Professional Documents

Culture Documents

0126 019

0126 019

Uploaded by

Vijay Kumar0 ratings0% found this document useful (0 votes)

29 views8 pagesOriginal Title

0126_019

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views8 pages0126 019

0126 019

Uploaded by

Vijay KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

Apple tne. in 2010 mo467

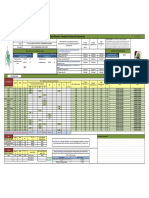

Exhibit? Apple's Competitors: Selected Financial Information, 2000-2009 (in millions of dollars)

2000___2002__ 20012005 2008-2009

Wewiett-Packara

“Total revenues 48870 56,588 79,905 91,658 118,384 114,552

Cost of salos 34813 41,457 60,621 69,178 89.370 87,198.

Rap 2627 3,988 3.563 3591 3,543 (2,819,

SGBA 6984 8,763 10,406 11,288 13,8268 11,613,

Not income 3697 903 3,497 6,198 8,329 7,660,

Total assets 34009 70,710 76.138 81,981 113,331 114,799

Total abilities 19,800 34.448 38,574 49,837 74.389 74,282

Total sharoholdors' equity 14,209 36,262 37.584 38,144 98.942 40.517,

‘Grose margin 28.9% 26.4% 25.0% 24.3% 24.2% © 23.6%

RaDIsales, 64% 6.0% «4.5% 0% 3.0% BEM

S08AVseles 143% 155% 18.1% 12.9% 11.0% 10.1%

Return on sales 70% 1.0% «4.4% «8% 7.0% «7%

Market captaization® 06,896 57,764 58.405 110,546 85,401 119,592

Delt

Total revenues 25265 41,444 55,788 61,133 61,101 52,902,

Cost of sales 20.047 33,892 45.897 49.462 49,998 43,404,

RAD 374 464 == 45RD

SG&A 2987 3544 4,988 7,446 6.906 6.465

Nat income 1,666 2645 «3.602 2.947 2a7e 1,493

Total assets 11.471 19,311 23.252 27.561 26.500 33.652

Total iabiltios 6.163 13.031 19.205 23.806 29.929 28011

Total shareholders’ equity «5,308 «6,280 «4.047 «3.735 A271 Seat

Grose margin 20.7% 18.09% 17.7% 10.1% 18.2% 18.0%

AsDisales 15% 11% 08% 1.0% 1.1% 1.0%

SO8AVsales 94% 8.6% «89% 12.2% «TAG «12.

Return on sales: 08% 64% —0S% «4% TH

Market capitalization” «123,194 90,572 68,185 44,640 20,18 28,485

Intel

Total revenues 99,726 26,764 34,009 95,982 97,586 35,127,

Cost of sales 12/650 19,940 14,301 17,164 16,742 15,566

RED 3897 4,094 4,778 5,873 5,722 5,653

SG&A 5089 4,334 4.859 6,138 B42 5,284

Net income 10.535 3,117 7.516 5.044 5.292 4.369,

Total assots 47945 44,204 48,143 48,968 50,472 53,095

Tota liabilities 10623 8,756 9,564 11,616 10,926 11,991

otal charcholdere’ equity 97,222 95,468 98,579 26,752 90,546 41,704

Grose margin 62% 50% SBR BTM BBM BEM

RaD/sales 12% 15% 14% TH 18H 16%

SGBAsales 15% 10% «14% 17H 15H TSH

tum on sales 31% 12% «22% 114% 1

Market capitalization 197,381 _ 105,418 147,954 120,242 _67,189_115,286

“Markt capitalization gure for each company is based onthe date the earnings Were He With the SEC

pet's market optalization figure for 2008 is rom March 18,2010 rather than he ling date,

79

This document is authorize for use ony in General Management Programme by P K Sinhs trom May 2011 to May

