Professional Documents

Culture Documents

Tax Assign.

Uploaded by

novy0 ratings0% found this document useful (0 votes)

6 views1 pagegfh

Original Title

tax assign.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgfh

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageTax Assign.

Uploaded by

novygfh

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

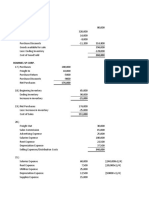

1. What is TRAIN LAW standard deductions on income tax?

1a. Pure Compensation

Annual taxable income below PHP 250,000 are now exempted of paying personal income tax.

- The person who has monthly income of 20,000 and below is not obligated to pay personal

income tax.

Annual taxable income from PHP 250,000 – PHP 400,000 are about to pay 20% of excess over

250,000 of their personal income taxes effective on January 1, 2018; on January 1, 2023 and

onwards the tax rate lessens to 15% of excess over 250,000.

- Individuals who have their annual taxable income of 250,000 – 400,000 or they have monthly

personal income of 21,000 to 33,000 will pay personal tax of 20% of the excess over 250,000.

Annual taxable income from PHP 400,00 – 800,000 are about to pay from their personal income

taxes of PHP 30,000 + 25% of excess over 400,000 effectives on January 1, 2018; on January 1, 2023

and onwards the tax rate lessens to P22,500 + 20% of excess over 400,000.

Annual taxable income from PHP 800,000 – 2M are about to pay from their personal income taxes of

PHP 130,000 + 30% of excess over 800,000 effectives on January 1, 2018; on January 1, 2023 and

onwards the tax rate lessens to P102,500 + 25% of excess over 800,000.

Annual taxable income from PHP 2M – 8M are about to pay from their personal income taxes of PHP

490,000 + 32% of excess over 2M effectives on January 1, 2018; on January 1, 2023 and onwards the

tax rate lessens to P402,500 + 30% of excess over 2M.

Annual taxable income from PHP 8M are about to pay from their personal income taxes of PHP

2,410,000 + 35% of excess over 8M effectives on January 1, 2018; on January 1, 2023 and onwards

the tax rate lessens to P2,202,500 + 35% of excess over 400,000.

1b. Professional and/or Business

Effective on January 1, 2018:

Whose gross sales/receipts not exceeding of P3 million have the option to pay Regular PIT

Rates or 8% of gross sales/receipts in exceeds of P250,000 in lieu of the income and

percentage tax.

And whose gross sales/receipts above P3 million have to pay the regular PIT Rates.

1c. Mixed Compensation and Business

Effective on January 1, 2018:

Compensation income will pay the regular PIT rates.

Whose income from business or practice of profession:

a. Whose gross sales/receipts not exceeding of P3 million have the option to pay

Regular PIT Rates or 8% of gross sales/receipts in exceeds of P250,000 in lieu of

the income and percentage tax.

b. And whose gross sales/receipts above P3 million have to pay the regular PIT

Rates.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Summary of Responsibility AccountingDocument2 pagesSummary of Responsibility AccountingnovyNo ratings yet

- Remedies of Unpiad SellerDocument17 pagesRemedies of Unpiad SellernovyNo ratings yet

- Government Accounting: Chapters 1-3 Sets of QuestionsDocument6 pagesGovernment Accounting: Chapters 1-3 Sets of QuestionsnovyNo ratings yet

- For All YouDocument2 pagesFor All YounovyNo ratings yet

- Handing Trust and Accuracy Redefined: Accounting. Audit. AdvisoryDocument6 pagesHanding Trust and Accuracy Redefined: Accounting. Audit. AdvisorynovyNo ratings yet

- Accounts TitleDocument1 pageAccounts TitlenovyNo ratings yet

- Related Review LiteratureDocument1 pageRelated Review LiteraturenovyNo ratings yet

- FreshBooks Cloud AccountingDocument1 pageFreshBooks Cloud AccountingnovyNo ratings yet

- Ched Midterm ExamDocument1 pageChed Midterm ExamnovyNo ratings yet

- The 5 Best Accounting Software For Small Business of 2021Document4 pagesThe 5 Best Accounting Software For Small Business of 2021novyNo ratings yet

- Most Accountants Train To Work With The SimplestDocument1 pageMost Accountants Train To Work With The SimplestnovyNo ratings yet

- Book Value Fair Value Building (10 Years Life) 10,000 8,000 Equipment (4 Years Life) 14,000 18,000 Land 5,000 12,000Document1 pageBook Value Fair Value Building (10 Years Life) 10,000 8,000 Equipment (4 Years Life) 14,000 18,000 Land 5,000 12,000novyNo ratings yet

