Professional Documents

Culture Documents

(Scan QR Code To Answer Pre-Assessment) : 1 of 22 (For Dfcamclp Used Only)

Uploaded by

maelyn calindongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Scan QR Code To Answer Pre-Assessment) : 1 of 22 (For Dfcamclp Used Only)

Uploaded by

maelyn calindongCopyright:

Available Formats

3

COURSE CODE AND TITLE: ACEL 1 – VALUATION CONCEPTS AND METHODS

TOPIC: EVALUATING FINANCIAL HEALTH OF THE FIRM

I. INTRODUCTION

This topic introduces significance of evaluating the financial health of the firm. We will

enumerate the different level of financial performance and explain how the management

uses them to evaluate financial performance and management control.

II. LEARNING OBJECTIVES

At the end of this module, the learners are expected to:

COGNITIVE

1. Enabling the students to analyze and interpret financial statements using different

financial ratios.

AFFECTIVE

1. To appreciate the significance of evaluating the financial health of the firm.

PSYCHOMOTOR

1. To enable them to perform and analyze financial ratios of the financial statements.

(SCAN QR CODE TO ANSWER PRE-ASSESSMENT)

III. PRE-ASSESSMENT

1. Name 2 common financial ratios used in evaluating the financial statements and

its uses.

2. How do you think it serves the company’s objective?

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

1 of 22

IV. PRESENTATION

LESSON INTRODUCTION

Evaluating the financial health of the firm is imperative for the continuous

monitoring and provides reasonable assurance of financial success of the company.

Various financial ratios were established in order to help the management in running their

business.

FINANCIAL STATEMENTS ANALYSIS

The financial statements of a company record important financial data on every

aspect of a business’s activities. As such they can be evaluated on the basis of past,

current, and projected performance. Financial statement analysis is the process of

analyzing a company's financial statements for decision-making purposes. External

stakeholders use it to understand the overall health of an organization as well as to

evaluate financial performance and business value. Internal constituents use it as a

monitoring tool for managing the finances.

KEY TAKEAWAYS

• Financial statement analysis is used by internal and external stakeholders to

evaluate business performance and value.

• Financial accounting calls for all companies to create a balance sheet, income

statement, and cash flow statement which form the basis for financial statement

analysis.

• Horizontal, vertical, and ratio analysis are three techniques analysts use when

analyzing financial statements.

Financial statements are maintained by companies daily and used internally for

business management. In general both internal and external stakeholders use the same

corporate finance methodologies for maintaining business activities and evaluating

overall financial performance.

When doing comprehensive financial statement analysis, analysts typically use

multiple years of data to facilitate horizontal analysis. Each financial statement is also

analyzed with vertical analysis to understand how different categories of the statement

are influencing results. Finally, ratio analysis can be used to isolate some performance

metrics in each statement and also bring together data points across statements

collectively.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

2 of 22

Financial analysis involves

• Comparing the firm’s performance to that of other firms in the same industry, and

• Evaluating trends in the firm’s financial position over time

LIMITATIONS OF FINANCIAL STATEMENT ANALYSIS

Although financial statement analysis is highly useful tool, the analyst should

consider its limitations. The limitations involve the comparability of financial data between

companies and the need to look beyond the ratios. The limitations are:

1. Information derived by the analysis are not absolute measures of performance in

any and all of the areas of business operations. They are only indicators of degrees

of profitability and financial strength of the firm.

2. Limitations inherent in the accounting data the analysis works with. These are

brought about by among others: (a) variation and lack of consistency in the

application of accounting principles, policies and procedures, (b) too-condensed

presentation of data, and (c) failure to reflect change in purchasing power

3. Limitations of the performance measures or tools and techniques used in the

analysis. Quantitative measurements are not absolute measures but should be

interpreted relative to the nature of the business and in the light of past, current

and future operations timing of transactions and the use of averages can also

affect the results obtained in applying the techniques in financial analysis.

4. Analysts should be alert to the potential for management to influence the outcome

of financial statements in order to appeal to creditors, investors and others.

Limitations of analysis may be overcome to some extent by finding appropriate

benchmarks used by most analysts such as the performance of comparable components

and the average performance of several companies in the same industry.

HORIZONTAL AND VERTICAL ANALYSIS

Horizontal analysis compares financial information over time, typically from past

quarters or years. Horizontal analysis is performed by comparing financial data from a

past statement, such as the income statement. When comparing this past information,

one will want to look for variations such as higher or lower earnings.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

3 of 22

Vertical analysis is a percentage analysis of financial statements. Each line item

listed in the financial statement is listed as the percentage of another line item. For

example, on an income statement each line item will be listed as a percentage of gross

sales. This technique is also referred to as normalization or common-sizing.

FINANCIAL RATIO ANALYSIS

Financial ratios are very powerful tools to perform some quick analysis of financial

statements. Financial ratio is a comparison in fraction, proportion, decimal or percentage

of two significant figures taken from financial statements.

The ratio can be categorized as follows:

1. Liquidity ratios. These ratios give us an idea of the firm’s ability to pay off debts

that are maturing within a year or within the next operating cycle. Liquidity ratios

are necessary if the firm is to continue operating.

