Professional Documents

Culture Documents

This Content Downloaded From 122.170.126.143 On Sun, 28 Mar 2021 09:32:50 UTC

Uploaded by

Gaurav AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Content Downloaded From 122.170.126.143 On Sun, 28 Mar 2021 09:32:50 UTC

Uploaded by

Gaurav AgrawalCopyright:

Available Formats

Governance of Mutual Funds and the Institution of Trustee

Author(s): G. Sethu

Source: Economic and Political Weekly , Apr. 15-21, 2006, Vol. 41, No. 15 (Apr. 15-21,

2006), pp. 1413-1416

Published by: Economic and Political Weekly

Stable URL: https://www.jstor.org/stable/4418074

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

Economic and Political Weekly is collaborating with JSTOR to digitize, preserve and extend

access to Economic and Political Weekly

This content downloaded from

122.170.126.143 on Sun, 28 Mar 2021 09:32:50 UTC

All use subject to https://about.jstor.org/terms

H T PIarekh finance forum

Governance of Mutual

lower middle class people to invest their

savings, whatever they may be - their

savings may be small or meagre - in any

Funds and the Institution

industrial enterprise or commercial under-

taking. In other words, they do not get any

benefit from the increasing prosperity of

of rustee

the country. They could do that only if two

conditions are satisfied, namely, that the

value of the shares of the industrial unit

is very low so that they can buy them with

The Securities and Exchange Board of India has in the recent past

their meagre savings and, secondly, they

taken big steps in fostering good governance in the mutualfund are prepared to take risk about the fortunes

of that individual unit. In order to diversify

industry, which provides an opportunity to move towards further

the risk, in order to reduce the risk to the

strengthening the governance structures and institutions in the minimum - the risk of investment - and

industry. This article examines afew alternative approaches to also give them a chance to invest any

strengthening mutual find governance through strengthening the amount, even as small as Rs 10, this Unit

institution of the trustee. Trust is being set up." The economic policy-

makers were convinced that mutual funds

G SETHU could offer a safe conduit for household

responding to the needs and circumstances

over the years. The Asian Development participation in equity markets.

Jnvestrment trusts1 had been in ex- Bank (2004) notes with satisfaction that Mutual funds have different kinds of

istence in India since 1869. Notable "unlike many developing markets... investors

the participating.5 While many would

among them were the IndustrialIndian mutual funds market broadly beisquite aware of what is happening to their

Investment Trust establ i shed by Premchand money, there are retail investors who are

able to function effectively, and has a legal

Roychand in 1933 and the Investment and regulatory framework that is farunawarein of the risks associated with invest-

Corporation of India organised by the Tatas advance of many markets, though some ing in the securities markets.6 The latter

in 1936. Though the government of India improvements can be made in both areas." pass the responsibility of managing the

deliberated the setting up of a mutual fund money to the fund houses. This delegation

in 1931, the fund industry, as we know Need for Mutual Funds is more of a fiduciary responsibility rather

it today, came to India in 1963 when Unit than a contractual responsibility. Consider-

Trust of India was established.2 UTI made When the economy is in a growth phase,

able regulatory oversight is required to

several pioneering efforts3 in the industry firms require considerable external financ-

ensure effective exercise of such fiduciary

and secured a strong place in the Indian ing. Unless significant equity capital is

responsibi lity. The power of a robust mutual

investmenet universe. In 1987, nationalised forthcoming, it would be difficult to foster

fund regulatory framework and the result-

banks and public sector insurance compa- innovation and enterprise, the twining

en-investor confidence to augment the

supply of equity capital seems substantial.

nies were allowed entry to the fund indus- gines of economic growth. Consequently,

try followed by the private sector and lack of equity capital might result in nations

international players in 1993. The indus- forfeiting high growth rates. Households

Mutual Fund: A Unique Concept

try has grown in terms of its size, number in poor economies do not have the ability

The mutual fund is a special case of a

of players, assets under management and to assume high levels of risk. Hence, the

the management processes. supply of risk capital in developingcollective

na- investment scheme. In a business

The erstwhile Unit Trust of India was tions would be limited. Any mechanism firm, the customer is different from the

governed by the UTI Act, 1963. The SEBI shareholder. In a collective investment

that mitigates risk would add to the avail-

(Mutual Fund) Regulations, 1996 govern scheme, the shareholder himself is the

ability of equity capital at the margin.

the entire industry at present. The regu- It is worth recalling the words of customer. When a customer wishes to

byT Krishnamachary when he introduceddisengage from a company, he merely

lation is continuously being fine-tuned T

way of amendmlents and circulars. the

TheUTI bill in Parliament in November stops buying things from that company.

regulatory process in the fund industry1963.

