Professional Documents

Culture Documents

Tax Calculator for Individuals

Uploaded by

Bharat Maddula0 ratings0% found this document useful (0 votes)

24 views1 pageThis document is an income tax calculator for tax residents in Singapore for the year of assessment 2021. It allows the user to enter their employment income, other income sources, approved donations, and personal reliefs to calculate their chargeable income, tax payable, and net tax payable amount. All income fields are initially set to $0 and the tax payable and net tax payable amounts are also calculated as $0 based on no income being entered.

Original Description:

Original Title

Tax Calculator - Residents_YA21

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an income tax calculator for tax residents in Singapore for the year of assessment 2021. It allows the user to enter their employment income, other income sources, approved donations, and personal reliefs to calculate their chargeable income, tax payable, and net tax payable amount. All income fields are initially set to $0 and the tax payable and net tax payable amounts are also calculated as $0 based on no income being entered.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageTax Calculator for Individuals

Uploaded by

Bharat MaddulaThis document is an income tax calculator for tax residents in Singapore for the year of assessment 2021. It allows the user to enter their employment income, other income sources, approved donations, and personal reliefs to calculate their chargeable income, tax payable, and net tax payable amount. All income fields are initially set to $0 and the tax payable and net tax payable amounts are also calculated as $0 based on no income being entered.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

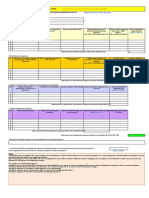

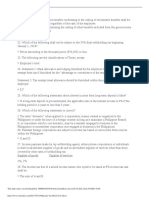

Income Tax Calculator for Tax Resident Individuals

YEAR OF ASSESSMENT 2021 (For the year ended 31 Dec 2020)

What to do: Enter amount in the gray boxes, where applicable.

Tips: For more information, move your mouse over the field or click on the field name.

INCOME

Employment income S$ .00

Less: Employment expenses S$ .00

NET EMPLOYMENT INCOME S$ 0 .00

Trade, Business, Profession or Vocation S$ .00

Add: OTHER INCOME

Dividends S$ .00

Interest S$ .00

Rent from Property S$ .00

Royalty, Charge, Estate/Trust Income S$ .00

Gains or Profits of an Income Nature S$ .00

TOTAL INCOME S$ 0 .00

Less: Approved Donations S$ .00

ASSESSABLE INCOME 0 .00

Less: PERSONAL RELIEFS

Earned income relief S$ .00

Spouse/handicapped spouse relief S$ .00

Qualifying/handicapped child relief S$ .00

Working mother's child relief S$ .00

Parent/handicapped parent relief S$ .00

Grandparent caregiver relief S$ .00

Handicapped brother/sister relief S$ .00

CPF/provident Fund relief S$ .00

Life Insurance relief S$ .00

Course fees relief S$ .00

Foreign domestic worker levy relief S$ .00

CPF cash top-up relief (self, dependant and Medisave account) S$ 0 .00

Supplementary Retirement Scheme (SRS) relief S$ 0 .00

NSman(Self/wife/parent) relief S$ 0 .00

Total Personal Reliefs (capped at $80,000) S$ 0 .00

CHARGEABLE INCOME S$ 0 .00

Tax Rate

Tax Payable on Chargeable Income S$ 0.00

Next

Less: Parenthood Tax Rebate S$

NET TAX PAYABLE S$ 0.00

You might also like

- Income Tax Calculator 2011Document1 pageIncome Tax Calculator 2011Tjun HuongNo ratings yet

- File-Form-B1-2022Document5 pagesFile-Form-B1-2022Daniel SohNo ratings yet

- Request Fee Waiver 73Document1 pageRequest Fee Waiver 73No addiNo ratings yet

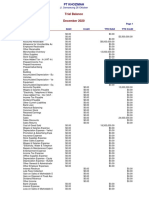

- Trial Balance December 2020: 10/26/2020 3:04:30 PM Account Debit Credit YTD Debit YTD CreditDocument2 pagesTrial Balance December 2020: 10/26/2020 3:04:30 PM Account Debit Credit YTD Debit YTD Creditkhozimah nurNo ratings yet

- Corporate Pay Stub Template-PDF Reader ProDocument1 pageCorporate Pay Stub Template-PDF Reader ProUmar AliNo ratings yet

- annotated-traditional-college-student-1-1Document1 pageannotated-traditional-college-student-1-1api-738698583No ratings yet

- BudgetDocument2 pagesBudgetbrodyschmidt14No ratings yet

- Cashflow 101 Game SheetDocument5 pagesCashflow 101 Game SheetdeligoezNo ratings yet

- Annotated-Traditional-College-Student-1-1 20 284 29 201 20 - 20Document1 pageAnnotated-Traditional-College-Student-1-1 20 284 29 201 20 - 20api-730246296No ratings yet