2. Asset management ratios. These ratios give us an idea of how efficiently the firm

is using its assets. Good asset management ratios are necessary for the firm to

keep its costs low and thus, its net income high.

3. Debt management ratios. These ratios would tell us how the firm has financed

its assets as well as the firm’s ability to repay its long-term debt. Debt management

ratios indicate how risky the firm is and how much of its operating income must be

paid to bondholders rather than stockholders.

4. Profitability. These ratios give us an idea of how profitability the firm is operating

and utilizing its assets. Profitability ratios combine the asset and debt management

categories and how their effects on return on equity.

5. Market book ratios. These ratios which consider the stock price give us an idea

of what investors think about the firm and its future prospects. Market book ratios

tell us what investors think about the company and its prospects.

I. Ratios Used to Evaluate Short-Term Financial Position (Short-Term Solvency

and Liquidity

1. Current ratio

2. Acid-test ratio or quick ratio

3. Working capital to total assets

4. Cash flow liquidity ratio

5. Defensive interval ratio

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

4 of 22

II. Ratios Used to Evaluate Asset Liquidity and Management Efficiency

1. Trade receivable turnover

2. Inventory turnover

3. Working Capital Turnover

4. Percent of each current asset to total current assets

5. Current asset turnover

6. Payable turnover

7. Operating cycle

8. Days Cash

9. Free Cash flow

10. Investment or asset turnover

11. Sales to Fixed assets (plant assets turnover)

12. Capital intensity ratio

III. Ratios Used to Evaluate Long-Term Financial Position or Stability / Leverages

1. Debt ratio

2. Equity ratio

3. Debt to equity ratio

4. Fixed Assets to long-term liabilities

5. Fixed assets to total equity

6. Book value per share of ordinary shares

7. Times interest earned

8. Times preferred dividend requirement earned

9. Times fixed charges-earned.

IV. Ratios Used to Measure Profitability and Returns to urn onetInvestors

1. Gross profit margin

2. Operating profit margin

3. Net profit margin (Rate of return on net sales)

4. Cash Flow Margin

5. Rate of return on assets (ROA)

6. Rate of return on equity

7. Earnings per share

8. Price/earnings ratio

9. Dividend Payout

10. Dividend Yield

11. Dividends per share

12. Rate of return on average current assets

13. Rate of return per turnover of current assets

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

5 of 22

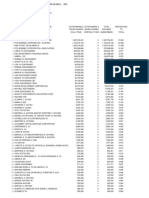

ILLUSTRATIVE CASE 6-1 (Financial Mgt Comp. Vol 2019-2020-E.BALATBAT)

The financial statements of EBC Enterprises, Inc. will be used to illustrate the use

of financial ratios in analyzing the company’s (1) liquidity. (2) activity or efficiency in

managing resources, (3) leverage, and (4) profitability.

Liquidity ratios are ratios that measure the firm’s ability to meet cash needs as

they arise (e.g. payment of accounts payable, bank loans and operating costs).

Activity ratios are ratios that measure the liquidity of specific assets and efficiency

in managing assets such as accounts receivable, inventory and fixed assets.

Leverage ratios are ratios that measure the extent of a firm’s financing the debt

relative to equity and its ability to cover interest and other fixed charges such as rent and

sinking fund payments.

Profitability ratios are ratios that measure the overall performance of the firm and

its efficiency managing assets, liabilities and equity.

The Statements of Financial Position as of December 31, 20X4 and 20X3, Income

Statements and Statements of Cash Flows of EBC Enterprises, Inc. for years 20X4, 20X3

and 20X2 are given below:

EBC Enterprise, Inc.

Statement of Financial Position

as of December 31, 20X4 and 20X3

20X4 20X3

Assets

Current Assets

Cash 2,030,500 1,191,000

Marketable Securities 2,636,000 4,002,000

Accounts Receivable 4,704,000 4,383,500

Allowance for doubtful accounts (224,000) (208,500)

Inventories 23,520,500 18,384,500

Prepaid Expenses 256,000 379,500

Total Current Assets 32,923,000 28,132,000

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

6 of 22

Noncurrent Assets

Property, Plant and Equipment

Land 405,500 405,500

Buildings and leasehold improvements 9,136,500 5,964,000

Equipment 10,761,500 6,884,000

Total 20,303,500 13,253,500

Less: Accumulated depreciation and amortization (5,764,000) (3,765,000)

Net property, plant and equipment 14,539,500 9,488,500

Other Assets 186,500 334,000

Total Noncurrent Asets 14,726,000 9,822,500

Total Assets 47,649,000 37,954,500

Liabilities and Shareholders' Equity

Current Liabilities

Accounts Payable 7,147,000 3,795,500

Notes payable - banks 2,807,000 3,006,000

Current maturities of long-term debt 942,000 758,000

Accrued Liabilities 2,834,500 2,656,500

Total Current Liabilities 13,730,500 10,216,000

Noncurrent Liabilities

Deferred Income Taxes 421,500 317,500

Long-term Debt 10,529,500 8,487,500

Total Noncurrent Liabilities 10,951,000 8,805,000

Total Liabilities 24,681,500 19,021,000

Shareholders' Equity

Ordinary Shares, paar value P1, authorizes 10,000,000 shares;

issued, 2,401,500 shares in 20X4 and 2,297,000 shares

in 20X3 2,401,500 2,297,000

Additional paid-in capital 478,500 455,000

Retained Earnings 20,087,500 16,181,500

Total Equity 22,967,500 18,933,500

Total Liability and Equity 47,649,000 37,954,500

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

7 of 22

EBC Enterprise, Inc.

