Professional Documents

Culture Documents

Quant Briefing: Earnings Surprise Monitor: Yardeni Research, Inc

Uploaded by

khalidgnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quant Briefing: Earnings Surprise Monitor: Yardeni Research, Inc

Uploaded by

khalidgnCopyright:

Available Formats

Quant Briefing:

Earnings Surprise Monitor

Yardeni Research, Inc.

March 2, 2021

Dr. Ed Yardeni

516-972-7683

eyardeni@yardeni.com

Joe Abbott

732-497-5306

jabbott@yardeni.com

Please visit our sites at

www.yardeni.com

blog.yardeni.com

thinking outside the box

Table Of Contents

Table Of Contents

S&P 500 Earnings & Revenue Surprise Summary 1

S&P 500/400/600 Earnings Surprise for Current Quarter 2

S&P 500/400/600 Revenue Surprise for Current Quarter 3

S&P 500/400/600 Change in Shares Outstanding 4

S&P 500 Revenue & Earnings % Surprise 5

S&P 500 Revenue & Earnings % of Companies +/- 6

S&P 500 Revenue & Earnings Surprise ex-Energy 7

S&P 500 Revenue & Earnings Surprise ex-Financials 8

S&P 500 Revenue & Earnings Growth ex-Energy 9

S&P 500 Revenue & Earnings Growth ex-Financials 10

S&P 500 Sectors Quarterly Earnings Surprises 11-12

S&P 500 Sectors Quarterly Revenue Surprises 13-14

S&P 500 Sectors Quarterly Earnings Growth 15

S&P 500 Sectors Quarterly Revenue Growth 16

March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Earnings & Revenue Surprise Summary

S&P 500 Earnings & Revenue Surprise Summary

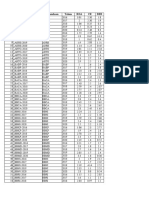

Table 1A: S&P 500 Earnings Surprise (as of March 2, 2021)

% Earnings % Y/Y Earnings % With Positive % With Negative % With Positive % With Negative # Companies

Surprise Growth Surprise Surprise Y/Y Growth Y/Y Growth Reported

Q4-2020 17.1 3.8 79.5 18.0 61.3 37.3 483

Q3-2020 19.7 -8.7 83.6 13.8 50.1 48.2 500

Q2-2020 23.4 -35.1 81.6 16.2 36.6 62.1 500

Q1-2020 3.9 -12.9 67.0 28.5 47.2 51.2 500

Q4-2019 5.4 4.0 70.9 21.2 66.5 31.8 500

Q3-2019 4.8 0.0 75.7 18.4 62.3 35.6 500

Q2-2019 6.1 1.7 74.0 18.8 64.9 33.7 500

Q1-2019 6.5 3.1 75.7 19.1 63.9 34.0 500

Q4-2018 3.5 14.3 70.1 24.5 71.2 26.8 500

Q3-2018 6.7 27.3 77.5 14.1 86.9 13.1 500

Q2-2018 5.2 26.5 80.6 16.4 86.0 13.0 500

Q1-2018 7.0 24.7 78.7 14.6 86.0 13.0 500

Q4-2017 5.0 16.7 76.1 16.8 77.5 20.0 500

Q3-2017 5.4 8.1 72.5 19.9 69.1 28.3 500

Q2-2017 5.6 11.7 72.7 19.3 70.1 27.3 500

Q1-2017 6.7 11.2 76.0 18.1 62.6 36.6 500

Q4-2016 3.7 10.0 68.2 22.5 68.4 28.2 500

Q3-2016 6.4 4.3 72.2 20.2 69.5 28.4 500

Q2-2016 4.6 -2.2 71.7 17.9 61.0 36.0 500

Q1-2016 4.9 -5.7 71.8 21.8 54.6 43.3 500

Q4-2015 3.8 -3.6 68.3 22.0 51.5 45.6 500

Q3-2015 5.6 -0.7 68.1 23.0 58.7 38.7 500

Q2-2015 5.3 1.5 69.7 21.7 61.6 36.5 500

Q1-2015 6.8 2.1 67.7 24.3 63.1 33.6 500

Q4-2014 4.4 6.8 68.9 20.7 70.0 27.3 500

Q3-2014 4.6 10.0 73.1 18.9 75.7 22.3 500

Q2-2014 2.8 7.9 66.6 23.4 75.7 22.4 500

Q1-2014 5.2 4.1 67.8 22.7 67.2 27.7 500

Q4-2013 3.3 9.4 64.8 23.9 68.7 28.2 500

Q3-2013 2.2 4.9 66.6 22.9 71.8 25.5 500

Q2-2013 3.0 4.1 66.0 24.5 68.5 30.1 500

Q1-2013 4.4 3.9 65.6 25.3 66.9 30.0 500

Q4-2012 5.2 6.2 68.1 22.4 64.4 33.1 500

Q3-2012 4.4 0.6 64.4 25.5 61.3 37.3 500

Q2-2012 4.2 7.0 66.7 24.5 63.6 35.0 500

Q1-2012 4.8 7.8 66.3 23.5 64.0 33.5 500

Q4-2011 4.8 9.0 62.7 27.2 67.3 30.5 500

Q3-2011 6.2 21.9 69.6 20.3 75.8 22.1 500

Q2-2011 6.0 11.8 70.5 19.4 77.3 20.9 500

Q1-2011 7.8 19.7 67.1 22.7 71.8 25.3 500

Q4-2010 6.6 211.1 69.6 21.1 76.4 21.5 500

Q3-2010 6.7 39.1 72.3 18.5 75.4 22.1 500

Q2-2010 9.9 27.9 74.5 16.1 76.7 20.8 500

Q1-2010 15.0 64.0 77.4 15.1 73.3 24.8 500

Q4-2009 6.9 -/+ 72.2 17.7 62.1 35.7 500

Q3-2009 17.1 -11.4 78.8 14.6 43.5 54.1 500

Q2-2009 17.1 -26.7 73.4 19.0 30.7 66.9 500

Q1-2009 5.5 -33.8 64.9 26.7 na na 500

Table 1B: S&P 500 Revenue Surprise

% Revenue % Y/Y Revenue % With Positive % With Negative % With Positive % With Negative # Companies

