Professional Documents

Culture Documents

O2 Micro - Zacks - SCR - Research

Uploaded by

rojOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

O2 Micro - Zacks - SCR - Research

Uploaded by

rojCopyright:

Available Formats

October 30, 2020

Zacks Small-Cap Research Lisa Thompson

312-265-9517

Sponsored Impartial - Comprehensive lthompson@zacks.com

scr.zacks.com 10 S. Riverside Plaza, Chicago, IL 60606

O2Micro International Ltd (NASDAQ: OIIM)

O2Micro Growth Accelerates as OUTLOOK

Backlighting and Power Management

Becomes Increasingly Important to the O2Micro International is a fabless semiconductor firm

that designs, develops and markets high

Market

performance integrated circuits primarily for power

management and battery management for TV

backlighting, LED lighting, and portable tools and

Using an industry average value to trailing 12-month

sales of 8.9 times and OIIM s $73 m trailing 12-month appliances. It had struggled to reach profitability and

revenue, we would calculate an enterprise value of cash flow breakeven but is now there. The company

$650 million, a market cap of $690 million and a price trades at an enterprise value of $114 million well

of $23.90 per share. below its peers. Its right-sizing efforts combined

with a surge in demand for high end TVs and battery-

operated devices is accelerating its growth and

producing higher and higher margins.

Current Price (10/29/20) $5.43

Valuation $23.90

SUMMARY DATA

52-Week High $6.23 Risk Level Above Average

52-Week Low $1.00 Type of Stock Small-Blend

One-Year Return (%) 338 Industry Elec Comp-Semis

Beta 1.0

Average Daily Volume (sh) 483,773

ZACKS ESTIMATES

Shares Outstanding (mil) 27

Market Capitalization ($mil) $154 Revenue

(in millions of $)

Short Interest Ratio (days) 1.0

Q1 Q2 Q3 Q4 Year

Institutional Ownership (%) 37

(Mar) (Jun) (Sep) (Dec) (Dec)

Insider Ownership (%) 8

2018 14.1 A 15.2 A 16.8 A 16.6 A 63 A

Annual Cash Dividend $0.00 2019 12.8 A 14.3 A 16.0 A 17.9 A 61 A

Dividend Yield (%) 0.00 2020 15.6 A 17.3 A 22.2 A 23.4 E 79 E

2021 94 E

5-Yr. Historical Growth Rates

Sales (%) 3.5 Earnings Per Share

(non-GAAP EPS before non-recurring items)

Earnings Per Share (%) N/A

Q1 Q2 Q3 Q4 Year

Dividend (%) N/A

(Mar) (Jun) (Sep) (Dec) (Dec)

2018 -$0.09 A -$0.05 A -$0.05 A -$0.05 A -$0.24 A

P/E using TTM EPS 27.4 2019 -$0.13 A -$0.08 A -$0.02 A $0.05 A -$0.18 A

P/E using 2020 Estimate 21.8 2020 -$0.00 A $0.03 A $0.12 A $0.13 E $0.24 E

P/E using 2021 Estimate 15.5 2021 $0.35 E

Zacks Projected EPS Growth Rate - Next 5 Years % 10

© Copyright 2020, Zacks Investment Research. All Rights Reserved.

WHAT S NEW

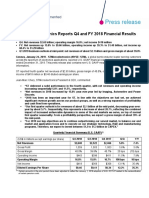

Revenue Growth Hits 39% in Q3 and Yields a Record EBITDA of $4.6 million

Today O2Micro announced record quarterly revenues and expects to beat that number in Q4. As a result

we are raising estimates for Q4 and for both 2020 and 2021. For Q4 revenues O2Micro expects

revenues between $22.7 and $24.0 million or a midpoint of $23.4 million, which would be growth of 31%

year over year. Usually Q4 and Q3 are flat with each so an increase of over a million dollars is

meaningful sign. As a result our 2020 estimate is going to $78.4 million (up 29%) and a non-GAAP EPS

of $0.24. We are also raising 2021 estimates to 20% growth to $94 million in sales and $0.35 non-GAAP

fully diluted EPS.

EBITDA Surged as Costs Remained Flat

The restructuring benefits have kicked in and EBITDA surged to $4.6 million or 21% of sales. Although

the company burned $1.1 million, mostly funding accounts receivable, it expects to be adding to cash in

Q4 and beyond.

Demand Remains Strong

Demand across the board remains strong. We had been worried that during the shut down consumers

would have bought their fill of cordless tools and high end TVs and demand would pause, but orders

remain strong. In fact, rather than its typical sequentially down Q1, O2Micro expects sales to be flat with

Q4 as new customers come on board. The company sells to end user markets that are on fire. 4K and 8K

TVs, HDR monitors, lithium ion battery powered cordless everything and even medical monitors. In

addition to display backlighting, power management is being a more and more important part of device

design as batteries become cheaper and more powerful and devices more sophisticated. In Europe

nickel cadmium (Ni-Cd) batteries for power tools have been banned. Meanwhile lithium-ion batteries are

becoming more and more economical. What used to cost $1,183 per kWh in 2010 dropped 86% to $156

kWh by 2019. Lithium ion battery production grew from19 GWh in 2010 to 285 GWh this year and could

quadruple by 2030.

