Professional Documents

Culture Documents

Vat Illustrations

Uploaded by

amora elyseCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat Illustrations

Uploaded by

amora elyseCopyright:

Available Formats

Merchandising Transactions with VAT

Value Added Tax (12%) Tax imposed by the Government on goods and services.

Input Tax Tax on purchases.

Output Tax Tax on sales.

P-I-S-O PURCHASE- INPUT-SALES-OUTPUT

Both are closed every month and the difference represent a Tax

Payable or a Deferred tax

How to compute:

Inclusive of VAT - P112,000

Invoice 112,000

Divide by 1.12

Net of VAT 100,000

Vat (100,000x12%) 12,000

Exclusive of VAT - P200,000

Net of VAT 200,000

Multiply by 1.12

Invoice price 224,000

Vat (200,000x12%) 24,000

Merchandising Transactions with VAT

Paul's BookHouse distributes books to retail stores on terms of 2/10, n/30 to

all of its customers. At the end of May, Paul's inventory consisted of 300

books purchased at P184,800. During the month of June, the following

transactions occured:

Note: All transactions are VAT Inclusive.

Purchased 200 novel books on account for P644 each from Log

Publishers, FOB Destination, terms 2/10, n/30. Log paid P5,600 for

1 the freight.

Sold 240 novel books on account to Rain Bookmark for P1,120

3 each.

Received P12,880 credit for 20 novel books returned to Log

6 Publishers.

9 Paid Log Publishers for the account of June 1.

15 Received payment from Rain Bookmark for the account of June 3.

Sold 180 novel books on account to Brainfall Books for P1,120

17 each.

Purchased 250 travel books on account for P672 each from Magic

Publishers, FOB Shippin Point, terms 2/15, n/30. Magic paid P5,600

20 for freight and charged it to Paul.

24 Received 50% payment from Brainfall Books.

26 Paid Magic Publishers for the account on June 20.

Sold 130 travel books on account to Prince Bookstore for P1,120

28 each.

30 Granted Prince Bookstore credit for 12 books returned.

Merchandising Transactions with VAT

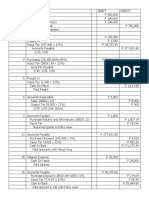

Date Particulars Debit Credit

1-Jun Purchases 115,000

Input Tax 13,800 128,800

Accounts Payable 128,800

(200xP644)/1.12

3 Accounts Receivable 268,800

Sales 240,000

Output Tax 28,800

(240*P1,120); 268,800/1.12

6 Accounts Payable 12,880

Purchase Returns & Allowances 11,500

Input Tax 1,380

9 Accounts Payable 115,920

Purchase Discount 2,070

Input Tax 248

Cash 113,602

15 Cash 268,800

Accounts Receivable 268,800

17 Accounts Receivable 201,600

Sales 180,000

Output Tax 21,600

20 Purchases 150,000

Input Tax 18,000

Accounts Payable 168,000

20 Freight In 5,000

Input Tax 600

Accounts Payable 5,600

24 Cash 100,800

Accounts Receivable 100,800

26 Account Payable 173,600

Purchase Discounts 3,000

Input Tax 360

Cash 170,240

28 Accounts Receivable 145,600

Sales 130,000

Output Tax 15,600

30 Sales Returns and Allowances 12,000

Output Tax 1,440

Accounts Receivable 13,440

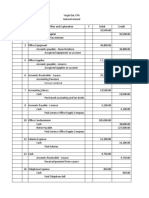

30 Output Tax 67,440

Input Tax 30,412

Vat Payable 37,028

Input Tax Output Tax

13,800 1,380 1,440 28,800

18,000 248 21,600

600 360 15,600

dr 32,400 1,988 cr 1,440 66,000

30,412 64,560

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Sol Man 17Document7 pagesSol Man 17samsungacerNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Elaine WorkDocument8 pagesElaine WorkElaine CasamaNo ratings yet

- VatDocument23 pagesVatMichole chin MallariNo ratings yet

- Value Added TaxDocument3 pagesValue Added TaxChristine Igna100% (1)

- VAT calculation for CONAN Corporation in January 2018Document1 pageVAT calculation for CONAN Corporation in January 2018Hazel Malveda GamillaNo ratings yet

- Finals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Document6 pagesFinals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Garpt KudasaiNo ratings yet

- Value Added TaxDocument6 pagesValue Added Taxarjohnyabut80% (10)

- CASE 1 - 20 PtsDocument6 pagesCASE 1 - 20 PtsCendimee PosadasNo ratings yet

- Cho Cho's - SarayDocument6 pagesCho Cho's - SarayLaiza Cristella SarayNo ratings yet

- Accounting For Merchandising Business With VAT & Special JournalsDocument24 pagesAccounting For Merchandising Business With VAT & Special Journalsapostol ignacioNo ratings yet

- Kashato Practice Set - 2020-10thedDocument84 pagesKashato Practice Set - 2020-10thedMary Jhiezael Pascual83% (12)

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- Journal Entry Document Tracks Business TransactionsDocument3 pagesJournal Entry Document Tracks Business TransactionsFrencess Mae MayolaNo ratings yet

