Professional Documents

Culture Documents

Jawaban Soal Latihan Ch.11

Uploaded by

Wira Dinata0 ratings0% found this document useful (0 votes)

622 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

622 views2 pagesJawaban Soal Latihan Ch.11

Uploaded by

Wira DinataCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Pembahasan Bab 11 [PENYUSUTAN, PENURUNAN NILAI DAN DEPLESI]

PEMBAHASAN SOAL CH 11

PENYUSUTAN, PENURUNAN NILAI DAN DEPLESI

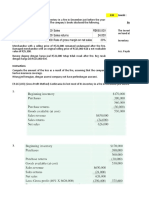

L 11-18

(a) 31 Desember 2010

Loss on Impairment...................................................... 1,000,000

Accumulated Depreciation—Equipment..... 1,000,000

Biaya perolehan €9,000,000

Akumulasi penyusutan (1,000,000)

Jumlah tercatat 8,000,000

Nilai Pakai (7,000,000)

Loss on impairment €1,000,000

(b) 31 Desember 2011

Depreciation Expense 1,750,000

Accumulated Depreciation—Equipment..... 1,750,000

Nilai tercatat baru €7,000,000

Masa manfaat ÷ 4 years

Penyusutan €1,750,000

(c) Accumulated Depreciation—Equipment.................... 1,800,000

Recovery of Impairment Loss........................ 1,800,000

S 11-3

(a) Depreciation Expense—Asset 3,900

Accumulated Depreciation—Asset A

(5/55 X [£46,000 – £3,100]) 3,900

Accumulated Depreciation—Asset A 35,100

Asset A (£46,000 – £13,000) 33,000

Gain on Disposal of Plant Assets 2,100

1 by Tantina Haryati_UPN Veteran Jatim

Pembahasan Bab 11 [PENYUSUTAN, PENURUNAN NILAI DAN DEPLESI]

(b) Depreciation Expense—Asset B 6,720

Accumulated Depreciation—Asset B

([£51,000 – £3,000] ÷ 15,000 X 2,100) 6,720

(c) Depreciation Expense—Asset C 6,000

Accumulated Depreciation—Asset C

([£80,000 – £15,000 – £5,000] ÷ 10) 6,000

(d) Asset E 28,000

Retained Earnings 28,000

Depreciation Expense—Asset E 5,600*

Accumulated Depreciation—Asset E 5,600

*(£28,000 X .20)

Catatan: Tidak diperlukan entri koreksi untuk aset D. Pada tahun 2010, Eshkol

mencatat beban penyusutan $ 80.000 X (10% X 2) = $ 16.000.

2 by Tantina Haryati_UPN Veteran Jatim

You might also like

- T4 - (Assets) - Qs and SolutionDocument22 pagesT4 - (Assets) - Qs and SolutionCalvin MaNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Nama Cornelius Cakra Adiwijaya NIM 041911333209Document3 pagesNama Cornelius Cakra Adiwijaya NIM 041911333209Cornelius cakraNo ratings yet

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- Pam Corporation stock issuance journal entriesDocument4 pagesPam Corporation stock issuance journal entriesDaniel cristoferNo ratings yet

- Latihan Soal Akuntansi Untuk PensionDocument4 pagesLatihan Soal Akuntansi Untuk PensionRini SusantyNo ratings yet

- IFRS vs GAAP differences and financial accounting conceptsDocument4 pagesIFRS vs GAAP differences and financial accounting conceptsRahmat AlamsyahNo ratings yet

- Specimen For Qiuz & Assignment .........................................Document3 pagesSpecimen For Qiuz & Assignment .........................................Umair AmirNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Tugas AKM II Minggu 9Document2 pagesTugas AKM II Minggu 9Clarissa NastaniaNo ratings yet

- 645873Document3 pages645873mohitgaba19No ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Kieso - Inter - ch10 - Ifrs Psak Ppe RevDocument59 pagesKieso - Inter - ch10 - Ifrs Psak Ppe RevJhoNo ratings yet