Q3 Results

Revenues were $22.2 million compared with $16.0 million in Q3 a year ago, up 39%.

For Q3 the gross margin was 51.8% compared to 51.4% a year ago and 51.2% in Q2 2020. The

company said to expect the Q4 2020 gross margin to be in the range of 50-52%.

Revenue By Segment

Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020

Consumer 40-45% 42-44% 49-51% 43-45% 46-48% 43-45% 44-46% 43-45% 44-46 47-49 42-44

Computer 10-15 15-17 8-10 6-8 6-8 6-8 6-8 5-7 5-7 5-7 5-7

Industrial 40-45 40-42 40-42 47-49 45-47 47-49 47-49 48-50 48-50 45-47 50-52

Communications <5 0 0 0 0 0 0 0 0 0 0

Reported total operating expenses were again $8.4 million in the quarter compared to $9.4 million a year

ago. The company went from 370 employees in Q1 to 289 in Q2 and 298 in Q3.

R&D expense was down year over year in the quarter to $4.1 million from $4.7 million.

Zacks Investment Research Page 2 scr.zacks.com

SG&A was $4.3 million and flat sequentially if the $200,000 in severance in Q2 is taken out of the Q2

number. It was down from $4.6 million a year ago.

Operating income in Q3 was $3.1 million versus a loss of $1.1 million last year. Adding back depreciation

and amortization ($913,000) and stock-based compensation ($326,000,) and adding the rental income,

the adjusted EBITDA looks to be a positive $4.6 million compared to $1.8 million in Q2 2020 and a

negative $110,000 in Q3 2019.

Total other income was $68,000 versus $1.2 million last year. This year included a $171,000 unrealized

loss on the company holding in Excelliance MOS stock while last year the holding showed a $715,000

gain. In Q3 O2Micro sold 155,000 shares of Excelliance MOS stock for proceeds of $658,000 at an

average price of $4.00 per share. It had a cost basis of $0.53 per share. It still holds 424,000 shares

(worth $1.8 million), and expects to sell more in Q4 2020.

The company reported a GAAP net income of $2.9 million versus last year s loss of $200,000 last year.

This yielded a fully diluted GAAP EPS of $0.10 versus a loss per share of $0.01 a year ago.

Non-GAAP income was $3.4 million, versus a loss of $542,000 last year. This yielded a non-GAAP EPS

of $0.12, versus a loss per share of $0.02 last year.

ADS outstanding were 27 million and fully diluted they stood at 28.9 million. In Q3 2020, the company

repurchased 14,933 ADS units at a cost of $44,000.

Balance Sheet

On September 30, 2020, the company had $40.8 million in cash and equivalents (or $1.51 per ADS),

down just $596,000 million sequentially. Net cash used by operating activities in the quarter was $1.1

million. Capital expenditures were $733,000 and depreciation and amortization was $913,000.

In Q1 the company streamlined operations for profitability; the company s cash breakeven point remains

between $14-16 million and the profit breakeven to $16-18 million. The full effect of these cost savings

efforts will be felt in Q4 2020.

After the Quarter Ended

On Oct. 01, 2020 O2Micro announced it was granted of a patent for circuits that drive light sources, along

with a light source module. It was issued 21 claims under US patent US 10,757,770 B2 on Aug 25, 2020.

The module supports dual light sources, along with a current allocation unit. The allocation unit adjusts

the current through each light source based on the output. This light source driver fills the need for multi-

color lighting applications through our intelligent current-allocation technique providing color adjustments.

This technology will allow for light output temperature adjustment between Pure White Light and more

traditional Warm Light without changing bulbs.

Zacks Investment Research Page 3 scr.zacks.com

VALUATION

Company Has Significant Upside If It Can End Cash Burn and Sustain a Profit

The company trades at an enterprise value of $114.0 million, up significantly since our last report as

investors begin to believe in sustainable profitability. At the end of Q3 2020, the company had $40.8

million (or $1.51 per ADS) in cash and equivalents, no debt, and valuable real estate in China and

California. In California it owns a 37,180 square foot building where it has its USA operations, which was

bought for $4.6 million in May 2004 and believe it is now easily worth more than $9 million. Plus it also

owns other real estate in China and Taiwan. Also on the balance sheet are long-term investments in

other companies, including 424,000 shares of stock in Excelliance MOS (worth $1.8 million.) The

company has a high acquisition, value. Activists had tried to encourage a transaction with an acquirer,

but the company has no interest in a sale and due to restrictions, it is difficult to force one.

Looking at O2 Micro from an M&A prospective we can look at other fabless semiconductor transactions.

In May 2018, Microchip Technology bought Microsemi for $10.15 billion, which was a valuation of 5.5

times its trailing twelve-month revenues of $1.845 billion. Two other comparable companies we had been

using, Intersil and Linear Technology, were acquired at very high valuations. Intersil was acquired by

Renesas for $3.2 billion at a valuation of 5.9xs the company s trailing $542.1 million in revenue. Analog

Devices acquired linear Technology for $14.8 billion. This was 9.9 times its trailing four quarters of

revenue of $1.5 billion.

Were we to use the current average enterprise value to trailing twelve-month sales of 8.9 times and apply

it to OIIM s trailing 12-month $73 million revenues, we would calculate an enterprise value of $650

million. Adding to it $40.8 million in cash and equivalents gives us a market cap of $690 million or $23.90

per share using fully diluted shares. We believe that once the company shows sustainable revenue

growth and cash generation, the market should afford it a valuation closer to this price. It is certainly on

the path to do this.