- 01 Elms Activity 2 Ia3Document1 page01 Elms Activity 2 Ia3Jen DeloyNo ratings yet

- Project 3 Problem 17Document3 pagesProject 3 Problem 17Jaquilyn JavierNo ratings yet

- Kashato Pracetice Set Answer KeyDocument66 pagesKashato Pracetice Set Answer KeySnowy WhiteNo ratings yet

- Assignment #13Document3 pagesAssignment #13Soleil AsierNo ratings yet

- (Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Document5 pages(Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Felicitte Mae Guico LabarosaNo ratings yet

- KASHATODocument39 pagesKASHATOUser 101No ratings yet

- 2.2 Problems - VAT PayableDocument11 pages2.2 Problems - VAT PayableHafi DisoNo ratings yet

- ACCOUNTING Practice Set TransactionsDocument8 pagesACCOUNTING Practice Set TransactionsXyza Faye Regalado0% (1)

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1Hina SanNo ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- VAT ENTRIESDocument3 pagesVAT ENTRIESRan CañeteNo ratings yet

- Total Gross Sales Total Gross PurchasesDocument2 pagesTotal Gross Sales Total Gross PurchasesMaui0% (1)

- Mock Test PreparationDocument6 pagesMock Test PreparationHà Quảng TâyNo ratings yet

- Sample 2 - Output and Input VatDocument2 pagesSample 2 - Output and Input VatAngelie PabuayaNo ratings yet

- FS MerchandisingDocument14 pagesFS MerchandisingDesirre TransonaNo ratings yet

- 01 ELMS Activity 2Document2 pages01 ELMS Activity 2Gonzaga FamNo ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- Illustrative Problems Chap7-8Document3 pagesIllustrative Problems Chap7-8Nikki GarciaNo ratings yet

- Jude Company Post Closing Trial Balance November 2018Document6 pagesJude Company Post Closing Trial Balance November 2018GeraldNo ratings yet

- ACTIVITY 1 BSA4A AutosavedDocument6 pagesACTIVITY 1 BSA4A AutosavedJonathan BausingNo ratings yet

- Accounts Receivable and Payable EntriesDocument15 pagesAccounts Receivable and Payable EntriesJuan Luis Lusong100% (2)

- Special Journals - Quiz 38Document7 pagesSpecial Journals - Quiz 38Joana TrinidadNo ratings yet

- Sales Receipts October 2015Document18 pagesSales Receipts October 2015AlvinNoay100% (2)

- Accounting for merchandising operationsDocument4 pagesAccounting for merchandising operationsQasim Khan0% (1)

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- Pangan CompanyDocument18 pagesPangan CompanyWendy Lupaz80% (5)

- Vat OptDocument24 pagesVat OptCharity Venus100% (1)

- Acctg Ass No. 10 Merchandising BusinessDocument5 pagesAcctg Ass No. 10 Merchandising BusinessDaisy Marie A. Rosel75% (4)

- Ho 08 VatDocument11 pagesHo 08 VatRachel LuberiaNo ratings yet

- IM-FA-LM03-CP02 Merchandising With VAT 2.0Document16 pagesIM-FA-LM03-CP02 Merchandising With VAT 2.0Stephanie IsuanNo ratings yet

- Excercise AccountingDocument8 pagesExcercise AccountingjefriazizNo ratings yet

- AP-Correction of Error Straight Problems Problem 1: RequiredDocument6 pagesAP-Correction of Error Straight Problems Problem 1: RequiredAldrin LiwanagNo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Solving Tax ProblemsDocument4 pagesSolving Tax ProblemsPaupauNo ratings yet

- Ricardo Pangan CompanyDocument38 pagesRicardo Pangan CompanyAndrea Tugot67% (15)

- Chapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDocument14 pagesChapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDani QureshiNo ratings yet

- SWAZI+ONE Accounting ExerciseDocument2 pagesSWAZI+ONE Accounting Exercisekj98mcqc5zNo ratings yet

- Acct-101-Begino, Vanessa Jamila D. TEST IDocument2 pagesAcct-101-Begino, Vanessa Jamila D. TEST IVanessa JamilaNo ratings yet

- Pr2 Prelim Solution Angelica CastilloDocument5 pagesPr2 Prelim Solution Angelica CastilloAngelica Joy CastilloNo ratings yet

- Chapter 7 Problems: Problem #14 P. 7-57 Problem #15 P. 7-58Document3 pagesChapter 7 Problems: Problem #14 P. 7-57 Problem #15 P. 7-58Zyrene Kei ReyesNo ratings yet

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- Business Tax & VAT ProblemsDocument2 pagesBusiness Tax & VAT ProblemsAyessa ViajanteNo ratings yet

- Journal Entry A. Gross MethodDocument1 pageJournal Entry A. Gross MethodEarl BandalaNo ratings yet

- Lesson 4 - The Steps in The Accounting CycleDocument5 pagesLesson 4 - The Steps in The Accounting Cycleamora elyseNo ratings yet

- Accounting For Merchandising OperationsDocument8 pagesAccounting For Merchandising Operationsamora elyseNo ratings yet