- Amirah Zahra Ariri - Soal Latihan Akuntansi ManajemenDocument7 pagesAmirah Zahra Ariri - Soal Latihan Akuntansi ManajemenHafizd FadillahNo ratings yet

- Chapter 7. KeyDocument8 pagesChapter 7. KeyHuy Hoàng PhanNo ratings yet

- Required: Chapter 12 / Tactical Decision MakingDocument3 pagesRequired: Chapter 12 / Tactical Decision MakingJanine TupasiNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- E21 16Document2 pagesE21 16Warmthx0% (1)

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Bab 8 by ProductDocument5 pagesBab 8 by ProductSilvani Margaretha SimangunsongNo ratings yet

- Bab 2 Cost Concept and The Cost Accounting Information SystemDocument5 pagesBab 2 Cost Concept and The Cost Accounting Information SystemFransiskusSinagaNo ratings yet

- FIFO S7-6: Menghitung Unit EkuivalentDocument6 pagesFIFO S7-6: Menghitung Unit EkuivalentDewi RenitasariNo ratings yet

- Pert 11 Tugas Dividend and Retained Earnings PDFDocument1 pagePert 11 Tugas Dividend and Retained Earnings PDFAini NS100% (1)

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Soal 1: 1. Computed Equivalent Unit For Production CostDocument10 pagesSoal 1: 1. Computed Equivalent Unit For Production CostRaihan Rohadatul 'AisyNo ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Soln SSP S1Document12 pagesSoln SSP S1Marjorie PalmaNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Subsidiary Preferred Stock CalculationsDocument3 pagesSubsidiary Preferred Stock CalculationsAlya Sufi IkrimaNo ratings yet

- Melton Company Special Order AnalysisDocument2 pagesMelton Company Special Order AnalysisclalalacNo ratings yet

- Soal Akm1Document2 pagesSoal Akm1putri50% (2)

- Tugas Akuntansi Biaya Bab 8Document4 pagesTugas Akuntansi Biaya Bab 8asdanpratamaNo ratings yet

- Inventory Chapter 9Document42 pagesInventory Chapter 9siti aubreyNo ratings yet

- Forum 6Document1 pageForum 6cecillia lissawatiNo ratings yet

- Pembahasan Ch 11 Intangible Assets LatihanDocument3 pagesPembahasan Ch 11 Intangible Assets LatihanWira DinataNo ratings yet

- Tug AsDocument5 pagesTug Asihalalis5202100% (2)

- Akuntansi Biaya - Tugas E4-23Document3 pagesAkuntansi Biaya - Tugas E4-23Rizkya Ajrin ArtameviaNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- COST ACCOUNTING ASSIGNMENTDocument6 pagesCOST ACCOUNTING ASSIGNMENTSugata SNo ratings yet

- TaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1Document6 pagesTaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1taufiq al insanNo ratings yet

- CH 19 SMDocument26 pagesCH 19 SMNafisah MambuayNo ratings yet

- Problem 21.3Document3 pagesProblem 21.3Fayed Rahman MahendraNo ratings yet

- ForumDocument5 pagesForumMariana Hb0% (1)

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanNo ratings yet

- 9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Document4 pages9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Christy Angkouw0% (1)

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- Tugas AkmenDocument1 pageTugas AkmenArie ArganthaNo ratings yet

- Sesi 9 & 10 Praktikum - SharedDocument9 pagesSesi 9 & 10 Praktikum - SharedDian Permata SariNo ratings yet

- 11.3 Break Even in Units ($75,000/15,000 Units) - Fixed Cost Is $37,500Document14 pages11.3 Break Even in Units ($75,000/15,000 Units) - Fixed Cost Is $37,500Rizzah Nianiah100% (1)

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- Tgs Kelompok Ganda Kasus 3Document18 pagesTgs Kelompok Ganda Kasus 3GARTMiawNo ratings yet

- Anugerah E11. 18-19 Anugerah AldiDocument2 pagesAnugerah E11. 18-19 Anugerah AldiAnugerah AldiNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- Worksheet 4Document6 pagesWorksheet 4Sneha KumariNo ratings yet