Surprise Growth Surprise Surprise Y/Y Growth Y/Y Growth Reported

Q4-2020 2.8 2.8 73.7 26.3 59.8 40.0 482

Q3-2020 3.7 -1.2 77.9 22.1 51.2 48.6 500

Q2-2020 2.9 -10.1 63.4 36.6 33.3 66.7 500

Q1-2020 -1.1 -2.3 60.1 39.9 55.2 44.8 500

Q4-2019 0.8 3.5 63.7 36.3 69.3 30.7 500

Q3-2019 0.8 3.6 58.2 41.8 67.7 32.1 500

Q2-2019 1.2 3.8 57.0 43.0 66.4 33.4 500

Q1-2019 0.2 4.9 57.1 42.9 67.5 32.3 500

Q4-2018 0.5 5.7 60.0 40.0 74.0 25.8 500

Q3-2018 1.3 8.6 60.9 39.1 83.1 16.9 500

Q2-2018 1.6 9.8 71.9 28.1 86.4 13.6 500

Q1-2018 1.1 8.2 75.7 24.3 87.6 12.4 500

Q4-2017 1.2 8.2 76.4 23.6 87.5 12.3 500

Q3-2017 1.3 5.8 67.6 32.4 78.8 21.2 500

Q2-2017 1.0 5.2 68.4 31.6 78.7 21.3 500

Q1-2017 0.7 8.0 63.1 36.9 39.4 14.2 500

Q4-2016 0.1 4.3 51.1 48.9 71.1 33.3 500

Q3-2016 0.2 2.6 54.2 45.8 66.7 33.3 500

Q2-2016 0.1 0.2 53.2 46.8 57.8 42.0 500

Q1-2016 -0.3 -1.4 52.4 47.4 55.2 44.8 500

Q4-2015 -0.5 -4.1 45.9 53.9 46.8 52.8 500

Q3-2015 -0.2 -3.9 43.1 56.7 51.4 48.6 500

Q2-2015 0.6 -3.7 48.4 51.6 52.2 47.8 500

Q1-2015 0.0 -3.9 43.2 56.8 55.2 44.8 500

Q4-2014 1.6 1.9 57.9 42.1 68.9 31.1 500

Q3-2014 0.3 4.2 59.7 40.3 72.2 27.8 500

Q2-2014 1.3 3.2 63.8 36.0 74.9 25.1 500

Q1-2014 0.0 2.7 52.2 47.8 71.0 28.7 500

Q4-2013 0.3 1.1 61.4 38.4 69.8 30.0 500

Q3-2013 1.0 3.4 54.0 46.0 71.6 28.2 500

Q2-2013 0.9 2.0 53.4 46.6 70.7 29.1 500

Q1-2013 -0.9 -0.2 45.8 54.0 64.3 35.5 500

Q4-2012 0.4 1.8 63.9 35.3 70.1 29.9 500

Q3-2012 -1.2 0.6 39.9 59.9 56.9 42.7 500

Q2-2012 -0.3 0.2 40.4 59.6 62.0 38.0 500

Q1-2012 1.1 5.4 64.9 35.1 73.2 26.8 500

Q4-2011 0.2 6.7 55.7 44.3 75.8 23.8 500

Q3-2011 1.5 10.9 60.4 39.6 81.2 18.8 500

Q2-2011 2.8 11.8 73.4 26.6 84.6 14.9 500

Q1-2011 1.1 9.5 66.3 33.7 77.8 22.2 500

Q4-2010 1.8 8.4 64.0 36.0 79.0 21.0 500

Q3-2010 0.7 8.5 60.6 39.4 80.7 19.1 500

Q2-2010 0.0 7.2 61.1 38.9 78.0 21.8 500

Q1-2010 1.2 11.4 67.9 32.1 78.2 21.8 500

Q4-2009 1.4 4.5 69.5 30.5 56.3 43.3 500

Q3-2009 0.2 -11.7 58.3 41.5 29.8 70.0 500

Q2-2009 0.1 -14.1 49.2 60.6 25.0 74.8 500

Q1-2009 -0.1 -10.6 36.5 63.5 na na 500

% surprise = difference between actual and consensus estimate at the time of the earnings report.

Page 1 / March 2, 2021 / Earnings Surprise Monitor

Source: I/B/E/S data by Refinitiv and Yardeni Research, Inc.

Yardeni Research, Inc.

Page 1 / March 2, 2021 / Earnings Surprise Monitor Yardeni www.yardeni.com

Research, Inc.

www.yardeni.com

S&P 500/400/600 Earnings Surprise for Current Quarter

S&P 500/400/600 Earnings Surprise for Current Quarter

Table 2A: S&P Indexes Aggregate Earnings Surprise Q4-2020 (as of March 2, 2021)

% with

Expected Actual Y/Y % % with % with % with % with Flat

% EPS Negative % with On

Sector Y/Y EPS EPS Growth Companies Positive EPS Positive Y/Y Negative Y/Y Y/Y EPS

Surprise EPS Target EPS

Growth (%) (%) Reported Surprise EPS Growth EPS Growth Growth

Surprise

S&P 500 LargeCap 17.1 -11.3 3.8 96.6 79.5 18.0 2.5 61.3 37.3 1.4

S&P 400 MidCap 16.9 -15.3 -0.9 92.5 76.8 22.4 0.8 57.0 40.8 2.2

S&P 600 SmallCap 28.5 -28.6 -8.2 85.3 73.6 23.4 2.9 58.4 38.9 2.7

LargeCap Sectors

Communication Services 24.6 -11.5 10.3 100.0 95.5 4.5 0.0 54.5 45.5 0.0

Consumer Discretionary 35.5 -24.6 2.1 86.9 73.6 26.4 0.0 66.0 34.0 0.0

Consumer Staples 6.1 0.5 6.6 90.6 72.4 20.7 6.9 65.5 34.5 0.0

Energy 26.9 -107.5 -105.5 96.0 58.3 41.7 0.0 12.5 87.5 0.0

Financials 26.3 -7.9 16.3 98.5 85.9 10.9 3.1 67.2 29.7 3.1

Health Care 6.0 5.5 11.9 96.8 80.3 18.0 1.6 65.6 34.4 0.0

Industrials 10.7 -43.1 -37.1 100.0 80.8 16.4 2.7 64.4 34.2 1.4

Information Technology 16.5 3.3 20.3 97.3 93.0 7.0 0.0 74.6 21.1 4.2

Materials 11.9 9.2 22.2 100.0 82.1 17.9 0.0 64.3 32.1 3.6

Real Estate 47.1 -39.5 -11.1 100.0 66.7 33.3 0.0 36.7 63.3 0.0

Utilities 1.4 -3.8 -2.5 100.0 60.7 21.4 17.9 53.6 46.4 0.0

MidCap Sectors

Communication Services -29.2 -43.1 -59.7 88.9 50.0 50.0 0.0 25.0 75.0 0.0

Consumer Discretionary 5.4 -16.2 -11.6 78.8 59.6 40.4 0.0 51.9 48.1 0.0

Consumer Staples 28.2 8.1 38.6 69.2 77.8 11.1 11.1 55.6 44.4 0.0

Energy 25.7 -65.3 -56.4 88.9 50.0 50.0 0.0 25.0 75.0 0.0

Financials 26.4 -6.2 18.6 98.5 86.6 13.4 0.0 67.2 32.8 0.0

Health Care 18.6 32.4 56.9 91.9 79.4 17.6 2.9 64.7 32.4 2.9

Industrials 10.2 -23.1 -15.3 97.0 84.4 15.6 0.0 56.3 40.6 3.1

Information Technology 19.6 -12.4 4.8 94.3 86.0 12.0 2.0 70.0 26.0 4.0

Materials 26.0 22.9 54.9 96.3 84.6 15.4 0.0 73.1 26.9 0.0

Real Estate -2.5 -70.3 -71.1 100.0 59.5 40.5 0.0 18.9 73.0 8.1

Utilities 6.8 -1.2 5.5 100.0 80.0 20.0 0.0 73.3 26.7 0.0

SmallCap Sectors

Communication Services 39.3 36.1 89.5 88.2 66.7 33.3 0.0 66.7 33.3 0.0

Consumer Discretionary 34.8 -34.6 -11.9 63.0 75.9 17.2 6.9 74.1 25.9 0.0

Consumer Staples 47.0 7.5 58.1 73.9 76.5 17.6 5.9 82.4 17.6 0.0

Energy -12.5 -167.3 -175.7 87.9 48.3 48.3 3.4 31.0 65.5 3.4

Financials 16.6 5.4 23.0 97.1 83.2 16.8 0.0 60.4 33.7 5.9

Health Care 39.0 -20.3 10.8 87.3 74.2 22.6 3.2 53.2 45.2 1.6

Industrials 20.3 -34.3 -21.0 82.1 67.9 29.5 2.6 47.4 51.3 1.3

Information Technology 19.8 17.8 41.2 94.6 88.6 10.0 1.4 72.9 24.3 2.9

Materials -32.1 -46.1 -63.4 86.1 71.0 25.8 3.2 48.4 48.4 3.2

Real Estate 349.6 -119.6 -51.1 91.8 53.3 40.0 6.7 46.7 48.9 4.4

Utilities 5.9 15.0 21.9 100.0 83.3 16.7 0.0 83.3 16.7 0.0

Table 2B: Slices & Dices

% with

Expected Actual Y/Y % % with % with % with % with Flat

% EPS Negative % with On

Sector/Industries Y/Y EPS EPS Growth Companies Positive EPS Positive Y/Y Negative Y/Y Y/Y EPS

