Professional Documents

Culture Documents

Residential Status MCQ

Uploaded by

Sarvar PathanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Residential Status MCQ

Uploaded by

Sarvar PathanCopyright:

Available Formats

MULTIPLE CHOICE QUESTIONS

1. Residential status is to be determined for:

a. Previous year

b. Assessment year

c. Accounting year

d. None

2. Incomes which accrue or arise outside india but are received directly into india are

taxable in case of:

a. Resident only

b. Both ordinarily resident and NOR

c. Non-resident

d. All the assesses

3. Total income of a person is determined on the basis of his:

a. Residential status in india

b. Citizenship in india

c. Both

d. None

4. M,a foreign national visited india during previous year for 180 day. Earlier for this he

never visited india. M in this case shall be:

a. Resident in india

b. Non-resident

c. Not ordinarily resident in india

d. None

5. M, a foreign national visited india during previous year for 180 day. During 4 preceding

years he was in india for 360 days. M shall be:

a. Resident in india

b. Non-resident in india

c. Not-ordinarily resident

d. None

6. Income which accrue or arise outside india and also received outside India is taxable in

case of:

a. Resident only

Tripathi Online Educare

1

b. Not -ordinarily resident

c. Both ordinarily resident and NOR

d. None

7. Income which accrue outside India from a business controlled from India is taxable in

case of:

a. Resident only

b. Not -ordinarily resident

c. Both ordinarily resident and NOR

d. Non -resident

8. Income deemed to accrue or arise in India is taxable in case of:

a. Resident only

b. Both-ordinarily resident and NOR

c. Non-resident

d. All the assesses

9. Income received in India:

a. is taxable only for a resident

b. is not taxable only for a non-resident

c. is taxable for a resident, a resident but not ordinarily resident and a non-resident

d. is exempt in all cases

10. Income which accrues in India from a business controlled from Delhi:

a. is taxable only for a resident

b. is not taxable only for a non-resident

c. is taxable for a resident, a resident but not ordinarily resident and a non-resident

d. is exempt in all cases

11. Income which accrues outside India from a business controlled from India:

a. is taxable only for a non-resident

b. is not taxable only for a non-resident

c. is taxable for a resident but not ordinarily resident

d. is exempt in all cases

12. Income accruing in japan and received there is taxable in India in the case of:

a. Resident and ordinarily resident only

b. Both resident and ordinarily resident and resident but not ordinarily resident

c. Both resident and nonresident

Tripathi Online Educare

2

d. Non-resident only

13. M, a person of Indian origin, visited India on 2-10-2015 and plans to stay here for 185

days. During 4 years prior to previous year, he was in India for 750 days. Earlier to that

he was never in India. For the assessment year, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. Non-resident

14. M, a citizen of India, left India for U.S.on 16-8-2015 for booking orders on behalf of an

Indian company for exporting goods to U.S. He came back to India on 5-5-2016. He had

been resident in India for the past 10 years. For the assessment year 2016-17 , he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

15. M, a citizen of India, is employed on an Indian ship. During the previous years year

2015-16 he leaves India for germany on 15-9-2015 for holidays and returned on

1-4-2016. He had been resident in India for the past 3 years. Earlier to that he was

permanently in India. For the assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

16. M, a foreign national, visited India during previous year 2015-16 for 180 days. Earlier to

this never visited India. For the assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

17. M, a foreign national but a person of Indian origin visited India during previous year

2015-16 for 181 days. During 4 preceding previous years he was in India for 400 days.

