Professional Documents

Culture Documents

CPA journal entries assignment

Uploaded by

Mara Shaira SiegaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CPA journal entries assignment

Uploaded by

Mara Shaira SiegaCopyright:

Available Formats

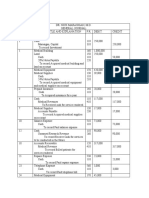

Name: Course & Year: Score:

Assignment # 2

INSTRUCTIONS: Make the journal entries for the following transactions.

Mr. Seokjin Kim, CPA opened a current account with Development Bank of the Philippines and

deposited ₱150,000 to start with his public practice.

CHART OF ACCOUNTS

ASSETS OWNER’S EQUITY

Cash on Hand S. Kim, Capital

Accounts Receivable S. Kim, Drawing

Advances to Employees INCOME

Prepaid Interest Professional Income

Supplies Inventory EXPENSES

Office Furniture & Fixtures Professional Development Expense

LIABILITIES Postage and Telephone

Accounts Payable Travelling Expense

Unearned Professional Income Rent Expense

Loans Payable Utilities Expense

Salaries Expense

Taxes and Licenses

Transactions:

Dec 3 Deposited ₱150,000 to the bank and invested office table and computer worth ₱80,000 in the

business.

4 Bought various office stationeries and supplies on account, ₱15,000.

5 Received cash of ₱15,000 for installation and design of accounting system.

7 Paid ₱6,000 convention registration fee for Philippine Institute of Certified Public Accountants

9 Paid ₱2,500 for transportation expense in visiting a client in Davao City.

1 Rendered professional service on account, ₱10,000

0

1 Received cash, ₱6,000 from Cebu Golden Plaza but professional service has yet to be rendered.

2

1 Salary advance given to his staff to be deducted against payroll, ₱5,000

3

1 Paid taxes and business permits for cash, ₱4,500

3

1 Paid ₱1,500 for telephone bills

4

1 Collected in full the account of a client on December 10.

6

1 Partial payment of account on December 4, ₱3,000.

7

1 Bought steel cabinets on account from Sungold, Inc. ₱25,000.

8

1 Received electric and water bill for ₱3,500 and immediately made payment.

9

2 Mr. Kim made a withdrawal from his bank account of ₱25,000 for his personal use.

1

2 Paid transportation expense in visiting a client in Zamboanga City, ₱3,000

2

2 Paid office rental of ₱5,000

3

2 Sent a brochure to a client in Davao City through Aboitiz 2-Go, ₱2,500

4

2 Rendered a professional service for cash to various clients, ₱45,000

5

2 Partial payment of account with Sungold, Inc., ₱10,000

6

2 Received a loan from Cebu Accountant’s Multi-Purpose Cooperative, ₱47,000, net of interest

7 payable six months after.

2 Received cash ₱15,000 as retainer’s fee from various clients.

9

Fundamentals of Accounting 1|Page

3 Paid salaries to his staff, ₱18,000 net of deduction for salary advance of December 13.

0

3 Full payment of account with Sungold, Inc.

0

3 Rendered professional service to Cebu Golden Plaza, paying out the advanced payment received

0 on December 12.

3 Full payment of December 4 account.

0

3 Billed a client for professional services rendere, ₱35,000

0

3 Plane ticket to avail of promotional fare re-travel to Manila to attend PICPA Convention, ₱6,200.

0

3 Send PICPA Bulletin through LBC Air Cargo, ₱1,200.

0

3 Received cash from a client for professional services rendered ₱8,000

0

3 Taxi fares claimed by staff while out in office for official business, ₱850

0

Fundamentals of Accounting 2|Page

You might also like

- Annuity, Gradient, PerpetuityDocument2 pagesAnnuity, Gradient, PerpetuityJsbebe jskdbsj100% (3)

- Poa Multiple Choice Questions 1-5Document16 pagesPoa Multiple Choice Questions 1-5nurul00078% (9)

- CENTRAL BANK OF THE PHILIPPINES vs. CA and TOLENTINODocument3 pagesCENTRAL BANK OF THE PHILIPPINES vs. CA and TOLENTINOAngela AngelesNo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationJeasa LapizNo ratings yet

- General Journal EntriesDocument26 pagesGeneral Journal EntriesAldrian Ala100% (1)

- MutualDocument92 pagesMutualYogi173No ratings yet

- Immunization With FuturesDocument18 pagesImmunization With FuturesNiyati ShahNo ratings yet

- PFRS Updates: PAS 1, PAS 19, PFRS 9, PFRS 10, PFRS 11, PFRS 13Document74 pagesPFRS Updates: PAS 1, PAS 19, PFRS 9, PFRS 10, PFRS 11, PFRS 13Mara Shaira Siega100% (1)

