Professional Documents

Culture Documents

Lifetime Benefit - Accident & Graded Sickness Rider

Uploaded by

Aaron PhuaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lifetime Benefit - Accident & Graded Sickness Rider

Uploaded by

Aaron PhuaCopyright:

Available Formats

LIFETIME BENEFIT – ACCIDENT & GRADED SICKNESS RIDER

Terms Used This rider is issued by us as part of the policy to which it is attached and is subject to the

provisions of the policy, except as may be modified or amended by this rider. Any

modification or amendment made by this rider is only in effect while this rider is in force.

The terms used in this rider have the same meaning as indicated in the policy, unless

otherwise specified or required in the context of the following rider provisions.

Rider Date The Rider Date will be the same as the Policy Date, if this rider is included in the policy

when it is first issued by us. Otherwise, the Rider Date will be such later date as

established by the amendment to the contract to include this rider. The Rider Date is used

to determine duration, premium due dates, anniversaries and your age with respect to this

rider.

Lifetime Benefit The Lifetime Benefit for Total Disability payable at the end of a particular calendar month

for Total Disability following your 65th birthday while a Period of Disability continues is:

a) the Lifetime Benefit for Total Disability shown for this rider on the Policy Details

page if Total Disability is caused by:

i. Injury before your 65th birthday; or

ii. Sickness first manifested before your 55th birthday; or

b) the Lifetime Benefit for Total Disability shown for this rider on the Policy Details

page multiplied by the applicable percentage shown in the table below if Total

Disability is contributed to or caused by Sickness first manifested after your

55th birthday, or by medical or dental treatment, including surgery, for the

Sickness.

Your Age on the date

you become Disabled Percentage

56 90%

57 80%

58 70%

59 60%

60 50%

61 40%

62 30%

63 20%

64 10%

If the Cost of Living (maximum 3% per year) Rider or Cost of Living (maximum 8% per

year) Rider is included in your policy, the Lifetime Benefit for Total Disability determined

above will be adjusted in the same manner as was the Monthly Disability Benefit under

the Cost of Living Benefit provision of the rider.

The Lifetime Benefit for Total Disability will be payable in accordance with the Payment of

Lifetime Benefit for Total Disability provision below.

(Continued on the back.)

This rider should be kept with the policy.

17230 – 5/07

LIFETIME BENEFIT – ACCIDENT & GRADED SICKNESS RIDER (continued)

Payment of The Lifetime Benefit for Total Disability will be payable if you:

Lifetime Benefit a) are Totally Disabled on your 65th birthday;

for Total Disability

b) have satisfied the Waiting Period, or the Waiting Period has been waived under

the Presumptive Disability provision, the Catastrophic Disability provision, or

elsewhere under the policy;

c) are receiving medical care from a Doctor that is of an appropriate nature and

frequency for the Disability; and

d) agree to be examined by a Doctor or other person determined by us, if and when

we reasonably require.

Payments will continue during your Disability until the earlier of:

a) the date you are no longer Totally Disabled; and

b) the date of your death.

The Lifetime Benefit for Total Disability will become payable at the end of the calendar

month in which you have satisfied the above conditions. Subsequent payments due will

be made at monthly intervals in arrears. For Lifetime Benefit for Total Disability payments

due for less than a calendar month, the benefit for each day of Disability will be 1/30th of

the applicable Lifetime Benefit for Total Disability.

The Lifetime Benefit for Total Disability during a period of Concurrent Disability will be

payable for only one cause of Disability at any time.

Presumptive If you are considered Totally Disabled under the Presumptive Disability or Catastrophic

Disability and Disability provision:

Catastrophic a) before your 65th birthday, the Lifetime Benefit for Total Disability will be increased

Disability by 25%; or

b) after your 65th birthday, the Lifetime Benefit for Total Disability will not be

increased by 25%.

A lump sum benefit will not be payable under this rider.

Survivorship Despite anything to the contrary, the Survivorship Benefit will not be payable if you die

Benefit Exclusion while the Lifetime Benefit for Total Disability Benefit is payable.

Rider Premium This rider is included in the policy in consideration for the payment of the Yearly Premium

shown for this rider on the Policy Details page. The premium for this rider is payable at the

same time and in the same manner and in addition to the premium for the basic policy.