Surprise EPS Target EPS

Growth (%) (%) Reported Surprise EPS Growth EPS Growth Growth

Surprise

LargeCap

S&P 500 ex-Energy 17.0 -7.7 8.0 96.6 80.6 16.8 2.6 63.8 34.6 1.5

S&P 500 ex-Financials & Real Estat 15.1 -12.0 1.2 96.3 78.5 19.1 2.4 60.4 38.4 1.2

S&P 500 ex-Tech 17.3 -15.6 -0.9 96.5 77.2 19.9 2.9 59.0 40.0 1.0

S&P 500 Retail Composite 22.8 -2.2 20.1 75.0 79.2 20.8 0.0 79.2 20.8 0.0

S&P 500 Discretionary Retail 17.3 -15.6 -0.9 96.5 77.2 19.9 2.9 59.0 40.0 1.0

S&P 500 Staples Retail 2.4 -4.5 -2.1 80.0 50.0 50.0 0.0 50.0 50.0 0.0

S&P 500 Industrials Composite 14.6 -8.0 5.4 95.6 80.9 17.6 1.4 62.7 35.8 1.4

S&P 500 Transportation 72.8 -115.6 -104.2 100.0 80.0 20.0 0.0 66.7 33.3 0.0

S&P 500 Industrials ex-Boeing 17.3 -42.3 -32.4 - - - - - - -

S&P 500 ex-Boeing 17.5 -11.4 4.1 - - - - - - -

Information Technology ex-Apple 16.5 3.3 20.3 - - - - - - -

MidCap

S&P 400 ex-Energy 16.8 -13.8 0.7 92.6 77.3 21.8 0.8 57.7 40.1 2.2

S&P 400 ex-Financials & Real Estat 13.8 -10.4 1.9 90.2 76.7 22.2 1.1 59.8 38.3 1.9

S&P 400 ex-Tech 16.5 -15.7 -1.8 92.2 75.3 24.1 0.6 55.0 43.1 1.9

S&P 400 Retail Composite 11.3 32.0 46.8 36.8 71.4 28.6 0.0 2071.4 1357.1 71.4

S&P 400 Discretionary Retail 16.5 3.3 20.3 40.0 66.7 33.3 0.0 2400.0 1583.3 83.3

S&P 400 Staples Retail 48.4 44.7 114.8 25.0 100.0 0.0 0.0 100.0 0.0 0.0

S&P 400 Industrials Composite 13.1 -6.2 6.1 89.3 76.1 22.6 1.2 58.8 39.1 2.1

S&P 400 Transportation 64.9 -139.2 -113.8 100.0 87.5 12.5 0.0 62.5 37.5 0.0

SmallCap

S&P 600 ex-Energy 27.7 -20.7 1.2 85.2 75.2 21.9 2.9 60.0 37.3 2.7

S&P 600 ex-Financials & Real Estat 25.7 -32.9 -15.7 81.9 73.5 23.2 3.3 59.3 39.1 1.6

S&P 600 ex-Tech 30.3 -34.0 -14.0 84.0 71.3 25.6 3.2 56.1 41.2 2.7

S&P 600 Retail Composite 38.2 -57.3 -41.0 56.5 65.4 23.1 11.5 84.6 15.4 0.0

S&P 600 Discretionary Retail 40.3 -58.3 -41.5 53.7 68.2 18.2 13.6 86.4 13.6 0.0

S&P 600 Staples Retail 2.5 -27.0 -25.2 80.0 50.0 50.0 0.0 75.0 25.0 0.0

S&P 600 Industrials Composite 26.0 -31.5 -13.7 81.1 73.5 23.3 3.2 58.8 39.5 1.7

S&P 600 Transportation 58.8 -81.5 -70.6 100.0 69.2 23.1 7.7 61.5 38.5 0.0

Source: I/B/E/S data by Refinitiv and Yardeni Research.

Page 2 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

Page 2 / March 2, 2021 / Earnings Surprise Monitor www.yardeni.com

Yardeni Research, Inc.

S&P 500/400/600 Revenue Surprise for Current Quarter

S&P 500/400/600 Revenue Surprise for Current Quarter

Table 3A: S&P Indexes Aggregate Revenue Surprise Q4-2020 (as of March 2, 2021)