2001

n0-467

Apple nein 2010

oon 2002 —-sned 9006 one 9000

Microsoft

Total revenues 22,958 28,905 96.895 44,282 © 60420 58,497

Cost of sales 33002 «5089586 7,650 11,598 12,195,

BD 3,772 . 0,299 7,795 85848105 «9,010

SG8A 5,176 8,095 10.640 12.276 «16,587 16.296

Net income 9421 5,355 8,168 12.589 17,681 14,569

Toial assots 52,150 67.646 94,368 «69.597 72,783 77,888,

Total labiltios 10,782 15,468 19,543 «20.493 36,507 38,330

Total shareholders’ equity 41,368 62,180 74,825 40,104 36,286 39,558,

Gross margin 87% 80% «= 2% «= 83% «BTM 7%

aD/sales 16% 22% «= 21% «= 18% 13% «15%

SGAA‘sales 29% «20% «= 20% «= 28% 27% = 28%

Return on sales 41% 19% 22% —2BM MN

Market capitalization 302,651 258,987 295,667 257,724 235,364 212,163,

Nokia (in million Euros)

Total revenues 30976 90,018 29,371 44,121 50,710. 40,904

Cost of sales 49072 18278 © 18,179 27.742 92,995 27,569

RAD 2884 3052 3,881 3.897 5.922 5,879

SG&A 2804 323831753980 5815 4.988

Net income 3938 3,381 3.192 «4,306,988, 891

Total assets 19.890 23,327 22,659 22,617 99,582 95,798

Total liabilities 9082 9.045 8438 10,649 «25,374 22,650

Total shareholders’ equity 10,908 14,281 14,231 «11,968 14,208 13,088,

Gross margin 37% = 80% HH BIH HH BMH

RaDisales o% = 10% 12% o% 12% 14%

SG&AIsales O%% «11% 11% 10% IHC

Return on sales 19% 11% = 11% = 10% % 2%

Market capitalization 119,702 60.835 54271 85,157 27,107 40,085,

RIM

‘Total revenuce 25 204 595 2,066 6,000 11,065.

Cost of sales 49 210 20 926 2,929 «6,968

Rao 8 37 63 159 ‘360 085,

SG&A 14 96 108 314 esi 1,496

Net income 10 8) 82 ars 1298 1,893

Total assots 337 948 «1937-2814 5118107

Total liabilities 26 n 215 319 1578-2207

Total shareholders’ equity ait e7 1,722 1,995 3.934 5,874

Gross margin 49% 29% = 46% «= 55% BTM 8H

RaDisales 0% = 18% 11% 8% & 6%

‘SG&A/sales 16% 82% = 18% «= 18% «= 15% «= 14%

Roturn on sales 12% 10% 8% 18% «22% 17%

Market captalization 3057 2.008 12.205 19.625 66,461 __ 93,899

Source: Created by casewriter using data from Capital 1Q, March 2010.

Note: All information ison a fiscal-vear basis, unless noted otherwise. HPs fiscal year endsin October Deli Janaary inte

and Nok in December, Micrsoft in June, and RIM in Februar.

20

“This documents authorized for use only in General Managoront Programme by PK Sinha from Ney 2011 to May

2art

Apple Ine. in 2010

n0-467

Exhibit § Worldwide Smartphone Sales to End User by Operating System, 2006-2009 (%% of Total

2008

52.4%

16.6%

11.8%

82%

7.6%

5%

2009

69%

19.9%

87%

144%

47%

3.9%

Market Share)

20062007

Symbian 2.4% 635%

RIM 69% 9.6%

Microsoft 9.8% 12.0%

Mac OS X NA 27%

Linux 178% 9.6%

Android® NA NA

Palm's Webos? NA NA

NA

07%

Others 43% 4.4%

2.0%

0.8%

Source: Adapted fom Gartner Smartphone Sales quarterly pres releases between 2007 and 2009; “Gartner Says Worldwide

‘Mobile Phone Sales to End Users Grew § Per Cent in Fouth Quarter 2009; Market Remained Fat in 2008," Gartnee

ress Release (Egham, UK, February 23,200)

* Ando was introduced in 2008; data prior to that year not applicable.