The premium is payable on the same terms and conditions as the premium for the basic

policy and for the Premium Period for this rider shown on the Policy Details page.

(Continued on the next page.)

This rider should be kept with the policy.

17230 – 5/07

LIFETIME BENEFIT – ACCIDENT & GRADED SICKNESS RIDER (continued)

Rider Termination Subject to the provisions of the basic policy and any riders and benefits included in the

contract, this rider will terminate on the earliest of the following dates:

a) the monthly anniversary following the date on which we receive the Owner’s

Written Request for termination of this rider;

b) your 65th birthday if you are not Totally Disabled;

c) if you are Totally Disabled on your 65th birthday, the date you are no longer

Totally Disabled;

d) the date of your death; and

e) the date on which the policy terminates for any other reason.

Despite anything to the contrary, if you are Totally Disabled on the Expiry Date, the policy

will not terminate before the date you are no longer Totally Disabled. However, any riders

with the exception of this rider and the Cost of Living (maximum 3% per year) Rider or

Cost of Living (maximum 8% per year) Rider if included in the policy, will terminate on the

Expiry Date.

THE CANADA LIFE ASSURANCE COMPANY

R. L. McFeetors, S. A. Wagar,

President and Chief Executive Officer Secretary

This rider should be kept with the policy.

17230 – 5/07

You might also like

- Accidental Death and Dismemberment RiderDocument8 pagesAccidental Death and Dismemberment RiderRicha BandraNo ratings yet

- LIC's Jeevan Umang Plan Provides Income, Protection and SavingsDocument21 pagesLIC's Jeevan Umang Plan Provides Income, Protection and SavingsManish MauryaNo ratings yet

- LIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)Document21 pagesLIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)sri_plnsNo ratings yet

- Jeevan Ankur LicDocument7 pagesJeevan Ankur LicVenkat RamanaaNo ratings yet

- Max Life Accidental Death and Dismemberment Rider - 23.07.2021Document3 pagesMax Life Accidental Death and Dismemberment Rider - 23.07.2021Mohammad Kamran SaeedNo ratings yet

- LIC's Jeevan Umang plan offers income, protection and savingsDocument14 pagesLIC's Jeevan Umang plan offers income, protection and savingsmanoj gokikarNo ratings yet

- Ensure Regular Income, Even in Case of DisabilityDocument4 pagesEnsure Regular Income, Even in Case of DisabilitySam SonNo ratings yet

- Vivo 7Document1 pageVivo 7Dheeraj YadavNo ratings yet

- Jeevan SafarDocument7 pagesJeevan SafarNishant SinhaNo ratings yet

- LIC's Bima Jyoti Plan Offers Savings and ProtectionDocument20 pagesLIC's Bima Jyoti Plan Offers Savings and ProtectionSamNo ratings yet

- Lic Leaflet Endoment Plan4 5x8 Inches WXH NewDocument16 pagesLic Leaflet Endoment Plan4 5x8 Inches WXH NewVishal 777No ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- Great Critical Care Relief GCCRDocument7 pagesGreat Critical Care Relief GCCRraathi_cdiNo ratings yet

- 821 MoneyBack25 278V01 SLDocument8 pages821 MoneyBack25 278V01 SLdvk.dummymailNo ratings yet

- HDFC Life Income Benefit On Accidental Disability RiderDocument4 pagesHDFC Life Income Benefit On Accidental Disability RiderrechargemystuffNo ratings yet

- Sales Brochure - LIC S Bhagya Lakshmi PlanDocument6 pagesSales Brochure - LIC S Bhagya Lakshmi PlanAbhinavHarshalNo ratings yet

- Benefits:: Date of Commencement of Risk Under The PlanDocument10 pagesBenefits:: Date of Commencement of Risk Under The PlanDwellerwarriorNo ratings yet

- LIC Jeevan Anurag Educational PlanDocument6 pagesLIC Jeevan Anurag Educational Planshyam_inkNo ratings yet

- LIC Jeevan Azad Brochure EngDocument14 pagesLIC Jeevan Azad Brochure EngPravin PatilNo ratings yet

- Preferred Term Plan: Faidey Ka InsuranceDocument7 pagesPreferred Term Plan: Faidey Ka InsurancePratik JainNo ratings yet