- Module 5 - Correcting EntriesDocument2 pagesModule 5 - Correcting EntriesFeiya LiuNo ratings yet

- The Global Financial CrisisDocument11 pagesThe Global Financial CrisisdmepdoNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- Holy Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Document3 pagesHoly Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Haries Vi Traboc Micolob100% (1)

- Problem 12 Accounting PDFDocument3 pagesProblem 12 Accounting PDFErika RepedroNo ratings yet

- Perpetual Inventory SystemDocument4 pagesPerpetual Inventory SystemJoe Honey Cañas CarbajosaNo ratings yet

- Effects of Transactions for Zabeth Rosales Freight ServicesDocument1 pageEffects of Transactions for Zabeth Rosales Freight ServicesHessiel Mae Jumalon Garcines100% (1)

- Learn Macroeconomics TheoryDocument10 pagesLearn Macroeconomics TheoryRonnel Aldin FernandoNo ratings yet

- Adjusting Entries Asnwer Key - in A NutshellDocument9 pagesAdjusting Entries Asnwer Key - in A NutshellKimberly G. EtangNo ratings yet

- EL201-Accounting For ITDocument84 pagesEL201-Accounting For ITJc BarreraNo ratings yet

- 6 Column Worksheet and Financial StatementsDocument4 pages6 Column Worksheet and Financial StatementsRich Angelie MuñezNo ratings yet

- Sam and Neneng capital contribution and profit sharing calculationsDocument19 pagesSam and Neneng capital contribution and profit sharing calculationsJasmine ActaNo ratings yet

- FABM Assignment WS FS P C TB 1Document34 pagesFABM Assignment WS FS P C TB 1memae0044No ratings yet

- Seatwork 1 Security Business TransactionsDocument1 pageSeatwork 1 Security Business TransactionsReniel Millar100% (1)

- Bart MDocument3 pagesBart MSteph Borinaga0% (1)

- Ulob Week 4-5Document10 pagesUlob Week 4-5Nicolas ArsagaNo ratings yet

- ADDU Worksheet, FS, CJE and EtcDocument67 pagesADDU Worksheet, FS, CJE and EtcKen BorjaNo ratings yet

- RR Diaz 1CED - CW Local and GlobalDocument2 pagesRR Diaz 1CED - CW Local and GlobalJr DiazNo ratings yet

- Reflection Instruction: in No More Than Seven (7) Sentences, Answer The Following Questions As Concise As Possible. (2 Items X 10 Points)Document1 pageReflection Instruction: in No More Than Seven (7) Sentences, Answer The Following Questions As Concise As Possible. (2 Items X 10 Points)J VIDSNo ratings yet

- Tutorial Week 6Document7 pagesTutorial Week 6Mai Hoàng100% (1)

- Pequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypeDocument41 pagesPequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypePia Suril0% (1)

- Business Transactions and Worksheet (Pio Baconga)Document1 pageBusiness Transactions and Worksheet (Pio Baconga)UnknownNo ratings yet

- Neo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleDocument17 pagesNeo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleGina Calling Danao100% (1)

- Teresit Buenaflor Company FinancialsDocument12 pagesTeresit Buenaflor Company FinancialsAllecks Juel LuchanaNo ratings yet

- Departmental AbcDocument23 pagesDepartmental AbcMaria DyNo ratings yet

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- Accounting Exam Review: Multiple Choice and Journal EntriesDocument3 pagesAccounting Exam Review: Multiple Choice and Journal EntriesPatricia Camille AustriaNo ratings yet

- CFAS Reviewer - Module 1 & 2Document12 pagesCFAS Reviewer - Module 1 & 2Lizette Janiya SumantingNo ratings yet

- NSTP 1 Module 1Document5 pagesNSTP 1 Module 1Jeorge HugnoNo ratings yet

- Historical Periods of Globalization Lesson OverviewDocument7 pagesHistorical Periods of Globalization Lesson OverviewPamela Fritz B. BrionesNo ratings yet

- Accounting ExercisesDocument41 pagesAccounting ExercisesKayla MirandaNo ratings yet

- Lesson 2 Journal Entries AccountingDocument1 pageLesson 2 Journal Entries AccountingKyle Bueno100% (1)

- Pasahol-Far-Adjusting Entries 2Document7 pagesPasahol-Far-Adjusting Entries 2Angel Pasahol100% (1)

- Section 800 Conditionally Tax andDocument49 pagesSection 800 Conditionally Tax andhellofrom theothersideNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Tobongbanua Aliza WEEN TradingDocument8 pagesTobongbanua Aliza WEEN TradingJan Leo EgamenNo ratings yet

- The Global EconomyDocument17 pagesThe Global EconomyAlliana HaneNo ratings yet

- SAP B1 Fundamentals AccountingDocument33 pagesSAP B1 Fundamentals AccountingJosef SamoranosNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationnikNo ratings yet