Income Statements and Retained Earnings

for the Years Ended December 31, 20X4, 20X3 and 20X2

20X4 20X3 20X2

Net Sales 107,800,000 76,500,000 70,350,000

Cost of Goods Sold 64,682,000 45,939,500 40,803,000

Gross Profit 43,118,000 30,560,500 29,547,000

Selling and administrative expenses 16,332,000 13,191,000 12,749,000

Advertising 7,129,000 5,396,000 4,770,500

Lease Payments 6,529,000 3,555,500 3,633,500

Depreciation and amortization 1,999,000 1,492,000 1,250,500

Repairs and Maintenance 1,507,500 1,023,000 1,515,500

Total 33,496,500 24,657,500 23,919,000

Operating Income 9,621,500 5,903,000 5,628,000

Other Income (expenses)

Interest Income 211,000 419,000 369,000

Interest Expense (1,292,500) (1,138,500) (637,000)

Earnings before income taxes 8,540,000 5,183,500 5,360,000

Income Taxes 3,843,000 2,228,500 2,412,000

Net Income 4,697,000 2,955,000 2,948,000

Earnings per common share P 2.00 P 1.29 P 1.33

Statement of Retained Earnings

Retained Earnings at beginning of the year 16,181,500 14,157,500 12,130,000

Net Income 4,697,000 2,955,000 2,948,000

Cash dividends (20X4 - P0.33 per share;

20X3 - P 0.41 per share (791,000) (931,000) (920,500)

Retained Earnings at end of the year 20,087,500 16,181,500 14,157,500

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

8 of 22

REQUIRED:

Using the financial ratios, evaluate the company’s financial position and operating

results for the years 20X4 and 20X3.

Solution: EBC Enterprises, Inc.

I. Analysis of Liquidity or Short-term Solvency

Current ratio

Total Current Assets Primary test of solvency to meet current

Total Current Liabilibilities obligation from current assets as a going concern;

measure of adequacy of working capital.

32,923,000

20X4 = 2.40 times

13,730,500

28,132,000

20X3 = 2.75 times

10,216,000

Quick or Acid test ratio

Quick Assets

(Cash + Marketable Securities + A more severe test of immeadite solvency; test of

Accounts Receivable Net) ability to meet deamnds from current assets.

Total Current Liabilities

9,146,500

20X4 = 0.67 times

13,730,500

9,368,000

20X3 = 0.92 times

10,216,000

This is designed to measure how well a company can meet its obligations without

having to liquidate or depend too heavily on its inventory. Since inventory is not an

immediate source of cash and may not even be saleable in times of economic stress,

it is generally felt that to be properly protected; each peso of liabilities should be

backed by at least P1 of quick assets.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

9 of 22

Cash Flow Liquidity Ratio

Cash + Marketable Securities

Measures short-term liquidity by considering as

+ Cash Flow from Operating

cash resources (numerator) cash plus cash

Activities

equivalents plus cash flow from operating

Current Liabilities

activities.

2,030,500 + 2,636,000 + 5,012,000

20X4 = 0.70 times

13,703,500

1,191,000 + 4,002,000 + (1,883,500)

20X3 = 0.32 times

10,216,000

II. Analysis of Asset Liquidity and Asset Management Efficiency

Accounts Receivable Turnover

Net Sales*

Fomula =

Ave. Accounts Receivable balance

107,800,000

20X4 = 24.90 times

4,480,000 + 4,175,000

2

20X3 76,500,000 = 18.32 times

4,175,000**

*when available, credit sales can be substituted for net sales since credit sales

produce receivable.

**Assumed average for 20X3.

The accounts receivable turnover roughly measures how many times a

company’s accounts receivable have been turned into cash during the year.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

10 of 22

Average Collection Period

365 days

Fomula =

Accounts Receivable Turnover

or

Average Accounts Receivable

Average daily sale

365

20X4 = 14.6 days or 15 days

24.9

365

20X3 = 19.9 days or 20 days

18.32

Inventory Turnover

Cost of goods sold

Fomula =

Average Inventory balance

64,682,000

20X4 = 3.09 times

23,520,500 +18,384,500

2

20X3 45,939,500 = 2.50 times

18,384,500*

*assume average for 20X3.

The inventory turnover measures the efficiency of the firm in managing and

selling inventory.

Average Sale Period

365 days

Fomula =

Inventory Turnover

365 days

20X4 = 118 days

3.09

20X3 365 days

= 146 days

2.5

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

11 of 22

The number of days being taken to sell the entire inventory one time (called the

average sale or conversion period) is computed by dividing 365 days by the inventory

turnover period. Generally, the faster inventory sells, the fewer funds are tied up in

inventory and more profits are generated.

