Professional Documents

Culture Documents

Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Uploaded by

LjubiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019

Uploaded by

LjubiCopyright:

Available Formats

Portfolio of investments concluded

CREF Inflation-Linked Bond Account ■ December 31, 2019

Value % of net

Principal Issuer (000) assets

U.S. TREASURY SECURITIES—continued

$221,317,800 k United States Treasury Inflation Indexed Bonds 0.250%, 07/15/29 $ 223,441 3.4%

25,370,275 k United States Treasury Inflation Indexed Bonds 3.375%, 04/15/32 34,826 0.5

37,000,000 United States Treasury Note 1.875%, 07/31/26 37,120 0.6

37,000,000 United States Treasury Note 1.750%, 11/15/29 36,412 0.5

6,460,241 97.4

TOTAL GOVERNMENT BONDS (Cost $6,346,622) 6,609,596 99.7

SHORT-TERM INVESTMENTS

GOVERNMENT AGENCY DEBT

10,000,000 Federal Home Loan Bank (FHLB) 1.556%, 01/13/20 9,995 0.2

14,995,000 FHLB 1.571%, 01/23/20 14,982 0.2

24,977 0.4

TREASURY DEBT

1,950,000 United States Treasury Bill 1.520%, 01/02/20 1,950 0.0

2,400,000 United States Treasury Bill 1.528%, 01/30/20 2,398 0.0

4,348 0.0

TOTAL SHORT-TERM INVESTMENTS (Cost $29,322) 29,325 0.4

TOTAL PORTFOLIO (Cost $6,375,944) 6,638,921 100.1

OTHER ASSETS & LIABILITIES, NET (8,591) (0.1)

NET ASSETS $6,630,330 100.0%

_________

h All or a portion of these securities were purchased on a delayed delivery basis.

k Principal amount for interest accrual purposes is periodically adjusted based on changes in the Consumer Price Index.

Cost amounts are in thousands.

70 2019 Annual Report ■ College Retirement Equities Fund See notes to financial statements

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Equity: True-FalseDocument46 pagesEquity: True-FalsedewiNo ratings yet

- M&ADocument151 pagesM&APallavi Prasad100% (1)

- Short Strangle OptionsDocument5 pagesShort Strangle Optionsmikeyg2xNo ratings yet

- Duddella - Stock Market PatternsDocument60 pagesDuddella - Stock Market PatternsVimal RavalNo ratings yet

- Acca BPP Practice & Revision KitDocument505 pagesAcca BPP Practice & Revision KitHenry Fayol89% (9)

- Bahan Presentasi - Kel 1 - Financial Statement, Cash Flow and Analysis of Financial StatementDocument32 pagesBahan Presentasi - Kel 1 - Financial Statement, Cash Flow and Analysis of Financial StatementNASYRUDDIN HARAHAPNo ratings yet

- All Subj - Mock Board Exam BBDocument9 pagesAll Subj - Mock Board Exam BBMJ YaconNo ratings yet

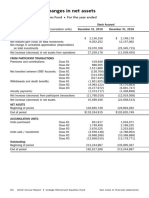

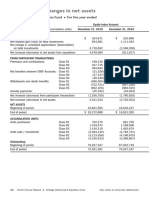

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDocument1 pageStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNo ratings yet

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDocument1 pageStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNo ratings yet

- Statements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019Document1 pageStatements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019LjubiNo ratings yet

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDocument1 pageStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNo ratings yet

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDocument1 pageStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNo ratings yet

- Statements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedDocument1 pageStatements of Changes in Net Assets: College Retirement Equities Fund For The Year EndedLjubiNo ratings yet

- Statements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019Document1 pageStatements of Operations: College Retirement Equities Fund For The Year Ended December 31, 2019LjubiNo ratings yet

