Professional Documents

Culture Documents

Mrs. Batliboi's income from other sources

Uploaded by

Sarvar PathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mrs. Batliboi's income from other sources

Uploaded by

Sarvar PathanCopyright:

Available Formats

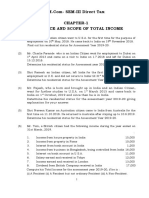

Q.1) Mrs. Batliboi is a professor of law in M.K.college.

The particulars of her income for the year

ending 31/03/2016 are as follows:-

1. Royalty from books Rs.25,000. Expenses on typing etc. were Rs.2,000.

2. Honorarium received from a management Institute as a visiting lecturer Rs.3,000.

Conveyance for visiting the Institute Rs.200.

3. Examinership fees from the University of Mumbai Rs.1,000.

4. Family pension of Rs.42,000 on death of her husband from his employer.

5. She received the “Dronacharya” Award of Rs.10,000 for the “Best Teacher of the year”

from the State Government.

Compute Income from Other Sources of Mrs. Batliboi for the assessment year 2016-17.

Solution:

Name of Assessee : Mr. Batliboi

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Other Sources

Particulars Rs. Rs.

1. Royalty from Books 25,000

Less: Expenses on typing 2,000 23,000

2. Honorarium from Management Institute 3,000

Less: Conveyance 200 2,800

3. Examinership Fees 1,000

4. Family Pension 42,000

Less: Standard Deduction (⅓ or Rs.15,000 whichever is less) 14,000 28,000

5. Dronacharya Award 10,000

Less: Exempt u/s 10(17A) 10,000 NIL

Income From Other Sources 54,800

Q.2) Mr. Lakdawala submits the following details for the year ending 31/03/2016.

1. He has rented his factory building along with plant and machinery, and furniture for a

lump sum hire charge of Rs.1,00,000 per year.

2. The following expenses were incurred

a. repairs to building Rs.10,000.

b. repairs to machinery Rs.5,000.

c. furniture purchases Rs.3,000.

3. Depreciation on building, machinery and furniture amounted to Rs.8,000 (as per Income

Tax Rules).

4. Salaries paid to Maintenance staff were Rs.20,000. Employees contribution to provident

fund deducted from salaries during the year Rs.2,000. Out of such contribution Rs.1,800

was paid within the due date to the credit of the employee's account.

Tripathi Online Educare

1

5. Salaries included payment to a close relative, which was excessive to the extent of

Rs.2,000.

6. One of the ex employees had embezzled Rs.10,000 cash in the past, which was allowed

as deduction in the assessment year 2012-13. The police had caught the employee and

recovered Rs.5,000 which was handed over to Mr.Lakdawala in October 2015.

Solution:

Name of Assessee : Mr. Lakdawala

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Other Sources

Particulars Rs. Rs. Rs.

1. Hire charges on building, plant & machinery and

furniture 1,00,000

Less: Expenses

a. Repairs to building 10,000

b. Repairs to machinery 5,000

c. Furniture purchased NIL

d. Depreciation 8,000

e. Salaries

20,000

Less: Excessive salaries to relative 18,000 41,000 59,000

Disallowed 2,000 2,000

2. Employees contribution to P.F 1,800 200

Less: Paid and credited within due date 5,000

3. Recovery against earlier deduction 64,200

Income from House Property

Q.3) Mr. Mody is a director of Lata Steels Ltd. He submits the following Income & Expenditure

Account for the year ended 31/03/2016.

Expenses Rs. Income Rs.

Interest Paid (on loan for Interest:

investments) 15,000 - Bank A/c 9,000

Wealth Tax 2,000 - Public Deposits 8,000

Legal Expenses 20,000 - Debentures 12,000

Collection Charges (Interest & - Securities 4,000

Dividends) 1,000 Dividends:

Life Insurance Premium 2,000 - Lata Steels Ltd. 5,000

Drawings 25,000 Board Meeting Fees 1,000

Surplus 36,000 Commission 2,000

Tripathi Online Educare

2

______ Royalty from mines 60,000

1,01,000 1,01,000

Further Information:

1. Interest include interest on securities exempt to the extent of Rs.1,000. The interest paid

is in respect of only taxable investments.