is He said "The Unit Trust provides In customer-centric markets, companies

marked by the active involvement of an theopportunity for the middle and lower even accept the returns and compensate

income groups to acquire without much

industry body, the Association of Mutual

Funds in India (AMFI)4 in the consultative

difficulty property in the form of shares..."The H T Ptarekh Finance Forum is

Morarka, a member of Parliament, whileedited and managed by Errol D'Souza,

process. It is acknowledged generally that

participating in the debate pointed out,

much has been done by SEBI in this domain Shubhashis Gangopadhyay, Subir Gokarn.,

"At the present moment there is no Ajay Shah and Praveen Mohanty.

in the past decade and that Indian mutual

fund regulation has been fairly dynamic,

opportunity for the middle class and the

Economic and Political Weekly April 15, 2006 1413

This content downloaded from

122.170.126.143 on Sun, 28 Mar 2021 09:32:50 UTC

All use subject to https://about.jstor.org/terms

MANO HAR

the customer adequately. But it is unusual freedom - that of voting with his/her feet.

to find a similar treatment offered to an The shareholder is given the facility to exit

equity shareholder. In fact, equity is con-from the mutual fund at any time he/she

sidered permanent capital. pleases. This liquidity avenue, as discussed

In a collective investment scheme, should earlier, is offered as an over-the-counter REPORTING THE PARTITION

the shareholder-customerl have a fiee exitfacility by the mutual fund itself. As the OF PUNJAB 1947

or should he/she be asked to find another shareholder in an open-ended mutual fund Press, Public and other Opinions

has the right to exit, she must have ad- Raghuvendra Tanvar

to replace him/her as shareholder-customer?

81-7304-674-3, 2006, 622p. Rs. 1195

The answer depends on which of the twoequate information about the happenings

roles - shareholder and customer - assumes in the investment to time the exit decision.

PUNJAB POLITICS,

primacy. If the shareholder-customer wereThis calls for high levels of disclosure in 1 JANUARY 1944-3 MARCH 1947

a mutual fund. At the time of exit, the

treated as a customer, she would be offered Last Years of the Ministries

free exit. This would mean the company shareholder must also receive a fair price.9 Governers' Fortnightly Reports and

should be prepared to redeem her shares at The foregoing discussion underscores other Key Documents

five features of a mutual fund: Lionel Carter (ed)

all points in time through an over-the-counter

81-7304-662-X, 2006, 392p. Rs. 950

operation. On the other hand, if she were (a) Economies of scale (through pooling)

treated as a shareholder, she would be asked

to participation in the equity market. PUNJAB POLITICS, 1940-1943:

to seek exit through a stock exchange. For (b) Delegation of (fiduciary) responsibility. Strains of War

(c) Right to "vote with the feet".

example, in a close-ende( mutual fund, the Governors' Fortnightly Reports and

shareholder-customer is treated primarily(d) High level of information disclosure. other Key Documents

as a shareholder. In an open-ended mutual(e) Fair. exit price through an over-the- Lionel Carter (ed)

fund he is treated more as a customer. counter redemption mechanism. 81-7304-626-3, 2005, 427p. Rs. 995

In a general collective investment vehicle,

PUNJAB POLITICS, 1936-1939:

the relationship between the shareholdersFiduciary Responsibility The Start of Provincial Autonomy

and the manager is one of contractual

Governors' Fortnightly Reports and

arrangement. The shareholder is the prin- The trustee has a fiduciary responsibility other Key Documents

cipal and the manager is their agent. The vis-ai-vis the investors. Legally, a unit trust Lionel Carter (ed)

relationship is contractual. Efficient enforce- is, as the name implies, a trust fund. The 81-7304-568-2, 2004, 443p. Rs. 995

ment of contract depends on completenesstrustee on behalf of the beneficiaries, the

PAKISTAN

of the contract, capacity of the principal unitholders, holds the assets. The trustee's

Nationalism without a Nation?

to monitor the contractual deliverables, principal role is to act as the custodian of the

Christophe Jaffrelot (ed)

and the efficacy of the legal system in actual securities in which the fund invests

81-7304-407-4, 2004 (2002),352p. Rs. 650,

enforcing contracts. When the principal is and to oversee the operations of the fund Rs. 450 (Pb)

not up to this task, she delegates this manager.i0 The trustee ensures that the

responsibility to another. The relationship fund sticks to its investment objective set PATHWAY TO INDIA'S PARTITION

between the principal and the entity that out in the trust deed. It is also the duty of Bimal Prasad

Vol. I: The Foundations of Muslim

assumes this responsibility is a fiduciary the trustee to ensure that no one group of

Nationalism

arrangement. The mutual fund structure unitholders is treated preferentially. In

assumes that the unitholders neither have 81-7304-248-9, 1999, 319p. Rs. 600

administrative terms, the assets of the fund

Vol. II: A Nation within a

are held in the trustee's name. It is the

the time nor the skills to monitor the agent's Nation 1877-1937

performance. In the trust structure, thetrustee who issues the unit certificates when 81-7304-249-7, 2000, 469p. Rs. 800

individuals buy units. Besides creating and

trustee assumes the fiduciary responsibility. 81-7304-248-9 (Set)