As it moves to profits, we can even look at the stock on a PE basis. Currently trades at 15.5 times 2021

estimated EPS.

Competitors EV TTM Sales EV/Sales

Monolithic Power Systems MPWR 13,000 688 18.9

Cree Inc. CREE 6,750 904 7.5

Microchip Technology MCHP 35,000 5,260 6.7

Maxim MXIM 17,800 2,280 7.8

Texas Instruments TXN 132,000 13,740 9.6

Cirrus Logic CRUS 3,720 1,290 2.9

Average 8.9

Zacks Investment Research Page 4 scr.zacks.com

OWNERSHIP

Grandeur Peak Global

Advisors

DNB Asset Management

Renaissance Technologies

White Pine Capital

BofA Global Research

Invenomic Capital

Management

Balter Capital

Management

Other

RISKS

O2Micro has high exposure to the global demand for TVs, particularly those sold in China. It is

depending on free dimming and high power LED lighting, 4K and 8K and other high end TVs and

monitors, lithium ion battery powered tools and appliances, and IoT to give it revenue and margin

growth.

In 2019, two customers accounted for 26% of revenues and their loss could cause a meaningful

decline in revenues. 86% of revenues were from China. Without the FEIT license fee, we believe

that number would be 89%.

The company is currently being affected by the proliferation of the coronavirus in China as their

production and most of their customers are located in China and sell to the Chinese market. Right

now is unknown how restrictions and health concerns will affect commerce in both the short and long

term.

The firm has had only two profitable GAAP quarter since 2011, and although probable, it remains to

be seen if positive results will be truly sustainable.

Given its large number of patents, litigation risk is a possibility as the company enforces its patents.

Zacks Investment Research Page 5 scr.zacks.com

INCOME STATEMENT

March June Sept Dec March June Sept Dec

Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20E 2018 2019 2020E 2021E

REVENUE

Net Revenue 12.8 14.3 16.0 17.9 15.6 17.3 22.2 23.4 62.7 60.9 78.5 94.1

Yr-to-yr Gr. -10% -6% -5% 8% 22% 21% 39% 31% 4% -3% 29% 20%

OPERATING EXPENSES

Cost of goods sold 6.3 7.1 7.8 7.7 7.5 8.4 10.7 11.2 30.7 29.0 37.9 46.1

Gross Margin 6.4 7.1 8.2 10.1 8.1 8.9 11.5 12.1 32.0 32.0 40.6 48.0

% of Sales 50.5% 50.1% 51.4% 56.7% 51.9% 51.2% 51.8% 51.9% 51.0% 52.5% 51.7% 51.0%

R&D 5.1 4.8 4.7 4.4 4.1 4.1 4.1 4.3 19.8 19.1 16.6 18.4

SG&A 5.0 4.9 4.6 4.8 4.5 4.3 4.3 4.5 20.3 19.3 17.6 20.8

One-time expenses & Adj. 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 (0.0) 0.0 0.0 0.0

Tot Operating Exp. 10.0 9.7 9.4 9.2 8.7 8.4 8.4 8.8 40.1 38.4 34.2 39.2

Operating Income (3.6) (2.6) (1.1) 0.9 (0.6) 0.5 3.1 3.3 (8.1) (6.4) 6.4 8.8

Operating margin -28% -18% -7% 5% -4% 3% 14% 14% -13% -10% 8% 9%

Interest income 0.1 0.1 0.2 0.2 0.2 0.2 0.1 0.1 0.4 0.5 0.5 0.4

Unrealized fair value on LT Investments 0.0 (0.2) 0.7 0.2 (1.1) 1.1 (0.2) 0.0 9.8 0.8 (0.2) 0.0

Foreign exchange loss (0.1) 0.1 0.0 (0.1) 0.0 (0.1) (0.1) 0.0 0.1 (0.2) (0.2) 0.0

Gain on sale of real estate 0.0 0.0 0.0 0.5 0.0 0.0 0.0 0.0 0.0 0.5 0.0 0.0

Other (rent) - net 0.1 0.1 0.4 0.2 0.1 0.2 0.3 0.2 1.0 0.8 0.7 1.1

One-time charge 0.0 0.0 0.0 0.0 0.0 (1.2) 0.0 0.0 0.0 0.0 (1.2) 0.0

Total other Income 0.1 0.1 1.2 1.1 (0.8) 0.2 0.1 0.3 11.4 2.5 (0.3) 1.5

Pretax Income (3.5) (2.5) 0.1 2.0 (1.3) 0.6 3.2 3.6 3.3 (3.9) 6.1 10.3

Pretax margin -27.6% -17.4% 0.8% 11.3% -8.6% 3.7% 14.3% 15.3% 5.2% -6.3% 7.7% 10.9%

Taxes 0.3 0.3 0.3 0.3 0.2 0.3 0.3 0.3 1.1 1.2 1.0 1.5

Tax Rate -8.5% -11.6% 251.5% 12.4% -15.4% 40.8% 8.0% 7.8% 34.9% -30.3% 16.5% 14.3%