2. The securities were purchased by him on 30/06/2015. Interest on securities is for one

year (2015-16).

3. Dividend from Lata Steel Works Ltd. was received in April, 2015. It was declared in the

Annual General Meeting of the company held in March 2015.

4. Commission is received from Lata Steel Works Ltd. for standing as a guarantor to a

bank.

5. Interest paid includes Rs.5,000 paid outside India on which no tax has been deducted at

source.

Solution:

Name of Assessee : Mr. Mody

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Other Sources

Particulars Rs. Rs. Rs.

1. Interest:

a. Bank A/c 9,000

b. Public Deposits 8,000

c. Debentures 12,000

d. Securities 4,000

(-) Exempt 1,000 3,000

32,000

Less: i) Interest Paid

15,000 10,000

(-) Tax not deducted 1,000 11,000 21,000

5,000 1,000

ii) Collection Charges 2,000

2. Board Meeting Fees 60,000

3. Commission for standing guarantor to bank 84,000

4. Royalty from mines

Income from Other Sources

Notes:

1. Interest of securities is taxed in the hands of the person holding the security on the due

date. The period of holding is, therefore, immaterial.

Tripathi Online Educare

3

2. Life Insurance Premium is a personal expenditure and Drawings is on capital account.

Hence both cannot be deducted.

3. Dividends from Lata Steel Works Ltd. is exempt u/s 10.

Q.4) Mr. Hari, received the following without consideration during the P.Y. 2015-16 from his

friend Mr. Rajesh:

1. Cash gift of Rs.51,000 on Diwali.

2. An expensive wristwatch, the value of which was Rs.55,000, on his birthday.

3. A plot of land at Bangalore on New Year, the stamp value of which is Rs.10 lakh on that

date. Mr. Rajesh had purchased the land in August, 2011 for Rs.3 lakh.

Compute the income of Mr. Hari chargeable under the head “Income from other sources” for the

A.Y. 2016-17.

Solution:

Name of Assessee : Mr. Hari

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Other Sources

Particulars Rs.

1. Cash gift is taxable under section 56(2)(vii), since it exceeds

Rs.50,000 51,000

2. Stamp value of plot of land at Bangalore, received without

consideration, is taxable under section 56(2)(vii) 10,00,000

Income from Other Sources 10,51,000

Note:

1. The value of property received without consideration would be taxable under section

56(2)(vii).

2. However, wrist watch is not included in the definition of property under section 56(2)(vii).

3. Therefore, receipt of wrist watch without consideration would not attract the provisions of

section 56(2)(vii).

Q.5) Check the taxability of the following gifts received by Mrs. Rashmi during the previous year

2015-16 and compute the taxable income from gifts for assessment year 2016-17.

1. On the occasion of her marriage on 14/08/2015, she has received Rs.90,000 as gift out

of which Rs.70,000 are from relatives and balance from friends.

2. On 12/09/2015, she has received gift of Rs.18,000 from cousin of her mother.

3. A cell phone worth Rs.21,000 is gifted by her friend on 15/08/2015.

4. She gets a cash gift of Rs.25,000 from the elder brother of her husband's grandfather on

25/10/2015.

5. She has received a cash gift of Rs.12,000 from her friend on 14/04/2015.

Tripathi Online Educare

4

Solution:

Name of Assessee : Mrs. Rashmi

Assessment Year : 2016-17

Previous Year : 2015-16

Status : Individual

Residential Status : R&OR

Pan No : _________

Computation of Income from Other Sources

Particulars Rs.