Fixed Asset Turnover

Net Sales

Fomula =

Average net property, plant and equipment

107,800,000

20X4 = 8.97 times

14,539,500 + 9,488,500

2

20X3 76,500,000

= 8.06 times

9,488,500 *

*Assumed average for 20X3.

The fixed asset turnover is another approach to assessing management’s

effectiveness in generating sales from investments in fixed assets particularly for a

capital-intensive firm.

Total Asset Turnover

Net Sales

Fomula =

Average Total Assets

107,800,000

20X4 = 2.52 times

47,649,000 + 37,954,500

2

20X3 76,500,000

= 2.02 times

37,954,500*

Total asset turnover is a measure of the efficiency of management to generate

sales and thus earn more profit for the firm.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

12 of 22

III. Analysis of Leverage: Debt Financing and Coverage

Debt Ratio

Total Liabilities

Fomula =

Total Asseets

24,681,500

20X4 = 51.80%

47,649,000

20X3 19,021,000

= 50.10%

37,954,500

The debt ratio measures the proportion of all assets that are financed with debt.

Generally, the higher the proportion of debt, the greater the risk because creditors

must be satisfied before owners in the event of bankruptcy.

The use of debt involves risk because debt carries a fixed obligation in the form of

interest charges and principal repayment. Failure to satisfy the fixed charges

associated with debt will ultimately result in bankruptcy.

Debt to Equity Ratio

Total Liabilities

Fomula =

Total Equity

24,681,500

20X4 = 107.46%

22,967,500

20X3 19,021,000

= 100.46%

18,933,500

The debt to equity ratio measures the riskiness of he firm’s capital structure in

terms of relationship between the funds supplied by creditors (debt) and investors

(equity).

Times Interest Earned

Operating Profit

Fomula =

Interest Expense

9,621,500

20X4 = 7.44 times

1,292,500

20X3 5,903,000

= 5.18 times

1,138,500

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

13 of 22

Times interest earned ratio is the most common measure of the ability of a firm’s

operations to provide protection to long-term creditors. The more times a company can

cover its annual interest expense from operating earnings, he better off will be the firm’s

investors.

Fixed Charge Coverage

Operating Profit + Lease Payments

Fomula =

Interest Expense + Lease Payments

9,621,500 + 6,529,000

20X4 = 2.06 times

1,292,500 + 6,529,000

20X3 5,903,000 + 3,555,500

= 2 times

1,138,500 + 3,555,500

The fixed charge coverage measures the firm’s coverage capability to cover not

only interest payments but also the fixed payment associated with leasing which must

be met annually.

IV. Operating Efficiency and Profitability

Gross Profit Margin

Gross Profit

Fomula =

Net Sales

43,118,000

20X4 = 40%

107,800,000

20X3 30,560,500

= 39.95%

76,500,000

Gross profit margin which shows the relationship between sales and the cost of

goods sold, measures the ability of a company both to control costs and inventories or

manufacturing of products and to pass along price increases through sales to

customers.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

14 of 22

Operating Profit Margin

Operating Profit

Fomula =

Net Sales

9,621,500

20X4 = 8.9%

107,800,000

20X3 5,903,000

= 7.7%

76,500,000

The operating profit margin is a measure of overall operating efficiency and

incorporates all of the expenses associated with ordinary or normal course of business

activities.

Net Profit Margin

Net Income

Fomula =

Net Sales

4,697,000

20X4 = 4.36%

107,800,000

20X3 2,955,000

= 3.86%

76,500,000

Net profit margin measures profitability after considering all revenue and

expenses, including interest, taxes and nonoperating items such as extraordinary items,

cumulative effect of accounting change, etc.

Cash Flow Margin

Cash Flow from Operating Activities

Fomula =

Net Sales

5,012,000

20X4 = 4.65%

107,800,000

20X3 -1,883,500

= -2.5%

76,500,000

This measures the ability of the firm to translate sales to cash to enable it to

service debt, pay dividends or invest in new capital assets.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

15 of 22

Summary of Financial Statement Analysis of EBC, Inc.

Short-Term Liquidity and Activity

Short term liquidity analysis is of particular significance to trade and short-

term creditors, management and other parties concerned with the ability of a firm

to meet near-term demands for cash.

EBC’s current and quick ratios decreased indicating a deterioration of short-

term liquidity. However, the cash flow liquidity ratio improved in 20X4 after a

negative cash generation in 20X3.

The average collection period for accounts receivable and the inventory

turnover improved in 20X4 which could indicate improvement in the quality of

accounts receivable and liquidity of inventory. The increase in inventory level has

been accomplished by reducing holdings of cash and cash equivalents. This

represents a trade-off of highly liquid assets for potentially less liquid assets. The

efficient management of inventories is critical for the firm’s ongoing liquidity.

Presently, there appears to be a major problems with firm’s short-term

liquidity position.

Long-Term Solvency

The debt ratios for EBC show a steady increase in the use of borrowed

funds. Total debt has increased relative in total assets, long-term debt has

increased as a proportion of the firm’s permanent financing and external or debt

financing has risen relative to internal financing.

Why has debt increase? The statement of cash flows shows the EBC has

substantially increased its investment in capital or fixed assets and their investment

have been financed largely by borrowing especially in 20X3 when the firm had a

rather sluggish operating performance and no internal cash generation.