GAAP Net Income (3.8) (2.8) (0.2) 1.8 (1.5) 0.4 2.9 3.3 2.1 (5.0) 5.1 8.8

Non-GAAP Net Income (3.5) (2.2) (0.5) 1.4 (0.0) 0.8 3.4 3.6 (6.3) (4.8) 6.7 10.3

GAAP EPS-Basic ($0.15) ($0.11) ($0.01) $0.07 ($0.06) $0.01 $0.11 $0.12 $0.08 ($0.19) $0.19 $0.33

GAAP EPS-Fully dil. ($0.14) ($0.11) ($0.01) $0.07 ($0.06) $0.01 $0.10 $0.11 $0.08 ($0.19) $0.19 $0.33

Non-GAAP ($0.13) ($0.08) ($0.02) $0.05 ($0.00) $0.03 $0.12 $0.13 ($0.24) ($0.18) $0.24 $0.35

Share Out 26.3 26.4 26.3 26.3 26.7 27.0 27.0 27.0 26.0 26.3 26.9 27.0

Fully diluted shares 26.9 26.4 26.3 27.1 26.7 27.7 28.9 28.9 26.6 26.3 28.1 28.9

Yr-to-yr Gr. 2% 0% 0% 2% -1% 5% 10% 7% 3% -1% 7% 3%

Zacks Investment Research Page 6 scr.zacks.com

BALANCE SHEET

June 30, March 31, Qtr-to-Qtr June 30, Yr-to-Yr

2019 2020 % Change 2019 % Change

CURRENT ASSETS

Cash and cash equivalents $12,676 $16,108 -21.3% $12,955 -2.2%

Restricted cash 36 35 2.9% 34 5.9%

Short-term investments 28,684 28,595 0.3% 21,950 30.7%

Accounts receivable, net 11,730 11,016 6.5% 11,143 5.3%

Inventories 12,416 9,876 25.7% 9,910 25.3%

Prepaid expenses and other current assets 1,505 1,361 10.6% 2,360 -36.2%

Total current assets 67,047 66,991 0.1% 58,352 14.9%

LONG-TERM INVESTMENTS 3,327 3,020 10.2% 6,463 -48.5%

PROPERTY AND EQUIPMENT, NET 15,150 15,222 -0.5% 17,365 -12.8%

OTHER ASSETS 5,484 2,662 106.0% 2,321 136.3%

Total other assets 23,961 20,904 14.6% 26,149 -8.4%

TOTAL ASSETS 91,008 87,895 3.5% 84,501 7.7%

CURRENT LIABILITIES

Notes and accounts payable 7,834 6,596 18.8% 2,839 175.9%

Income tax payable 318 702 -54.7% 384 -17.2%

Lease liabilities 644 714 -9.8% 975 -33.9%

Accrued expenses and other current liabilities 5,090 3,540 43.8% 4,420 15.2%

Total current liabilities 13,886 11,552 20.2% 8,618 61.1%

OTHER LONG-TERM LIABILITIES

Accrued pension liabilities 193 207 -6.8% 295 -34.6%

Deferred tax liabilities 629 651 -3.4% 673 -6.5%

Lease liabilities 1,752 1,829 -4.2% 2,124 -17.5%

Other liabilities 66 65 1.5% 86 -23.3%

Total long-term liabilities 2,640 2,752 -4.1% 3,178 -16.9%

Total liabilities 16,526 14,304 15.5% 11,796 40.1%

SHAREHOLDERS EQUITY

Ordinary shares 33 33 0.0% 33 0.0%

Additional paid-in capital 142,928 142,853 0.1% 142,775 0.1%

Accumulated deficits (53,987) (54,087) -0.2% (53,282) 1.3%

Accumulated other comprehensive income 4,573 4,408 3.7% 4,544 0.6%

Treasury stock (19,063) (19,616) -2.8% (21,365) -10.8%

Total shareholders equity 74,484 73,591 1.2% 72,705 2.4%

TOTAL LIABILITIES AND SHAREHOLDERS

EQUITY 91,008 87,895 3.5% 84,501 7.7%

Cash and equivalents $41,360 $44,703 -7.5% $34,905 18.5%

Change in cash and equivalents (3,343) (1,686) 98.3% 6,455 -151.8%

Market value 62,383,500 40,614,400 53.6% 37,161,960 67.9%

Enterprise value 20,987,500 (4,123,600) -609.0% 2,222,960 844.1%

DSO 59 62 -4.8% 62 -4.8%

Inventory Days 119 112 6.3% 130 -8.5%

Zacks Investment Research Page 7 scr.zacks.com

ANNUAL CASH FLOW

2019 2018 2017 2016 2015

OPERATING ACTIVITIES

Net loss $ (5,039) $ 2,088 $ (6,145) $ (2,986) $ (21,095)

Adjustments to reconcile net loss to net cash used in

operating activities:

Depreciation and amortization 1,780 1,641 1,667 1,682 2,446

Stock-based compensation 1,462 1,421 1,589 1,606 1,912

Loss on asset write-off 0 0 0 0 0

Inventory write-downs 1,359 1,328 642 1,527 913

Net gain recognized on LT investments (788) (9,916) 0 0 0

Gain on sale of long-term investments (500) 0 (20) (948) (8)

Impairment loss on long-term investments 0 0 0 0 4,953

Gain on disposal of property & eqt, net 2 (6) (137) (1,726) (738)