% with % with % with % with

Expected Actual Y/Y % % with Flat

% Sales Positive Negative % with On Positive Y/Y Negative Y/Y

Sector Y/Y Sales Sales Companies Y/Y Sales

Surprise Sales Sales Target Sales Sales Sales

Growth (%) Growth (%) Reported Growth

Surprise Surprise Growth Growth

S&P 500 LargeCap 2.8 -0.1 2.8 96.4 73.7 26.3 0.0 59.8 40.0 0.2

S&P 400 MidCap 3.4 -3.0 0.3 91.5 74.6 25.4 0.0 59.3 40.7 0.0

S&P 600 SmallCap 3.3 -4.9 -1.8 84.2 73.5 26.5 0.0 56.8 43.2 0.0

LargeCap Sectors

Communication Services 3.4 4.2 7.7 100.0 90.9 9.1 0.0 54.5 45.5 0.0

Consumer Discretionary 2.8 8.1 11.2 86.9 62.3 37.7 0.0 58.5 41.5 0.0

Consumer Staples 2.3 3.8 6.1 90.6 79.3 20.7 0.0 79.3 20.7 0.0

Energy 0.3 -33.6 -33.4 96.0 70.8 29.2 0.0 0.0 100.0 0.0

Financials 5.3 -2.7 2.4 96.9 79.4 20.6 0.0 63.5 36.5 0.0

Health Care 2.2 9.8 12.3 96.8 85.2 14.8 0.0 85.2 13.1 1.6

Industrials 3.5 -11.5 -8.4 100.0 75.3 24.7 0.0 49.3 50.7 0.0

Information Technology 5.0 6.2 11.5 97.3 83.1 16.9 0.0 70.4 29.6 0.0

Materials 3.7 -0.9 2.8 100.0 75.0 25.0 0.0 64.3 35.7 0.0

Real Estate 2.5 -4.9 -2.6 100.0 63.3 36.7 0.0 43.3 56.7 0.0

Utilities -8.7 6.3 -3.0 100.0 21.4 78.6 0.0 46.4 53.6 0.0

MidCap Sectors

Communication Services 1.6 -17.2 -15.9 88.9 75.0 25.0 0.0 50.0 50.0 0.0

Consumer Discretionary 1.6 0.5 2.1 78.8 73.1 26.9 0.0 57.7 42.3 0.0

Consumer Staples -0.1 -2.8 -2.9 69.2 66.7 33.3 0.0 77.8 22.2 0.0

Energy -3.3 -34.2 -36.3 88.9 62.5 37.5 0.0 25.0 75.0 0.0

Financials 9.0 1.2 10.3 95.6 83.1 16.9 0.0 75.4 24.6 0.0

Health Care 0.2 11.1 11.3 91.9 73.5 26.5 0.0 70.6 29.4 0.0

Industrials 2.8 -5.6 -2.9 97.0 73.4 26.6 0.0 40.6 59.4 0.0

Information Technology 8.9 -5.9 2.5 94.3 84.0 16.0 0.0 68.0 32.0 0.0

Materials 2.9 0.8 3.7 96.3 84.6 15.4 0.0 69.2 30.8 0.0

Real Estate 1.8 -18.3 -16.8 100.0 64.9 35.1 0.0 40.5 59.5 0.0

Utilities -10.3 22.1 9.5 86.7 30.8 69.2 0.0 61.5 38.5 0.0

SmallCap Sectors

Communication Services 2.0 4.1 6.2 82.4 92.9 7.1 0.0 78.6 21.4 0.0

Consumer Discretionary 1.9 -1.3 0.6 63.0 69.0 31.0 0.0 62.1 37.9 0.0

Consumer Staples 10.2 3.6 14.2 69.6 93.8 6.3 0.0 75.0 25.0 0.0

Energy -2.4 -33.0 -34.7 87.9 55.2 44.8 0.0 17.2 82.8 0.0

Financials 7.5 1.8 9.5 95.2 72.7 27.3 0.0 72.7 27.3 0.0

Health Care 2.8 -7.2 -4.6 85.9 72.1 27.9 0.0 55.7 44.3 0.0

Industrials 4.1 -7.4 -3.6 82.1 73.1 26.9 0.0 39.7 60.3 0.0

Information Technology 3.6 -0.4 3.2 91.9 89.7 10.3 0.0 64.7 35.3 0.0

Materials 3.7 2.9 6.6 86.1 74.2 25.8 0.0 51.6 48.4 0.0

Real Estate 4.5 -4.3 0.0 91.8 62.2 37.8 0.0 44.4 55.6 0.0

Utilities -4.8 10.6 5.4 100.0 33.3 66.7 0.0 100.0 0.0 0.0

Table 3B: Slices & Dices

% with % with % with % with

Expected Actual Y/Y % % with Flat

% Sales Positive Negative % with On Positive Y/Y Negative Y/Y

Sector/Industries Y/Y Sales Sales Companies Y/Y Sales

Surprise Sales Sales Target Sales Sales Sales

Growth (%) Growth (%) Reported Growth

Surprise Surprise Growth Growth

LargeCap

S&P 500 ex-Energy 3.0 3.1 6.1 96.4 73.8 26.2 0.0 62.9 36.9 0.2

S&P 500 ex-Financials & Real Estat 2.6 0.2 2.8 96.3 72.8 27.2 0.0 59.2 40.6 0.2

S&P 500 ex-Tech 2.5 -0.9 1.6 96.3 72.0 28.0 0.0 57.9 41.8 0.2

S&P 500 Retail Composite 2.8 11.7 14.8 75.0 70.8 29.2 0.0 75.0 25.0 0.0

S&P 500 Discretionary Retail 2.5 -0.9 1.6 96.3 72.0 28.0 0.0 57.9 41.8 0.2

S&P 500 Staples Retail 2.1 4.4 6.6 80.0 75.0 25.0 0.0 75.0 25.0 0.0

S&P 500 Industrials Composite 2.8 1.0 3.9 95.6 77.7 22.3 0.0 62.4 37.3 0.3

S&P 500 Transportation 6.3 -22.7 -17.8 100.0 73.3 26.7 0.0 40.0 60.0 0.0

S&P 500 Industrials ex-Boeing 3.6 -11.3 -8.1 - - - - - - -

S&P 500 ex-Boeing 2.8 0.0 2.9 - - - - - - -

Information Technology ex-Apple 4.9 6.3 11.6 - - - - - - -

MidCap

S&P 400 ex-Energy 3.6 -1.7 1.9 91.6 74.9 25.1 0.0 60.1 39.9 0.0

S&P 400 ex-Financials & Real Estat 2.6 -3.0 -0.5 89.5 73.9 26.1 0.0 58.0 42.0 0.0

S&P 400 ex-Tech 2.4 -2.5 -0.1 91.1 73.1 26.9 0.0 57.9 42.1 0.0

S&P 400 Retail Composite 0.6 4.4 5.1 36.8 57.1 42.9 0.0 2071.4 1471.4 0.0

S&P 400 Discretionary Retail 4.9 6.3 11.6 40.0 50.0 50.0 0.0 2400.0 1716.7 0.0

S&P 400 Staples Retail 1.3 15.9 17.4 25.0 100.0 0.0 0.0 100.0 0.0 0.0

S&P 400 Industrials Composite 3.0 -3.1 -0.2 89.3 76.5 23.5 0.0 58.8 42.4 0.0

S&P 400 Transportation 5.1 -15.0 -10.6 100.0 62.5 37.5 0.0 25.0 37.5 0.0

SmallCap

S&P 600 ex-Energy 3.7 -2.1 1.6 84.0 74.6 25.4 0.0 59.2 40.8 0.0

S&P 600 ex-Financials & Real Estat 3.0 -5.5 -2.7 81.9 73.6 26.4 0.0 53.0 47.0 0.0

S&P 600 ex-Tech 3.3 -5.5 -2.4 83.1 70.9 29.1 0.0 55.6 44.4 0.0

S&P 600 Retail Composite 2.9 -3.6 -0.8 56.5 73.1 26.9 0.0 65.4 34.6 0.0

S&P 600 Discretionary Retail 1.1 -4.7 -3.6 53.7 68.2 31.8 0.0 63.6 36.4 0.0

S&P 600 Staples Retail 13.0 2.8 16.1 80.0 100.0 0.0 0.0 75.0 25.0 0.0

S&P 600 Industrials Composite 2.9 -5.6 -2.9 79.9 75.1 24.9 0.0 52.9 47.1 0.0

S&P 600 Transportation 4.4 -6.9 -2.8 100.0 92.3 7.7 0.0 61.5 38.5 0.0

Source: I/B/E/S data by Refinitiv and Yardeni Research.

Page 3 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

Page 3 / March 2, 2021 / Earnings Surprise Monitor www.yardeni.com

Yardeni Research, Inc.

S&P 500/400/600 Change in Shares Outstanding

S&P 500/400/600 Change in Shares Outstanding

Table 4: S&P Indexes Changes in Basic Shares Outstanding (as of March 2, 2021)

% cos with % cos with % cos with % cos with

# companies Y/Y % Q/Q %

falling share o/s falling share o/s

Sector with share data change in change in

shares o/s down >4% shares o/s down >4%

for Q4-2020 shares shares

y/y y/y q/q q/q

S&P 500 LargeCap 484 0.5 50.0 5.6 0.2 31.4 1.2

S&P 400 MidCap 369 2.3 42.3 9.8 0.4 27.6 1.4

S&P 600 SmallCap 504 3.7 32.9 5.2 0.7 22.0 1.8

LargeCap Sectors

Communication Services 22 0.8 31.8 9.1 -0.1 27.3 0.0

Consumer Discretionary 55 1.2 50.9 3.6 1.0 21.8 0.0

Consumer Staples 29 -0.2 37.9 0.0 -0.1 41.4 0.0

Energy 24 0.8 25.0 0.0 0.5 12.5 0.0

Financials 64 0.9 76.6 6.3 1.8 37.5 0.0

Health Care 61 1.8 49.2 4.9 -0.7 34.4 3.3

Industrials 73 3.2 56.2 6.8 0.2 34.2 1.4

Information Technology 71 -2.3 66.2 12.7 -0.5 43.7 2.8

Materials 28 -0.8 50.0 0.0 0.0 32.1 0.0

Real Estate 30 2.4 20.0 6.7 -0.3 16.7 3.3

Utilities 27 1.2 11.1 0.0 0.1 14.8 0.0

MidCap Sectors

Communication Services 8 0.5 25.0 0.0 0.3 0.0 0.0

Consumer Discretionary 51 2.9 54.9 13.7 1.4 25.5 2.0

Consumer Staples 9 -0.6 33.3 22.2 -0.1 44.4 0.0

Energy 8 18.9 50.0 25.0 2.4 37.5 0.0

Financials 67 1.9 59.7 16.4 -0.1 41.8 1.5

Health Care 33 -3.1 33.3 9.1 -3.5 21.2 0.0

Industrials 63 0.7 54.0 9.5 1.3 31.7 4.8

Information Technology 50 1.8 30.0 4.0 0.8 20.0 0.0

Materials 27 1.8 44.4 7.4 -0.3 37.0 0.0

Real Estate 37 3.1 16.2 2.7 0.6 16.2 0.0

Utilities 16 2.3 6.3 0.0 0.2 6.3 0.0

SmallCap Sectors

Communication Services 15 6.5 26.7 6.7 0.4 20.0 6.7

Consumer Discretionary 58 0.6 39.7 3.4 1.3 22.4 0.0

Consumer Staples 16 2.7 31.3 0.0 0.3 6.3 0.0

Energy 29 5.1 34.5 6.9 2.0 17.2 3.4

Financials 100 2.8 52.0 14.0 0.1 31.0 5.0

Health Care 59 4.3 5.1 1.7 1.1 10.2 1.7

Industrials 78 1.2 44.9 3.8 0.4 24.4 0.0

Information Technology 68 3.0 27.9 4.4 0.1 27.9 1.5

Materials 31 14.7 32.3 0.0 1.2 29.0 0.0

Real Estate 44 3.7 11.4 0.0 0.7 11.4 0.0

Utilities 6 4.5 0.0 0.0 0.7 0.0 0.0

Source: I/B/E/S data by Refinitiv and Yardeni Research.

