Professional Documents

Culture Documents

Component I - Define Financial Goals

Uploaded by

Jonathan Speessen0 ratings0% found this document useful (0 votes)

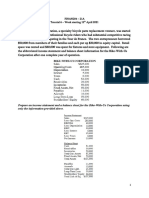

13 views2 pagesThe document contains Jonathan Speessen's short, intermediate, and long-term personal finance goals. His short-term goals for the next year include renewing his lease for $600, taking a $1000 vacation, and buying new clothes for $200. His intermediate goals for the next 2-5 years include getting married for $32,000, starting a family, accumulating $10,000 in stock, buying a house for $250,000, and finishing college for $30,000. His long-term goals for the next 6+ years include paying off his house for $250,000, prepaying his child's college for $100,000, and increasing his investment portfolio.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains Jonathan Speessen's short, intermediate, and long-term personal finance goals. His short-term goals for the next year include renewing his lease for $600, taking a $1000 vacation, and buying new clothes for $200. His intermediate goals for the next 2-5 years include getting married for $32,000, starting a family, accumulating $10,000 in stock, buying a house for $250,000, and finishing college for $30,000. His long-term goals for the next 6+ years include paying off his house for $250,000, prepaying his child's college for $100,000, and increasing his investment portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesComponent I - Define Financial Goals

Uploaded by

Jonathan SpeessenThe document contains Jonathan Speessen's short, intermediate, and long-term personal finance goals. His short-term goals for the next year include renewing his lease for $600, taking a $1000 vacation, and buying new clothes for $200. His intermediate goals for the next 2-5 years include getting married for $32,000, starting a family, accumulating $10,000 in stock, buying a house for $250,000, and finishing college for $30,000. His long-term goals for the next 6+ years include paying off his house for $250,000, prepaying his child's college for $100,000, and increasing his investment portfolio.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Jonathan Speessen

20201 Personal Finance 4545

8/29/2019

Short Term Goals (1 year)

Goal Priority Target Date Cost Estimate

Renew Lease High 7/1/2019 $600

Vacation Low 12/31/2019 $1000

New Clothes Low 9/1/2019 $200

Intermediate Goals (2-5 years)

Goal Priority Target Date Cost Estimate

Get Married High 1/1/2024 32,000

Start Family High 8/29/2024 -

Accumulate 10k in Stock Medium 1/1/2020 6,000

Buy House High 12/1/2022 250,000

Finish College High 1/1/2021 30,000

Long-Term Goals (6+ years)

Goal Priority Target Date Cost Estimate

Pay off House Medium 2035 250,000

Prepaid College High 2040 100,000

Increase Investment Portfolio High 2030 Varies

Luxury Vacation Low 2025 15,000

I plan on achieving my financial goals by thorough planning. Every month I go through my

expenses, what I’m expecting to pay, alongside what I actually paid last months. I calculate my income,

before and after taxes, check all cashflow coming in. I book keep all my assets, keeping track of the

increase and decrease in value. Every 6 months I check in to rework my investment portfolio calculate

the expected returns and the actual returns from the previous 6 months. I choose based on my income

changes and asset value if I want to increase my reoccurring investment strategy. I try to cut costs and

eliminate all un-necessary spending. Every 6 months I plan to also research my job title, other job offers,

and expected pay compared to actual pay. I like to keep an emergency fund at hand, so when it does

come an emergency, I’m not losing asset value or pulling from funds and getting hit with fees, or missing

bills.

WC:164

You might also like

- AFA CaseStudy Scenario DetailsDocument12 pagesAFA CaseStudy Scenario DetailsmybaggageNo ratings yet

- Stock & Bond Investing in Your 60s: Protecting Our Principal While Earning Income: Financial Freedom, #145From EverandStock & Bond Investing in Your 60s: Protecting Our Principal While Earning Income: Financial Freedom, #145No ratings yet

- DGI vs. BGI: Dividend Growth Investing vs. Bond Growth Investing: Financial Freedom, #53From EverandDGI vs. BGI: Dividend Growth Investing vs. Bond Growth Investing: Financial Freedom, #53No ratings yet

- Reflection Paper 2 - Financial Management PlanDocument2 pagesReflection Paper 2 - Financial Management PlanRoger VirayNo ratings yet

- Read This First:: Loan & General InfoDocument14 pagesRead This First:: Loan & General InfoJoannaNo ratings yet

- RtgsDocument3 pagesRtgsFungaiNo ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- Income to the Moon: Income Investing Your Way to Retirement: Financial Freedom, #84From EverandIncome to the Moon: Income Investing Your Way to Retirement: Financial Freedom, #84No ratings yet

- Personal Fin Group 6 PowerpointDocument40 pagesPersonal Fin Group 6 PowerpointFTU.CS2 Nguyễn Lý Minh NhưNo ratings yet

- 1 Financial Plan Cover PageDocument5 pages1 Financial Plan Cover Pageapi-404263747No ratings yet

- Personal Finance 2nd Edition Walker Solutions ManualDocument25 pagesPersonal Finance 2nd Edition Walker Solutions ManualElaineStewartrbdt100% (54)

- Federal Budget 2021Document4 pagesFederal Budget 2021api-227304535No ratings yet