For the assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

18. Mr.Ram an Indian citizen left India on 22-09-2015 for the first time to work as an officer

of company in Germany. For the assessment year 2016-17, he is:

Tripathi Online Educare

3

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

19. Mr. Sumit, a citizen of India has a business in India. He has left India for meeting foreign

supplier for the first time on 01-09-2015 and did not return till 31-3-2016. For the

assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

20. Mr Manmohan Sharma goes out of India every year for 274 days. For the assessment

year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

21. Mr. Rishab Patil, a citizen of japan, has come to India for the first time on 03-10-2015 for

200 days. For the assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

22. Mr. Sameer Khanna, a german citizen, came to India on 23-05-2014 and left India on

30-05-2015. For the assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

23. Brett Lee, an Australian cricket player visits India for 100 days in every financial year.

This has been his practice for the past 10 financial years. For the assessment year

2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

24. In the year 2015-16 (Previous year), a sailor his remained on ship for a private company

owning ocean going ships as follows:

Outside the territorial waters of India for 183 days.

Tripathi Online Educare

4

Inside the territorial waters of India for 182 days.

For the Assessment year 2016-17, he is a:

a. Resident

b. Non-resident

c. None

25. A, an Indian Citizen was working as an employee on an Indian ship plying in the Pacific

Ocean. During the current previous year, the ship did not touch the Indian cost, except for

80 days. For the Assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

26. Y, an Indian citizen left India on appointment by Government of lran for the first time on

September 12,2014 to join his duty. During the financial year 2015-16, he came to India

and stayed for 80 days. For the Assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

27. Mr.X, a noted singer in India, goes abroad every year to give concerts. His stay out of

India is 120 days on an average for the last 12 years. For the Assessment year 2016-17,

he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

28. A, came to India for the first time on November 1,2014. During his stay in India upto

October 30,2015 he stayed at Mumbai upto May 10, 2015 and thereafter remained in

Bangalore till his departure from India. For the Assessment year 2016-17, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

29. M, joined Infonet Ltd. on 1-4-2015 and obtained his passport for the first time on

20-4-2015. he went on several foreign tours to obtain business for the company and was

out of India for 225 days during the previous year ending 31-3-2016. For the Assessment

year 2016-17, he is

a. a resident and ordinarily resident

Tripathi Online Educare

5

b. a resident but not ordinarily a resident

c. a non-resident

30. Y was sponsored by his employer in India for technical training in the U.S.A. He left

India on june 3,2015 and come back to India on April 5,2016. For the previous year

2015-16, he is:

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

31. P, a German National came to India for the first time, during 2011-12. During 2011-12,

2012-13, 2013-14, 2014-15 and 2015-16, he was in India, for 70 days, 130 days, 59 days,

100 days and 80 days, respectively. He is-

a. a resident and ordinarily resident

b. a resident but not ordinarily a resident

c. a non-resident

CHECK YOUR ANSWERS

1.(a) 2.(d) 3.(a) 4.(b) 5.(b) 6.(a) 7.(c) 8.(d) 9.(c) 10.(c) 11.(b) 12.(a) 13.(c) 14.(a)

15.(a) 16.(c) 17.(c) 18.(c) 19.(a) 20.(b) 21.(c) 22.(c) 23.(b) 24.(a) 25.(c) 26.(c) 27.(a) 28.(b)

29.(a) 30.(a) 31.(c)

HINTS

18. Indian citizen leaving for employment.

19. Indian citizen leaving for business, not employment.

20. 729 days in preceding 7 years.

21. Stay in PY 180 days.

22. Stay in PY 60 days.

23. 60 in PY; 400 in preceding 4 years; 700 days in preceding 7 years.

25. 80 days in India in PY.

26. 80 days in India in PY.

27. 245 days in India in PY.

28. 213 days in India in PY. 120 days in preceding 4 years.

29. 140 days in India in PY. 1,460 days in preceding 4 years, resident in 10 years.

30. 80 days in India in PY.364 days in preceding 4 years.