Mutual funds in India have, therefore, liquidating units, the trustee supervises the

decided to follow the trustee structure.7 register of unitholders, settles all invest- PANGS OF PARTITION

In a mutual fund there are two kinds of ment transactions, collects the income of S. Settar and Indira Beptista Gupta (eds)

Vol. I: The Parting of Ways

ownerships. First, the shareholders8 arethe trust in the form of dividends on the

the beneficial owners: second, the trustee shares held, and distributes it to the share- 81-7304-306-X, 2002, 368p. Rs. 700

Vol. II: The Human Dimension

is the registered (and controlling) ownerholders. The two parts of fiduciary obli-

81-7304-307-8, 2002, 358p. Rs. 700

of the assets of the mutual fund. While the gation are duty of loyalty and duty of 81-7304-305-1 (Set)

benefits arising out of investments go tocompetence. Absence of either renders thefor our complete catalogue please write to us at:

the shareholders, the management controlfiduciary role ineffective. The first prin-

~' 0 ' * " :'K

of the investment manaager vests with theciple of mutual fund governance is the

trustee. As shareholders are ill-equippedfiduciary role played by the trustee.

to monitor the investment function, they are

unlikely to be able to assess the perfor-Role and Position of Trustees B "S

mance of the trustee too. For this reason, in

a trust structure, the beneficial owner has In India, mutual funds seem to combine

no control on the business judgment exer-practices from the US and UK. The trust

cised by the trustee. Given this loss of controlstructure came from the UK. While tle

B{

on the way his/her money is managed, theregulation offers the choice of forming a

shareholder is given a compensating trustee company or a board of trustees.

1414 Economic and Political Weekly April 15. 2006

This content downloaded from

122.170.126.143 on Sun, 28 Mar 2021 09:32:50 UTC

All use subject to https://about.jstor.org/terms

almost all mutual funds in India follow the high level of mutual fund expertise. This

A possible method of improving mutual

trustee company model. A company is situation is not conducive to the exercise fund governance in India would be to

consider entrusting the trusteeship to cor-

formed and the sole duty of the company of competence. The directors of the trustee

is to function as the trustee of a mutual company receive sitting fees when theyporations whose business is to provide

fund. The board of the trustee company attend the board meetings. This amount is trustee services. 14 Such practice is prevalent

is required to have a minimum number (at moderatet2 and perhaps not commensuratein the debt markets of India where deben-

ture trustees intercede between the lenders

least two-thirds) of independent directors.with the level of responsibilities expected

In theory, the members of the board of the to be discharged by them. Inadequate and borrowers. This mitigates the credit

trustee company are identified by the compensation may result in a superficialrisk and helps in monitoring the debenture

sponsor. For all practical purposes, thistrusteeship function. covenants and terms more effectively.

task is left to the asset management com- Under Indian mutual fund regulations, There are three specific advantages. First,

pany. These names have to be approveda minimum of 40 per cent of shareholding inthe trustee company could be large15 and

by the Securities and Exchange Board of the asset management company is requiredindependent. Second, the specialist trustee

India. Whether the independent directors to be held by the sponsor. The trustee iscompany would be able to discharge the

would act independently is predicated uponappointed by the sponsor. The assettrusteeship duty more professionally. Third,

the directors identified. the regulator would be able to specify the

management company is appointed either

preconditions for an entity to be registered

The responsibilities of the trustee com- by the sponsor or the trustee. It is not clear

pany resemble the responsibilities placedif it is possible for the trustee to terminate with it as a specialist trustee company.

on the directors of mutual funds in the US. the asset management contract. It appears Among other conditions, it would be

The first level regulation of mutual funds in that the sponsor, the asset management possible for assessing the risk of the trustee-

India rests with the trustee. The actions company and the trustee are tied to one ship business and prescribing adequate risk

taken by the trustee are deemed to be the another in a gridlock. Unless clear inde- mitigating mechanisms through a possible

actions of the mutual fund. The trustee is pendence is established between the assetcapital adequacy norm for the trustee

charged with many duties. It is the dutymanagement company and trustee, con- company.

of the trustee to approve the appointmentflict of interest13 is unavoidable. Such

of directors of the asset manacgement conflict of interest dilutes the loyalty of

Institutionalising Better

company, obtain periodic reports from the the trustee to the unitholder. Thus, the two

Governance

asset management company about the fund parts of fiduciary obligation, Inamely, duty

operations, monitoring security dealings of loyalty and duty of competence, are Currently, the Securities and Exchang

of key personnel of the asset management likely to be vitiated. Board of India encourages the AMFI to

company, review of contracts, file As the trustee company in the currentbring industry inputs in framing better

periodic reports to the regulator, and tomutual fund regulations has low capitalregulations for the mutual fund industry.