- annotated-traditional-college-student-1-1 20 284 29 201 20- 20copyDocument1 pageannotated-traditional-college-student-1-1 20 284 29 201 20- 20copyapi-730246296No ratings yet

- Balance Sheet As of December 2020: Jl. Semawung 26 OktoberDocument1 pageBalance Sheet As of December 2020: Jl. Semawung 26 Oktoberkhozimah nurNo ratings yet

- Quarterly Income Statement Report for 2018Document1 pageQuarterly Income Statement Report for 2018KnownUnknowns-XNo ratings yet

- Urvi Dhala Paystub 2021 12 31Document1 pageUrvi Dhala Paystub 2021 12 31uNo ratings yet

- St. Lucia Manufactures Association: Account List Friday, February 17, 2017Document4 pagesSt. Lucia Manufactures Association: Account List Friday, February 17, 2017LuciankattyNo ratings yet

- BudgetworksheetDocument2 pagesBudgetworksheetThalles FerreiraNo ratings yet

- College Student (18-25) Budget WorksheetDocument5 pagesCollege Student (18-25) Budget Worksheetapi-483445581No ratings yet

- College Student (18-25) Budget WorksheetDocument5 pagesCollege Student (18-25) Budget Worksheetapi-483445581No ratings yet

- How I LiveDocument1 pageHow I Liveapi-699123170No ratings yet

- Traditional-College-Student 3 1 1Document6 pagesTraditional-College-Student 3 1 1api-697550672No ratings yet

- Bryanna BudgDocument8 pagesBryanna Budgapi-736263991No ratings yet

- fernando casimiro traditional-college-student 3 -2 1Document6 pagesfernando casimiro traditional-college-student 3 -2 1api-737289547No ratings yet

- Budget Worksheet-JODocument2 pagesBudget Worksheet-JOJames OyeniyiNo ratings yet

- Account Summary 01-27-2018Document4 pagesAccount Summary 01-27-2018Metodio Caetano MonizNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceVochariNo ratings yet

- traditional-college-student 3 -2Document8 pagestraditional-college-student 3 -2api-738706415No ratings yet

- Budget ProjectDocument6 pagesBudget Projectapi-703306744No ratings yet

- IC Hourly Invoice Template GoogleDocument3 pagesIC Hourly Invoice Template GoogleThanh NguyenNo ratings yet

- About This TemplateDocument2 pagesAbout This Templateapi-658027506No ratings yet

- Tax Return Transcript for Elizabeth HartDocument7 pagesTax Return Transcript for Elizabeth HartJames Franklin67% (3)

- Track Monthly Budgets with Projected vs Actual ExpensesDocument3 pagesTrack Monthly Budgets with Projected vs Actual ExpensesZain KhanNo ratings yet

- Track Monthly Income & ExpensesDocument3 pagesTrack Monthly Income & ExpensesianachieviciNo ratings yet

- Monthly BudgetDocument3 pagesMonthly BudgetDaiNo ratings yet

- Personal Monthly Budget Excel TemplateDocument3 pagesPersonal Monthly Budget Excel TemplateOumeyma HamlauiNo ratings yet

- Book 1Document3 pagesBook 1ianachieviciNo ratings yet

- RMI Personal Budget Worksheet v05Document10 pagesRMI Personal Budget Worksheet v05Arul Kumaran KothandapaniNo ratings yet

- About This TemplateDocument3 pagesAbout This TemplateDennis KingNo ratings yet

- About This TemplateDocument3 pagesAbout This TemplateKhánh ĐặngNo ratings yet

- Six Eleven Global PayslipsDocument38 pagesSix Eleven Global PayslipsShane Rubino AdremesinNo ratings yet

- Personal Monthly BudgetDocument3 pagesPersonal Monthly BudgetPT Baraka CiptaNo ratings yet

- Personal Financial Statement TemplateDocument3 pagesPersonal Financial Statement TemplateAaron JacksonNo ratings yet

- Personal Balance Sheet: AssetsDocument6 pagesPersonal Balance Sheet: AssetsamanullahjamilNo ratings yet

- Annie Padilla June 2022 PayslipDocument1 pageAnnie Padilla June 2022 PayslipJay Mark DimaanoNo ratings yet

- Salinan Dari Zero Based BudgetDocument3 pagesSalinan Dari Zero Based BudgetKookies 123No ratings yet

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- CHurch BudgetDocument2 pagesCHurch BudgetdeycallmebudNo ratings yet

- Angelica Francisco - Payslip June 1-15 2022Document1 pageAngelica Francisco - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- Personal Bal SheetDocument6 pagesPersonal Bal SheetIrfan MalikNo ratings yet

- Personal Monthly Budget1Document3 pagesPersonal Monthly Budget1Shah NordinNo ratings yet