Tripathi Online Educare

6

You might also like

- Residential StatusDocument15 pagesResidential StatusDeepak MinhasNo ratings yet

- Chapter 26 MCQs On International TaxationDocument26 pagesChapter 26 MCQs On International TaxationSuranjali Tiwari100% (1)

- CH 1. FEMA MCQ PDFDocument11 pagesCH 1. FEMA MCQ PDFSunil Singhaniya100% (3)

- MCQs of Residential Status - Incidence of Tax by CA Kishan KR SirDocument13 pagesMCQs of Residential Status - Incidence of Tax by CA Kishan KR SirHetvi VoraNo ratings yet

- MCQ's on Tax Laws for CS ExamsDocument208 pagesMCQ's on Tax Laws for CS ExamsnaveedamurnaveedamurNo ratings yet

- Insurance Claim AccountDocument12 pagesInsurance Claim AccountKadam Kartikesh50% (2)

- Income Tax MCQ 1Document9 pagesIncome Tax MCQ 1mohammedumair100% (3)

- Isssue of Shares and Debentures MCQDocument42 pagesIsssue of Shares and Debentures MCQlolNo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- MCQ of GSTDocument23 pagesMCQ of GSTOnline tally guide100% (2)

- Sample MCQ For Unit 2Document8 pagesSample MCQ For Unit 2varunendra pandey100% (1)

- MCQ - Law 1 PDFDocument160 pagesMCQ - Law 1 PDFBharathNo ratings yet

- MCQ Comp LawDocument39 pagesMCQ Comp LawplannernarNo ratings yet

- MCQ (ICAI Study Material)Document6 pagesMCQ (ICAI Study Material)Sanket Mhetre67% (3)

- Complete List of Sections of Income Tax Act, 1961Document20 pagesComplete List of Sections of Income Tax Act, 1961scribdcarpediem100% (4)

- 50 Companies Act MCQs SEBIDocument97 pages50 Companies Act MCQs SEBIpreeti siriyaNo ratings yet

- Chapter 2 MCQs On House PropertyDocument24 pagesChapter 2 MCQs On House PropertyRam Iyer100% (1)

- MCQ Financial Regulatory FrameworkDocument13 pagesMCQ Financial Regulatory Frameworkthorat82No ratings yet

- MCQ On Consumer Protection ActDocument2 pagesMCQ On Consumer Protection ActMayank Rajput67% (3)

- BASEL Norms MCQDocument15 pagesBASEL Norms MCQBiswajit Das100% (1)

- CA Final Direct Tax Laws - MCQ On HUFDocument3 pagesCA Final Direct Tax Laws - MCQ On HUFAadish JainNo ratings yet

- 300+ TOP Companies Act 2013 MCQs and Answers 2021Document11 pages300+ TOP Companies Act 2013 MCQs and Answers 2021Bhagat DeepakNo ratings yet

- Chapter 9 MCQs On Capital GainDocument34 pagesChapter 9 MCQs On Capital GainNiraj Pandey100% (1)

- Taxation Handwritten Notes by Vivek Gaba SirDocument333 pagesTaxation Handwritten Notes by Vivek Gaba SirPRASHANT SINGH100% (7)

- Accounting Standard 6 - DepreciationDocument34 pagesAccounting Standard 6 - DepreciationSarthak Gupta100% (2)

- Costing MCQDocument30 pagesCosting MCQkomalNo ratings yet

- Income Tax MCQ Compilation PDFDocument76 pagesIncome Tax MCQ Compilation PDFjesurajajosephNo ratings yet

- MCQ On GSTDocument21 pagesMCQ On GSTSanket MhetreNo ratings yet

- Advance Account II MCQ FinalbsisjshDocument33 pagesAdvance Account II MCQ FinalbsisjshPranit Pandit100% (1)

- Joint Venture MCQDocument3 pagesJoint Venture MCQSonu SagarNo ratings yet

- Direct Tax MCQDocument320 pagesDirect Tax MCQRam Iyer100% (1)

- Sale of Goods Act MCQ 20 MarksDocument22 pagesSale of Goods Act MCQ 20 MarksKapil DalviNo ratings yet

