Professional Documents

Culture Documents

H JNB519 14405636 2013 Feb

Uploaded by

Luis Ovalle0 ratings0% found this document useful (0 votes)

17 views1 pageOriginal Title

H-JNB519-14405636-2013-FEB

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views1 pageH JNB519 14405636 2013 Feb

Uploaded by

Luis OvalleCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

INSIGHT

oracle

On the lookout for new econoll1ic growth

inancial markets have begun the interest rate differentials with overseas

year on a more buoyant note. financial centres - is becoming

The US has played a significant increasingly problematic for many

role with evidence the housing sector businesses, and there does not appear

has bottomed, and after the so-called to be any sensible policy options open

"fiscal cliff" (of simultaneous tax to the Reserve Bank or the Government

increases and spending cuts) was for dealing with it.

averted. There is also clearer evidence As businesses come to accept the

of a pick-up in the Chinese economy continued strength of the Australian

(spilling over into a rebound in the dollar, and consumers aren't going

iron ore price), and signs the European back to the spending habits of the

economy and financial markets have pre-GFC era anytime soon, they

stabilised. are increasingly looking at ways of

However, notwithstanding the -l improving productivity and reducing

optimism evident in financial markets, ~ costs, something which hasn't been a

2013 is likely to prove challenging 8- priority for most Australian businesses

as the search for alternative sources _ _ _-'9- since the late 1990s.

of growth continues as we approach households are rebuilding their Almost inevitably, that includes

and pass the peak in the mining balance sheets, which means saving "headcount reductions" - and

investment boom. a high (by standards of the past two although there hasn't been a wave of

Mining investment is expected decades) proportion of their incomes mass layoffs, employers have clearly

to peak at just under 8 per cent of and paying down debt, and being become more hesitant about new

GDP later this year - compared with much more selective in their spending hiring, something which is evident

an average of 1. 75 per cent of GDP than before the GFC. both in tallies of job vacancies and in

during the decade ended 2010. Mining Hence, even with mortgage rates unemployment among the young.

investment has probably accounted down to within 55-70 basis points of In addition, the more stringent

for about one-third of the growth in their post-financial crisis lows - the budgetary policies being pursued

Australia's GDP over the past two years. by lhe Commonweallh and Slale

Although likely to remain at a high IT SEEMS QUITE LIKELY Governments are being reflected in

level (by historical standards at least UNEMPLOYMENT cutbacks in public sector employment.

until work on the current crop of major Hence, it seems quite likely

LNG and CSG projects is completed) it

WILL RISE THIS YEAR, unemployment will rise this year,

will no longer be adding to the overall PROBABLY REACHING probably reaching 6 per cent, a

growth in the Australian economy. 6 PER CENT prospect which is likely to weigh on

Nor will Australia's national income consumer confidence.

be boosted by rising commodity recovery in housing demand has been Finally, a federal election is due

prices, notwithstanding the recent quite tentative. Would-be buyers by late November. On top of the

rebound in iron ore prices. Australia's appear to remain apprehensive about uncertainty which elections always

"terms of trade" (the ratio of export the possibility of further declines in bring, this year's contest seems likely

to import prices) actually peaked in house prices, as well as wary about to be unusually bitter, with both major

the September quarter of 2011: it fell taking on additional debt. Hence, any parties more inclined to resort to

by nearly 9 per cent last year, and will upturn in new housing construction "populist" policies, something which

probably fall another 3 per cent this this year (with flow-on benefits to doesn't bode well for the outlook for

year. That will detract from company manufacturing and retailing) will economic policy over the medium

profits and government revenues. probably be quite modest. term. All told, while Australia's

So if overall economic growth is to Businesses outside of the mining economy will remain in better shape

remain close to "trend" (of about 3-3.5 sector remain very pessimistic and than the economies of most of our

per cent) new sources of growth will non-mining investment in 2013 seems traditional "peer group", it's unlikely to

need to become more evident as 2013 likely to fall to its lowest level as a offer an "easy ride" for businesses or

unfolds. Unfortunately, most of the share of GDP in more than 25 years. investors in 2013.11i!]

obvious candidates for fresh impetus The strength of the Australian

to Australian economic growth face dollar - in the face of falling Saul Eslake is chief economist at Bank of

some formidable hurdles. In particular, commodity prices and narrowing America-Merrill Lynch Australia.