discipline the asset nmanageiment coim- and a meagre revenue base, it does not The Mutual Fund Advisory Committee

pany.1l These duties are considerable inhave the capital adequacy to meet the deliberates on desirable changes in regu-

liabilities that could be faced by the trusteelatory practices and recommends them to

magnitude and call for significant exper-

tise and devotion of time. Trustees meet company in its cturrent form in India. Whilethe regulator. An interesting aspect of this

the trust laI does not provide for the unit-

six (or more) timles in a ycar to deliberate edifice is that the trustees are not institu-

on these matters. In addition, often deci- holder to sue the trustee company, tionally represented in the process. AMFI

sions are taken by circulation if deemedindividual mlemibers on the board of the is a body of asset management companies.

urgent. As all directors of the tlustee trustee company could be sued undercertainWhile all activities are undertaken by the

company are non-executive directols,circumstances.

it is Some mechlanisms have asset management companies, legally it

been

debatable how much oversight is feasible. evolved in terms of director's insur- would be difficult to assume that asset

ance but that seems inadequate when assets management companies represent the

Unlike the practice in the US, regulations

in India do not mandate that the trustee under maniaagement are large. A more robust unitholders. In fact, the legal position points

alternative is required to deal with this risk. to considerable conflict of interest. It is

colnpany (and its directors) be provided

with adequate administrative support for only the trustees that can be considered to

discharging their responsibilities. LTrustee represent the unitholder interest.

Specialist Trustee Company

companies have neither an otfice nor staff In the US, independent directors of

of their own. The only office- that has The a situation mentioned above seems mutual funds have established the Mutual

unique to India. In the US, the directors

direct reporting relationship with the t tustee Fund Directors Forum. It is a not-for-profit

company is the compliance officer. The organisation, whose mission is to improve

of the fund appoint all service providers.

fund governance by promoting the devel-

compliance officer is usually an officerInofthe UK, there is no concept of sponsor.

the asset management company. She The has trust deed is between the managementopment of vigilant and well-informed

compalny and the authorised corporate

a dual reporting relationship, one with the directors. This is accomplished by offering

asset management company and the other continuing education programmes to inde-

trustee. In the contractual pool formn preva-

with the trustee company. lent in continental Europe, the depository

pendent directors, providing opportunities

The mutual fund business has its own (which also functions as custodian) super-

for independent directors to discuss mat-

technology and businless complexities. vises the fund operations. In all these ters

threeof common interest, and serving as

When the directors of the trustee company advocates on behalf of independent direc-

cases, the entity that assumes the fiduciary

are drawn from diverse backgrounds, it would

responsibili t is 1sir"'. .. . i' capitalised,

tors.16 The forum is entirely independent

be unrealistic to expect them to possessanda specialised. of the mutual fund advisory industry.

Economic and Political Weekly April 15, 2006 1415

This content downloaded from

122.170.126.143 on Sun, 28 Mar 2021 09:32:50 UTC

All use subject to https://about.jstor.org/terms

In India too a similar initiative could be Notes (ii) Compliance with representations made in

documents distributed to prospective

encouraged by the regulator. A forum of investors.

independent directors on the boards of trustee 1 It is said that the investment trust principle (iii) Performance of the fund portfolio.

companies could provide the necessary originated as a device to avoid the splitting (iv) Quality and cost of portfolio executions.

up of an estate, at the time of transfer to the (v) The manner and cost of distribution of

checks and balances in industry governance.

heirs. Instead of taking a portion of the estate, fund units.

each heir received his corresponding interest

(vi) The custody of fund securities.

Governance Reforms in the trust. The early investment trusts had (vii) Administration of individual investor

their origin. about the middle of the 19th accounts.

century, among certain Scotch lawyers engaged

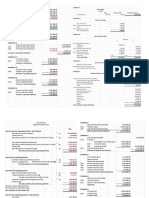

The major heads of governance reforms 11 This is only an illustrative list.

in the administration of estates. This first

12 Mutual funds collect trustee fees. This fee

in the fund industry have been addressed

investment trust that sought public participation

would be about 0.05 percent of the assets under

by Ruder (2004). These are paraphrased

was the International Financial Society, management or may be even lesser. In all

as follows: London, 1863.

probability, this could be the smallest item of

2 The idea of starting a unit trust was before the

(i) Independence of directors on the board expense in a mutua! fund scheme in India.

governlnent of India since 1931 [Aney 13 See Erlichman (1993) for descriptions of

of the trustee company (three-fourths). 1963:3226]. conflicts of interest.