- Ratio Analysis McqsDocument10 pagesRatio Analysis McqsNirmal PrasadNo ratings yet

- MCQ'S - 1 To 50Document12 pagesMCQ'S - 1 To 50varunendra pandeyNo ratings yet

- Xii Mcqs CH - 16 Cash FlowDocument6 pagesXii Mcqs CH - 16 Cash FlowJoanna GarciaNo ratings yet

- MCQs On Contract IIDocument26 pagesMCQs On Contract IINeha Sharma100% (1)

- Cost Accounting Objective (MCQ)Document243 pagesCost Accounting Objective (MCQ)mirjapur0% (1)

- Direct Taxation: Income Tax Act Multiple Choice QuestionsDocument31 pagesDirect Taxation: Income Tax Act Multiple Choice Questionsbigbulleye6078No ratings yet

- Income Tax MCQ Question Bank May 2023 (130 Pages)Document130 pagesIncome Tax MCQ Question Bank May 2023 (130 Pages)PRITESH JAIN100% (1)

- Account MCQ PDFDocument93 pagesAccount MCQ PDFsunil kalura100% (1)

- The Payment of Gratuity Act 1972Document5 pagesThe Payment of Gratuity Act 1972Storage DivisionNo ratings yet

- EKATVAM: Commerce Ke Liye Hamesha Pratham Foundation Maths/Stats/LRDocument4 pagesEKATVAM: Commerce Ke Liye Hamesha Pratham Foundation Maths/Stats/LRSrushti Agarwal100% (2)

- The Accounting Education EPFO Accounting MCQ QUIZDocument20 pagesThe Accounting Education EPFO Accounting MCQ QUIZAnmol ChawlaNo ratings yet

- 30 Income Tax Objective Type QuestionsDocument25 pages30 Income Tax Objective Type QuestionsRakesh Sharma50% (6)

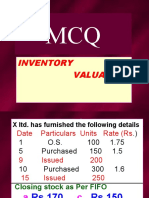

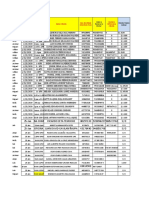

- MCQ Inventory Valuation LBSIMDocument49 pagesMCQ Inventory Valuation LBSIMSumit SharmaNo ratings yet

- On Residential Status and Scope of Total IncomeDocument72 pagesOn Residential Status and Scope of Total Incomeaim_naina100% (3)

- Sales of Goods Act MCQDocument21 pagesSales of Goods Act MCQshubham kumar50% (2)

- Accounting Concepts MCQsDocument1 pageAccounting Concepts MCQsAdil IqbalNo ratings yet

- Banking Law MCQDocument33 pagesBanking Law MCQShivansh Bansal100% (7)

- MCQS Chapter 6 Company Law 2017Document8 pagesMCQS Chapter 6 Company Law 2017BablooNo ratings yet

- Payment of Bonus ActDocument13 pagesPayment of Bonus Act61Mansi Saraykar100% (3)

- Company Classification MCQDocument3 pagesCompany Classification MCQAtiq50% (4)

- Practice Questions NSDL - Depository Operations ModuleDocument9 pagesPractice Questions NSDL - Depository Operations Moduleஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- MCQ CAG StandardsDocument11 pagesMCQ CAG StandardsAjay Singh PhogatNo ratings yet

- AS-2 accounting standard multiple choice questionsDocument3 pagesAS-2 accounting standard multiple choice questionsNikhil KarkhanisNo ratings yet

- Sem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease AccountingDocument11 pagesSem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease Accountinglol0% (1)

- Mock Test 2Document15 pagesMock Test 2Diksha SharmaNo ratings yet

- Assignment DTDocument2 pagesAssignment DTJayashree SahaNo ratings yet

- Inter CA Direct Tax Homework SolutionsDocument67 pagesInter CA Direct Tax Homework SolutionsAbhijit HoroNo ratings yet

