Professional Documents

Culture Documents

Quiz 2 - Income Tax Concepts and Compliance

Uploaded by

lcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 2 - Income Tax Concepts and Compliance

Uploaded by

lcCopyright:

Available Formats

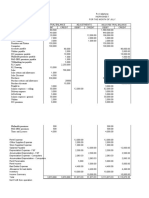

Income Taxation SOLUTIONS Income Tax Concepts and Compliance

Problem 1

Basic Tax (68,000/25%) 272,000 4/15/2017

Surchage Penalty 68,000 12/31/2017 260

Interest for 2017 (272,000 x 20% x 260/365) 38,751 1/11/2021 1,107

Interest for 2018 and later (272,000 x 12% x 1,107/365) 98,993

Total, exclusive of compromise penalty 477,744

Problem 2

Tax Accrual Basis Tax Cash Basis

Gross Income:

Cash Income 770,000 830,000

Accrued Income 50,000 -

Advanced Income 40,000 860,000 40,000 870,000

Deductions:

Cash Expense 380,000 405,000

Depreciation 80,000 80,000

Amortization of Prepayments 20,000 20,000

Accrued Expense 35,000 515,000 - 505,000

Net Income 345,000 365,000

Problem 3

Outright Method

Cost of the Building 2,700,000

Rentals during 2020 240,000

2020 Taxable Income 2,940,000

Spread-Out Method

Cost of the Building 2,700,000

Multiply: Useful Life after Lease Term (40-22.5) 17.5

Divide by: Total Useful Life 40

Depreciated Value 1,181,250

Divide by: Useful Life Within the Lease Term (25-2.5) 22.5

Annual Income from Leasehold Improvement 52,500

Half-Year Usage for 2020 2

Income from Leasehold Improvement during 2020 26,250

Rentals during 2020 240,000

2020 Taxable Income 266,250

Problem 4

Monthly Earnings 90,000

October to December 5

Total 450,000

Problem 5

Within Without Total

Compensation 420,000 420,000

Professional Fees 80,000 80,000

Rent Income 500,000 500,000

Gain on sale 100,000 100,000

Business income 600,000 600,000

Interest Income 50,000 50,000

Total 1,170,000 580,000 1,750,000

Income Taxation SOLUTIONS Income Tax Concepts and Compliance

Problem 6

Step 1

The sale is made by a dealer of real property.

Step 2

Downpayment 200,000

Quarterly Payments (9 x 100,000) 900,000

Mortgage Assumed 1,700,000

Selling Price 2,800,000

Step 3

Mortgage Assumed 1,700,000

Tax Basis 1,500,000

Excess Mortgage 200,000

Step 4

Downpayment 200,000

Excess Mortgage 200,000

Quarterly Payments within 2020 (3 quarters) 300,000

Initial Payment 700,000

Step 5

Initial Payment 700,000

Divide by: Selling Price 2,800,000

IP/SP Ratio 25.00%

~Instalment Method is allowed.

Step 6

Selling Price 2,800,000

Mortgage Assumed (1,700,000)

Excess Mortgage 200,000

Contract Price 1,300,000

Step 7

Selling Price 2,800,000

Tax Basis 1,500,000

Gross Profit 1,300,000

Step 8

Initial Payment (Total Collections in 2020) 700,000

Multiply by: Contract Price 1,300,000

Divide by: Gross Profit 1,300,000

Gross Income in 2020 700,000

Problem 7

2020 2021 2022 2023

Contract Price 5,000,000 5,000,000 5,000,000 5,000,000

Income Taxation SOLUTIONS Income Tax Concepts and Compliance

Percent Completed 10% 25% 35% 30%

Construction Revenue - Current 500,000 1,250,000 1,750,000 1,500,000

Construction Expense - Current 300,000 800,000 700,000 800,000

Gross Income 200,000 450,000 1,050,000 700,000

You might also like

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and ComplianceDela cruz, Hainrich (Hain)No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- CPAR B94 TAX Final PB Exam - Answers - SolutionsDocument12 pagesCPAR B94 TAX Final PB Exam - Answers - SolutionsSilver LilyNo ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- AEC-7 MIDTERM EXAMINATION SOLUTIONSDocument9 pagesAEC-7 MIDTERM EXAMINATION SOLUTIONSDaisy TañoteNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- September 8 - Capital Gains TaxDocument2 pagesSeptember 8 - Capital Gains TaxAlbert XuNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Problem 1: Journal EntryDocument11 pagesProblem 1: Journal EntrySarah Nelle PasaoNo ratings yet

- Real Realty financial statementsDocument4 pagesReal Realty financial statementsbadNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Pa Revision For FinalsDocument9 pagesPa Revision For FinalsKhải Hưng NguyễnNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- Make Up Exercises ACCTG1 Sept20Document10 pagesMake Up Exercises ACCTG1 Sept20keith niduelan100% (1)