- Statements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019Document1 pageStatements of Assets and Liabilities: College Retirement Equities Fund December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Global Equities Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Global Equities Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Money Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Money Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Social Choice Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Social Choice Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Portfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019Document1 pagePortfolio of Investments: CREF Inflation-Linked Bond Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Growth Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Growth Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Bond Market Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Bond Market Account December 31, 2019LjubiNo ratings yet

- Summary Portfolio of Investments: CREF Equity Index Account December 31, 2019Document1 pageSummary Portfolio of Investments: CREF Equity Index Account December 31, 2019LjubiNo ratings yet

- Riv Palm Lot 140 Ilot 8 06 BP 6940 ABIDJAN 06 Riv Palm Lot 140 Ilot 8Document1 pageRiv Palm Lot 140 Ilot 8 06 BP 6940 ABIDJAN 06 Riv Palm Lot 140 Ilot 8Alimatou Traore KossougroNo ratings yet

- Group Project SRPMDocument5 pagesGroup Project SRPMLakshmi SrinivasanNo ratings yet

- NPV Vs IRRDocument10 pagesNPV Vs IRRSaeed Ahmed KiyaniNo ratings yet

- Loan SyndicationDocument2 pagesLoan SyndicationChandan Kumar ShawNo ratings yet

- Post Task 3, Question 1Document4 pagesPost Task 3, Question 1SHARMAINE CORPUZ MIRANDANo ratings yet

- Green TransformationDocument17 pagesGreen TransformationCissiVRNo ratings yet

- Finance 2Document7 pagesFinance 2Vũ Hải YếnNo ratings yet

- Summer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDDocument71 pagesSummer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDSatyendraSinghNo ratings yet

- Accretion Dilution ModelDocument10 pagesAccretion Dilution ModelQuýt BéNo ratings yet

- Lecture 3Document29 pagesLecture 3Nurfaiqah AmniNo ratings yet

- 12 Test 2 Aud339 June 2022 SS 1 PDFDocument5 pages12 Test 2 Aud339 June 2022 SS 1 PDFNUR LYANA INANI AZMINo ratings yet

- Handouts ConsolidationSubsequent To Date of AcquisitionDocument5 pagesHandouts ConsolidationSubsequent To Date of AcquisitionCPANo ratings yet

- Fundcard: ICICI Prudential Value Discovery Fund - Direct PlanDocument4 pagesFundcard: ICICI Prudential Value Discovery Fund - Direct PlanHemant DujariNo ratings yet

- Intangible Assets Test Bank PDFDocument11 pagesIntangible Assets Test Bank PDFAB CloydNo ratings yet

- Deliverable 14 - Statutory Financial Statements Redachem Industries Maghreb V08042022Document3 pagesDeliverable 14 - Statutory Financial Statements Redachem Industries Maghreb V08042022Loubna MikouNo ratings yet

- Liquidity Management Tools in Collective Investment Schemes: Results From An IOSCO Committee 5 Survey To MembersDocument31 pagesLiquidity Management Tools in Collective Investment Schemes: Results From An IOSCO Committee 5 Survey To MembersMETANOIANo ratings yet

- Canara Robeco AMC TeamDocument29 pagesCanara Robeco AMC TeamSarfarazzKhanNo ratings yet

- Meaning and Features of AbsorptionDocument4 pagesMeaning and Features of AbsorptionPriyankaNo ratings yet

- Capital Markets Research in Accounting: S.P. KothariDocument1 pageCapital Markets Research in Accounting: S.P. KothariFebrian FebriNo ratings yet

- Impact of Inflation On The Financial StatementsDocument22 pagesImpact of Inflation On The Financial StatementsabbyplexxNo ratings yet

- ValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalValuEngine.comNo ratings yet

- Modul AKLII-2 - Investor Acc MethodDocument31 pagesModul AKLII-2 - Investor Acc MethodLisa SilviNo ratings yet

- What Is An ISDA Master AgreementDocument4 pagesWhat Is An ISDA Master AgreementUday JainNo ratings yet