- Accounting Problems and SolutionsDocument17 pagesAccounting Problems and SolutionsLoyalNamanAko LLNo ratings yet

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- ACC 121 Answer Key Account ClassificationDocument10 pagesACC 121 Answer Key Account ClassificationKerby Gail RulonaNo ratings yet

- Chapter 10Document16 pagesChapter 10Charlene LeynesNo ratings yet

- Angels and Demons Key PointsDocument19 pagesAngels and Demons Key PointsAzka GilaniNo ratings yet

- CH 03Document7 pagesCH 03Bind Prozt100% (1)

- Accounting ReviewerDocument21 pagesAccounting ReviewerAdriya Ley PangilinanNo ratings yet

- Accounting Review: Key Financial ConceptsDocument23 pagesAccounting Review: Key Financial Conceptsjoyce KimNo ratings yet

- (Studocu) Int Acc Chapter 4 - Valix, Robles, Empleo, MillanDocument3 pages(Studocu) Int Acc Chapter 4 - Valix, Robles, Empleo, MillanHufana, ShelleyNo ratings yet

- General Leger Cleaning Business FinancialsDocument3 pagesGeneral Leger Cleaning Business FinancialsAriel Palay100% (1)

- Virtudazo Ween Trading GJDocument15 pagesVirtudazo Ween Trading GJMary Rose Ann VirtudazoNo ratings yet

- Dr. Marasigan Medical PracticeDocument21 pagesDr. Marasigan Medical PracticeJean FlordelizNo ratings yet

- C3 - Problem 11 - Journalizing TransactionsDocument2 pagesC3 - Problem 11 - Journalizing TransactionsLorence John ImperialNo ratings yet

- Antonio WorksheetDocument7 pagesAntonio WorksheetAntonNo ratings yet

- Cultural Dimensions of FilipinosDocument2 pagesCultural Dimensions of FilipinosJustine AltheaNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagNo ratings yet

- IFRS updates-CEBUDocument41 pagesIFRS updates-CEBUMara Shaira SiegaNo ratings yet

- Mas Practice Standards and Ethical ConsiderationsDocument81 pagesMas Practice Standards and Ethical ConsiderationsMara Shaira SiegaNo ratings yet

- Accounting Equation MCQDocument10 pagesAccounting Equation MCQiisjaffer100% (1)

- Partnership AccountingDocument14 pagesPartnership AccountingLongWongChengNo ratings yet

- Right of Stoppage in TransitDocument8 pagesRight of Stoppage in TransitMara Shaira SiegaNo ratings yet

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- F7int 2013 Dec QDocument9 pagesF7int 2013 Dec Qkumassa kenyaNo ratings yet

- Exercise # 5Document1 pageExercise # 5Mara Shaira SiegaNo ratings yet

- Multiple Choice: Please Mark Your Answer On The Both Bubble Sheet and On This Test. (7 Points Each)Document15 pagesMultiple Choice: Please Mark Your Answer On The Both Bubble Sheet and On This Test. (7 Points Each)Mara Shaira SiegaNo ratings yet

- Fin Acctg - Sample With Answers USEDDocument5 pagesFin Acctg - Sample With Answers USEDMara Shaira SiegaNo ratings yet

- 158 634353431366610342 New Test 2Document14 pages158 634353431366610342 New Test 2Mara Shaira SiegaNo ratings yet

- The 2009 Winter Accounting TribeDocument15 pagesThe 2009 Winter Accounting TribeMara Shaira SiegaNo ratings yet

- 158 634353432214914023 Winter 2010 Key 2 ADocument9 pages158 634353432214914023 Winter 2010 Key 2 AMara Shaira SiegaNo ratings yet

- The Summer 2012 Accounting Tribe The Second Encounter: RulesDocument15 pagesThe Summer 2012 Accounting Tribe The Second Encounter: RulesMara Shaira SiegaNo ratings yet

- Setting Product StrategyDocument28 pagesSetting Product StrategyMara Shaira SiegaNo ratings yet

- Multiple Choice: Please Mark Your Answer On The Both Bubble Sheet and On This Test. (7 Points Each)Document15 pagesMultiple Choice: Please Mark Your Answer On The Both Bubble Sheet and On This Test. (7 Points Each)Mara Shaira SiegaNo ratings yet

- 158 634353431366610342 New Test 2Document14 pages158 634353431366610342 New Test 2Mara Shaira SiegaNo ratings yet

- 157 634877992918485148 Mollys Munchies Summer 2011 PracticeDocument5 pages157 634877992918485148 Mollys Munchies Summer 2011 PracticeMara Shaira SiegaNo ratings yet

