Professional Documents

Culture Documents

Chapter 2 Review Exercise

Chapter 2 Review Exercise

Uploaded by

Kenisha Manicksingh0 ratings0% found this document useful (0 votes)

26 views1 pageThis document contains Kenisha Manicksingh's student ID and solutions to 10 chapter review questions. The solutions calculate various cash flow statement items such as CFFA, NCS, addition to NWC, dividends, interest paid, and cash flow to shareholders and creditors. Kenisha provides the calculations to arrive at the amounts for items like EBIT, taxes, depreciation, beginning and ending balances of assets, liabilities, equity and more.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains Kenisha Manicksingh's student ID and solutions to 10 chapter review questions. The solutions calculate various cash flow statement items such as CFFA, NCS, addition to NWC, dividends, interest paid, and cash flow to shareholders and creditors. Kenisha provides the calculations to arrive at the amounts for items like EBIT, taxes, depreciation, beginning and ending balances of assets, liabilities, equity and more.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views1 pageChapter 2 Review Exercise

Chapter 2 Review Exercise

Uploaded by

Kenisha ManicksinghThis document contains Kenisha Manicksingh's student ID and solutions to 10 chapter review questions. The solutions calculate various cash flow statement items such as CFFA, NCS, addition to NWC, dividends, interest paid, and cash flow to shareholders and creditors. Kenisha provides the calculations to arrive at the amounts for items like EBIT, taxes, depreciation, beginning and ending balances of assets, liabilities, equity and more.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

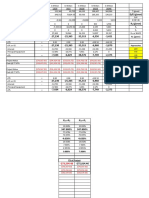

Name: Kenisha Manicksingh; Student ID: 2022071

Chapter 2 Review Solutions

1. CFFA = OCF – NCS – Addition to NWC

= 200 – 400 - 150 = -350

2. NWC = CA – CL

FA + CA = CL + LTD + E

CA – CL = LTD + E – FA

= 200 (50% of 400) + 600 – 500 = 300

3. NCS = Ending FA – Beginning FA + Depreciation

= 1,413 – 1,680 + 210 = -57

4. FA = 1,700 (Book value)

NWC = CA-CL = 300

LTD = 700

FA + CA = CL + LTD + E

FA + (CA-CL) – LTD = E

E = 1,700 + 300 – 700 = 1,300

5. NI = 750 M

Addition to retained earnings = 600 M

Dividend paid = 750 – 600 = 150 M

Dividend per share = 150 / 100 = $1.5

6. NCS = Ending FA – Beginning FA + Depreciation

= 6,000 – 4,000 + 400 = 2,400

7. CF to shareholders = Dividend paid – Net new equity raised

= 150 – 100 = 50

8. CF to creditors = Interest paid – Net new borrowings

= 20 – (210-180) = -10 M

9.

10. CFFA = OCF – NCS – Addition to NWC

OCF = EBIT + Depreciation – Taxes

= 691 + 276 – 187 = 780

NCS = 2,880 – 2,731 + 276 = 425

Addition to NWC = (708 -540) – (642 - 543) = 69

CFFA = 286

CF to shareholders = Dividend paid – Net new equity raised

= 121 – 50 = 71

CF to creditors = Interest paid – Net new borrowings

= 141 – (-74) = 215

You might also like

- CH 2 SolutionDocument4 pagesCH 2 SolutionHoang MinhNo ratings yet

- ACC121 SEM3 ExamplesDocument12 pagesACC121 SEM3 ExamplesTia1977No ratings yet

- Accounting Project Level IVDocument80 pagesAccounting Project Level IVEdom50% (6)

- Fnce370 Assign3Document29 pagesFnce370 Assign3smaNo ratings yet

- Answers (مبادئ مالية) Ch.2and3Document11 pagesAnswers (مبادئ مالية) Ch.2and3moon lightNo ratings yet

- 14 Jan 13Document4 pages14 Jan 13Sneh Toshniwal MaheswariNo ratings yet

- Chapter 9 AssignmentDocument4 pagesChapter 9 AssignmentabraamNo ratings yet

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Indv. AssignmentDocument5 pagesIndv. AssignmentPuteri NinaNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- WBF Wu Dan Standar DeviasiDocument9 pagesWBF Wu Dan Standar DeviasiADLYANSCYAH AMMAR SYAUQINo ratings yet

- Ch1 - Exercises SolutionsDocument3 pagesCh1 - Exercises SolutionsReem AbanmiNo ratings yet

- Module-5 Valuation Concepts (EVA, MVA)Document19 pagesModule-5 Valuation Concepts (EVA, MVA)vinit PatidarNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Chapter 8 Solutions Corporate FinanceDocument5 pagesChapter 8 Solutions Corporate FinanceWill GarciaNo ratings yet

- 5.3 Five PartnersDocument6 pages5.3 Five PartnersScribdTranslationsNo ratings yet

- Chapter 5 SolutionsDocument8 pagesChapter 5 Solutionsmajid asadullahNo ratings yet

- Online Lecture Material FR IMAGE 03Document28 pagesOnline Lecture Material FR IMAGE 03Dave ClintonNo ratings yet

- Mara CorporationDocument8 pagesMara CorporationRashid Ali JatoiNo ratings yet

- Capital Budgeting: Let's AnalyzeDocument3 pagesCapital Budgeting: Let's AnalyzeYeshua DeluxiusNo ratings yet