- Residential Status SolutionsDocument5 pagesResidential Status SolutionsChelsy RochlaniNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- E-Way Bill System PDFDocument1 pageE-Way Bill System PDFSarvar PathanNo ratings yet

- Mi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverDocument2 pagesMi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverSarvar PathanNo ratings yet

- 1c.OM - Strategy-Rev-2020 - BVRMDocument24 pages1c.OM - Strategy-Rev-2020 - BVRMSarvar PathanNo ratings yet

- Prodn - Ops - PLNG & Control-2019Document42 pagesProdn - Ops - PLNG & Control-2019Raman KulkarniNo ratings yet

- Asian Paints (Rakesh Painter)Document2 pagesAsian Paints (Rakesh Painter)Sarvar PathanNo ratings yet

- 5b. Capacity PlanningDocument21 pages5b. Capacity PlanningSarvar PathanNo ratings yet

- Facility LayoutDocument31 pagesFacility LayoutSarvar PathanNo ratings yet

- Acknowledgement of Online Application For Services On Existing DLDocument1 pageAcknowledgement of Online Application For Services On Existing DLSarvar PathanNo ratings yet

- Facility LocationDocument22 pagesFacility LocationSarvar PathanNo ratings yet

- Online DL address change acknowledgementDocument1 pageOnline DL address change acknowledgementSarvar PathanNo ratings yet

- Residential Status IllustrationsDocument16 pagesResidential Status IllustrationsSarvar PathanNo ratings yet

- Scope of Total Income IllustrationDocument13 pagesScope of Total Income IllustrationSarvar PathanNo ratings yet

- New Product DevelopmentDocument18 pagesNew Product DevelopmentSarvar PathanNo ratings yet

- 1b. Production SystemsDocument13 pages1b. Production SystemsSarvar PathanNo ratings yet

- SalaryDocument29 pagesSalarySarvar PathanNo ratings yet

- Tripathi Online EducareDocument7 pagesTripathi Online EducareSarvar PathanNo ratings yet

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Residential Status True or FalseDocument2 pagesResidential Status True or FalseSarvar PathanNo ratings yet

- Residential StatusDocument4 pagesResidential StatusSarvar PathanNo ratings yet

- Tripathi Online Educare GuideDocument10 pagesTripathi Online Educare GuideSarvar PathanNo ratings yet

- Income Tax Act Fill in the BlanksDocument1 pageIncome Tax Act Fill in the BlanksSarvar PathanNo ratings yet

- Residential StatusDocument17 pagesResidential StatusSarvar PathanNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Important Theory Questions: Tripathi Online EducareDocument1 pageImportant Theory Questions: Tripathi Online EducareSarvar PathanNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesSarvar PathanNo ratings yet

- Mrs. Batliboi's income from other sourcesDocument5 pagesMrs. Batliboi's income from other sourcesSarvar PathanNo ratings yet

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- Introduction To Income TaxDocument26 pagesIntroduction To Income TaxTripathi Online EducareNo ratings yet

- (Speech) Muammar Gaddafi at The 64th UN General Assembly in 2009Document14 pages(Speech) Muammar Gaddafi at The 64th UN General Assembly in 2009VincentNo ratings yet

- Midterms RIPH ReviewerDocument4 pagesMidterms RIPH ReviewerPrince LitchNo ratings yet

- Final Essay - Delima Nurjulita - 1706023164Document3 pagesFinal Essay - Delima Nurjulita - 1706023164Delima NurjulitaNo ratings yet

- TP & TocDocument2 pagesTP & TocasdfghjkattNo ratings yet

- Dwnload Full Essentials of Meteorology An Invitation To The Atmosphere 7th Edition Ahrens Solutions Manual PDFDocument36 pagesDwnload Full Essentials of Meteorology An Invitation To The Atmosphere 7th Edition Ahrens Solutions Manual PDFmasona2l2black100% (10)