- My High-Yield Savings Account: Year in Review 2022: Financial Freedom, #101From EverandMy High-Yield Savings Account: Year in Review 2022: Financial Freedom, #101No ratings yet

- Personal Investment Portfolio Plan ManagementDocument8 pagesPersonal Investment Portfolio Plan ManagementJustin joel BelarminoNo ratings yet

- 30-Year Bonds vs. Blue-Chip Dividends Stocks: Choose Your 4%Yielding Investment: Financial Freedom, #93From Everand30-Year Bonds vs. Blue-Chip Dividends Stocks: Choose Your 4%Yielding Investment: Financial Freedom, #93No ratings yet

- Nguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceDocument14 pagesNguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceNgọc MaiNo ratings yet

- Exam 2 Practice ProblemsDocument12 pagesExam 2 Practice ProblemsumerubabNo ratings yet

- W2 Non-Current LiabilitiesDocument36 pagesW2 Non-Current LiabilitiesVanessa LeeNo ratings yet

- Saving is Defense: Investing is Offense: Financial Freedom, #161From EverandSaving is Defense: Investing is Offense: Financial Freedom, #161No ratings yet

- Assignment 3 MathDocument7 pagesAssignment 3 MathEugen OdojeNo ratings yet

- Continuing Case Part 1Document20 pagesContinuing Case Part 1api-309341411No ratings yet

- Fair Value Adjustment 44,305: Unrealized Gain (Or Cummulative Amount of OCI) 8,730Document2 pagesFair Value Adjustment 44,305: Unrealized Gain (Or Cummulative Amount of OCI) 8,730Gray Javier100% (1)

- Gupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementDocument11 pagesGupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementAnand YadavNo ratings yet

- Chave 40085558 (Case 1)Document10 pagesChave 40085558 (Case 1)Chris ChaveNo ratings yet

- 2022 Individual Tax Return Tax PlanDocument3 pages2022 Individual Tax Return Tax PlanYoslaine BernalNo ratings yet

- Test 2 SolutionsDocument12 pagesTest 2 SolutionssamanialenaNo ratings yet

- FM - Valuation of Bond and StocksDocument10 pagesFM - Valuation of Bond and StocksMaxine SantosNo ratings yet

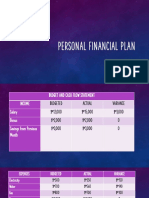

- Personal Financial PlanDocument6 pagesPersonal Financial PlanThomgie TilaNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial Planningsabarais100% (3)

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- YIP Property Wealth Coach Article Real LifeDocument5 pagesYIP Property Wealth Coach Article Real LifebenempowerNo ratings yet

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420No ratings yet

- 6 Pillars TO Financial Planning: Presented by Sonal Jain Team of 100 Financial ConsultanDocument22 pages6 Pillars TO Financial Planning: Presented by Sonal Jain Team of 100 Financial ConsultansonalNo ratings yet

- Accounting Chapter 10Document11 pagesAccounting Chapter 10Andrew ChouNo ratings yet

- Sample Financial PlanDocument23 pagesSample Financial PlansprivatesterNo ratings yet

- 2022.debate and Individual ExercisesDocument5 pages2022.debate and Individual ExercisesDuy AAnhNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- Personal Financial Planning Statement and Investment Policy StatementDocument21 pagesPersonal Financial Planning Statement and Investment Policy Statementcollins KimaiyoNo ratings yet

- Chapter 04Document26 pagesChapter 04GIAO NGUYỄN VÕ QUỲNHNo ratings yet

- FINAN204-21A - Tutorial 6 Week 7Document10 pagesFINAN204-21A - Tutorial 6 Week 7Danae YangNo ratings yet

- Presentation 4 - Basics of Capital Budgeting (Final)Document38 pagesPresentation 4 - Basics of Capital Budgeting (Final)sanjuladasanNo ratings yet

- Fa 2Document2 pagesFa 2vietdung25112003No ratings yet

- Sample of AssignmentDocument25 pagesSample of AssignmentSweethaa ArumugamNo ratings yet

- Managing Your Personal FinanceDocument20 pagesManaging Your Personal FinanceshainasNo ratings yet

- Foreign Currency Transaction and TranslationDocument4 pagesForeign Currency Transaction and TranslationKrizia Mae Flores100% (1)

- Saving and Investing For Your FutureDocument55 pagesSaving and Investing For Your FutureRajan RajNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Thi Hong Loan Phan - s5191658 - 1202AFE - Part ADocument2 pagesThi Hong Loan Phan - s5191658 - 1202AFE - Part Aphan loanNo ratings yet

- Financial Plan FinalDocument5 pagesFinancial Plan Finalapi-275968399No ratings yet

- Reflection Paper 2 - Financial Management PlanDocument3 pagesReflection Paper 2 - Financial Management PlanANGEL JIYAZMIN DELA CRUZNo ratings yet

- Konsep Perencanaan KeuanganDocument15 pagesKonsep Perencanaan KeuanganRony huluNo ratings yet

- Financial Strategies: Keith Patterson and Kathryn PattersonDocument75 pagesFinancial Strategies: Keith Patterson and Kathryn PattersonHoward KeziahNo ratings yet

- FinanceDocument9 pagesFinancecrystalNo ratings yet