1. Gifts received on the occasion of marriage are not taxable. NIL

2. Cousin of Mrs. Rashmi’s mother is not a relative. Hence, the

cash gift is taxable. 18,000

3. Cell phone is not included in the definition of property a per

Explanation to section 56(2)(vii). Hence, it is not taxable. NIL

4. Brother of husband’s grandfather is not a relative. Hence, the

cash gift is taxable. 25,000

5. Cash gift from friend is taxable. 12,000

Income from Other Sources 55,000

Q.6) The following details have been furnished by Mrs. Hemali pertaining to the year ended

31/03/2016.

1. Cash gift of Rs.51,000 received from her friend on the occasion of her “Shastiaptha

Poorthi”, a function celebrated on her husband completing 60 years of age.

2. On the above occasion, a diamond necklace worth Rs.2,00,000 was presented by her

sister living in Dubai.

Compute the income, if any, assessable as income from other sources.

Solution:

1. Any sum of money received by an individual on the occasion of the marriage of the

individual is exempt. This provision is, however, not applicable to a cash gift received

during a function celebrated on completion of 60 years of age. The gift of Rs.51,000

received from a non-relative is, therefore, chargeable to tax under section 56(2)(vii) in

the hands of Mrs. Hemali.

2. The provisions of section 56(2)(vii) are not attracted in respect of any sum of money or

property received from a relative .Thus,the gift of diamond necklace received from her

sister is not taxable under section 56(2)(vii), even though jewellery falls within the

definition of “property”.

Tripathi Online Educare

5

You might also like

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Banking Company Final Accounts QuestionsDocument8 pagesBanking Company Final Accounts QuestionsPradeepaa BalajiNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Problems On Taxable Salary Income Additional PDFDocument24 pagesProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068No ratings yet

- Taxable Income Calculation Mrs. NarayaniDocument5 pagesTaxable Income Calculation Mrs. NarayaniSumit PattanaikNo ratings yet

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- Income Tax Numerical QuestionsDocument2 pagesIncome Tax Numerical QuestionsAli0% (2)

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Income From House PropertyDocument26 pagesIncome From House PropertySuyash Patwa100% (1)

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Capital Gains IllustrationDocument15 pagesCapital Gains IllustrationSarvar PathanNo ratings yet

- Single Entry (F. Y. B.com) Sem.1Document13 pagesSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- Budgetory Control Flexible Budget With SolutionsDocument6 pagesBudgetory Control Flexible Budget With SolutionsJash SanghviNo ratings yet

- Capital Gain Sums With SolutionDocument10 pagesCapital Gain Sums With Solutionkomil bogharaNo ratings yet

- Consolidated Balance Sheets of Holding and Subsidiary CompaniesDocument11 pagesConsolidated Balance Sheets of Holding and Subsidiary CompaniesMr. 360No ratings yet

- Profits and Gains From Business and ProfessionDocument4 pagesProfits and Gains From Business and ProfessionAyaan AhmedNo ratings yet

- Company Final Accounts - ProblemsDocument5 pagesCompany Final Accounts - ProblemsDhinesh0% (1)

- Royalty AccountsDocument5 pagesRoyalty AccountsRobert Henson100% (2)

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Income From Other SourcesDocument11 pagesIncome From Other Sourcessrocky2000100% (1)

- Calculating Income from Salary and House PropertyDocument9 pagesCalculating Income from Salary and House PropertyArpita Artani100% (1)

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- Income From Salary Final SEM 3Document49 pagesIncome From Salary Final SEM 3Baleshwar ChauhanNo ratings yet

- Bnaking Profit and Loss Account 1Document12 pagesBnaking Profit and Loss Account 1madhumathi100% (1)

- Final Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDDocument3 pagesFinal Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDermiasNo ratings yet

- income From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasDocument76 pagesincome From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasAnkit Dhyani100% (6)

- 02 Financing Decisions - Leverages - Practice SheetDocument22 pages02 Financing Decisions - Leverages - Practice SheetPatrick LoboNo ratings yet

- Residential Status Problems 2021-2022-1Document5 pagesResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANo ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- UNIT 3 Income From House PropertyDocument104 pagesUNIT 3 Income From House Propertydob BoysNo ratings yet