"Palms WebOs was introduce in 2009; data prior to that yea snot applicable

Exhibit9_ Overview of Smartphone Operating Systems and App Stores (as of March 2010)

Operating Owner Major Handset Licensing App Store Approximate Number

System Vendors Fee of Available Apps

‘Symbian Nokia Nokia, Sony No OviSiore NA

Ericsson, and

Samsung

MacOSX Apple Apple Proprictary Apo Store 485,000

Blackberry RIM RIM Proprietary BlackBerry App World 6,000

Windows Microsoft. HTC, Samsung, LG. Yes Windows Marketplace 700

Mobile ‘Sony Ericsson for Mobile

Android Open HTC, Motorola, No Android Marketplace 30,000

Handset Samsung

Allance

Palm Web OS Paim Palm Proprietary Palm 2,100

MeoGo Nokia, Intal_Nokia No. Ovi Store NA

Source: Cronted by ate wsier based on various public eources.

Note: NA.= Not Available or Not Applicable.

2

“Thi document is autnonzed for use only in General Management Programme by P K Sinha from May 2011 to May

20r1

Apple Ine: in 2010

Endnotes

1 +The Book of Jobe,” The Eeouonia, January 30, 2010, p. 1.

2 Kevin McLaughin, “Apple COO: We're a Mobil

|tp:/ /www.crn.com/mobile/223100456;sessionid:

March 15,2010.

Device Company,” ChannelWeb, February 23, 2010,

NF2WELKTIATSQEIGHRSKESATMY32JVN, accessed

® Sales inclucled music and iPhone related products and services, such as: the iTunes Store sales, carrier

agreements, and Apple-branded and third-party accessories for both products,

4 This discussion of Apple's history is based lagely on Jim Carlton, Apple: The Insite Story of Intrigue,

Egomania, and Business Bhovders (New York: Times Business/Random House, 1997) David B. Yotfe, “Apple

Computer 1992,” HBS No. 702-081 (Boston: Harvard Business School Publishing, 192); and David B. Yoie and

Yast Wang, "Apple Computer 2002," HBS No. 702-69 (Boston: Harvard Business School Publishing, 2002).

Unless otherwise attributed, all quotations and all data cited inthis section are drawn from those two cases

Carlton, Apple, p. 10.

‘45teve Jobs Takes Another Bite at Apple,” Te Indevendent, January 6, 1997.

7 Yotfie. “Apple Computer 1962.”

® David B, Yotte, “Apple Computer 1996,” HIS No. 796-126 (Boston: Harvard Dusiness School Publishing,

1996)

° Charles McCoy, “Apple, IBM Kill Kaleida Labs Venture,” The Wall Steet Journal, Noverbet 20, 1995.

}© Louise Kehoe, “Apple Shares Drop Sharply," The Financia! Times, January 19, 1996.

4 David Kirkpatrick,

me Second Coming of Apple,

Fortune, November 9, 1998.

12 hutp:/ /ww.applecom/macbookair/environment html, accessed March 2010.

43 IDC (International Data Corp.) data, as cited in Graham-Hackett, “Computers: Hardware,” Standard &

Poor's Industry Surveys, December 8, 2005, p.7.

4 bul Shope and Elizabeth Borboll, “IT Hardware: Top Issue for 2006 and Industry Primer” (analyst

report) JP Morgan, January 30,2006, pp. 28-29.

15 Michelle Kessler, “Computer Industry Sits at Critical Crossroads,” USA Tony, March 5, 2007, p. BI

accessed via activa

16 “PC Market Rebound Will Drive Double-Digit Growth Through 2014, According to IDC,” IDC Press

Release (Framingham, MA, March 15, 2010),

} David Wong, Amit Chandra, and Lindsey Matheme, “Chip/Computer/Celiphone Data,” (research

seport), Wachovia Capital Markets LLC, December 10, 2007, pp- 3-H “November Computer Technology US.

Retail Sales Revenue Positive for First Time in 2009, According to NPD,” NPD Press Release (Port Washington,

NY, December 17, 2008).

18 Thomas W. Smith, “Computers: Hardware.” Standard & Poor's Industry Surveys, October 22,2008, p. 3.

» wid, p27.

2 “Why Buy a Generic PC?” PC Generic, April 30, 2009, http://www.pegeneric.com/articles/5131 /Why-

buy-a-genarie-PC, accessed March 2010,

21 “Global PC market Leaps Back to Double-Digit Growth in the Fourth Quarter, Led by a Record Quarter in

the US, According to IDC,” IDC Press Release (Framingham, MA, January 13,2010),

“This documents authorized for use only in General Management Programme by P K Sinhe from May 2011 10 May

21k

Apple Ine-in 2010 ‘ose?