(ii) Independent chairman of the trustee 3 The original scheme of US-64 stipulated NAV-

14 See ADB Report TA 4010-IN.

company. based sale and repurchase prices. This was

15 The Securities and Exchange Commiission noted

amended in June 1965 allowing UTI to vary

(iii) Establishment of a nominating com- in 2003: Our concern is that in many fund

tile sale and repurchase prices from the NAV-groups the fund adviser exerts a dominant

mittee, an audit committee, a compliance based levels to the extent it deemed lit

influence over the boardc. Because of its mono-

committee and an investment committee, [Pendharkar 2003:2121. In addition to NAV-

poly over informattion about the fund and its

substantially composed of independent based pricing. UTI pioneered the reinvestment frequent ability to control the board's agenda,

directors. plan, voluntary savings plan, children'sthe

gilt

adviser is i in a positio to attempt to impede

plan, savings-cum-insurance plan, distribution

the directors from exercising their oversight

(iv) Facility to the trustee to hire indepen- through bank branches, distribution through

dent counsel and staff. role. In some cases, boards may have simply

post offices, multidimcnsional approach to

abdicated their responsibilities, or failed to ask

(v) Chief compliance officer reporting to marketing, creation of a strong agency network,

tough questions of advisers; in other cases,

use of vernacular language for communications

the trustee (in addition to reporting to the boards may have lacked the information or

with unitholders, etc lalso see Bhatt 19961.

asset management company). 4 Asset management companies are the memlbers

organisational structure necessary to play their

proper role (Investment Company Governance,

(vi) Written compliance policies and of AMFI.

Rel IC-26323. January 15, 2003, p 3).

procedures. 5 The corporate customers and high networth 16 In 2003. Securities and Exchange Commission

(vii) Certification of financial statements investors alve been able to take advantage of asked the forumi to develop guidelines and best

bond funds and short-termi liquid funds under practices in fIve areas where directors' oversight

by the chief executive officer and the chief certain circumlstances. Th valIue of the sche s lmes

financial officer. ,and decisions are critical for the protection of

held by themi ranged from 60 per cent to 90 funid shareholders.

While some of these features are already per cent. See the report on ReJfor, ' o Muttlal

present in the Indian industry, others are Funds. ill Ilndi prepared by Cadogen Financial

and A F Ferguson and Co in November 2003. References

not. These ideas are worth considering 6 In 2001 tlhere were 11.8 million households

with a view to establishing true inde- investing in mIlIltual fitllds in India. This was

Asian Development Bank (2004): 'India:

pendence of the trustee. 6.7 per cent of all households. Middle to highReform of Mutual Funds', Final Report TA

income households dominai;ted. Retail 4010-IN.

investment iln mutual funds was mlostly froml

Ancy, M S (1963): 'Proceedings of Lok Sabha,

Conclusion ur.ban centres. See Stirve\ lf hllici Inivtestol-s,

Decemlber 5, 1963, Unit Trust of India Bill,

SEBI-NCAER, March 2003.

1963', p 3226.

If the nation has to fund its economic 7 There are other formis of legal structures Bhatt,

for R S ( 1996): 'Unit Trust of India and Mutual

growth internally, mobilising household nmutual funds. In the US,the legal structure is an Funds', UT1 Institute of Capital Markets, Navi

savings towards equity capital is inevi- investment company. In some parts of Europe, Mumhai.

mutual funds are contractual pools. In the Brown,

UK D A (2000): Towards Improved Fund

table. The mutual fund industry could play and Australia, mutual funds are unit trusts.

Governance: The Way Forward', (ntario

a vital role in this nation-building task.8 The terms shareholder aInd unitholder are used Securities Commission.

Small investors would be comfortable interchangeably by us in the context of mutual Erlichman, S I (1993): 'Managing Potential

funds. In India, the term unitholder is used; in Contlicts of Interest' in Mutual F,unds: NAew

entrusting their meagre savings to mutual

the US, the term shareholder is used. Productls, New Comlpetitors, Newv Ruiles, the

funds if they perceive good governance in parties should see the price as fair: the

9 Three Canadian Institute, Toronto.

the fund industry. The trustee of a mutualselling/buying shareholder, the other share- Pendharkar, V G (2003): 'Unit Trust of India-

holders who do not intend leaving the mutual

fund plays a crucial role in this regard. We Retrospect and Prospect', UBS Publishers'

have examined a few alternative approachesfund, and the asset manager. I fthc price deviates Distribution, New Delhi.

from the fair value, then the exiting shareholder Rucer, David S (2004): 'Mutual Fund Reform',

to strengthening mutual fund governance either gets subsidy or offers subsidy. Fair price Statement, Committee on Banking, Housing,

through strengthening the institutionmeans of the precise value of his share of the and Urban Affairs of the US Senate.

mutual fund trustees. The Securities and investments. Valuation of the investment is Stevens, David P (2002): Trust Law Implications of

Exchange Board of India has taken big likely to be a complex and contentious matter Proposed Regulatory Reform of Mutual Fund

under most circumstances. There is one notable Governance Structures', Goldman and Car- LLP.

strides in fostering good corporate gover- exception, however. If the asset has a The Law Commission (1993): 'Collective

nance in the recent past. There is an competitive market, the market price is likely Investments: Other People's Money', Report

opportunity to consider strengthening to be the fairest method to value the asset. For Number 65, the Companies and Securities

this reason, mutual funds are mandated to focus AdvisoryCommittee,Commonwealth ofAustralia.

governance in the mutual fund industry

investments on marketable securities. Thompson, J K and Sang-Mok Choi (2001):

and make it even better. fIs

10 The trustee's supervisory function includes: 'Governance Systems forCollective Investment

(i) Advisory fees and fees of other entities Schemes in OECD Countries', Financial Affairs

Email: gsethu@utiicm.com providing services. Division, Occasional Paper, Number 1, OECD.