- Lesson 3 Business Transaction AnalysisDocument2 pagesLesson 3 Business Transaction Analysisamora elyseNo ratings yet

- Accounting as the Language of BusinessDocument9 pagesAccounting as the Language of Businessamora elyseNo ratings yet

- Lesson 1 Accounting and Its EnvironmentDocument10 pagesLesson 1 Accounting and Its Environmentamora elyseNo ratings yet

- Activity 1 - The Good LifeDocument1 pageActivity 1 - The Good Lifeamora elyseNo ratings yet

- Course OutlineDocument3 pagesCourse Outlineamora elyseNo ratings yet

- Understanding The SelfDocument18 pagesUnderstanding The Selfamora elyseNo ratings yet

- Uphsd FCLDocument7 pagesUphsd FCLamora elyseNo ratings yet

- Uphsd FCLDocument7 pagesUphsd FCLamora elyseNo ratings yet

- Microeconomics: Theory and Applications With Calculus (Perloff)Document74 pagesMicroeconomics: Theory and Applications With Calculus (Perloff)AmmarNo ratings yet

- 5.1 Quiz Fair Value Measurement AssetsDocument17 pages5.1 Quiz Fair Value Measurement AssetsSanath Fernando100% (1)

- Template-FinStatement Analysis v8 1Document14 pagesTemplate-FinStatement Analysis v8 1maahi7No ratings yet

- Low Cost CarriersDocument24 pagesLow Cost CarriersMuhsin Azhar ShahNo ratings yet

- Sa+Tourism+Annual+Report+2010 2011Document186 pagesSa+Tourism+Annual+Report+2010 2011Anonymous P1dMzVx100% (1)

- PROFITABILITY AND RISK: UNDERSTANDING CAPMDocument31 pagesPROFITABILITY AND RISK: UNDERSTANDING CAPMHoài ThuNo ratings yet

- Anti Competitive AgreementsDocument7 pagesAnti Competitive AgreementsfarazNo ratings yet

- Lecture 1Document15 pagesLecture 1Abahnya UkasyahNo ratings yet

- Improve Action 5. Explore Action: Epochs IV, V Epoch VDocument3 pagesImprove Action 5. Explore Action: Epochs IV, V Epoch VJose MariaNo ratings yet

- Sales and Distribution of HUL V/s RBDocument27 pagesSales and Distribution of HUL V/s RBSujit100% (8)

- Warren Buffett and Interpretation of Financial Statements - FLAME PDFDocument33 pagesWarren Buffett and Interpretation of Financial Statements - FLAME PDFAlexander Rios67% (3)

- Right Supply Chain for Your ProductDocument2 pagesRight Supply Chain for Your Productrjaliawala100% (4)

- Existence Equilibrium Competitive Economy PDFDocument2 pagesExistence Equilibrium Competitive Economy PDFCristinaNo ratings yet

- Leasing Land Calculating A Rental DpiDocument3 pagesLeasing Land Calculating A Rental DpiJunkim QuimadaNo ratings yet

- Iquanta SET 7Document2 pagesIquanta SET 7Autonomo UsNo ratings yet

- Sales of Goods Act MCQDocument21 pagesSales of Goods Act MCQshubham kumar50% (2)

- Free Cash Flow ValuationDocument14 pagesFree Cash Flow ValuationabcNo ratings yet

- Dip. Analytical Chemistry Business PlanDocument27 pagesDip. Analytical Chemistry Business Planjames mwangi100% (3)

- Deco504 Statistical Methods in Economics EnglishDocument397 pagesDeco504 Statistical Methods in Economics EnglishBipasha TalukdarNo ratings yet

- Trojan Investing Newsletter Volume 2 Issue 2Document6 pagesTrojan Investing Newsletter Volume 2 Issue 2AlexNo ratings yet

- Standard Costs and Variance Analysis PDFDocument3 pagesStandard Costs and Variance Analysis PDFMister GamerNo ratings yet

- Residual Valuations & Development AppraisalsDocument16 pagesResidual Valuations & Development Appraisalscky20252838100% (1)

- Opening Range BreakoutDocument5 pagesOpening Range BreakoutSangamesh SanguNo ratings yet

- Inter Company Price List SetupDocument6 pagesInter Company Price List SetupMahendar Naidu ANo ratings yet

- Understanding Demand, Supply and EquilibriumDocument5 pagesUnderstanding Demand, Supply and EquilibriumKiarra Nicel De TorresNo ratings yet

- Determination of Income and EmploymentDocument43 pagesDetermination of Income and EmploymentNainika ReddyNo ratings yet

- FIDIC Quick Reference Guide: Red BookDocument112 pagesFIDIC Quick Reference Guide: Red BookMateo Lunden100% (1)

- S K Somaiya Vinay Mandir Junior CollegeDocument1 pageS K Somaiya Vinay Mandir Junior CollegeAnisha NaharNo ratings yet

- Chapter 7 Books of Accounts Journals and LedgersDocument28 pagesChapter 7 Books of Accounts Journals and Ledgersjcxes Del rosarioNo ratings yet

- 4 P's of SunsilkDocument11 pages4 P's of SunsilkZeeshan FarhatNo ratings yet