Given the increased level of borrowing, the times interest earned and fixed

charge coverage improved slightly in 20X4. These ratios should however be

monitored closely in the future particularly if EBC continues to expand.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

16 of 22

Operating Efficiency and Profitability

As noted earlier, EBC has increased its investment in fixed asset as a result

of store expansion. The asset turnover increased in 20X4, the progress traceable

to improved management of inventories and receivable. There has been

substantial sales growth which suggests future performance potential.

The gross profit margin was stable, a positive sign in the light of new store

openings featuring discounted and “sale” items to attract customers. The firm also

managed to improve its operating profit margin in 20X4 principally due to the firm’s

ability to control operating costs. The net profit margin also improved despite

increased interest and tax expenses and a reduction in interest income from

marketable security investment.

CONCLUSION

It appears that EBC Enterprises, Inc. is well positioned for future growth.

Close monitoring the firm’s management of inventories is important considering

the size of the company’s capital tied up in it. The expansion in their operation may

necessitate aa sustained effort to advertise more, to attract more customers to

both new and old areas. EBC has financed much of its expansion with debt, and

so far, its shareholders have benefited from the use of debt through financial

leverage. The company should however be cautious of the increased risk

associated with the debt financing.

BREAK-EVEN POINT

The break‐even point represents the level of sales where net income equals zero.

In other words, the point where sales revenue equals total variable costs plus total fixed

costs, and contribution margin equals fixed costs. Using the previous information and

given that the company has fixed costs of $300,000, the break‐even income statement

shows zero net income.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

17 of 22

This income statement format is known as the contribution margin income

statement and is used for internal reporting only.

The $1.80 per unit or $450,000 of variable costs represent all variable costs

including costs classified as manufacturing costs, selling expenses, and administrative

expenses. Similarly, the fixed costs represent total manufacturing, selling, and

administrative fixed costs.

Break‐even point in dollars. The break‐even point in sales dollars of $750,000 is

calculated by dividing total fixed costs of $300,000 by the contribution margin ratio of

40%.

Another way to calculate break‐even sales dollars is to use the mathematical equation.

In this equation, the variable costs are stated as a percent of sales. If a unit has a

$3.00 selling price and variable costs of $1.80, variable costs as a percent of sales is 60%

($1.80 ÷ $3.00). Using fixed costs of $300,000, the break‐even equation is shown below.

The last calculation using the mathematical equation is the same as the break‐

even sales formula using the fixed costs and the contribution margin ratio previously

discussed in this chapter.

Break‐even point in units.

The break‐even point in units of 250,000 is calculated by dividing fixed costs of

$300,000 by contribution margin per unit of $1.20.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

18 of 22

The break‐even point in units may also be calculated using the mathematical

equation where “X” equals break‐even units.

Again, it should be noted that the last portion of the calculation using the

mathematical equation is the same as the first calculation of break‐even units that used

the contribution margin per unit. Once the break‐even point in units has been calculated,

the break‐even point in sales dollars may be calculated by multiplying the number of

break‐even units by the selling price per unit. This also works in reverse. If the break‐

even point in sales dollars is known, it can be divided by the selling price per unit to

determine the break‐even point in units.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

19 of 22

MASTER BUDGET

A master budget consists of a projected income statement (planned operating

budget) and a projected balance sheet (financial budget) showing the organization’s

objectives and proposed ways of attaining them.

A master budget is the central planning tool that a management team uses to direct

the activities of a corporation, as well as to judge the performance of its various

responsibility centers.

The budgets that roll up into the master budget include:

• Direct labor budget

• Direct materials budget

• Ending finished goods budget

• Manufacturing overhead budget

• Production budget

• Sales budget

• Selling and administrative expense budget

GENERALIZATION

Financial ratios give the stakeholders a way of interpreting the financial position

and financial condition of the company that enable them to make sound judgement in

decision making. Despite the help of these financial ratios in assessing a firms’ financial

health, one must understand that decision and judgment cannot be solely relied with this

financial ratio because of risk involvement, limitations and inability to predict future events.

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

20 of 22

APPLICATION

Financial ratio analysis is conducted by three main groups of analysts: credit

analysts, stock analysts and managers. What is the primary emphasis of each group, and

how would that emphasis affect the ratios they focus on?

EVALUATION

Explain the concept of liquidity and why it is crucial to company survival.

ASSIGNMENT / REINFORCEMENT

The Statement of Financial Position for Bryan Corporation is shown below. Sales for the year were

P3,040,000 with 75% of sales on credit.

Bryan Corporation

Statement of Financial Position

as of December 31, 20X4

Asset Liabiliies and Owner's Equity

Cash 50,000 Accounts payable 220,000

Accounts Receivable 280,000 Accrued Taxes 80,000

Inventory 240,000 Bonds payable 118,000

Plant and Equipment 380,000 Common stock 100,000

Paid-in capital 150,000

Retained Earnings 282,000

Total Assets 950,000 Total Liabilities and Owners' Equity 950,000

Required:

a. Compute the current ratio

b. Quick ratio

c. Debt-to-total-assets ratio

d. Asset turnover

e. Average collection period

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

21 of 22

REFERENCES:

• Financial Management Comprehensive Volume 2019-2020 Edition – Ma. Elenita Balatbat

Cabrera

• https://www.cliffsnotes.com/study-guides/accounting/accounting-principles-ii/cost-

volume-profit-relationships/cost-volume-profit-

analysis#:~:text=Cost%2Dvolume%2Dprofit%20(CVP,Total%20fixed%20costs%20are%

20constant.