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocument13 pagesLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- Contact Your Agent/Branch or Visit Our Website WWW - Licindia.in or SMS YOUR CITY NAME TO 56767474 (Eg. MUMBAI)Document12 pagesContact Your Agent/Branch or Visit Our Website WWW - Licindia.in or SMS YOUR CITY NAME TO 56767474 (Eg. MUMBAI)RustyNo ratings yet

- Paysaver+: Savings With Extra ProtectionDocument16 pagesPaysaver+: Savings With Extra Protectionaril eduNo ratings yet

- Bhagyalakshmi Sales Brochure W 4 5in X H 8in SPDocument8 pagesBhagyalakshmi Sales Brochure W 4 5in X H 8in SPMexico EnglishNo ratings yet

- Brochure - Family Income Benefit Rider V03Document6 pagesBrochure - Family Income Benefit Rider V03Anurup PatnaikNo ratings yet

- Ensure your income even during accidental disabilityDocument4 pagesEnsure your income even during accidental disabilitysusman paulNo ratings yet

- Smart Suraksha Plan Brochure PDFDocument6 pagesSmart Suraksha Plan Brochure PDFmahendraNo ratings yet

- LICJeevan AnuragDocument10 pagesLICJeevan Anuragnadhiya2007No ratings yet

- Bajaj Alliance Lifelong-Brochure PDFDocument9 pagesBajaj Alliance Lifelong-Brochure PDFSriram SundararamanNo ratings yet

- Reach For The Stars With Guaranteed Benefits.: Exide LifeDocument10 pagesReach For The Stars With Guaranteed Benefits.: Exide LifeRajishkumar RadhakrishnanNo ratings yet

- 9.3 Prospects of Agricultural Insurance: YYY YDocument5 pages9.3 Prospects of Agricultural Insurance: YYY YParvati BoraNo ratings yet

- Super Series BrochureDocument20 pagesSuper Series Brochuremantoo kumarNo ratings yet

- Sales Brochure LIC S Jeevan Lakshya PDFDocument11 pagesSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10No ratings yet

- LIC's Jeevan Anurag PlanDocument10 pagesLIC's Jeevan Anurag PlanMandheer ChitnavisNo ratings yet

- Group Term Life Product SummaryDocument6 pagesGroup Term Life Product SummaryNicholas JeremyNo ratings yet

- HDFC Life Sampoorn Samridhi Plus - Brochure PDFDocument12 pagesHDFC Life Sampoorn Samridhi Plus - Brochure PDFmonicaNo ratings yet

- Metlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Document4 pagesMetlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Amit PrasadNo ratings yet

- AD Rider V05 - BrochureDocument7 pagesAD Rider V05 - Brochurenaren syNo ratings yet

- A Nu RagDocument9 pagesA Nu RagHarish ChandNo ratings yet

- Product Summary - ECIDocument7 pagesProduct Summary - ECIEugene LimNo ratings yet

- Jeevan Kiran BrochureDocument24 pagesJeevan Kiran BrochureIsmailYusufAscJrcollegeNo ratings yet

- Wop Rider BrochureDocument13 pagesWop Rider Brochurea26geniusNo ratings yet

- Aegon Life AD Rider Brochure - 0Document5 pagesAegon Life AD Rider Brochure - 0aravindhana1a1No ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanRupran RaiNo ratings yet

- CAB Rider ContractDocument5 pagesCAB Rider ContractpravinNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term PlanRKNo ratings yet

- ICICI Pru Saral Jeevan BimaDocument9 pagesICICI Pru Saral Jeevan BimaThampy ATNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaRajnish SinghNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaRai BrijNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaPraveen latteNo ratings yet

- Aviva i-Life Secure Provides Regular Income for 15 YearsDocument1 pageAviva i-Life Secure Provides Regular Income for 15 YearsPinal JEngineerNo ratings yet

- Table No 178Document3 pagesTable No 178ssfinservNo ratings yet

- Life BrochureDocument8 pagesLife BrochureHar DonNo ratings yet

- Term Protector Product Summary: Important NoteDocument8 pagesTerm Protector Product Summary: Important NotesoxoNo ratings yet

- LIC's Single Premium Group Insurance PlanDocument5 pagesLIC's Single Premium Group Insurance PlanAditya SharmaNo ratings yet