Page 4 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

Page 4 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings % Surprise

Figure 1.

4.0 4.0

S&P 500 NET REVENUE SURPRISE*

3.5 (percent) 3.5

3.0 3.0

Q4

2.5 2.5

2.0 2.0

1.5 1.5

1.0 1.0

.5 .5

.0 .0

-.5 -.5

-1.0 -1.0

-1.5 -1.5

yardeni.com

-2.0 -2.0

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage that S&P 500 companies reported revenues above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 2.

25 25

S&P 500 NET EARNINGS SURPRISE*

20 (percent) 20

Q4

15 15

10 10

5 5

0 0

-5 -5

-10 -10

-15 -15

-20 -20

yardeni.com

-25 -25

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

* Percentage that S&P 500 companies reported earnings above or below the consensus estimate at the time of the earnings report.

Earnings surprise capped at -20% during Q4-2008.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 5 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings % of Companies +/-

Figure 3.

100 100

S&P 500 POSITIVE & NEGATIVE REVENUE SURPRISES*

(percent of companies)

80 Q4 80

60 60

40 40

20 20

0 0

-20 Q4 -20

-40 -40

-60 -60

yardeni.com

-80 -80

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

* Percentage of S&P 500 companies that reported revenues above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 4.

100 100

S&P 500 POSITIVE & NEGATIVE EARNINGS SURPRISES*

(percent of companies)

80 Q4 80

60 60

40 40

20 20

0 0

-20 Q4 -20

-40 -40

yardeni.com

-60 -60

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

* Percentage of S&P 500 companies that reported earnings above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 6 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Surprise ex-Energy

Figure 5.

10 10

8 QUARTERLY REVENUE SURPRISE* 8

6 (percent) 6

4 4

2 Q4 2

0 0

-2 -2

-4 -4

-6 -6

-8 -8

-10 S&P 500 (2.8) -10

-12 S&P 500 Energy (0.3) -12

-14 S&P 500 ex-Energy (3.0) -14

-16 -16

1.25 1.25

1.00 1.00

.75 Percent Surprise Attributable to Energy (-0.2) .75

.50 .50

.25 .25

.00 .00

-.25 Q4 -.25

-.50 -.50

-.75 -.75

-1.00 -1.00

-1.25 -1.25

yardeni.com

-1.50 -1.50

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that revenues were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 6.

125 125

QUARTERLY EARNINGS SURPRISE*

100 (percent) S&P 500 (17.1) 100

S&P 500 Energy (26.9)

75 S&P 500 ex-Energy (17.0) 75

50 50

25 25

Q4

0 0

-25 -25

2.0 2.0

1.5

Percent Surprise Attributable to Energy (0.1) 1.5

1.0 1.0

.5 .5

.0 Q4 .0

-.5 -.5

-1.0 -1.0

yardeni.com

-1.5 -1.5

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that earnings were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 7 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Surprise ex-Financials

Figure 7.

15 15

QUARTERLY REVENUE SURPRISE*

10 (percent) 10

5 5

Q4

0 0

-5 S&P 500 (2.8) -5

S&P 500 Financials (5.3)

-10 -10

S&P 500 ex-Financials (2.6)

-15 -15

-20 -20

2.5 2.5

2.0 2.0

1.5 1.5

1.0 1.0

.5 .5

Q4

.0 .0

-.5 -.5

-1.0 -1.0

-1.5 -1.5

-2.0 -2.0

Percent Surprise Attributable to Financials (0.2)

-2.5 -2.5

-3.0 yardeni.com -3.0

-3.5 -3.5

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that revenues were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 8.

30 30

QUARTERLY EARNINGS SURPRISE*

20 (percent) 20

Q4

10 10

0 0

-10 S&P 500 (17.1) -10

S&P 500 Financials (20.0)

-20 -20

S&P 500 ex-Financials (15.1)

Surprise capped at 20% and -20% due to extreme values.

-30 -30

15 15

10 Percent Surprise Attributable to Financials (2.0) 10

5 5

Q4

0 0

-5 -5

-10 -10

-15 -15

yardeni.com

-20 -20

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

* Percentage amount that earnings were above or below the consensus estimate at the time of the earnings report.

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 8 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Growth ex-Energy

Figure 9.

40 40

30

QUARTERLY REVENUE GROWTH* 30

(percent)

20 20

10 10

0 Q4 0

-10 -10

-20 -20

-30 -30

S&P 500 (2.8)

-40 -40

S&P 500 Energy (-33.4)

-50 S&P 500 ex-Energy (6.1) -50

-60 -60

4 4

Percentange Points Attributable to Energy (-3.3)

2 2

0 0

-2 -2

Q4

-4 -4

-6 -6

yardeni.com

-8 -8

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 10.

80 80

QUARTERLY EARNINGS GROWTH*

60 (percent) 60

40 40

20 20

0 Q4 0

-20 -20

S&P 500 (3.8)

-40 S&P 500 Energy (-50.0) -40

-60 S&P 500 ex-Energy (8.0) -60

Growth capped at 50% and -50% due to extreme values.

-80 -80

6 6

4 Percentange Points Attributable to Energy (-4.2) 4

2 2

0 0

-2 -2

-4 Q4 -4

-6 -6

-8 -8

yardeni.com

-10 -10

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 9 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Revenue & Earnings Growth ex-Financials

Figure 11.

20 20

QUARTERLY REVENUE GROWTH*

15 15

(percent)

10 10

5 5

Q4

0 0

-5 -5

-10 -10

S&P 500 (2.8)

-15 S&P 500 Financials (2.4) -15

-20 S&P 500 ex-Financials (2.8) -20

-25 -25

3 3

2

Percentage Points Attributable to Financials (0.0) 2

1 1

0 Q4 0

-1 -1

-2 -2

-3 -3

yardeni.com

-4 -4

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Figure 12.

80 80

QUARTERLY EARNINGS GROWTH*

60 (percent) 60

40 40

20 20

0 Q4 0

-20 S&P 500 (3.8) -20

S&P 500 Financials (16.3)

-40 S&P 500 ex-Financials (1.2) -40

-60 Growth capped at 60% and -60% due to extreme values. -60

-80 -80

75 75

Percent Points Attributable to Financials (2.6)

50 50

25 25

Growth contribution capped at 60% and -60% due to extreme values.

0 Q4 0

-25 -25

-50 -50

yardeni.com

-75 -75

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 10 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Earnings Surprises

Figure 13.

