Professional Documents

Culture Documents

FAQ: Changes To The Marketplace in The American Rescue Plan

Uploaded by

Indiana Family to FamilyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQ: Changes To The Marketplace in The American Rescue Plan

Uploaded by

Indiana Family to FamilyCopyright:

Available Formats

FAQ: Changes to the Marketplace in the American Rescue Plan

The American Rescue Plan is a new law to address the COVID-19 public health and economic crisis. It

makes significant improvements to the availability and size of premium tax credits, as well as providing

relief from 2020 premium tax credit repayment. These changes impact HealthCare.gov and all state-based

marketplaces.

How does the American Rescue Plan impact premiums?

1. Lower premiums for people who are currently eligible for APTCs. The percentage of income an

enrollee pays toward their premium (expected premium contribution) is reduced across the board for

people with income under 400 percent of the federal poverty line (FPL). That means higher advance

premium tax credits (APTCs).

Anyone whose income is at or below 150 percent of FPL can enroll in a zero-premium benchmark

(second-lowest cost silver) plan, after APTC. The maximum premium an enrollee would pay is 8.5

percent of income, instead of 9.83 percent under prior law. (For 2021 and 2022)

Added benefit: higher APTCs may help some enrollees buy a silver or gold plan with lower cost-sharing.

2. New APTC eligibility for higher-income people. People with

income over 400 percent of FPL are newly eligible for APTC.

The maximum any enrollee will pay for a benchmark plan is

8.5 percent of their income. (For 2021 and 2022)

3. Additional premium help for people who are unemployed.

When determining APTC eligibility, the marketplace will

consider people who receive unemployment benefits at any

point in 2021 (including those in the Medicaid coverage gap)

to have income at 133 percent of FPL, regardless of their

actual annual income. This means they’ll be eligible for a

zero-premium benchmark plan, after APTC, and for reduced

cost-sharing. Income will be deemed to be 133 percent of FPL

for the entire year and at reconciliation. (For 2021 only)

How does the American Rescue Plan affect 2020 APTC repayment?

1. Repayment forgiveness. People who owe back some or all of their 2020 APTC will not have to repay

the tax credit. People who received a smaller premium tax credit in 2020 than they were eligible for will

still get money back.

2. Disregard of $10,200 in UI from income. Any taxpayer who received unemployment benefits in 2020

can subtract the first $10,200 in benefits from their taxable income. This will lower income, including for

the calculation of the premium tax credit.

Questions? Email us at beyondthebasics@cbpp.org.

March 2021

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- ACP Wind-Down Fact Sheet FinalDocument2 pagesACP Wind-Down Fact Sheet FinalIndiana Family to FamilyNo ratings yet

- Project EngageDocument1 pageProject EngageIndiana Family to FamilyNo ratings yet

- FBR Transportation 6.23.2023Document8 pagesFBR Transportation 6.23.2023Indiana Family to FamilyNo ratings yet

- BT 202378Document3 pagesBT 202378Indiana Family to FamilyNo ratings yet

- BT 202378Document3 pagesBT 202378Indiana Family to FamilyNo ratings yet

- CYVYC Flyer Speakerseries4Document1 pageCYVYC Flyer Speakerseries4Indiana Family to FamilyNo ratings yet

- Youth Subcommittee TH Flyer FINALDocument1 pageYouth Subcommittee TH Flyer FINALIndiana Family to FamilyNo ratings yet

- BT 202359Document7 pagesBT 202359Indiana Family to FamilyNo ratings yet

- BT 202303Document2 pagesBT 202303Indiana Family to FamilyNo ratings yet

- BT 2022120Document2 pagesBT 2022120Indiana Family to FamilyNo ratings yet

- IHCP Bulletins BT202347 & BT 202348Document2 pagesIHCP Bulletins BT202347 & BT 202348Indiana Family to FamilyNo ratings yet

- BT 2022119Document2 pagesBT 2022119Indiana Family to FamilyNo ratings yet

- BT 202329Document1 pageBT 202329Indiana Family to FamilyNo ratings yet

- 2022 Health of Parents and Self Compassion FlierDocument1 page2022 Health of Parents and Self Compassion FlierIndiana Family to FamilyNo ratings yet

- Study Announcement ParentasdDocument1 pageStudy Announcement ParentasdIndiana Family to FamilyNo ratings yet

- BR 202252Document1 pageBR 202252Indiana Family to FamilyNo ratings yet

- How Early Puberty Affects Childrens Mental HealthDocument4 pagesHow Early Puberty Affects Childrens Mental HealthIndiana Family to FamilyNo ratings yet

- BT 2022113Document2 pagesBT 2022113Indiana Family to FamilyNo ratings yet

- 2022 State of Coverage Policy Summit ProgramDocument2 pages2022 State of Coverage Policy Summit ProgramIndiana Family to FamilyNo ratings yet

- Parenting Tweens What You Should KnowDocument5 pagesParenting Tweens What You Should KnowIndiana Family to FamilyNo ratings yet

- BT 2022107Document3 pagesBT 2022107Indiana Family to FamilyNo ratings yet

- Sbirt Ls FlyerDocument1 pageSbirt Ls FlyerIndiana Family to FamilyNo ratings yet

- BT 202297Document4 pagesBT 202297Indiana Family to FamilyNo ratings yet

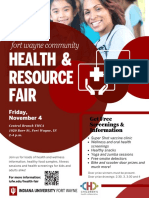

- Health Fair FlyerDocument1 pageHealth Fair FlyerIndiana Family to FamilyNo ratings yet