- Underwriting of Shares & Debentures - CWDocument32 pagesUnderwriting of Shares & Debentures - CW19E1749 BALAJI MNo ratings yet

- Admission of PartnerDocument3 pagesAdmission of PartnerPraWin KharateNo ratings yet

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocument53 pagesAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- B.Com. Degree Exam Income Tax PaperDocument0 pagesB.Com. Degree Exam Income Tax PaperbkamithNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Unit - V Budget and Budgetary Control ProblemsDocument2 pagesUnit - V Budget and Budgetary Control ProblemsalexanderNo ratings yet

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Document21 pages6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- 18415compsuggans PCC FM Chapter7Document13 pages18415compsuggans PCC FM Chapter7Mukunthan RBNo ratings yet

- Techniques of Capital Budgeting SumsDocument15 pagesTechniques of Capital Budgeting Sumshardika jadavNo ratings yet

- SalaryDocument42 pagesSalaryNidhi LathNo ratings yet

- Ebit Eps AnalysisDocument2 pagesEbit Eps AnalysisUma N100% (1)

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Problems From Unit - 5Document8 pagesProblems From Unit - 5jeganrajrajNo ratings yet

- Ratio Analysis ProblemsDocument28 pagesRatio Analysis Problemsraghavendra_20835414100% (1)

- UNIT 1 PFP Classwork Sums RevisedDocument5 pagesUNIT 1 PFP Classwork Sums RevisedVarun jajalNo ratings yet

- Business TaxationDocument4 pagesBusiness Taxationshejal naikNo ratings yet

- Facility LocationDocument22 pagesFacility LocationSarvar PathanNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- Mi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverDocument2 pagesMi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverSarvar PathanNo ratings yet

- E-Way Bill System PDFDocument1 pageE-Way Bill System PDFSarvar PathanNo ratings yet

- Prodn - Ops - PLNG & Control-2019Document42 pagesProdn - Ops - PLNG & Control-2019Raman KulkarniNo ratings yet

- 5b. Capacity PlanningDocument21 pages5b. Capacity PlanningSarvar PathanNo ratings yet

- Asian Paints (Rakesh Painter)Document2 pagesAsian Paints (Rakesh Painter)Sarvar PathanNo ratings yet

- 1b. Production SystemsDocument13 pages1b. Production SystemsSarvar PathanNo ratings yet

- Facility LayoutDocument31 pagesFacility LayoutSarvar PathanNo ratings yet

- New Product DevelopmentDocument18 pagesNew Product DevelopmentSarvar PathanNo ratings yet

- Online DL address change acknowledgementDocument1 pageOnline DL address change acknowledgementSarvar PathanNo ratings yet

- 1c.OM - Strategy-Rev-2020 - BVRMDocument24 pages1c.OM - Strategy-Rev-2020 - BVRMSarvar PathanNo ratings yet

- SalaryDocument29 pagesSalarySarvar PathanNo ratings yet

- Acknowledgement of Online Application For Services On Existing DLDocument1 pageAcknowledgement of Online Application For Services On Existing DLSarvar PathanNo ratings yet

- Tripathi Online EducareDocument7 pagesTripathi Online EducareSarvar PathanNo ratings yet

- Residential StatusDocument4 pagesResidential StatusSarvar PathanNo ratings yet

- Income Tax Act Fill in the BlanksDocument1 pageIncome Tax Act Fill in the BlanksSarvar PathanNo ratings yet

- Scope of Total Income IllustrationDocument13 pagesScope of Total Income IllustrationSarvar PathanNo ratings yet

- Residential Status True or FalseDocument2 pagesResidential Status True or FalseSarvar PathanNo ratings yet

- Residential StatusDocument17 pagesResidential StatusSarvar PathanNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Important Theory Questions: Tripathi Online EducareDocument1 pageImportant Theory Questions: Tripathi Online EducareSarvar PathanNo ratings yet