Deferred income taxes (133) (155) 40 (1,231) 1,989

Other, net 0 0 0 0 0

Changes in operating assets and liabilities:

Accounts receivable, net 1,053 (2,204) (1,979) (2,008) 1,592

Inventories 133 (2,286) (697) (1,140) (1,933)

Prepaid expenses and other current assets 981 (1,031) (139) (6) 191

Deferred charges (571) (983) (553) (375) (416)

Operating lease right of use assets (1,477) 0 0 0 0

Notes and accounts payable 285 2,122 (1,869) 996 1,202

Income tax payable 198 72 161 (2,065) 1,595

Accrued expenses and other current liabilities 661 (105) 186 (1,064) (1,039)

Operating lease liabilities 1,494 0 0 0 0

Accrued pension liabilities (42) (20) 13 (4) (11)

Other liabilities 3 (1) 3 (56) (168)

Net cash used in operating activities 861 (8,035) (7,238) (7,798) (8,615)

Acquisition of:

Short-term investments (34,649) (11,197) (8,505) (28,797) (7,128)

Long-term investments 0 0 0 0 0

Property and equipment (1,672) (1,272) (704) (673) (724)

Decrease (increase) in:

Restricted assets 0 0 0 0 0

Restricted cash 0 0 0 0 132

Other assets 6 (12) 22 40 82

Proceeds from:

Sale of short-term investments 4,953 22,540 12,635 18,331 16,755

Sale of long-term investments 7,061 2,582 0 5,982 167

Return of capital from LT investment 0 0 1,163 17 370

Sale of real estate 2,169

Disposal of property and equipment 1 16 145 3,837 3,205

Net cash provided by investing activities (22,131) 12,657 4,756 (1,263) 12,859

FINANCING ACTIVITIES

Acquisition of treasury stock (510) (451) (708) (619) (3,233)

Proceeds from:

Exercise of stock options 7 10 29 2 31

Issuance of ordinary shares under the ESP Plan 109 86 84 73 180

Net cash used in financing activities (394) (355) (595) (544) (3,022)

EFFECTS OF CHANGES IN FOREIGN EXCHANGE (53) (374) 268 (261) (1,092)

RATE

NET INCREASE (DECREASE) IN CASH AND CASH (21,717) 3,893 (2,809) (9,866) 130

EQUIV.

CASH & CASH EQUIV. AT BEGINNING OF YR 32,448 28,555 31,364 41,230 41,069

CASH & CASH EQUIVALENTS AT END OF YR 10,731 32,448 28,555 31,364 41,199

Cash paid for tax $ 1,171 $ 1,218 $ 818 $ 4,349 $ 1,068

Cash Flow (1,857) (3,599) (2,364) (2,076) (9,628)

Free cash flow (3,529) (4,871) (3,068) (2,749) (10,352)

Zacks Investment Research Page 8 scr.zacks.com

HISTORICAL STOCK PRICE

Zacks Investment Research Page 9 scr.zacks.com

DISCLOSURES

The following disclosures relate to relationships between Zacks Small-Cap Research (Zacks SCR), a division of Zacks Investment Research (ZIR), and the

issuers covered by the Zacks SCR Analysts in the Small-Cap Universe.

ANALYST DISCLOSURES

Zacks SCR Analysts hereby certify that the view expressed in this research report or blog article accurately reflect the personal views of the analyst about

the subject securities and issuers. Zacks SCR also certifies that no part of any analysts compensation was, is, or will be, directly or indirectly, related to the

recommendations or views expressed in this research report or blog article. Zacks SCR believes the information used for the creation of this report or blog

article has been obtained from sources considered reliable, but we can neither guarantee nor represent the completeness or accuracy of the information

herewith. Such information and the opinions expressed are subject to change without notice. The Zacks SCR Twitter is covered herein by this disclosure.

INVESTMENT BANKING AND FEES FOR SERVICE

Zacks SCR does not provide investment banking services nor has it received compensation for investment banking services from the issuers of the

securities covered in this report or article. Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor

relations consulting firm engaged by the issuer for providing non-investment banking services to this issuer and expects to receive additional compensation

for such noninvestment banking services provided to this issuer. The non-investment banking services provided to the issuer include the preparation of this

report, investor relations services, investment software, financial database analysis, organization of non-deal road shows, and attendance fees for

conferences sponsored or co-sponsored by Zacks SCR. Each issuer has entered into an agreement with Zacks to provide continuous independent

research for a period of no less than one year in consideration of quarterly payments totaling a maximum fee of $40,000 annually.

POLICY DISCLOSURES

This report provides an objective valuation of the issuer today and expected valuations of the issuer at various future dates based on applying standard

investment valuation methodologies to the revenue and EPS forecasts made by the SCR Analyst of the issuer s business. SCR Analysts are restricted

from holding or trading securities in the issuers that they cover. ZIR and Zacks SCR do not make a market in any security followed by SCR nor do they act

as dealers in these securities. Each Zacks SCR Analyst has full discretion over the Valuation of the issuer included in this report based on his or her own

due diligence. SCR Analysts are paid based on the number of companies they cover. SCR Analyst compensation is not, was not, nor will be, directly or

indirectly, related to the specific valuations or views expressed in any report or article.

