Professional Documents

Culture Documents

3 Participation of ESS in Electricity Market:: 2.9 Barriers To DR and Future Improvements

Uploaded by

anaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Participation of ESS in Electricity Market:: 2.9 Barriers To DR and Future Improvements

Uploaded by

anaCopyright:

Available Formats

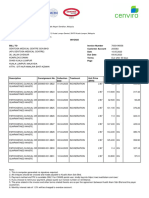

Financially, DRs reduces the electricity price. From Table 3, the percent of peak demand shaving 6.6%.

Translating this percent into saved money is out of the scope of this paper, this would be reserved to

quantification studies. To give an idea, one study by the Brattle Group quantified the value of demand

response, and it was estimated that less than 2% load curtailment in PJM’ s market would reduce energy

market prices between $8 and $25 per megawatt hour, or 5– 8% on average, depending on market

conditions. Which is a significant saving alongside other non-financial benefits [1].

Another study of the Price-Effect of Demand Response on the Iberian Market showed that a small amount

of load reduction of 5% resulted in 76.62 million euros [2].

2.9 Barriers to DR and future improvements:

Despite the promising results of different DR programs worldwide, their implementation is limited. The

main reason for that is the cost of initial investment in necessary equipment to integrate the programs. While

this financial burden may be bearable by large customers, small ones won’t be able to afford it. For example,

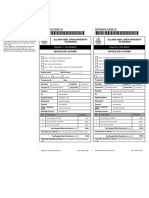

a metal industry company called Alcoa had to invest $750,000 between the telemetry infrastructure, the

EMS, the bidding interface and the database system to participate in DR program in MISO [6].

To overcome this burden, I think policymakers should intervene to encourage the development of new

affordable DR technology and /or subsidize the existing one. Governments should also encourage

widespread deployment of DR in collaboration with the electricity providers.

Another barrier to make attract consumers to participate in DR programs is the uncertainty surrounding the

financial gains from the DR programs. For instance, only 23% of customers enrolled in the available DR

programs in the U.S. in 2012 [6]. The rewards must exceed the inconvenience that is associated with load

curtailment for customers to participate in DRs. To remove this barrier, electricity providers should apply

robust analytical approaches to implement win-win DR programs.

3 Participation of ESS in Electricity Market :

3.1 Energy arbitrage:

Energy arbitrage consists of buying electricity from the wholesale market when the price is low and selling

it back when the price is high. This is would be profitable only if the return on investment is covered from

the profit made from the difference between the purchase and resale of the stored electricity energy.

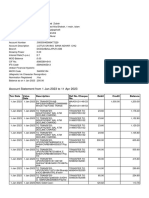

As an example, in [10] an estimation has been made to calculate the revenue of a 1 MW storage system.

The calculations gave an annual value ranging from €25k/MW (1 h of discharge) to €75k/MW (7 h of

discharge), for a revenue at 8% over 10 years of €170k–500k/MW which is not attractive.

11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Receipt: Transfer OverviewDocument3 pagesReceipt: Transfer OverviewMel Joy Natad100% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Images - Groupmeeting - A Passive Solution For Interference Estimation in WiFiDocument13 pagesImages - Groupmeeting - A Passive Solution For Interference Estimation in WiFianaNo ratings yet

- Figure 3:ESS Technology ClassificationDocument1 pageFigure 3:ESS Technology ClassificationanaNo ratings yet

- 2.5 Different DR ProgramsDocument1 page2.5 Different DR ProgramsanaNo ratings yet

- Region Annual Potential Peak Demand Savings (MW) Year-on-Year Change 2017 2018 MW %Document1 pageRegion Annual Potential Peak Demand Savings (MW) Year-on-Year Change 2017 2018 MW %anaNo ratings yet

- Proponent Project Contracted DR Capacity (MW) Scheduling Type Commitment Type Location (Trans-Mission Zone) Tembec Industries Inc. (Wholesale Consumer)Document1 pageProponent Project Contracted DR Capacity (MW) Scheduling Type Commitment Type Location (Trans-Mission Zone) Tembec Industries Inc. (Wholesale Consumer)anaNo ratings yet

- IELTS Writing Task 2/ IELTS Essay:: You Should Spend About 40 Minutes On This TaskDocument1 pageIELTS Writing Task 2/ IELTS Essay:: You Should Spend About 40 Minutes On This TaskanaNo ratings yet

- 13.5: Directional Derivatives and Gradient Vectors: Learning ObjectivesDocument12 pages13.5: Directional Derivatives and Gradient Vectors: Learning ObjectivesanaNo ratings yet