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Residential Status IllustrationsDocument16 pagesResidential Status IllustrationsSarvar PathanNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesSarvar PathanNo ratings yet

- Introduction To Income TaxDocument26 pagesIntroduction To Income TaxTripathi Online EducareNo ratings yet

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Tripathi Online Educare GuideDocument10 pagesTripathi Online Educare GuideSarvar PathanNo ratings yet

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- Authorization LetterDocument1 pageAuthorization Lettersridhar4No ratings yet

- Fort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012Document3 pagesFort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012GraceNo ratings yet

- CIR vs. United SalvageDocument14 pagesCIR vs. United Salvagenathalie velasquezNo ratings yet

- 1 - 2019 - Fundamentals of Taxation An Introduction To Tax Policy Tax Law and Tax AdministrationDocument197 pages1 - 2019 - Fundamentals of Taxation An Introduction To Tax Policy Tax Law and Tax AdministrationSeydina-Ousmane Dramé100% (1)

- Court upholds zero-rating of cultured pearl exportsDocument6 pagesCourt upholds zero-rating of cultured pearl exportsKriszan ManiponNo ratings yet

- CustomerInvoiceDocument1 pageCustomerInvoicePritam JanaNo ratings yet

- Tutorial 1Document7 pagesTutorial 1Shan JeefNo ratings yet

- Mushak 9.1 UpdatedDocument15 pagesMushak 9.1 UpdatedRakibul HassanNo ratings yet

- S01 Review On SFP, NFS and RPTDocument3 pagesS01 Review On SFP, NFS and RPTYen YenNo ratings yet

- Train TicketsDocument1 pageTrain TicketsBhavesh PoojariNo ratings yet

- Calculation of GSTDocument13 pagesCalculation of GSTSukanta PalNo ratings yet

- Jurists - TaxationDocument16 pagesJurists - TaxationKarla RigorNo ratings yet

- Scheme 1Document19 pagesScheme 1Jayesh ValwarNo ratings yet

- Managerial Economics For Quick RevisionDocument224 pagesManagerial Economics For Quick RevisionSuparna2No ratings yet

- East India CompanyDocument192 pagesEast India CompanyFIZA SHEIKHNo ratings yet

- 2021 TZHC 5830 - 0Document15 pages2021 TZHC 5830 - 0MZS LAW CHAMBERSNo ratings yet

- Direct Tax II Loss Set OffDocument30 pagesDirect Tax II Loss Set Off5561 ROSHAN K PATELNo ratings yet

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyNo ratings yet

- Income Taxation 2015 Edition Solman PDFDocument53 pagesIncome Taxation 2015 Edition Solman PDFPrincess AlqueroNo ratings yet

- Sir Josiah Stamp, Some Economic Factors in Modern LifeDocument291 pagesSir Josiah Stamp, Some Economic Factors in Modern Lifemaivin2No ratings yet

- DownloadDocument1 pageDownloadSabbot aradNo ratings yet

- Form 1120-S Tax Return for S CorpDocument5 pagesForm 1120-S Tax Return for S CorpHimani SachdevNo ratings yet

- Crux of EconomicsDocument379 pagesCrux of EconomicsShubhamAuspiciosoGothwal100% (1)

- Barangay San Vicente Garbage Fee OrdinanceDocument3 pagesBarangay San Vicente Garbage Fee OrdinanceLerio Cabanizas Adaro100% (1)

- ECO-12 CBSE Additional Practice Questions 2023-24Document20 pagesECO-12 CBSE Additional Practice Questions 2023-24Sadjaap SinghNo ratings yet

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- Data updated in Form 26AS till 13-Nov-2019Document14 pagesData updated in Form 26AS till 13-Nov-2019Aakash Gupta0% (1)

- GST White Paper in PDFDocument14 pagesGST White Paper in PDFReggeloNo ratings yet

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiNo ratings yet

- Estate MGT Adewale Siwes Report-1Document14 pagesEstate MGT Adewale Siwes Report-1Elijah Adeyemo OluwatobiNo ratings yet