done in a prior period) is blended in with current

period costs.

© 2012 Pearson Prentice Hall. All rights reserved.

Weighted-Average

Process-Costing Method

Calculates cost per equivalent unit of all work done to

date (regardless of the accounting period in which it

was done)

Assigns this cost to equivalent units completed and

transferred out of the process, and to incomplete units

in still-in-process

© 2012 Pearson Prentice Hall. All rights reserved.

Steps 1 and 2, Illustrated

Step 2

Step 1 Equivalent units

WAC

Transferred Direct Conversion

Physical units

in materials costs

Work in process, beginning (March 1) 240

Transferred in during March 400

To account for 640

Completed and transferred out during 440 440 440

440

March

200 x 80%

Work in process, ending (March 31) 200 200 x100% 0 = 160

To account for 640

Equivilant units OFwork done to date 640 440 600

© 2012 Pearson Prentice Hall. All rights reserved.

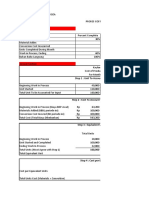

Steps 3, 4, and 5, Illustrated

Transferred Direct Conversion

in materials costs

Total costs

Step 3 WIP, beginning 51,600 33,600 0 18,000

Costs added during March 113,800 52,000 13,200 48,600

Total costs to accounted for 165,400 85,600 13,200 66,600

640 440 600

Step 4 Cost per equivalent unit of work done to date $274.75 =133.75 = 30 =111

Step 5 Assignment of costs:

Completed and transferred out during March 440 x 133.75 440 x 30 440 x 111

Work in process, ending (March 31) 200 x 133.75 0 x 30 160 x 111

Total costs accounted for 165,400

© 2012 Pearson Prentice Hall. All rights reserved.

First-in, First-Out

Process-Costing Method

Assigns the cost of the previous accounting period’s

equivalent units in beginning work-in-process

inventory to the first units completed and

transferred out of the process CF kì này / sp kì này only

Assigns the cost of equivalent units worked on

during the current period first to complete

beginning inventory, next to stat and complete new

units, and lastly to units in ending work-in-process

inventory

© 2012 Pearson Prentice Hall. All rights reserved.

First-in, First-Out

Process-Costing Method

A distinctive feature of FIFO process-costing method

is that work done on beginning inventory is kept

separate from work done in the current period.

© 2012 Pearson Prentice Hall. All rights reserved.

Steps 1 and 2, Illustrated

Step 2

Step 1 Equivalent units

Direct Conversion

Physical units Transferred in

materials costs

Work in process, beginning (March 1) 240

Transferred in during March 400

To account for 640

Completed and transferred out during March 440

(100%-62.5%)x240

From BWIP hthanh nốt kì trc 240 0 240 = 90

Started and completed làm mới trg kì 200 200 200 200

Work in process, ending (March 31) dở dang 200 200 0 160

sang kì sau

To account for 640

Equivalent units of work done in March 400 440 450

© 2012 Pearson Prentice Hall. All rights reserved.

Steps 3, 4, and 5, Illustrated

Transferred Direct Conversion

Total costs in materials costs

Step 3 WIP, beginning

Costs added during May 114,280 52,480 13,200 48,600

Total costs to accounted for

52,480/400 13,200/440 48,600/450

in March

Step 4 Cost per equivalent unit of work done to date 131.2 30 108

Step 5 Assignment of costs:

Completed and transferred out during March

Work in process, beginning (March 1) 33,600 0 18,000

Costs added to BWIP 0 240x30 90x108

From beginning

Started and completed 200x131.2 200x30 200x108

Work in process, ending (March 31) 200x131.2 0 160x108

Total costs accounted for

© 2012 Pearson Prentice Hall. All rights reserved.

© 2012 Pearson Prentice Hall. All rights reserved.