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Journal Entries Problem 1Document4 pagesJournal Entries Problem 1Sarah Nelle PasaoNo ratings yet

- afarDocument29 pagesafarGONZALES, MICA ANGEL A.No ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Installment Method and Accounting Method Steven Richmon T GenerilloDocument4 pagesInstallment Method and Accounting Method Steven Richmon T GenerilloSteven RichmonNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- Income Statement Beccoe Sweet CorporationDocument3 pagesIncome Statement Beccoe Sweet CorporationJeth Vigilla NangcaNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Gross Profit 200,000 Down Payment 100,000Document9 pagesGross Profit 200,000 Down Payment 100,000Marko JerichoNo ratings yet

- Notes Receivables ActivitiesDocument3 pagesNotes Receivables ActivitiesAdam CuencaNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Problem 14 - 1Document6 pagesProblem 14 - 1Rouise GagalacNo ratings yet

- Bachelor of Management With Honours (Bim)Document11 pagesBachelor of Management With Honours (Bim)Aizat Ahmad100% (3)

- ALEJAGA FM Project Week 4Document5 pagesALEJAGA FM Project Week 4Andrea Monique AlejagaNo ratings yet

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- MZM Grocery Income StatementDocument7 pagesMZM Grocery Income StatementIphegenia DipoNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Cash Flow Statement for 2017 ProjectDocument2 pagesCash Flow Statement for 2017 ProjectShakil ShekhNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationRendry Da Silva SantosNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Solutions For Notes and Loans ReceivableDocument4 pagesSolutions For Notes and Loans ReceivableKenaniah SanchezNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Multiple Choice Practice QuestionsDocument3 pagesMultiple Choice Practice QuestionsKATHRYN CLAUDETTE RESENTENo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- Guarantees and Warranties: Solutions To The Lemon ProblemDocument1 pageGuarantees and Warranties: Solutions To The Lemon ProblemlcNo ratings yet

- International BusinessDocument43 pagesInternational BusinessJames Carrel GolosindaNo ratings yet

- BACOSTMX Module 2 Learning Activity 2Document7 pagesBACOSTMX Module 2 Learning Activity 2lc100% (1)

- FLEX Lecture 5 International BusinessDocument32 pagesFLEX Lecture 5 International BusinesslcNo ratings yet

- FLEX Lecture 6 International BusinessDocument44 pagesFLEX Lecture 6 International BusinesslcNo ratings yet

- BACOSTMX Module 2 Self-ReviewerDocument7 pagesBACOSTMX Module 2 Self-ReviewerlcNo ratings yet

- BACOSTMX Module 2 Sample Illustrations Cost BehaviorDocument22 pagesBACOSTMX Module 2 Sample Illustrations Cost BehaviorlcNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Chapter 7 Notes on Accounting Policies, Estimates and ErrorsDocument22 pagesChapter 7 Notes on Accounting Policies, Estimates and ErrorslcNo ratings yet

- Lesson 1 Patterns in Nature (Fibonacci)Document40 pagesLesson 1 Patterns in Nature (Fibonacci)lcNo ratings yet

- Chapter 5 Statement of Changes in EquityDocument6 pagesChapter 5 Statement of Changes in EquitylcNo ratings yet

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDocument28 pagesFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- BASTRCSX Module 1 Self-Test Managerial Accounting and Business EnvironmentDocument3 pagesBASTRCSX Module 1 Self-Test Managerial Accounting and Business EnvironmentlcNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Capital Items With Infinite Value Types of TransfersDocument3 pagesCapital Items With Infinite Value Types of TransferslcNo ratings yet

- Lesson 2 Mathematical Language and SymbolsDocument26 pagesLesson 2 Mathematical Language and SymbolslcNo ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- REGULAR INCOME TAX RATES AND FILING DEADLINESDocument10 pagesREGULAR INCOME TAX RATES AND FILING DEADLINESlcNo ratings yet

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1lc100% (1)

- Capital Gains Taxation: Lesson 6Document30 pagesCapital Gains Taxation: Lesson 6lc100% (4)

- VAT QuizzerDocument28 pagesVAT Quizzerlc100% (1)

- Financial Accounting Reporting - Partnership DissolutionDocument3 pagesFinancial Accounting Reporting - Partnership DissolutionlcNo ratings yet

- National University Financial Accounting Finals SeatworkDocument1 pageNational University Financial Accounting Finals SeatworklcNo ratings yet

- Basic Principles of TaxationDocument45 pagesBasic Principles of TaxationlcNo ratings yet

- TX 1102 Deductions from Gross Income Itemized and Special DeductionsDocument10 pagesTX 1102 Deductions from Gross Income Itemized and Special DeductionsJulz0% (1)