1416 Economic and Political Weekly April '5, 2006

This content downloaded from

122.170.126.143 on Sun, 28 Mar 2021 09:32:50 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Finance Project On "Analysis On Performance of Mutual Fund Companies in India"Document94 pagesFinance Project On "Analysis On Performance of Mutual Fund Companies in India"balaji bysani84% (32)

- Introduction of Mutual Funds: "Analysis On Performance of Mutual Fund Companies in India"Document94 pagesIntroduction of Mutual Funds: "Analysis On Performance of Mutual Fund Companies in India"Rocks KiranNo ratings yet

- AMFI Budget Proposals - FY 2019-20Document23 pagesAMFI Budget Proposals - FY 2019-20rajeshtripathi2006No ratings yet

- A Study On Performance of The Indian Mutual Fund IndustryDocument67 pagesA Study On Performance of The Indian Mutual Fund IndustryChethan.sNo ratings yet

- Introduction of Mutual Funds: "Analysis On Performance of Mutual Fund Companies in India"Document96 pagesIntroduction of Mutual Funds: "Analysis On Performance of Mutual Fund Companies in India"HarshSuryavanshiNo ratings yet

- Governance of Firms: Corporations Exist To Economize The Costs of Buying and Selling Everything Under The SunDocument20 pagesGovernance of Firms: Corporations Exist To Economize The Costs of Buying and Selling Everything Under The SunMichel Monkam MboueNo ratings yet

- Chapter-1 Introduction of Mutual Funds: "A Study On Performance of The Indian Mutual Fund Industry"Document67 pagesChapter-1 Introduction of Mutual Funds: "A Study On Performance of The Indian Mutual Fund Industry"ChethanNo ratings yet

- Assignment-1: Subject-Management of Financial Services. Topic - Effect of Budget 2011-12 On Mutual FundsDocument11 pagesAssignment-1: Subject-Management of Financial Services. Topic - Effect of Budget 2011-12 On Mutual Fundschintu2789No ratings yet

- Chapter-1: 1.1 An Overview About Mutual FundsDocument37 pagesChapter-1: 1.1 An Overview About Mutual FundsIndu yadavNo ratings yet

- Investors Preferences Towards Mutual FunDocument8 pagesInvestors Preferences Towards Mutual FunDhilip Kumar AnbazhaganNo ratings yet

- Navigating The Private Equity SpaceDocument44 pagesNavigating The Private Equity SpaceWei Cong TanNo ratings yet

- Compartaive Analysis of Mutual Fund Scheme by Harshil P HundiaDocument44 pagesCompartaive Analysis of Mutual Fund Scheme by Harshil P HundiaHarshil HundiaNo ratings yet

- Investor Behavior Towards Investment in Mutual Funds - A Comparative Study in Telangana Region in The State of Andhra PradeshDocument16 pagesInvestor Behavior Towards Investment in Mutual Funds - A Comparative Study in Telangana Region in The State of Andhra PradeshvinilNo ratings yet

- Introduction of Mutual 22222Document210 pagesIntroduction of Mutual 22222mahaNo ratings yet

- BCG Banner7 PDFDocument23 pagesBCG Banner7 PDFAnupam LoiwalNo ratings yet

- Role of Mutual Funds in Indian Finacial Market: Dr. V. Ramesh Naik, P.PRUDHVI KUMARI, J.PUJITHADocument9 pagesRole of Mutual Funds in Indian Finacial Market: Dr. V. Ramesh Naik, P.PRUDHVI KUMARI, J.PUJITHAaditya pariharNo ratings yet

- Mutual Funds BB FinalDocument41 pagesMutual Funds BB FinalAadesh ShahNo ratings yet

- PAPER Comparative Analysis of Mutual Funds in Geojit Financial Services LTD GulbargaDocument9 pagesPAPER Comparative Analysis of Mutual Funds in Geojit Financial Services LTD GulbargaDr Bhadrappa HaralayyaNo ratings yet

- PAPER Venture Capital A Potential Model of MusyarakahDocument18 pagesPAPER Venture Capital A Potential Model of MusyarakahMuhammad QuraisyNo ratings yet

- Article 3Document7 pagesArticle 3Bel Bahadur BoharaNo ratings yet

- Performance of Mutual Funds and EquityDocument7 pagesPerformance of Mutual Funds and EquityMohmmedKhayyumNo ratings yet

- Research Proposal: Title of The StudyDocument67 pagesResearch Proposal: Title of The Studyhardikpatel11No ratings yet

- Ronty Project2Document16 pagesRonty Project2Techboy RahulNo ratings yet

- Mutual Funds: BelgiumDocument4 pagesMutual Funds: BelgiumMuthu SelviNo ratings yet