- Shriram Extra Insurance Cover Rider DetailsDocument4 pagesShriram Extra Insurance Cover Rider DetailsRomil TiwariNo ratings yet

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Document16 pagesLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNo ratings yet

- 825 E-Term 288V01 SLDocument5 pages825 E-Term 288V01 SLIncredible MediaNo ratings yet

- CL 2015 Specimen (Own)Document1 pageCL 2015 Specimen (Own)Aaron PhuaNo ratings yet

- CL 2015 Specimen (Fio)Document3 pagesCL 2015 Specimen (Fio)Aaron PhuaNo ratings yet

- CL 2019 Specimen (Cola, 3)Document3 pagesCL 2019 Specimen (Cola, 3)Aaron PhuaNo ratings yet

- CL 2019 Specimen BasicDocument16 pagesCL 2019 Specimen BasicAaron PhuaNo ratings yet

- CL - 2019 - Specimen (Health Care W Residual)Document2 pagesCL - 2019 - Specimen (Health Care W Residual)Aaron PhuaNo ratings yet

- CL 2019 Specimen (Cola, 3)Document3 pagesCL 2019 Specimen (Cola, 3)Aaron PhuaNo ratings yet

- CL 2019 Specimen (Cola, 3)Document3 pagesCL 2019 Specimen (Cola, 3)Aaron PhuaNo ratings yet

- Canada Life Lifestyle ProtectionDocument28 pagesCanada Life Lifestyle ProtectionAaron PhuaNo ratings yet

- CL - 2019 - Specimen (Health Care W Residual)Document2 pagesCL - 2019 - Specimen (Health Care W Residual)Aaron PhuaNo ratings yet

- CL 2019 Specimen (Cola, 3)Document3 pagesCL 2019 Specimen (Cola, 3)Aaron PhuaNo ratings yet

- CL 2019 Specimen BasicDocument16 pagesCL 2019 Specimen BasicAaron PhuaNo ratings yet

- 2020 - Living Benefit Essentials - Canada LifeDocument5 pages2020 - Living Benefit Essentials - Canada LifeAaron PhuaNo ratings yet

- CL 2019 Specimen (Cola, 3)Document3 pagesCL 2019 Specimen (Cola, 3)Aaron PhuaNo ratings yet

- CL 2019 Full SpecimenDocument33 pagesCL 2019 Full SpecimenAaron PhuaNo ratings yet

- 2016 - Should You Rely On GroupDocument6 pages2016 - Should You Rely On GroupAaron PhuaNo ratings yet

- CL 2019 Full SpecimenDocument33 pagesCL 2019 Full SpecimenAaron PhuaNo ratings yet

- 2017 - Look at Disability Insurance ClaimsDocument2 pages2017 - Look at Disability Insurance ClaimsAaron PhuaNo ratings yet

- 2020 - Disability Guide - CLDocument108 pages2020 - Disability Guide - CLAaron PhuaNo ratings yet

- Disability Guide - CLDocument99 pagesDisability Guide - CLAaron PhuaNo ratings yet

- 2015 - Protect What Matters MostDocument7 pages2015 - Protect What Matters MostAaron PhuaNo ratings yet

- DR - Gold Immunology NotesDocument11 pagesDR - Gold Immunology NotesAaron PhuaNo ratings yet

- Endocrinology TEXTDocument21 pagesEndocrinology TEXTAaron PhuaNo ratings yet

- 2014 - What Happens If Your Plans Get InterruptedDocument1 page2014 - What Happens If Your Plans Get InterruptedAaron PhuaNo ratings yet

- Advisor Reference Guide: Startright Disability Insurance Grad Program 2020/21Document11 pagesAdvisor Reference Guide: Startright Disability Insurance Grad Program 2020/21Aaron PhuaNo ratings yet

- DR - Gold Immunology NotesDocument11 pagesDR - Gold Immunology NotesAaron PhuaNo ratings yet

- 6.financial Status and Framework of GOCCDocument4 pages6.financial Status and Framework of GOCCmadonna azuelaNo ratings yet

- Tu Delft Thesis Presentation TemplateDocument8 pagesTu Delft Thesis Presentation TemplateBuyEssaysOnlineForCollegeNewark100% (2)