40 25

30

S&P 500 HEALTH CARE

earnings surprise (%) 20

20 (17.1)

Q4 15

10

(6.0)

10

0

Q4 5

-10

-20 0

Q4-2008 capped at -20%

-30 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

30 80

COMMUNICATION SERVICES Q4 INDUSTRIALS 70

20

60

10 (10.7) 50

40

0

30

-10 20

(24.6) Q4 10

-20

0

-30 -10

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

100 25

75 CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY

20

50 Q4

Q4 15

25 (16.5)

0 10

-25 5

-50 (35.5)

-75 0

-100 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

15 80

CONSUMER STAPLES MATERIALS

12 60

9 (6.1) (11.9) 40

6 Q4

20

3 Q4

0 0

-3 -20

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

140 100

120 ENERGY REAL ESTATE

80

100

80 (26.9) (47.1) 60

60 Q4

40

40

20 Q4 20

0

0

-20

-40 -20

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

75 15

FINANCIALS UTILITIES

50

(1.4) 10

25 Q4

(26.3)

0 5

-25 Q4

0

-50

yardeni.com

-75 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 11 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Earnings Surprises

Figure 14.

150 125

125 S&P 500 HEALTH CARE 100

100 % of companies with positive and negative earnings Q4

surprise (percent) 75

75 Q4

50

50

25

25

0 0

-25 -25

-50 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

150 125

COMMUNICATION SERVICES INDUSTRIALS 100

100 Q4 Q4 75

50 50

0 25

0

-50

-25

-100 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

125 125

100

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY 100

Q4

75 Q4 75

50 50

25 25

0 0

-25 -25

-50 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

125 125

100

CONSUMER STAPLES MATERIALS 100

75 Q4 75

Q4

50 50

25 25

0 0

-25 -25

-50 -50

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

100 100

ENERGY REAL ESTATE 75

75 Q4

Q4 50

50

25

25

0

0

-25

-25 -50

-50 -75

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

100 100

FINANCIALS Q4 UTILITIES

75

Q4

50 50

25

0

0

-25 -50

-50

yardeni.com

-75 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 12 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Revenue Surprises

Figure 15.

5 4

4

S&P 500 HEALTH CARE

revenue surprise (%) 3

3 (2.8) Q4

Q4 2

2

1

1

0

0

(2.2) -1

-1

-2 -2

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

5 6

4 COMMUNICATION SERVICES INDUSTRIALS

Q4 4

3 Q4

2 (3.4) (3.5) 2

1

0 0

-1

-2

-2

-3 -4

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

6 6

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY Q4

4 4

(2.8) Q4 (5.0)

2 2

0 0

-2 -2

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

3 9

CONSUMER STAPLES Q4 MATERIALS 6

2

Q4 3

1 (2.3) 0

0

-3

-1

-6

-2 (3.7)

-9

-3 -12

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

12 8

8

ENERGY REAL ESTATE

6

4

0 Q4 (2.5) 4

-4 Q4

2

-8

(0.3) 0

-12

-16 -2

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

15 15

10

FINANCIALS UTILITIES 10

5 Q4 (-8.7) 5

0 0

-5 -5

-10 Q4 -10

(5.3)

-15 -15

yardeni.com

-20 -20

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 13 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Revenue Surprises

Figure 16.

200 100

S&P 500 HEALTH CARE Q4

75

150 % of companies with positive and negative revenue

surprise (percent) 50

100

Q4 25

50

0

0

-25

-50 -50

-100 -75

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

125 100

100

COMMUNICATION SERVICES INDUSTRIALS Q4 75

Q4

75 50

25

50

0

25

-25

0 -50

-25 -75

-50 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

125 125

100 CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY 100

75 Q4 75

Q4

50 50

25 25

0 0

-25 -25

-50 -50

-75 -75

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

100 150

75

CONSUMER STAPLES Q4 MATERIALS

100

50 Q4

25 50

0 0

-25

-50

-50

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

100 100

75

ENERGY REAL ESTATE 75

Q4

Q4 50

50

25

25

0

0

-25

-25 -50

-50 -75

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

100 100

FINANCIALS Q4 UTILITIES

75

50 50

25 Q4

0

0

-25 -50

-50

yardeni.com

-75 -100

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 14 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Earnings Growth

Figure 17.

150 25

S&P 500 HEALTH CARE

100 y/y earnings growth (%) 20

(3.8) (11.9) 15

50 Q4

10

0 Q4

5

-50 0

capped at 60%

-100 -5

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

40 75

COMMUNICATION SERVICES INDUSTRIALS 50

20 25

Q4

0

0

-25

Q4

-20 -50

(10.3) (-37.1)

-75

-40 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

150 100

CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY 80

100

60

50 (2.1) (20.3) 40

0 Q4 Q4 20

0

-50

-20

-100 -40

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

40 150

CONSUMER STAPLES MATERIALS

30 100

20 (6.6) (22.2) 50

Q4

10 0

Q4

0 -50

-10 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

140 100

ENERGY REAL ESTATE

70 50

(-100.0) (-11.1)

0 0

Q4

-70 -50

Q4

Capped at 100% and -100% due to extreme values.

-140 -100

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

150 50

FINANCIALS UTILITIES 40

100

30

50 (16.3) (-2.5) 20

Q4 10

0

Q4 0

-50

-10

yardeni.com

-100 -20

08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 15 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

S&P 500 Sectors Quarterly Revenue Growth

Figure 18.

25 20

20 S&P 500 HEALTH CARE

15 y/y revenue growth (%) (12.3)

15

Q4

10 (2.8) 10

5

Q4 5

0

-5

0

-10

-15 -5

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

30 15

COMMUNICATION SERVICES INDUSTRIALS 10

20 (7.7) 5

0

10 -5

Q4 Q4 -10

0 (-8.4) -15

-20

-10 -25

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

20 30

15 CONSUMER DISCRETIONARY INFORMATION TECHNOLOGY

10 Q4 20

5 (11.5) Q4

0 10

-5 (11.2) 0

-10

-15 -10

-20

-25 -20

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

15 40

CONSUMER STAPLES MATERIALS 30

10 20

(6.1) (2.8) 10

Q4 Q4

5 0

-10

0 -20

-30

-5 -40

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

60 15

ENERGY REAL ESTATE

40 10

(-33.4)

20 (-2.6) 5

0

0

-20 Q4

Q4 -5

-40

-60 -10

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

40 20

30

FINANCIALS UTILITIES 15

20 (-3.0) 10

5

10

Q4 0

0 Q4

-5

-10 -10

(2.4)

-20 -15

yardeni.com

-30 -20

09 10 11 12 13 14 15 16 17 18 19 20 21 22 09 10 11 12 13 14 15 16 17 18 19 20 21 22

Source: I/B/E/S data by Refinitiv and Yardeni Research Inc.

Page 16 / March 2, 2021 / Earnings Surprise Monitor Yardeni Research, Inc.

www.yardeni.com

Copyright (c) Yardeni Research, Inc. 2021. All rights reserved. The information

contained herein has been obtained from sources believed to be reliable, but is not

necessarily complete and its accuracy cannot be guaranteed. No representation or

warranty, express or implied, is made as to the fairness, accuracy, completeness, or

correctness of the information and opinions contained herein. The views and the other

information provided are subject to change without notice. All reports and podcasts posted on

http://blog.yardeni.com

www.yardeni.com, blog.yardeni.com, and YRI’s Apps are issued

without regard to the specific investment objectives, financial situation, or particular needs

of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell

any securities or related financial instruments. Past performance is not necessarily a guide

to future results. Company fundamentals and earnings may be mentioned occasionally, but

should not be construed as a recommendation to buy, sell, or hold the company’s stock.

Predictions, forecasts, and estimates for any and all markets should not be construed as

recommendations to buy, sell, or hold any security--including mutual funds, futures

contracts, and exchange traded funds, or any similar instruments.