- Answer To Corporate Finance, AssignmentDocument1 pageAnswer To Corporate Finance, AssignmentYIN SOKHENGNo ratings yet

- Answers For Assignment 1Document10 pagesAnswers For Assignment 1Zikra AbdusemedNo ratings yet

- Reo Afst TryDocument4 pagesReo Afst TryAEDRIAN LEE DERECHONo ratings yet

- Example AssociateDocument5 pagesExample AssociateDiana KNo ratings yet

- 4A8 OperationDocument8 pages4A8 OperationCarl Dhaniel Garcia SalenNo ratings yet

- Assignment 1Document14 pagesAssignment 1azimlitamellaNo ratings yet

- Perhitungan Net Present Value: Cash FlowDocument1 pagePerhitungan Net Present Value: Cash FlowRakhmad SucahyoNo ratings yet

- Level Four Code 3 Answer-1Document7 pagesLevel Four Code 3 Answer-1EdomNo ratings yet

- Null 1Document2 pagesNull 1Mazen SalahNo ratings yet

- Fin 320 - Individual AssignmentDocument14 pagesFin 320 - Individual AssignmentAnis Umaira Mohd LutpiNo ratings yet

- Cost Estimation SolutionsDocument2 pagesCost Estimation SolutionsAshish MathewNo ratings yet

- Tugas04 - AKM 1-D - 23013010276 - Bagas Arya Satya DinataDocument13 pagesTugas04 - AKM 1-D - 23013010276 - Bagas Arya Satya DinataBagas Arya Satya DinataNo ratings yet

- Tuga 2 Pengantar Akuntansi 1Document25 pagesTuga 2 Pengantar Akuntansi 1Akbar MansyNo ratings yet

- Presentation 1Document11 pagesPresentation 1Ambarita PutriNo ratings yet

- Engineering Economy Solution of HW2: Exercise 1Document5 pagesEngineering Economy Solution of HW2: Exercise 1Moe ShNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- Answer KeyDocument52 pagesAnswer KeyDevonNo ratings yet

- Answer Chapter 4 Time Value of MoneyDocument6 pagesAnswer Chapter 4 Time Value of MoneyFatikchhari USO100% (1)

- Chapter #1 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument9 pagesChapter #1 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (10)

- Case Example (Plain Slides) SolutionsDocument17 pagesCase Example (Plain Slides) SolutionsolaNo ratings yet

- ACCT 1003 Worksheet 3 Solutions2010!11!2Document3 pagesACCT 1003 Worksheet 3 Solutions2010!11!2HimshowaNo ratings yet

- Exercise 11: Stockholders EquityDocument21 pagesExercise 11: Stockholders EquityAdnan AshrafNo ratings yet

- Imroatus Solihah 192618 Akuntansi Ks2 2019 - Tugas 1 Individu Akuntansi ManajemenDocument3 pagesImroatus Solihah 192618 Akuntansi Ks2 2019 - Tugas 1 Individu Akuntansi ManajemenDimas Dwi CahyonoNo ratings yet

- Nama: Zahra Luthfiah Setiawan NIM:: 20/468910/NEK/00305 Kelas: Pra Mba - BDocument3 pagesNama: Zahra Luthfiah Setiawan NIM:: 20/468910/NEK/00305 Kelas: Pra Mba - BBought By UsNo ratings yet

- Problems Process Costing SOLUTIONDocument12 pagesProblems Process Costing SOLUTIONPatDabz67% (3)

- Tutorial Capital Budgeting Question and Answer Plus MIRRDocument6 pagesTutorial Capital Budgeting Question and Answer Plus MIRRhanatasha25No ratings yet

- Zenaida Solutions To Exercises Chap 14 15 IncompleteDocument8 pagesZenaida Solutions To Exercises Chap 14 15 IncompletekonyatanNo ratings yet

- Si7 - Tarquin (1) 1 9Document9 pagesSi7 - Tarquin (1) 1 9AlvarezMartinNo ratings yet

- The IB League 2022 - Support File - XIMB - Team BlastersDocument2 pagesThe IB League 2022 - Support File - XIMB - Team Blastersmanshi choudhuryNo ratings yet

- Level III PracticesDocument3 pagesLevel III PracticesElias TesfayeNo ratings yet

- Analisis Break Even Zidhane RizkiDocument2 pagesAnalisis Break Even Zidhane Rizkitasyarizki533No ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Laboratory Exercises in Astronomy: Solutions and AnswersFrom EverandLaboratory Exercises in Astronomy: Solutions and AnswersNo ratings yet

- Week 3 - Peer DiscussionDocument2 pagesWeek 3 - Peer DiscussionKenisha ManicksinghNo ratings yet

- Week 2 - Peer DiscussionDocument2 pagesWeek 2 - Peer DiscussionKenisha ManicksinghNo ratings yet

- Draft-Report - Final Project Organizational Behavior AnalysisDocument3 pagesDraft-Report - Final Project Organizational Behavior AnalysisKenisha ManicksinghNo ratings yet

- Pestel TableDocument1 pagePestel TableKenisha ManicksinghNo ratings yet

- CSR Group Activity - Week 4Document3 pagesCSR Group Activity - Week 4Kenisha ManicksinghNo ratings yet

- BUAD 121 - Chapters 13, 14, 15 QuizDocument11 pagesBUAD 121 - Chapters 13, 14, 15 QuizKenisha ManicksinghNo ratings yet