• https://www.accountingtools.com/articles/2017/5/14/master-budget

• https://courses.lumenlearning.com/sac-managacct/chapter/master-and-fleible-budgets/

(FOR DFCAMCLP USED ONLY) Prepared by: AGF

22 of 22

You might also like

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangNo ratings yet

- Cost Accounting Flashcards - QuizletDocument7 pagesCost Accounting Flashcards - QuizletWilliam SusetyoNo ratings yet

- Chapter 7 Asset Investment Decisions and Capital RationingDocument31 pagesChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNo ratings yet

- FAR 0-ValixDocument5 pagesFAR 0-ValixKetty De GuzmanNo ratings yet

- Intermediate Accounting 2Document2 pagesIntermediate Accounting 2stephbatac241No ratings yet

- Marginal & Differential CostingDocument11 pagesMarginal & Differential CostingShahenaNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- A Company Sells and Services Photocopying Machines Its Sales DepartmentDocument2 pagesA Company Sells and Services Photocopying Machines Its Sales DepartmentAmit Pandey0% (1)

- Financial SystemDocument7 pagesFinancial SystemsaadsaaidNo ratings yet

- Set A Strat CostDocument11 pagesSet A Strat CostArsenio Nague RojoNo ratings yet

- Time Value of MoneyDocument58 pagesTime Value of MoneyJennifer Rasonabe100% (1)

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitDocument5 pagesSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiNo ratings yet

- Chapter8 Fiancial Reporting by James HallDocument43 pagesChapter8 Fiancial Reporting by James Hallkessa thea salvatoreNo ratings yet

- Pas 28Document6 pagesPas 28AnneNo ratings yet

- Problem 5Document3 pagesProblem 5AyhuNo ratings yet

- Summary of Ifrs 5Document4 pagesSummary of Ifrs 5Divine Epie Ngol'esuehNo ratings yet

- Chapter # 8 Exercise & Problems - AnswersDocument8 pagesChapter # 8 Exercise & Problems - AnswersZia UddinNo ratings yet

- BSA181A Interim Assessment Bapaud3X: PointsDocument8 pagesBSA181A Interim Assessment Bapaud3X: PointsMary DenizeNo ratings yet

- MODULE 8 (Part 1)Document6 pagesMODULE 8 (Part 1)trixie maeNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionDocument1 pageCHAPTER 17 Borrowing Cost Problem 17-7 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedRazel MhinNo ratings yet

- Action Systems Develop Because There Are Hybrid CostingDocument2 pagesAction Systems Develop Because There Are Hybrid CostingAndriaNo ratings yet

- The Market For Foreign Exchange: Chapter FiveDocument30 pagesThe Market For Foreign Exchange: Chapter FiveshouqNo ratings yet

- Ford Motor Company A Case Study Presentation With TransitionsDocument22 pagesFord Motor Company A Case Study Presentation With TransitionsMelissa FabillarNo ratings yet

- Chapter 13 - Principles of DeductionsDocument13 pagesChapter 13 - Principles of DeductionsjellNo ratings yet

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Document10 pagesACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- Client Selection and RetentionDocument20 pagesClient Selection and RetentionJurie MayNo ratings yet

- 2 Inventory Cost Flow Intermediate Accounting ReviewerDocument3 pages2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- Auditing and Assurance PDFDocument320 pagesAuditing and Assurance PDFCasey Mae NeriNo ratings yet

- Activities - Cash Payments To Acquire PropertyDocument2 pagesActivities - Cash Payments To Acquire PropertyPrecious ViterboNo ratings yet

- Introduction To Audit Services and Financial Statements AuditDocument35 pagesIntroduction To Audit Services and Financial Statements AuditBryzan Dela CruzNo ratings yet

- Business Combinations (Ifrs 3)Document29 pagesBusiness Combinations (Ifrs 3)anon_253544781No ratings yet

- Managerial Accounting 15th Ed. GNB - Chapter 6 Variable CostingDocument11 pagesManagerial Accounting 15th Ed. GNB - Chapter 6 Variable CostingAivie PangilinanNo ratings yet

- Intro To Cost Accounting ReviewerDocument2 pagesIntro To Cost Accounting ReviewerJosephine YenNo ratings yet

- C1 The Accounting ProfessionDocument5 pagesC1 The Accounting ProfessionAllaine ElfaNo ratings yet

- FM - Cost of CapitalDocument26 pagesFM - Cost of CapitalMaxine SantosNo ratings yet

- Chapter 4Document20 pagesChapter 4Oskard MacoNo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- Pas 8Document1 pagePas 8Ella MaeNo ratings yet