The text, images, and other materials contained or displayed on any Yardeni Research, Inc.

product, service, report, email or website are proprietary to Yardeni Research, Inc. and

constitute valuable intellectual property. No material from any part of www.yardeni.com,

http://blog.yardeni.com

blog.yardeni.com, and YRI’s Apps may be downloaded, transmitted,

broadcast, transferred, assigned, reproduced or in any other way used or otherwise

disseminated in any form to any person or entity, without the explicit written consent of

Yardeni Research, Inc. All unauthorized reproduction or other use of material from Yardeni

Research, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary

and intellectual property rights, including but not limited to, rights of privacy. Yardeni

Research, Inc. expressly reserves all rights in connection with its intellectual property,

including without limitation the right to block the transfer of its products and services and/or

to track usage thereof, through electronic tracking technology, and all other lawful means,

now known or hereafter devised. Yardeni Research, Inc. reserves the right, without further

notice, to pursue to the fullest extent allowed by the law any and all criminal and civil

remedies for the violation of its rights.

The recipient should check any email and any attachments for the presence of viruses.

Yardeni Research, Inc. accepts no liability for any damage caused by any virus transmitted

by this company’s emails, website, blog and Apps. Additional information available on

request.

requests@yardeni.com

You might also like

- 66 KV Submarine Cable Systems For Offshore WindDocument20 pages66 KV Submarine Cable Systems For Offshore WindAnonymous 1AAjd0No ratings yet

- James Walker Oil and Gas GuideDocument72 pagesJames Walker Oil and Gas GuidemcouchotNo ratings yet

- RTS350OperationsGuide 85Document1,400 pagesRTS350OperationsGuide 85Eduardo Valldeperas100% (1)

- 6T40-Vac Test LocationsDocument4 pages6T40-Vac Test LocationsMauricio Exequiel ChavezNo ratings yet

- Banana JuiceDocument33 pagesBanana JuiceDeepak Ola50% (2)

- Samsung Foundry StrategyDocument19 pagesSamsung Foundry StrategyxellosdexNo ratings yet

- AIRBAGS! Technical ManualDocument13 pagesAIRBAGS! Technical Manualhagar18No ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- A Project Report On PLC and Its ApplicationDocument28 pagesA Project Report On PLC and Its Applicationpoonam00140% (1)

- NVDA F3Q23 Investor Presentation FINALDocument62 pagesNVDA F3Q23 Investor Presentation FINALandre.torresNo ratings yet

- TLB890 Hydraulic Pressure Testing PDFDocument13 pagesTLB890 Hydraulic Pressure Testing PDFjwd50% (2)

- Labor Market Statistics q12020 en 1Document4 pagesLabor Market Statistics q12020 en 1Toofy AlNo ratings yet

- Actual Forecast Previous CEIC (Real GDP %) Trading EconDocument3 pagesActual Forecast Previous CEIC (Real GDP %) Trading EconAnya NieveNo ratings yet

- Shubham Moon Marketing 4.0 Final Assignment MBA 1Document26 pagesShubham Moon Marketing 4.0 Final Assignment MBA 1shubham moonNo ratings yet

- Gross Domestic ProductDocument8 pagesGross Domestic ProductEmmylou Molito PesidasNo ratings yet

- Sweet Biscuits in India DatagraphicsDocument3 pagesSweet Biscuits in India DatagraphicsSiddhant KoradiaNo ratings yet

- Prashant Sharma BudgetDocument24 pagesPrashant Sharma BudgetPrashant SharmaNo ratings yet

- Business CommunicationDocument16 pagesBusiness CommunicationHarsh ManralNo ratings yet

- BOIPPTNew 06112020Document36 pagesBOIPPTNew 06112020Rohit AggarwalNo ratings yet

- Analysis NewDocument12 pagesAnalysis NewFairooz AliNo ratings yet

- Drinking Milk Products in Vietnam - Datagraphics: Country Report - Aug 2019Document3 pagesDrinking Milk Products in Vietnam - Datagraphics: Country Report - Aug 2019Tiger HồNo ratings yet

- Gabriel IndiaDocument137 pagesGabriel IndiaIshaan MakkerNo ratings yet

- India's BOP shifts from surplus to deficit in 2018Document7 pagesIndia's BOP shifts from surplus to deficit in 2018Simran chauhanNo ratings yet

- RCB - México 2017Document5 pagesRCB - México 2017Freddy Ilave HuamaniNo ratings yet

- Pakistan Forecast - Unemployment Rate (1983 - 2019) (Data & Charts)Document1 pagePakistan Forecast - Unemployment Rate (1983 - 2019) (Data & Charts)Aleem RasoolNo ratings yet

- Alibaba Group Holding Limited: Strong BuyDocument9 pagesAlibaba Group Holding Limited: Strong BuyAnonymous P73cUg73L100% (1)

- Financial Ratios of Indonesian Companies 2016-2020Document4 pagesFinancial Ratios of Indonesian Companies 2016-2020Bela KhairunnisyakNo ratings yet

- Blemishing GDP Quarterly ResultsDocument4 pagesBlemishing GDP Quarterly ResultsCritiNo ratings yet

- Why North Macedonia - 2020 - Real Estate Market - Fortonmka Cushman & WakefieldDocument54 pagesWhy North Macedonia - 2020 - Real Estate Market - Fortonmka Cushman & Wakefieldana.filiposka124No ratings yet

- Savoury Biscuits in India DatagraphicsDocument2 pagesSavoury Biscuits in India DatagraphicsSiddhant KoradiaNo ratings yet

- Beta CalculatorDocument19 pagesBeta CalculatorcakartikayNo ratings yet

- Draft Financial Performance of Nairobi Stock ExchangeDocument9 pagesDraft Financial Performance of Nairobi Stock ExchangekinduNo ratings yet

- Wilcon Depot Quarterly Earnings, Revenue, EPS and Forecast SummaryDocument9 pagesWilcon Depot Quarterly Earnings, Revenue, EPS and Forecast SummaryAleli BaluyoNo ratings yet

- Haider Bhai Account StatementDocument1 pageHaider Bhai Account StatementSalman SajidNo ratings yet

- Netflix Subscribers by Country - Updated July 2020Document3 pagesNetflix Subscribers by Country - Updated July 2020Kirana Paramita UlalaNo ratings yet

- Alle FSA ExercisesDocument11 pagesAlle FSA Exercisesmsoegaard.kristensenNo ratings yet

- Result Presentation (Result)Document14 pagesResult Presentation (Result)Shyam SunderNo ratings yet

- MS-CIT-Year-wise-Admission-Count_2021-01Document1 pageMS-CIT-Year-wise-Admission-Count_2021-01rajshrichormare21No ratings yet

- fm2 Project Phase 1Document7 pagesfm2 Project Phase 1SACHIN THOMAS GEORGE MBA19-21No ratings yet

- Prepaid Expenses 31.03.2019Document5 pagesPrepaid Expenses 31.03.2019pradeep vermaNo ratings yet

- GNP and GDPDocument4 pagesGNP and GDPov_ramoneNo ratings yet

- Subject: Islamic Finance: Assignment: 3Document9 pagesSubject: Islamic Finance: Assignment: 3AimeeNo ratings yet

- CAPMDocument3 pagesCAPMalwyn sequeiraNo ratings yet

- Ii. Fiscal Situation: Combined Government Finances: 2008-09Document7 pagesIi. Fiscal Situation: Combined Government Finances: 2008-09gkmishra2001 at gmail.comNo ratings yet

- Education and Health Sector in PakistanDocument17 pagesEducation and Health Sector in PakistanMuhammad UmairNo ratings yet

- Profit Rates November 2021Document4 pagesProfit Rates November 2021Abubakar112No ratings yet

- 2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioDocument10 pages2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioNurul JannahNo ratings yet

- BMG704 (16432)Document20 pagesBMG704 (16432)EhinomenNo ratings yet

- Финансовая модель СтартапаDocument107 pagesФинансовая модель СтартапаЧудо НяниNo ratings yet

- Quarterly Estimated GDPDocument11 pagesQuarterly Estimated GDPb2023ankitkumar.singhNo ratings yet

- Pavise Equity Partners LP Performance Summary and Commentary for July 2022Document4 pagesPavise Equity Partners LP Performance Summary and Commentary for July 2022Kan ZhouNo ratings yet