16 MANAGEMENT TODAY I February 2013

You might also like

- Dmms Tutorial 4Document2 pagesDmms Tutorial 4Luis OvalleNo ratings yet

- Dmms Module 1 SlidesnDocument11 pagesDmms Module 1 SlidesnLuis OvalleNo ratings yet

- Dmms Module 2Document30 pagesDmms Module 2Luis OvalleNo ratings yet

- Dmms Module 4 SlidesDocument6 pagesDmms Module 4 SlidesLuis OvalleNo ratings yet

- Dmms Module 4Document29 pagesDmms Module 4Luis OvalleNo ratings yet

- Dmms Module 1Document11 pagesDmms Module 1Luis OvalleNo ratings yet

- ThwmbutiowDocument193 pagesThwmbutiowLuis OvalleNo ratings yet

- Cybergriping - Violating The Law While E-ComplainingDocument20 pagesCybergriping - Violating The Law While E-ComplainingLuis OvalleNo ratings yet

- Wells 2006 Applying Systems Engineering To NaDocument14 pagesWells 2006 Applying Systems Engineering To NaLuis OvalleNo ratings yet

- Anthony F Molland - Stephen R Turnock - Dominic A Hudson-Ship Resistance and Propulsion - Practical Estimation of Ship Propulsive Power-Cambridge University Press (2011)Document563 pagesAnthony F Molland - Stephen R Turnock - Dominic A Hudson-Ship Resistance and Propulsion - Practical Estimation of Ship Propulsive Power-Cambridge University Press (2011)ghanbari8668100% (1)

- Ref 4Document7 pagesRef 4kamarajchowdaryNo ratings yet

- MANTOD2014JanFeb2014 - 025 Send & Package para Esay 1Document3 pagesMANTOD2014JanFeb2014 - 025 Send & Package para Esay 1Luis OvalleNo ratings yet

- Rina 1860-2010 2010-2020Document92 pagesRina 1860-2010 2010-2020Luis OvalleNo ratings yet

- Including Navigation PatternsDocument16 pagesIncluding Navigation PatternsLuis OvalleNo ratings yet

- MEPC 1-Circ 878Document13 pagesMEPC 1-Circ 878Li Ann ChungNo ratings yet

- The Comma (,) : English, 2Document3 pagesThe Comma (,) : English, 2Luis OvalleNo ratings yet

- DNV GL - IMO Ship Implementation PlanDocument1 pageDNV GL - IMO Ship Implementation PlanShivani SarkarNo ratings yet

- Sulphur 2020: From Contracting To Final CombustionDocument24 pagesSulphur 2020: From Contracting To Final Combustionvran77No ratings yet

- 1 PDFDocument9 pages1 PDFAnnieNo ratings yet

- LR Marine Training Services Brochure Digital v1.0 PDFDocument16 pagesLR Marine Training Services Brochure Digital v1.0 PDFCristina Díaz ÁlvarezNo ratings yet

- MO Sulphur 2020 GuidanceDocument24 pagesMO Sulphur 2020 GuidanceF FNo ratings yet

- Vice-Chancellor's Leadership Program Guidelines 2019: Student Leadership, Career Development and EmploymentDocument13 pagesVice-Chancellor's Leadership Program Guidelines 2019: Student Leadership, Career Development and EmploymentLuis OvalleNo ratings yet

- Simple Solow Model: Savings Rate 0.238 Depreciation Rate 0.02 Technology A 1.46 Plot Range 1410Document2 pagesSimple Solow Model: Savings Rate 0.238 Depreciation Rate 0.02 Technology A 1.46 Plot Range 1410Luis OvalleNo ratings yet

- The Apostrophe (') : The Apostrophes and NounsDocument2 pagesThe Apostrophe (') : The Apostrophes and NounsLuis OvalleNo ratings yet

- 2013 Timothy Dickeson Ielts High Score VocabularyDocument38 pages2013 Timothy Dickeson Ielts High Score Vocabularymaxman11094% (18)

- 2013 Timothy Dickeson Ielts High Score VocabularyDocument38 pages2013 Timothy Dickeson Ielts High Score Vocabularymaxman11094% (18)

- Howitt Weil Economic GrowthDocument12 pagesHowitt Weil Economic GrowthLuis OvalleNo ratings yet

- Rand Rr1093Document294 pagesRand Rr1093Luis OvalleNo ratings yet

- A Contribution To The Empirics of Economic GrowthDocument32 pagesA Contribution To The Empirics of Economic GrowtharlenevieiraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

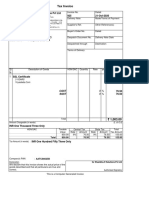

- Tax Invoice: Gstin/Uin: 24AABCY0257H1ZI State Name: Gujarat, Code: 24Document1 pageTax Invoice: Gstin/Uin: 24AABCY0257H1ZI State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Kalp Shah Mobile: 9106359201 EmailDocument25 pagesKalp Shah Mobile: 9106359201 EmailBharathNo ratings yet