2 Clyde Montevirgen and Karan Kawaguchi, “Semiconductors,” Standard & Poor's Industry Surveys, May

i Bs y y

31, 2007, p. 25.

® David D. Yoffie, Dharmesh M. Mehta, and Rudina 1. Suse,

(Boston: Harvard Business Schoo! Publishing, 2006).

ficrosoft in 2005," HDS Case No. 705-505,

21 Microsoft Reports Record Second Quarter Results,” Microsoft Press Release (Redmond, WA, January 28,

2010),

2 rik Hesseldahl, “What's Behind Apple's (Work?” BusinessWeek Online, August 10, 2007, via Factiva,

accessed April 2010

2 "Global PC market Leaps Back to Double-Digit Growth in the Fourth Quarter, Led by a Record Quarter in

the US, According to IDC," IDC Press Release (Framingham, MA, January 13,2010).

2 Windows 7 Release May Test Apple's Winning Streak,” Reuters News, October 14, 2009, via Factiva,

accessed March 2010.

% Nick Turner and Patrick Seite, “Apple's intel Machines Ahead of Schedule,” Investor's Business Daily,

January I, 2005, p. As; Thomas Clayburn and Darrell Dunn, “Apple Bels Its Chips,” information Week,

“Januaty 16,2006 p26; Daniel Drew Tutner, "Apple Shows New Intel Notebooks, Software,” eWee, January 10,

2006; “Apple, Inc,’ Hoover's, Inc, www-hoovers.com, accessed January 2008,

2 Stephen Fenech, “Apple's New Core: New Macs with Intel Dual Processors Revealed,” Daily Tolograple

(London), January 18, 2006, p, 1.

® Robert Semple, “Apple Inc., Leopard's Lickin’ Its Chops,” (research report) Credit Suisse North America,

October 30,2007, p.1.

51 *Mac OS X Market Share Up 29%, Leopard Still Most Common,” Appleinsider blog, February 27, 2010,

http://www appleinsicer-com,print/ 10/02/27 /mac_os_x_market_share_up_29_leopard_still_most_common.h

tl, accessed March 2010.

2B “ppple's Mac OS X Snow Leopard Sales Double Previous Records,” Applelnsider blog, October 1, 2008,

‘nups/ sew appleinsidercom/erticles/09/10/19/apples_mac_ce.

snow_leopard,sales_douible_previous_rec

ordordshtml, accessed March 2010.

58 Brent Schlender, “How Big Can Apple Get?" Fortune, February 21,2005, p. 66,

% Heseldahl, “What's Behind Apple's {Work?"; Walter 5. Mossberg, "New Oifice for Mac Speeds Up

Programs, Integrates Formats, Te Wall Stree Journal, January 3,208, p. BI, via Factiva, accessed January 2008.

© “Store Financials Blaze Despite Down Eeonomy.” Moapplestorescom, October 19, 2008,

Intps/ www foapplestorecom/the_stores html, accessed April 2010.

26 Apple Inc. 10-K/A, January 25,2010 (Cupertino, CA, 2010), p. 11 and p. 14

® Katie Hafner, “Inside Apple Stores, a Certain Aura Enchants the Faithful,” The New York Times, December

27,2007, p.C1, via Factiva, accessed December 2007,

58 Peter Burrows and Ronald Glover, with Heather Green, “Steve Jobs’ Magic Kingdom.” BusinessWeek,

February 6, 2006, p. 62.