You might also like

- Lecture 5 - AMADocument8 pagesLecture 5 - AMALưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Chapter 17 In-Class ExercisesDocument13 pagesChapter 17 In-Class ExercisesNguyễn Thị Thanh ThúyNo ratings yet

- 17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoDocument6 pages17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoMajd MustafaNo ratings yet

- Q & Soln - Process CostingDocument6 pagesQ & Soln - Process CostingAbhay SahuNo ratings yet

- Lesson 3Document168 pagesLesson 3kirawang098No ratings yet

- Chapter 10 PPT Agm-1Document13 pagesChapter 10 PPT Agm-1Paulina DocenaNo ratings yet

- Illustration - Cost of Production ReportDocument9 pagesIllustration - Cost of Production ReportJomari FalibleNo ratings yet

- UntitledDocument4 pagesUntitledAastha ShettyNo ratings yet

- 17-16 (25 Min.) Equivalent Units, Zero Beginning InventoryDocument5 pages17-16 (25 Min.) Equivalent Units, Zero Beginning Inventorymohamet farahNo ratings yet

- Average Method and Fifo Method Copr TemplateDocument2 pagesAverage Method and Fifo Method Copr TemplateRosete San Agustin GalvezNo ratings yet

- CH 17Document15 pagesCH 17emmyindraNo ratings yet

- Chapter 2 Costing SystemsDocument26 pagesChapter 2 Costing SystemsfekadeNo ratings yet

- Flow of Production Physical Units Equivalent Units Direct Materials Conversion CostsDocument2 pagesFlow of Production Physical Units Equivalent Units Direct Materials Conversion CostsMuhamad Ihsan RafiansyahNo ratings yet

- Process Costing Chapter SummaryDocument40 pagesProcess Costing Chapter SummaryMuhammad Ali KazmiNo ratings yet

- Class Case For Chapter 17 2015 AdjustedDocument8 pagesClass Case For Chapter 17 2015 Adjustedahmed.alaradi88No ratings yet

- Chapter 4 - Process CostingDocument12 pagesChapter 4 - Process CostinggsdhNo ratings yet

- Total Costs For July 2017Document4 pagesTotal Costs For July 201705. Aktadea Frisya GitanandaNo ratings yet

- Process Costing: © 2012 Pearson Prentice Hall. All Rights ReservedDocument26 pagesProcess Costing: © 2012 Pearson Prentice Hall. All Rights ReservedayyazmNo ratings yet

- Module No 2 - Average CostingDocument8 pagesModule No 2 - Average CostingAnthony DyNo ratings yet

- ACCY918 T3 2023 Wk3 Process Costing Lecture NoteDocument82 pagesACCY918 T3 2023 Wk3 Process Costing Lecture NoteNIRAJ SharmaNo ratings yet

- 4 Costing SystemsDocument38 pages4 Costing Systemsx6xhr6gk2mNo ratings yet

- Lecture Presentation 9Document31 pagesLecture Presentation 9L GNo ratings yet

- Process Costing: © 2009 Pearson Prentice Hall. All Rights ReservedDocument33 pagesProcess Costing: © 2009 Pearson Prentice Hall. All Rights ReservedGesaNo ratings yet

- CH 14 ImanagerialDocument45 pagesCH 14 ImanagerialFatma Hassan ElxeniNo ratings yet

- Systems Design: Process Costing: Mcgraw Hill/IrwinDocument15 pagesSystems Design: Process Costing: Mcgraw Hill/IrwinMarc Jim GregorioNo ratings yet

- Process Costing: © 2009 Pearson Prentice Hall. All Rights ReservedDocument30 pagesProcess Costing: © 2009 Pearson Prentice Hall. All Rights ReservedAnonymous d1eylzUpNo ratings yet

- CA Ch.18 Process Costing Part 1 NureniDocument22 pagesCA Ch.18 Process Costing Part 1 Nurenisandi ibrahimNo ratings yet

- Study Case Process Costing 4.17 & 4.18Document4 pagesStudy Case Process Costing 4.17 & 4.18bagustradi89No ratings yet

- Process Costing Methods and CalculationsDocument42 pagesProcess Costing Methods and CalculationsKarimatun NisaNo ratings yet

- Process CostingDocument46 pagesProcess CostingRasyikah FitriaNo ratings yet

- Total direct materials: $2,342Total direct labor: $2,138Total applied factory overhead: $1,120Total manufacturing cost: $5,600Sales price (with 40% markup): $5,600 x 1.4 = $7,840Document29 pagesTotal direct materials: $2,342Total direct labor: $2,138Total applied factory overhead: $1,120Total manufacturing cost: $5,600Sales price (with 40% markup): $5,600 x 1.4 = $7,840Ben ShahbandarNo ratings yet