- Personal Monthly Budget1Document2 pagesPersonal Monthly Budget1Mutgaa OtgonjargalNo ratings yet

- Name of Agency Here: Part 1: Monthly Income Estimated ActualDocument1 pageName of Agency Here: Part 1: Monthly Income Estimated ActualFaith MarcathyNo ratings yet

- Monthly Budget TemplateDocument7 pagesMonthly Budget TemplateKshama AgrawalNo ratings yet

- 4087-4-29p-I5 (5 Files Merged)Document5 pages4087-4-29p-I5 (5 Files Merged)erferNo ratings yet

- Devian Coulton's Personal Budget: Housing EntertainmentDocument1 pageDevian Coulton's Personal Budget: Housing Entertainmentapi-27363460No ratings yet

- Monthly BudjetDocument2 pagesMonthly BudjetA Wahid KemalNo ratings yet

- Benefits SummaryDocument2 pagesBenefits SummaryGustavo StorNo ratings yet

- Monthly Budget Tracker1Document2 pagesMonthly Budget Tracker1mark uchihaNo ratings yet

- Construction Compendium (Painting)Document7 pagesConstruction Compendium (Painting)Bharat MaddulaNo ratings yet

- Aug 2015Document1 pageAug 2015Bharat MaddulaNo ratings yet

- Aug 2015Document1 pageAug 2015Bharat MaddulaNo ratings yet

- Quality Matters Issue 69Document1 pageQuality Matters Issue 69Bharat MaddulaNo ratings yet

- Aug 2015Document1 pageAug 2015Bharat MaddulaNo ratings yet

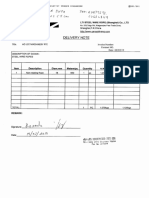

- 19-03-2010 650m Wire RopeDocument1 page19-03-2010 650m Wire RopeBharat MaddulaNo ratings yet

- Workplace Safety Risk Assessment GuideDocument10 pagesWorkplace Safety Risk Assessment GuideBharat MaddulaNo ratings yet

- Risk ManagementDocument4 pagesRisk ManagementBharat MaddulaNo ratings yet

- Ar 650Document1 pageAr 650Bharat MaddulaNo ratings yet

- Employment Expenses ScheduleDocument1 pageEmployment Expenses ScheduleBharat MaddulaNo ratings yet

- Train Name Train No From Station To Station No. Train Name Train No From StationDocument36 pagesTrain Name Train No From Station To Station No. Train Name Train No From StationBharat MaddulaNo ratings yet

- 04 HDB BIM Model Quality Checklist - Jun17Document6 pages04 HDB BIM Model Quality Checklist - Jun17Bharat MaddulaNo ratings yet

- Full Medical Examination Form For Foreign Workers: Work Pass DivisionDocument1 pageFull Medical Examination Form For Foreign Workers: Work Pass Divisionkarthik.swamyNo ratings yet

- Authorization Letter SampleDocument1 pageAuthorization Letter SampleBharat MaddulaNo ratings yet

- Personal Reliefs Eligibility ToolDocument5 pagesPersonal Reliefs Eligibility ToolBharat MaddulaNo ratings yet

- Occupancy Load (OL) Declaration Form v1Document4 pagesOccupancy Load (OL) Declaration Form v1Wanping TangNo ratings yet

- Personal Reliefs Eligibility ToolDocument5 pagesPersonal Reliefs Eligibility ToolBharat MaddulaNo ratings yet

- Coretrade Application: Home Renewal Check Status E-Services Upgrade New RegistrationDocument1 pageCoretrade Application: Home Renewal Check Status E-Services Upgrade New RegistrationBharat MaddulaNo ratings yet

- Employment Expenses ScheduleDocument1 pageEmployment Expenses ScheduleBharat MaddulaNo ratings yet

- HDB InfoWEB Printer Friendly Page 20201123T165258ZDocument1 pageHDB InfoWEB Printer Friendly Page 20201123T165258ZBharat MaddulaNo ratings yet

- 02 HDB VDC Template Jun17Document27 pages02 HDB VDC Template Jun17Bharat MaddulaNo ratings yet

- Personal Reliefs Eligibility ToolDocument5 pagesPersonal Reliefs Eligibility ToolBharat MaddulaNo ratings yet

- Gym Room 2:45pm - 4:45pm July August September October: K2 Graduation Concert Practice SessionsDocument1 pageGym Room 2:45pm - 4:45pm July August September October: K2 Graduation Concert Practice SessionsBharat MaddulaNo ratings yet

- HDB InfoWEB Printer Friendly Page 20201123T101642ZDocument1 pageHDB InfoWEB Printer Friendly Page 20201123T101642ZBharat MaddulaNo ratings yet

- 03 HDB Clash Detection Report Template - Apr15Document5 pages03 HDB Clash Detection Report Template - Apr15Bharat MaddulaNo ratings yet