- Intermediate Accounting 3 Prelim Examination - Set BDocument18 pagesIntermediate Accounting 3 Prelim Examination - Set BnovyNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- Introduction To Strategic Cost Management and Management AccountingDocument3 pagesIntroduction To Strategic Cost Management and Management AccountingnovyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Third Degree Price DiscriminationDocument34 pagesThird Degree Price DiscriminationMarie Adriano BadilloNo ratings yet

- Report Singue Revised4Document11 pagesReport Singue Revised4EDINPETROL ESPINOZANo ratings yet

- Business Mathematics - Accounting and FinanceDocument15 pagesBusiness Mathematics - Accounting and Financesharmila100% (3)

- International Entry Modes: Shikha SharmaDocument32 pagesInternational Entry Modes: Shikha SharmashikhagrawalNo ratings yet

- Thomas Cook (India) Limited-Annual Report 2018-19-AGM Notice-Attendance Slip-Proxy FormDocument338 pagesThomas Cook (India) Limited-Annual Report 2018-19-AGM Notice-Attendance Slip-Proxy FormGaurav TaleNo ratings yet

- Cap Bud - UltDocument11 pagesCap Bud - UltKhaisarKhaisarNo ratings yet

- Studying Different Systematic Value Investing Strategies On The Eurozone MarketDocument38 pagesStudying Different Systematic Value Investing Strategies On The Eurozone Marketcaque40No ratings yet

- Noor Ul Ain Minhas (16959) Ishrat Fatima (20203) Maria Tameez (22535) Ariba Aswat (22872)Document4 pagesNoor Ul Ain Minhas (16959) Ishrat Fatima (20203) Maria Tameez (22535) Ariba Aswat (22872)AquaNo ratings yet

- Bid Evaluation Report 14-02-2013Document1 pageBid Evaluation Report 14-02-2013Kamran Ali AnsariNo ratings yet

- EST Escalation MatrixDocument7 pagesEST Escalation MatrixSasitharan MNo ratings yet

- UNIT 5.3: Break-Even AnalysisDocument11 pagesUNIT 5.3: Break-Even AnalysisSachin SahooNo ratings yet

- PPSC Charter Bill 18th CongressDocument10 pagesPPSC Charter Bill 18th CongressRaki IliganNo ratings yet

- AFM Sample Model - 2 (Horizontal)Document18 pagesAFM Sample Model - 2 (Horizontal)munaftNo ratings yet

- Edmund Halvor of The Controller S Office of East Aurora CorporatDocument1 pageEdmund Halvor of The Controller S Office of East Aurora CorporatM Bilal SaleemNo ratings yet

- Module 9Document3 pagesModule 9trixie maeNo ratings yet

- TA6 Safeguard Measures (F)Document39 pagesTA6 Safeguard Measures (F)Heather Brennan100% (1)

- Definition of MOOC - Loosely Defined As Online Courses Aimed at Large-Scale Interaction, Were SeenDocument6 pagesDefinition of MOOC - Loosely Defined As Online Courses Aimed at Large-Scale Interaction, Were SeenRajkumarNo ratings yet

- Running Head: Cost Allocation ConceptsDocument6 pagesRunning Head: Cost Allocation ConceptsjaijohnkNo ratings yet

- Panel Data EconometricsPanel Data SetsDocument9 pagesPanel Data EconometricsPanel Data SetsFawaz M KhaNo ratings yet

- Shareholders Equity NotesDocument52 pagesShareholders Equity NotesDeepen Yay NebhwaniNo ratings yet

- Residental PlotDocument5 pagesResidental PlotXplore RealtyNo ratings yet

- Module 3 Job Order Costing Lecture Notes11Document20 pagesModule 3 Job Order Costing Lecture Notes11chorie navarreteNo ratings yet

- Horizontal Analaysis GLOBEDocument2 pagesHorizontal Analaysis GLOBEjerameelnacalaban1No ratings yet

- Shipping Sector of PakistanDocument12 pagesShipping Sector of PakistanZain BhikaNo ratings yet

- Fin202 - Chap 3,4,5,6Document9 pagesFin202 - Chap 3,4,5,6An Gia Khuong (K17 CT)No ratings yet

- 2006-2007 Dartmouth Tuck CC Case BookDocument103 pages2006-2007 Dartmouth Tuck CC Case Bookr_oko100% (3)

- Taxation Law: Questions and Suggested AnswersDocument142 pagesTaxation Law: Questions and Suggested AnswersDianne MedianeroNo ratings yet

- Cover FadilDocument42 pagesCover FadiltitirNo ratings yet

- Iloilo-Capiz-Aklan Road (New Route)Document1 pageIloilo-Capiz-Aklan Road (New Route)Legal Division DPWH Region 6No ratings yet

- Income Taxation Chapter1Document50 pagesIncome Taxation Chapter1Ja Red100% (1)