- Phasor Diagram ToolDocument2 pagesPhasor Diagram ToolanaNo ratings yet

- September 2020 VocabDocument56 pagesSeptember 2020 VocabanaNo ratings yet

- August 2020 VocabDocument111 pagesAugust 2020 VocabanaNo ratings yet

- Wipo Ip Dar 13 V MebratuDocument68 pagesWipo Ip Dar 13 V MebratuLeo PaladaNo ratings yet

- Kualiti Alam April 2023Document63 pagesKualiti Alam April 2023Zarifah AlamsahNo ratings yet

- Official Communication Lines For The Commercial & Tax Division of The High CourtDocument29 pagesOfficial Communication Lines For The Commercial & Tax Division of The High CourtSamuel NgatheNo ratings yet

- Distribution Requirements PlanningDocument8 pagesDistribution Requirements PlanningnishantchopraNo ratings yet

- Crescent Steel and Allied Products LTD.: Balance SheetDocument14 pagesCrescent Steel and Allied Products LTD.: Balance SheetAsadvirkNo ratings yet

- 1290 Bank Teller Interview Questions Answers GuideDocument7 pages1290 Bank Teller Interview Questions Answers GuideCrishawn BlakeNo ratings yet

- Impact-Report-2021-2022-1 2Document17 pagesImpact-Report-2021-2022-1 2Pratik AgarwalNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMian Husnain AliNo ratings yet

- HLL Vs Itc Big Fight 300805 SskiDocument35 pagesHLL Vs Itc Big Fight 300805 Sskimohit_rawatNo ratings yet

- This Study Resource Was: Alyssa Quast MKT 4330 Professor Pullig Individual Case-Write-up #4: Altius GolfDocument2 pagesThis Study Resource Was: Alyssa Quast MKT 4330 Professor Pullig Individual Case-Write-up #4: Altius GolfNic CannonNo ratings yet

- HRM502 - MID - 18364098 NDocument8 pagesHRM502 - MID - 18364098 NWalid Bin Zahid TonmoyNo ratings yet

- Q1 Summative Exam NO.2 EntrepDocument3 pagesQ1 Summative Exam NO.2 EntrepKemberly Desamparado Batictic100% (1)

- Z KP DOSqafsxrsn 5 FDocument6 pagesZ KP DOSqafsxrsn 5 FwelcommdzubairNo ratings yet

- Housing - Dr. PSN RaoDocument9 pagesHousing - Dr. PSN RaoNeha RaniNo ratings yet

- CandlesDocument6 pagesCandlesCrypto BitcoinNo ratings yet

- Organizational Study On VolvoDocument33 pagesOrganizational Study On Volvoಬಿ ಆರ್ ವೇಣು ಗೋಪಾಲ್No ratings yet

- Sustainable Business ReportDocument8 pagesSustainable Business ReportKIRTI PAWARNo ratings yet

- Sid Audit CourseDocument26 pagesSid Audit CourseSE02 Purvesh Agrawal100% (1)

- Aeon Report 2017Document226 pagesAeon Report 2017Lê Tố NhưNo ratings yet

- Activity Based CostingDocument7 pagesActivity Based CostingKHAkadsbdhsgNo ratings yet

- Sun Hung Kai CaseDocument17 pagesSun Hung Kai CaseHienka TranNo ratings yet

- Feasibility Studies (Building Surveying UiTM)Document11 pagesFeasibility Studies (Building Surveying UiTM)Muzzammil AyobNo ratings yet

- PAT DigestsDocument7 pagesPAT DigestsTsuuundereeNo ratings yet

- Case Problem 10.1:: Somerset Furniture Company's Global Supply ChainDocument2 pagesCase Problem 10.1:: Somerset Furniture Company's Global Supply ChainAlyssa CasabalNo ratings yet

- Summative Test (Bank Recon) : 1. Email AddressDocument12 pagesSummative Test (Bank Recon) : 1. Email AddressDennis Feliciano VirayNo ratings yet

- Business Questions - Edited-1697955343.6471043Document4 pagesBusiness Questions - Edited-1697955343.6471043Philis NafulaNo ratings yet

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Document13 pagesStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!HARDIK JAINNo ratings yet

- International Trade Transactions: Part I: HandoutsDocument324 pagesInternational Trade Transactions: Part I: HandoutsKhánh Sơn LêNo ratings yet

- ch12 - PPT - Inventory ManagementDocument22 pagesch12 - PPT - Inventory ManagementMariya NoorNo ratings yet