- Management Accounting Practices of The Philippines Small and Medium-Sized EnterprisesDocument21 pagesManagement Accounting Practices of The Philippines Small and Medium-Sized Enterprisespamela dequillamorteNo ratings yet

- Chapter 19Document6 pagesChapter 19Joan Angelica ManaloNo ratings yet

- C2 Objective of Financial ReportingDocument5 pagesC2 Objective of Financial ReportingAllaine ElfaNo ratings yet

- 1 The Basis of Strategy: StructureDocument17 pages1 The Basis of Strategy: StructureAlliah Gianne JacelaNo ratings yet

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- BSBA in Operations ManagementDocument8 pagesBSBA in Operations ManagementCes UniqueNo ratings yet

- Leases Slides - FinalDocument34 pagesLeases Slides - FinalAnonymous n3n1Ae100% (1)

- (Intermediate Accounting 3) : Lecture AidDocument28 pages(Intermediate Accounting 3) : Lecture AidFrost Garison100% (1)

- Lauderbach TB Ch09Document16 pagesLauderbach TB Ch09Nadine SantiagoNo ratings yet

- CH 09Document78 pagesCH 09Jeep RajNo ratings yet

- PFRS 17Document2 pagesPFRS 17Annie JuliaNo ratings yet

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- 1 - Decentralization-Responsibility AccountingDocument40 pages1 - Decentralization-Responsibility AccountingZedie Leigh VioletaNo ratings yet

- FIMA 40023 Security Analysis FinalsDocument14 pagesFIMA 40023 Security Analysis FinalsPrincess ErickaNo ratings yet

- Property, Plant, and Equipment: Acquisition and Disposal: Chapter ObjectivesDocument20 pagesProperty, Plant, and Equipment: Acquisition and Disposal: Chapter ObjectivesCatherine Joy MoralesNo ratings yet

- Ae 123 Management ScienceDocument7 pagesAe 123 Management ScienceMa MaNo ratings yet

- 1655965117leases - IFRS 16Document9 pages1655965117leases - IFRS 16Akash BenedictNo ratings yet

- Level Up - Conceptual Framework ReviewerDocument15 pagesLevel Up - Conceptual Framework Reviewerazithethird100% (1)

- Investment Property Accounting StandardDocument18 pagesInvestment Property Accounting StandardvijaykumartaxNo ratings yet

- Sai Naik ProjectDocument78 pagesSai Naik ProjectSAIsanker DAivAMNo ratings yet

- Sanico, Myra Matutina, Samantha Salvador, Armalyn ToDocument2 pagesSanico, Myra Matutina, Samantha Salvador, Armalyn Tomaelyn calindongNo ratings yet

- Course Code and Title: ACED 7Document18 pagesCourse Code and Title: ACED 7maelyn calindongNo ratings yet

- ACED 7 - Financial Management Module 5Document15 pagesACED 7 - Financial Management Module 5maelyn calindongNo ratings yet

- Module 5 ACED1 LUCIA LAZODocument7 pagesModule 5 ACED1 LUCIA LAZOmaelyn calindongNo ratings yet

- Major Ethical Issues in EntrepreneurshipDocument18 pagesMajor Ethical Issues in Entrepreneurshipmaelyn calindong100% (1)

- Course Code and Title: ACED 7Document16 pagesCourse Code and Title: ACED 7maelyn calindongNo ratings yet

- SMFI Partner Schools 2021 - 0Document2 pagesSMFI Partner Schools 2021 - 0maelyn calindongNo ratings yet

- Lesson 2: Virus Updates Read The Latest Business News and Analysis About The Coronavirus OutbreakDocument2 pagesLesson 2: Virus Updates Read The Latest Business News and Analysis About The Coronavirus Outbreakmaelyn calindongNo ratings yet

- ACED 7 Financial Management - Module 4Document10 pagesACED 7 Financial Management - Module 4maelyn calindongNo ratings yet

- Module 2 - Assessing Financial Health of The Firm - Week 2 4Document14 pagesModule 2 - Assessing Financial Health of The Firm - Week 2 4maelyn calindongNo ratings yet

- Dr. Filemon C. Aguilar Memorial College of Las Piñas: Aced 4 - Managerial EconomicsDocument11 pagesDr. Filemon C. Aguilar Memorial College of Las Piñas: Aced 4 - Managerial Economicsmaelyn calindongNo ratings yet

- Learning OutcomesDocument3 pagesLearning Outcomesmaelyn calindongNo ratings yet

- Managerial Economics M3Document10 pagesManagerial Economics M3maelyn calindongNo ratings yet

- ACED 7 Financial Management Module 1Document10 pagesACED 7 Financial Management Module 1maelyn calindongNo ratings yet

- Dr. Filemon C. Aguilar Memorial College of Las Piñas: Aced 4 - Managerial EconomicsDocument7 pagesDr. Filemon C. Aguilar Memorial College of Las Piñas: Aced 4 - Managerial Economicsmaelyn calindongNo ratings yet

- Lesson 1Document2 pagesLesson 1maelyn calindongNo ratings yet

- Metaphors and Theories of Globalization: Ge103 - The Contemporary WorldDocument5 pagesMetaphors and Theories of Globalization: Ge103 - The Contemporary Worldmaelyn calindongNo ratings yet