® Yinka Adegoke, “Apple Seen Having Upper Hand! in Music Negotiations,” Reuters News, April 0, 2007,

accessed via Factiva; Ben Cherny and Roger Cheng, “Pressure from IPhone, Rivals Weighs on Latest IPod

Debut," Dow Jones Newswires, September 4, 2007, accessed via Factiva; Ricki Morell, “MP3 Options, From

‘Apple to Zune,” The Boson Globe, June 8, 208, p. G2, accessed via Factiva; Chris Sorensen, “A Pod-Forsaken

Future?” Toronto Str, June 14,2008, p. Bl, accessed via Factiva,

‘This document is authorized for use only in General Management Programme by PK Sinha from May 2011 to May

Dor"

nio-ser Apple Inc. in 2010,

‘Thomas Ricker, “iSuppli: New iPod Nano Costs Apple Less than $83 in Components.” September 19, 2007,

tp: //www-engadget com/2007 /09/19 /isupplicnew-ipod-nanos-cost-apple-just-59-and-$3-in-component/,

accessed March 2010,

“Arik Hesseldahl, “Unpeeting Apple's Nano,” BusinessWeek Online, September 22, 2007, via Factiva,

accessed September 2007.

Damon Darlin, “The iPod Beosystem,” New York Times, February 9, 2006.

Damon Darlin, “Add-Ons Have Become a Billion-Dollar Bonanza,” The New York Times, February 3, 2006,

Cl. accessed via Factiva: Nick Wingfield and Don Clark. “Apple Goes Hi-Fi,” The Wall Stree Journal, March 1,

2006, p. BI, accessed via Factiva; Peter Burrows, “Welcome to Planet Apple.” BusinessWeek, july 9, 2007 p. 88,

accessed via Factiva,

Chris Whitmore, Sherri Scribner, and Joakim Mahiberg, “Beyond iPod’ (analysts’ report), Deutsche Bank,

September 21, 2005, p. 31; Megan Graham-Hackett, “Computers: Hardware” (industry survey), Standard &

Poor's, December 8, 2005, p. 8; Arik Hesseldahl, “Apple's Growing Army of Converts,” BusinessWeek Online,

‘November 10, 2005, via Factiva

$8 Jason Kincaid, “Apple Has Sold 450,000 iPade, 50,000 Milion iPhones to Date," TechCrunch, Aptl 8, 2010,

|https/ techcrunch com/2010/04/08 /apple-ha-sold.450000-ipads 50-million-iphones-to-date/, accossed April

2010.

4 Robert Semple, Stephanie Sun, and Thompson Wu, “Apple Computer Inc.” (analysts’ report), Credit

Suisse, June 5, 2007, p.6

7 rTunes was available from 2001 with the ox

wal iPod but the functionality as a store did not come until

2008.

48 Chris Taylor, “The 99¢ Solution,” Tine, November 17,2008, p. 66, via Factiva, accessed November 2007

«© "Tunes Store Tops 10 Billion Songs Sol,” Apple Inc. Press Release (Cupertino, CA, February 25,2010).

S bia, p7

51 Shope. eta. “Apple Computer: iPod Economics TL.” p. 26: Ronald Grover and Peter Burrows, “Universal

Music Takes on iTunes.” BusinessWeek. October 22,2017, p. 30, via Factiva, accessed October 2007

% Ibid, pp. 8-10.

5 Ibid pp. 10-13.

5 Taylor, “The 99¢ Solution”; Walker, “The Guts of the New Machine.”

5° Michael Arrington, “Spotify Closing New Financing at €200 Million Valuation, Music Labels Already

Shareholders,” TechCrunch, August 9, 2009, _htp://techcrunch.com/ 2009/08 04 spotify-closing-new-

‘hnancing-a-e200-million-valuation-music-labels-already-shareholders/, accessed April 2010.

56 Donna Fuscaldo and Mark Boslet, “Jabs Says Apple to Rename Itself Apple Ine,” Dow Janos News Service,

January 9, 2007, via Factiva, accessed March 2010.

57 Nick Wingfield and Li Yuan, “Apple's iPhone: Is It Worth It?" The Wall Street Journal, January 10, 2007.

5 Kharif and Burrows, “On the Trall of the Missing iPhones”; Feter Burrows, “Inside the IPhone Gray

Market,” BusinessWeek com, February 13, 2008, acessed via Factiva; David Barbeza, “Iphone on Gray Market

Merry-Go-Round,” The International Herald Tribune, February 18, 2003, p. 1, accessed. via Tactiva; Atk

Hisseldahl and Jennifer L. Schenker, “IPhone 20 Takes on the World,” BusinessWeek.com, June 9, 2008,

accessed via Faclive; Jeremiah Marquez, “Asia Underground Market’ Awaits iPhone,” Associated’ Press

[Newswives, July 11, 2008, acoessed via Factiva; Maria Kiselyova and Sophie Taylor, “Apple in No Rush to Bring

“This documents authorized for use onl in Ganeral Managoment Programme by P K Sinha fom May 2011 to May

2014

‘Apple Ine-in 2010 710-467

Phone to Russia, China," Reuters News, July 17, 2008, accessed via Factiva; Paul Sonne, “iPhones Hot Even in

laces Apple Has Yet to Reach," Associated Press Newswires, July 18, 2008, accessed via Factiva.