- Property, Plant and Equipment DepreciationDocument13 pagesProperty, Plant and Equipment DepreciationJannelle SalacNo ratings yet

- Solution Case 1Document2 pagesSolution Case 1Ario LintangNo ratings yet

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- P12-1 Dan P 12-5 - Ak KeuanganDocument2 pagesP12-1 Dan P 12-5 - Ak KeuanganNenna SadukNo ratings yet

- Business PlanDocument15 pagesBusiness PlanMyka Maningding100% (10)

- Module-3-Investment-Properties CorrectionDocument18 pagesModule-3-Investment-Properties CorrectionLoven BoadoNo ratings yet

- GulahmedDocument8 pagesGulahmedOmer KhanNo ratings yet

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- Team 1 Section 5 Final BPDocument25 pagesTeam 1 Section 5 Final BPapi-607330821No ratings yet

- Intacc SolmanDocument104 pagesIntacc Solmanpam92% (36)

- Financial RatiosDocument13 pagesFinancial RatiosAaron Coutinho0% (1)

- E3 (ANS) - Depreciation of Non-Current AssetsDocument18 pagesE3 (ANS) - Depreciation of Non-Current AssetsansonNo ratings yet

- Consolidated Statement of Profit and LossDocument9 pagesConsolidated Statement of Profit and LossHrushikesh DahaleNo ratings yet

- Info Memo 1H2011FinDocument16 pagesInfo Memo 1H2011FinprakososantosoNo ratings yet

- FIN 300 Chapter 3 Analysis of Financial StatementsDocument9 pagesFIN 300 Chapter 3 Analysis of Financial StatementsJean EliaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument5 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- UNISEM FinStatementDocument32 pagesUNISEM FinStatementDeepak GhugardareNo ratings yet

- معايير CH11-IAS 16 (P.P.E)Document38 pagesمعايير CH11-IAS 16 (P.P.E)Hamza MahmoudNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document12 pagesFundamentals of Accountancy, Business and Management 2Julia ConceNo ratings yet

- Exercise 2-General LedgerDocument2 pagesExercise 2-General LedgerTerefe DubeNo ratings yet

- AS 12 Accounting For Government GrantDocument16 pagesAS 12 Accounting For Government GrantBharatbhusan RoutNo ratings yet

- A Comprehensive Introduction To Accounting AssetsDocument12 pagesA Comprehensive Introduction To Accounting AssetsShaurya PalitNo ratings yet

- Cpa K Intermediate Financial ReportingDocument371 pagesCpa K Intermediate Financial ReportingHosea KanyangaNo ratings yet

- Wo Intro and Setup 121914Document12 pagesWo Intro and Setup 121914api-2917900770% (1)

- Intercompany Profit Transactions - Plant AssetsDocument53 pagesIntercompany Profit Transactions - Plant AssetsJeremy JansenNo ratings yet

- 7 Steps For SAP Fixed Assets Migration - SAP ExpertDocument18 pages7 Steps For SAP Fixed Assets Migration - SAP ExpertZlatil100% (1)

- Microsoft Word - Chapter 1Document4 pagesMicrosoft Word - Chapter 1SoblessedNo ratings yet

- Financial Assets and Liabilities BreakdownDocument16 pagesFinancial Assets and Liabilities BreakdownInfinity TechNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsAhmed Rawy100% (1)

- Group Work Fa1 - FPTDocument28 pagesGroup Work Fa1 - FPTCẩm NhungNo ratings yet

- CES (Chip Eng Seng) Salcon PTE LTD BVD 23 - 08 - 2022 13 - 31Document75 pagesCES (Chip Eng Seng) Salcon PTE LTD BVD 23 - 08 - 2022 13 - 31harryxwjNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- Dabur India LimitedDocument47 pagesDabur India Limiteddeegaur100% (2)

- Introduction To Balance SheetDocument26 pagesIntroduction To Balance Sheet^passwordNo ratings yet