ADDITIONAL INFORMATION

Additional information is available upon request. Zacks SCR reports and articles are based on data obtained from sources that it believes to be reliable, but

are not guaranteed to be accurate nor do they purport to be complete. Because of individual financial or investment objectives and/or financial

circumstances, this report or article should not be construed as advice designed to meet the particular investment needs of any investor. Investing involves

risk. Any opinions expressed by Zacks SCR Analysts are subject to change without notice. Reports or articles or Tweets are not to be construed as an offer

or solicitation of an offer to buy or sell the securities herein mentioned.

CANADIAN COVERAGE

This research report is a product of Zacks SCR and prepared by a research analyst who is employed by or is a consultant to Zacks SCR. The research

analyst preparing the research report is resident outside of Canada, and is not an associated person of any Canadian registered adviser and/or dealer.

Therefore, the analyst is not subject to supervision by a Canadian registered adviser and/or dealer, and is not required to satisfy the regulatory licensing

requirements of any Canadian provincial securities regulators, the Investment Industry Regulatory Organization of Canada and is not required to otherwise

comply with Canadian rules or regulations.

Zacks Investment Research Page 10 scr.zacks.com

You might also like

- Equinix, Inc.: Neutral/ModerateDocument19 pagesEquinix, Inc.: Neutral/ModerateashishkrishNo ratings yet

- Zacks CPRT Copart, Inc (CPRT) Zacks Company Report 2Document9 pagesZacks CPRT Copart, Inc (CPRT) Zacks Company Report 2Ekambaram Thirupalli TNo ratings yet

- Zacks Small-Cap Research: Corecivic, IncDocument8 pagesZacks Small-Cap Research: Corecivic, IncKarim LahrichiNo ratings yet

- The Value Guy: Western Digital (WDC)Document5 pagesThe Value Guy: Western Digital (WDC)thevalueguyNo ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- Zacks SCR Research 05222023 GRIL KerrDocument19 pagesZacks SCR Research 05222023 GRIL KerrRhonda CroweNo ratings yet

- Stanley Black & Decker Poised for Long Term Growth Despite Short Term HeadwindsDocument8 pagesStanley Black & Decker Poised for Long Term Growth Despite Short Term HeadwindsAnup KelkarNo ratings yet

- MTCH - Match Group IncDocument10 pagesMTCH - Match Group Incdantulo1234No ratings yet

- Rul Mamoelis Update 181122Document6 pagesRul Mamoelis Update 181122jonathan gohNo ratings yet

- Zack GM Outperform-Strong Buy-DDocument12 pagesZack GM Outperform-Strong Buy-DMeng KeNo ratings yet

- Starboard Value LP LetterDocument4 pagesStarboard Value LP Lettersumit.bitsNo ratings yet

- Microsoft Corp. $260.36 Rating: Neutral Neutral NeutralDocument3 pagesMicrosoft Corp. $260.36 Rating: Neutral Neutral Neutralphysicallen1791No ratings yet

- Zacks CPRT Copart, Inc (CPRT) Zacks Company ReportDocument9 pagesZacks CPRT Copart, Inc (CPRT) Zacks Company ReportEkambaram Thirupalli TNo ratings yet

- NR Agarwal Industries: Leading Indian recycled paper manufacturer with growth potentialDocument16 pagesNR Agarwal Industries: Leading Indian recycled paper manufacturer with growth potentialrchawdhry123No ratings yet

- AAPL.O Apple Inc. Profile - ReutersDocument7 pagesAAPL.O Apple Inc. Profile - ReutersSheryl PajaNo ratings yet

- Webslides Q221 FinalDocument19 pagesWebslides Q221 FinalxtrangeNo ratings yet

- News Release: Intel Reports First-Quarter 2022 Financial ResultsDocument16 pagesNews Release: Intel Reports First-Quarter 2022 Financial ResultsFernando Cebreros BeltránNo ratings yet

- ITC Analyst Meet Key TakeawaysDocument19 pagesITC Analyst Meet Key TakeawaysTatsam VipulNo ratings yet

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- Wipro Limited - Update On Material Event: Summary of Rating(s) OutstandingDocument7 pagesWipro Limited - Update On Material Event: Summary of Rating(s) OutstandingMegha PrakashNo ratings yet

- Alpha and Omega Semiconductor Ltd. (AOSL)Document7 pagesAlpha and Omega Semiconductor Ltd. (AOSL)Shreelalitha KarthikNo ratings yet

- Alcoa Corporation $45.80 Rating: Very NegativeDocument3 pagesAlcoa Corporation $45.80 Rating: Very Negativephysicallen1791No ratings yet

- NRDS Trade ReportDocument3 pagesNRDS Trade Report2thnzkcssjNo ratings yet

- Data Overview: Wireless EquipmentDocument9 pagesData Overview: Wireless Equipmentderek_2010No ratings yet

- Ey Bellwethers of Indian SaasDocument36 pagesEy Bellwethers of Indian SaasApurva ChamariaNo ratings yet

- Ovett: Western Digital (WDC)Document5 pagesOvett: Western Digital (WDC)thevalueguyNo ratings yet

- Daily Story - Driver IC Sector - 2023 - 05 - 09 - C - TWDocument7 pagesDaily Story - Driver IC Sector - 2023 - 05 - 09 - C - TW風雲造天No ratings yet