- Robertson'S and Ritzer'S Conceptions of Globalization: Marijad@fzf - Ukim.edu - MKDocument16 pagesRobertson'S and Ritzer'S Conceptions of Globalization: Marijad@fzf - Ukim.edu - MKmaelyn calindongNo ratings yet

- Introduction To The Study of Globalization: Ge103 - The Contemporary WorldDocument4 pagesIntroduction To The Study of Globalization: Ge103 - The Contemporary Worldmaelyn calindongNo ratings yet

- 21st Century LiteratureDocument18 pages21st Century Literaturemaelyn calindongNo ratings yet

- Approval SheetangoringDocument1 pageApproval Sheetangoringmaelyn calindongNo ratings yet

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- Cir 42 - 2019-20 - Compassionate AppointmentsDocument13 pagesCir 42 - 2019-20 - Compassionate Appointmentskiran dupati100% (1)

- Presentation On Business Icon: by Ankita Sthapak Roll No.57Document9 pagesPresentation On Business Icon: by Ankita Sthapak Roll No.57Ankita SthapakNo ratings yet

- Absa Multi Managed Preserver Fund of Funds PDFDocument2 pagesAbsa Multi Managed Preserver Fund of Funds PDFmarko joosteNo ratings yet

- Previous Years Question Papers - Financial Services - Cpc6aDocument8 pagesPrevious Years Question Papers - Financial Services - Cpc6ajeganrajrajNo ratings yet

- FinanceDocument81 pagesFinanceAyesha GuptaNo ratings yet

- Launch Ncubator Hedge FundDocument12 pagesLaunch Ncubator Hedge FundMasterWinNo ratings yet

- Your Kotak Corporate Credit Card Statement: Account SummaryDocument2 pagesYour Kotak Corporate Credit Card Statement: Account SummaryManikantaNo ratings yet

- Financial Accounting Course OutlineDocument4 pagesFinancial Accounting Course OutlineFantayNo ratings yet

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDocument1 pageStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance Unitee206023No ratings yet

- JGS-List of The Top100 Stockholders and PDTC Participants As of September 30, 2020Document6 pagesJGS-List of The Top100 Stockholders and PDTC Participants As of September 30, 2020ADFAfsNo ratings yet

- Effect of Digital Currency On Finance and Accounting.: Vishal Rao S School of Commerce B-Com Honors 4 Semester B-SectionDocument8 pagesEffect of Digital Currency On Finance and Accounting.: Vishal Rao S School of Commerce B-Com Honors 4 Semester B-SectionVishal SNo ratings yet

- Proforma Invoice: Description Quantity Price ($) Total ($)Document2 pagesProforma Invoice: Description Quantity Price ($) Total ($)Abdi Ahmed YuyaNo ratings yet

- ch04 5eDocument32 pagesch04 5eAulia Thalita SadaNo ratings yet

- SWIFT FIN Payment Format Guide For European AcctsDocument19 pagesSWIFT FIN Payment Format Guide For European AcctsShivaji ManeNo ratings yet

- Kec Internatinal Ltd.Document14 pagesKec Internatinal Ltd.Rahul RathoreNo ratings yet

- Real Estate MortgageDocument3 pagesReal Estate MortgageJuven MoradaNo ratings yet

- Unit 2 Introduction To Acounting IDocument10 pagesUnit 2 Introduction To Acounting IHang NguyenNo ratings yet

- I Was Paying Fee For Neet Application Form. But Due To Some Technical Error Payment Was Not Completed But The Money Is DeductedDocument1 pageI Was Paying Fee For Neet Application Form. But Due To Some Technical Error Payment Was Not Completed But The Money Is DeductedGanisius 2020No ratings yet

- April StatementDocument2 pagesApril StatementRAHUL SINGH50% (2)

- Answers To Exercises: ExerciseuDocument69 pagesAnswers To Exercises: ExerciseuGunjan GaganNo ratings yet

- Malelang - Activity No. 1 IA CharterDocument22 pagesMalelang - Activity No. 1 IA CharterRoseanneNo ratings yet

- Introduction To Financial Ratios and The Cool PLC ExerciseDocument14 pagesIntroduction To Financial Ratios and The Cool PLC ExerciseFebri AndikaNo ratings yet

- Agricultural Cooperative Society ReportDocument44 pagesAgricultural Cooperative Society Reportckeerthana56No ratings yet

- Happy Tails Inc Has A September 1 Accounts Payable BalanceDocument1 pageHappy Tails Inc Has A September 1 Accounts Payable BalanceM Bilal SaleemNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- Advanced Finance, Banking and Insurance SamenvattingDocument50 pagesAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNo ratings yet

- Tax Invoice Tax Invoice: Venturehaven Pte LTDDocument2 pagesTax Invoice Tax Invoice: Venturehaven Pte LTDisty5nntNo ratings yet

- Chapters Marathon Questionnaire Group 2 Nov 22Document27 pagesChapters Marathon Questionnaire Group 2 Nov 22Abhishek GoenkaNo ratings yet

- Chapter 1 (Updated) - Audit On Financial StatementDocument100 pagesChapter 1 (Updated) - Audit On Financial Statement黄勇添No ratings yet