- Solicitation 306-10-53 OIG FSNDocument2 pagesSolicitation 306-10-53 OIG FSNpasoonsukootNo ratings yet

- Historiography - OverviewDocument1 pageHistoriography - OverviewYi Qi NieNo ratings yet

- Ats1326 ReaderDocument279 pagesAts1326 ReaderTinashe MpasiriNo ratings yet

- A Need For LaborDocument4 pagesA Need For LaborMinnelyz RiveraNo ratings yet

- Eurocon 14 2017 SummerDocument60 pagesEurocon 14 2017 SummerMarko BabicNo ratings yet

- Questions Related To Role Playing Group # 1 Pope Pius VIDocument5 pagesQuestions Related To Role Playing Group # 1 Pope Pius VIANISHA YERPULANo ratings yet

- Kill The Indian Save The ChildDocument11 pagesKill The Indian Save The Childapi-263190336No ratings yet

- TN Haj Committee - List of Qurrah Provisional CoversDocument25 pagesTN Haj Committee - List of Qurrah Provisional CoverskayalonthewebNo ratings yet

- CH 4 Urban Amerca Unit PlanDocument23 pagesCH 4 Urban Amerca Unit Planapi-317263014No ratings yet

- From The Gulf To The Nile: Water Security in An Arid RegionDocument23 pagesFrom The Gulf To The Nile: Water Security in An Arid RegionThe Atlantic CouncilNo ratings yet

- Judicial Accountability and IndependeceDocument28 pagesJudicial Accountability and Independecerkaran22100% (1)

- Witch Hunting of The Adivasi Women in JharkhandDocument7 pagesWitch Hunting of The Adivasi Women in JharkhandIshitta RuchiNo ratings yet

- Philippines' Electoral System ExplainedDocument20 pagesPhilippines' Electoral System ExplainedWilliam Vincent Soria70% (10)

- Programacion General 25 - 01Document3 pagesProgramacion General 25 - 01Roberto Carlos AntaurcoNo ratings yet

- Nature and Scope of Public AdministrationDocument7 pagesNature and Scope of Public AdministrationBORIS ODALONUNo ratings yet

- Memo Ki MaaDocument10 pagesMemo Ki MaaSomya AgrawalNo ratings yet

- Micro Chapter 2 Study Guide Questions 14eDocument6 pagesMicro Chapter 2 Study Guide Questions 14eBeauponte Pouky MezonlinNo ratings yet

- First Nations Strategic Bulletin August-Oct 14Document20 pagesFirst Nations Strategic Bulletin August-Oct 14Russell Diabo100% (1)

- What is Socialism, What is Capitalism, What is Communism, Difference Between Socialism and Capitalism, Critiques of Socialism and Capitalism, Simple Explanation of Socialism and Capitalism, Pros and Cons of Communism & SocialismDocument4 pagesWhat is Socialism, What is Capitalism, What is Communism, Difference Between Socialism and Capitalism, Critiques of Socialism and Capitalism, Simple Explanation of Socialism and Capitalism, Pros and Cons of Communism & SocialismAmit Kumar100% (1)

- BA LLB I Sem PSC111Document9 pagesBA LLB I Sem PSC111VikasNo ratings yet

- Equality Impact Assesment Milson RoadDocument5 pagesEquality Impact Assesment Milson RoadMasbro CentreNo ratings yet

- Lala Har DayalDocument6 pagesLala Har DayalSoorya VanshamNo ratings yet

- Review Sbmit Ti Mansoor ZubairDocument5 pagesReview Sbmit Ti Mansoor ZubairFiza Minal MazharNo ratings yet

- Guidelines For Grant ApplicantsDocument19 pagesGuidelines For Grant ApplicantsRama DoankNo ratings yet

- Stuart Hall: "Culture Is Always A Translation"Document5 pagesStuart Hall: "Culture Is Always A Translation"MelissaChouglaJoseph100% (1)