- UAE-All Companies Addresses and Contact DetailsDocument9 pagesUAE-All Companies Addresses and Contact Detailswafaa al tawil100% (1)

- Virtual Energy Audit Identifies Cost-Effective RetrofitsDocument1 pageVirtual Energy Audit Identifies Cost-Effective RetrofitsAlejandra LopNo ratings yet

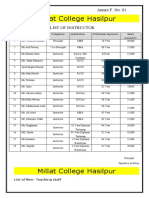

- Millat College Hasilpur: Annex F. No. 01Document3 pagesMillat College Hasilpur: Annex F. No. 01Hashim IjazNo ratings yet

- SBR Practice Questions 2019 - QDocument86 pagesSBR Practice Questions 2019 - QALEX TRANNo ratings yet

- RuPay TrainingDocument4 pagesRuPay TrainingSeldon Pradhan DoraeholicNo ratings yet

- Understanding Business Cycles Through IndicatorsDocument2 pagesUnderstanding Business Cycles Through Indicatorsawais mehmoodNo ratings yet

- IBS301 International Business Work Plan 2023Document19 pagesIBS301 International Business Work Plan 2023sha ve3No ratings yet

- Deed of Conditional SaleDocument2 pagesDeed of Conditional SaleJustin Mikhael Abraham100% (1)

- Business Advantages and DisadvantagesDocument2 pagesBusiness Advantages and DisadvantagesTYA HERYANINo ratings yet

- Black & Veatch Pltu Tanjung Jati B Pltu Tanjung Jati B JeparaDocument1 pageBlack & Veatch Pltu Tanjung Jati B Pltu Tanjung Jati B Jeparabass_121085477No ratings yet

- Bolt May 201592181742354Document103 pagesBolt May 201592181742354Debasish RauloNo ratings yet

- b2 1 AndoDocument60 pagesb2 1 AndoSudhagarNo ratings yet

- Internal Control and Control Risk HandoutsDocument38 pagesInternal Control and Control Risk Handoutsumar shahzadNo ratings yet

- Arcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 PartsDocument5 pagesArcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 Partsarpit agrawalNo ratings yet

- Final Examination TT For Cert & Dip - Feb 2023Document3 pagesFinal Examination TT For Cert & Dip - Feb 2023wilfredNo ratings yet

- Test Bank For Human Resource Management 11th Edition Rue Byars and Ibrahim 0078112796 9780078112799Document36 pagesTest Bank For Human Resource Management 11th Edition Rue Byars and Ibrahim 0078112796 9780078112799TerryRandolphdsec100% (24)

- Making and Acknowledging Payment DocumentsDocument12 pagesMaking and Acknowledging Payment DocumentsAlif Viana RachmawatiNo ratings yet

- Chapter 6 - Organizational StudyDocument26 pagesChapter 6 - Organizational StudyRed SecretarioNo ratings yet

- Pad381 - Am1104b - Group 1 ReportDocument19 pagesPad381 - Am1104b - Group 1 ReportNOR EZALIA HASBINo ratings yet

- ARCHANADocument1 pageARCHANAsales.kayteeautoNo ratings yet

- Rags2Riches by Reese FernandezDocument1 pageRags2Riches by Reese FernandezChristian Gerard P. BerouNo ratings yet

- Safety Planner and TBT Roster of HCSL For The Month of Oct-21Document4 pagesSafety Planner and TBT Roster of HCSL For The Month of Oct-21Kãùshîk MâjümdérNo ratings yet

- CH-2 (LR) FinalDocument41 pagesCH-2 (LR) FinalJason RaiNo ratings yet

- Updated Blaw Past Papers by RNK-1Document90 pagesUpdated Blaw Past Papers by RNK-1muzamil azizNo ratings yet

- Mckinsey How To Write A Business PlanDocument29 pagesMckinsey How To Write A Business PlanGianlucaNo ratings yet

- Bifma X5 5-2008Document106 pagesBifma X5 5-2008PedFerragens Metalnox67% (3)

- Introduction To Business ImplementationDocument31 pagesIntroduction To Business ImplementationDumplings DumborNo ratings yet

- Semester 4 Theory Regional Indian Cuisine and LarderDocument13 pagesSemester 4 Theory Regional Indian Cuisine and LarderCletus PaulNo ratings yet