- The Summer 2012 Accounting Tribe The Second Encounter: RulesDocument15 pagesThe Summer 2012 Accounting Tribe The Second Encounter: RulesMara Shaira SiegaNo ratings yet

- Marketing Product StrategyDocument13 pagesMarketing Product StrategyMara Shaira SiegaNo ratings yet

- 157 634848777641227667 Practice Exam 1 KeyDocument5 pages157 634848777641227667 Practice Exam 1 KeyMara Shaira SiegaNo ratings yet

- Accounting Exam 1Document14 pagesAccounting Exam 1PrinceAndreNo ratings yet

- 209a - Standard Costing and Variance AnalysisDocument62 pages209a - Standard Costing and Variance AnalysisMara Shaira SiegaNo ratings yet

- New Market Offerings Development ProcessDocument33 pagesNew Market Offerings Development ProcessMara Shaira SiegaNo ratings yet

- The Summer 2012 Accounting Tribe The Second Encounter: RulesDocument15 pagesThe Summer 2012 Accounting Tribe The Second Encounter: RulesMara Shaira SiegaNo ratings yet

- Corporate Finance: Cash ManagementDocument29 pagesCorporate Finance: Cash ManagementMara Shaira SiegaNo ratings yet

- Financial Analysis in Operations ManagementDocument17 pagesFinancial Analysis in Operations ManagementMara Shaira SiegaNo ratings yet

- Bartering: DefiniciónDocument6 pagesBartering: DefiniciónBladimir FloresNo ratings yet

- Accounting For Non-Profit Making Org-1Document14 pagesAccounting For Non-Profit Making Org-1Amelia Bailey100% (1)

- Personal Finance Chapter 6 - Do The MathDocument3 pagesPersonal Finance Chapter 6 - Do The Mathapi-526065196No ratings yet

- Chapter 17 International Banking - Reserves Debt and RiskDocument47 pagesChapter 17 International Banking - Reserves Debt and Riskngletramanh203No ratings yet

- Determinants of Stock Market Liquidity A Macroeconomic PerspectiveDocument22 pagesDeterminants of Stock Market Liquidity A Macroeconomic PerspectiveMuhammad MansoorNo ratings yet

- Investing and Financing Decisions and The Accounting SystemDocument33 pagesInvesting and Financing Decisions and The Accounting SystemJessicaNo ratings yet

- Pdam 1Document1 pagePdam 1Ratnasari RatnasariNo ratings yet

- CAPM MentoringDocument8 pagesCAPM MentoringKashish AroraNo ratings yet

- Raihan Rohadatul 'Aisy - 205154055 - Tugas Consolidations-Changes in Ownership InterestsDocument4 pagesRaihan Rohadatul 'Aisy - 205154055 - Tugas Consolidations-Changes in Ownership InterestsRaihan Rohadatul 'AisyNo ratings yet

- Chapter Five 5. The Regulation of Financial Markets & InstitutionsDocument6 pagesChapter Five 5. The Regulation of Financial Markets & Institutionsሔርሞን ይድነቃቸውNo ratings yet

- NCI Balance, December 31, 2013 P114,000: Multiple Choices - ComputationalDocument43 pagesNCI Balance, December 31, 2013 P114,000: Multiple Choices - ComputationalLove FreddyNo ratings yet

- Factors Influencing Adoption of Agency Banking in EthiopiaDocument43 pagesFactors Influencing Adoption of Agency Banking in EthiopiaHenok AsemahugnNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Financial Statements Analysis: Bangko de Oro & Bank of The Philippine IslandsDocument34 pagesFinancial Statements Analysis: Bangko de Oro & Bank of The Philippine IslandsNikol DayanNo ratings yet

- MYVI 1.3: Automatic ManualDocument2 pagesMYVI 1.3: Automatic ManualMuhammad NazwanNo ratings yet

- RMGB Statement Kakndwala PDFDocument5 pagesRMGB Statement Kakndwala PDFRny buriaNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- Introduction To Financial ManagementDocument46 pagesIntroduction To Financial ManagementChethan KumarNo ratings yet

- Q1Document16 pagesQ1satyamNo ratings yet

- CO VallejoDocument9 pagesCO VallejoTeyangNo ratings yet

- Financial ManagementDocument51 pagesFinancial Managementq2boby71% (7)

- 07 - Online Monetary TransactionsDocument20 pages07 - Online Monetary TransactionsELTSPDNo ratings yet

- E-Bulletin Foundation Dec2016Document49 pagesE-Bulletin Foundation Dec2016Ashish Singh NegiNo ratings yet

- Kyodai Remittance - IME RatesDocument1 pageKyodai Remittance - IME Ratesharmeeksingh01No ratings yet

- R15 PDFDocument119 pagesR15 PDFIndonesian ProNo ratings yet