- Research PaperDocument13 pagesResearch PaperShuvajit BhattacharyyaNo ratings yet

- The Influence of Exchange Rate, Interest Rate and Inflation On Stock Price of LQ45 Index in IndonesiaDocument7 pagesThe Influence of Exchange Rate, Interest Rate and Inflation On Stock Price of LQ45 Index in IndonesiaWiria SalvatoreNo ratings yet

- Recent Developments in India's Mutual Fund IndustryDocument15 pagesRecent Developments in India's Mutual Fund IndustryAbdur RahmanNo ratings yet

- Which Fund Yields More ReturnsDocument8 pagesWhich Fund Yields More ReturnskdurgeshcwaNo ratings yet

- Analysis of Up Vs MFDocument72 pagesAnalysis of Up Vs MFblackpantherr2101No ratings yet

- 2.why Do Financial Institutions ExistDocument33 pages2.why Do Financial Institutions ExistАндријана Б. ДаневскаNo ratings yet

- Introduction To Mutual Fund: Mutual Funds & Investor AwarenessDocument41 pagesIntroduction To Mutual Fund: Mutual Funds & Investor AwarenesssapnasuriNo ratings yet

- Pension Fund Infrastructure VivesDocument24 pagesPension Fund Infrastructure Vivesantoniov1No ratings yet

- Mutual Funds: An OverviewDocument83 pagesMutual Funds: An OverviewbadmeshNo ratings yet

- 8 DR MukeshDocument4 pages8 DR Mukeshmahimahimagupta2002No ratings yet

- A Study On Investors' Perception Towards Mutual Funds and Its Scopes in IndiaDocument5 pagesA Study On Investors' Perception Towards Mutual Funds and Its Scopes in IndiaEditor IJTSRDNo ratings yet

- Striking The Perfect Balance: Volume VI, No. 6Document52 pagesStriking The Perfect Balance: Volume VI, No. 6ShantanuNo ratings yet

- Venture Fundings Industry ReportDocument21 pagesVenture Fundings Industry ReportshreeshNo ratings yet

- Chapter - I Mutual Funds in IndiaDocument28 pagesChapter - I Mutual Funds in India1986anuNo ratings yet

- List of Tables: Data From Financial Websites 67,71,75,79,83 Data From Factsheets 67,71,75,79,83 Riskometer 57Document93 pagesList of Tables: Data From Financial Websites 67,71,75,79,83 Data From Factsheets 67,71,75,79,83 Riskometer 57VijayGogulaNo ratings yet

- Summary/Abstract: Association of Mutual Funds in India (AMFI) On Creating Awareness AmongDocument68 pagesSummary/Abstract: Association of Mutual Funds in India (AMFI) On Creating Awareness AmongvinaydineshNo ratings yet

- Development Finance in IndiaDocument18 pagesDevelopment Finance in IndiaPrajitha Jinachandran T KNo ratings yet

- Analysis of Mutual Funds in IndiaDocument78 pagesAnalysis of Mutual Funds in Indiadpk1234No ratings yet

- Project On Fixed DepositDocument34 pagesProject On Fixed Depositbalirajsingh67% (3)

- A Study On Mutual Funds at India InfolineDocument24 pagesA Study On Mutual Funds at India Infolinearjunmba119624No ratings yet

- Role of Capital Market in Developing Economy: Sakshi TomarDocument18 pagesRole of Capital Market in Developing Economy: Sakshi Tomarsakshi tomarNo ratings yet

- An Empirical Study On Indian Mutual Funds Equity Diversified Growth Schemes" and Their Performance EvaluationDocument18 pagesAn Empirical Study On Indian Mutual Funds Equity Diversified Growth Schemes" and Their Performance Evaluationkanwal12345hudaatNo ratings yet

- Sunrise For Solar Rooftops: Develop Corporate Bond Market SustainablyDocument2 pagesSunrise For Solar Rooftops: Develop Corporate Bond Market SustainablysumitNo ratings yet

- A Study On Mutual Fund: Comparison Between Equity Diversification and Sector Specific SchemesDocument67 pagesA Study On Mutual Fund: Comparison Between Equity Diversification and Sector Specific SchemesChethan.sNo ratings yet

- Lebs 210Document29 pagesLebs 210lekha1997No ratings yet

- Ncert Financial MarketsDocument29 pagesNcert Financial Marketsjyoti singhNo ratings yet

- A Detailed Analysis of The Mutual Fund Industry & A Customer Perception StudyDocument93 pagesA Detailed Analysis of The Mutual Fund Industry & A Customer Perception StudyNishant GuptaNo ratings yet

- Akash ProjectDocument64 pagesAkash ProjectChethan.sNo ratings yet

- Mutual FundDocument170 pagesMutual FundPatel UrveshNo ratings yet

- Pooja Project 2Document109 pagesPooja Project 2Rashmitha HonnaiahNo ratings yet