- In Thousand 60kg Bags: World Coffee ConsumptionDocument2 pagesIn Thousand 60kg Bags: World Coffee ConsumptionLia ElNo ratings yet

- + Why Subsidy and Dumping Is Closedly Linked?Document2 pages+ Why Subsidy and Dumping Is Closedly Linked?ALù DũngNo ratings yet

- Hinduja National Power Corporation LIMITED (Hinduja Power Plant)Document2 pagesHinduja National Power Corporation LIMITED (Hinduja Power Plant)Anurag AllaNo ratings yet

- Key Pointers For The RDM Role - TIEDDocument3 pagesKey Pointers For The RDM Role - TIEDNalla Thambi100% (1)

- Circular Debt in PakistanDocument17 pagesCircular Debt in PakistanHira Noor91% (11)

- Mind Map EcoDocument1 pageMind Map EcoJung JihyunNo ratings yet

- Ibe MCQDocument7 pagesIbe MCQLokesh Kawale0% (1)

- International Trade at A Casual Environment Exercise & Script - Listening ComprehensionDocument2 pagesInternational Trade at A Casual Environment Exercise & Script - Listening ComprehensionFrancisco J. Salinas B.No ratings yet

- Economics 1 Problem Set 5 - Suggested AnswersDocument5 pagesEconomics 1 Problem Set 5 - Suggested AnswersLi XiangNo ratings yet

- Insurance PpsDocument13 pagesInsurance Ppsaziz_sediqiNo ratings yet

- Amaia Payment SchemesDocument6 pagesAmaia Payment SchemesMhack ColisNo ratings yet

- Important Bank Mergers From 2017 To 2019: Merger of Bank of Baroda, Vijaya Bank, Dena BankDocument2 pagesImportant Bank Mergers From 2017 To 2019: Merger of Bank of Baroda, Vijaya Bank, Dena BankParasuRam37No ratings yet

- LEVI's SWOT and TOWS AnalysisDocument13 pagesLEVI's SWOT and TOWS AnalysisRakeysh Coomar67% (3)

- Real Estate in Israel - Y.H. Dimri Construction - Israel ExporterDocument1 pageReal Estate in Israel - Y.H. Dimri Construction - Israel ExporterIsrael ExporterNo ratings yet

- Using The Material Given in The Case Studies 1 & 2, Answer The Following QuestionsDocument1 pageUsing The Material Given in The Case Studies 1 & 2, Answer The Following QuestionsPRAKRITI SANKHLANo ratings yet

- Bill No. 162 Atc 08.09.2021Document3 pagesBill No. 162 Atc 08.09.2021TILAK RAJ KambojNo ratings yet

- Exam Kit E2 Answers EngDocument6 pagesExam Kit E2 Answers EngWasangLiNo ratings yet

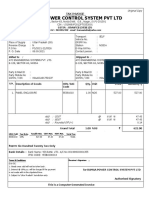

- Tax Invoice: B.D. Inno Ventures Private LimitedDocument1 pageTax Invoice: B.D. Inno Ventures Private Limitedzeel dholakiyaNo ratings yet

- ASEB1102 Module 1 The Role of Agric in Economic DevelopmentDocument3 pagesASEB1102 Module 1 The Role of Agric in Economic Developmentdylan munyanyiNo ratings yet

- Russia Ukraine ConflictDocument3 pagesRussia Ukraine ConflictSimon DruryNo ratings yet

- Bcom Sem Vi Business EconomicsDocument36 pagesBcom Sem Vi Business EconomicsRamesh BabuNo ratings yet

- 7 - Bcom Benefits of GST To Economy and IndustryDocument13 pages7 - Bcom Benefits of GST To Economy and Industrymnr81No ratings yet

- World Trade: An Overview: - Who Trades With Whom?Document21 pagesWorld Trade: An Overview: - Who Trades With Whom?Bachuu HossanNo ratings yet

- Bill of Exchange 078Document1 pageBill of Exchange 078trung2iNo ratings yet

- Class 10th EconomicsDocument4 pagesClass 10th EconomicsNihalSoniNo ratings yet

- Meaning of Fema: Switch From FERADocument6 pagesMeaning of Fema: Switch From FERAAalok GhoshNo ratings yet

- Marcom PlanDocument2 pagesMarcom PlanSuhaib BaluchNo ratings yet

- Chapter 2 - Comparative Economic DevelopmentDocument62 pagesChapter 2 - Comparative Economic DevelopmentKenzel lawasNo ratings yet