- 321b0800 4111smartDocument11 pages321b0800 4111smartpankajNo ratings yet

- Comparison SBIN ICICIDocument135 pagesComparison SBIN ICICIGauravNo ratings yet

- Member Statement 2720289 PDFDocument3 pagesMember Statement 2720289 PDFnelsonNo ratings yet

- Marred by Regulatory Scrutiny: Qiwi PLCDocument4 pagesMarred by Regulatory Scrutiny: Qiwi PLCRalph SuarezNo ratings yet

- Trend Analysis: September 2020Document6 pagesTrend Analysis: September 2020Sharmarke Mohamed AhmedNo ratings yet

- Extraordinary When One Looks at The Performance of The Broader Universe" As Well As WhenDocument9 pagesExtraordinary When One Looks at The Performance of The Broader Universe" As Well As Whenravi_405No ratings yet

- Dabur Honey Case Study: Estimating Demand and Optimizing PricingDocument5 pagesDabur Honey Case Study: Estimating Demand and Optimizing PricingNirajanNo ratings yet

- Cia DAMDocument24 pagesCia DAMvishalNo ratings yet

- FM Graphs and Ratios TableDocument10 pagesFM Graphs and Ratios TableNehal SharmaNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/31Document4 pagesCambridge International AS & A Level: BUSINESS 9609/31underhiswings0110No ratings yet

- Sensiblu Marketing Management OptimizationDocument11 pagesSensiblu Marketing Management OptimizationMihaela VladNo ratings yet

- Comparative Economic Analysis of India and SpainDocument19 pagesComparative Economic Analysis of India and SpainDiksha LathNo ratings yet

- Davelouis LTD: Sales $24,750,000 $25,368,750 Costs and Expenses $8,910,000 $9,640,125 Tax (25%) $6,682,500 $7,230,094Document6 pagesDavelouis LTD: Sales $24,750,000 $25,368,750 Costs and Expenses $8,910,000 $9,640,125 Tax (25%) $6,682,500 $7,230,094Josué LeónNo ratings yet

- Corporate Finance Ii Project: Tvs MotorsDocument11 pagesCorporate Finance Ii Project: Tvs MotorsMr JainNo ratings yet

- Total Expenditure 2018-2019 5540120 471810 2155699 165218 335078 558084 719067 407958 61550 122954 365561Document4 pagesTotal Expenditure 2018-2019 5540120 471810 2155699 165218 335078 558084 719067 407958 61550 122954 365561Hassan RanaNo ratings yet

- The Relationship Between Unemployment and GDP: Unempolyment Rate (%)Document4 pagesThe Relationship Between Unemployment and GDP: Unempolyment Rate (%)senith lasenNo ratings yet

- The Relationship Between Unemployment and GDP: Unempolyment Rate (%)Document4 pagesThe Relationship Between Unemployment and GDP: Unempolyment Rate (%)senith lasenNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- The Following Items Are Not Eligible For Shipping: Unacceptable ListDocument1 pageThe Following Items Are Not Eligible For Shipping: Unacceptable ListkhalidgnNo ratings yet

- 12 Important SEO KPIs You Should TrackDocument19 pages12 Important SEO KPIs You Should TrackkhalidgnNo ratings yet

- مقارنة بين أشهر برامج التحليل النوعيDocument3 pagesمقارنة بين أشهر برامج التحليل النوعيkhalidgnNo ratings yet

- Uncovering Progress of Health Information Management PracticesDocument32 pagesUncovering Progress of Health Information Management PracticeskhalidgnNo ratings yet

- Award Tickets Request Form V-0517Document1 pageAward Tickets Request Form V-0517khalidgnNo ratings yet

- Optigrill: DE NL FR EN DA SV FI NODocument17 pagesOptigrill: DE NL FR EN DA SV FI NOkhalidgnNo ratings yet

- Real Estate Industry Report: Republic of Turkey Prime MinistryDocument23 pagesReal Estate Industry Report: Republic of Turkey Prime MinistryMaryna BolotskaNo ratings yet

- Award Tickets Request Form V-0517Document1 pageAward Tickets Request Form V-0517khalidgnNo ratings yet

- GC712D TEF Recipe Book PDFDocument76 pagesGC712D TEF Recipe Book PDFRamesh PallikaraNo ratings yet

- RH7500 RH7800 EngDocument62 pagesRH7500 RH7800 EngfraumoNo ratings yet

- Sell RulesDocument1 pageSell RuleskhalidgnNo ratings yet

- Sell RulesDocument1 pageSell RuleskhalidgnNo ratings yet

- Coast Kuwait Tourism and Media (07-Mar-10)Document10 pagesCoast Kuwait Tourism and Media (07-Mar-10)khalidgnNo ratings yet

- KFH Research Turkey Focus 2012 A Strained YearDocument2 pagesKFH Research Turkey Focus 2012 A Strained YearkhalidgnNo ratings yet

- Pune Residential Market Beat 2q10Document1 pagePune Residential Market Beat 2q10khalidgnNo ratings yet

- 2008 - Review of Methods in Technology AssessmentDocument10 pages2008 - Review of Methods in Technology AssessmentpalmiereNo ratings yet

- Autofrettage in Pressure VesselsDocument28 pagesAutofrettage in Pressure Vesselssran1986No ratings yet

- Katalog LincolnaDocument612 pagesKatalog LincolnaHaris TrešnjoNo ratings yet

- 7. Suppose an inductor has XL = 555 Ω at f = 132Document4 pages7. Suppose an inductor has XL = 555 Ω at f = 132Jhacel CelesteNo ratings yet

- Aeroscout Scout B1-100 BrochureDocument4 pagesAeroscout Scout B1-100 BrochureSebastian RentschNo ratings yet

- Fabric Ducting & Diffusers: Technical DataDocument32 pagesFabric Ducting & Diffusers: Technical DataruwangaroshalNo ratings yet

- Bw4HANA Conversion Overview 20191568211191781Document27 pagesBw4HANA Conversion Overview 20191568211191781tomNo ratings yet

- MB89635RDocument59 pagesMB89635Rmanly2909No ratings yet

- Donna Gawlik 2 PG Resume 2014Document2 pagesDonna Gawlik 2 PG Resume 2014api-244892096No ratings yet

- Management Information System Rensi-VillaDocument3 pagesManagement Information System Rensi-VillaVilla SantikaNo ratings yet

- Ultra-low voltage high gain OTA for biomedical appsDocument4 pagesUltra-low voltage high gain OTA for biomedical apps90413027No ratings yet

- PL 660 ManualDocument27 pagesPL 660 ManualSpeedyGonsalesNo ratings yet

- Sherlock Whole ThesisDocument94 pagesSherlock Whole ThesisKimNo ratings yet

- MedicalOilLessScrollSpec Rev5Document5 pagesMedicalOilLessScrollSpec Rev5Roger BustosNo ratings yet

- FKUv 1660 Premium - LiebherrDocument3 pagesFKUv 1660 Premium - Liebherraleks baltNo ratings yet

- Projection types and viewsDocument4 pagesProjection types and viewsOscarArteagaNo ratings yet

- Nptel SafetyDocument3 pagesNptel SafetySindhu ShijuNo ratings yet

- SID-CPD-03 Rev 02 Self DirectedDocument2 pagesSID-CPD-03 Rev 02 Self DirectedJeff Tingin MarceloNo ratings yet

- Controls: Instruction ManualDocument16 pagesControls: Instruction ManualOG100% (1)

- Sony kdl-65w855c Chassis gn1g SM PDFDocument66 pagesSony kdl-65w855c Chassis gn1g SM PDFCarlos CastroNo ratings yet

- APES March 2016 Quick-Study CardDocument2 pagesAPES March 2016 Quick-Study CardSami Ullah Khan NiaziNo ratings yet