- CCM FormDocument5 pagesCCM FormBharat MaddulaNo ratings yet

- Bachelor of Civil Engineering (With Dates) 11 Jul 2019 (r1)Document4 pagesBachelor of Civil Engineering (With Dates) 11 Jul 2019 (r1)Bharat MaddulaNo ratings yet

- Abakada Vs Executive Secretary Case DigestDocument2 pagesAbakada Vs Executive Secretary Case DigestEsnani MaiNo ratings yet

- Johannah Stub 1Document1 pageJohannah Stub 176xzv4kk5vNo ratings yet

- Income Tax in EtiopiaDocument10 pagesIncome Tax in EtiopiaDESALEGN DEGIFENo ratings yet

- Calculation of Total Tax Incidence (TTI) For ImportDocument4 pagesCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNo ratings yet

- Abuse of Double Taxation Avoidance Agreement by Treaty PART-IDocument31 pagesAbuse of Double Taxation Avoidance Agreement by Treaty PART-IPJ 123No ratings yet

- Annex "A": Contract of Lease Know All Men by These PresentsDocument2 pagesAnnex "A": Contract of Lease Know All Men by These PresentsGerald RojasNo ratings yet

- The Amazon Method - of TaxationDocument54 pagesThe Amazon Method - of TaxationMike McPowelNo ratings yet

- Income Tax Mock Test 3Document2 pagesIncome Tax Mock Test 3Mary Ellen LuceñaNo ratings yet

- INDIVIDUAL TAX COMPUTATIONS FOR VARIOUS CASES"TITLE TITLE"CALCULATING INCOME TAX FOR RESIDENTS AND ALIENSDocument17 pagesINDIVIDUAL TAX COMPUTATIONS FOR VARIOUS CASES"TITLE TITLE"CALCULATING INCOME TAX FOR RESIDENTS AND ALIENSLealyn CuestaNo ratings yet

- Revenue Report - July 2021Document8 pagesRevenue Report - July 2021Russ LatinoNo ratings yet

- Paying Your Income Taxes Note Taking GuideDocument4 pagesPaying Your Income Taxes Note Taking GuideMaggie ScottNo ratings yet

- Invisible China DownloadDocument2 pagesInvisible China DownloadNatálie ZubkováNo ratings yet

- Form 1945 - Application For Certificate of Tax Exemption For CooperativesDocument4 pagesForm 1945 - Application For Certificate of Tax Exemption For CooperativesDarryl Jay Medina100% (1)

- Overview of Nigerian Tax SystemDocument6 pagesOverview of Nigerian Tax SystemAdeyemi MayowaNo ratings yet

- Rostows Stages of GrowthDocument4 pagesRostows Stages of GrowthAngel MesiasNo ratings yet

- Tax Digest Case 10Document1 pageTax Digest Case 10Boogie San JuanNo ratings yet

- Gmail - Your 1st August Thursday Evening Trip With Uber PDFDocument3 pagesGmail - Your 1st August Thursday Evening Trip With Uber PDFAjit mhatreNo ratings yet

- Global Cash Card - Paystub Detail PDFDocument1 pageGlobal Cash Card - Paystub Detail PDFVerónica Del RioNo ratings yet

- Taxation GSTDocument33 pagesTaxation GSTJain Rajat Chopra100% (1)

- DOF Local Finance Circular 3 92Document3 pagesDOF Local Finance Circular 3 92Mykel King Noble100% (4)

- San Juan City's Socialized Housing Tax CollectionDocument10 pagesSan Juan City's Socialized Housing Tax CollectionTaxation LawNo ratings yet

- Circle Electric 40, Yousuf Mansion, New Elephant Road, Dhaka Pay SlipDocument12 pagesCircle Electric 40, Yousuf Mansion, New Elephant Road, Dhaka Pay SlipDJ ATANUNo ratings yet

- Tax Invoice 67Document1 pageTax Invoice 67shiva kumarNo ratings yet

- PEST Analysis of Bulgaria: Prepared by BICADocument21 pagesPEST Analysis of Bulgaria: Prepared by BICAKavin DasanayakeNo ratings yet

- Joint venture ruled as corporation for tax purposesDocument2 pagesJoint venture ruled as corporation for tax purposesBam BathanNo ratings yet

- DownloadDocument1 pageDownloadSabbot aradNo ratings yet

- Cir VS Union ShippingDocument1 pageCir VS Union Shippingaliya andersonNo ratings yet

- Updated Syllabus in Tax 1Document33 pagesUpdated Syllabus in Tax 1prince pacasumNo ratings yet

- Tax Assessment ValidityDocument1 pageTax Assessment ValidityMary AnneNo ratings yet

- Alexander Hamilton's Role in US Financial SystemDocument4 pagesAlexander Hamilton's Role in US Financial SystemKyle DuffyNo ratings yet