- Chapter - 1. An Introduction To Capital MarketDocument31 pagesChapter - 1. An Introduction To Capital MarketDIPESH BHATTACHARYYANo ratings yet

- Divya Rajendran Final ProjectDocument88 pagesDivya Rajendran Final ProjectmanjuNo ratings yet

- Ackman RandomDocument18 pagesAckman RandomscribdhankNo ratings yet

- Pawar ProjectDocument95 pagesPawar ProjectROHIT MALLAHNo ratings yet

- Axe Effect PresentationDocument17 pagesAxe Effect PresentationAmey SankheNo ratings yet

- Tata Motors Finance Limited: Vinay - Lavannis@tmf - Co.inDocument250 pagesTata Motors Finance Limited: Vinay - Lavannis@tmf - Co.inDISHARI DUTTNo ratings yet

- Load Balancing in Microsoft AzureDocument40 pagesLoad Balancing in Microsoft Azurekumara030350% (2)

- Lit266 Bli Heal Abut Options FinalDocument2 pagesLit266 Bli Heal Abut Options FinalJean-Christophe PopeNo ratings yet

- Marketing 13th Edition Kerin Test BankDocument25 pagesMarketing 13th Edition Kerin Test BankFranciscoOliverisgb99% (71)

- Twinning Procedures - Light - EN - Sept23 - FINALDocument38 pagesTwinning Procedures - Light - EN - Sept23 - FINALTamuna MadurashviliNo ratings yet

- Indonesian Coal Index Report: Argus/CoalindoDocument2 pagesIndonesian Coal Index Report: Argus/CoalindoRahmat Dian Syah PutraNo ratings yet

- Akzonobel Report15 Entire, 146Document266 pagesAkzonobel Report15 Entire, 146jasper laarmansNo ratings yet

- Enterprise Architecture Proposal For UndergraduateDocument6 pagesEnterprise Architecture Proposal For UndergraduateNamata Racheal SsempijjaNo ratings yet

- Instruction Kit For Eform Sh-8Document11 pagesInstruction Kit For Eform Sh-8maddy14350No ratings yet

- FACTS: Francisco de Guzman Was Hired by San MiguelDocument1 pageFACTS: Francisco de Guzman Was Hired by San MiguelGabriel LiteralNo ratings yet

- Online Auction: 377 Brookview Drive, Riverdale, Georgia 30274Document2 pagesOnline Auction: 377 Brookview Drive, Riverdale, Georgia 30274AnandNo ratings yet

- Estimate Boq MPMDocument6 pagesEstimate Boq MPMhj203800No ratings yet

- PSMOD - Chapter 5 - Estimation and Confidence IntervalDocument3 pagesPSMOD - Chapter 5 - Estimation and Confidence Interval陈安宁No ratings yet

- Wintershall DeaDocument11 pagesWintershall Dearadoslav micicNo ratings yet

- Cash BudgetDocument8 pagesCash BudgetKei CambaNo ratings yet

- Caribbean 2021 E&p Summit Program Book - 13september2021Document10 pagesCaribbean 2021 E&p Summit Program Book - 13september2021Renato LongoNo ratings yet

- Unit 4 Leadership and ManagementDocument9 pagesUnit 4 Leadership and ManagementMuhammad UzairNo ratings yet

- Success of MK RestaurantDocument4 pagesSuccess of MK RestaurantPhuu Phuu MyintNo ratings yet

- Computerised System Validation - Introduction To Risk Management - The GAMP® 5 ApproachDocument6 pagesComputerised System Validation - Introduction To Risk Management - The GAMP® 5 ApproachHuu TienNo ratings yet

- InvoiceDocument1 pageInvoiceRonak JainNo ratings yet

- SimhaDocument14 pagesSimhaArunachalam ANo ratings yet

- BC Question PaperDocument4 pagesBC Question PaperVVNA BhargaviNo ratings yet

- COVID-19 Crisis: The Impact of Cyber Security On Indian OrganisationsDocument8 pagesCOVID-19 Crisis: The Impact of Cyber Security On Indian OrganisationsGautam SinghiNo ratings yet

- Related Literature and Methodology of Inventory SystemDocument1 pageRelated Literature and Methodology of Inventory SystemJames Marturillas44% (9)

- Determinants of Successful Loan Repayment Performance of Private Borrowers in Development Bank of Ethiopia, North RegionDocument84 pagesDeterminants of Successful Loan Repayment Performance of Private Borrowers in Development Bank of Ethiopia, North Regionnega cheruNo ratings yet

- Purchases ContractDocument6 pagesPurchases ContractVõ Minh HuệNo ratings yet

- APG-Audit Planning PDFDocument4 pagesAPG-Audit Planning PDFdio39saiNo ratings yet

- CRM BCBLDocument60 pagesCRM BCBLHasnat ShakirNo ratings yet

- A Goal Game - The Theory of ConstraintsDocument20 pagesA Goal Game - The Theory of ConstraintsJVTripp97% (32)