- Barclays U Unity Software Inc. Beat & Raise With $1B EBITDA TargetDocument15 pagesBarclays U Unity Software Inc. Beat & Raise With $1B EBITDA Targetoldman lokNo ratings yet

- NH Korindo CTRA - Focus On Existing ProjectsDocument6 pagesNH Korindo CTRA - Focus On Existing ProjectsHamba AllahNo ratings yet

- Vanguard U.S. Growth FundDocument2 pagesVanguard U.S. Growth FundZANo ratings yet

- Care Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Document4 pagesCare Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Jai SinghNo ratings yet

- Q3 2021 Earnings PresentationDocument18 pagesQ3 2021 Earnings PresentationZerohedgeNo ratings yet

- Jamna Auto Jamna Auto: India I EquitiesDocument16 pagesJamna Auto Jamna Auto: India I Equitiesrishab agarwalNo ratings yet

- MR D.I.Y. Group (M) (MRDIY MK) : Shopping For A Great BargainDocument18 pagesMR D.I.Y. Group (M) (MRDIY MK) : Shopping For A Great BargainMohd ShahrirNo ratings yet

- EMBRAC.B - ABG Sundal Collier SponsoredDocument17 pagesEMBRAC.B - ABG Sundal Collier SponsoredJacksonNo ratings yet

- Nyse Cas 2010Document94 pagesNyse Cas 2010gaja babaNo ratings yet

- The Creator Economy LandscapeDocument43 pagesThe Creator Economy LandscapeAbhay VikasNo ratings yet

- ECM+Report Q3 +2023Document8 pagesECM+Report Q3 +2023Jeffery AlvarezNo ratings yet

- Cisco Systems, Inc.: OutperformDocument12 pagesCisco Systems, Inc.: OutperformdilsmithNo ratings yet

- The Kroger Co. (KR) : Price, Consensus & SurpriseDocument8 pagesThe Kroger Co. (KR) : Price, Consensus & SurprisetigaciNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- NCSM Earnings WF May 2018Document5 pagesNCSM Earnings WF May 2018minurkashNo ratings yet

- SCHW - ZackDocument10 pagesSCHW - ZackJessyNo ratings yet

- ICRA - Stock Update - 070322Document10 pagesICRA - Stock Update - 070322arunNo ratings yet

- Itc Clsa Oct2020Document100 pagesItc Clsa Oct2020ksatishbabuNo ratings yet

- ITC 21 08 2023 EmkayDocument15 pagesITC 21 08 2023 Emkayvikram112in20002445No ratings yet

- Equity Valuation Report - TwitterDocument3 pagesEquity Valuation Report - TwitterFEPFinanceClubNo ratings yet

- 2023-05-01-APH.N-TD Cowen-Model Update - PT To $70 From $75-101746375Document11 pages2023-05-01-APH.N-TD Cowen-Model Update - PT To $70 From $75-101746375Nikhil PadiaNo ratings yet

- FSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideDocument25 pagesFSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideSandeep WandreNo ratings yet

- Third Quarter 2020 Earnings Results Presentation: October 14, 2020Document16 pagesThird Quarter 2020 Earnings Results Presentation: October 14, 2020Zerohedge100% (1)

- QuarterlyUpdateReport AngelOneLtd Q4FY23Document9 pagesQuarterlyUpdateReport AngelOneLtd Q4FY23Abhishek TondeNo ratings yet

- Jarir GIB 2022.10Document15 pagesJarir GIB 2022.10robynxjNo ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- Cornerstone Ondemand: Investment ThesisDocument18 pagesCornerstone Ondemand: Investment ThesisKemala Andriani100% (1)

- Appendix 4E: South32 LimitedDocument42 pagesAppendix 4E: South32 LimitedTimBarrowsNo ratings yet

- Leading The Evolution of Networking and Security: Driving Convergence To Enable Security at Any Network EdgeDocument12 pagesLeading The Evolution of Networking and Security: Driving Convergence To Enable Security at Any Network EdgeNhan PhanNo ratings yet

- Cfra - TmusDocument9 pagesCfra - TmusJeff SturgeonNo ratings yet

- Q32022 Shareholder LetterDocument25 pagesQ32022 Shareholder Lettertichips mobileNo ratings yet

- SABR - Sabre CorporationDocument9 pagesSABR - Sabre Corporationdantulo1234No ratings yet

- Agencies, Brokerages & Insurance Related Activity Revenues World Summary: Market Values & Financials by CountryFrom EverandAgencies, Brokerages & Insurance Related Activity Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Castlight Health CEO Discusses Q3 2020 ResultsDocument10 pagesCastlight Health CEO Discusses Q3 2020 ResultsrojNo ratings yet

- ARK Invest BigIdeas 2021Document112 pagesARK Invest BigIdeas 2021Aditya Lingampally100% (2)

- Leader in AI-Driven Storage Solutions: December 2020Document48 pagesLeader in AI-Driven Storage Solutions: December 2020rojNo ratings yet

- Tremor International LTD ("Tremor" or The "Company") Trading StatementDocument2 pagesTremor International LTD ("Tremor" or The "Company") Trading StatementrojNo ratings yet

- NexTech FY20Q3 - Shareholder ReportDocument32 pagesNexTech FY20Q3 - Shareholder ReportrojNo ratings yet