- BT 202276Document3 pagesBT 202276Indiana Family to FamilyNo ratings yet

- Talevski v. HHC Fact SheetDocument4 pagesTalevski v. HHC Fact SheetIndiana Family to FamilyNo ratings yet

- BT 202278Document3 pagesBT 202278Indiana Family to FamilyNo ratings yet

- FAQ Immigrant EligibilityDocument5 pagesFAQ Immigrant EligibilityIndiana Family to FamilyNo ratings yet

- Ensuring Access To Assistance From State and Local Governments NonprofitsDocument4 pagesEnsuring Access To Assistance From State and Local Governments NonprofitsIndiana Family to FamilyNo ratings yet

- BT 202270Document2 pagesBT 202270Indiana Family to FamilyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Full Download Test Bank For Nursing A Concept Based Approach To Learning Volume II 3rd Edition 3rd Edition PDF Full ChapterDocument36 pagesFull Download Test Bank For Nursing A Concept Based Approach To Learning Volume II 3rd Edition 3rd Edition PDF Full Chaptersignor.truss.j26uk100% (17)

- Tended Range Sixteen Channel Supervised Stationary ReceiverDocument2 pagesTended Range Sixteen Channel Supervised Stationary ReceiverAimee chaconNo ratings yet

- Basic HomeopathyDocument2 pagesBasic Homeopathypravin216No ratings yet

- How To Conduct A Situation AnalysisDocument10 pagesHow To Conduct A Situation AnalysisÂmany AymanNo ratings yet

- 1 s2.0 S0378517311000226 MainDocument9 pages1 s2.0 S0378517311000226 MainFIRMAN MUHARAMNo ratings yet

- Kevin Coleman's Sentencing MemoDocument26 pagesKevin Coleman's Sentencing MemoThe Valley IndyNo ratings yet

- The Safe Motherhood InitiativeDocument3 pagesThe Safe Motherhood InitiativeAnonymous g6L7jJWNo ratings yet

- Transition FX3U - C To iQ-F Series HandbookDocument58 pagesTransition FX3U - C To iQ-F Series HandbookKelly Leandro MazieroNo ratings yet

- California Department of Corrections EmailDocument3 pagesCalifornia Department of Corrections EmailHeidi McCaffertyNo ratings yet

- Nutrients: Dietary Fiber, Atherosclerosis, and Cardiovascular DiseaseDocument11 pagesNutrients: Dietary Fiber, Atherosclerosis, and Cardiovascular Diseasemichael palitNo ratings yet

- CFM56 3Document148 pagesCFM56 3manmohan100% (1)

- Collier v. Milliken & Company, 4th Cir. (2002)Document3 pagesCollier v. Milliken & Company, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- VálvulasDocument44 pagesVálvulasCarlos LópezNo ratings yet

- 4a-Ancient Indian Engineering BotanyDocument44 pages4a-Ancient Indian Engineering BotanyAshok NeneNo ratings yet

- 138 Student Living: New Returning Yes NoDocument2 pages138 Student Living: New Returning Yes NojevaireNo ratings yet

- Greetings: HVAC Design of Commercial Buildings With TESDocument49 pagesGreetings: HVAC Design of Commercial Buildings With TESchitradevipNo ratings yet

- Drugstudy - Delivery RoomDocument12 pagesDrugstudy - Delivery RoomAUBREY MARIE . GUERRERONo ratings yet

- Recipe For SuccesDocument27 pagesRecipe For Successtefany alvarezNo ratings yet

- Leviticus 12 Pulpit Commentary Homiletics PDFDocument16 pagesLeviticus 12 Pulpit Commentary Homiletics PDFEmiel AwadNo ratings yet

- WhatsApp Chat With Chinnu HeartDocument30 pagesWhatsApp Chat With Chinnu HeartSäi DäťťaNo ratings yet

- Benign Prostate Hyperplasia 2Document125 pagesBenign Prostate Hyperplasia 2Danieal NeymarNo ratings yet

- Hindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiDocument2 pagesHindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiUtkarsh KadamNo ratings yet

- vdYoyHdeTKeL7EhJwoXE - Insomnia PH SlidesDocument40 pagesvdYoyHdeTKeL7EhJwoXE - Insomnia PH SlidesKreshnik IdrizajNo ratings yet

- 21 Day Level Up Challenge My PathDocument52 pages21 Day Level Up Challenge My PathDavid Stark100% (1)

- Plumbing Specifications: Catch Basin PlanDocument1 pagePlumbing Specifications: Catch Basin PlanMark Allan RojoNo ratings yet

- Nurs 512 Andersen Behavioral TheoryDocument7 pagesNurs 512 Andersen Behavioral Theoryapi-251235373No ratings yet

- Magic Coco Tiles: Green Building MaterialDocument17 pagesMagic Coco Tiles: Green Building MaterialnikoNo ratings yet

- Guía Oficial de La Delegación Argentina de Los Juegos Olímpicos Tokio 2020Document330 pagesGuía Oficial de La Delegación Argentina de Los Juegos Olímpicos Tokio 2020Leandro BonavidaNo ratings yet

- OSA Winter 2011 NewsletterDocument18 pagesOSA Winter 2011 NewsletterNABSWOSANo ratings yet

- Pizza Hut and Dominos - A Comparative AnalysisDocument19 pagesPizza Hut and Dominos - A Comparative AnalysisSarvesh Kumar GautamNo ratings yet