- Moral HazardDocument1 pageMoral HazardlcNo ratings yet

- Partnership Profit Distribution MethodsDocument3 pagesPartnership Profit Distribution MethodsApril QuiboteNo ratings yet

- Insurance Sector: What Is Adverse Selection?Document5 pagesInsurance Sector: What Is Adverse Selection?lcNo ratings yet

- CHAPTER 5 (Accounting For Service)Document26 pagesCHAPTER 5 (Accounting For Service)lc100% (1)

- Hydraulic Fluids in Mobile Application Re98128 - 2015-06 - Online PDFDocument13 pagesHydraulic Fluids in Mobile Application Re98128 - 2015-06 - Online PDFDennis Huanuco CcamaNo ratings yet

- OKsa DepEd FinalsDocument9 pagesOKsa DepEd FinalsCarmelito Nuque JrNo ratings yet

- Diagnosis in OncologyDocument22 pagesDiagnosis in OncologyAndi SuryajayaNo ratings yet

- Metal Hose Manual 1301 - Uk - 8 - 05 - 20 - PDFDocument388 pagesMetal Hose Manual 1301 - Uk - 8 - 05 - 20 - PDFklich77No ratings yet

- Trix Price List OCT 2018 PDFDocument2 pagesTrix Price List OCT 2018 PDFApNo ratings yet

- Final Duct Wraps Brochure 98-0213-4600-6rrDocument8 pagesFinal Duct Wraps Brochure 98-0213-4600-6rrDiego Armando Martinez GutierrezNo ratings yet

- Hardees ReviewDocument17 pagesHardees ReviewFarhan KamalNo ratings yet

- Indian Cookware and Home Decor Product CatalogDocument31 pagesIndian Cookware and Home Decor Product CatalogSuraj PramanikNo ratings yet

- Trophy Winners 2019Document10 pagesTrophy Winners 2019blackguard999No ratings yet

- Analyzing Project ViabilityDocument2 pagesAnalyzing Project ViabilityKumar VikasNo ratings yet

- Strack 1976 A Single-Potential Solution For Regional Interface Problems in Coastal AquifersDocument10 pagesStrack 1976 A Single-Potential Solution For Regional Interface Problems in Coastal AquifersMarie.NeigeNo ratings yet

- Notes-RJ Speed Seduction Gold WalkupsDocument7 pagesNotes-RJ Speed Seduction Gold Walkupsdulixuexi100% (1)

- Checklist of Construction SiteDocument7 pagesChecklist of Construction SiteSurya PNo ratings yet

- LogDocument12 pagesLogrifaniagustinNo ratings yet

- Maxiflex Spiral Wound Gaskets Product DocumentDocument5 pagesMaxiflex Spiral Wound Gaskets Product DocumentPham Thien TruongNo ratings yet

- TS Ewk 2Document14 pagesTS Ewk 2bodale vergaNo ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- Diabetic Retinopathy: Basic InformationDocument12 pagesDiabetic Retinopathy: Basic InformationipkNo ratings yet

- ALKANES Quiz SheetDocument5 pagesALKANES Quiz Sheetnajifaahmed223No ratings yet

- Sonotron NDTDocument3 pagesSonotron NDTNour MasmoudiNo ratings yet

- Hawaiian Hibiscus Facts: Care, Features & Endangered StatusDocument2 pagesHawaiian Hibiscus Facts: Care, Features & Endangered StatusJustine Airra OndoyNo ratings yet

- BukuDocument12 pagesBukuErika Laura Magdalena SibaraniNo ratings yet

- Perfume Notes & FamiliesDocument24 pagesPerfume Notes & Familiesmohamed tharwatNo ratings yet

- Gas/Liquids Separators - Part 2: Quantifying Separation PerformanceDocument13 pagesGas/Liquids Separators - Part 2: Quantifying Separation PerformanceLizbeth Ramirez AlanyaNo ratings yet

- From Paragraph to Essay: Structure and ComparisonDocument21 pagesFrom Paragraph to Essay: Structure and ComparisonDiego EscobarNo ratings yet

- Hygro-Thermometer Pen: User's GuideDocument4 pagesHygro-Thermometer Pen: User's GuideTedosNo ratings yet

- Challenges in Modern HRMDocument25 pagesChallenges in Modern HRMvineet sarawagi64% (11)

- Prayer of Protection Against The PlagueDocument9 pagesPrayer of Protection Against The PlagueJuan Jaylou Ante100% (2)

- Chemistry Ssc-I: Answer Sheet No.Document7 pagesChemistry Ssc-I: Answer Sheet No.Mohsin SyedNo ratings yet

- Nust Hostel Rules H-12 Campus IslamabadDocument10 pagesNust Hostel Rules H-12 Campus IslamabadNeha KhanNo ratings yet