- Zuckerberg Statement To CongressDocument7 pagesZuckerberg Statement To CongressJordan Crook100% (1)

- Zuckerberg Statement To CongressDocument7 pagesZuckerberg Statement To CongressJordan Crook100% (1)

- Cost Reviewer Part 1Document2 pagesCost Reviewer Part 1Sherlyn NolandNo ratings yet

- Cambridge IGCSE: 0455/12 EconomicsDocument12 pagesCambridge IGCSE: 0455/12 Economicst.dyakivNo ratings yet

- Solutions PracProblems Visit 4Document19 pagesSolutions PracProblems Visit 4Falak HanifNo ratings yet

- TAX INVOICEDocument1 pageTAX INVOICEAshirbad SahuNo ratings yet

- Tata Motors' Acquisition of Jaguar Land RoverDocument17 pagesTata Motors' Acquisition of Jaguar Land Roverashish singhNo ratings yet

- Dinesh Kumar: Account StatementDocument5 pagesDinesh Kumar: Account Statementdineshjangir310No ratings yet

- A Practical and Analytic View On Legal Framework of Circular Economics As One of The Recent Economic Law Insights: A Comparative Legal StudyDocument26 pagesA Practical and Analytic View On Legal Framework of Circular Economics As One of The Recent Economic Law Insights: A Comparative Legal StudyNatalia Delgado GuerreroNo ratings yet

- The Relationship Between Openness and Economic Growth in Iraq (1997-2012Document23 pagesThe Relationship Between Openness and Economic Growth in Iraq (1997-2012OMAE01No ratings yet

- MARKETING 4.0 and B4B: The New Marketing Models P I E R R E S A I D 2 0 2 3 - 2 0 2 4Document38 pagesMARKETING 4.0 and B4B: The New Marketing Models P I E R R E S A I D 2 0 2 3 - 2 0 2 4Salwa.fakhirNo ratings yet

- Hku Compfee 0000598476Document3 pagesHku Compfee 0000598476Hong_Kong_Bin_LadenNo ratings yet

- SEBI Regulations For Merchant BankersDocument3 pagesSEBI Regulations For Merchant Bankerspraveena DNo ratings yet

- CAD designer passionate about circular economyDocument2 pagesCAD designer passionate about circular economyRodrigoCastagnoNo ratings yet

- International Financial Management 13 Edition: by Jeff MaduraDocument32 pagesInternational Financial Management 13 Edition: by Jeff MaduraAbdulaziz Al-amroNo ratings yet

- English For Economics: Case Study 3 - Trade War (International Trade)Document21 pagesEnglish For Economics: Case Study 3 - Trade War (International Trade)Ngọc Phương Linh LêNo ratings yet

- ACC101 BASIC ACCOUNTING CONCEPTS PRACTICEDocument6 pagesACC101 BASIC ACCOUNTING CONCEPTS PRACTICETimileyin AjibadeNo ratings yet

- RhodaDocument3 pagesRhodaNana Hemaa RhodaNo ratings yet

- ENT202 - Importance of Entrepreneurship and Business Opportunities in NigeriaDocument5 pagesENT202 - Importance of Entrepreneurship and Business Opportunities in NigeriaAkinyemi IbrahimNo ratings yet

- Comparative Advantage Time ProductionDocument1 pageComparative Advantage Time ProductionPhung NhaNo ratings yet

- Merck Innovation Centre Case StudyDocument11 pagesMerck Innovation Centre Case StudyGokul ThilakNo ratings yet

- Glory EV8626Document2 pagesGlory EV8626Des HNo ratings yet

- Akuntansi Keuangan Menengah - Chapter 14Document9 pagesAkuntansi Keuangan Menengah - Chapter 14nurul hasanahNo ratings yet

- Evaluating Mutually Exclusive Projects and Break Even AnalysisDocument5 pagesEvaluating Mutually Exclusive Projects and Break Even AnalysisJatin NandaNo ratings yet

- ACREV 426 - AP 02 ReceivablesDocument5 pagesACREV 426 - AP 02 ReceivablesEve Jennie Rose MagnificoNo ratings yet

- Sage Green Minimalist Business Proposal PresentationDocument25 pagesSage Green Minimalist Business Proposal PresentationCassie ParkNo ratings yet

- Presentation CPD Budget Dialogue 2023Document44 pagesPresentation CPD Budget Dialogue 2023Mubin HasanNo ratings yet

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Document3 pagesAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandNo ratings yet

- Saving and Loan Mobilization in Cooperative: (With Reference To Samuhik Saving and Credit Co Operative Ltd. Bhojpur)Document82 pagesSaving and Loan Mobilization in Cooperative: (With Reference To Samuhik Saving and Credit Co Operative Ltd. Bhojpur)Pratik100% (1)

- BUS 102 Fundamentals of Buiness II 2022Document4 pagesBUS 102 Fundamentals of Buiness II 2022Hafsa YusifNo ratings yet

- 1) Specific. Tax of Fixed Amount Imposed by The Head or Number, or by Some Standard of Weight orDocument4 pages1) Specific. Tax of Fixed Amount Imposed by The Head or Number, or by Some Standard of Weight orSha LeenNo ratings yet

- IAS 7 - Statement of Cash FlowsDocument4 pagesIAS 7 - Statement of Cash FlowsSky WalkerNo ratings yet