- Cost Accounting: Charles T. Horngren Srikant M. Datar Madhav V. RajanDocument49 pagesCost Accounting: Charles T. Horngren Srikant M. Datar Madhav V. RajanIqbal FakhrurNo ratings yet

- Process Costing - Chapter 4Document18 pagesProcess Costing - Chapter 4Asadullahil GalibNo ratings yet

- NOTE CHAPTER 8 - Process CostingDocument20 pagesNOTE CHAPTER 8 - Process CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- Cost of Production ReportDocument6 pagesCost of Production ReportJomari FalibleNo ratings yet

- Process Costing NotesDocument5 pagesProcess Costing NotesRaghib AliNo ratings yet

- Lecture 11 Process Costing - 2ndDocument35 pagesLecture 11 Process Costing - 2ndMahyy AdelNo ratings yet

- Kelompok 3 - Case Study 1Document4 pagesKelompok 3 - Case Study 1bagustradi89No ratings yet

- Kasus 6 Proses Costing (FIFO) Biizatil SR - 1Document12 pagesKasus 6 Proses Costing (FIFO) Biizatil SR - 1Bzatil RzNo ratings yet

- Process CostingDocument13 pagesProcess CostingAmie Jane MirandaNo ratings yet

- Quiz AkbiDocument3 pagesQuiz AkbiRavindra PratamaNo ratings yet

- Cost Accounting The Process Costing SystemDocument29 pagesCost Accounting The Process Costing SystemaasNo ratings yet

- Chapter 5 Applying - Excel2Document12 pagesChapter 5 Applying - Excel2trungnt.studyNo ratings yet

- 137a-1 Exam#1 RDocument2 pages137a-1 Exam#1 RWallace YeungNo ratings yet

- costaccDocument4 pagescostaccjaringanlimagNo ratings yet

- SPPTChap 004Document50 pagesSPPTChap 004QUANG NGUYỄN VINHNo ratings yet

- Process Costing StudentsDocument39 pagesProcess Costing StudentsNour Al KaddahNo ratings yet

- Process Costing EDocument22 pagesProcess Costing Ev8ysqzd9pbNo ratings yet

- Chap004, Process CostingDocument17 pagesChap004, Process Costingrief1010No ratings yet

- Understanding Process Costing SystemsDocument13 pagesUnderstanding Process Costing SystemsMulumebet EshetuNo ratings yet

- Process CostingDocument5 pagesProcess CostingNo NotreallyNo ratings yet

- Chapter 3: Process Costing: Cost & Management Accounting I/ Lecture Note On Process CostingDocument12 pagesChapter 3: Process Costing: Cost & Management Accounting I/ Lecture Note On Process CostingFear Part 2No ratings yet

- Process Costing MethodsDocument7 pagesProcess Costing MethodsKaryl FailmaNo ratings yet

- ACTG 360 Cost Accounting Midterm Exam 01Document12 pagesACTG 360 Cost Accounting Midterm Exam 01Nguyễn Thị Thanh ThúyNo ratings yet

- 17-19 Page 631 Physical Direct Conversion Units Materials CostsDocument4 pages17-19 Page 631 Physical Direct Conversion Units Materials CostsMisty Dawn BancroftNo ratings yet

- Cost Accounting Chapter 17Document4 pagesCost Accounting Chapter 17Yordan Lawijaya100% (1)

- Process CostingDocument20 pagesProcess CostingkirosNo ratings yet

- Proccess Costing ProblemsDocument10 pagesProccess Costing ProblemsDachi ChaduneliNo ratings yet

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowFrom EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowRating: 4 out of 5 stars4/5 (1)

- Siebel Asset Based Ordering ( ABO )From EverandSiebel Asset Based Ordering ( ABO )Rating: 2 out of 5 stars2/5 (1)

- Resolve ManualDocument240 pagesResolve ManualNJ333100% (1)

- COA - Unit2 Floating Point Arithmetic 2Document67 pagesCOA - Unit2 Floating Point Arithmetic 2Devika csbsNo ratings yet

- Tanque: Equipment Data SheetDocument1 pageTanque: Equipment Data SheetAlonso DIAZNo ratings yet

- MS2680-2017 Energy Efficiency and Use of Renewable Energy For Residential BuildingsDocument61 pagesMS2680-2017 Energy Efficiency and Use of Renewable Energy For Residential BuildingsChern Yue EweNo ratings yet