59“ Apple Inc.” (analyst report) Credit Suisse, February 4,2010, p. 3; Om Malik, “U.S. Mobile Market: Highly

‘Competitive and the iPhone Still Rocks,” Cigaom, March 4, 2010, http://gigaom.com/2010/03/04/u-s-mobile

smatkethighly-competitive-and-the iphone-stil-zocks/, accessed Apri 2010.

Arik Hesseldahl, “Tearing Down the iPhone 3GS,” BusinessWeek com, june 23,200, via Factiva, accessed

‘Apail 2000

© ia.

© Om Malik, “US. Mobile Matket: Highly Competitive and the iPhone Still Rocks,” Gigaom, March 4, 2010,

hitp:/ /gigaom.com/2010/03/04/u-e-mobile-markot highly-competitiveand-the-iphone-stillrocks/, accessed

April 2010,

© Kincai

“Apple Has Sold 450,000 iPads, $0,000 Million iPhones to Date.”

‘1 Walter S. Mossberg, “Apps that Make the iPhone Worth the Price,” The Wall Street fournul, March 26, 2008,

6 Kevin |. O’Bran, “A Conference Keen on Finding Open Communication,” The New York Times, Rebruary

16,2010

wid

© RIM Annual Information Form, Apel 1, 2010, p 6,htip:/ /www.rim.com/investors/docaments/; accessed

Apa 2010,

sara Silver; “Apple, RIM Outsmart Phone Market,” The Wel Stet Journal July 20, 2008,

© android was offically part ofthe Open Handset Alliance, a consortium of more than 45 technology and

aobile phone companies, including Google, HTC, Samsung, Intel, Texas Instruments, and Sprint Nextel

7 Dave Rosenberg, “Apple and Google Race for Mobile Deminence,” CNET, March 91, 2010,

Itp:/ /newscnet.com/8901-13846_$-10471786-62.html, accessed! April 2010,

71 “Nielson New App Playbook Debunks Mobile App Store Myth.” Nielson Wire, March 24, 2010,

|nttp://blog.nielsen com /nielsenwire consumer /nielsen%E29.80%99s-new-app-playbook-debunks-mobile-app-

store-myth/, accessed April 2010

72 Erika Brown, Elizabeth Corcoran, and Brian Caulfield, “Apple Buys Chip Designer,” Forbes.com, April 23,

2008, via Factiva, accessed April 2010, and Ashlee Vance and Brad Stone, “Apples Buys Intrinsity, a Maker of

Fast Chips,” The New York Times, Aptl 27, 2010,

7° “Apple Sells over 900,00 iPad First Day,” Apple In. Press Release (Cupertino, CA, April5, 2010).

7% Connie Guglielmo, “Apple iPad’s Debut-Weekend Sales May be Surpassing Estimates,”

BusinessWeek.com, April 4, 2010, http://www-businessweek.com/news /2010-04-D1/apple-ipad-s-debut-

weekend-sales-may-be-surpassing-estimateshtml, accessed April 2010.

25

“This document is authorized for use ony in General Management Programme by P K Sinha from May 2011 to May

Dart

You might also like

- DM ChangesDocument1 pageDM ChangesVijay KumarNo ratings yet

- Glazed Elements - Fenestration Performance RequirementsDocument1 pageGlazed Elements - Fenestration Performance RequirementsVijay KumarNo ratings yet

- Item Item: Company Name: Department NameDocument2 pagesItem Item: Company Name: Department NameVijay KumarNo ratings yet

- Keeping ScoreDocument95 pagesKeeping ScoreVijay KumarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)