- Multipass AssemblerDocument5 pagesMultipass AssemblerBoobalan R100% (3)

- Mark VieDocument4 pagesMark VieWalid Bahi100% (1)

- Math8 - q1 - Mod5a - Multiplying and Dividing Rational Algebraic Expressions - 08092020Document34 pagesMath8 - q1 - Mod5a - Multiplying and Dividing Rational Algebraic Expressions - 08092020JaylanGalasi100% (4)

- E06 - CONSTANTINACHE PompiliuDocument4 pagesE06 - CONSTANTINACHE PompiliuNgô Hải ĐăngNo ratings yet

- Peritoneal DialysisDocument26 pagesPeritoneal DialysisKath LeenNo ratings yet

- Download Risc V Assembly Language Programming Stephen Smith all chapterDocument67 pagesDownload Risc V Assembly Language Programming Stephen Smith all chapteralec.powell515100% (3)

- Whoqol: User ManualDocument59 pagesWhoqol: User ManualDina AuliyaNo ratings yet

- LX6 520 Boartlongyear - TechData - Spanish - Sept2012 (AppReady) PDFDocument12 pagesLX6 520 Boartlongyear - TechData - Spanish - Sept2012 (AppReady) PDFAlvaro AlfaroNo ratings yet

- Saudi Aramco Fence Construction General NotesDocument1 pageSaudi Aramco Fence Construction General Notesabou bakar100% (1)

- DS34C87T CMOS Quad TRISTATE Differential Line Driver: General Description FeaturesDocument8 pagesDS34C87T CMOS Quad TRISTATE Differential Line Driver: General Description FeaturesBOGDANNo ratings yet

- GCE Examinations Mechanics Module M1 Paper K MARKING GUIDEDocument4 pagesGCE Examinations Mechanics Module M1 Paper K MARKING GUIDEAbhiKhanNo ratings yet

- Power MOSFET Stage For Boost Converters: I 35 A V 500 V R 0.12Document4 pagesPower MOSFET Stage For Boost Converters: I 35 A V 500 V R 0.12Franklyn AcevedoNo ratings yet

- SCI19 - Q4 - M5 - Heat and Energy TransformationDocument14 pagesSCI19 - Q4 - M5 - Heat and Energy TransformationlyzaNo ratings yet

- JavaScript Factorial CalculatorDocument13 pagesJavaScript Factorial CalculatorSandipa ShindeNo ratings yet

- Ev 3 Solar StationDocument52 pagesEv 3 Solar Stationavira0002No ratings yet

- 11th Science Maths Answer KeyDocument15 pages11th Science Maths Answer KeyBhavesh AsapureNo ratings yet

- The Van Der Pauw Method of Measurements in High-TcDocument12 pagesThe Van Der Pauw Method of Measurements in High-TcNolbert Renzo Umpire IncaNo ratings yet

- Suzanne Saroff - Year 9 Exam AnnaDocument1 pageSuzanne Saroff - Year 9 Exam Annaapi-569107627No ratings yet

- ICEA-AEIC Diameter ComparisonDocument3 pagesICEA-AEIC Diameter ComparisonsupernaenergyNo ratings yet

- Base Design - SecondaryDocument20 pagesBase Design - SecondaryFarah Diba Pos-PosNo ratings yet

- PowerFactory TechRef - PVDocument13 pagesPowerFactory TechRef - PVАлександрNo ratings yet

- IN Sneddon - The Distribution of Stress in The Neighborhood of A Crack in An Elastic Solid - For Shape Factor QDocument32 pagesIN Sneddon - The Distribution of Stress in The Neighborhood of A Crack in An Elastic Solid - For Shape Factor QShaun Raphael LeeNo ratings yet

- Stoichiometry and Gravimetric Analysis of Strontium CarbonateDocument4 pagesStoichiometry and Gravimetric Analysis of Strontium CarbonateIbelise MederosNo ratings yet

- Diels-Alder Reaction CharacterizationDocument3 pagesDiels-Alder Reaction CharacterizationMohit SinghalNo ratings yet

- Fire Protection Systems Engineering GuideDocument18 pagesFire Protection Systems Engineering GuideAli MehrpourNo ratings yet

- Minor FalcONDocument15 pagesMinor FalcONGursimran Singh100% (1)